Bimodal HDPE Market Size, Growth Trends, Segment Insights, Regional Breakout, Manufacturers, Suppliers & Competitive Intelligence

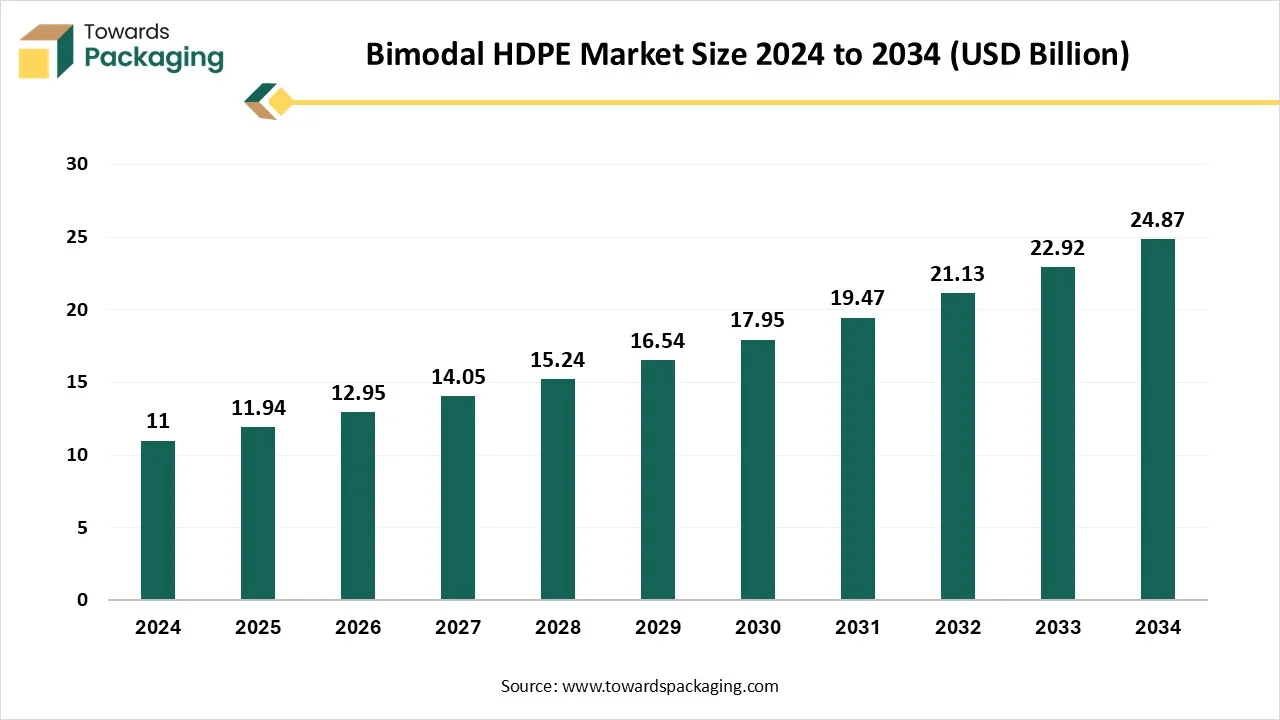

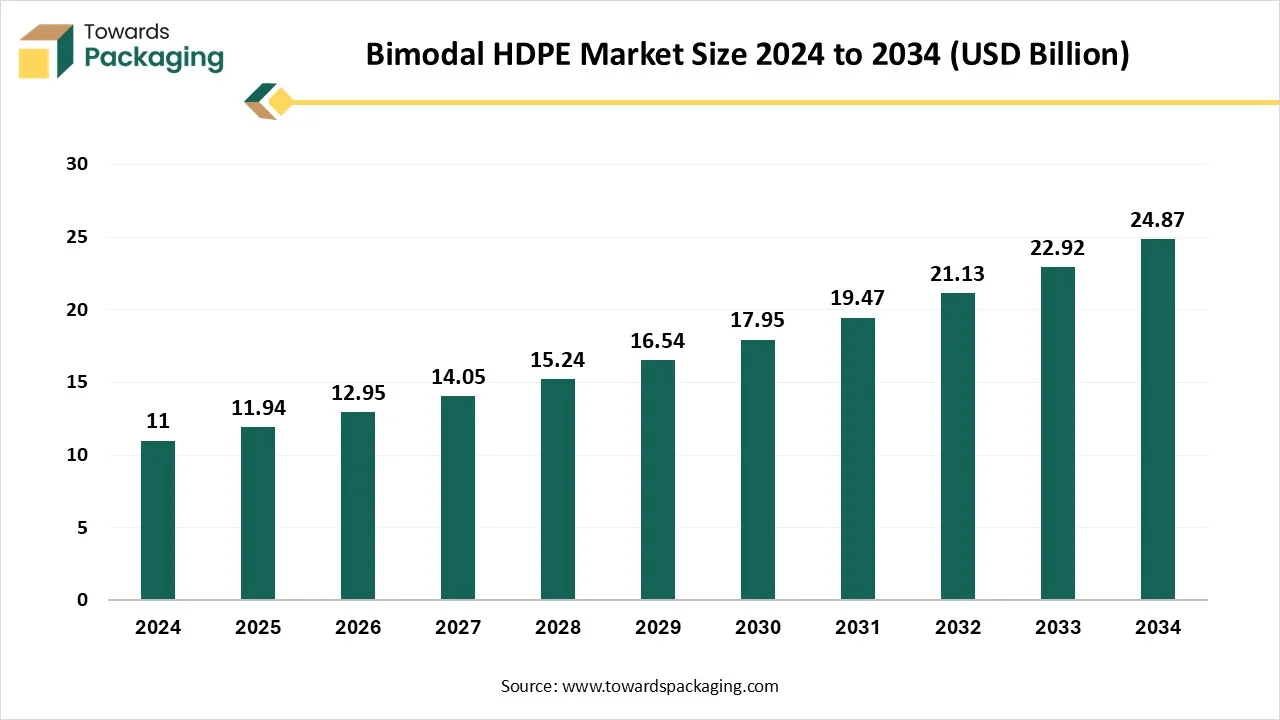

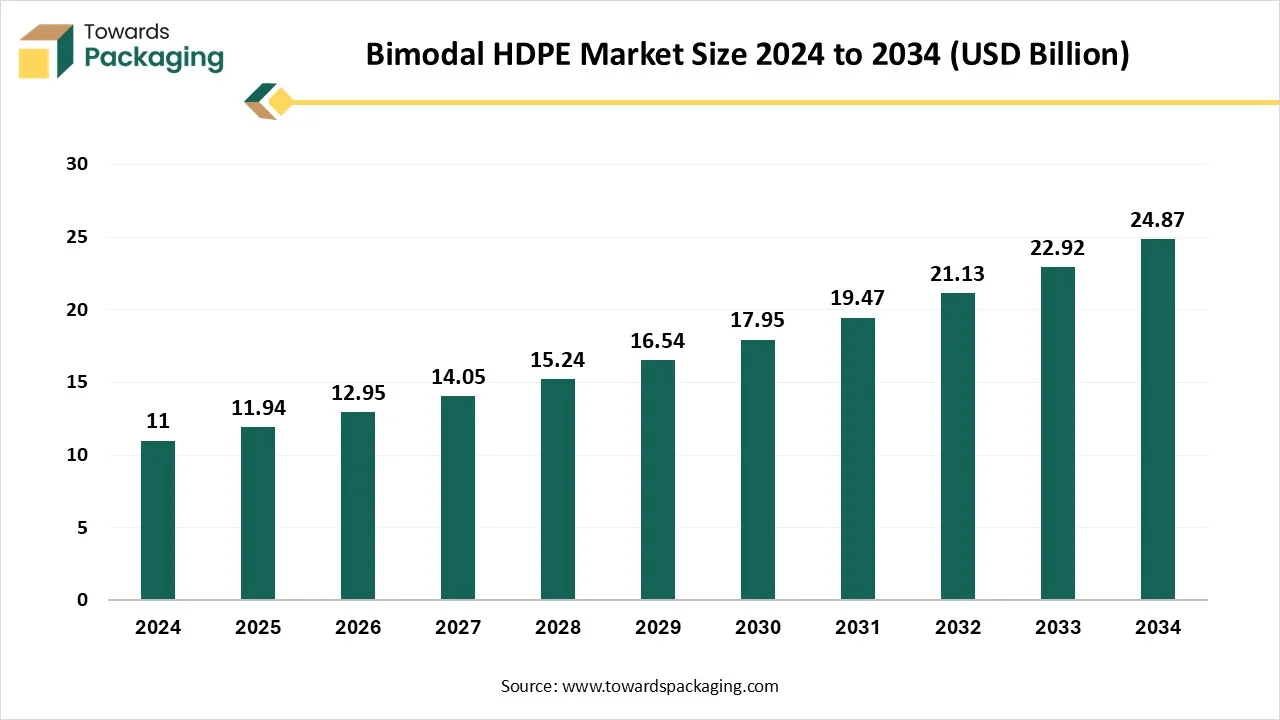

The Bimodal HDPE market is forecasted to expand from USD 12.95 billion in 2026 to USD 26.98 billion by 2035, growing at a CAGR of 8.5% from 2026 to 2035. It includes full segmentation by process (slurry, gas phase, solution), application, end-use industries, and distribution channels.

The study offers regional data for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, supported with production and consumption statistics. It also examines value chain structures, trade flows, competitive landscapes, and profiles of major manufacturers and suppliers including LyondellBasell, INEOS, SABIC, ExxonMobil, CNPC, Reliance, and others.

Key Takeaways

- In terms of revenue, the market is valued at USD 11.94 billion in 2025.

- The market is projected to reach USD 26.98 billion by 2035.

- Rapid growth at a CAGR of 8.5% will be observed in the period between 2025 and 2034.

- Asia Pacific dominates the bimodal HDPE market.

- The Middle East and Africa are expected to host the fastest-growing market in the coming years.

- By process technology, the slurry segment accounted for a 45% revenue share in 2024.

- By process technology, the gas phase process will grow at a significant CAGR between 2025 and 2034.

- By application, the pressure pipes segment dominates the global market.

- By application, the large containers segment is growing rapidly.

- By end-use industry, the water and gas segment held the largest revenue share in 2024.

- By end-use industry, the industrial segment will grow at a significant CAGR between 2025 and 2034.

- By distribution channel, the direct sales segment dominated the market in 2024.

- By distribution channel, the online platform will grow at a significant CAGR between 2025 and 2034.

Market Overview

Bimodal HDPE refers to a type of high-density polyethylene produced using two distinct molecular weight fractions—one with a high molecular weight and one with a low molecular weight. This dual-modal structure imparts a unique balance of processability and mechanical properties such as stiffness, toughness, and environmental stress crack resistance (ESCR), making it suitable for high-performance applications.

Polyethylene consists of molecules of varying chain lengths, resulting in a range of molecular weights. The ratio of crystalline matter to the quantity determines the polyethylene's melting point. The melting point increases with the increase in crystallinity and density. The melting point changes between 110 degrees Celsius and 128 degrees Celsius. Usually, the LMV/HMV weight fraction can be controlled with a huge range. The resin has a molecular weight distribution, which is characterized by the ratio of Mw/Mn or MFR. The bimodal molecular weight rains can be initiated into films on current equipment, exhibit perfect workability in films, and provide film products of excellent FQR.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 11.94 Billion |

| Projected Market Size in 2035 |

USD 26.98 Billion |

| CAGR (2026 - 2035) |

8.5% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Process Technology, By Application, By End-Use Industry, By Distribution Channel and By Region |

| Top Key Players |

LyondellBasell Industries, INEOS Group, Chevron Phillips Chemical, ExxonMobil Corporation, SABIC, Borealis AG, TotalEnergies, Braskem, Formosa Plastics Corporation. |

What Are the New Trends in the Bimodal HDPE Market?

- Enhanced polymer formulations: Current HDPE pipes include high-level additives and co-monomers to serve chemical resistance. For instance, the addition of carbon black (particularly at a concentration of 2-3% by weight) provides excellent UV resistance, extending the pipe's outdoor lifespan.

- Precision manufacturing techniques: Computer-controlled extrusion procedure ensures constant wall thickness and material distribution. This accuracy contributes to uniform pipe power and performance, with thickness differentiation often carried to within +- 5% of the particular value.

- Incorporation of strengthening materials: Some producers are discovering the addition of nanocomposites, such as carbon nanotubes or nano clay, to further enhance the pipe's mechanical properties. Current studies suggest that capable improvements in terms of tensile strength by up to 20%.

- Multi-layer pipe design: Personalized uses now take advantage of multi-layer HDPE pipes. For example, potable water pipes have an inner layer updated for water quality, a central layer for strength, and an outer layer for environmental protection.

How is AI Integration Impacting the Bimodal HDPE Market?

As AI gains attention, its role may be misunderstood, especially among the latest users in sectors such as polymer science, where it can be easily confused with traditional modeling techniques or industrial automation. Researchers familiar with regular computational procedures can struggle to classify AL from explicitly programmed simulations or automated control systems. This could lead to a delusion about what exactly defines AI and how it differs from other digital tools. As a result, several may assume that any computational system, from molecular simulations to factory sensors, is entitled to be called AI. This misunderstanding could blur the exact distinction between traditional computing and data-oriented intelligence. Material genome, machine learning (ML), and huge data approaches heavily overlap in their power, algorithms, and models. They can even target different definitions, correlations, and distributions of physical matter elements in given polymer systems. And have growing applications as a new paradigm, essential to conventional ones.

Market Dynamics

Driver

HDPE: Corrosion-Resistant Game Changer for Oil and Gas Pipelines

Due to its exceptional qualities, which include high tensile power, opposition to environmental stress cracking, and superior chemical inertia, HDPE has sculptured out of place, in the oil and gas industry, These characteristics render it to material of selection for different applications, that series from pipe systems to storage tanks, protective coatings to geomembranes. Pipeline construction is one of the most widespread applications of HDPE in the oil and gas sector. Steel, a traditional material, is rigid yet corrosion-resistant, and therefore requires regular maintenance and incurs significant investment. HDPE, on the other hand, exhibits excellent corrosion resistance, making it an ideal material for transporting chemicals, water, and hydrocarbons. Furthermore, its lightweight design enables convenient installation, lowering labor costs and project timeframes.

Restraint

Tackling Costs and Expanding Potential

While the HDPE sector has enormous capability, one of the main limitations is the volatility of raw material costs, notably crude oil, which is utilized as a feedstock for HDPE manufacturing. Fluctuations in crude oil prices affect HDPE Costs, posing issues for both end-users and manufacturers. Another issue is resolving performance restraints in heavy environments. While HDPE is heavily durable, it can be damaged by increased exposure to ultraviolet light or extremely high temperatures. To address this, producers are investing in research and development to enhance the material's performance characteristics. Despite these destructions, there are various prospects for HDPE, especially in the oil and gas industry. The overall transformation towards renewable energy and carbon neutrality is increasing the demand for materials that support sustainable operations.

Opportunity

Bimodal HDPE: A Sustainable Solution

The thermoplastic substance HDPE, or high-density polyethylene, is known for its high -high-strength-to-density ratio. A specialized production technique ensures the durability, flexibility, and resistance to external pressures of HDPE pipes. Due to its unique qualities, it is an ideal option for various applications, including gas lines, cable conduits, and potable water. This ensures long-life service that often exceeds 50 years, even in challenging surroundings. HDPE pipes are joined using heat fusion, which creates a monolithic system that vanishes leaks. This specifically benefits water distribution systems, where water loss can be a significant issue. As a recyclable material, HDPE contributes to sustainable growth; its lightweight nature reduces transportation emissions, and its durability lowers the demand for frequent replacements.

Segmental Insights

The Slurry Segment Dominates the Bimodal HDPE Market in 2024

Bimodal HDPE Market Size, By Process Technology (USD Billion)

| |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Slurry Process |

6.103 |

6.552 |

7.053 |

7.717 |

8.443 |

9.125 |

9.692 |

10.499 |

11.637 |

12.465 |

14.025 |

| Gas Phase Process |

3.110 |

3.251 |

3.529 |

3.845 |

4.068 |

4.347 |

4.790 |

4.989 |

5.375 |

5.999 |

6.303 |

| Solution Process |

1.788 |

2.132 |

2.368 |

2.488 |

2.733 |

3.068 |

3.464 |

3.984 |

4.115 |

4.458 |

4.542 |

The slurry process dominated the market, accounting for a 45% share in 2024. HDPE 002DF50 is a heavy molecular weight, high-density, bimodal grade generated by the LyondellBasell Holstaten slurry process, as it has perfect processability, good optical properties, and superior dart effect strength and sealing properties too. HDPE 003DB52 is a natural, high-density, bimodal polyethylene grade characterized by good strength and ESCR properties.

The gas phase process in the LLDPE/HDPE procedure uses a liquidized bed gas phase process. All polymerization procedures are exothermic, and the heat generated during the reaction must be constantly eliminated, or there is a risk of a runaway reaction or chunk formation. The heat from the polymer materials dissipates, circulating hydrocarbon gas, which keeps the polymer bed in a swirled condition, thereby preventing particle-particle fusion. The actual fluidization velocity, which is 3-05 times the lesser fluidization velocity, is maintained using the central gas compressor, which recycles the gas from the reactor. The circulating gas from the cycle gas compressor is then cooled using either decalcified water or a cooling system in a shell-and-tube-type heat exchanger.

Which Application Dominates the Bimodal HDPE Market?

Pressure pipes dominated the market, accounting for a 35% share in 2024. HDPE pressure pipe is a pipe made from heavy-density polyethylene material, characterized by its high density and molecular weight, which provide it with excellent mechanical properties and chemical stability. It is a highly crystalline, non-polar thermoplastic resin with excellent corrosion resistance, water resistance, long service life, and insulation properties. These features make a pressure pipe a perfect alternative to a regular steel pipe. And PVC pipe, too. Pressure pipe is perfect in many ways. Primarily, the inner wall is smooth, resulting in lower energy consumption and smaller flow resistance. Additionally, it possesses great power and can withstand rigid exterior pressure and force, ensuring the safety and stability of the pipeline.

Large containers are storage units that can be designed using different types of polymers derived from natural gas or crude oil. These kinds of polymers are made through a range of complex chemical procedures that transform raw petroleum into thermoplastic. Such materials are specifically designed to be molded, shaped, and formed into rigid, long-lasting containers that are highly durable and large. The most widely used material for making large containers is polyethylene terephthalate (PET), commonly used for water, juice, and soda bottles. High-density polyethylene (HDPE) is another popular choice, commonly used for packaging everyday items such as household cleaners, shampoos, and detergents.

Water and Gas Utilities Dominate the Market in 2024

Water and gas dominated the market, accounting for a 30% share in 2024. IOCL's complete density PE production line will enable the production of both linear low-density polyethylene (LLDPE) and high-density polyethylene (HDPE), covering a broad range of key development applications necessary for the PE sector. To develop both the unimodal and bimodal PE Market segments, IOCL has chosen an industry to adopt the conventional UCAT J Unimodal HDPE Technology. The combination of these technology platforms enables IOCL to align with the stringent end-use performance standards required for complex PE applications, including flexible packaging, rigid packaging, high-pressure pipes, and a wide range of durable uses.

Polyethylene is counted as a flammable plastic with an oxygen index number of 17%. Materials that burn with less than 21% of oxygen in the air are considered to be flammable. Below 17% oxygen, HDPE self-extinguishes and the concentration too. PE drips and constantly burns without soot after the ignition source is removed. When PE burns, toxic substances, initially carbon dioxide and carbon monoxide, are released. Carbon monoxide is typically the most toxic byproduct of combustion to humans. The following classification, by various combustion standards, is utilized: According to the UL94, PE is classified as HB (Horizontal Burning). The self-ignition temperature is 62°F.

How Will Direct Sales Dominate the Bimodal HDPE Market in 2024?

Bimodal HDPE Market Size, By Distribution Channel (USD Billion)

| |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| Direct Sales |

3.911 |

4.262 |

4.758 |

5.220 |

5.574 |

5.981 |

6.575 |

7.137 |

8.086 |

8.492 |

9.229 |

| Distributors |

5.817 |

6.225 |

6.579 |

6.900 |

7.651 |

8.169 |

8.901 |

9.595 |

10.407 |

11.349 |

12.097 |

| Online Platforms |

1.272 |

1.448 |

1.612 |

1.930 |

2.020 |

2.390 |

2.470 |

2.739 |

2.633 |

3.081 |

3.544 |

Direct sales dominated the market, accounting for a 60% share in 2024. It is a strategy in which a producer or generator serves products directly to consumers. This type of distribution rarely involves the use of wholesalers or other types of distributors, as organizations typically process and sell the products themselves. This type of distribution may also help companies increase revenue and reduce out-of-pocket marketing expenses. Service is offered as a promotion through their website and in-store flyers, as well.

Packaging in the context of e-commerce extends beyond the simple act of containment; it's a combination of product protection and brand representation. It presents as a primary physical touchpoint for customers in a digital transaction, setting the stage for their complete shopping experience. The primary objectives of packaging in e-commerce are twofold: to protect goods during rigorous shipping and to effectively communicate the brand identity. In the e-commerce industry, where brands compete for attention in the digital space, packaging serves as the primary point of contact between the customer and the brand.

By Region

Bimodal HDPE Market Size, By Region (USD Billion)

| |

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

2030 |

2031 |

2032 |

2033 |

2034 |

| North America |

2.294 |

2.544 |

2.588 |

2.834 |

3.059 |

3.623 |

4.074 |

3.944 |

3.848 |

3.872 |

4.305 |

| Europe |

5.311 |

5.735 |

6.316 |

6.930 |

7.501 |

8.014 |

8.612 |

9.428 |

10.633 |

11.632 |

12.984 |

| Asia-Pacific |

1.161 |

1.353 |

1.617 |

1.742 |

1.807 |

1.931 |

2.235 |

2.564 |

3.060 |

3.514 |

3.630 |

| Latin America |

1.643 |

1.799 |

1.738 |

1.847 |

1.976 |

1.986 |

2.179 |

2.604 |

2.853 |

3.057 |

3.057 |

| Middle East & Africa |

0.592 |

0.504 |

0.691 |

0.697 |

0.901 |

0.987 |

0.846 |

0.932 |

0.732 |

0.847 |

0.895 |

Asia Pacific

Asia Pacific dominated the market with a 42% share in 2024. The Asia Pacific bimodal HDPE market is experiencing rapid growth, driven by industrialization, the expansion of urban sectors, and supportive government policies. Japan, China, and India are at the forefront, leveraging their production strength and technological potential. The region benefits from competitive labor costs, growing infrastructure, and increasing demand across end-use sectors. Additionally, powerful government initiatives promoting intelligent factories, digital infrastructure, and AI adoption are driving productivity and resulting outcomes, which makes the Asia Pacific the primary growth engine for the bimodal HDPE industry.

Middle East and Africa

In the Middle East, a region renowned for its oil production, HDPE is gaining attention for its role in enhancing operational efficiency. Countries such as the UAE and Saudi Arabia are investing heavily in modernizing their gas and oil infrastructure, resulting in strong demand for innovative materials like HDPE. The demand for bimodal high-density polyethylene in the Middle East and Africa is steadily growing, driven by fast infrastructure development, expanding construction activities, and a growing packaging industry. Countries like Saudi Arabia and the UAE are investing heavily in large-scale water supply and gas pipeline projects that favor bimodal HDPE due to its superior strength and durability.

Bimodal HDPE Market Key Players

Recent Developments

- On 2 December 2024, BASF disclosed Easiplas, a new high-density polyethylene (HDPE) brand crafted to meet the rising demand for high-level plastics in the Chinese Market. ( Source: Chemindigest)

- On 25 November 2024, Fortress Investment Group disclosed that funds handled by its affiliates have acquired Infra Pipe Solutions, which is a top manufacturer of small to large-diameter high-density polyethylene structures and pipes that are sold under brand names including Endopure, Enduct, and Weholit. (Source: Business Wire)

Segmentation of the Bimodal HDPE Market

By Process Technology

- Slurry Process

- Gas Phase Process

- Solution Process

By Application

- Pressure Pipes

- Water Distribution (Municipal)

- Gas Distribution

- Industrial Piping

- Blow Molding

- Large Containers (e.g., drums, IBCs)

- Small Containers (e.g., bottles, jerrycans)

- Film & Sheet

- Agricultural Films

- Industrial Packaging Films

- Geomembranes

- Injection Molding

- Crates & Pallets

- Automotive Parts

- Caps & Closures

- Wire & Cable Insulation

- Others

- Fuel Tanks

- Construction Materials

By End-Use Industry

- Packaging

- Industrial Packaging

- Consumer Packaging

- Agriculture

- Water & Gas Utilities

- Construction

- Automotive

- Electrical & Electronics

- Others

- Healthcare

- Chemical Processing

By Distribution Channel

- Direct Sales

- Distributors

- Online Platforms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa