Ophthalmic Packaging Market Size, Demand and Trends

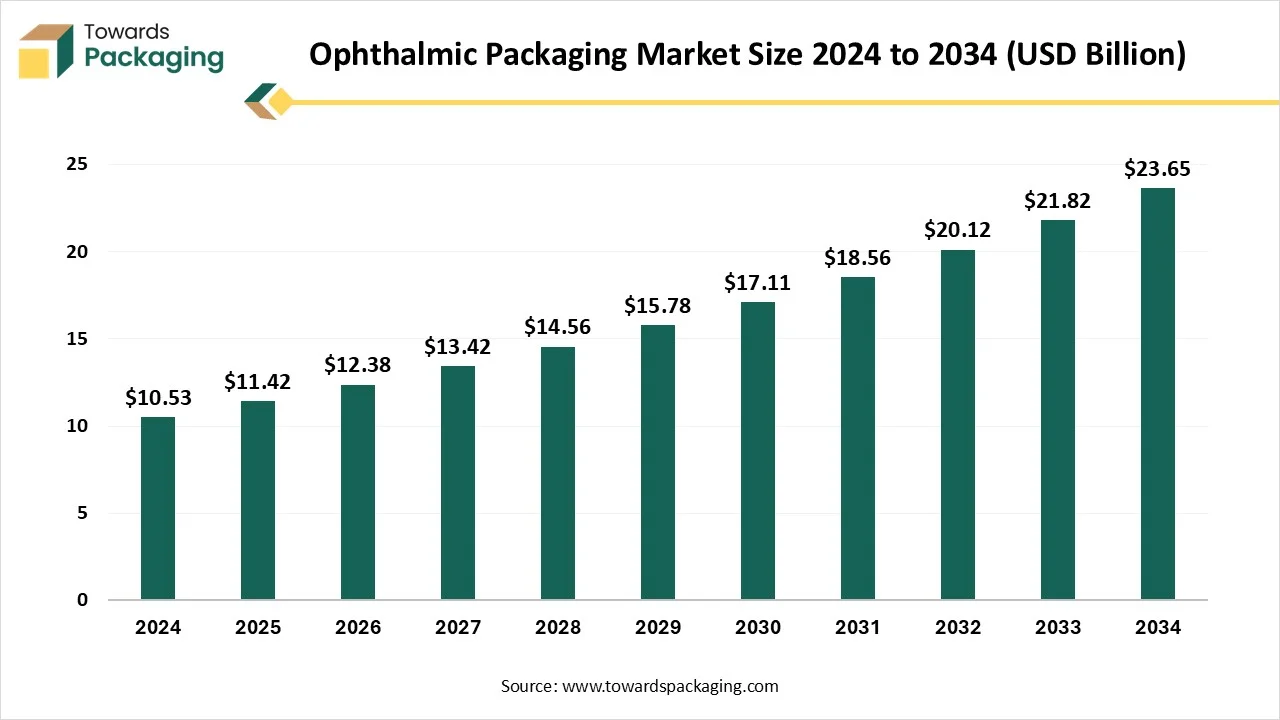

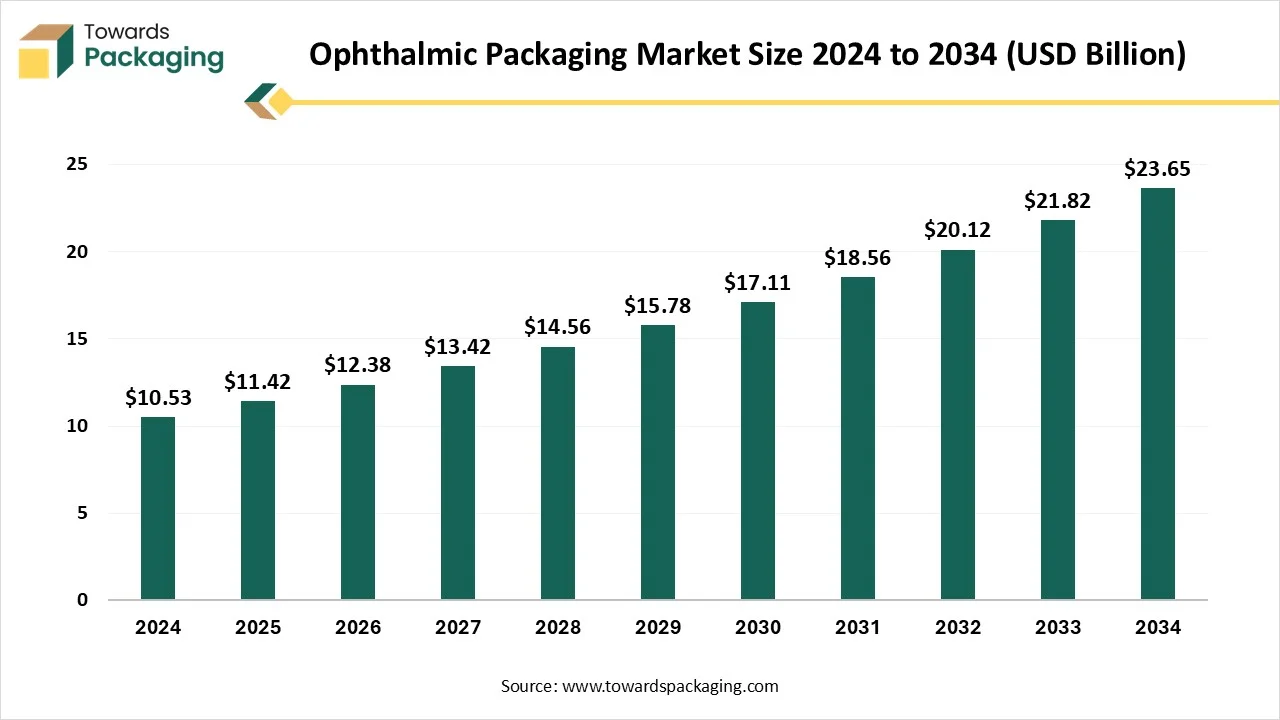

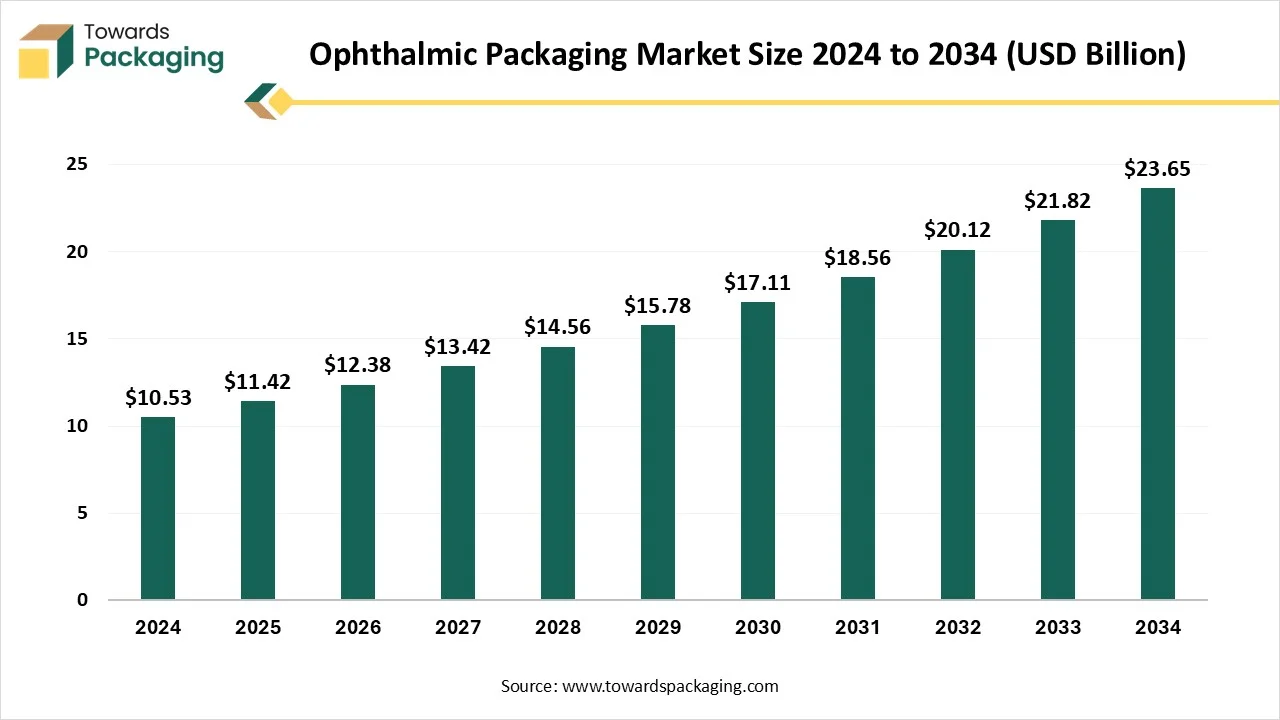

The ophthalmic packaging market is projected to grow from USD 18.36 billion in 2026 to USD 37.39 billion by 2035, registering a strong 8.43% CAGR (2025–2034). This report covers complete segmentation by packaging type (bottles, vials, blister packs, droppers), material (PE, PP, glass, aluminum), and applications (prescription, OTC, surgical ophthalmics). It provides regional insights across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, along with profiles of major companies, competitive analysis, value chain mapping, and global trade data for raw materials and finished ophthalmic containers.

Key Takeaways

- In terms of revenue, the market is valued at USD 18.36 billion in 2026.

- The market is projected to reach USD 37.39 billion by 2035.

- Rapid growth at a CAGR of 8.43% will be observed in the period between 2025 and 2034.

