Barrier-Coated Flexible Paper Packaging Market Overview Segmentation, Value Chain, and Manufacturer Analysis

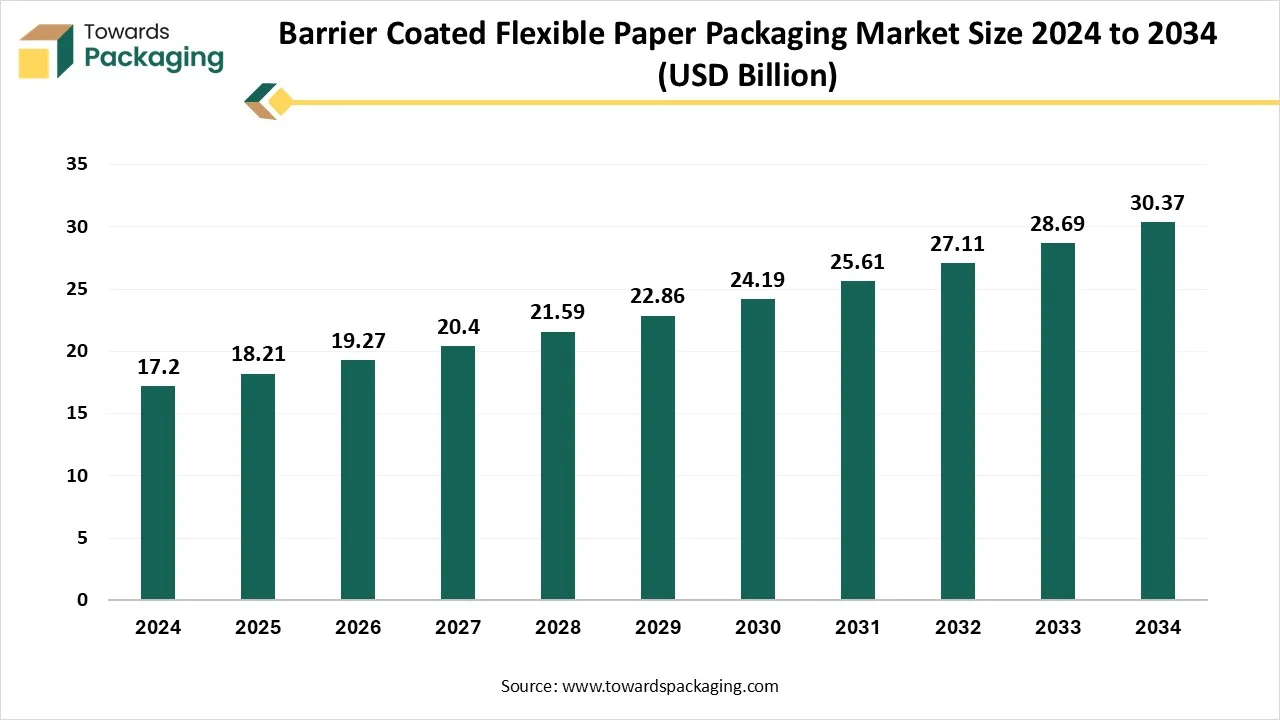

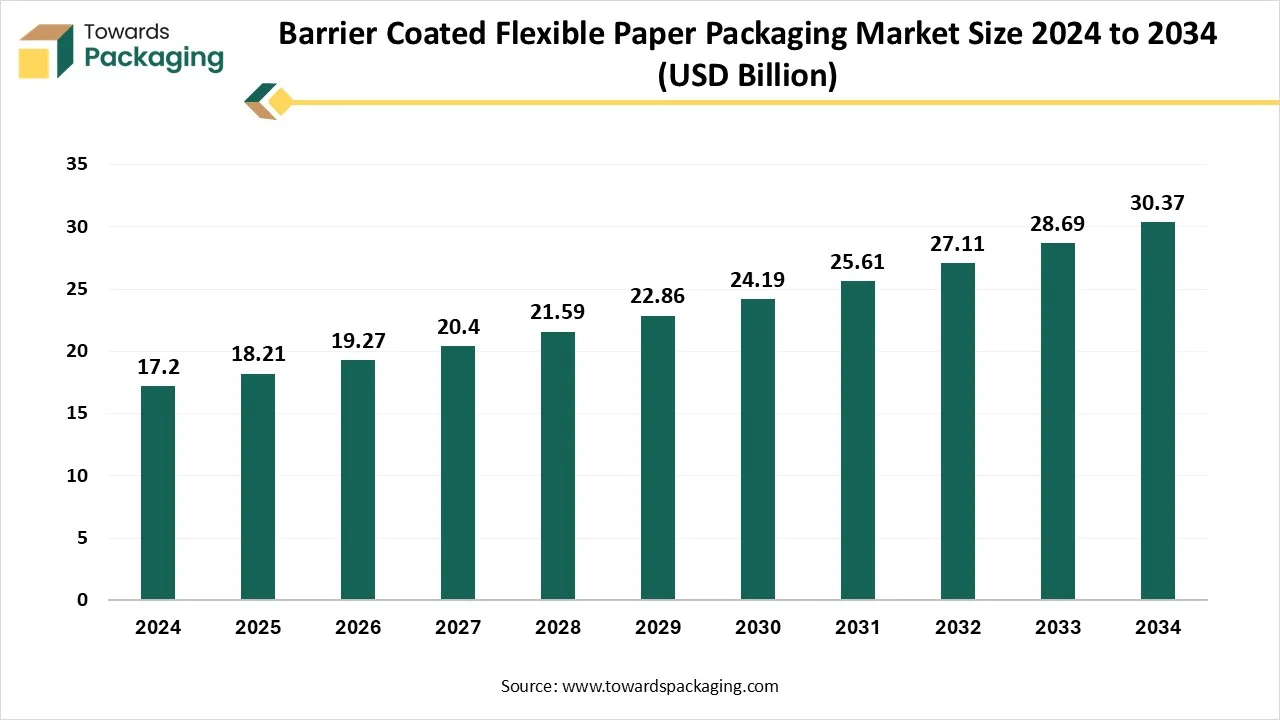

The barrier-coated flexible paper packaging market report presents a complete assessment of the industry, covering market size from USD 18.21 billion in 2025 to USD 30.37 billion by 2034, alongside a 5.85% CAGR. It includes deep insights into trends such as sustainable coatings, biodegradable materials, and rising demand for pouches and sachets. The study features full segmentation by coating type, barrier property, packaging format, end-use industry, and paper type, including all statistical values (e.g., Europe’s 34% share in 2024, food & beverages at 55%, polymer coatings at 42%).

It provides regional analysis across North America, Europe, Asia-Pacific, Latin America, and MEA, competitive profiling of top companies like Mondi, Amcor, Huhtamaki, Sappi, DS Smith, plus value chain analysis, trade flow mapping, and manufacturer/supplier intelligence.

Key Takeaways

- In terms of revenue, the market is valued at USD 18.21 billion in 2025.

- The market is projected to reach USD 30.37 billion by 2034.

- Rapid growth at a CAGR of 5.85% will be observed in the period between 2025 and 2034.

- Europe dominated the barrier-coated flexible paper packaging market with the largest revenue share of 34% in 2024.

- Asia Pacific is the fastest-growing region in the market.

- By coating type, the polymer coating segment contributed the biggest revenue share of 42% in 2024.

- By coating type, the biodegradable coating segment will expand at a significant CAGR between 2025 and 2034.

- By barrier type, the moisture barrier segment contributed 46% revenue share in 2024.

- By barrier type, the aroma/ flavor segment will expand at a significant CAGR between 2025 and 2034.

- By packaging format, the pouches and sachets segment contributed 38% revenue share in 2024.

