Beverage Carton Packaging Machinery Market Growth, Innovations and Market Size Forecast

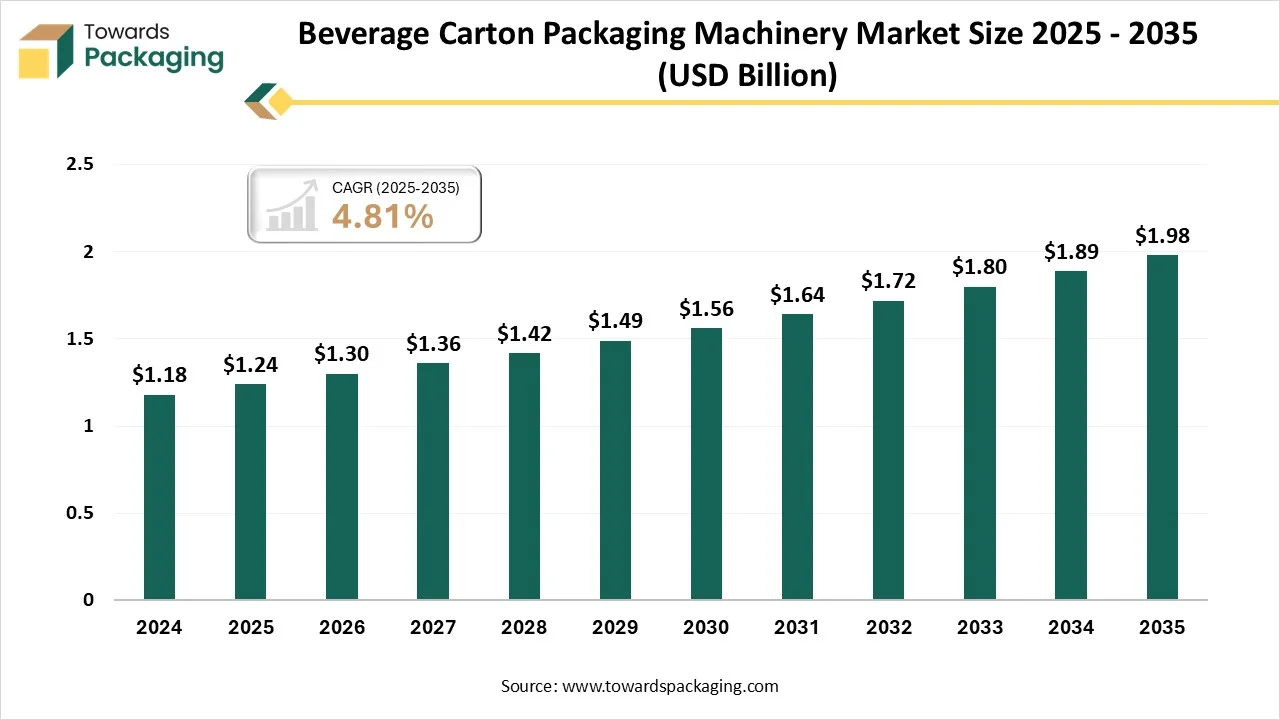

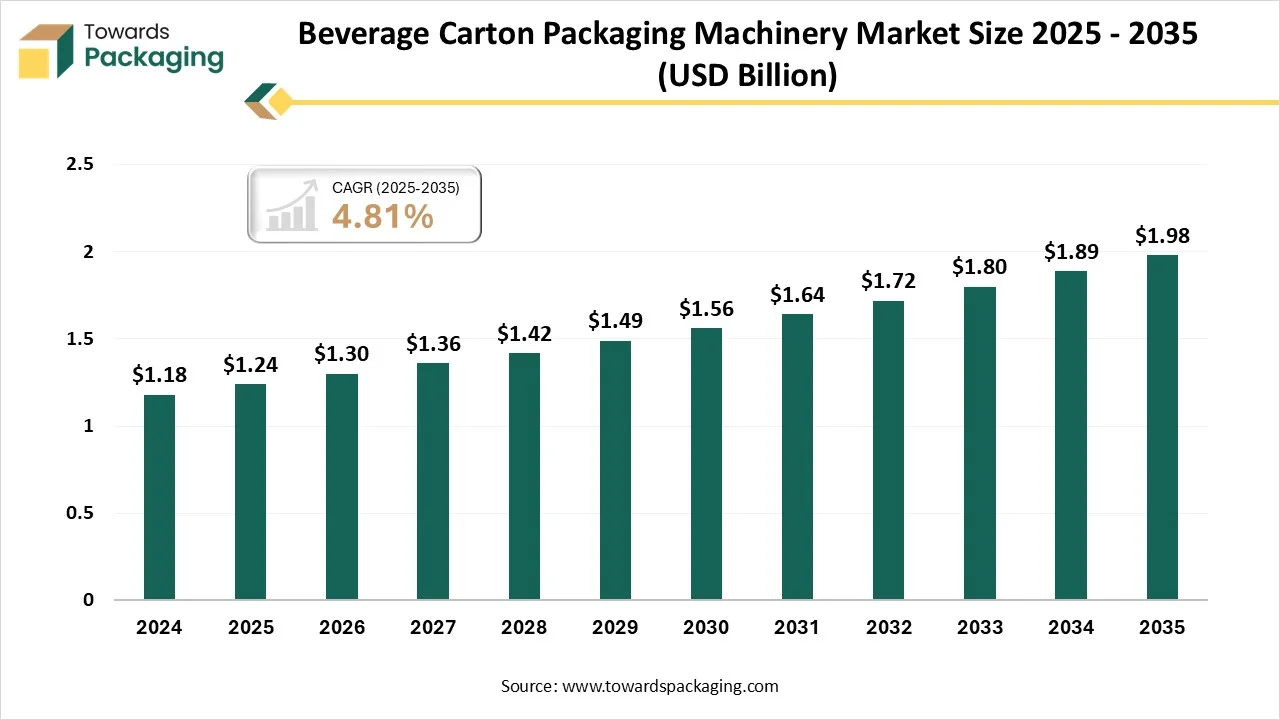

The global beverage carton packaging machinery market is anticipated to grow from USD 1.30 billion in 2026 to USD 1.98 billion by 2035, with a compound annual growth rate (CAGR) of 4.81% during the forecast period from 2026 to 2035.

The increasing awareness of sustainability, growing demand for lightweight packaging, a surge in beverage consumption, rapid expansion of the e-commerce sector, rising environmental concerns, and a shift toward recyclable materials are expected to drive the global beverage carton packaging machinery market over the forecast period. Automation, high-speed systems, and modular packaging lines are key trends shaping the future of this market. Sustainability and environmental consciousness are playing a crucial role in transforming the beverage carton packaging machinery market.

Key Takeaways

- In terms of revenue, the market is valued at USD 1.24 billion in 2025.

- The market is projected to reach USD 1.98 billion by 2035.

- Rapid growth at a CAGR of 4.81% will be observed in the period between 2025 and 2034.

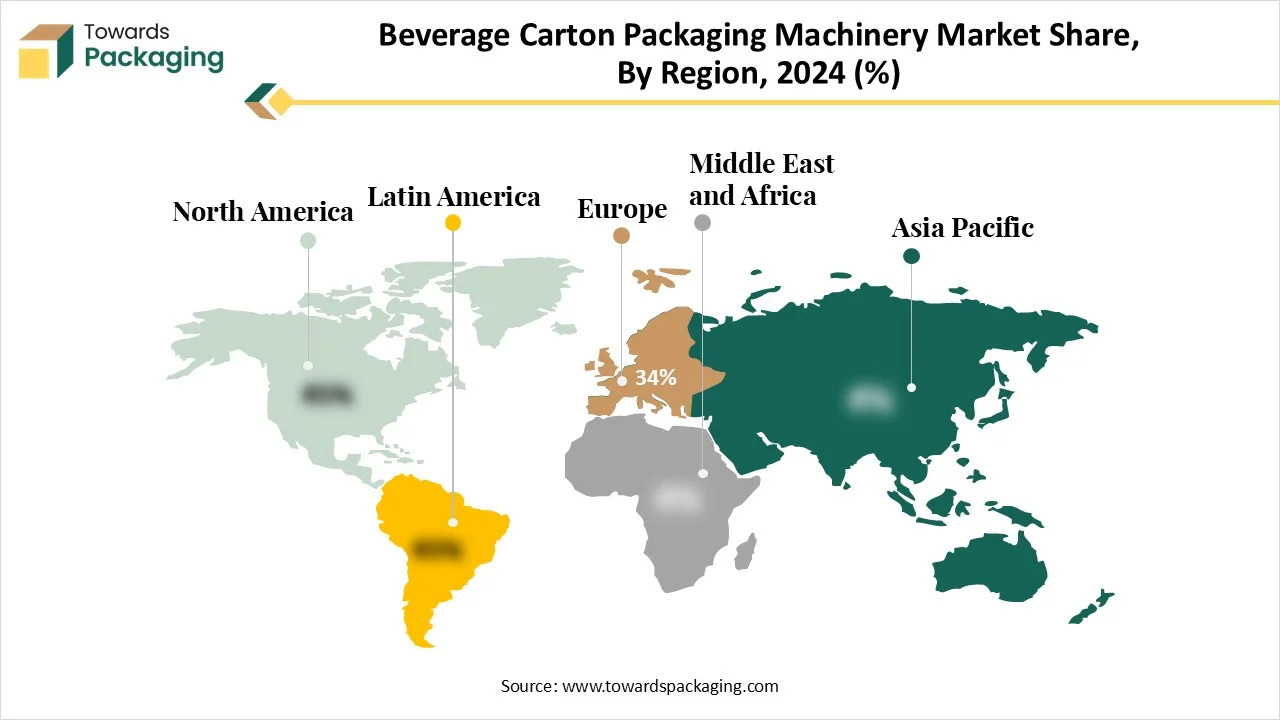

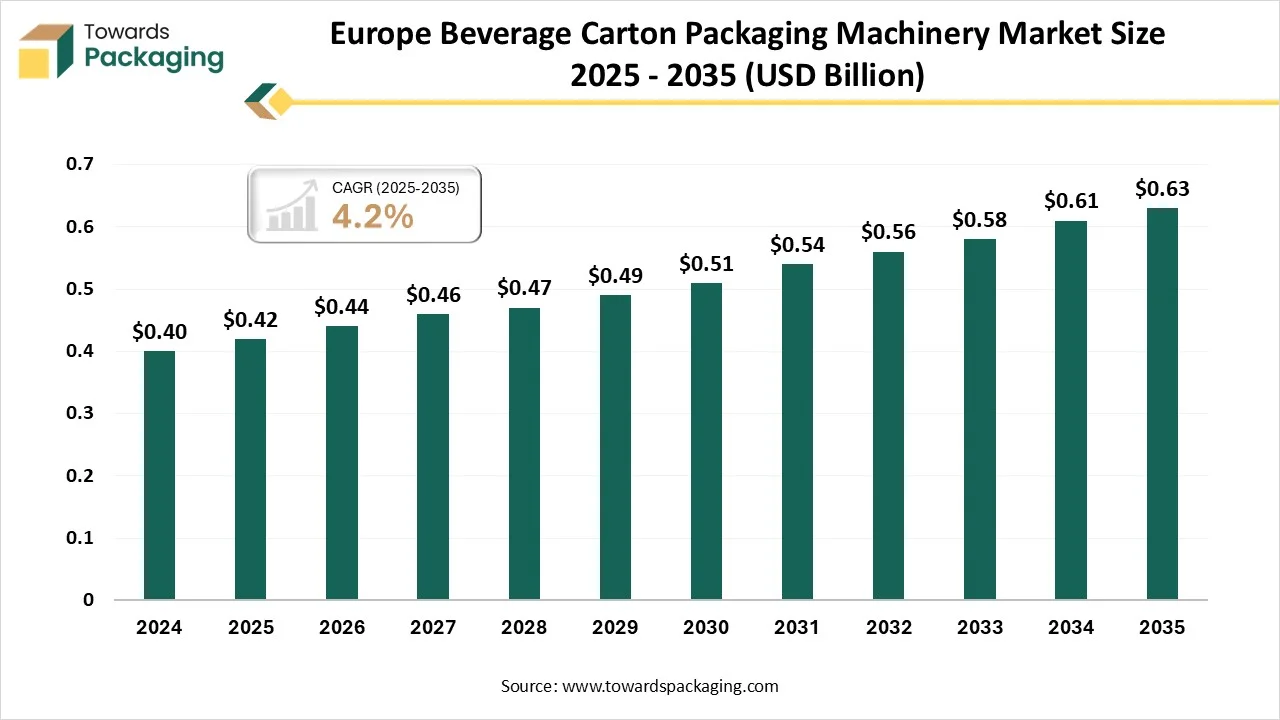

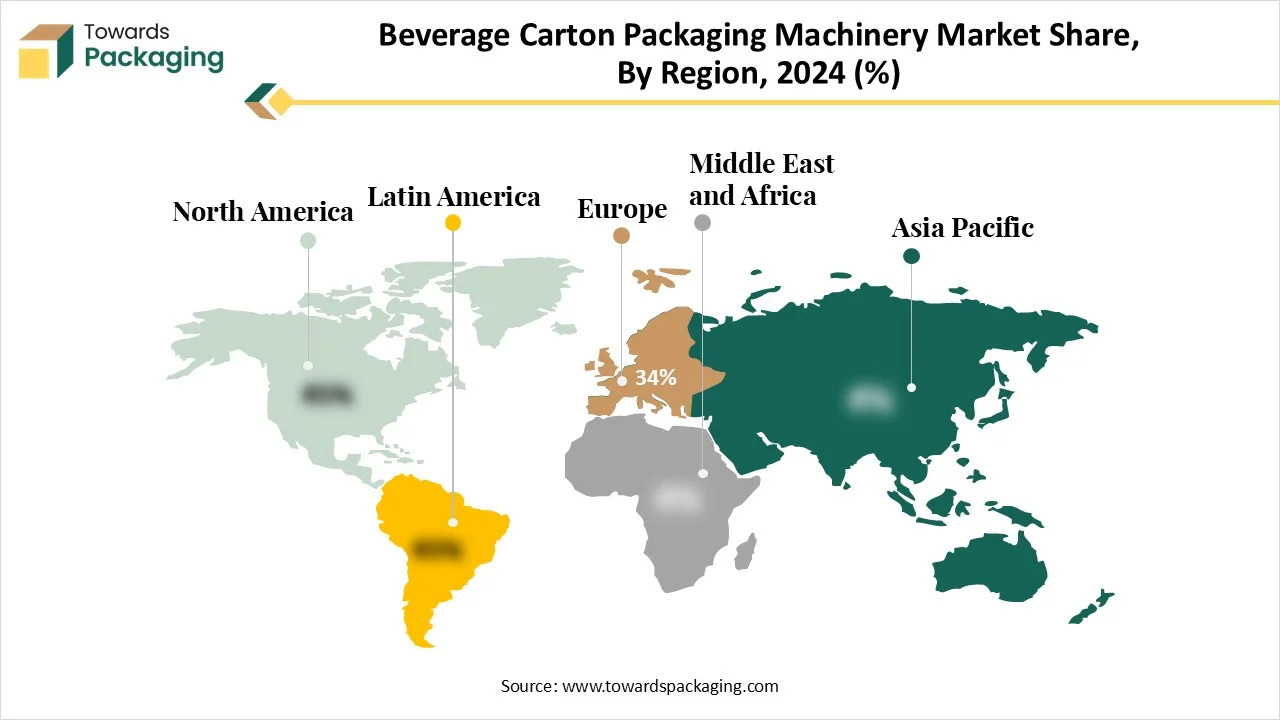

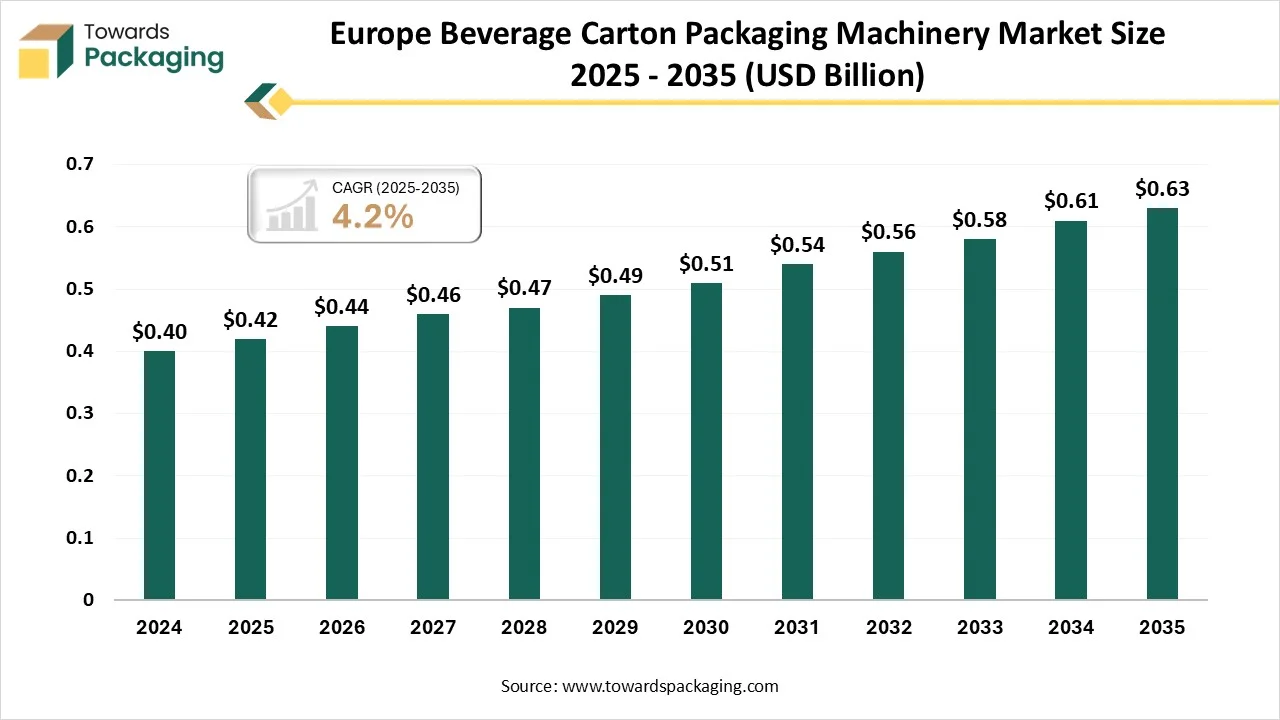

- Europe dominated the beverage carton packaging machinery market in 2024 with 34%.

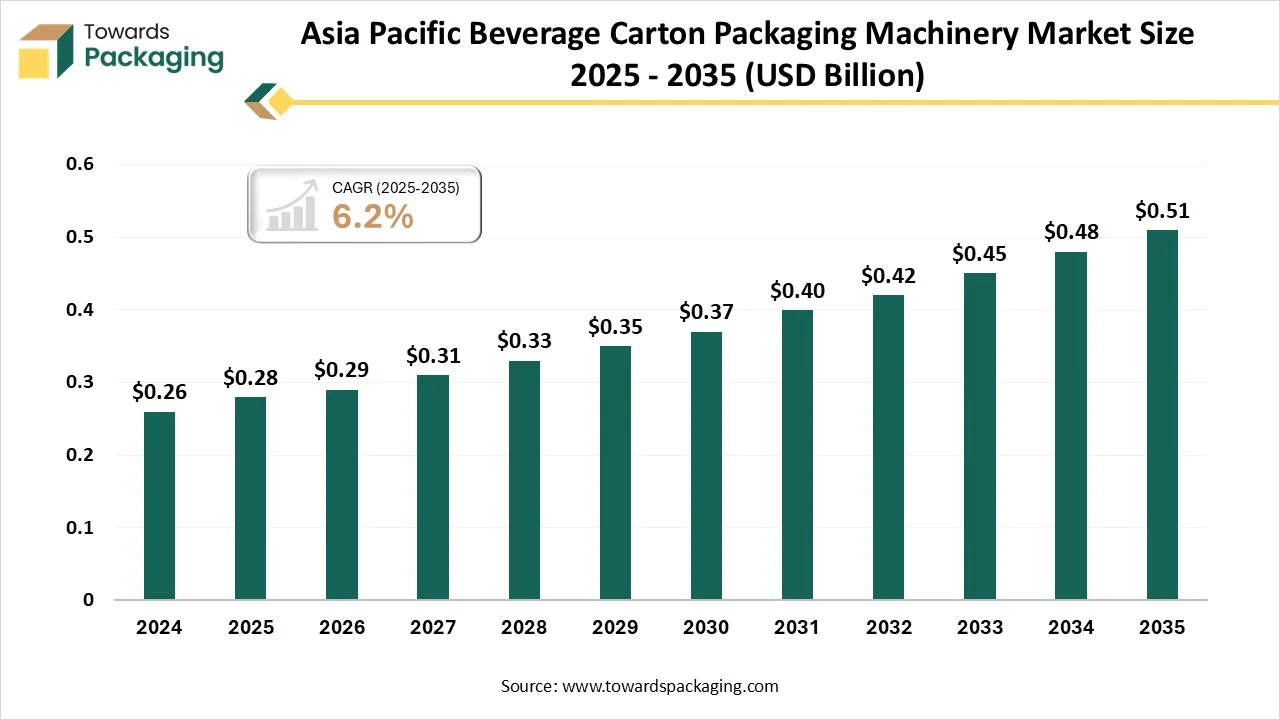

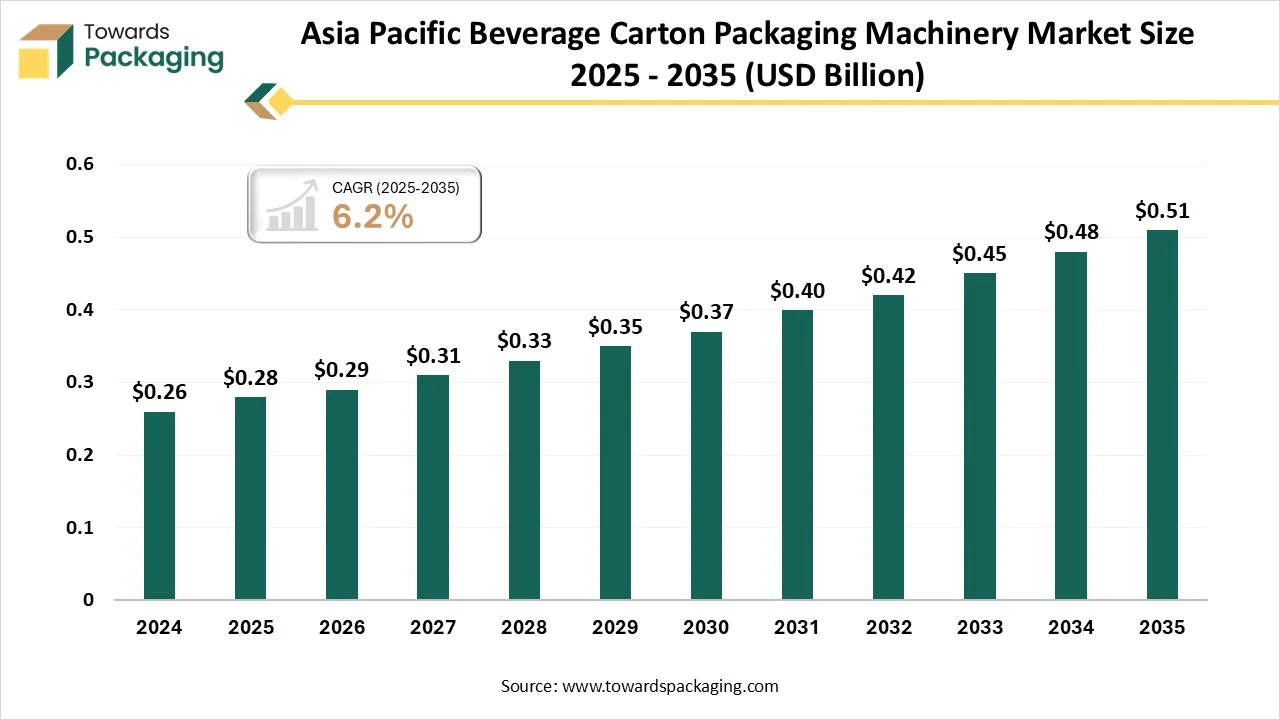

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By machine type, the Form-Fill-Seal (FFS) machines segment held a dominant presence in the market in 2024, with 38%.

- By machine type, the filling machines segment accounted for considerable growth in the global beverage carton packaging machinery market over the forecast period.

- By automation level, the fully automatic machines segment contributed 72% revenue share in 2024 and is expected to further grow at the fastest CAGR.

- By carton type, the aseptic cartons segment held the major market share of 45% in 2024.

- By carton type, the gable-top cartons segment is projected to grow at a CAGR between 2025 and 2034.

- By beverage type, the dairy (milk, flavored milk, cream) segment contributed the biggest market share of 33% in 2024.

- By beverage type, the plant-based beverages segment is expanding at a significant CAGR during the forecast period.

- By end user, the large beverage manufacturers segment registered its dominance with 51% over the global beverage carton packaging machinery market in 2024.

- By end-user, the SMEs in the beverage production segment are expected to experience significant growth during the forecast period.

Market Overview

The beverage carton packaging machinery market includes the design, production, and sale of machinery used for forming, filling, sealing, and secondary packaging of beverages in carton-based formats. Beverage carton packaging machinery plays a crucial role in the global food and beverage industry. With the rising consumer demand for packaged beverages, the need for efficient, sustainable, and cost-effective packaging continues to grow. These machines are integral to the processing of dairy products, juices, plant-based drinks, alcoholic beverages, and water in gable-top, brick, and aseptic cartons.

What Are the Key Trends Driving the Growth of the Beverage Carton Packaging Machinery Market?

- The beverage carton packaging machinery market has witnessed significant developments aimed at improving efficiency, sustainability, and automation. One of the major advancements has been the integration of smart technologies such as IoT-enabled sensors, which allow real-time monitoring and predictive maintenance. This advancement not only reduces downtime but also increases overall production efficiency.

- The rising consumer demand for lightweight, tamper-proof, and durable packaging is expected to propel the growth of the beverage carton packaging machinery market. The lightweight and durable packaging materials are widely used for reducing shipping costs and providing product protection.

- The surge in beverage consumption and rising integration of smart technologies are expected to accelerate the market’s revenue during the forecast period.

- The rapid expansion of the e-commerce sector, along with increasing focus of businesses on better protection of goods during shipment, significantly contributes to the overall growth of the beverage carton packaging machinery market.

- The rising disposable incomes and urbanization, particularly in emerging economies, are anticipated to fuel the market’s growth during the forecast period.

- The rising shift toward automation in beverage packaging is fueled by the growing demand for high-speed production and the ability to optimize operations to align with evolving market needs.

- The rising environmental concerns and a shift toward recyclability are expected to propel the market’s expansion is anticipated to fuel the market’s growth during the forecast period.

How is Artificial Intelligence Integration Impacting the Growth of the Beverage Carton Packaging Machinery Market?

As technology continues to advance, the integration of Artificial intelligence holds great potential to reshape the landscape of the beverage carton packaging machinery market by improving production speed, optimizing production schedules, predicting maintenance needs, increasing focus on sustainability, and enhancing the quality. AI enables the creation of personalized packaging designs and adaptable machinery to meet consumer preferences.

Machine learning algorithms and computer vision algorithms enable automated quality control that detects defects or imperfections that are often overlooked by human inspection. AI-driven automation effectively streamlines packaging processes, which assists in reducing manual labor, and boosts output. Several companies are embracing AI integration to be well-positioned for growth and innovation in the evolving beverage industry carton packaging machinery landscape.

Market Dynamics

Driver

Growing Demand for Ready-to-drink Beverages

The rising demand for ready-to-drink beverages and health-conscious products is expected to boost the growth of the beverage carton packaging machinery market during the forecast period. The consumer base for ready-to-drink beverages is growing substantially with the surge in disposable income and rapid urbanization, particularly in developed and developing countries. This trend increases the need for efficient, tamper-proof, and cost-effective packaging solutions to meet growing demand. Moreover, the increasing focus on health and wellness, along with the increasing demand for convenience, are spurring the demand for ready-to-drink beverages, which further boosts the growth of the global beverage carton packaging machinery market during the forecast period.

Restraint

High Cost

The high initial investment is anticipated to hinder the market's growth. A significant upfront cost is required to purchase and install beverage carton packaging machinery, which often discourages small and medium-sized companies from entering the market. In addition, the integration of advanced features such as smart packaging elements or multi-layered cartons adds to the technical complexity of the machinery. Such factors may hinder the growth of the global beverage carton packaging machinery market during the forecast period.

Opportunity

Technological Improvements and Increasing Sustainability Trends

The technological advancements and increasing sustainability trends are projected to offer lucrative growth opportunities to the growth of the beverage carton packaging machinery market during the forecast period. The adoption of automation, robotics, and IoT integration has significantly enhanced the efficiency, accuracy, product quality, and monitoring capabilities of carton packaging machinery. The advanced technologies are improving the shelf life of packaged beverages, which propels the demand for efficient carton packaging. Moreover, the rising environmental concerns in anticipated to fuel the market’s expansion in the coming years.

Segmental Insights

Beverage Carton Packaging Machinery Market Size, By Machine Type (USD Billion)

| |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Form-Fill-Seal (FFS) Machines |

0.234 |

0.247 |

0.262 |

0.271 |

0.283 |

0.303 |

0.312 |

0.325 |

0.347 |

0.363 |

0.378 |

| Filling Machines |

0.211 |

0.224 |

0.235 |

0.251 |

0.258 |

0.271 |

0.272 |

0.299 |

0.309 |

0.325 |

0.342 |

| Carton Erectors & Sealers |

0.176 |

0.182 |

0.194 |

0.198 |

0.215 |

0.219 |

0.237 |

0.241 |

0.260 |

0.267 |

0.282 |

| Wrapping & Bundling Equipment |

0.141 |

0.144 |

0.154 |

0.162 |

0.171 |

0.180 |

0.192 |

0.196 |

0.203 |

0.219 |

0.225 |

| Labeling & Coding Machines |

0.121 |

0.126 |

0.125 |

0.135 |

0.142 |

0.148 |

0.157 |

0.163 |

0.170 |

0.181 |

0.189 |

| Palletizing & Case Packing Systems |

0.155 |

0.165 |

0.169 |

0.176 |

0.184 |

0.197 |

0.206 |

0.215 |

0.225 |

0.231 |

0.243 |

| Turnkey Beverage Carton Packaging Lines |

0.142 |

0.149 |

0.156 |

0.166 |

0.170 |

0.174 |

0.187 |

0.199 |

0.204 |

0.216 |

0.229 |

How Did the Form-Fill-Seal (FFS) Machines Dominate the Beverage Carton Packaging Machinery Market in 2024?

The form-fill-seal (FFS) machines (Vertical FFS and Horizontal FFS) segment held a dominant presence in the beverage carton packaging machinery market in 2024. FFS machines offer crucial solutions for various beverage types and packaging formats. FFS machines offer high speed and improved efficiency in packaging which making them the preferred choice for mass production in the beverage industry. FFS machines are more economical than others, especially for high-volume production. Moreover, the rapid technological innovation in FFS technology, such as digitalization, Machine learning (ML), and automation, is anticipated to propel the segment’s growth during the forecast period.

On the other hand, the filling machines (aseptic fillers and Gravity & volumetric fillers) segment is expected to grow at a significant rate. Filling machines are highly versatile and find numerous applications within the food industry. Filling machines are most extensively adopted in the beverage industry for filling beverage cartons with various liquids, including juice, milk, sports drinks, non-alcoholic beverages, and other beverages. In addition, the automation, robotics, and precision control systems in packaging machinery are significantly improving efficiency and reducing errors.

Which Segment Holds the Majority of the Share in the Beverage Carton Packaging Machinery Market?

The large beverage manufacturers segment accounted for the dominating share in 2024. The growth of the segment is mainly driven by the rising need for convenient and sustainable packaging solutions. Large beverage manufacturers in this market, like Coca-Cola, PepsiCo, and Anheuser-Busch InBev, significantly influence the market’s growth due to their massive production volumes and their established presence globally. Large beverage manufacturers are constantly seeking efficient, sustainable, and innovative packaging solutions to ensure product integrity during shipping.

On the other hand, the SMEs in the beverage production segment are expected to witness a significant share during the forecast period. SMEs are increasingly investing in suitable beverage carton packaging machinery to boost production capacity and to increase profitability in the long run. SMEs are also leveraging eco-friendly packaging materials and machinery designed for recyclability and reduced waste, aligning with sustainable practices.

Beverage Carton Packaging Machinery Market Size, By Automation Level (USD Billion)

| |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Fully Automatic Machines |

0.768 |

0.805 |

0.839 |

0.884 |

0.929 |

0.966 |

1.019 |

1.068 |

1.117 |

1.175 |

1.228 |

| Semi-Automatic Machines |

0.295 |

0.306 |

0.325 |

0.340 |

0.354 |

0.376 |

0.387 |

0.404 |

0.425 |

0.452 |

0.475 |

| Manual Machines (niche use in small facilities) |

0.117 |

0.126 |

0.132 |

0.135 |

0.141 |

0.151 |

0.159 |

0.168 |

0.176 |

0.174 |

0.185 |

Automation Dominated the Beverage Carton Packaging Machinery Market in 2024

The automatic segment is expected to dominate the market with the largest share in 2024, owing to the increasing focus on automated solutions to meet the increasing demand for ready-to-drink (RTD) beverages, to reduce reliance on manual labour, adherence to safety government regulations, and boost productivity as well as efficiency. Moreover, the rapid technological advancements have significantly increased the adoption of robotics, Artificial Intelligence (AI) technologies, and the Internet of Things (IoT) have made automated beverage carton packaging processes more efficient, smarter, and precise.

The Aseptic Cartons Segment Dominated the Market

The aseptic cartons segment is mainly driven by the rising demand for aseptic cartons in the beverages industry and the growing preference for sustainable packaging solutions. Aseptic cartons, which generally combine multiple layers to safeguard the contents from contaminants and other external environmental factors which are particularly favored to extend shelf life without dependence on refrigeration or preservatives. Aseptic cartons offer a longer shelf life than others, which makes them an ideal choice for various beverages.

On the other hand, the gable-top cartons segment is expected to grow at a notable rate owing to the rising need to prevent the contamination of beverages from the outer environment, and a surge in the consumption of beverages, particularly in developing nations. The gable-top liquid cartons are made up of coated paper and are used to contain a variety of beverages such as milk, juices, health drinks, and others. These cartons are considered safe for the transportation and storage of liquid products.

What Makes the Dairy Segment Drive the Market?

The dairy (milk, flavored milk, cream) segment is expected to dominate the circular economy in the market. The surge in global population and rising disposable incomes are leading to higher consumption of several dairy products like milk, lassi, flavored milk, and cream. The rising awareness about the nutritional benefits of dairy products is expected to boost consumption and further increase the need for efficient packaging solutions. Moreover, government regulations and incentives promote the adoption of sustainable packaging practices, which increases the demand for eco-friendly cartons in the dairy industry.

On the other hand, the plant-based beverages segment is growing at the fastest CAGR, owing to the increasing demand for Ready-to-Drink (RTD) plant-based beverages and high disposable income. The growing popularity of plant-based beverages is expected to create substantial demand for specialized and protective packaging solutions. The rapid expansion of online retail is expected to boost the demand for robust and reliable packaging solutions to ensure product safety and integrity during shipping.

Regional Insights

Beverage Carton Packaging Machinery Market Size, By Region (USD Billion)

| |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

0.296 |

0.308 |

0.321 |

0.344 |

0.354 |

0.373 |

0.391 |

0.414 |

0.430 |

0.454 |

0.474 |

| Europe |

0.258 |

0.272 |

0.286 |

0.299 |

0.313 |

0.329 |

0.347 |

0.358 |

0.380 |

0.394 |

0.413 |

| Asia-Pacific |

0.358 |

0.370 |

0.388 |

0.408 |

0.428 |

0.450 |

0.465 |

0.493 |

0.516 |

0.539 |

0.569 |

| Latin America |

0.150 |

0.160 |

0.167 |

0.173 |

0.188 |

0.191 |

0.202 |

0.213 |

0.225 |

0.232 |

0.244 |

| Middle East & Africa |

0.118 |

0.126 |

0.133 |

0.134 |

0.140 |

0.149 |

0.160 |

0.162 |

0.167 |

0.181 |

0.187 |

North America

The horizontal end-side load cartoner segment is both the biggest and fastest-growing kind of carton packaging in the region. Growth is being driven by sustainable packaging, including the cartons that are recyclable or made from eco-friendly materials, due to user selection and regulatory pressure. Automation and speed are the main priorities; machinery with high-level control systems, higher throughput, and lower manual intervention is being selected. The United States leads within North America in revenue and acceptance, with Canada and Mexico also growing investments, particularly for dairy juice and ready-to-drink beverages.

Europe is Dominating the Market

Europe dominated the beverage carton packaging machinery market in 2024. The region is experiencing increasing adoption of beverage carton packaging machinery owing to the rapid economic growth, increasing presence of prominent market players, and rapid expansion of the beverage sector, especially the non-alcoholic beverage sector, like sports drinks and functional beverages. The rising focus on technological innovations, such as automation and IoT, is significantly enhancing the monitoring capabilities, efficiency, and overall performance of beverage carton packaging machinery. The region’s high per capita income is increasing the demand for RTD beverages, bolstering the segment's growth. The rapid expansion of e-commerce in the region is anticipated to spur the demand for innovative and secure packaging solutions to ensure product safety and integrity during shipping and transportation.

Government-led sustainability initiatives implemented by governments, countries promoting sustainable packaging practices, which have also significantly increased the adoption of eco-friendly packaging materials and machinery designed for recyclability and reduced waste to meet the evolving consumer demand, and potentially enhancing their brand image. The region's commitment to lowering the environmental impact and favouring the utilization of recyclable materials aligns with the principle of the circular economy. Such a combination of factors is driving the growth of the region during the forecast period.

Asia Pacific Beverage Carton Packaging Machinery Market Size 2025 - 2035 (USD Billion)

On the other hand, Asia Pacific is expected to grow at a significant rate in the market during the forecast period. The Asia Pacific region has a robust presence of the beverage industry, which is a major user of beverage carton packaging machinery. The growth of the region is attributed to the rapid urbanization, changing lifestyles, rising economic growth, supportive government framework, rising integration of advanced technologies, and increasing consumer preferences for packaged beverages.

The rising growth of the beverage industry and increasing focus on sustainability, especially in countries like China, Japan, India, Singapore, and South Korea, encourage businesses to invest more in advanced beverage carton packaging machinery. The stringent regulations on plastic usage and rising emphasis on sustainability, compelling manufacturers to adopt carton-based solutions. Recycled and renewable packaging materials are gaining immense popularity in the market as eco-friendly packaging solutions. Additionally, the growth of the e-commerce sector is increasing the demand for secure and tamperproof packaging solutions, and the embracing of smart packaging solutions increases the efficiency and traceability in beverage carton packaging solutions.

Latin America

The beverage carton packaging machinery demand in Latin America is due to heavy application in the field of food and beverages for various purposes, such as storage of liquid food items, safe transport of the items, and protection of the goods. Also, depending on the analysis, owing to growing awareness linking to healthy lifestyles and consumer choice for the fruit juices, protein shakes, dietary supplements, and others, too, the market is experiencing huge development over the years. Furthermore, the beverage cartons are largely demanded as they prevent the liquid goods from any form of pollutant, toxic damage, and other hazards.

Top Beverage Carton Packaging Machinery Market Players

- Tetra Pak International S.A.

- SIG Group AG

- Krones AG

- Elopak ASA

- Bosch Packaging Technology (Syntegon)

- Shikoku Kakoki Co., Ltd.

- IMA Group

- Bosgraaf Group

- FBR-ELPO S.p.A.

- Jacob White Packaging Ltd.

- ELOPAK Inc.

- GEA Group AG

- Evertis Packaging Solutions

- IWK Verpackungstechnik GmbH

- R.A Jones (a Coesia company)

- KHS GmbH

- Paxxus Inc.

- Omori Machinery Co., Ltd.

- Greatview Aseptic Packaging

- Nichrome India Ltd.

Latest Announcement by Industry Leader

- In May 2025, SIG Drinksplus enables TH true MILK’s launch of UHT chocomalt snack drinks with oats or nata de coco in aseptic cartons. The true MILK LIGHT MEAL, a nutritious blend of milk, oat flakes, and nuts. The new chocomalt snack drinks cater to Vietnamese consumers’ growing appetite for healthy indulgence and leverage a technology that allows filling of beverages with real, perceptible pieces of grains, fruit, vegetables, nuts, or jelly into aseptic cartons using SIG’s standard aseptic carton filling machines for beverages.

Recent Developments

- In July 2025, a top global supplier of aseptic carton packaging solutions had revealed the opening of its latest plant in Italy with the assistance of major shareholder, NewJF. This kind of huge expansion solves the rising demand for European-generated, sustainability-manufactured packaging.

- In May 2025, one of the top packaging suppliers, Elopak, disclosed that the latest paperboard for the fresh liquids is in chilled distribution channels. As compared to cartoons, which are made with standard board, the Natural White board lowers the packaging carbon footprint by up to 14%.

- In September 2024, Tetra Pak collaborated with a leading company in the European juices, nectars, and soft drinks markets to launch the new Tetra Prisma Aseptic 300 Edge beverage carton. This innovative portion package stands out on the shelf, with its distinct look and ergonomic design catering to the preference of modern consumers for taller, slimmer packaging. Designed for ease of use, the shape of the new paper-based carton package also makes it more comfortable to hold, particularly for smaller hands.

- In April 2025, the Libyan United Beverage Bottling Company unveiled a strategic partnership with SIG by adding four additional filling lines for aseptic carton packs to LUBBC, including a SIG Midi 12 Aseptic, two SIG XSlim 24 Aseptics, and a SIG Mini 24 Aseptic. The collaboration is set to boost LUBBC’s production capabilities, increase local market volumes, and enhance export opportunities, while also consolidating SIG’s position in the region.

Beverage Carton Packaging Machinery Market Segments

By Machine Type

- Form-Fill-Seal (FFS) Machines

- Vertical FFS

- Horizontal FFS

- Filling Machines

- Aseptic fillers

- Gravity and volumetric fillers

- Carton Erectors & Sealers

- Wrapping & Bundling Equipment

- Labeling & Coding Machines

- Palletizing & Case Packing Systems

- Turnkey Beverage Carton Packaging Lines

By Carton Type

- Aseptic Cartons

- Tetra Brik, SIG Combibloc

- Gable-Top Cartons (Fastest Growing)

- Standard Cartons

- Non-aseptic or short shelf-life drinks

- Shaped Cartons

- Reclosable Cartons

By Beverage Type

- Dairy (Milk, Flavored Milk, Cream)

- Plant-Based Beverages

- Alcoholic Beverages

- Wine, Cocktails, RTDs in cartons

- Water

- Functional & Nutritional Drinks

- Liquid Foods (e.g., soups, broths, purees)

By Automation Level

- Fully Automatic Machines

- Semi-Automatic Machines

- Manual Machines (niche use in small facilities)

By End User

- Large Beverage Manufacturers

- Multinational dairy and juice brands

- Contract Packaging Organizations (CPOs)

- SMEs in Beverage Production (Fastest Growing)

- Foodservice & HORECA Suppliers

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait