Beverage Container Market Size, Trends, Innovations and Forecast

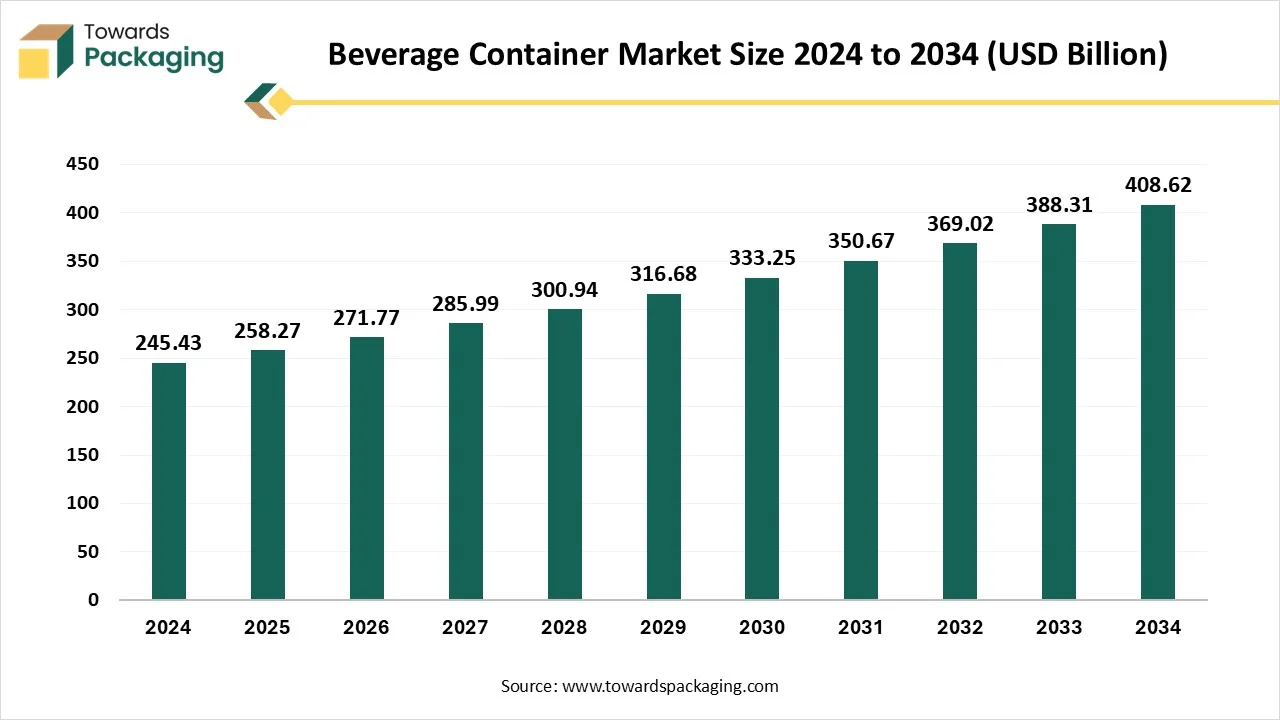

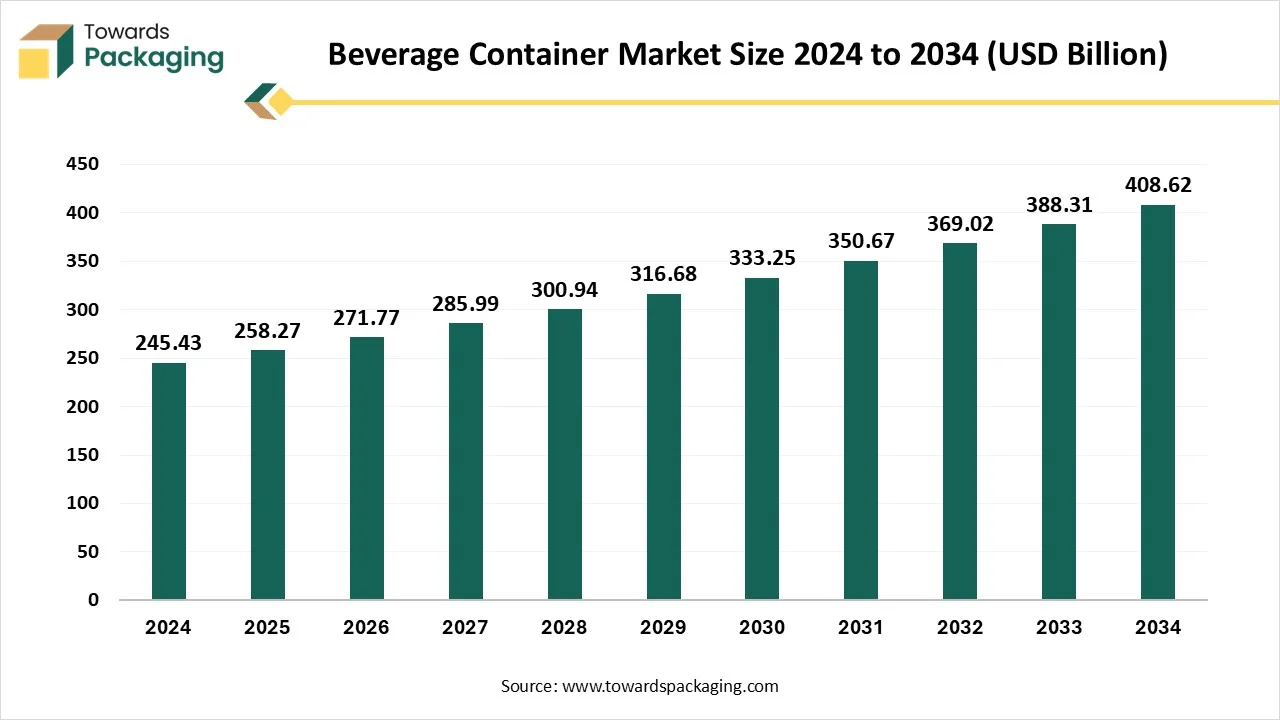

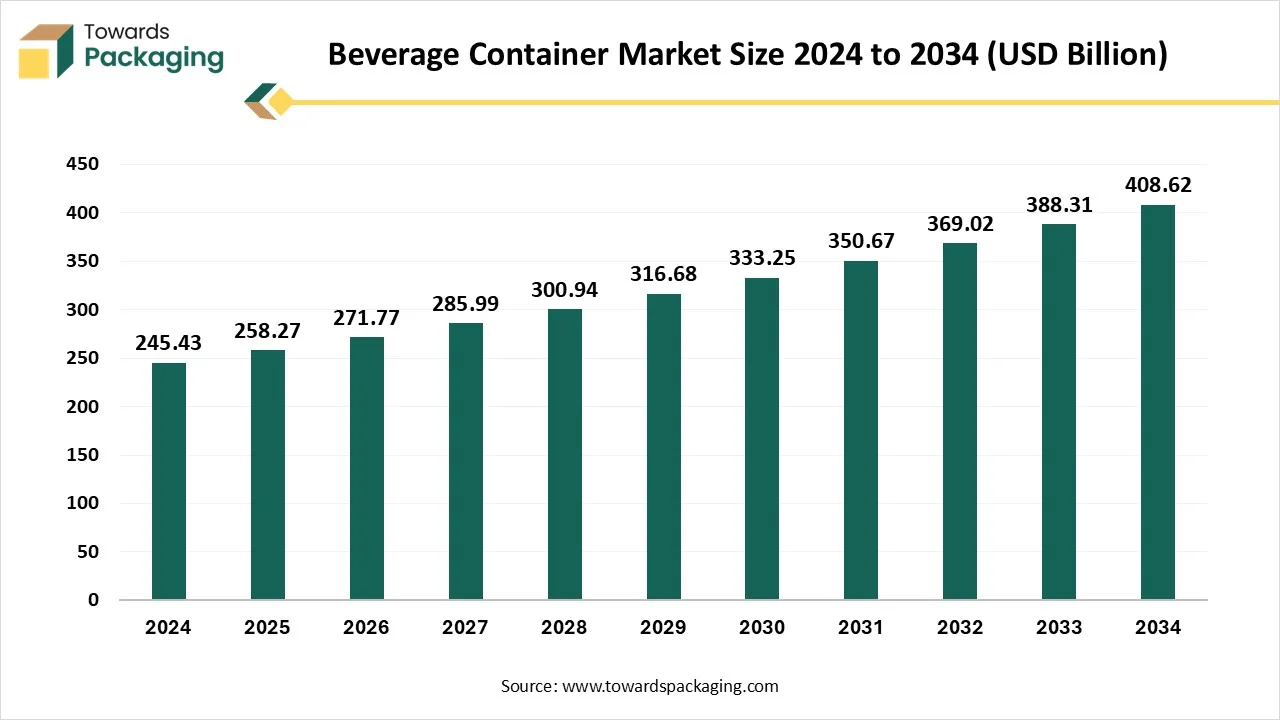

The beverage container market is forecasted to expand from USD 271.77 billion in 2026 to USD 429.99 billion by 2035, growing at a CAGR of 5.23% from 2026 to 2035. This report covers market size, emerging trends, capacity-based segmentation, material analysis, and application insights, along with a deep breakdown across North America, Europe, Asia Pacific, Latin America, and MEA. It also evaluates major companies such as Ball Corporation, Crown Cork & Seal, WestRock, Berry Global, and Ardagh, and includes competitive analysis, global trade flows, manufacturing landscape, and a complete value chain assessment.

Key Takeaways

- Asia Pacific led the beverage container market with the highest share in 2024.

- By region, Europe is expected to witness the highest CAGR during the forecast period.

- By material, the plastic segment dominated the beverage container market.

- By capacity, the small (250 ml) segment dominated the market share.

- By application type, the alcoholic beverages segment dominated the market share in 2024.

Market Overview

The beverage container market is growing significantly due to the rising demand for beverages due to various factors. A beverage container is a dedicated vessel considered for the transportation and storage of several drinks, comprising alcoholic beverages, soft drinks, water, juices, and more. These vessels come in several varieties of resources, sizes, and shapes, each personalized to exact beverage categories and consumption choices. Common resources for beverage containers consisting of stainless steel, plastic, glass, and aluminum with each contributing exclusive benefits such as temperature retention, portability, and durability.

The functionality and design of such beverage containers have changed over the years, integrating features such as eco-friendly, insulation, and resealable caps resources to provide changes to customer demands and ecological concerns. Beverage containers play a crucial role in conserving the quality and freshness of beverages and confirming suitability and availability for customers across the world.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 258.27 Billion |

| Projected Market Size in 2035 |

USD 429.99 Billion |

| CAGR (2026 - 2035) |

5.23% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Material, By Capacity, By Application and By Region Covered |

| Top Key Players |

Ball Corporation, Crown Cork & Seal Co, WestRock, Graphic Packaging International, Ardagh Metal Packaging, Berry Global |

Beverage Container Market Trends

- The increasing shift towards urban areas has influenced the demand for beverage container market.

- The continuous technological advancement in the beverage packaging industry.

- The growing consumption of beverages and the rising requirement of its storage has boosted the market to develop.

- The rising demand for sustainable packaging for beverage storage purpose and preserve the quality of the beverage.

- The continuous innovation in the packaging of the beverages has influenced the demand of the market.

AI Integration in the Beverage Container Market

In the beverage container market, there is a huge impact of AI in both formulation as well as packaging of beverages. Artificial intelligence system has evolved the inspection process of the packaging industry which ensure error-free packaging and enhance the reliability of the brands. It helps to customize the beverages packaging such as adding QR codes, specific messages, or unique patterns to enhance the visibility of the packaging. It ensures the digital specification, improving the prints on the packaging, and maintain the detailing in personalized packaging even in bulk production.

Predictive maintenance arrangements analyze the gathered data from sensors on the system, recognizing potential problems prior to any disruptions. It enhanced the sustainability of the packaging as it has become a major priority of the consumers. The incorporation of advanced technology like AI can calculate the required thickness and weight of the packaging to maintain the quality. It also minimizes the wastage of the packaging by identifying the requirement of the market.

Market Dynamics

Driver

Rising Health Consciousness and innovation Drives the Beverage Container Market

The beverage container market is facing strong development which is driven by several factors that leads to evolve the customer preferences, ecological concerns, and business innovations, the worldwide shift in the direction of better lifestyles has amplified the demand for appropriate, on-the-go beverage choices, enhancing the industry for single-portion containers such as aluminum cans and PET bottles.

Moreover, the rising acceptance of useful and energy drinks has resulted in an increased requirement for dedicated packing that can resist exclusive storage needs and maintain the freshness of the product. Ecological consciousness is another important driver of modification in the beverage container market. With an increasing attention on sustainability, customers are dynamically looking for environment friendly packaging choices. This has encouraged the acceptance of recyclable resources such as glass and aluminum, which are noticeably recyclable and have less ecological footprint in comparison to single-use plastics.

Additionally, creativities endorsing reduction in plastic waste, like bottle deposit arrangements and plastic bans in several regions, have inspired beverage industries to discover more sustainable packaging substitutes. Inventions in packaging skill and strategy are also influencing the beverage container industry.

Producers are continuously introducing new resources and manufacturing procedures to improve the shelf life of the beverages, expand packaging efficacy, and decrease production charges. Growing e-commerce industries and the altering retail business have generated a demand for beverage packaging that is visually appealing and durable. Beverage brands are capitalizing in eye-catching, useful labels and packaging that can resist the inflexibilities of online orders and home delivery process.

Opportunity:

Rising Demand for Biodegradable and Eco-friendly Packaging Enhances Beverage Container Market Potential

The growth and adoption of biodegradable and eco-friendly packaging substitutes signifies a considerable opportunity for development in the beverage container market. As ecological concerns raise, consumers are progressively seeking sustainable options, and beverage companies are observing the plans that includes eco-friendly packaging into their deliverables. Biodegradable resources, such as biodegradable plastics that are produced from plants, are getting popular as they show the matter of plastic pollution although align with the business's complete trend in the direction of sustainability. Customer likings, governmental restrictions, and business accountability for innovation all offer the enhancement of this market potential.

Governments across the globe are endorsing stronger limitations to eradicate single-use plastics and inspire eco-friendly packaging processes. As a consequence, beverage companies are capitalizing in R&D to get creative resolutions that are biodegradable and also have the sturdiness and functionality that is the primary demand for beverage containers. The growth of such ecologically friendly solutions not only profitable to the brands in the perception of ecologically reliable customers, but it also proposes new chances for market to expand and differentiate in a progressively competitive sector.

Restraint

Rising Global Norms for the Reduction of Usage of Plastic in the Beverage Container Market

The global norms for the reduction of usage of plastics has forced the major market players to look for sustainable substitutes, which sometimes come with higher production charges. The fluctuations in the prices of raw material, mainly for glass and aluminum, can influence the complete cost of the beverage containers. Supervisory obstacles, like changing recycling process and deposit schemes in the entire globe, can cause challenges for producers looking for reliability in packaging resolutions.

Segmental Insights

Lightweight, Recyclable and Cost-effective: Tube Segment Led in 2024

The plastic segment dominated the market in 2024 due to its lightweight, recyclable, and cost-effectiveness of this material. The strict government regulation towards the packaging industry has influenced the demand for beverage container manufacturing that can be stored for a longer period without disturbing the quality of the beverages. The growing demand for bottled water has influenced the usage of plastic material as these are easy to carry which attract huge number of customers towards this market to use these bottles. The recyclable property of these bottles has attracted huge number of customers as they are highly influenced by these properties due to growing concern about ecological issues rising significantly. For instance, in India the Govt. initiative such as “Make In India”, Skill In India” and “Digital India” have increased the growth of plastic products.

On-the-go Beverages Consumption: The Small Containers Segment Led in 2024

The small containers segment dominated the market in 2024 due to the rising demand for on-the-go beverages consumption. With the growing trend for travelling, the demand for small size beverages containers has also increased as these are considered easy to carry and convenient to use as well. A wide variety of beverages such as energy drinks, milk, and many others comes in small size packaging and are in high demand as they are convenient to carry while moving. This lightweight of the containers of small size is the major reason behind the growth of the small size beverage container market.

Premium Alcoholic Beverages: The Alcoholic Segment Led in 2024

The alcoholic beverages segment dominated the market in 2024 due to the rising demand for high-quality premium alcoholic beverages. The rising urbanization and party culture has influenced this segment significantly. There is a huge demand for alcoholic beverages such as beer, spirits, and wine which attract several people involving in parties in urban areas majorly.

According to the Ministry of Food Processing Industries estimates, the number of people consuming alcohol increased from approximately 219 million in 2005 to 293 million in 2018; it is projected to increase to 386 million by 2030.

Regional Insights

Presence of Huge Number of Beverages Industries: Asia Pacific to Sustain as a Leader

Asia Pacific held the largest share in 2024. This is due to the presence of huge number of beverages industries. In countries like India, China, Japan, South Korea, Thailand, and several others has huge number of beverages companies introducing various variety of beverages to the market and demand for modification in the storage containers to enhance the shelf life of the beverages. Companies such as Suntory, The coca-cola company, Itoen, Asahi Holdings, LEOC Japan, Daiei sangyo kaisha ltd, Nestlé SA, and many other.

Rising Demand for Sustainable Packaging Solution: Europe to be the Fastest Growing Region

Europe is expected to grow at the fastest rate during the forecast period. This is due to the rising demand for sustainable packaging solution. The strong culture of consuming beer in countries like Germany has enhanced the scope of packaging containers. The continuous growth in the demand for ready-to-drink beverages has raised the demand for safe storage to maintain the integrity and taste of the drink.

France is considered as one of the major wine producing countries across the globe and utilize glass bottles to contain the beverage as an option to preserve the quality, taste intact, and endorse the brand. Furthermore, luxury brands of champagne and spirits use high quality packaging for distinguishing themselves from other market players.

Beverage Container Market Key Players

Latest Announcements by Market Leaders

- In December 2024, Mayank Kumar, Vice President Marketing, Dabur India Ltd expressed, "At Réal, our goal is to continually innovate and cater to the evolving preferences of our consumers. The introduction of Réal Bites in aluminium cans not only broadens our product portfolio but also meets the demand for longer shelf life and more sustainable packaging. We are excited to offer our customers the same great taste in a format that is both convenient and fully recyclable."

Recent Development:

- In November 2024, Sidel announced the launch of Innovative Bottle Washer for Beverage Industry in low charges which make it an affordable option for packaging.

- In December 2024, Ball Corporation collaborated with Dabur India. It is to expand their Réal juice portfolio with the launch of the new Réal Bites in fully recyclable aluminum cans in India.

Beverage Container Market Segments

By Material

- Plastic

- PET (Polyethylene Terephthalate)

- HDPE (High-Density Polyethylene)

- PP (Polypropylene)

- Bioplastics

- Metal

- Aluminum

- Steel (Tinplate)

- Glass

- Soda-lime Glass

- Borosilicate Glass

- Paper and Paperboard

- Molded Fiber

- Tetra Pak & Aseptic Cartons

- Other Materials

By Capacity

- Small (below 250 ml)

- Medium (250 – 750 ml)

- Large (above 750 ml)

By Application

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Soft Drinks

- Juices

- Tea & Coffee

- Others

By Region Covered

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait