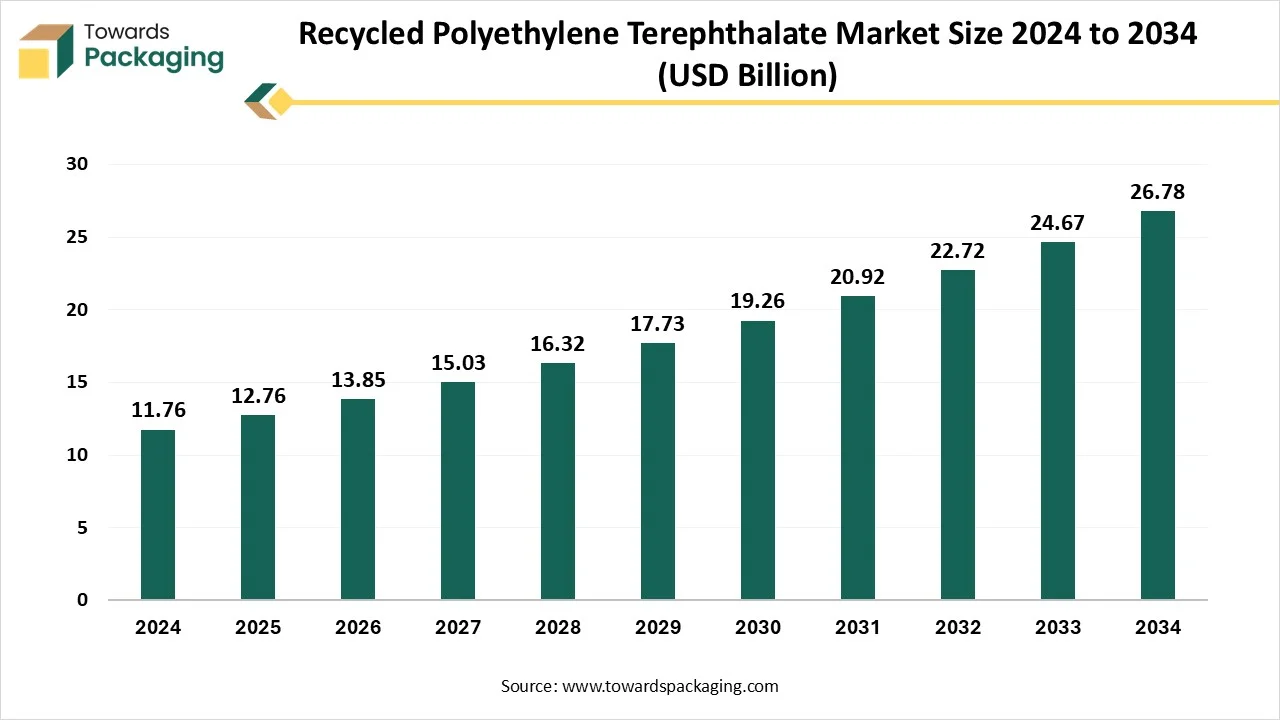

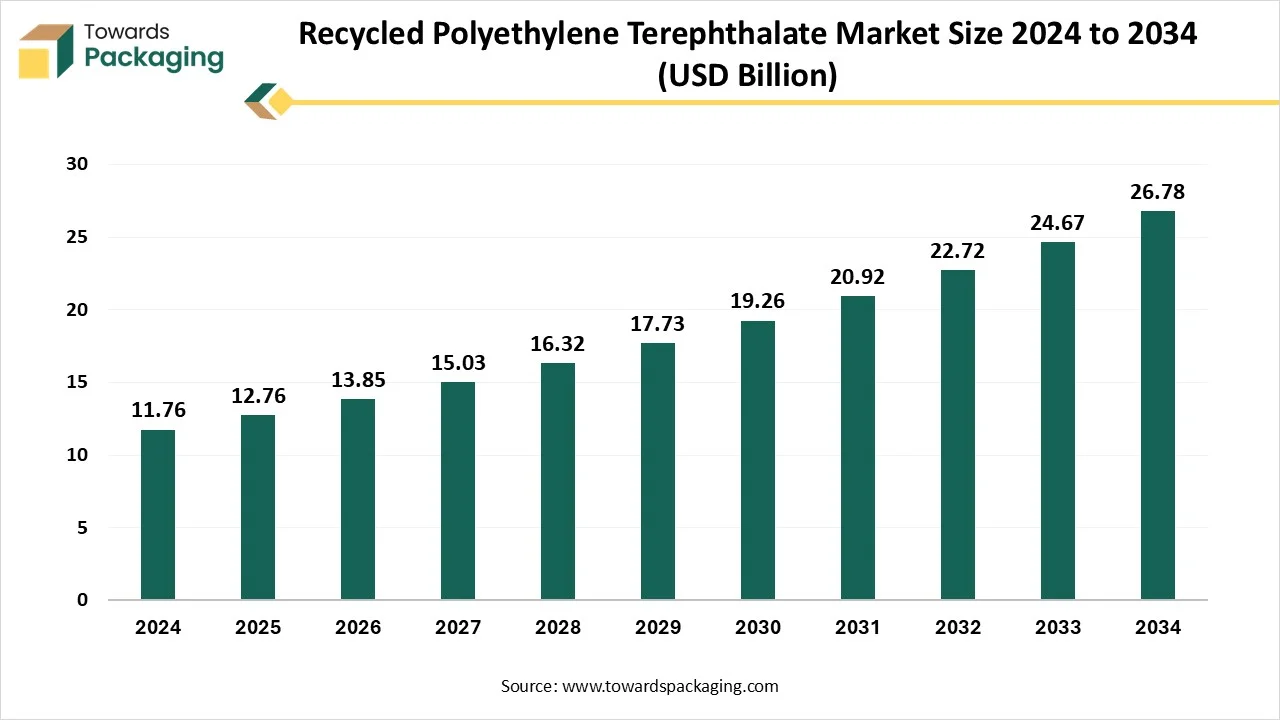

The recycled polyethylene terephthalate (rPET) market is forecasted to expand from USD 13.85 billion in 2026 to USD 28.94 billion by 2035, growing at a CAGR of 8.53% from 2026 to 2035. The report includes source-wise volumes (bottles, films), grade (A/B), form (flakes/chips), product (clear/colored), and end-use distribution. Regional datasets cover North America, Europe, Asia Pacific, Latin America, and MEA, with APAC leading 2024 consumption and NA/EU showing strong recycling efficiency gains. It further includes PET collection rates, EU28 LDPE/LLDPE trade statistics, PE film recycling efficiencies, logistics models, distributor networks, and competitive analysis of Indorama, Placon, Clear Path & PolyQuest, along with a complete value chain from feedstock sourcing to converter supply.

The beverage, food, and textile industries are major consumers, driven by efforts to reduce plastic waste and carbon footprint. Advancements in recycling technologies and strong consumer preference for eco-friendly products are also contributing to market expansion. Additionally, brand owners and manufacturers are incorporating rPET into their packaging to meet sustainability goals and circular economy targets.

The plastic material made from recycled used PET products, such as water bottles, food containers, and other packaging items, is known as recycled polyethylene terephthalate (rPET). PET (Polyethylene Terephthalate) is a type of clear, strong, and lightweight plastic commonly used for packaging beverages and foods. When these PET products are collected and processed through mechanical or chemical recycling, they are cleaned, melted, and reformed into rPET pellets or flakes, which can then be reused to manufacture new packaging, textiles, automotive parts, and more. Using rPET helps reduce plastic waste, conserve natural resources, and lower greenhouse gas emissions, making it an important component of sustainable materials and the circular economy.

| Metric | Details |

| Market Size in 2025 | USD 12.76 Billion |

| Projected Market Size in 2035 | USD 28.94 Billion |

| CAGR (2025 - 2035) | 8.53% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Source, By Grade, By Form, By End-use and By Region |

| Top Key Players | Placon, Clear Path Recycling LLC, Verdeco Recycling, Inc., Indorama Ventures Public Ltd. |

AI integration can significantly enhance the recycled polyethylene terephthalate industry by boosting efficiency, quality, and sustainability throughout the recycling value chain. AI-powered vision systems and machine learning algorithms enable automated sorting and precise contamination detection, improving feedstock purity and reducing material loss. Within recycling facilities, AI optimizes operations by monitoring real-time process parameters and adjusting machinery for optimal performance, while predictive maintenance tools help minimize equipment downtime.

AI enhances supply chain transparency through smart tagging and blockchain, allowing brands to verify rPET content and meet sustainability goals. Demand forecasting and material flow modelling also benefit from AI, ensuring efficient logistics, steady rPET supply, and optimized inventory management. Furthermore, AI-driven analysis of consumer behaviour supports targeted recycling awareness campaigns, encouraging higher PET collection rates. Altogether, AI fosters a smarter, more sustainable, and circular rPET ecosystem.

Key Players: Informa Ventures, Alpha, Sorepla

Key Players: Indorama Ventures, ALBA Group, Sorepla

Key Players: Indorama Ventures, ALBA Group, Veolia

(Values based on PRE market estimates and polymer purity assumptions: Household 70%, Commercial 85%, Agricultural 50%) Polyethylene (PE) flexible films such as packaging films, agricultural films, and commercial wrapping are widely used, but recycling performance varies greatly depending on their source.

In 2018, about 8.5 million tonnes of PE flexible films were placed on the market across Europe. Out of this, 2.6 million tonnes of sorted film bales were collected and sent to recycling facilities. However, due to contamination and the presence of non-PE materials, only 2.01 million tonnes of actual PE content reached recyclers resulting in an overall recycling rate of just 23%.

Recycling efficiency differs by sector:

This data highlights that improving collection systems, reducing contamination, and designing mono-material packaging will be key to increasing recycling rates.

| Product/Application Segment | Share of PE Flexible Films (%) | Approx. Volume (Mt) |

| Non-Food Packaging Films | 41% | 3.48 – 3.69 |

| Food Packaging | 23% | 1.96 – 2.07 |

| Bags & Sacks | 22% | 1.87 – 1.98 |

| Agricultural Films | 7% | 0.60 – 0.63 |

| Building & Construction Films | 2% | 0.17 – 0.18 |

| Other | 5% | 0.42 – 0.45 |

| Total | 100% | 8.50 – 9.00 Mt |

| Sub-Category | Share % | Approx. Volume (Mt) |

| Stretch Film | 18% | 1.53 – 1.62 |

| Shrink Film | 14% | 1.19 – 1.26 |

| Film on Reel | 9% | 0.77 – 0.81 |

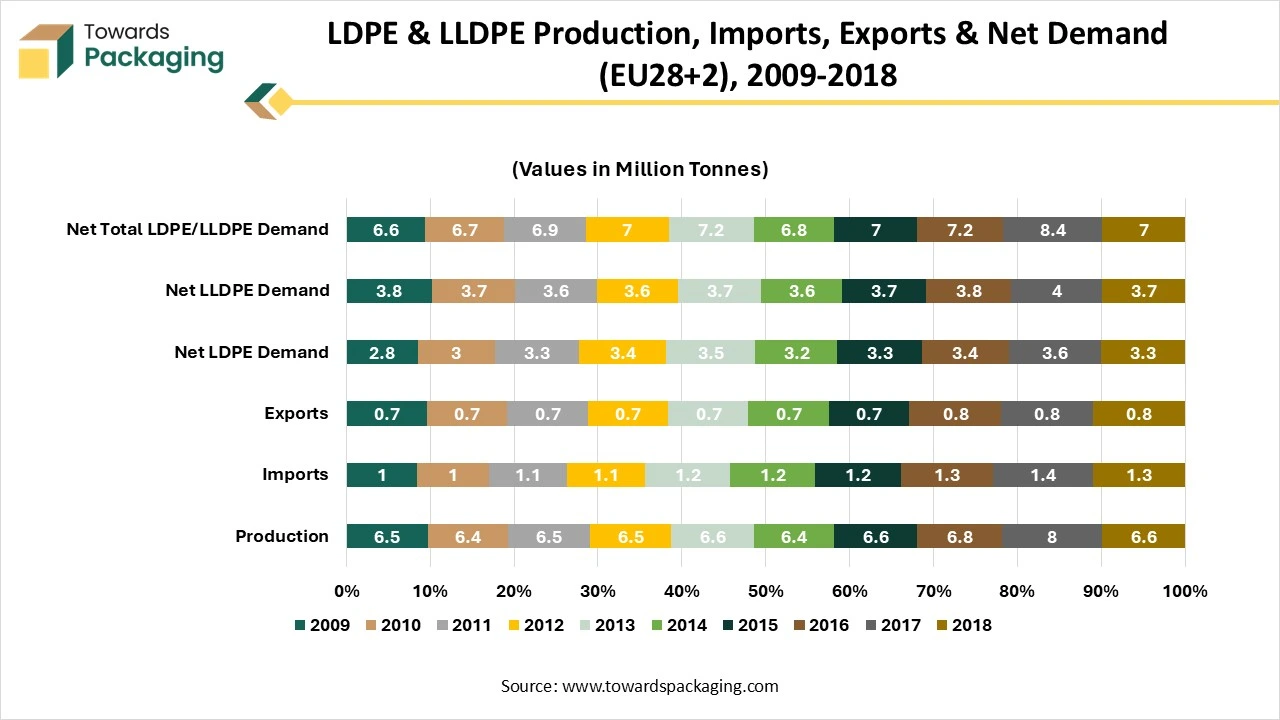

| Product Category | EU28 Trade Status | Quantity | Value Impact |

| LLDPE (Primary form) | Net Importer | +720 Kt imports | Negative trade balance |

| LDPE (Primary form) | Net Exporter | +330 Kt exports | Positive impact |

| Combined LDPE/LLDPE | Net Importer | - | –€200M |

| Film & Sheet | Net Exporter | - | +€950M |

| Sacks & Bags | Net Importer | - | –€700M |

| Major sources/destinations | Imports: Saudi Arabia | Exports: China, Turkey | - |

Rising Environmental Concerns and Government Regulations, and Policies

Increased awareness about plastic pollution and its environmental impact is prompting both consumers and industries to shift toward sustainable alternatives like recycled polyethylene terephthalate. Regulatory push for reducing plastic waste is encouraging recycling and the use of recycled materials. Governments worldwide are implementing stricter regulations regarding plastic use and waste management, including bans on single-use plastics and mandates for recycled content in packaging.

Limited Collection and Recycling Infrastructure and Competition from Virgin PET

The key players operating in the market are facing issues due to limited collection and recycling infrastructure and inconsistent supply of raw material, which is estimated to restrict the growth of the market. In many developing regions, inadequate waste collection and segregation systems hinder the availability of high-quality PET waste for recycling. Lack of organized infrastructure leads to contamination and lower recycling efficiency. Virgin PET is often cheaper due to lower oil prices or subsidized production, making it more attractive to manufacturers despite environmental concerns.

Rapid urbanization, industrialization, and growing environmental awareness in Asia-Pacific, Latin America, and Africa create strong demand for sustainable packaging solutions. Governments in these regions are launching recycling initiatives and infrastructure improvements, opening up market potential.

Global brands like Coca-Cola, PepsiCo, Nestle, and Unilever are committing to using recycled content, creating consistent and large-scale demand for recycled polyethylene terephthalate. These sustainability goals are boosting investments in recycled Polyethylene terephthalate infrastructure and capacity.

In April 2025, an important step toward achieving India’s circular economy objectives was taken with the approval of recycled polyethylene terephthalate (PET) for use in food-contact applications by the country’s food safety body. In order to allow the use of recycled PET for food packaging, the Food Safety and Standards Authority of India (FSSAI) announced a change to the 2018 Food Safety and Standards (Packaging) Regulations. The decision became legally enforceable when the change was formally published in the Indian Gazette on March 28, 2025. The new provision states that all applicable national standards or rules must be followed and that such materials may be used in food packaging "as and when standards and guidelines are notified by the Food Authority."

Industry executives have praised the action and forecast a sharp increase in the market for recycled PET. The director general of the Indian Association of PET Recyclers (APR Bharat), Shailendra Singh, stated that this is a significant development that will hasten the use of recycled PET in food packaging. It will provide a strong boost to the country's circular economy. The approval's timing coincides with an impending regulatory change in India brought forth by the Plastic Waste Management Rules. Rigid plastic containers, including beverage bottles, must contain at least 30% recycled PET starting on April 1, 2025. A PET recycling capacity of 400,000 metric tons per year is now in operation in India. APR Bharat claims that recyclers are ready to handle the growing demand. According to the organization, around USD 950 million has recently been invested in cutting-edge recycling facilities. The collaboration between Indorama Ventures and Varun Beverages, the biggest PepsiCo bottler outside of the U.S.

The bottles and containers by source segment hold a dominant position in the recycled polyethylene terephthalate market due to several key factors. PET bottles and containers, especially those used for beverages, water, and food products, are produced and discarded in high volumes, providing a steady and abundant source of recyclable material. These items are also easier to collect, sort, and process compared to complex or multi-layered plastics, making them a preferred input for rPET production. Deposit-return systems and curbside recycling programs in many regions specifically target PET bottles, further enhancing recovery rates and feedstock quality. Additionally, recycled PET from bottles is capable of meeting food-grade standards set by regulatory bodies such as the FDA and EFSA, enabling its use in closed-loop recycling systems. Growing regulatory and corporate pressures to increase recycled content in packaging also support the dominance of this segment, as bottles are ideal for producing high-quality, sustainable rPET.

The films and sheets source segment is growing at the fastest rate in the recycled polyethylene terephthalate market due to several key factors. Advancements in recycling technology have improved the quality and purity of rPET films and sheets, such as biaxially oriented PET (BoPET), making them suitable for high-performance applications in packaging, electronics, automotive, and textiles. These improvements allow rPET films to match the barrier, mechanical, and thermal properties of virgin PET. Additionally, rising consumer and regulatory demand for sustainable packaging is accelerating the use of rPET films in food, beverage, and labeling applications, particularly as single-use plastic bans and eco-conscious purchasing influence market behaviour. The versatility of rPET films and sheets further supports their rapid growth, with applications ranging from biodegradable packaging and electrical insulation to automotive laminates and flexible electronics. These combined factors are driving the segment’s strong momentum in the rPET market.

| Year | Bottles and Containers | Films and Sheets | Others |

| 2024 | 6.47 | 3.53 | 1.76 |

| 2025 | 7.05 | 3.75 | 1.97 |

| 2026 | 7.67 | 4.07 | 2.11 |

| 2027 | 8.34 | 4.59 | 2.10 |

| 2028 | 8.98 | 4.93 | 2.41 |

| 2029 | 9.91 | 5.41 | 2.39 |

| 2030 | 10.65 | 5.16 | 3.41 |

| 2031 | 11.78 | 6.47 | 2.60 |

| 2032 | 12.82 | 7.01 | 2.81 |

| 2033 | 14.13 | 7.64 | 2.79 |

| 2034 | 14.26 | 8.32 | 4.09 |

The Grade A segment holds a dominant position in the recycled polyethylene terephthalate market due to its high purity, quality, and broad applicability. Derived primarily from clean, post-consumer PET sources like clear beverage bottles, Grade A rPET undergoes advanced cleaning and decontamination processes to ensure superior quality. It meets strict regulatory standards set by agencies such as the FDA and EFSA, making it suitable for direct food and beverage contact. This has led to strong demand from industries like food and beverage packaging, pharmaceuticals, and personal care, where clarity, strength, and safety are critical. Additionally, Grade A rPET is preferred for premium applications such as bottle-to-bottle recycling and high-end packaging. As sustainability targets become increasingly important, major brands are committing to the use of high-quality recycled content, further driving demand for Grade A rPET and reinforcing its dominant position in the market.

The recycled polyethylene terephthalate flakes form segment holds a dominant position in the rPET market due to its widespread availability, cost-effectiveness, and versatility. rPET flakes are the most commonly produced output during the mechanical recycling of PET bottles and containers, making them readily available across global markets at relatively low cost. These flakes are used in a broad range of industries, including packaging, textiles, automotive, and construction, which drives consistent demand. Their ease of processing through methods like extrusion and injection molding makes them highly convenient for manufacturers. Additionally, the textile industry is a major consumer of rPET flakes, particularly for the production of polyester fibers. Furthermore, flakes support closed-loop recycling systems, such as bottle-to-bottle recycling, helping companies meet sustainability targets and regulatory requirements. These combined factors contribute to the flakes form segment’s dominance in the rPET market.

The clear recycled polyethylene terephthalate segment holds a dominant position in the rPET market due to its superior optical properties and wide applicability. Clear rPET closely resembles virgin PET in terms of transparency and brightness, making it highly desirable for packaging applications where product visibility and shelf appeal are important. It also meets stringent food-grade standards set by regulatory bodies like the FDA and EFSA, allowing its use in direct-contact food and beverage packaging. Consumer preference for transparent packaging further drives demand for clear rPET over tinted or opaque alternatives. Additionally, clear rPET commands a higher market value, encouraging recyclers and manufacturers to focus on clear PET waste streams. It is also easier to identify and sort using optical sorting technologies, ensuring consistent feedstock quality. Moreover, clear rPET is ideal for closed-loop bottle-to-bottle recycling systems, helping companies meet recycled content targets and support circular economy initiatives.

The colored recycled polyethylene terephthalate product segment is experiencing the fastest growth in the rPET market due to its expanding use in various non-food applications. Industries such as textiles, automotive, construction, and consumer goods are increasingly adopting colored rPET, where transparency is not a primary requirement. It is also more cost-effective than clear rPET, as it typically involves lower sorting and processing costs, making it attractive for budget-conscious applications.

Advancements in recycling technologies have enabled more efficient collection and processing of colored PET waste, increasing its availability. Additionally, the textile industry a major consumer of colored rPET for polyester fiber is growing rapidly, driven by sustainability initiatives and rising demand for eco-friendly apparel. Furthermore, colored rPET allows manufacturers to create distinct, branded products without relying on additional dyes or pigments, reducing environmental impact and production costs. These factors collectively contribute to the accelerated growth of the colored rPET segment in the global market.

The fibers end-use segment is dominant in the recycled polyethylene terephthalate market due to its extensive use in the textile industry for producing polyester fibers. These fibers are widely used in clothing, upholstery, carpets, and industrial applications. The segment benefits from high demand for cost-effective and sustainable materials, especially as the fashion and textile industries commit to eco-friendly practices. Additionally, rPET fibers are durable, lightweight, and easy to produce, making them a preferred alternative to virgin polyester across multiple applications.

The food and beverage containers and bottles end-use segment is the fastest growing in the recycled polyethylene terephthalate market due to rising consumer demand for sustainable packaging and increasing regulatory pressure to incorporate recycled content. Many global food and beverage brands are committing to circular economy goals, driving the adoption of rPET in bottle-to-bottle recycling. Clear rPET meets food-grade safety standards, making it ideal for direct contact packaging. Additionally, advancements in decontamination technology and improved recycling infrastructure have enabled safer, high-quality rPET for food applications, accelerating growth in this segment.

Asia Pacific dominates the recycled polyethylene terephthalate market due to its large-scale PET consumption, strong manufacturing base, and increasing focus on sustainability. Countries like China and India are major contributors, with China leading as both the largest producer and exporter of rPET, supported by a well-established recycling infrastructure. India’s rapidly growing textile industry drives strong demand for rPET fibers, further supported by government initiatives like Extended Producer Responsibility (EPR). Japan and South Korea contribute advanced recycling technologies, efficient waste management systems, and high-quality food-grade rPET production. Additionally, Southeast Asian nations such as Thailand, Indonesia, and Vietnam are emerging as key players due to growing investments in recycling infrastructure and rising exports of rPET materials. The region’s dominance is further fuelled by increasing environmental regulations, corporate sustainability commitments, and the widespread use of rPET in textiles, packaging, and consumer goods industries.

China Market Trends

Largest producer and consumer of rPET globally. Strong infrastructure for PET bottle collection and recycling. Major exporter of rPET flakes and fibers. Government policies are increasingly promoting circular economy practices.

India Market Trends

Rapidly expanding textile and apparel industry, a major consumer of rPET fibers. Increasing adoption of sustainability in the packaging and clothing sectors. Government initiatives such as Extended Producer Responsibility (EPR) are boosting recycling rates.

Japan Market Trends

Advanced waste segregation and recycling systems lead to high recovery rates of PET bottles. Strong demand for food-grade rPET in beverage packaging. Corporate focus on zero-waste and sustainable packaging solutions.

South Korea Market Trends

High awareness and strong regulatory policies on plastic waste management. Robust domestic recycling industry with emphasis on high-quality rPET production.

The North America market is expanding rapidly due to the growing rapidly due to corporate sustainability commitments and advanced recycling technologies in the region. The U.S. and Canada are implementing strict policies around plastic waste reduction, recycling mandates, and sustainable packaging standards. Laws such as California’s SB 54 and Canada’s Zero Plastic Waste initiative are pushing brands to adopt rPET. Major consumer brands headquartered in North America (e.g., Coca-Cola, PepsiCo, P&G) are pledging to use high percentages of recycled content in packaging. These commitments drive consistent demand for food-grade and industrial-grade rPET. North America is home to numerous innovative recycling companies developing cutting-edge chemical recycling, closed-loop systems, and high-efficiency material recovery facilities (MRFs). Consumers in the U.S. and Canada are increasingly concerned about plastic waste and prefer products with recycled or eco-friendly packaging, boosting recycled polyethylene terephthalate product sales.

The Europe region is expected to grow at a notable rate in the foreseeable future. The European Union has some of the most comprehensive waste management and recycling regulations globally, including the EU Plastics Strategy and Single-Use Plastics Directive. Mandatory targets for recycled content in plastic packaging (e.g., 25% rPET in PET bottles by 2025 and 30% by 2030) drive the demand for rPET. The EU circular economy action plan promotes sustainable product design, waste reduction, and increased use of secondary raw materials like rPET.

Extended Producer Responsibility (EPR) schemes hold producers accountable for the lifecycle of their packaging, encouraging the use of recycled materials. Europe has a highly developed network of material recovery facilities (MRFs), deposit return schemes (DRS), and collection systems, ensuring a steady supply of clean PET waste for recycling. Most European-based companies in the food, beverage, and fashion industries are actively transitioning to rPET as part of their sustainability goals, e.g., Nestle, Danone, Adidas, and H&M.

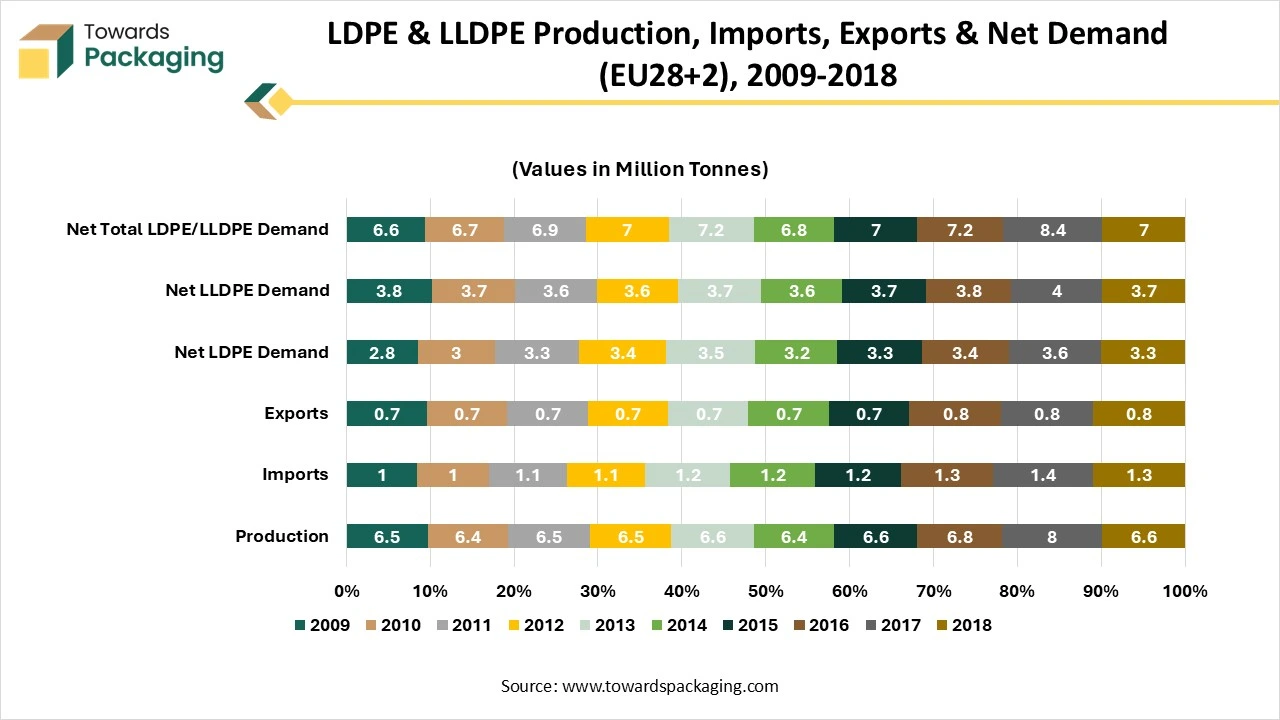

The data shows the trend in production and use of LDPE and LLDPE-the main polymers used in flexible packaging films in the EU28+2 region over the past decade. Production levels remained relatively stable between 6.1 and 6.7 million tonnes, except for 2017, when production peaked at 8 million tonnes before returning to typical levels in 2018. Net demand for LDPE and LLDPE stayed steady between 6.5 and 7.1 million tonnes, exceeding production by about 0.5 million tonnes in 2018, which had to be covered through imports.

In 2018, the total demand for PE flexible films was estimated at 8.5-9 million tonnes, of which 1.2-1.3 million tonnes came from recycled material. When including other polymers such as PP, multilayer materials, PET, PVC and biodegradable plastics, the overall flexible film market reached 13–15 million tonnes. PP and multilayer films each accounted for 2-2.5 million tonnes.

By Source

By Grade

By Form

By End-use

By Region

March 2026

March 2026

February 2026

February 2026