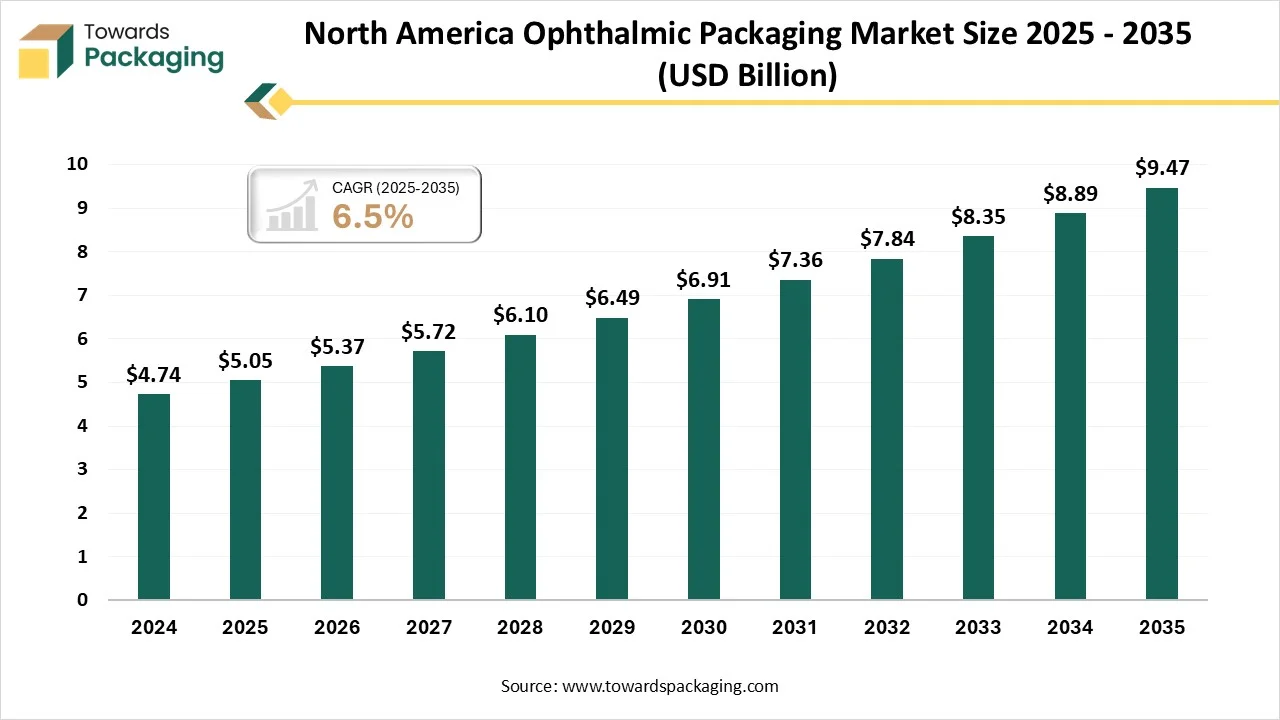

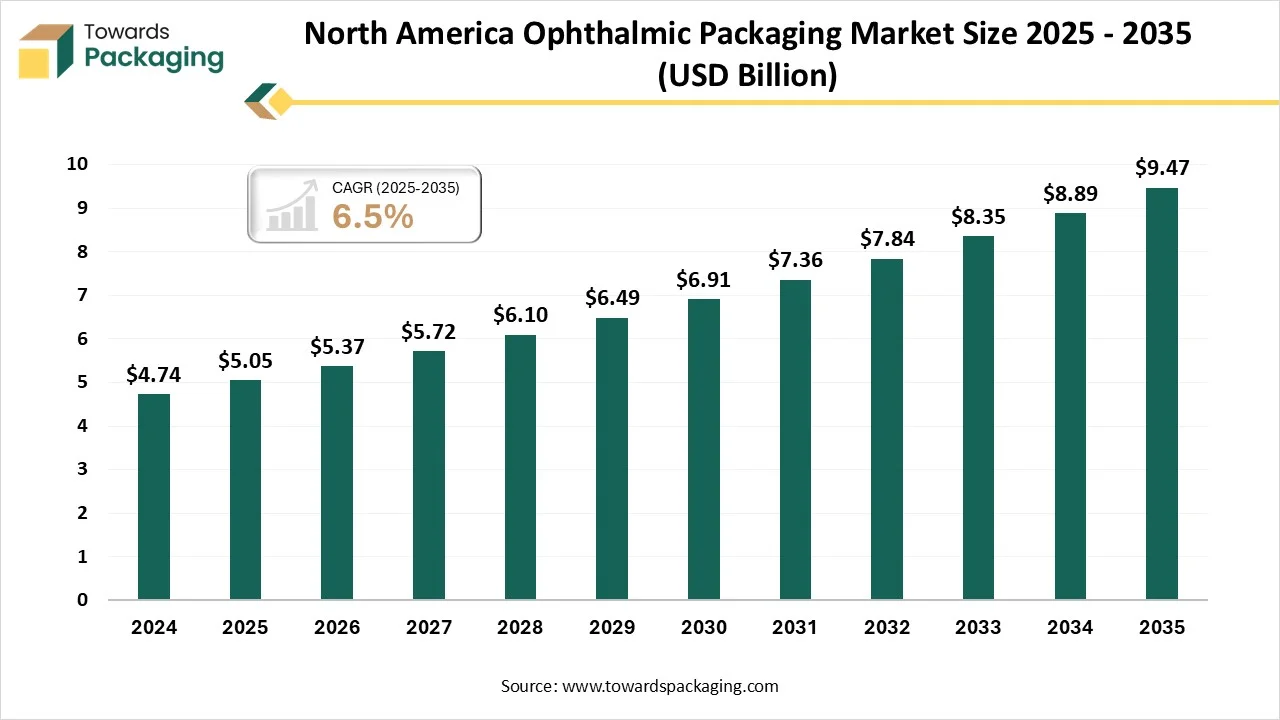

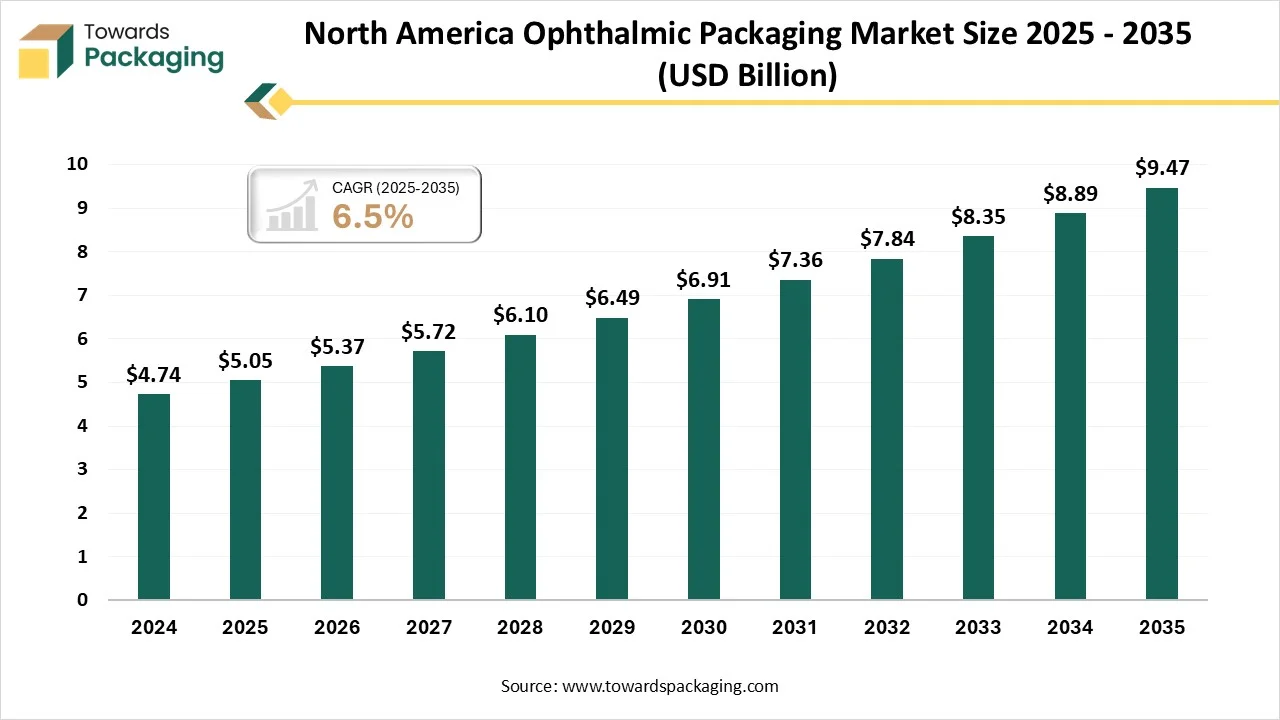

- By region, North America dominated the global market with the largest revenue share in 2024.

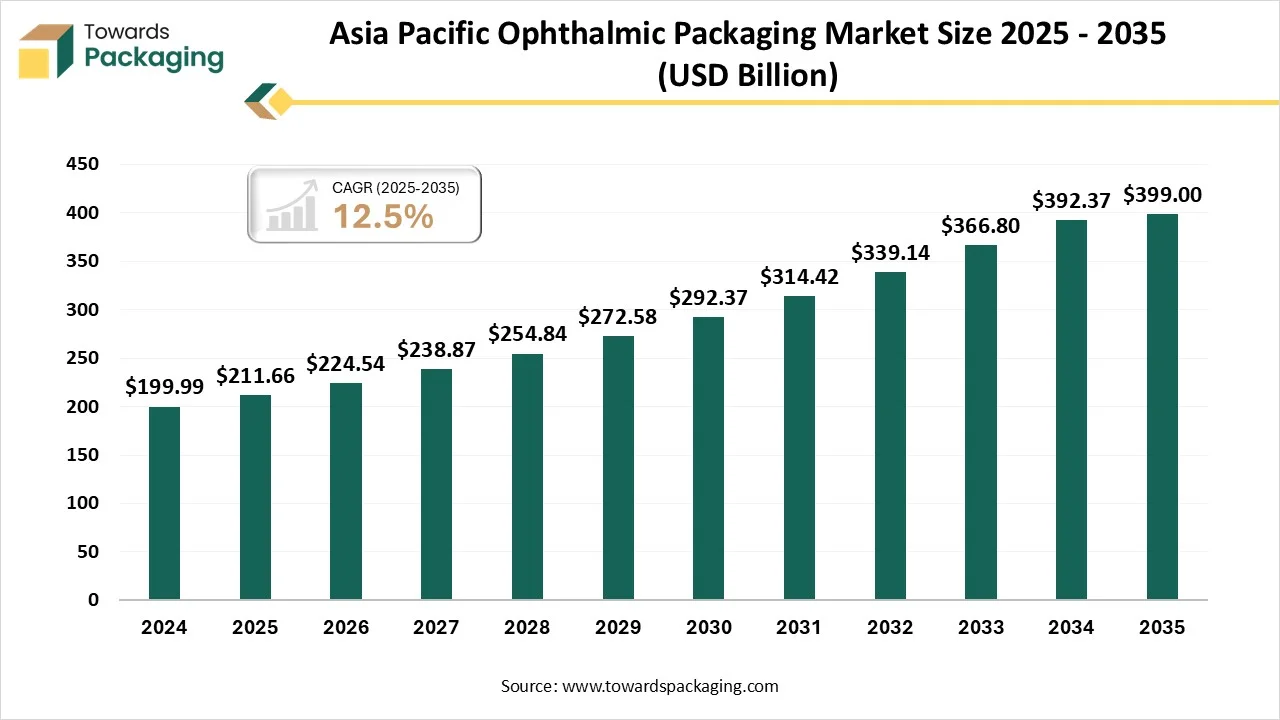

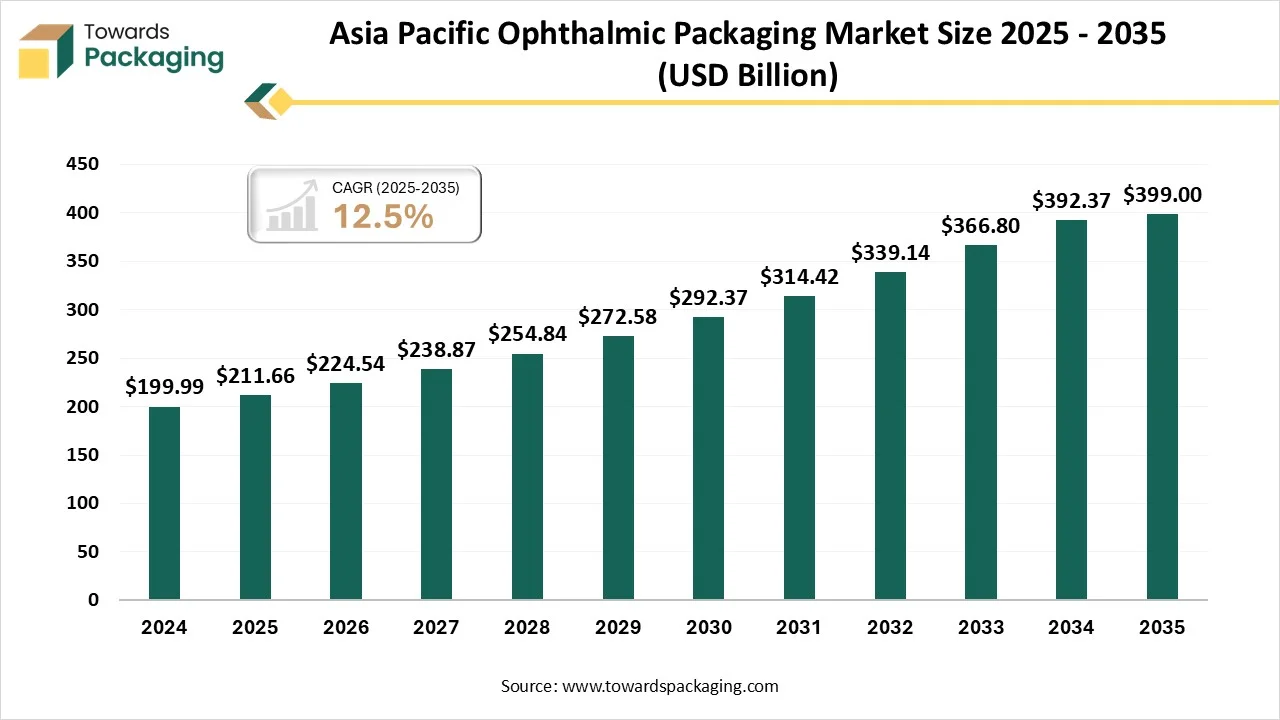

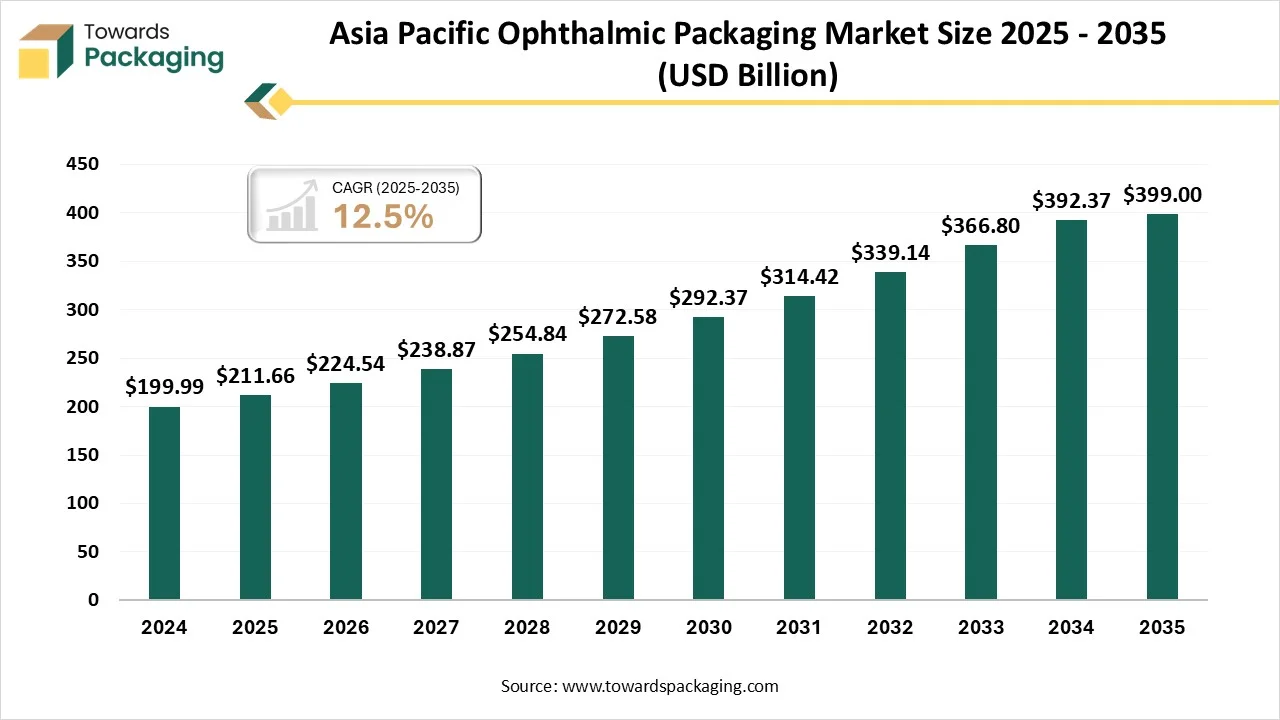

- By region, Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By packaging type, the bottles segment contributed the biggest revenue share in 2024.

- By packaging type, the multi-dose dropper materials segment will expand at a significant CAGR between 2025 and 2034.

- By material type, the plastic (LDPE) segment contributed the biggest revenue share in 2024.

- By material type, the polypropylene (PP) segment is expected to grow rapidly in the coming years.

- By dosage form, the eye drops segment dominated the market in 2024.

- By dosage form, the gels segment is expected to grow significantly over the studied period.

- By usage format, the multi-dose segment dominated the market in 2024.

- By usage format, preservative-free systems are predicted to grow at a rate significantly over the studied period.

- By end-user, pharmaceutical companies dominated the market in the year 2024.

- By end-user, contract manufacturing organisations are expected to grow significantly over the studied period.

Market Overview

Development and Invention in Ophthalmic Packaging

The ophthalmic packaging market refers to the specialized packaging solutions used to store, preserve, and dispense ophthalmic pharmaceutical products, including eye drops, ointments, and gels. These packaging formats are designed to maintain the sterility, efficacy, and shelf life of the contents while ensuring accurate dosing and user-friendly application. Packaging types include bottles, tubes, droppers, vials, blister packs, and multi-dose containers, often designed to be tamper-evident, contamination-resistant, and suitable for single or multiple uses.

Packaging for ophthalmic medicines is a space that needs high-level solutions to align with increasingly complicated clinical and regulatory requirements. Invention in this field concentrates not only on drug protection and preservation, but also on the patient's user experience, making sure of safety, convenience of administration, and sustainability. As technologies develop, the future of ophthalmic packaging will be heavily customer-centric towards environmentally-friendly solutions, intelligent, and developing the quality of eye care globally.

Ophthalmic Packaging Market Trends

- Smart Technologies in Eye Care: Smart Technologies are transforming eye care diagnostics and treatments. Systems such as OCT(Optical Coherence Tomography ) and digital refraction systems scanners serve high-level accuracy, allowing faster and more precise diagnosis. With the assistance of smart technologies, eye care professionals are ready to create data-oriented, fast, and clinical decisions, developing results for countless patients.

- Sustainability improvements in Ophthalmics: Sustainability is becoming more important in the healthcare sector, and ophthalmology is no exception. Equipment has taken a closer look at single-use medical devices and excess product packaging. Producers are moving towards eco-friendly practices for ophthalmic products like multi-dose eye drop medications and surgical supplies. Recyclable packaging and bio-based plastics serve as promising solutions for lowering the environmental impact of these items.

- Wearable innovations for Vision therapy: Wearable technology serves as a new option for vision therapy. Smart glasses filled with virtual reality and augmented reality potential are allowing huge rehabilitation of patients and vision therapy with visual damage, like binocular vision diseases. At the same time, contact lenses filled with sensors can track intraocular pressure and provide real-time data that practitioners can utilise to manage the progression of glaucoma.

- Enhanced customization in Eyewear: As the space of 3D printing continues to develop, some eyewear producers have started to serve custom-fit frames. These options can solve the different needs of every person. Facial scanning technology ensures a perfect fit and avoids discomfort. Organisations that print eyewear on request lower material waste and storage needs and demands to house a large inventory. Lenses can be updated for particular activities, whether it's reducing the eye strain from utilising digital devices or developing vision for outdoor activities.

- The role of Telemedicine in Ophthalmology: Telemedicine has expanded the use of eye care to people in underserved or remote areas. Cloud-based diagnostics or online consultations enable professionals to update patients from virtually anywhere.

AI Integration in the Ophthalmic Packaging Market

Developments in Artificial Intelligence (AI) have introduced intelligent solutions whose goal is to solve some challenges. One noticeable invention is the smart electronic eye drop container, crafted to discreetly manage eye drop usage. Filled with sensors, the device manages the frequency and timing of eye drop administration, serving real-time data to both healthcare providers and patients. This quick response enables timely mediation and focused education, mainly developing adherence rates.

Additionally, mixing AI into ophthalmic care, smartphone-based uses now provide high-level help for patients. These applications use AI Algorithms to guide consumers through proper instillation procedures, set reminders for medication schedules, and even help in the treatment of eye conditions using the smartphone's camera. An organized review has highlighted the result of such procedures, showcasing their capabilities in patient tracking and telemedicine.

Market Dynamics

Market Driver

Eye Drives The Ophthalmic Packaging Sector

Eye-related diseases are becoming more prevalent due to an aging population, increased screen time, and the growing incidence of diabetes. As per the World Health Organization, over 2 million people experience vision impairment. This fuels the urge for ophthalmic pharmaceuticals and by stretching, robust packaging solutions. On the other hand, sterility is crucial in ophthalmology to avoid infection issues. Ophthalmic packaging materials are crafted to prevent microbial pollutants and ensure a tamper-evident experience for users, which is becoming a standard need in both developed and growing regions.

Market Restraint

Unidose Container Is The Challenge

One major limitation or challenge is material compatibility, as the packaging must not react with sensitive ophthalmic formulations, which restricts the series of materials that can be used. Sterility maintenance is another challenge -once opened, multi-dose containers risk microbial contamination despite preservatives. Additionally, cost constraints can grow because ophthalmic packaging needs specialized sterile manufacturing. Tamper-evident sealing and accurate dosing systems, all of which increase expenses.

Market Opportunity

Several Injections Lead To Future Possibilities

Growing demand for sterile, ready-to-use preparations minimizes errors and minimizes contamination risk during intravitreal injections. Packaging designs that keep drug elements separate until use ensure extended shelf life and high formulation stability. Inventions in micro-needle and depot injection packaging can deliver drugs over weeks or months, reducing patient visits and improving adherence. Pre-packaged sterile kits having syringes, needles, and drug vials streamline surgical and in-office procedures, boosting convenience and sterility assurance. Also, opportunities exist for ophthalmic-specific injection systems with perfect grip, anti-needlestick mechanisms, and clear dose indicators to aid ophthalmologists.

Segmental Insights

Packaging Type Insights

How Did Bottles Segment Dominate The Packaging Type In The Ophthalmic Packaging Market?

The bottles segment dominated the market in 2024, bottles in ophthalmic packaging are a main solution for keeping and dispensing liquid eye care products such as antibiotic solutions, lubricating drops, glaucoma, and anti-allergy drops. They are crafted to track sterility, stability, and ease of application throughout the product’s shelf life. Typically, these bottles are manufactured from pharmaceutical-grade plastics like low-density polyethylene, high-density polyethylene, or polypropylene, chosen for their chemical resistance, flexibility, and compatibility with the drug formulation.

Multi-dose droppers segment expects the fastest growth in the ophthalmic packaging market during the forecast period. These luxury bottles are accurately suited for pharmaceutical products, and they can be utilised for preservative-free formulations. The multi-dose container has a highly accurate bottle neck that can be integrated with different dosing systems. Personalized to different dosing systems, multi-dose serves different applications, such as nasal sprays and eye drops. So, squeeze dropper systems with sterile packaging are for formulations. The bottle has a dropper cap and a system that develops intuitive dosing. An atmospheric bottle for metered dose uses of liquid formulations serves high user convenience. Having a patented spray pump and cross-profile bottom enables an updated spray design and accurate dosing.

Material Type Insights

How Did The Plastic (LDPE) Segment Dominate The Material Type In The Ophthalmic Packaging Market?

Plastic (LDPE) segment dominated the market in 2024, Low-density polyethylene is one of the most widely used plastics in ophthalmic packaging, specifically for eye drop bottles and dispensing tips. Its popularity stems from its soft, squeezable texture, which enables patients to conveniently dispense controlled drops without excessive effort, a crucial feature for elderly users or those with limited hand strength. It observes excellent chemical resistance, making sure compatibility with a huge range of ophthalmic drug formulations, including aqueous and oil-based solutions. It is also highly inert, meaning it won't react with or absorb the active ingredients, thus protecting the efficacy and stability of the medication.

The polypropylene (PP) segment is expected to experience the fastest growth in the ophthalmic packaging market during the forecast period. Polypropylene is a widely used material in ophthalmic packaging, especially for closures, caps, certain bottle components, and certain bottle components. Its popularity comes from its high chemical resistance, cost-effectiveness, and durability, making it perfect for storing delicate eye care formulations such as lubricating drops, anti-allergy solutions, and medicated treatments. PP is lightweight yet strong, with excellent resistance to mixtures and many chemicals, making sure that the packaging does not react with or degrade the drug product. As compared to LDPE, it provides better rigidity, which is beneficial for elements that need structural stability, like threaded caps or tamper-evident seals.

How Did Eye Drops Dominate The Ophthalmic Packaging Market?

The eye drops dominate the ophthalmic packaging market in 2024; A sterile liquid preparation created from API and suitable for injecting into the eye. It is most prevalently used in ophthalmic dosage form, which is quickly absorbed and plays a quick role. Due to the conjunctival sac carrying only 20ml of fluid, while the volume of 1 drop of eye fluid is about 39 ML, linked with the corneal tissue barrier and tear dilution, the assimilation amount of eye drops after penetrating the eye is less than 10%. Eye drops are the diagnosis of choice for several eye conditions, such as inflammation, infections, dry eye, allergies, and glaucoma, accounting for 90 % of the five commercial products in the worldwide eye medicine industry.

Gels segment expects the fastest growth in the ophthalmic packaging market during the forecast period. Ophthalmic gels are semi-solid eye medications created in aseptic gel form by suitable excipients and medicine. Its viscosity is huge, convenient to mix with tears, and can extend the action time of drugs. It reduces the puffiness as a cooling ingredient is used in eye gels, like caffeine, which helps to lower puffiness, making tired eyes appear more awake. Cucumber, aloe vera, and other soothing ingredients refresh the under-eye area, helping to calm tired skin. Under-eye gels are generally water-based, which makes them hydrating yet light. Accurate for anyone who wants moisture without a load or greasy feeling. Because of their non-greasy formula, under-eye gels work perfectly on all skin types, including combination and oily skin. Several under-eye gels have peptides and antioxidants that assist in reducing fine lines and protect against environmental changes.

How Did The Multi-Dose Dominate The Usage Format In The Ophthalmic Packaging Market?

Multi-dose packaging has dominated the market in 2024, as it refers to a packaging design or system crafted to have different doses of a medication or product in one single package. It is generally used in the pharmaceutical sector to serve as an easy and organised path of administering and dispensing medications over a prolonged period. The multi-dose packaging solution is an overall strategy to packaging that includes the design, distribution, and production of containers or packages with the potential of carrying several doses of a product. This procedure usually includes personalised packaging materials, like blister packs or strip packs, along with instructions to use and labelling too.

Preservative-free systems segment expects the fastest growth in the ophthalmic packaging market during the forecast period. Preservative systems are an important advancement in ophthalmic packaging, designed to solve concerns about ocular irritation, allergic reactions, and long-term damage caused by preservatives like benzalkonium chloride. Such systems are especially crucial for patients with chronic eye conditions who need frequent or long-term use of eye drops. With the growing demand for safer, more tolerable eye care items, preservative systems are predicted to diminish the luxury ophthalmic packaging segment in the coming years, specifically in dry eye, glaucoma, and post-surgical care markets.

End-Use Industry Insights

How Did The Pharmaceutical Companies Dominate The Ophthalmic Packaging Market?

The pharmaceutical companies have dominated the market in 2024, because the checking of pharmaceutical packaging material is important to make sure that it does not negatively affect the safety, stability, and efficacy of the product. The main goal is to examine, track, and control any physicochemical communication between the drug formulation and packaging material. A perfect packaging material should be non-reactive, completely inert, and have the potential to serve maximum shelf life while tracking the probity of the pharmaceutical product. Hence, packaging materials often have different additives such as stabilizers, anti-oxidants, monomers, contaminants, and lubricants, that can interact with the drug and capably alter their characteristics.

Contract manufacturing organizations segment expects the fastest growth in the ophthalmic packaging market during the forecast period. Contract Manufacturing Organizations play an important role in ophthalmic packaging by serving specialized manufacturing, filling, and sterile packaging solutions for eye care products such as eye drops, ointments, and gels. These CMOs serve advanced technologies like blow-full-seal systems, multi-layer barriers, and single-dose unit containers to ensure product sterility and patient safety. With growing regulatory requirements and demand for preservative-free ophthalmic formulations, CMOs support pharmaceutical companies by serving compliance-ready, cost-effective, and scalable packaging solutions.

Region Insights

How Did North America Dominate The Ophthalmic Packaging Market In 2024?

North America dominated the market in 2024, as it showcases the global ophthalmic drug industry, driven by the growing importance of eye-related disorders, the strong presence of main market players, and favourable reimbursement policies. The region benefits from the high-level healthcare infrastructure, specifically in the United States, with high healthcare spending and fast acceptance of innovative ophthalmic medications. Mexico and Canada also contribute mainly to the regional industry, with rising awareness about eye conditions and growing access to high-level eye care diagnosis. The representation of well-established research companies and current clinical trials further extends the region's position in the overall market.

- In February 2025, Glenmark Pharmaceuticals stated that it had disclosed the general medication to diagnose glaucoma in the United States. Glenmark Pharmaceuticals Inc., USA, had launched Latanaprost ophthalmic solution in the sector with a concentration of 0.0005%, which is developed by a Mumbai-based drug maker.

Asia Pacific Ophthalmic Packaging Market Size 2025 - 2035 (USD Billion)

Asia Pacific expects the fastest growth in the ophthalmic packaging market during the forecast period. Asia-Pacific is the fastest-growing region because of a growing middle-class population, growing awareness of eye health, and fast urbanization. Countries like India, China, and Japan are witnessing incidences of diabetic retinopathy and refractive errors, which are driving sales of ophthalmic packaging and drugs. It is not just a main production hub but also the fastest-growing region for ophthalmic packaging. Strong demographic shifts, growing healthcare access, and strategic investments in eye care support this fast expansion, making it an important focus area for packaging manufacturers and pharmaceutical stakeholders alike.

Ophthalmic Packaging Market Top Companies

- Gerresheimer AG

- AptarGroup, Inc.

- Amcor Plc

- Schott AG

- Berry Global Inc.

- West Pharmaceutical Services, Inc.

- Bormioli Pharma

- Nolato AB

- Catalent, Inc.

- Nemera

- RPC Group Plc (Berry Global)

- Tekni-Plex

- Nipro Corporation

- Albea Group

- DWK Life Sciences

- SGD Pharma

- Silgan Holdings

- Origin Pharma Packaging

- RxPack

- Raepak Ltd

Latest Announcements By Industry Leaders

- In June 2025, Torrent Pharmaceuticals revealed that it had acquired the majority stake in JB Chemicals and Pharmaceuticals in an Rs 19,500-Crore deal, which will make it the second most valued pharmaceutical company in India.

- In March 2025, TC Biopharm officially signed a non-binding letter of intent to gain an ophthalmic pharmaceutical organisation concentrating on commercialising intraocular pressure-lowering therapies for patients with ocular hypertension and glaucoma. The goal organisations have a US Food and Drug Administration-approved one-time-a-day eye drop which lowers intraocular pressure, and a growth-stage asset pipeline in ophthalmology indications.

- In December 2024, Gerresheimer, an inventive solution and systems provider and worldwide partner for the biotech, pharma, and cosmetic industries, completed the acquisition of Blitz LuxCo Sarl, the holding company of the Bormioli Pharma Group. The profile of the pharmaceutical company is being created using glass and plastic, as well as closure solutions.

Recent Developments

- In August 2025, Aptar Pharma revealed a major development in sustainable pharmaceutical packaging with its Freepod nasal spray pump now being manufactured with high balance bio-based resins.

- In July 2025, Worldwide pharma main company Lupin Limited revealed the launch of Loteprednol Etabonate Ophthalmic suspension of 0.5% in the United States. Lotepredonal Etabonate Suspension of 0.5% is identical to Lotemax Ophthalmic Suspension, of Bausch and Lomb.

- In April 2025, Akums Drugs and Pharmaceutical Ltd, which is India's Top contract development and manufacturing organization, disclosed the launch of cutting-edge Ripasudil-Timolol combination therapy for glaucoma diagnosis. This DCGI examined the product that displays a main growth in ophthalmic care, with Akums becoming the initial Indian CDMO to receive this inventive formulation.

Ophthalmic Packaging Market Segments

By Packaging Type

- Bottles (LDPE, HDPE)

- Vials & Ampoules

- Droppers

- Tubes

- Blister Packs

- Pouches

- Cartridges & Syringes

- Other Custom Packaging Formats

By Material Type

- Plastic

- LDPE

- HDPE

- Polypropylene (PP)

- Polycarbonate (PC)

- Glass

- Borosilicate

- Type I, II, III Glass

- Aluminum

- Others (Elastomers, Rubber, Silicone)

By Dosage Form

- Eye Drops

- Ointments

- Gels

- Solutions & Suspensions

- Emulsions

By Usage Format

- Single-Dose

- Multi-Dose

- Preservative-Free Systems

- Controlled/Timed Release Packaging

By End User

- Pharmaceutical Companies

- Contract Manufacturing Organizations (CMOs)

- Hospitals & Clinics

- Retail Pharmacies

- Ophthalmology Research Institutes

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait