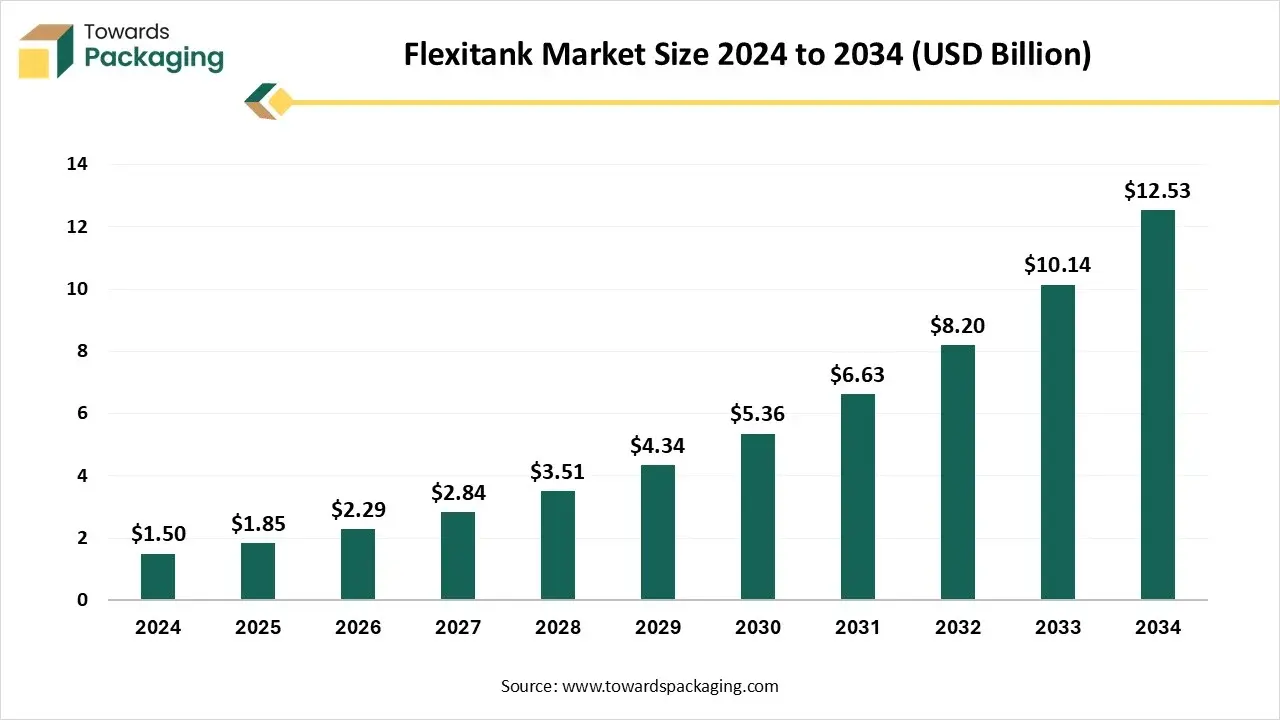

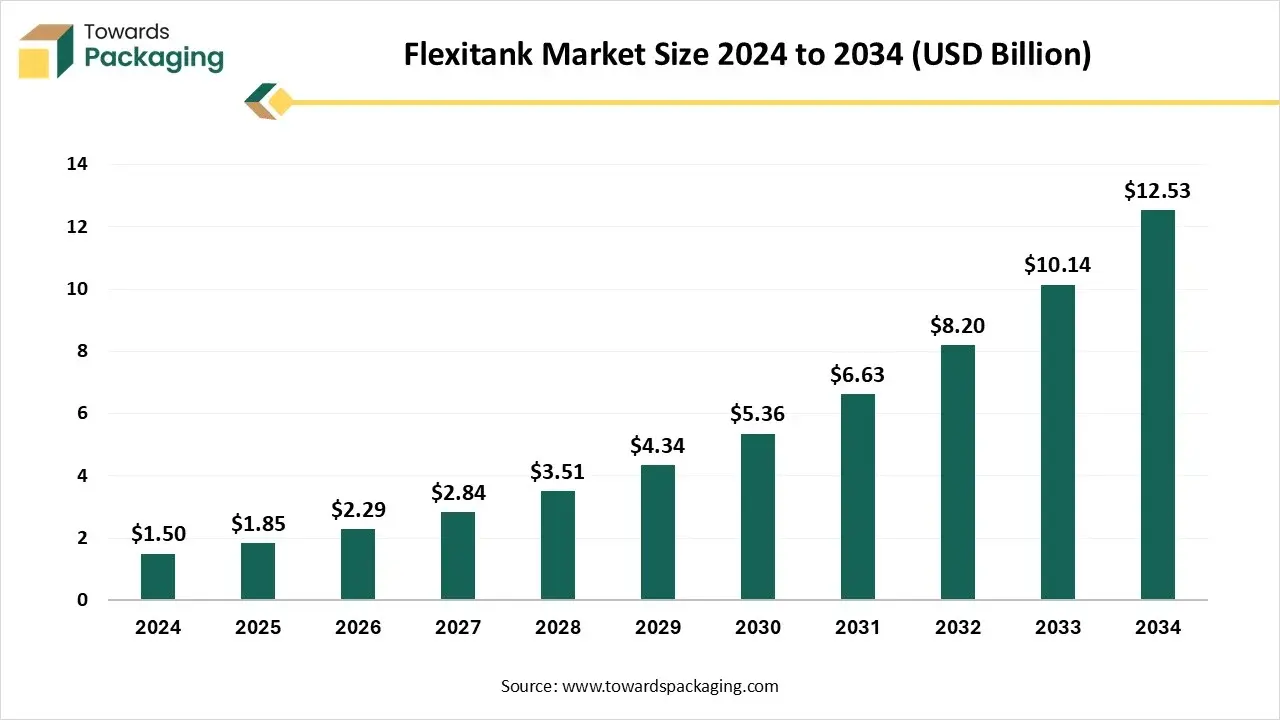

The flexitank market is forecasted to expand from USD 2.29 billion in 2026 to USD 15.49 billion by 2035, growing at a CAGR of 23.65% from 2026 to 2035. The market demand is driven by food materials, agrochemicals, and pharmaceutical raw materials, which is encouraging the demand for flexitank in the market.

The market is driven by growth in international bulk liquid trade, cost-saving logistics demand, and rising adoption in emerging economies. The flexitank Market refers to the global industry involved in manufacturing and supplying large, flexible containers (flexitanks/flexibags) used for transporting non-hazardous bulk liquids inside standard shipping containers. Flexitanks are cost-effective alternatives to drums, IBCs, and tank containers, offering higher payload efficiency and reduced handling costs. They are widely adopted across food & beverage (oils, juices, wine), chemicals, agriculture, and pharmaceutical liquids.

| Driver | Description/Impact |

| Cost-efficient bulk transport | Companies prefer flexitank over drums/IBCs to save on shipping and handling costs, driving higher adoption |

| Sustainability & lower carbon footprint | Flexitanks reduce material use and emissions, aligning with EU environmental regulations and corporate sustainability goals |

| Growing liquid exports | Rising exports of food-grade oils, beverages, and chemicals in Europe increase demand for safe, large-volume liquid transport. |

| Food safety & contamination prevention | Flexitanks provide hygienic, single-use liners that reduce contamination risks for sensitive liquids. |

| Technological Improvements | The development of recyclable liners, higher payload capabilities, and enhanced safety features makes flexitanks more attractive to shippers. |

| Regulatory compliance | EU and international packaging regulations encourage the use of transport solutions that are safe, recyclable, and traceable. |

Seamless fusion technology is one of the main technological growth areas in Flexitank manufacturing. Just like regular sewn bags, which can have weak points along the seams, Flexitanks are produced using heat fusion, which joins the fabric without sewing. This results in a smooth structure that lowers the risk of leaks and increases the overall strength of the tank.

Flexitanks are utilised for liquid cargo, such as food-grade and chemical liquids, and are crafted with integrated venting systems that enable the safe release of pressure or gas. Furthermore, tracking systems can be included in flexitanks to manage pressure, temperature, and fill levels too. This makes sure that the cargo remains safe and the quality is tracked throughout the path.

| Metric | Details |

| Market Size in 2025 | USD 1.85 Billion |

| Projected Market Size in 2035 | USD 15.49 Billion |

| CAGR (2026 - 2035) | 23.65% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Product / Type, By Capacity / Size, By Application, By End-User, By Loading Type / Mode and By Region |

| Top Key Players | BLT Flexitank Industrial Co., Ltd., SIA Flexitanks, Hoyer Group, Bulk Liquid Solutions, Gold Coast Packaging Pty Ltd, Monon Tankers Pvt. Ltd., Proagri Solutions LLC, Anthente International |

The flexitank market is gaining strong momentum as businesses search for alternatives to conventional bulk liquid containers that are affordable, lightweight, and environmentally friendly. Flexitanks use a single-use high-capacity liner in place of drums and IBCs to lower shipping costs, minimize contamination risks, and reduce carbon emissions. Adoption is being fueled by rising demand from food-grade oils, chemicals, and beverages, particularly in export-pending markets. Flexitanks with recyclable materials increased payload capacity and enhanced safety standards, are increasingly the preferred option for international liquid logistics as the need for sustainability grows.

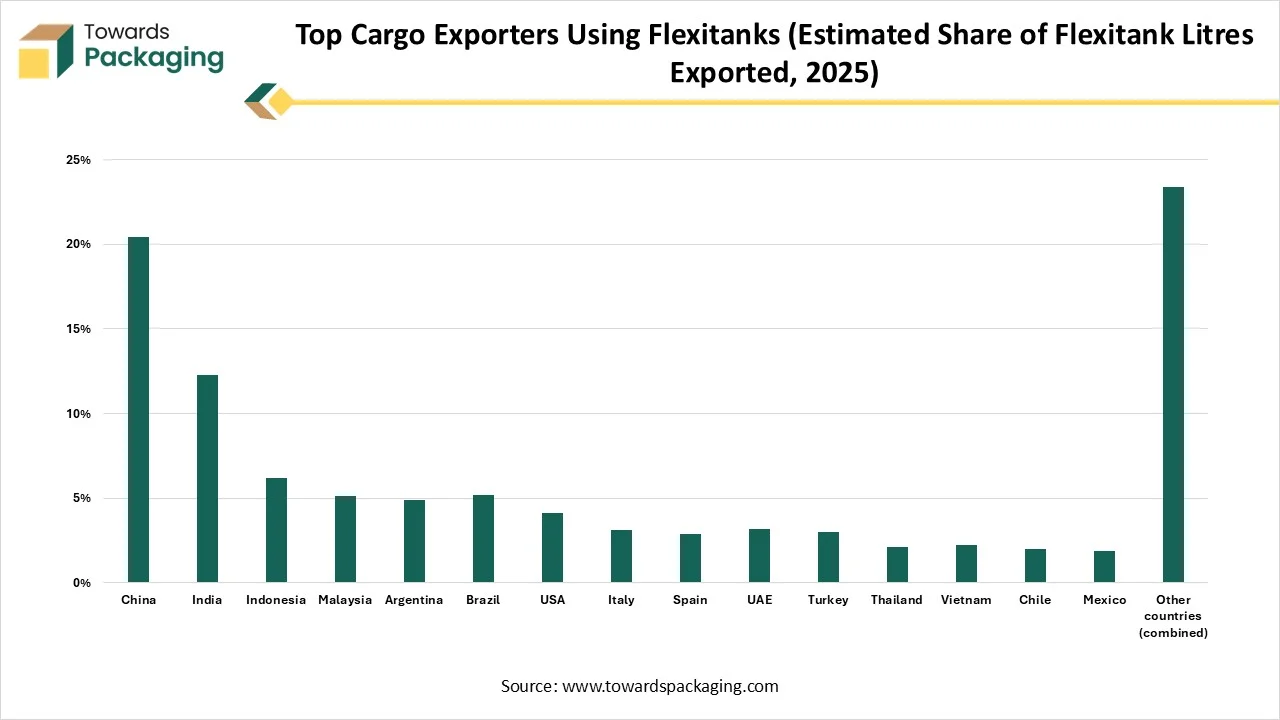

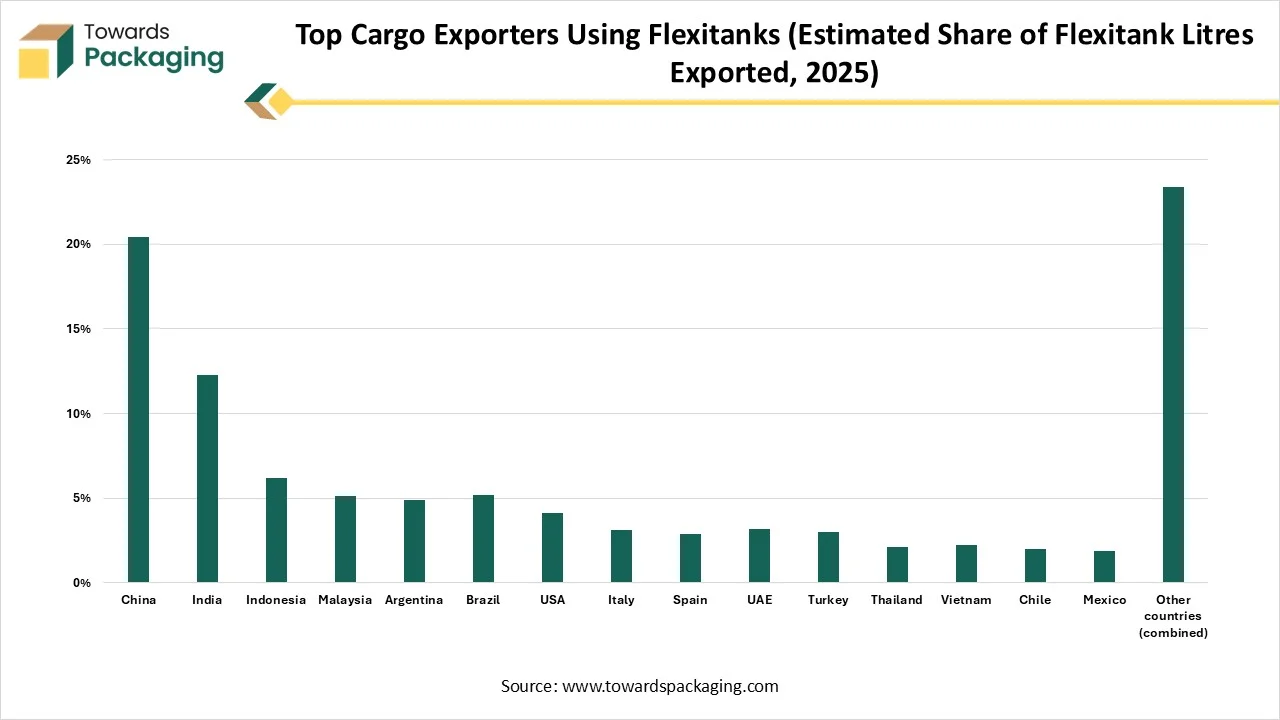

| Country | % Share of Global Flexitank Export Litres |

| China | 20% |

| India | 12% |

| Indonesia | 6% |

| Malaysia | 5% |

| Argentina | 5% |

| Brazil | 5% |

| USA | 4% |

| Italy | 3% |

| Spain | 3% |

| UAE | 3% |

| Turkey | 3% |

| Thailand | 2% |

| Vietnam | 2% |

| Chile | 2% |

| Mexico | 2% |

| Other countries (combined) | 23% |

| Types of Products to be Shifted | Density (kg/m3) | Recommended Size of Flexitank |

| Polyol | 1,100 | 19,000 L |

| Latex | 60-95 | 19,000 l |

| Glycerin | 1,260 | 20,000 L |

| Olive Oil | 905 | 22,000L |

| Palm Oil | 887.5 | 21,000 L |

| Wine | 985.7 | 24,000 L |

Apart from their flexibility, flexitanks are also a cost-effective path to transport bulk liquid cargo. As they can transfer up to 24,000 litres in a sophisticated 20-foot container, for organizations seeking to ship big volumes of liquid cargo, this maximizes the price that can be transported while assisting to lower the cost per litre. The pattern of flexitanks can assist in reducing waste by reducing the amount of liquid left in the bag upon service. This develops the complete cost-effectiveness of liquid cargo shipping for organizations by maximizing the price of cargo that can be shipped and safely served.

Also, by updating space, flexitank containers can also help reduce emissions per unit of shifted liquid. If any business is included in liquid shipping on a regular basis, this can help grow overall supply chain carbon footprints and can help in aligning your shipping practices with huge sustainability goals.

Ruptures or leaks can come due to weak materials, overfilling, sharp edges inside the container, operational or manufacturing mistakes, and container handling, too. So, in this case, check the container for sharp edges, procedures, or rust before installation. Chemical reactions or pollutants can occur if the liquid isn’t consistent with the Flexitank material. The solution to this is to cross-check material compatibility with the liquid before suage and select food-grade or tailored flexitanks, such as aseptic, for cargo types like juices, food, and milk too.

| Parameter | Value |

| Compatible container type | 20 ft standard dry container |

| Typical internal floor area (m²) | 13.2 |

| Typical max flexitank length (m) | 3.92 |

| Typical max flexitank width (m) | 2.33 |

| Typical max flexitank height (m) | 0.82–1.03 |

| Typical loaded weight (kg) | 20,300–26,400 |

| Container max gross weight (kg) | 24,200–30,550 (varies by model) |

| Required lashing points | 4–7 |

| Floor protective layer | Heavy-duty corrugated board + timber dunnage |

| Valve access position | Rear-end access (standard configuration) |

| Component | Adjusted Weight (kg) |

| Inner liner (PE/LDPE multi-layer) | 6.2–9.3 |

| Outer woven bag / sleeve (PP) | 1.6–3.1 |

| Composite laminate layers | 0.85–1.55 |

| Valves & fittings (HDPE/PP) | 0.42–0.82 |

| Sealing tapes & straps | 0.22–0.43 |

| Packaging (corrugated + pallet) | 0.55–1.25 |

| Total dry material weight (avg) | 9.8–16.3 kg |

| Average used for calculations | 12.8 kg / unit |

The single-use flexitank segment has dominated the market with approximately 60% share in 2024 as single-use containers are being crafted to transport heavy liquids inside sophisticated shipping containers, which serve as a cost-effective alternative to regular tank drums or containers. Flexitanks are utilised to securely manage non-hazardous liquids like beverages in huge quantities, increasing cargo potential in a 20-ft food container. They assist organisations in reducing packaging waste, streamlining the management of liquid goods, and lowering shipping costs, too.

The reusable/semi-reusable segment are expected to be the fastest in the market during the forecast period. A reusable flexitank container is a big-performance water storage container that is made of polymer composite materials like PVC or TPU, and even coated mesh fabric too. They are being managed by a professional heat packaging machine and manual procedure, with perfect flexibility and durability, too. The natural service life can achieve 20 years, which makes it a perfect choice for transportation and liquid storage.

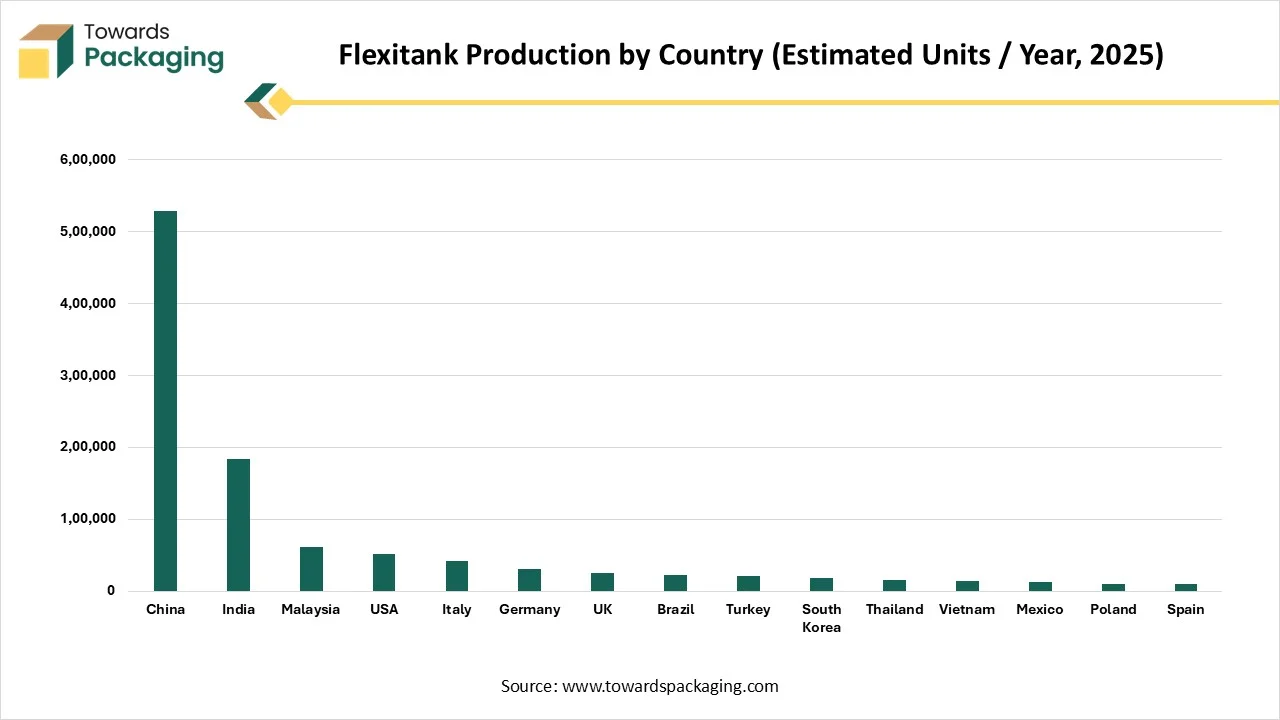

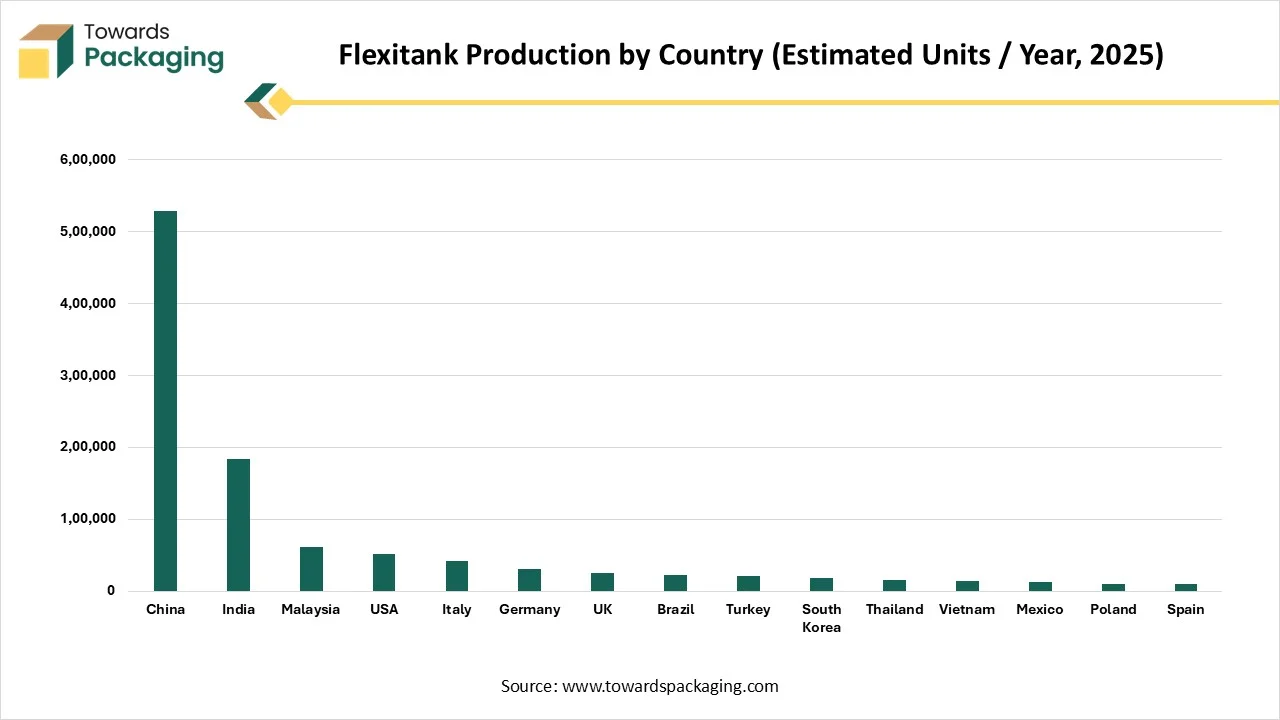

| Country | Adjusted Estimated Units / Year (2025) |

| China | 5,28,500 |

| India | 1,84,200 |

| Malaysia | 61,300 |

| USA | 51,700 |

| Italy | 41,600 |

| Germany | 31,200 |

| UK | 25,900 |

| Brazil | 22,600 |

| Turkey | 20,800 |

| South Korea | 18,500 |

| Thailand | 15,700 |

| Vietnam | 14,400 |

| Mexico | 12,600 |

| Poland | 10,400 |

| Spain | 10,200 |

The medium capacity (10K-18K L) segment dominated the flexitank market with approximately 50% share in 2024, as they are utilised for transporting non-toxic liquids in which full max-size tanks of 20,000+ L are not needed or reliable, often due to density or lower volume demands. They serve as a cost-effective way to utilise any standard 20-ft containers, which maximizes the payload without over-filling, and lowers logistics costs as compared to drums or ISO tanks. These flexitanks are multilayer PE (polyethylene) film-lined and frequently have an outer PP (polypropylene) woven jacket for manufacturing. Bulkheads, valves, and safety fittings are crafted to handle loading and unloading.

The large (>18 L) segment are predicted to be fastest in the market during the forecast period. These are used to transport big volumes of non-hazardous liquids like wine, juices, liquid food ingredients, and industrial liquids. These tanks specifically consist of several inner layers of polyethylene (PE) and an outer woven polypropylene (PP) jacket, having button or top discharge and loading valves. They perfectly fit into sophisticated 20-foot or 40-foot ISO dry-van containers. Some variants count oxygen barrier innings and temperature-sensitive liquids. Benefits include a higher payload per container or simplified logistics since the flexitank is single-use.

The food and beverage segment has dominated the market with approximately 45% share in 2024, as in the worldwide food and beverage industry, transferring food-grade liquids around borders must be efficient, safe, and cost-effective. Regular procedures like intermediate bulk containers and drums often try to manage with pollutant risks and high costs. Flexitanks have collaborated as a breakthrough solution, which changes how organizations manage cross-border transportation of juices, edible oils, concentrates, and other consumable liquids, too.

Current flexitanks are constructed to international food-grade transport standards and can firmly face long paths without leaking. By utilising the certified flexitanks, bearers can be confident in their bulk liquids, which will come securely and meet regulations. Flexitank avoid the demand for big totes or drums. Used tanks can be overall recycled, mainly reducing waste too.

The chemicals and specialty liquids segment are expected to be the fastest-growing in the market during the forecast period. The flexitanks are ideal for transferring non-toxic liquids like edible oils, chemicals, lubricants, base oils, and latex, too. So flexitank acceptability is something that frequently highlights to clients with different demands. For instance, the textile sector often needs the transport of liquid latex. The rigidness of flexitanks ensures fragile materials stay undamaged throughout their path.

Basically, there are two ways that highlight chemical logistics while avoiding the issue in it, which include economic benefits and product level too. The advantages linked to the product level are protection from leaks, temperature compatibility, and chemical compatibility.

The food and beverage producer segment has dominated the market with approximately 40% share in 2024, as the bulk liquid transportation industry for beverages that includes products like fruit and vegetable juices, concentrates, and agricultural oils like olive oil and sunflower oil, too, has penetrated the changing mode. A more environmentally friendly and smart procedure of shipping these cargoes has come up in the form of flexitanks. These inventive encapsulated transporting options serve as a developed means of shipping non-hazardous bulk liquids both globally and internally.

The logistics and freight companies segment are predicted to be the fastest-growing in the market during the forecast period. Flexitank serve an overall, packed, one-time use solution for transporting liquids, ensuring exceptional product integrity and cleanliness. It is made with several layers of food-grade polyethylene and polypropylene, as they secure against exterior pollutants like transit through. Since every flexitank is disposable after each single-use, as there is no risk of cross-contamination between shipments, they are perfect for sensitive products like food-grade liquids, pharmaceuticals, and beverages.

flexitank are an efficient shipping solution. Their lightweight pattern avoids the demand for additional packaging materials and heavy containers, which lowers the total transportation costs.

The bulk filling at the manufacturing site segment has dominated the market with approximately 55% in 2024 as a trained server installs the big, collapsible bag inside a sophisticated 20-foot shipping container and then utilizes the hoses and pump to fill it with liquid. Accurate container making, careful flexitank installation, and managed filling rates are necessary to ensure the integrity and safety of the bulk liquid cargo.

For bulk filling at the manufacturing site, use clean and tested hoses that are compatible with the bulk liquid. To connect the filling with the flexitanks valve and to the pumping machine. Also, avoid the valve’s safety cap and pin, then push the lever to open the valve. This enables the flexitank to stretch smoothly and the operator to check for leaks.

The tanker-to-container segment is predicted to be the fastest in the market during the forecast period. Flexitanks are the smoothest way to transport bulk liquid from one point to another, whether it is water or land. They serve perfect protection against oxidation and pollutants, making sure that the liquid reaches its final journey in a pristine state. It is important to make sure that no spillage takes place during transportation. Hence, the filler must compulsorily install all spillage protection mechanisms before transport.

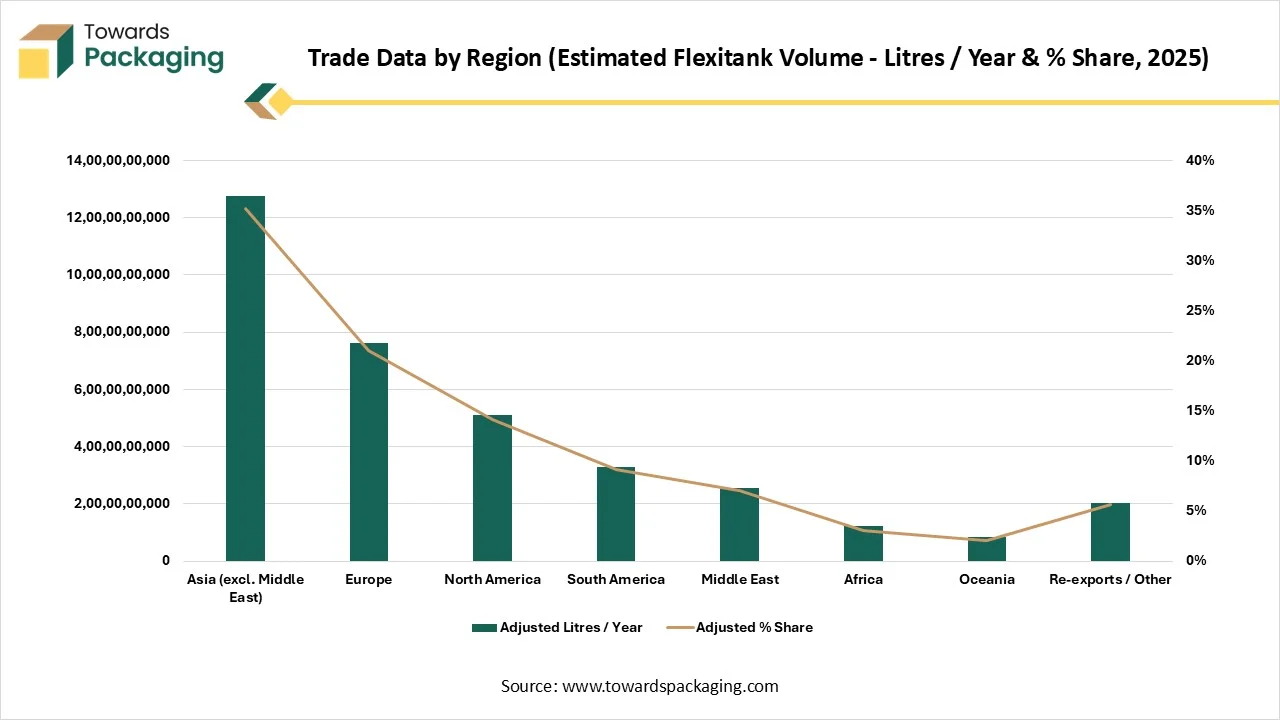

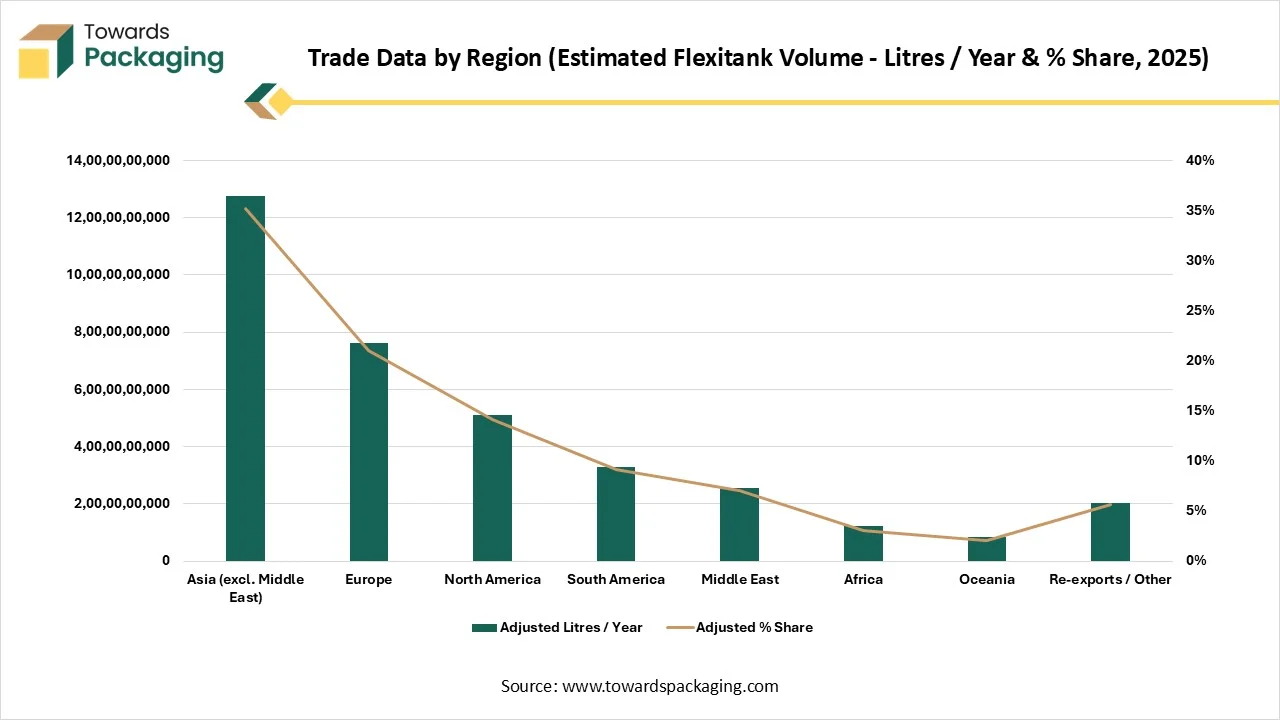

| Region (Export Origin Basis) | Adjusted Litres / Year | Adjusted % Share |

| Asia (excl. Middle East) | 12,74,50,00,000 | 35% |

| Europe | 7,61,00,00,000 | 21% |

| North America | 5,09,50,00,000 | 14% |

| South America | 3,28,50,00,000 | 9% |

| Middle East | 2,54,50,00,000 | 7% |

| Africa | 1,21,50,00,000 | 3% |

| Oceania | 85,50,00,000 | 2% |

| Re-exports / Other | 2,04,50,00,000 | 6% |

Asia Pacific dominated the flexitank market in 2024, as this region is experiencing the main growth in the flexitank industry, driven by expanding industries like chemicals, agriculture, and food. Countries such as India, China, and Japan are progressively accepting flexitanks as a reliable and cost-effective transport solution for heavy liquids. The rising urge for eco-friendly solutions, integrated with the demand for efficient supply chains in growing markets, is further fueling the market’s demand. Flexitanks are specifically famous in the region for shipping edible oils, palm oils, and chemicals, in which large quantities need to be shipped securely and smoothly.

Flexitank producers in India are in the field of transporting liquids. In which cost-effectiveness and smoothness region need supreme, regular methods like barrels and drums, which are beginning to feel a bit like yesterday’s news. Flexitank manufacturers in India are also optimised in the game of bulk liquid transport.

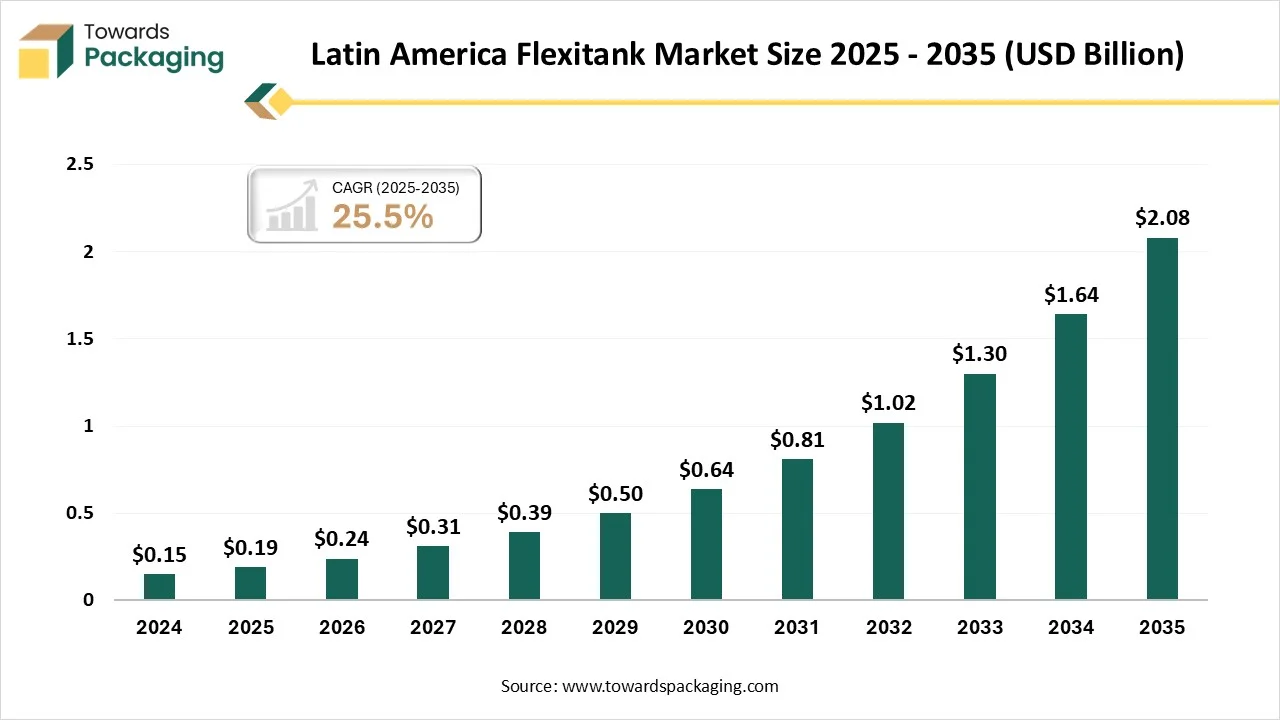

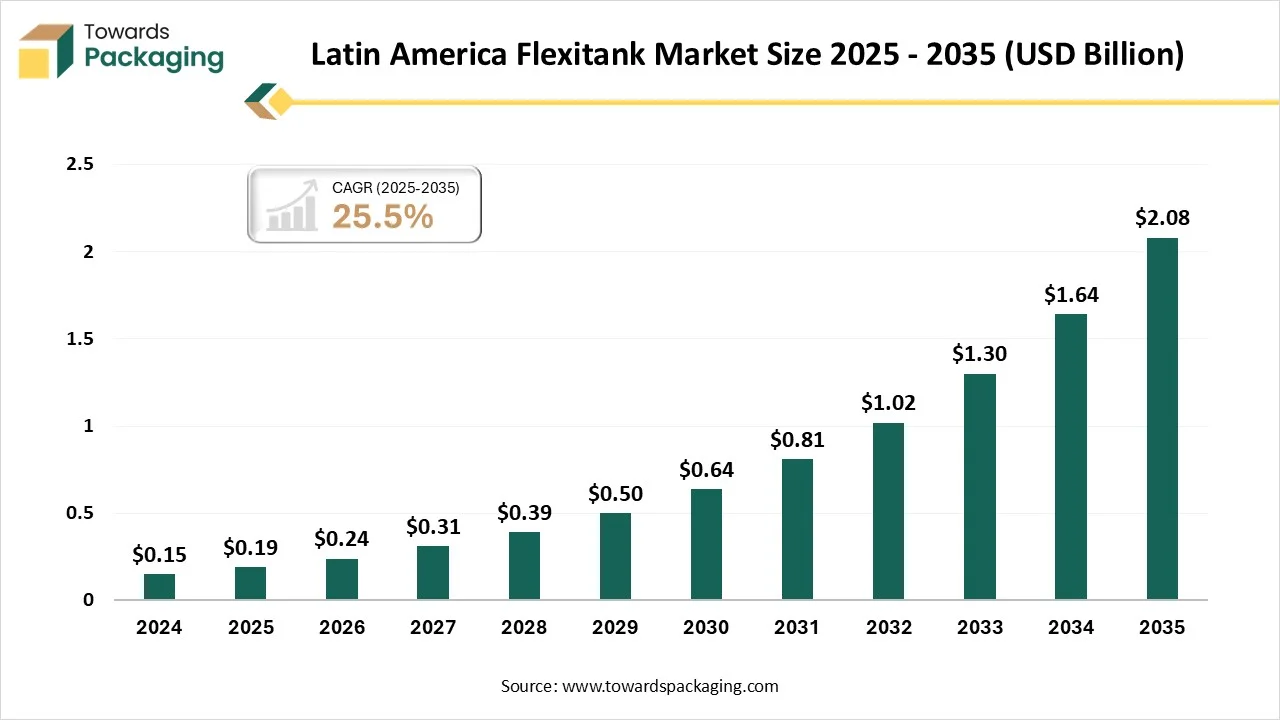

Latin America expected to be the fastest-growing in the market during the forecast period. Circular economy principles are redefining material selection, with 42% of the latest flexitank prototypes, which include the biodegradable additives that promote decomposition under landfill surroundings. A current pilot in Brazil shows 90% material analysis within 12 months for post-user flexitanks carrying edible oils. Hence, managing and tracking biodegradability with performance stays challenging; high-level ethylene-vinyl alcohol (EVOH) barrier layers now allow 19-month shelf life for temperature-sensitive items like palm oil derivatives.

Also, the Mexican development is being fueled by expanding production and export activities, particularly in food industries and chemicals. The closeness to the United States and growing trade agreements demand increasing cross-border shipments, further boosting the urge. The acceptance of flexitanks is being driven by their compliance and cost-effectiveness with safety standards. Industry players are heavily concentrating on localised production and strategic partnerships to capture regional possibilities, which makes Mexico a main developed growth corridor with the Americas.

The North America flexitank market is growing steadily as companies look for large volume, economical liquid transportation solutions. Flexitanks are replacing traditional drums and IBCs due to growing demand in the food, beverage, and chemical industries, as well as sustainability initiatives. The regions market is expanding thanks to technological advancements like safer handling features and stronger liners.

U.S. Flexitank Market Trends

In the US, the flexitank market is witnessing faster growth due to rising exports of industrial liquids, juices, and edible oils. High-capacity recyclable flexitanks are a popular option because businesses are concentrating on cutting transportation expenses and minimizing their impact on the environment. Manufacturers and logistics companies are being encouraged to transition from traditional bulk containers to flexitank solutions due to increased safety regulations and advancements in liner materials.

Tier 1

Tier 2

Tier 3

By Product / Type

By Capacity / Size

By Application

By End-User

By Loading Type / Mode

By Region

February 2026

February 2026

February 2026

February 2026