- By packaging format, the wraps and rolls packaging segment will expand at a significant CAGR between 2025 and 2034.

- By paper type, the bleached kraft paper segment contributed the biggest revenue share of 40% in 2024.

- By paper type, the greaseproof paper segment will expand at a significant CAGR between 2025 and 2034

- By end-use, the food and beverages segment dominated the market with a share of 55% in the year 2024.

- By end-use, the personal care and cosmetics segment is expected to grow significantly over the studied period.

Market Overview

The barrier coated flexible paper packaging market involves the development and supply of flexible paper packaging materials enhanced with barrier coatings (such as polymer, wax, aluminium, or bio-based coatings) to protect against moisture, oxygen, grease, and aroma loss. These are the products that are deliberately substituting plastic-based packaging with biodegradable and sustainable alternatives while also being functional. Barrier coatings are complicated to grow the durability and protective capacity of paper-based products, which enables paper use in beverages, food, personal care, or pharmaceuticals, among other uses.

The barrier-coated flexible paper packaging industry is looking for constant growth, encouraged by surrounding issues, while experiencing the planet and demand for more environmentally friendly consumer packaging options. In addition, explosive development in e-commerce and demand for durable and lightweight packaging solutions have further driven the share in these products. Companies across a huge range of industries are accepting the surge of barrier-coated paper packaging as a channel to develop sustainability efforts and make an attraction for ecologically-minded consumers.

Barrier-coated flexible paper packaging Market Trends

- Barrier-coated flexible paper packaging lowers exposure to moisture and oxygen, preventing spoilage and maintaining the integrity of products over time. This lessens the demands for frequent substitutions, contributing to cost efficiency and a better customer experience.

- High-barrier films make sure that products like coffee, crisps, and similar items that are sensitive to environmental elements like taste, aroma, and texture remain fresh for long periods. By protecting these items from oxygen and moisture, the packaging makes sure that consumers enjoy high-quality products as needed, even after travelling or prolonged storage.

- By avoiding external contaminants such as pollutants, dust, and micro-organisms, high-barrier packaging assists in tracking safety and cleanliness, lowering the dependency on chemical preservatives, and expanding the product’s natural shelf life.

- Also, the industry is experiencing a growth in the acceptance of bio-based and compostable barrier coatings, which are increasingly favored because of their compatibility with circular economy goals. Inventions in nanotechnology and biotechnology have allowed the growth of high-performance bio-based coatings derived from chitosan, starch, cellulose, and polylactic acid (PLA), serving both barrier functionality and environmental compatibility.

- These innovations are also driven by rising regulatory pressures to lower the environmental footprint of their packaging materials, specifically in the food and consumer goods sectors.

- Digital printing and intelligent coating technologies are also gaining attention, allowing tailored packaging with integrated functionalities like freshness indicators, QR Codes, and anti-counterfeit features. Also, manufacturers are heavily investing in multifunctional barrier coatings that integrate grease barriers and oxygen to serve as a huge range of uses.

- Another main trend includes the usage of hybrid coatings -combinations like metallic, polymeric, or ceramic materials -which develop mechanical strength and thermal resistance, serving versatility across different packaging formats.

Advanced Technologies Boosting the Flexible Paper Packaging Industry

The integration of Industry 4.0 and advanced technologies is changing the barrier-coated flexible paper packaging sector. Smart manufacturing practices -like IoT-enabled machines, automation, and real-time data analytics -are developing production effectiveness, lowering waste, and improving quality control in the coating and paper conversion process. Technological advancements in barrier coatings now include water-based coatings, bio-based polymers, and nanomaterials, providing perfect resistance to grease, mixture, and oxygen without compromising recyclability. Digital printing plays an important role by allowing high-resolution, tailored packaging solutions with shorter turnaround times. It enables small-batch printing with different data, perfect for brand differentiation and seasonal or localized campaigns.

Market dynamics

Driver

The bulk of flexible paper packaging in the industry includes laminated composites, which are disposed of via collection systems for plastic packaging, which can only be recycled by specialised companies. For cardboard and paper, the waste paper cycle has been successful. Therefore, it would be perfect for flexible barrier packaging created from paper, which could also be included in this material cycle. The recycling sector, hence, must now make sure that a secure recycling stream is established so that these latest sustainable paper solutions can be utilised on a large scale to grow the circular economy capable of this raw material selection. At the current time, there is a demand to continue in the market to display paper packaging as a possible alternative to plastic packaging, and to implement this slowly in packaging development.

Restraint

One major hurdle is the cost of creating and applying these coatings. While prices are falling as technology grows, primary investments can deter small businesses. The coating is mostly compatible with flexo, gravure, and several coating applications like air knife coater and curtain coater, too. A double coat can develop the barrier characteristics in which the first coat is applied as a primer with a top coat. While gravure or flexo printing needs lower deposit capacity and specifically needs low viscosity with high dry content, offline coating machines can need a higher deposit with higher viscosity as long as the drying capacity is sufficient.

Opportunity

Minimalist designs place a rigid importance on sustainability, but receiving the materials mix matters as much as lowering the visual noise. With the minimization demand in the Packaging and Packaging Waste Regulation (PPWR), it is ready to make excess packaging a liability. , as brands now experience legal and financial pressure to serve a snug-fit, material-effective format. This means reducing weight, avoiding unwanted components, and serving it. Another main trend is paperization, as swapping plastic for fiber-based packaging. It is due to barrier coatings that paper is substituting for plastic in areas like mailers, trays, and even some flexible wraps. These paper products are specifically recyclable and sourced from carefully managed forests, thereby reducing their footprint.

Segmental Insights

By Coating Type

How did the Polymer Coating Dominate the Coating Type in the Barrier-coated Flexible Paper Packaging Market?

Polyethylene or polythene is a type of thermoplastic material. It is available in various crystalline structures, referred to as HDPE, LDPE, and LLDPE. This is prevalently utilised in production by addition or radical polymerization. It is applicable in a large array of uses. Plastic containers, bags, bottles, plastic toys, etc. It is durable and lightweight in nature, and one of the most prevalent plastics. It is greatly utilised for frozen foods, cereal liners, bottles, and yogurt containers. It is created from the ethylene or polymerization monomer. The PE chains are created by radical or addition polymerization. The possible synthesis procedures are Metalocene catalysis and Ziegler-Natta Polymerization. At the same time, polyethylene terephthalate means a chemical compound which is a form of thermoplastic polymer resin that is widely used as a fiber for clothing, thermoforming for production, and as generating engineering resin. It is also utilised as a corrosion preventive coating.

Starch-based coatings work perfectly in sustainable food packaging, as they are recyclable and compostable. They fit perfectly within the aim of a circular economy. Furthermore, by including active compounds like starch, it is crucial to make functional or active packaging materials. On the other side, chitosan is another rising star as a bio-coating material because it is naturally sourced, easily biodegradable, and meets several useful needs. Several people make transparent and flexible films from chitosan, and these films support paper, creating an unbroken barrier on the surface.

How did the Moisture Barrier Dominate the Barrier-coated Flexible Paper Packaging Market?

Moisture barrier packaging serves this important level of protection, preventing moisture from the surrounding environment from polluting package-sealed products. This kind of packaging is specifically useful when it comes to keeping delicate contents, such as food items or pharmaceuticals. In order to avoid moisture damage and track the quality of stored items, moisture barrier packaging material needs to consider some main criteria. Primarily, some water vapor transmission rate should be included. This is important because it is the rate at which water vapor travels through a specific material. The lower the WVTR, the more effective the moisture barrier of the material is.

Aroma barriers are specialized layers applied in barrier-coated flexible packaging to protect against the loss of fragrance and protect against external odours. This assists in maintaining the product’s original perfume, freshness, and quality, especially crucial for cosmetics, food, and luxury teas and coffees. These barriers enhance shelf life and consumer experience without compromising on availability.

For instance, to this,

- On 20 September 2024, Koehler's paper revealed a product launch specially for tea packaging that serves as a solution for the high demand for organic Tea and sustainable packaging in the Tea industry. (Source: FOOD ENGINEERING)

How did the Pouches and Sachets Dominate the Barrier-coated Flexible Paper Packaging Market?

Flexible pouches have become the fastest-growing packaging design across sectors due to their convenience, versatility, and sustainable advantages. One of the advantages is cost-effectiveness as compared to rigid packaging like bottles, cans, or jars. Pouches use less material, resulting in lower production costs as well as reduced travelling expenses. Their heavy product-to-product ratio also results in less material waste. The shape flexibility enables inventive structural designs that are distinguished on retail shelves. Flexible pouches also have a smaller environmental footprint, generating less greenhouse gas during production and transportation. On the other hand, a sachet is a one-time utilised small pouch or bag with a seal on three or four sides. These flexible, tiny pouches have an easy opening system on the end. Also, sachet packaging includes different products like medicine, food, or cosmetics for a single serving.

Wraps and rolls created from barrier-coated flexible paper are utilised for packaging items like chocolates, snacks, bakery products, and deli foods. They serve protection against grease, moisture, and oxygen while tracking printability and flexibility. These eco-friendly alterations to plastic wraps ensure product freshness and assist sustainable packaging goals. These wraps and rolls integrate the functionality of plastic with the eco-appeal of paper, making them a rising choice for brands aiming to reduce plastic wastage without compromising on performance.

How does the Bleached Kraft Paper dominate the Paper Type in the Barrier-coated Flexible Paper Packaging Market?

Bleached kraft paper is greatly utilised in packaging food products, including bakery items, dairy items, confectioneries, and beverages. Its potential to serve as a strong and durable packaging solution, while also being safe for direct food contact, makes it a selected choice in the sector. The pharmaceutical sector is another crucial end-user of bleached kraft paper. The demand for secure and durable packaging for pharmaceutical products is important, and bleached kraft paper completes this demand with its power and barrier characteristics. The developing pharmaceutical sector, driven by growing healthcare needs and advancements in medical technology, is expected to contribute to the growth of this segment.

- For instance, to this,Solenis, a top producer of specialty chemicals, had partnered with Heidelberger Druckmaschinen, an inventive technology company with a top position in the worldwide printing sector, to develop a more cost-effective way of mixing barrier coatings for paper packaging directly linked with the current flexographic printing procedure. (Source: Solenis)

Greaseproof paper is a unique kind of paper crafted to serve as a barrier against moisture and grease, making it a perfect choice for food packaging. Like regular paper, greaseproof paper experiences a production procedure that mainly reduces its permeability. This update gives it a smooth surface that efficiently opposes grease and oil, to make sure food stays fresh and palatable without any unwanted dampness. Greaseproof paper is classified by its translucent look, and it is created by improving the paper pulp through a procedure known as supercalendering, which includes passing the paper through a series of heavy rollers. This procedure includes the fibers being tightly collected, making a dense and non-porous surface.

How did the Food and Beverage Industry dominate the Barrier-coated Flexible Paper Packaging Market?

Flexible paper packaging prevents products from oxygen, moisture, contaminants, and UV Light, preserving freshness and ensuring safety. With barrier-enhanced characteristics, food items are better protected, assisting in lowering wastage. As per the global studies, developed packaging could capably reduce food waste by up to 30%. The hard nature of flexible packaging lowers storage and logistical overhead, developing supply chain effectiveness. They are also convenient to ship and manage. Flexible packaging has updated the food and beverage sector, which is used for transporting, storing, and consuming food and beverages. These food packaging film barrier properties -protect against moisture, oxygen, and UV rays play an important role in tracking product freshness and expanding shelf life.

The barrier-coated flexible paper packaging industry is crafted to develop everyday sustainability and ease with personal care packaging materials. Inventive materials align with a huge range of uses, from liquid detergents and household cleaners to shampoos, feminine care products, and beyond. Crafted for flexibility, durability, and eco-consciousness performance, various options can enhance the urge for current users while supporting brand sustainability goals. Sustainability drives invention in barrier-coated flexible packaging. By incorporating mechanically recycled post-consumer resin (PCR) into uses like feminine care, one can assist in reducing virgin plastic use and assist a circular economy. These choices minimize resource usage, lower transportation releases, and meet growing consumer demand for eco-friendly products.

By Region

How did Europe dominate the Barrier-coated Flexible Paper Packaging Market?

Packaging is not only important in protecting and transporting goods, but also a crucial environmental issue. The growing usage of packaging, integrated with less use and recycling rates, hampers the growth of a low-carbon circular economy. Consumer demand for environmentally friendly packaging is increasing. Furthermore, legislation in Europe and around the world is accepting and driving regulation towards a more sustainable future. For packaging, the demand to serve as a barrier, solutions such as multi-layer substrates are widely used in the sector. Hence, due to their poor recyclability, these materials show a major sustainability drawback and are meant to be updated.

Asia Pacific is the Fastest-growing Region in the Coated Flexible Paper Packaging Parket.

The urge for barrier-coated flexible packaging in the Asia Pacific region is experiencing constant growth due to growing environmental issues, increasing environmental concerns, increasing government regulations, and marketing sustainable packaging alternatives. Countries like India, China, and Japan are leading this transformation, driven by rapid development in the food, beverage, and personal care industries. As urban populations grow and e-commerce booms, there’s a growing need for packaging that serves both protection and eco-friendliness. Barrier-coated paper provides grease, moisture, and oxygen resistance, making it perfect for food wraps, take-away containers, and dry snack packaging. Local manufacturers are also investing in the latest coating technologies using biodegradable and recyclable materials, further fueling regional market expansion.

Flexible Packaging Market

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

Top Companies in the Barrier Coated Flexible Paper Packaging Market

- Mondi Group

- UPM-Kymmene Corporation

- Huhtamaki Oyj

- Amcor Plc

- Stora Enso Oyj

- Sappi Limited

- DS Smith Plc

- Billerud AB

- Ahlstrom-Munksjö

- WestRock Company

- Sealed Air Corporation

- Nippon Paper Industries Co., Ltd.

- APP (Asia Pulp & Paper)

- KRPA Holding CZ

- Twin Rivers Paper Company

- Felix Schoeller Group

- Ecologic Brands Inc.

- AR Packaging

- Koehler Paper Group

- Tetra Pak International S.A.

Recent Development

- On 19 November 2024, Amcor plans to acquire Berry Global in an all-stock deal, as the organizations revealed that the global market is becoming more dominant in consumer and healthcare packaging. (Source: Packaging Dive)

Segmentation of the Barrier Coated Flexible Paper Packaging Market

By Coating Type

- Polymer Coatings

- Wax Coatings

- Aluminium Foil Coatings

- Water-Based Coatings

- Bio-Based/Biodegradable Coatings

By Barrier Property

- Moisture Barrier

- Oxygen Barrier

- Grease/Oil Barrier

- Vapor Barrier

- Aroma/Flavour Barrier

By Packaging Format

- Pouches & Sachets

- Wraps & Rolls

- Bags (Flat & Gusseted)

- Labels & Lidding

- Liners

By End-Use Industry

- Food & Beverage

- Personal Care & Cosmetics

- Pharmaceuticals

- Household Products

- Retail & Apparel

- Pet Food

By Paper Type

- Bleached Kraft Paper

- Unbleached Kraft Paper

- Greaseproof Paper

- Specialty Coated Papers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa