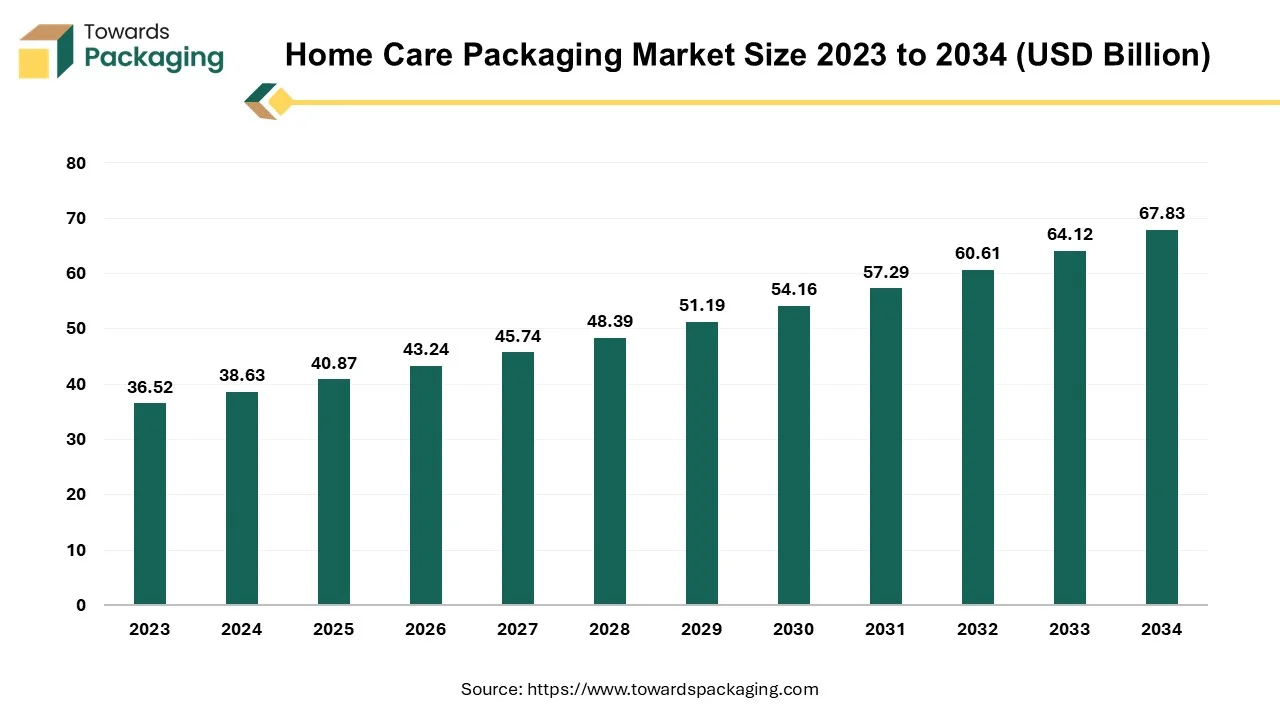

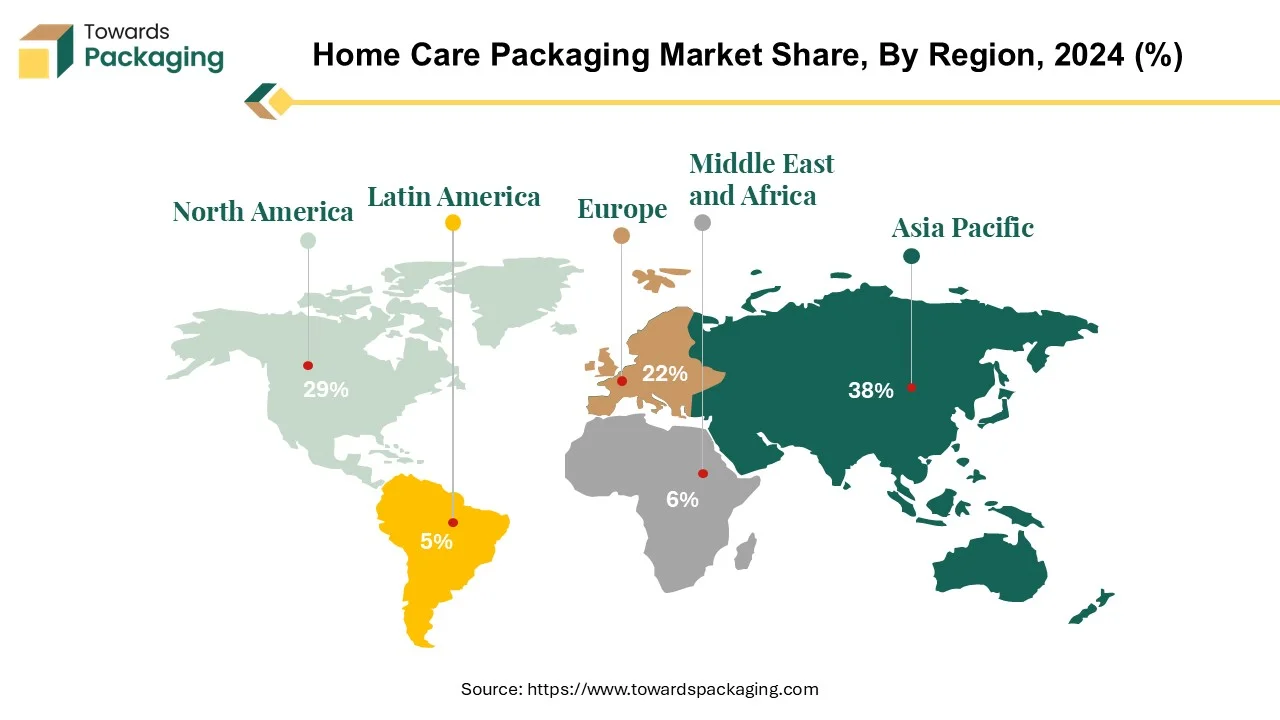

The home care packaging market is forecasted to expand from USD 43.23 billion in 2026 to USD 71.75 billion by 2035, growing at a CAGR of 5.79% from 2026 to 2035. This report covers market segments such as plastics, paper & paperboard, metal, and glass, as well as packaging types including bottles, containers, and pouches & bags. The market is expected to see significant growth in Asia Pacific, which accounted for 38.23% of the market share in 2023, driven by e-commerce expansion and sustainability.

North America is poised for steady growth, with a CAGR of 4.87%, fueled by consumer hygiene trends and innovative packaging solutions. This analysis also includes insights into key players, including Amcor, Berry Global, and AptarGroup, along with competitive analysis, value chain, and manufacturers’ data.

The home care packaging market is anticipated to witness significant growth during the forecast period. Prior to 2020, most markets saw a decline in the home care sector. Currently, meanwhile, months spent at home and health issues have affected the consumer purchasing habits, with many home care products being viewed as necessary in the light of COVID-19. Customers are increasingly buying home care items online for the purpose of keeping their houses safe, hygienic and clean. Sturdy packaging is necessary to meet the demands of the stringent ecommerce supply model. Companies in the industry provide a broad variety of rigid and flexible packaging choices to safeguard commodities during transit without sacrificing the sustainability or design.

The growing consumer preference for convenience and ease of use in household products coupled with the rise of e-commerce and online retailing is anticipated to augment the growth of the home care packaging market within the estimated timeframe. The growing awareness and concern for environmental sustainability along with advancements in packaging technology are also expected to support the market growth. Furthermore, the expanding middle-class population in emerging economies as well as the rising disposable incomes and changing lifestyle patterns is also likely to contribute to the growth of the market in the years to come. The global packaging market size is growing at a 3.16% CAGR between 2025 and 2034.

The growing awareness of hygiene and sanitation has significantly influenced consumer behavior, particularly in the wake of the COVID-19 pandemic. More than ever, people are concerned about cleanliness and hygiene. They now have developed new routines such as washing their clothes regularly and cleaning the phones after the deliveries. This gives home care companies a chance to become more involved in the lives of their customers. P&G revealed in October 2020 that sales of their organic home care products increased by over 30%, with double-digit growth observed in all the regions. With 59% of the US customers and 52% of UK consumers increasing their usage of the disinfectants or other cleaning products, sales of bleach and other home care disinfectants increased. Similarly, Unilever showed doubled turnover for home care products in 2021.

Furthermore, home care products became lifestyle brands as a result of the epidemic. They are able to advise customers on when and how to utilize cleaning and disinfection products. To help educate consumers, Clorox, for instance, released a number of "how to" content pieces, such as "How to prepare a homemade disinfectant using Clorox." Another example involves Unilever's brand Domestos, which witnessed strong double-digit growth by educating customers about the need to clean high-touch surfaces in the home specifically to stop the virus from spreading. The company worked with specialists of environmental health to achieve this goal.

Brands should utilize creative packaging to convey useful information regarding how to utilize the products most efficiently, as consumers are likely to maintain this elevated degree of interaction with the cleaning products in the future. Amcor, for instance, offers an on-pack link through its MaXQ digital style packaging to develop relationships and trust with the customers. A fast mobile scan of the MaXQ pack can provide the consumers with instant access to a variety of information including cleaning advice and how-to guides for various products. Additionally, it enables enterprises to follow and trace the specific packs, which can help with the supply chain optimization as well as the battle against counterfeiting. It is anticipated that consumers would take years to recover from their new cleaning habits and that they will have a greater awareness for home hygiene in the years to come.

The rising environmental concerns and regulations are likely to restraint the growth of the home care packaging market during the forecast period. As the awareness of the environmental issues grows across the globe, the regulatory organizations are implementing stringent regulations on the packaging materials to reduce their environmental impact. The first state to enact an extensive legislation covering the plastics recycling and reduction is California. The law mandates a 25% decrease in the single-use plastic by 2023 and a 25% decrease in the expanded polystyrene use by 2023 with reference to the reduction of plastics. By 2028, the law mandates that minimum 30% of the plastic products sold or purchased in California be recyclable. Lastly, by 2032, California will require 65% of all the plastic products distributed or sold to be recyclable. Any organization that refuses to follow the new law may be fined up to $50,000 every day.

Additionally, UK has also implemented certain laws to reduce the plastic use. Companies that will manufacture or import over ten tonnes of finished plastic packaging in (to) the UK during a period of twelve months will need to register for the Plastic Packaging Tax starting in April 2022. A tax of £200 is imposed on each tonne of the plastic that has less than thirty percent of the recycled plastic in it. To qualify for an exemption, organizations must be able to prove as well as maintain documentation that their plastic is at least 30% recycled plastic. These laws and shift towards greener and better environment is expected to affect the home care packaging industry by restricting the types of materials that can be utilized, consequently influencing both design and cost structures.

The growing consumer preference for eco-friendly products is likely to drive the demand for sustainable packaging solutions in the home care market. This trend includes the adoption of biodegradable, compostable and recyclable materials. Companies are increasingly investing and focusing on developing sustainable packaging solutions to enhance the brand loyalty and potentially command higher price points.

These innovations are likely to create various opportunities for the growth of the home care packaging market in the years to come.

The plastics segment captured largest market share of 47.78% in 2023. Due to its ability to reduce emissions and make shipping lighter and safer, plastic has completely changed the packaging industry. Flexibility, durability, lightness, stability, barrier function, and simplicity in sterilization are just a few of its many advantages as a packing material. Furthermore, the innovation driven by technology is causing plastic packaging to become increasingly circular. Soon, developments such as printable RFID (radio-frequency identification) chips on packaging is going to be capable to communicate critical information about product quality and condition, as well as recycling instructions. Products are being moved through the supply chain more effectively due to the specially made plastic packaging for transportation.

Furthermore, with the growing popularity of light weighting, which involves using fewer materials in packaging, fewer trucks are required to transport the same quantity of goods in lighter loads. This strategy lowers the emissions; shipping costs as well as the amount of fuel used for transportation. These factors are likely to support the segmental growth of the market.

The pouches & bags segment is expected to grow at fastest CAGR of 25.65% during the forecast period. Historically, a lot of household cleaning goods have been offered for sale in the bulky HDPE bottles and jars. These days, a lot of companies are either adding the refill pouches to their bottles or making the switch to the flexible packaging (like spouted pouches). Spouted pouches that are flexible allow for refills and consume less plastic. When compared to HDPE bottles, pouches can reduce package weight by up to 90% and have a 65% reduced carbon impact. The trend toward reusable packaging choices is supported by flexible packaging. Customers can reuse their current bottles and containers by using refill pouches for home products like soap, detergents and cleaners, which promotes a circular economy. Shoppers find the refill concept appealing due of its greater sustainability. Additionally, the rising cost of living crisis is another major factor for the growing acceptance of refill pouches among consumers. Since they are more careful with their money, consumers are choosing companies that provide less expensive refill options.

Asia Pacific held largest market share of 38.23% in 2023 and is expected to grow at a fastest CAGR of 7.36% during the forecast period. This is owing to the rapid growth of e-commerce along with the expanding middle-class population across the region. The Over the past decade, the Chinese e-commerce market has grown significantly due to the rise of a wealthier and educated consumer base as well as the growing popularity of online international shopping. Furthermore, the demand for convenient packaging is also likely to support the regional growth of the market. Organizations in this region are under a lot of pressure to advance and embrace sustainability as the environment is becoming more polluted. The home care packaging key players are no more exception and are effectively shifting towards sustainability.

North America is expected to grow at a substantial CAGR of 4.87% in 2023. This is due to the increasing demand for convenience and the growing adoption of innovative packaging solutions across the region. Also, the increasing emphasis on sustainability and eco-friendly packaging is further expected to drive the demand for labels in the years to come. Furthermore, the growing health awareness and increase in consumer cleaning and hygiene is also expected to support the regional growth of the market in the near future.

By Material

By Type

By Product

By Region

February 2026

February 2026

February 2026

February 2026