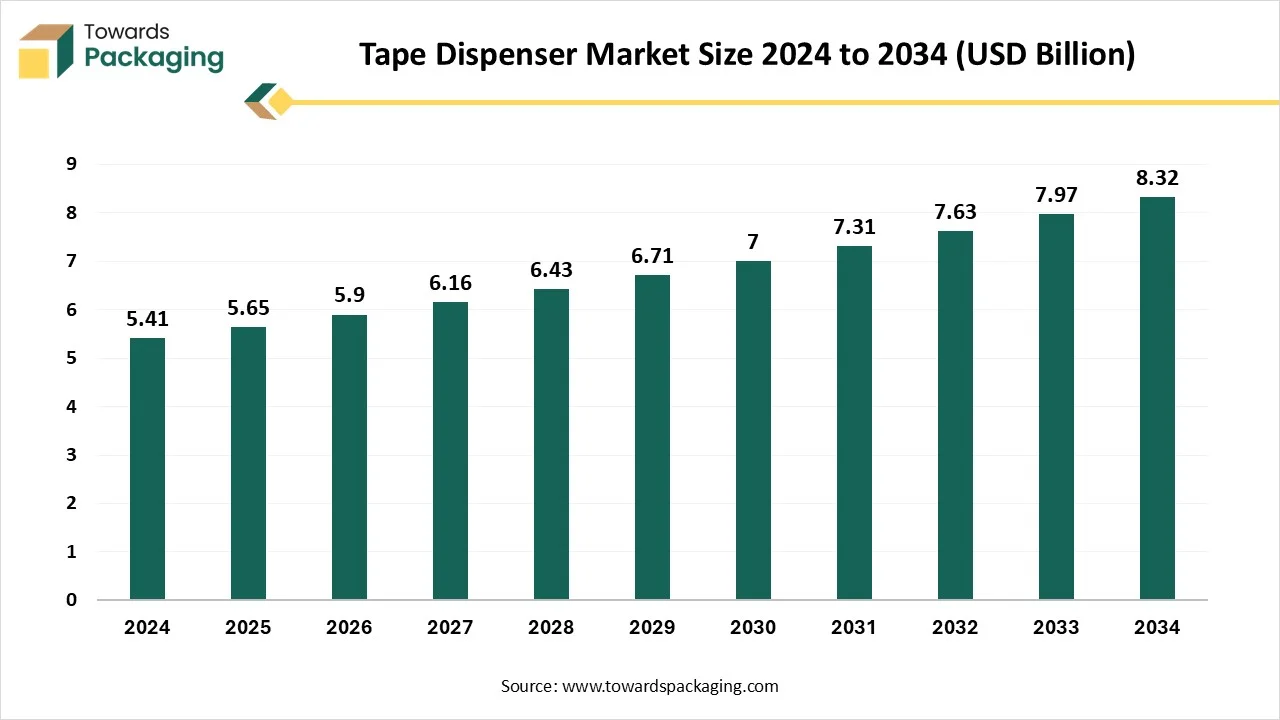

The tape dispenser market is forecasted to expand from USD 5.90 billion in 2026 to USD 8.72 billion by 2035, growing at a CAGR of 4.43% from 2026 to 2035. It provides detailed segmentation by product type (handheld, tabletop, definite length, stretchable tape dispensers), technology (manual, automatic), and end-use (industrial, office/commercial). Regional insights include dominance in Asia Pacific, growth potential in North America, and notable trends in Europe, Latin America, and MEA. The report also profiles major companies like 3M Company, Tesa SE, Intertape Polymer Group Inc., and Shurtape Technologies LLC, analyzing their strategies, value chains, trade data, and supplier networks to provide a holistic view of the competitive landscape.

A tape dispenser is a mechanical device designed to hold and cut adhesive tape efficiently and cleanly. It plays a crucial role in both personal and professional settings, enabling users to apply tape with precision and ease. Tape dispensers come in various forms, ranging from simple handheld models to advanced automatic machines, depending on the specific use and environment. The most basic form, often used in homes or offices, consists of a plastic or metal base that holds a roll of tape and a serrated cutting edge for tearing. These manual dispensers are compact, affordable, and user-friendly, making them ideal for everyday tasks such as sealing envelopes, wrapping gifts, or organizing documents.

Industrial tape dispensers are commonly used in more demanding environments such as warehouses, manufacturing units, and shipping facilities. These include tabletop and automatic dispensers that are designed to increase productivity and reduce manual labor. Automatic tape dispensers are equipped with features like programmable tape lengths, sensors, and high-speed motors, making them suitable for high-volume packaging operations. Some models are also capable of dispensing specialty tapes, including double-sided, filament, and masking tapes, which are frequently used in construction, electronics, and automotive industries.

The design of tape dispensers is focused on functionality, ergonomics, and durability. Many are built with heavy-duty materials to ensure long-lasting performance, and some include anti-slip bases or weighted frames to prevent movement during use. Safety features such as blade guards are also incorporated to reduce the risk of injury. Additionally, the growing emphasis on sustainability has led to the development of tape dispensers made from recycled or biodegradable materials, aligning with eco-friendly practices.

| Metric | Details |

| Market Size in 2025 | USD 5.65 Billion |

| Projected Market Size in 2035 | USD 8.72 Billion |

| CAGR (2025 - 2035) | 4.43% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Product Type, By Technology, By End-Use and By Region |

| Top Key Players | 3M Company, Tesa SE, Intertape Polymer Group Inc., Fellow Brands, Shurtape Technologies LLC, Koziol USA, START International |

The increasing adoption of automated and smart tape dispensers is revolutionizing packaging processes. These devices utilize sensors, programmable settings, and artificial intelligence to adjust tape lengths based on package sizes, enhancing efficiency and reducing material waste. Some models offer voice-activated controls, catering to accessibility needs and improving user experience.

Environmental concerns are prompting manufacturers to develop tape dispensers and tapes made from recyclable and biodegradable materials. This shift aligns with global sustainability goals and appeals to environmentally conscious consumers, influencing purchasing decisions across various sectors.

There is a growing emphasis on ergonomic and customizable tape dispensers to cater to specific industry needs. Features such as adjustable tape lengths, easy tape loading capabilities, and designs that reduce strain on workers are becoming increasingly important in sectors like manufacturing and logistics.

AI integration has the potential to significantly enhance the tape dispenser industry by improving efficiency, precision, customization, and overall operational performance. One of the primary advantages is the development of smart, automated tape dispensers capable of detecting package size, shape, and material to adjust tape length and tension accordingly. This automation minimizes waste and accelerates packaging, which is especially beneficial in high-volume environments like e-commerce and logistics. Additionally, AI can enable predictive maintenance by monitoring the condition of the dispenser’s internal components, identifying signs of wear or malfunction before they result in downtime. This proactive approach helps reduce maintenance costs and ensures uninterrupted operations.

Another key improvement comes from AI’s ability to personalize and learn from user behavior. Intelligent dispensers can remember frequently used settings, adjust performance based on individual preferences, and streamline repetitive tasks for greater user convenience. Integration with inventory systems is also a game-changer; AI can track tape usage, forecast supply needs, and trigger automatic reordering, thereby optimizing inventory management and preventing shortages or overstocking. Moreover, AI-powered vision systems can enhance quality control by detecting misaligned or improperly applied tape, ensuring each package is sealed correctly and consistently.

Sustainability is another area where AI adds value. By analyzing usage patterns, AI can help businesses minimize tape waste, recommend environmentally friendly alternatives, and suggest packaging optimizations that reduce material consumption. In smart factory environments, AI-integrated tape dispensers can communicate with other automated machinery, such as labelers and conveyors, as part of a fully coordinated production line, supporting the broader goals of Industry 4.0. Overall, AI transforms the tape dispenser from a basic tool into a strategic asset, enabling smarter operations, better resource management, and enhanced competitiveness in the modern packaging and manufacturing sectors.

Boom in E-commerce and Logistics

The rapid expansion of e-commerce platforms globally has led to an increased demand for effective packaging solutions. Tape dispensers are essential tools in the shipping and fulfillment process, where speed, consistency, and reliability are crucial. As more businesses shift to online sales, the need for high-performance tape dispensers especially automatic and industrial-grade models continues to rise. According to the data published by the B2B eCommerce Association, Business-to-business (B2B) sales, as opposed to consumer retail or business-to-consumer (B2C), account for the majority of e-commerce revenue. The aggregate revenue from B2B and B2C e-commerce worldwide was projected to reach USD 34.1 trillion in 2024.

Market Saturation in Developed Regions and Digitalization and Paperless Workflows

The key players operating in the tape dispenser market are facing issues due to digitalization and paperless workflows, as well as market saturation in developed regions. In mature markets like North America, Europe, and parts of Asia, the demand for basic tape dispensers is largely saturated. Most offices, warehouses, and homes already possess dispensers, leading to replacement demand rather than new adoption. The shift to digital documentation and reduced reliance on physical paperwork reduces the overall use of adhesive tapes in offices and other sectors, indirectly limiting the need for tape dispensers.

Tape dispensers are widely used in manufacturing environments for sealing, assembling, and bundling applications. As industrial production scales up, especially in emerging markets like India, China, and Southeast Asia, the demand for efficient tape application tools grows in parallel.

Automation is transforming packaging processes across many industries. Tape dispensers with advanced features—such as programmable tape lengths, automatic cutting, and smart sensors—help reduce manual labor, enhance precision, and increase throughput. Companies are increasingly investing in automated dispensers to improve productivity and reduce operational costs.

Modern workplaces place a high value on employee safety and comfort. As a result, there’s a growing demand for ergonomic tape dispensers that reduce physical strain and are easier to use over long periods. Features such as lightweight designs, anti-slip bases, and easy tape loading mechanisms contribute to this trend.

As environmental awareness increases, so does demand for tape dispensers compatible with eco-friendly tapes (biodegradable, recyclable, or paper-based). In response, manufacturers are also developing dispensers made from sustainable materials, further driving market interest.

The handheld tape dispensers segment holds a dominant presence in the market owing to its portable nature and allowance for the user to apply tape quickly. Handheld tape dispensers are used extensively across various industries and settings due to their practicality, portability, and efficiency. One of the primary factors driving their widespread use is convenience they allow users to apply tape quickly and accurately with one hand, which is especially valuable in high-paced environments like packaging, shipping, and retail. Their compact design makes them easy to store and transport, making them ideal for both commercial and home use.

In industries where large volumes of items need to be sealed or packaged, such as logistics, warehousing, and e-commerce, handheld dispensers increase productivity by speeding up the taping process and reducing waste from uneven application. Additionally, their affordability compared to automated or industrial taping machines makes them accessible to small businesses and individuals. The ability to use them with different types and widths of tape also adds to their versatility. Finally, improvements in ergonomic design and safety features, such as retractable blades, have enhanced user comfort and reduced the risk of injury, contributing further to their widespread adoption.

The manual tape dispenser segment accounted for the dominant revenue share of the tape dispenser market in 2024. Manual tape dispensers are widely used for packaging purposes primarily because of their simplicity, cost-effectiveness, and ease of use. They require no power source or complex setup, making them ideal for a wide range of environments, from small businesses and offices to warehouses and retail settings. Their portability allows workers to move freely and package items efficiently at different locations, which is especially useful in dynamic workspaces.

Manual tape dispensers also help improve productivity by allowing quick, one-handed application of tape, which reduces the time and effort needed to seal boxes or parcels. They are compatible with various tape types and sizes, adding to their versatility across different packaging needs. Additionally, they offer greater control during tape application, resulting in cleaner, more secure seals with less tape wastage. Due to their low maintenance requirements and long lifespan, manual dispensers are an economical choice for businesses aiming to streamline their packaging operations without investing in automated machinery.

The industry segment dominates the market due to high volume usage in packaging and growth in the logistics industry. Due to extensive use in high-volume packaging operations across sectors such as manufacturing, logistics, warehousing, and e-commerce, the industry segment projects dominance. These industries handle large quantities of packages daily, requiring efficient, durable, and ergonomic tape dispensers to maintain productivity. The growing demand for automation and efficiency further drives this dominance, as businesses increasingly rely on automatic and semi-automatic tape dispensers to speed up operations and reduce labor costs. Industrial-grade dispensers are also capable of handling larger tape rolls, minimizing downtime and improving workflow.

Many industrial applications require customized or heavy-duty dispensers, such as those designed for reinforced or water-activated tape, which manufacturers are well-positioned to supply. The rise of e-commerce and the expansion of logistics networks have significantly increased the need for fast, reliable packaging solutions, further boosting demand for industrial tape dispensers. These products also offer long-term cost efficiency, with higher durability and performance justifying their higher initial cost. Moreover, industrial settings often have strict safety and compliance requirements, encouraging the use of professional-grade dispensers that help reduce workplace injuries and improve operational safety.

Asia Pacific held the largest share of the take dispenser market in 2024, owing to rapid E-commerce growth and low-cost production in the region. Asia Pacific countries like China, India, Japan, and South Korea have robust manufacturing and industrial sectors. These industries require large volumes of packaging materials, including tape and dispensers, driving sustained demand. Also, the region is witnessing explosive growth in e-commerce, particularly in countries like China, India, and Southeast Asian countries. This surge fuels demand for efficient packaging solutions, making tape dispensers essential tools for logistics and fulfillment centers.

Asia Pacific is known for cost-effective manufacturing, enabling local producers to supply tape dispensers at competitive prices globally. This supports both domestic consumption and exports. Ongoing infrastructure projects and urbanization in emerging Asia Pacific economies lead to increased industrial activity and construction-related logistics, both of which contribute to the tape dispenser market. Several leading tape and packaging equipment manufacturers are based in or have operations in the region, ensuring high product availability and innovation tailored to regional needs.

India Market Trends

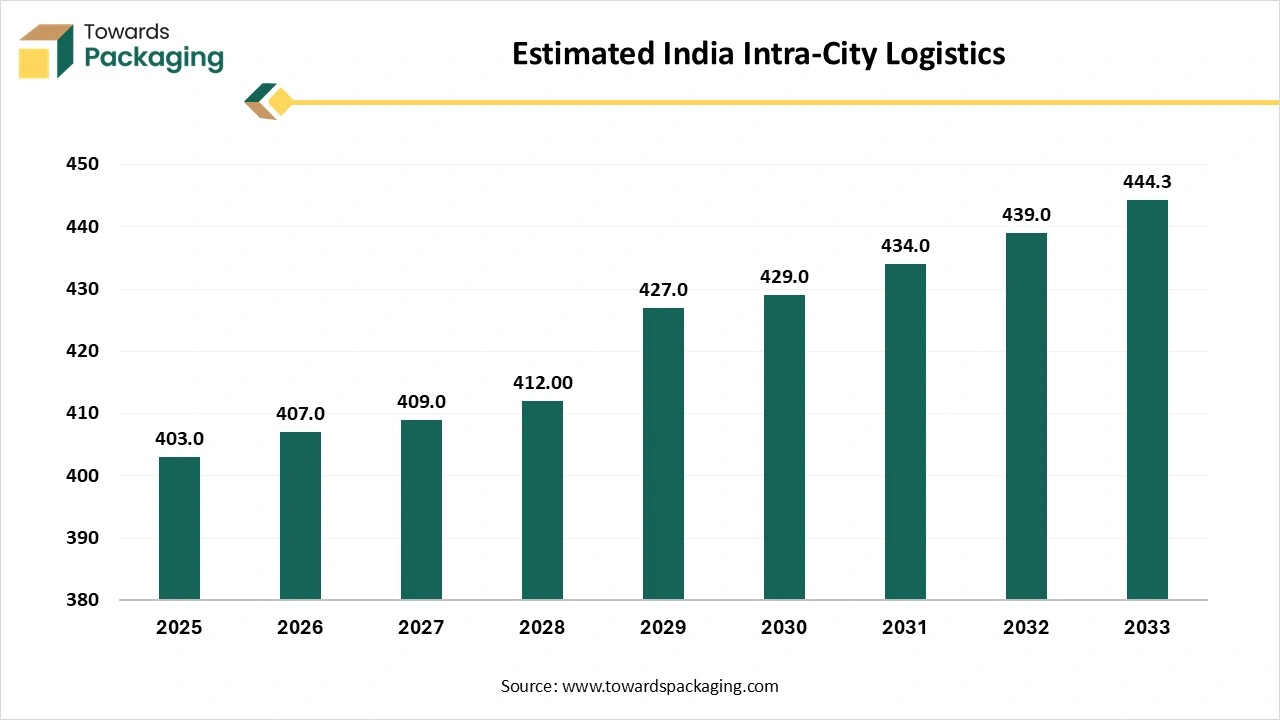

India’s strong focus on expanding its manufacturing base, supported by initiatives like “Make in India,” has increased the demand for packaging materials and tools, including tape dispensers. Sectors like automotive, pharmaceuticals, FMCG, and electronics all rely on efficient packaging solutions. With the exponential rise of e-commerce platforms such as Amazon, Flipkart, Meesho, and others, the need for quick, safe, and efficient packaging has skyrocketed. This growth directly drives demand for manual and automatic tape dispensers in warehouses, delivery hubs, and packaging units.

India offers low-cost manufacturing capabilities and a large, skilled labor force. This allows domestic companies to produce tape dispensers at competitive prices, both for local consumption and export. India's large and growing population, along with rapid urbanization, leads to increased consumption of goods. More consumer goods production means more packaging and thus, higher demand for packaging tools like tape dispensers.

China Market Trends

The Chinese tape dispenser market is driven by the boom in e-commerce and robust manufacturing facilities in the country. China is often referred to as the "factory of the world". Its massive industrial ecosystem includes the production of tape, adhesives, and packaging machinery, giving it a strong foothold in both the supply and production of tape dispensers. China is a major exporter of tape dispensers and packaging equipment, supplying a large share of the global market. Its well-established export infrastructure, including major ports and logistics networks, facilitates efficient global distribution.

China’s large consumer base, growing e-commerce platforms, and expanding logistics sector create massive domestic demand for packaging tools, including tape dispensers. Many Chinese companies have adopted automated and high-tech production methods, improving both the quality and variety of tape dispensers, from manual to semi-automatic and automatic models. China has a well-integrated supply chain for packaging products, including raw materials, which ensures efficient and cost-effective production of tape dispensers.

Policies like “Made in China 2025” aim to move Chinese manufacturing up the value chain, supporting the development of advanced packaging equipment and increasing local innovation. China is home to some of the largest and most efficient tape and packaging machinery manufacturers, many of which serve both OEM and branded markets around the world. Chinese manufacturers are increasingly investing in product innovation, offering a wide range of dispensers tailored for different industries, retail, warehousing, logistics, and electronics.

North America is expanding rapidly due to the presence of various brands, Availability in retail chains, and distribution channels. The rise in e-commerce platforms like Amazon, Walmart, and Shopify has significantly increased the need for packaging solutions, including tape dispensers. Warehouses and fulfillment centers require fast and efficient taping solutions, driving demand for both manual and automatic dispensers. Growth in logistics and distribution centers across North America increases the need for durable and ergonomic tape dispensers. Outsourcing of packaging and logistics services boosts the usage of commercial-grade tape dispensers.

Innovations in tape dispenser technology are appealing to businesses looking for efficiency and reduced labor strain. OSHA and other workplace safety requirements in the U.S. prompt companies to invest in safe, ergonomic dispensers. Companies are adopting eco-friendly packaging practices, often supported by modern dispensers that minimize waste. Leading companies like 3M, Uline, and Scotch dominate the market and have strong distribution networks in North America. Easy availability of tape dispensers in stores like Home Depot, Staples, and Walmart supports both B2B and B2C sales.

U.S. Market Trends

The U.S. tape dispenser market is driven by the large and diverse industrial base. The U.S. is home to a wide range of industries automotive, aerospace, electronics, and consumer goods, that rely on tape dispensers for packaging and production processes. Industrial sectors are increasingly adopting automatic tape dispensers to improve efficiency and reduce labor costs. With the U.S. being home to global e-commerce giants like Amazon, the demand for packaging materials, including tape and dispensers, is consistently high.

Warehouses and distribution centers require fast, reliable, and ergonomic taping tools to handle millions of packages daily. The U.S. has a mature and expansive warehousing system that supports large-scale use of tape dispensers. Widespread outsourcing of packaging and fulfillment services increases bulk purchases of industrial tape dispensers. U.S. companies are quick to adopt new technologies like battery-operated, automatic, and programmable tape dispensers.

Home to major brands like 3M, the U.S. leads in research and development and innovation in packaging solutions, including ergonomic and eco-friendly designs. Companies like 3M, Uline, Duck Brand, and Scotch are based in the U.S. and have a strong influence on both domestic and global markets. These companies have well-established retail and wholesale distribution through stores like Walmart, Staples, and online platforms. American consumers engage in crafting, shipping, and home organizing, driving demand for consumer-grade tape dispensers.

Canada Market Trends

The Canadian tape dispenser market is driven by the advancement in automation and growing DIY and home renovation trends. The integration of automation and smart technologies is revolutionizing the market in Canada. Automated dispensers enhance efficiency and reduce labor costs, making them increasingly popular in industrial applications. Additionally, innovations like voice-activated dispensers and AI-driven models that adjust tape lengths based on package size are gaining traction, particularly in sectors requiring high-volume packaging.

The surge in e-commerce has significantly increased the demand for efficient and reliable packaging solutions. Tape dispensers play a crucial role in streamlining packaging processes, ensuring secure deliveries, and enhancing customer satisfaction. This trend is particularly evident in Canada, where the e-commerce sector is expanding rapidly. There is a growing consumer preference for environmentally responsible products. Manufacturers in Canada are responding by developing tape dispensers made from recyclable and biodegradable materials. This shift aligns with global sustainability goals and appeals to environmentally conscious consumers.

The increasing popularity of DIY projects and home renovations is fueling the demand for masking tape dispensers and double-sided tape dispensers. These tools provide practical solutions for a variety of applications, from crafts to home improvements, contributing to market growth. Canada is home to significant manufacturers like Intertape Polymer Group (IPG), which is the second-largest tape producer in North America. IPG's extensive manufacturing facilities and product offerings strengthen Canada's position in the global tape dispenser market.

Europe is driven by several key factors, including advanced manufacturing capabilities, a strong presence of established packaging and office supply companies, and high demand from diverse industries such as e-commerce, logistics, and retail. The region also benefits from a well-developed distribution network and strong regulatory standards that encourage the use of sustainable and efficient packaging solutions. Additionally, growing awareness about workplace efficiency and ergonomics has spurred demand for innovative and user-friendly tape dispensers across both commercial and industrial sectors.

By Product Type

By Technology

By End-Use

By Region

January 2026

January 2026

January 2026

January 2026