Rigid Substrate Market Global Forecast with Market Size, Drivers, Challenges, Regional Coverage, Value Chain Review & Supplier Benchmarking

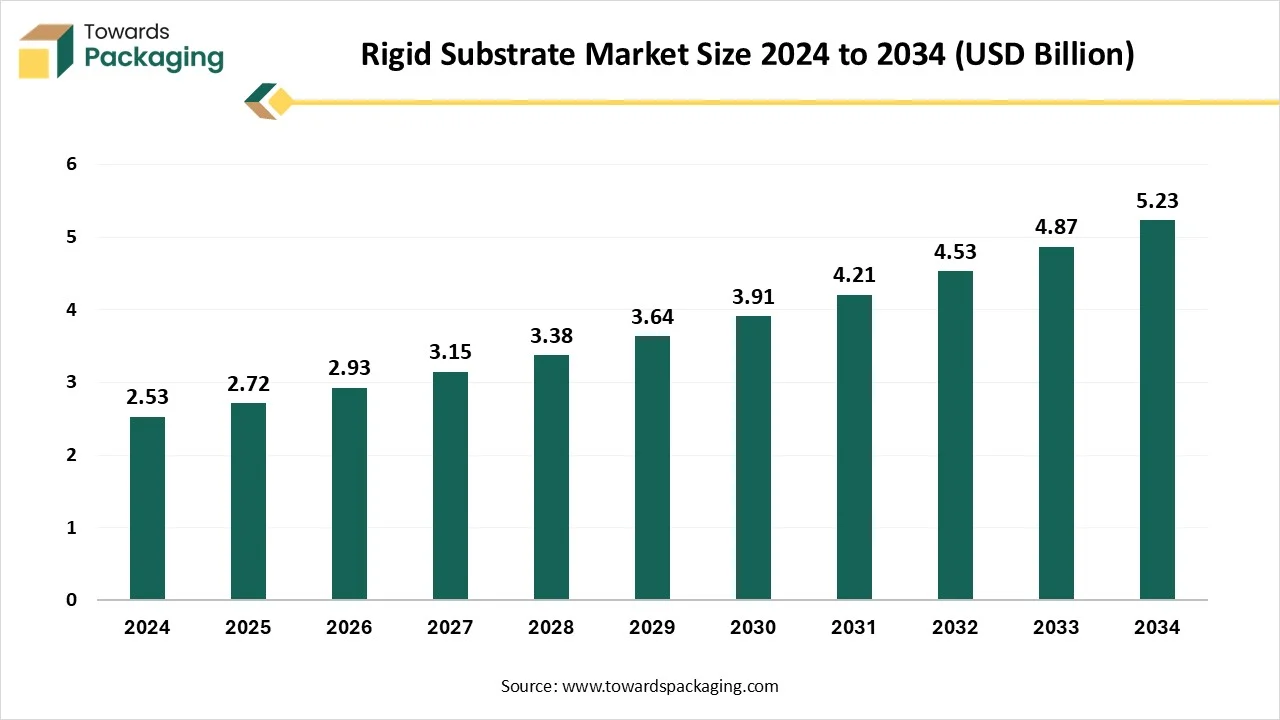

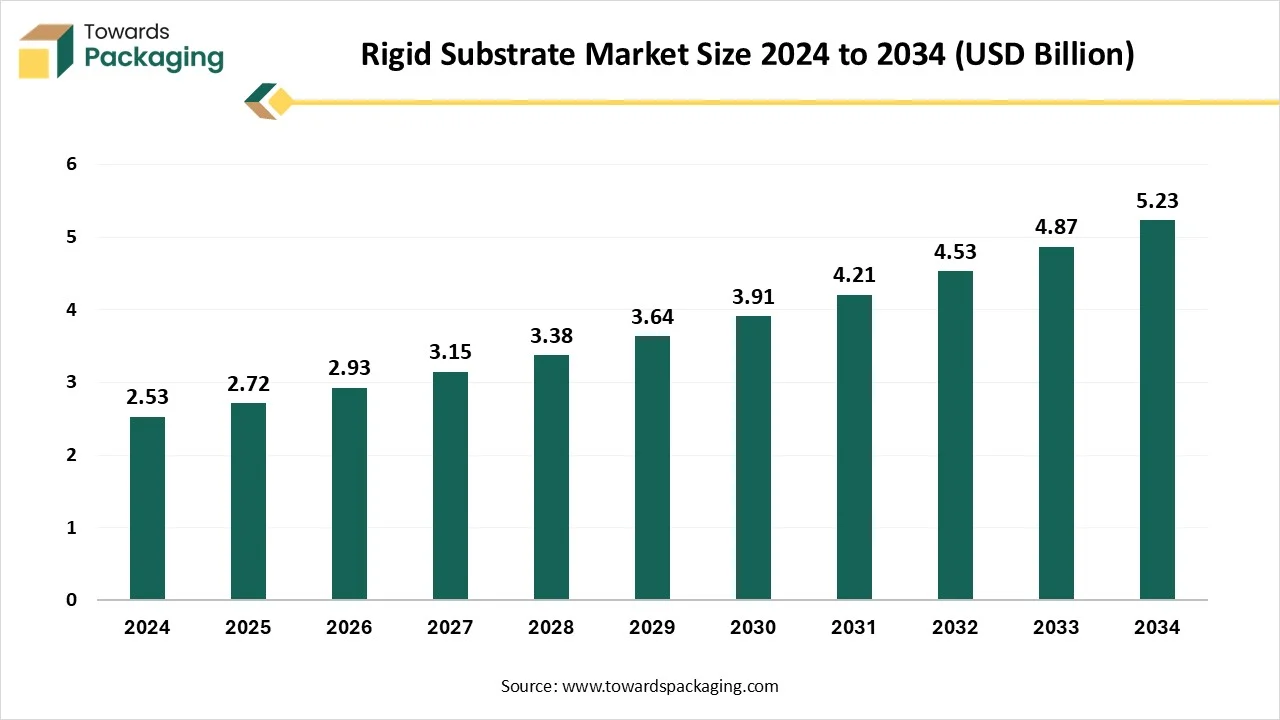

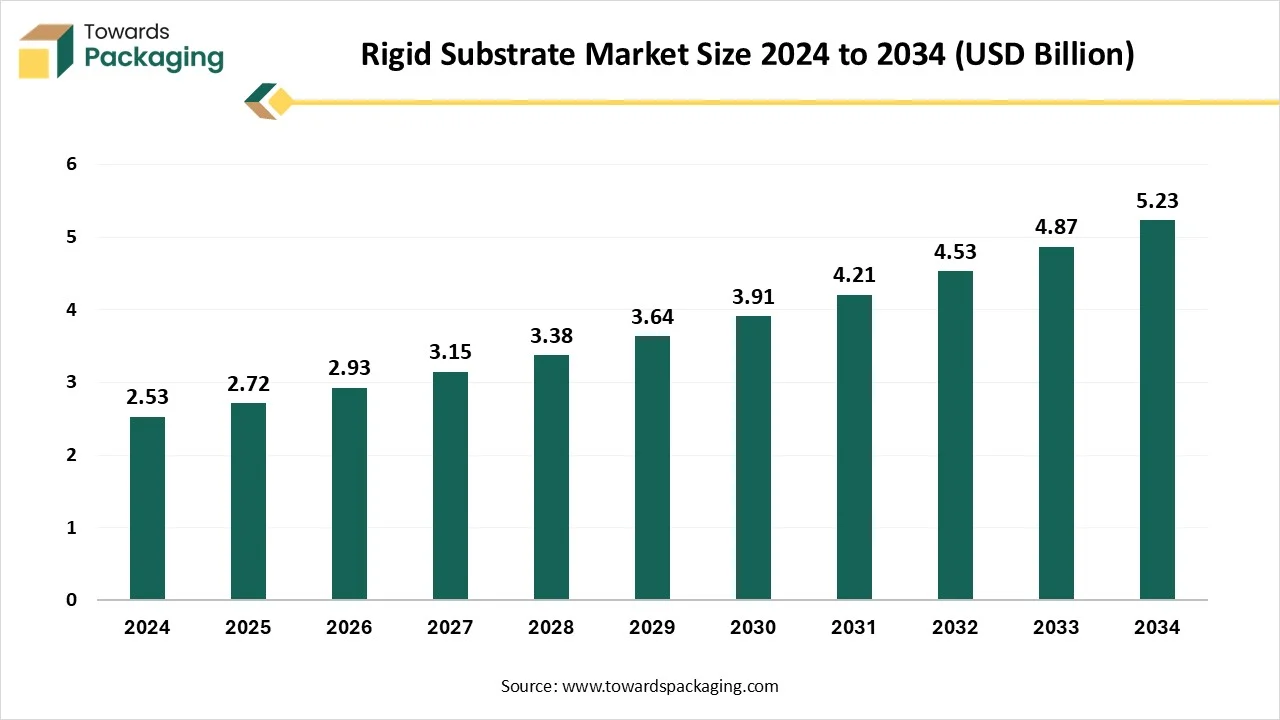

The rigid substrate market is forecasted to expand from USD 2.93 billion in 2026 to USD 5.63 billion by 2035, growing at a CAGR of 7.54% from 2026 to 2035. The report includes a full breakdown across North America, Europe, Asia Pacific, Latin America, and MEA, with country-level insights such as U.S., China, India, Germany, and Brazil. It also presents competitive analysis of companies like Nippon Mektron, Unimicron, SEMCO, Young Poong, Ibiden, ZDT, and TTM, along with value chain mapping, raw material sourcing, manufacturing footprint, supplier network, and global trade statistics, including export-import patterns for rigid plastics, metal substrates, paperboard, and composites.

Major Key Insights of the Rigid Substrate Market:

- Asia Pacific dominated the rigid substrate market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By material type, the plastic segment dominated the market with the largest share in 2024.

- By product type, the boxes segment registered its dominance over the global rigid substrate market in 2024.

- By end-user, the packaging segment dominated the market with the largest share in 2024.

- By thickness, the medium (1mm to 5mm) segment registered its dominance over the global rigid substrate market in 2024.

- By application, the food packaging segment dominated the rigid substrate market in 2024.

Rigid Substrate Market: Supports Packaging

In the packaging industry, a rigid substrate refers to a firm, inflexible material used as the base structure for packaging products. It serves as the main body or support of the packaging, giving it shape, strength, and durability. The key characteristics of rigid substrate in packaging is that they are non-flexible, strong, durable, and provides structural support. Rigid substrate does not easily bend or deform. They protect contents during handling, shipping, and storage. They maintain the form of the packaging.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 2.72 Billion |

| Projected Market Size in 2035 |

USD 5.63 Billion |

| CAGR (2026 - 2035) |

7.54% |

| Leading Region |

North America |

| Market Segmentation |

By Material Type, By product Type, By End User, By Thickness, By Application and By Region |

| Top Key Players |

Nippon Mektron, Unimicron, SEMCO, Young Poong Group, Ibiden, ZDT, Tripod, TTM, SEI, INLINE. |

What are the Latest Trends in the Rigid Substrate Industry?

Eco-Friendly and Sustainability Materials

Environmental concerns are propelling the adoption of sustainable practices in rigid packaging. Companies are increasingly utilizing recycled materials, such as recycled PET (rPET), and exploring biodegradable options to align with circular economy principles. This shift not only addresses regulatory pressures but also caters to eco-conscious consumers.

Lightweighting for Efficiency

Manufacturers are focusing on reducing the weight of packaging materials without compromising strength. Lightweighting contributes to resource conservation, lowers transportation costs, and minimizes environmental impact.

Functionality and Innovative Design

There's a growing emphasis on packaging designs that enhance user experience and product appeal. Features such as easy-open mechanisms, resealable closures, and ergonomic shapes are becoming standard, improving functionality and consumer satisfaction.

Smart Packaging Technologies

The integration of technologies like QR codes, RFID tags, and sensors into rigid packaging is on the rise. These smart features enable real-time tracking, product authentication, and interactive consumer engagement, adding value beyond traditional packaging roles.

E-Commerce-Optimized Packaging

With the surge in online shopping, packaging must ensure product protection during transit. Rigid packaging solutions are being tailored for e-commerce, focusing on durability, tamper-evidence, and efficient space utilization to meet the demands of this growing retail channel.

Circular Economy and Regulation

Legislation in the EU, North America, and parts of Asia is pushing for closed-loop manufacturing, boosting interest in recyclable and reusable rigid substrates. Certifications like RoHS, REACH, and UL 94 are influencing design and sourcing decisions.

Miniaturization and High-Density Interconnects (HDI)

The push for smaller, thinner, and lighter devices is driving the need for ultra-thin, thermally stable rigid substrates. Increased use of glass and ceramic substrates in microelectronics and chip packaging.

High-Performance Electronics and 5G Integration

Rising use of high-frequency, low-loss materials like PTFE-based substrates and ceramic-filled composites in 5G and advanced RF applications. Demand for rigid-flex PCBs is increasing in smartphones, IoT, automotive electronics, and defense systems.

How Can AI Improve the Rigid Substrate Industry?

Artificial intelligence integration gives benefits such as lower costs, higher efficiency, and better scalability. AI tools can help engineers and designers: simulate stress, impact, and load-bearing capacity of packaging; optimize design for strength-to-weight ratio; reduce trial-and-error by predicting the performance of new materials and shapes. The artificial intelligence integration provides faster innovation and more effective packaging with less materials requirement. Using computer vision and AI algorithms provides 100% inspection rates become possible without slowing down the production line. The artificial intelligence provides fewer defective products, improved brand reputation.

AI can help companies monitor the carbon footprint of substrate production, track recyclable and non-recyclable materials. The artificial intelligence models suggest alternative eco-friendly substrates based on data analysis. The artificial intelligence integration provides enhanced compliance with environmental regulations and ESG goals.AI algorithms can forecast demand and optimize inventory of rigid substrates: reduce overproduction and understocking, plan raw material procurement efficiently, manage logistics to avoid delays. The AI integration provides cost savings and faster response to market changes.

Market Dynamics:

Driver

Booming E-commerce Industry

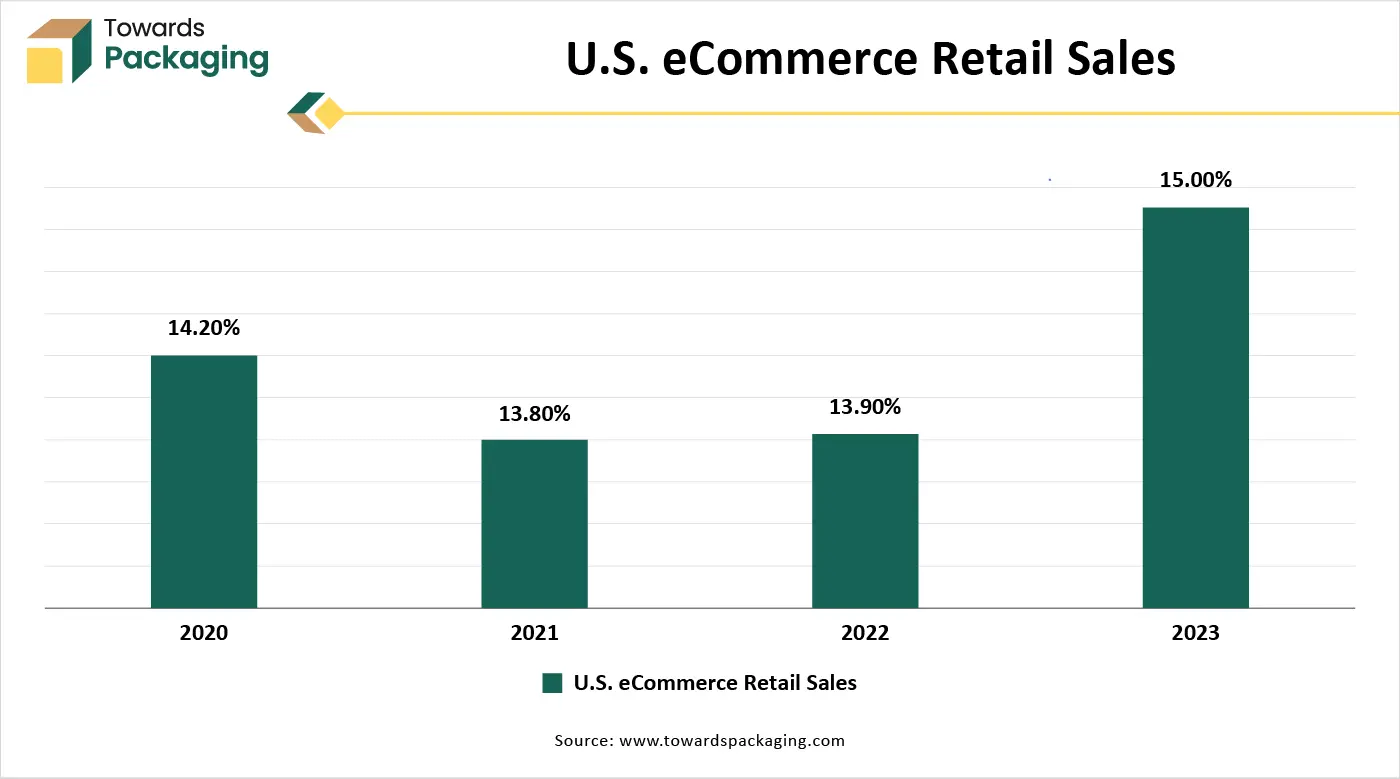

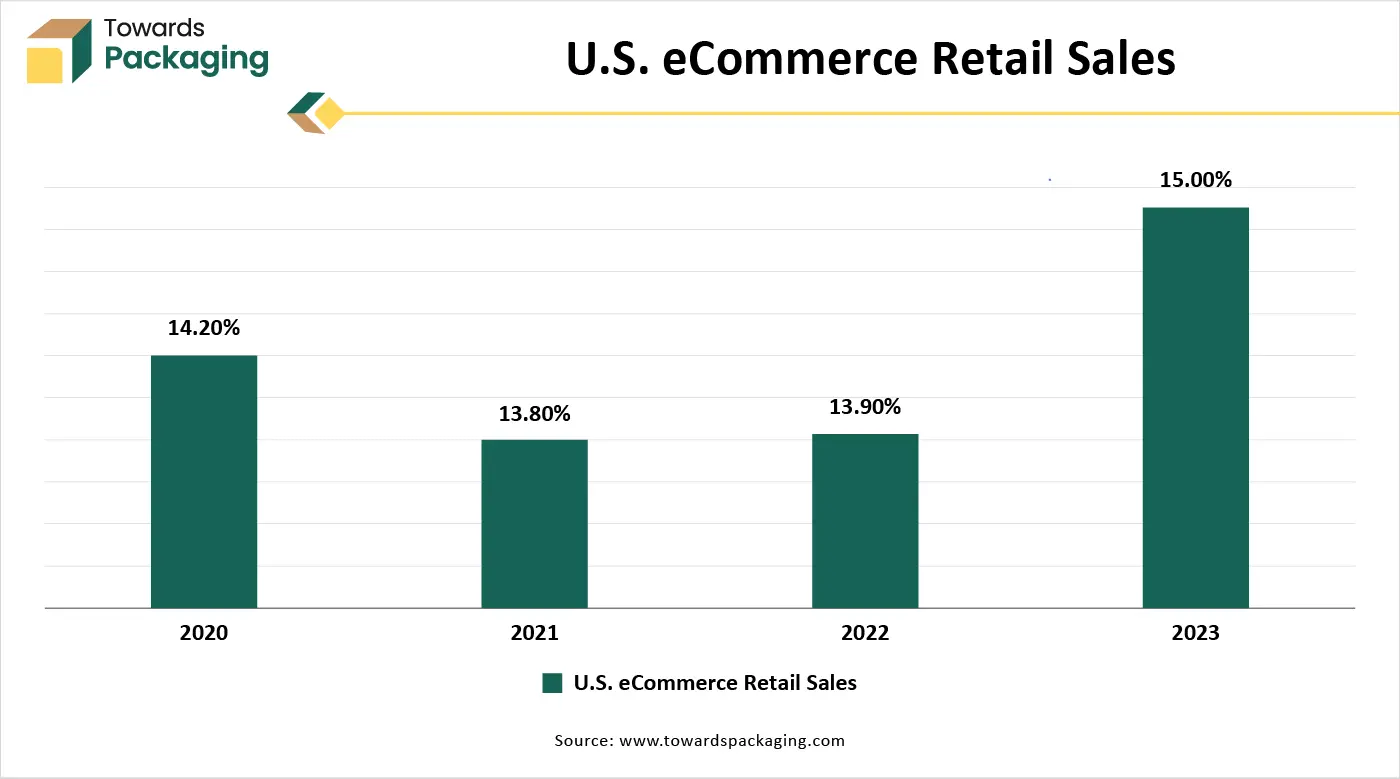

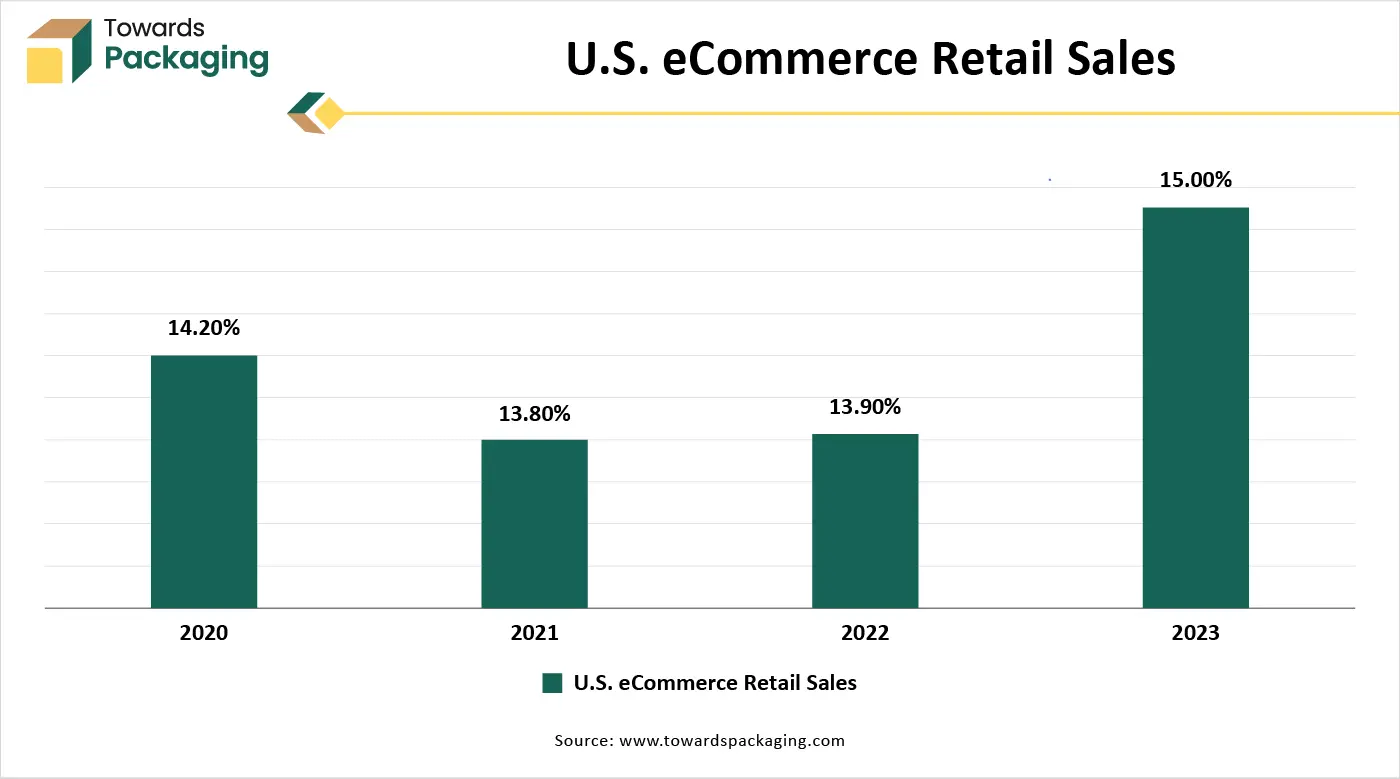

Increased demand for durable packaging in food, beverages, pharmaceuticals, and cosmetics. E-commerce growth is pushing the need for strong, tamper-resistant packaging. Premium product presentation requires high-quality rigid substrates (e.g., glass, hard plastic, or metal).Hence due to rising e-commerce platform there is higher demand for rigid materials like cardboard, rigid plastics, metal, and glass.

- According to the data published by the National e-commerce associations in the United States and globally, Amazon.com is the top e-commerce shop, with JD.com coming in second. Amazon.com outperformed JD.com by 19.9% in 2024 in terms of e-commerce revenue. According to statistics that is currently available, Amazon.com receives 476.1 million average monthly search visitors worldwide, more than any other e-commerce website. Business-to-business (B2B) sales, as opposed to consumer retail or business-to-consumer (B2C), account for the majority of e-commerce revenue. In 2024, the combined revenue from B2B and B2C e-commerce was projected to reach US$36.8 trillion. According to projections, global B2B and B2C e-commerce is expected to reach a valuation of over US$86 trillion by 2030.

Restraint

Environmental and Regulatory Pressures

Rigid plastics and other non-biodegradable substrates face increasing regulatory scrutiny due to pollution and landfill concerns. Governments and environmental groups are pushing for recyclable or compostable alternatives, especially in Europe and North America.

Flexible packaging is growing rapidly due to lower cost, lighter weight, and easier shipping. Sectors like food, personal care, and pharmaceuticals are adopting flexible pouches, sachets, and films, reducing the need for rigid containers. Rigid packaging is bulky and takes up more storage and transport space than flexible alternatives. High shipping costs and inefficient space utilization reduce appeal in global supply chains.

Opportunity

Healthcare and Pharmaceutical Expansion

Rigid substrates are essential in sterile, tamper-proof packaging for medicines and medical devices. The growth of the global healthcare sector especially post-COVID 19 has increased the need for safe and durable packaging. The healthcare and pharmaceutical expansion drives growth in both traditional rigid plastics and specialized barrier materials. Rigid substrates offer better barrier properties than flexible materials, helping preserve product freshness and reduce spoilage. They also improve product safety, particularly in food and beverages. Makes rigid packaging more attractive for perishable or high-value products.

Segmental Insights

Plastic Held the Largest Share in 2024

The plastic segment held a dominant presence in the rigid substrate market in 2024. Plastics offer high strength-to-weight ratios, minimizing shipping costs and making handling easier. They are resistant to impact, corrosion, and many chemicals, which ensures the protection of the contents. Plastics can be easily molded into complex shapes using processes like injection molding or thermoforming, which is ideal for custom rigid packaging. Some plastics (like PET and HDPE) are recyclable, which supports sustainability goals when properly managed.

Boxes Segment Witnessed Significant Share in 2024

The boxes segment accounted for a significant share of the rigid substrate market in 2024. Boxes, especially corrugated cardboard, offer excellent rigidity and cushioning, protecting products during handling, storage, and transport. Boxes can be easily customized in size, shape, and printing, which makes them suitable for a wide range of products from electronics to food. Most boxes are manufactured from recyclable materials and are biodegradable, supporting sustainability initiatives and consumer demand for eco-conscious packaging.

Huge Demand from Packaging Industry Supported the Segment’s Dominance

The packaging segment led the global rigid substrate market. Rigid substrate is essential in packaging industry food & beverages, pharmaceuticals, personal care, electronics, and consumer goods, which consistently require durable and protective packaging. Rigid substrate allows for high-equality printing and structural design, enhancing product visibility and brand identity on retail shelves.

Features like easy handling, reusability, and resealability in rigid packaging improve user experience, increasing consumer preference for such formats. Rigid substrates like recyclable plastics, glass, and paperboard align with environmental goals, supporting circular economy models and eco-conscious packaging. As a product are shipped across longer distances, the demand for robust packaging solutions that withstand pressure and climate changes continues to rise.

Medium (1mm to 5mm) Segment Led the Market in 2024

The medium (1mm to 5mm) segment to segment registered its dominance over the global market in 2024. This thickness range offers sufficient structural integrity for protecting products without being overly bulky or heavy. Compared to thicker substrates, 1mm–5mm materials provide durability while remaining lightweight, reducing transportation costs and making handling easier. These substrates are economical to produce and process (e.g., die-cutting, printing, laminating), making them ideal for mass production.

Medium-thickness substrates are used in a variety of sectors such as: packaging (e.g., box inserts, blister backs), signage and display (e.g., foam boards, PVC sheets), electronics (e.g., printed circuit boards) and construction (e.g., insulation panels, laminate sheets). Common rigid materials like PVC, acrylic, polystyrene, corrugated plastic, and paperboard are easily available in this thickness, supporting wide application. Medium-thickness substrates can be cut, bent, drilled, or machined without cracking or delaminating, making them flexible for design and assembly. Many materials in this range, such as recycled paperboard or bio-based plastics, offer eco-friendly alternatives while maintaining performance.

Large Consumer Base from Food Industry to Project Dominance

The food packaging segment dominated the rigid substrate market globally. Rigid substrates like plastic containers, glass jars, and metal cans offer excellent barrier properties against moisture, oxygen, and light. They help extend shelf life, preserve flavor and texture, and protect food from contamination or tampering. Rigid packaging (e.g., trays, tubs, bottles) allows for: ready-to-eat or microwaveable meals, portion control, resealability, and stackability. Rigid substrate provides a stable surface for high-quality printing and labelling. The rigid substrate enhances product visibility and brand recognition on retail shelves. The rigid substrate offers a premium look for high-end food products (e.g., sauces in glass jars, gourmet items in tins).

Regional Insights

North America’s Advance Technology to Promote the Growth

North America is seen to grow at the fastest rate during the forecast period, owing to advanced infrastructure and technology advancement in the region. North America, especially the U.S., has a well-established packaging sector supporting food, beverage, healthcare, and consumer goods industries—all major users of rigid substrates. The region's large population and high per capita income drive demand for packaged products, especially in e-commerce, retail, and FMCG sectors. North American manufacturers invest heavily in innovation and automation, producing high-quality, customizable rigid substrates efficiently and at scale. The region is home to leading packaging and materials companies like International Paper, WestRock, Berry Global, and 3M, which fuel market growth and innovation. Strict regulations related to product safety, food-grade materials, and environmental compliance drive the adoption of high-quality rigid substrates.

U.S. Market Trends

U.S. rigid substrate market is driven by the growing advancement in the manufacturing technique in the country. High demand across industries including food & beverage, personal care, pharmaceuticals, and electronics. Strong infrastructure for automated production, innovation in packaging technologies, and material development (e.g., bioplastics, advanced composites). Government and consumer pressure for eco-friendly and recyclable materials encourages use of rigid paperboard, PET, and biodegradable plastics. Growth of platforms like Amazon fuels demand for rigid corrugated boxes and molded plastic packaging. A significant share of rigid substrates is used for sterile, tamper-proof medical packaging.

Canada Market Trends

Canada’s strict plastic waste reduction policies and extended producer responsibility (EPR) programs drive demand for rigid paperboard and recyclable plastics. The country’s strong agriculture and processed food sectors use rigid containers for preservation and transport. While smaller in size, Canada's packaging standards are high, encouraging the use of premium rigid substrates for branding and product protection. Ontario and Quebec are centers for paperboard and molded pulp manufacturing.

Asia’s Growing Industrial Hub: Dominance to Sustain till 2034

Asia Pacific held the largest share of the rigid substrate market in 2024 and is seen to sustain the position during the forecast period. Countries like China, India, Vietnam, Indonesia, and Bangladesh are experiencing fast-paced industrial development. Growth of manufacturing sectors (electronics, automotive, pharmaceuticals, etc.) drives demand for durable and protective packaging solutions. Surge in online shopping requires rigid and reliable packaging to ensure product safety during transit. Countries like China and India have seen exponential growth in platforms like Alibaba, Flipkart, and Amazon. A growing middle-class population with higher disposable incomes in the region fuels demand for packaged food, cosmetics, electronics, and healthcare products. These products often require rigid substrate packaging to maintain product integrity.

Top Trends of China’s Rigid Substrate Manufacturing- 2025

China rigid substrate market is driven by the expanding electronics and semiconductor industry in the country. Made in China 2025 a national strategy to upgrade manufacturing capabilities, including in electronics and semiconductors. China is a global hub for consumer electronics, driving demand for rigid substrates used in: Printed Circuit Boards (PCBs), Display panels and Semiconductor packaging. Domestic giants like BOE, Huawei, SMIC, and others contribute to local sourcing and ecosystem development. 5G, IoT, AI, and Automotive Electronics applications require more advanced rigid substrates (e.g., high-frequency, heat-resistant materials).

China's leading EV market boosts demand for electronic components, further fueling substrate demand. Increased investment in materials science and substrate innovations in China has risen the demand for the rigid substrate. Development of advanced rigid substrates like FR-4, CEM-3, and high-speed/low-loss laminates. China remains a major exporter of electronic components, benefiting from global demand for rigid substrates. US-China trade tensions pushed China to develop self-sufficiency in semiconductor and electronics supply chains, boosting local rigid substrate production.

India Rigid Substrate Market Trends

India rigid substrate market is driven by the large consumption of the consumer electronics. “Make in India” Campaign is encouraging domestic manufacturing across sectors including electronics. National Policy on Electronics (NPE 2019) aims to position India as a global hub for Electronics System Design and Manufacturing (ESDM). India is becoming a major assembly hub for smartphones, consumer electronics, and automotive electronics.

Big manufacturers like Wistron, Foxconn, Tata Group, and Samsung are expanding operations, which increases local demand for rigid substrates (used in PCBs and displays). India is investing in semiconductor fabs and packaging units, which will drive demand for advanced rigid substrates. Projects like the Vedanta-Foxconn chip plant and Tata's semiconductor plans highlight long-term potential and has driven the demand for the rigid substrate.

Europe’s Sustainable Initiative to Project Notable Growth

Europe region is seen to grow at a notable rate in the foreseeable future. The key players operating in the Europe region has strong focus on high-performance and specialty applications. Europe excels in producing high-end rigid substrates for: aerospace and defense, automotive electronics (especially EVs and ADAS), and industrial automation and medical devices. These applications demand rigid substrates with high thermal stability, low signal loss, and excellent reliability. European companies lead in material science and substrate engineering, focusing on: high-frequency laminates, low-loss dielectric materials, and eco-friendly and halogen-free substrates.

Companies like Rogers Corporation (Europe division), Isola Group, and Ventec contribute to this innovation. Europe is home to major automotive OEMs like Volkswagen, BMW, Mercedes-Benz, Volvo, etc. These companies demand sophisticated rigid PCBs and substrates for: electric vehicles (EVs), In-vehicle infotainment and power electronics. Companies like AT&S (Austria), Würth Elektronik (Germany), Cicor Group (Switzerland) focus on: high-reliability and low-volume, high-complexity rigid substrates. Medical, aerospace, and industrial sectors. European factories are early adopters of smart manufacturing, which helps in: reducing defects, enhancing precision in multi-layer rigid substrate fabrication and improving material utilization.

Top Market Players of the Rigid Substrate Market

- Nippon Mektron

- Unimicron

- SEMCO

- Young Poong Group

- Ibiden

- ZDT

- Tripod

- TTM

- SEI

- Daeduck Group

- HannStar Board (GBM)

- Nanya PCB

- CMK Corporation

- Shinko Electric Ind

- Compeq

- AT&S

- Kingboard

- Ellington

- Topcb

- DSBJ

- Kinwong

- Samsung

- Fujikura

- MEIKO ELECTRONICS

- SCC

New Advancements in Rigid Substrate Industry

- In March 2025, Amcor, a world leader in creating and manufacturing environmentally friendly packaging solutions, announced that the Amor Lift-Off Sprints, a new challenge under its Amor Lift-Off initiative, is now accepting applications. For paper and other biodegradable substrates, the challenge seeks to reward creative businesses that offer novel, recyclable, or compostable barrier coating solutions. The goal of the Amor Lift- Off program is to promote technical partnerships with entrepreneurs and start-ups whose products tackle certain research & development problems. In addition to receiving funding of up to US$500,000, successful applicants will have the chance to sign a collaborative development agreement with Amor's R&D team. [Source: Amcor]

- In October 2024, Zhen Ding Technology Group (Zhen Ding) (4958-TW) and DuPont announced that they have signed a strategic partnership agreement in the field of advanced printed circuit board (PC) technology. Yi Zhang, President of the Asia Pacific Region at DuPont; Than Ming Tan, Global Business Director for Laminates at DuPont; and Charles Shen, Chairman of Zhen Ding, attended the signing event yesterday at the Shenzhen Avary Time Center. By means of this strategic collaboration, DuPont and Zhen Ding will endeavor to increase material performance, advance state-of-the-art research and development, improve end-user applications, and support the electronics industry's sustainable growth. They also want to strengthen their collaboration in promoting sustainability, corporate governance, and smart manufacturing projects. [Source: PR Newswire]

- In January 2024, Tropicana is introducing limited-edition packaging that emphasizes that its orange juice is natural by eliminating the letters "A" and "I" from its name. According to the company's news release this week, advancements in artificial intelligence appear to happen every week. "Every new development in Al seems to move us further from the natural world and toward the artificial one. There is a lot of consumer interest and even worry," it stated. As a result, the company is emphasizing its "natural" product in bottles with the name "Tropen," omitting the "A" and "I." The exclusive Tropen bottles will be "hidden" in Kroger supermarkets across the country. [Source: Packaging Dive ]

- In February 2025, The goal of Kongsberg PCS, a top supplier of digital cutting solutions, is to revolutionize sample-making and short-run production in a variety of industry sectors by the time Printpack India 2025 arrives. The business is exhibiting its most recent inventions, which are intended to simplify short-run production and sample creation for the packaging sector. [Source: The Packman ]

Global Rigid Substrate Market Segments

By Material Type

- Plastic

- Metal

- Glass

- Composite Materials

- Paper and Paperboard

By product Type

- Trays

- Boxes

- Labels

- Plates

- Sheets

By End User

- Packaging

- Electronics

- Automotive

- Consumer Goods

- Healthcare

By Thickness

- Thin (less than 1mm)

- Medium (1mm to 5mm)

- Thick (greater than 5mm)

By Application

- Food Packaging

- Medical Devices

- Construction Materials

- Automotive Components

- Consumer Electronics

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa