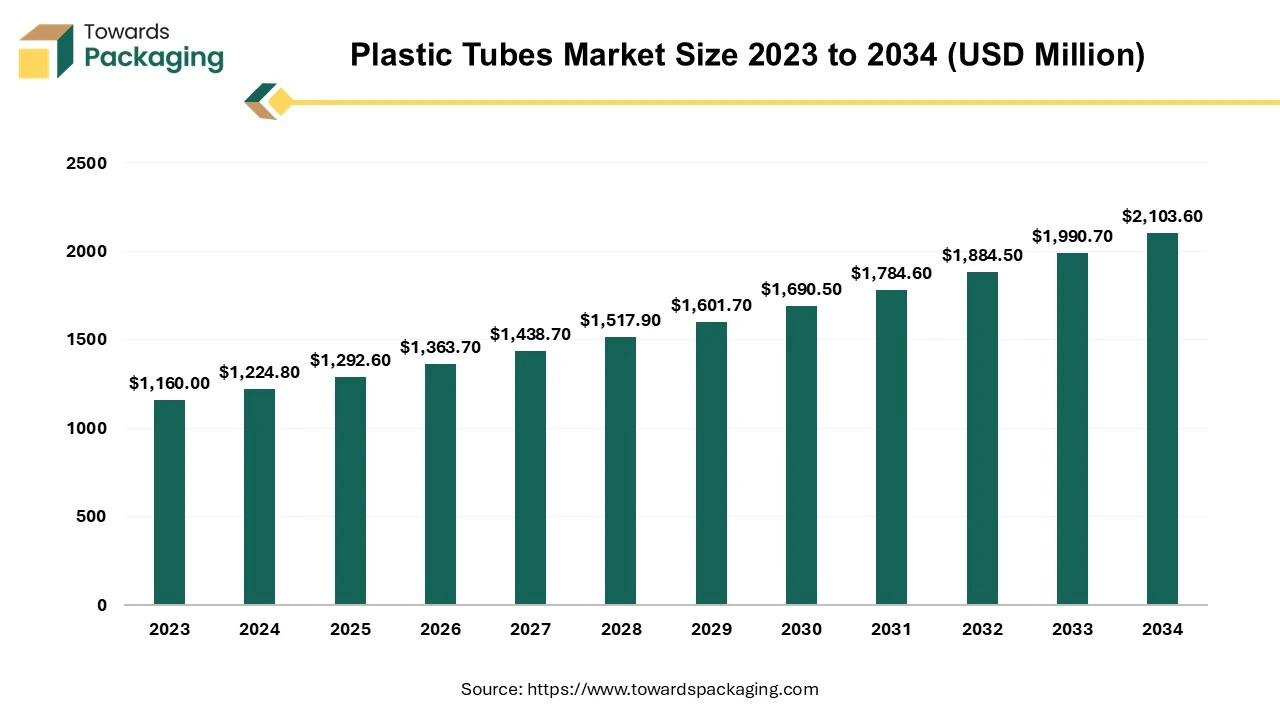

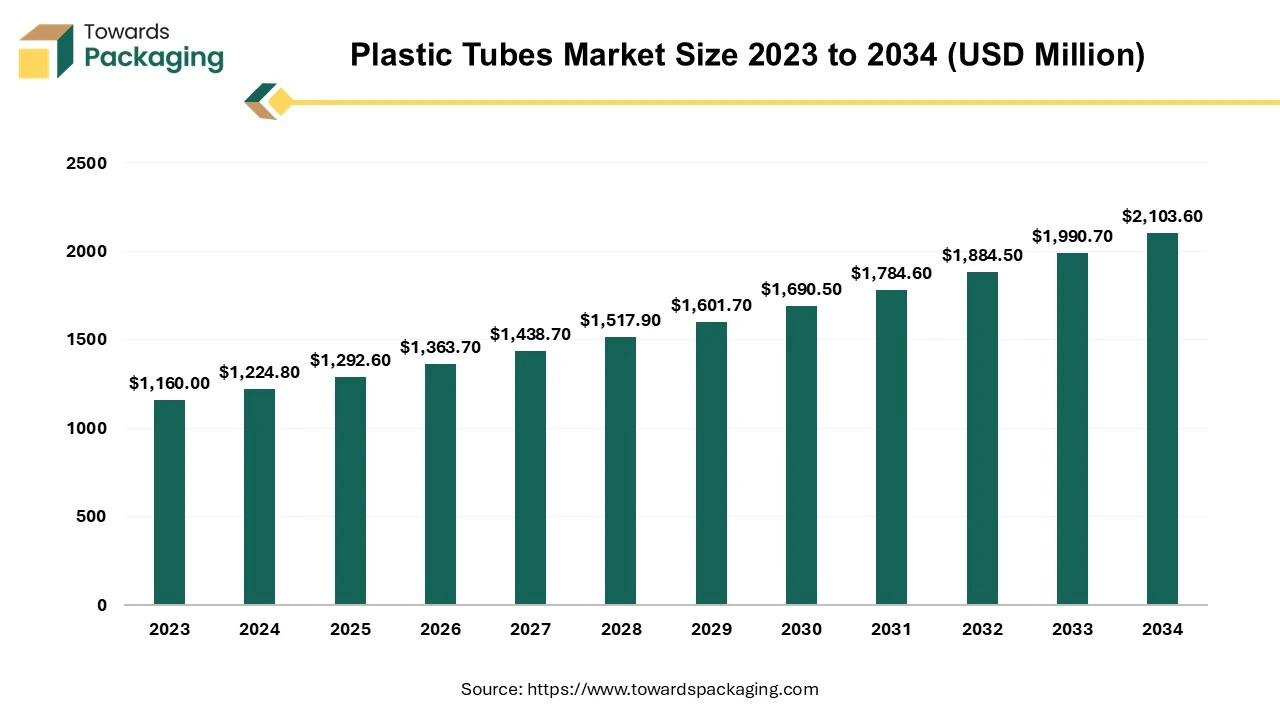

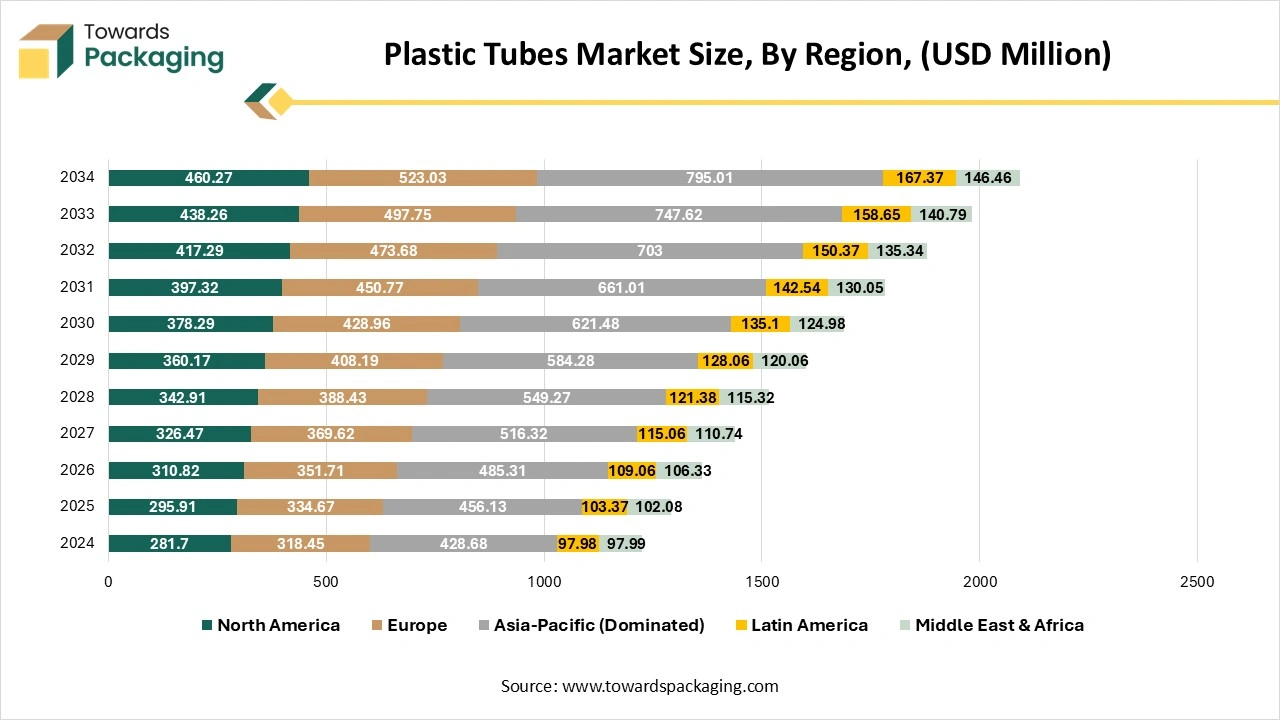

The plastic tubes market is forecasted to expand from USD 1,363.23 million in 2026 to USD 2,207.20 million by 2035, growing at a CAGR of 5.5% from 2026 to 2035. This report delivers a complete analysis of market segments by material, capacity, closure type, and application across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. It includes competitive benchmarking of key players such as EPL Limited, Berry Global Inc., Huhtamäki Oyj, Albea S.A., and CCL Industries Inc., alongside value chain analysis, trade statistics, import–export data, and profiles of major manufacturers and suppliers shaping the global landscape.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing plastic tubes which is estimated to drive the global plastic tubes market over the forecast period.Major Key Insights of the Plastic Tubes Market

Plastic tube packaging is a versatile and popular choice in various industries, including cosmetics, pharmaceuticals, food, and household products. This type of packaging offers numerous benefits, making it an attractive option for both manufacturers and consumers. Lightweight and DurablePlastic tubes are generally lighter than glass or metal alternatives, which can reduce shipping costs and the carbon footprint associated with transportation. They are also less prone to breakage. Manufacturing plastic tubes is often less expensive than other materials, which can lead to lower costs for producers and consumers.

Plastic tubes are utilized for creams, lotions, and gels, offering easy application and preservation of product integrity. Plastic tubes are ideal for ointments and gels, providing secure, hygienic packaging. Squeezable tubes for condiments like mustard, ketchup, and sauces. Plastic tube packaging continues to be a favoured choice across multiple industries due to its numerous advantages, including versatility, cost-effectiveness, and user convenience. As sustainability becomes increasingly important, the industry is evolving to incorporate eco-friendly practices, ensuring that plastic tubes remain relevant and responsible in the modern marketplace. The global packaging market size is growing at a 3.16% CAGR between 2025 and 2034.

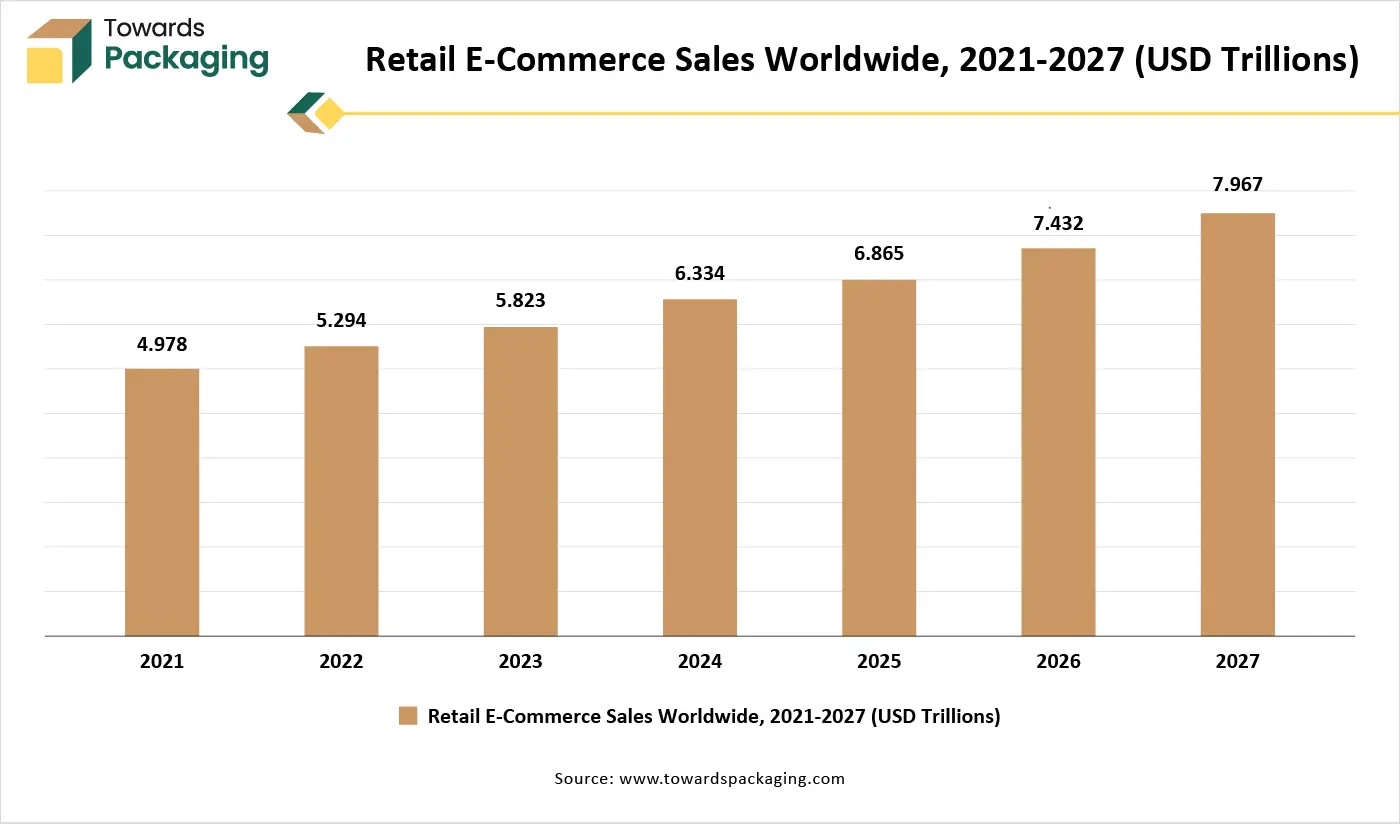

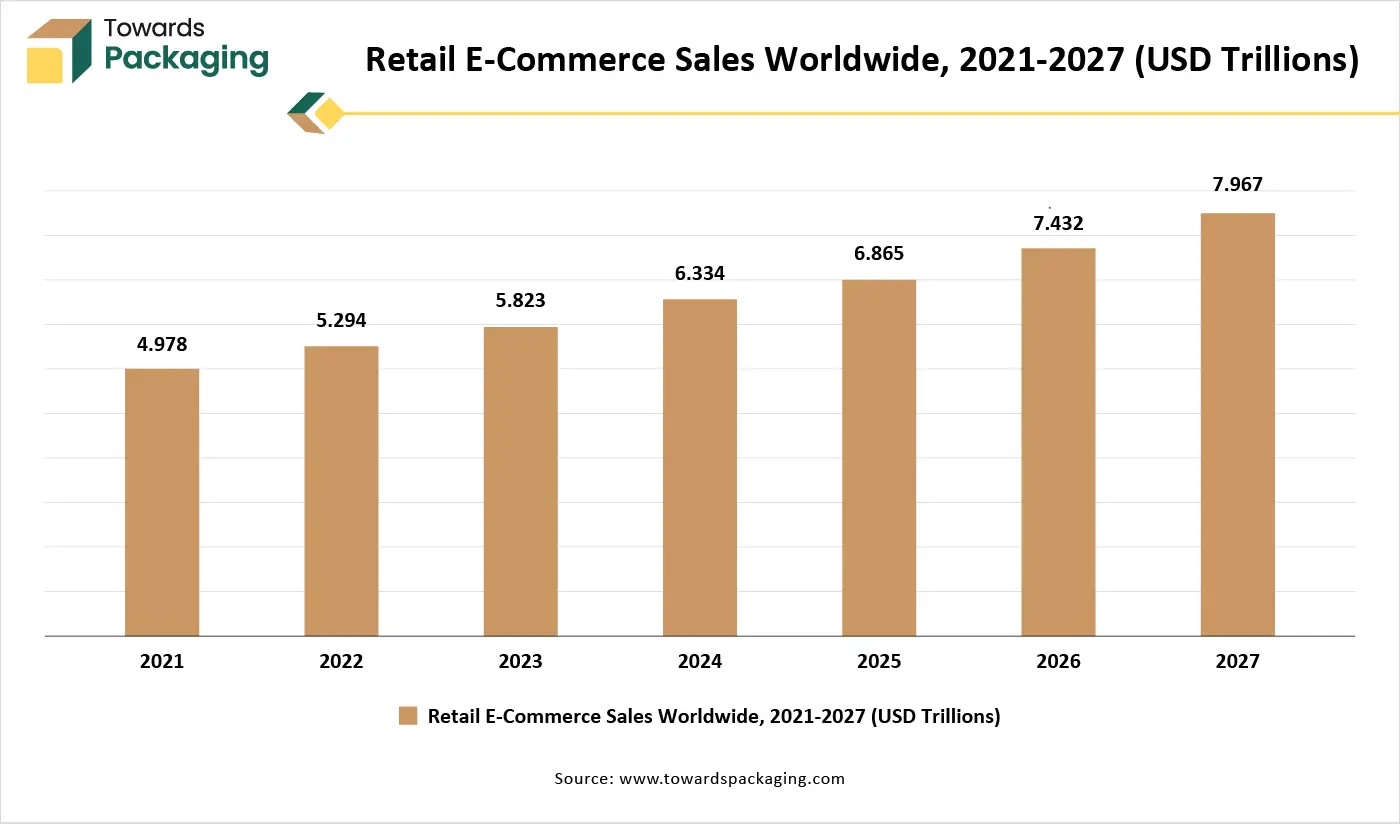

The surge in online shopping has increased the demand for secure and efficient packaging, with plastic tubes being favoured for their protective qualities. Brands are seeking unique packaging solutions, resulting in the growth of customized tube designs, sizes, and closures to enhance brand identity and product appeal. As online shopping grows, products require secure and protective packaging to prevent damage during transit. Plastic tubes, known for their durability, provide an effective solution. consumers prefer packaging that is easy to handle and store. Plastic tubes offer lightweight and space-efficient designs, making them ideal for e-commerce shipments. As online shopping expands, the need for efficient and protective packaging rises. Plastic tubes are lightweight, durable, and suitable for various products, enhancing their appeal.

With the rise of product presentation in e-commerce, attractive and visually appealing packaging becomes crucial. Plastic tubes can be designed with vibrant colors and high-quality printing, enhancing online appeal. As consumers increasingly favour eco-friendly products, the demand for sustainable packaging solutions rises. Plastic tubes that are recyclable or made from biodegradable materials can attract eco-conscious shoppers. For sensitive products, such as creams and pharmaceuticals, plastic tubes provide excellent barrier properties, ensuring product integrity during shipping. In conclusion, the growth of e-commerce creates a favourable environment for the plastic tubes market by enhancing demand for protective, aesthetically pleasing, and customizable packaging solutions that meet the evolving needs of online consumers.

E-commerce enables brands to reach broader markets without geographical limitations. This expansion increases the demand for plastic tubes across various regions and demographics.

Rising government initiatives for developing sustainable plastic tubes packaging, is estimated to drive the growth of the plastic tubes market over the forecast period.

Initially, design was a major obstacle, according to Stina Inc. company. For instance, toothpaste tubes with aluminum barrier layers were problematic, and it was unclear if other tubes would work well with them. According to Stina, producer cooperation and multistakeholder involvement across the plastic recycling value chain allowed for an understanding of the recyclers' viewpoint, which encouraged manufacturers to create tubes with recycling in mind.

Custom Designs and Branding OpportunitiesOffering unique designs and finishes can help brands differentiate themselves and enhance consumer appeal. Companies adopting sustainable production methods can enhance their brand image and appeal to a broader market. The key players operating in the market are focused on adopting inorganic growth strategies like partnership developing sustainable and lightweight plastic tube packaging for cosmetics, which is estimated to create lucrative growth opportunities for the plastic tubes market over the forecast period.

The plastic tubes market faces various challenges that impact the growth of the plastic tubes market in the near future. Rising awareness about plastic waste and its environmental impact has led to negative perceptions of plastic packaging. Governments are implementing stricter regulations regarding plastic use and waste management, pushing companies to seek alternatives or improve recycling processes.

There is a growing demand for biodegradable and recyclable materials, which can be costly to develop and implement. The recycling rates for plastic tubes are lower compared to other packaging types due to contamination and material complexity.

Adhering to various regulations regarding safety and quality, especially in sectors like pharmaceuticals and food, can be complex and costly. Product ConsistencyMaintaining high quality across production runs is essential but can be challenging due to variations in materials and manufacturing processes. Addressing these challenges requires companies in the plastic tubes market to innovate continuously, invest in sustainable practices, and adapt to changing consumer demands. Those that successfully navigate these issues will be better positioned for long-term growth and success.

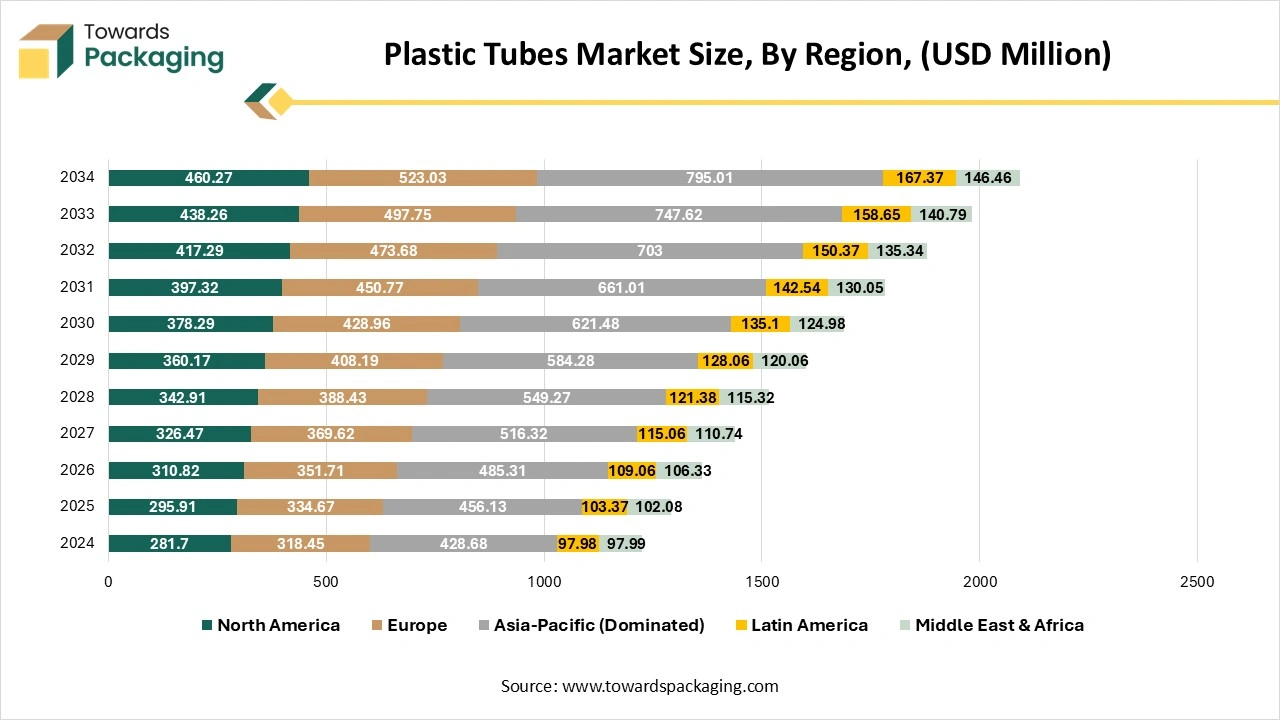

Asia Pacific region dominated the global plastic tubes market in 2024. Increasing consumer preference for ready-to-use products across personal care, healthcare, and food sectors drives demand for practical and easy-to-use plastic tubes. The region has experienced significant industrial growth, leading to increased demand for plastic tubes in various sectors, including pharmaceuticals, cosmetics, and food packaging. A large and expanding population, particularly in countries like China and India, drives demand for personal care, healthcare products, and packaged goods, increasing the need for effective packaging solutions.

As disposable incomes increase, consumers are spending more on premium products and packaging, boosting the demand for high-quality plastic tubes. Rapid urbanization in India is changing consumer lifestyles, leading to a greater demand for convenient and ready-to-use products, which plastic tubes effectively provide. Many countries in Asia Pacific have lower production costs, enabling manufacturers to produce plastic tubes at competitive prices while maintaining quality.

Increased investment in technology and innovation within the Asia Pacific region has led to the development of advanced manufacturing processes and product designs, enhancing the appeal of plastic tubes. Growing economies in Asia-Pacific present significant opportunities due to increasing consumer spending on personal care and packaged goods.

North America region is anticipated to grow at the fastest rate in the plastic tubes market during the forecast period. Increasing consumer preference for ready-to-use products across personal care, healthcare, and food sectors drives demand for practical and easy-to-use plastic tubes.

A growing focus on health and hygiene, particularly in the pharmaceutical and personal care industries, boosts the need for safe, hygienic, and reliable packaging solutions. Brands are seeking innovative packaging designs to enhance user experience and brand identity. Customizable options in size, shape, and functionality are attracting more businesses. A rising emphasis on eco-friendly packaging is prompting manufacturers to develop recyclable and biodegradable plastic tubes, appealing to environmentally conscious consumers.

The polyethylene segment held a dominant presence in the plastic tubes market in 2024. Polyethylene tubes are lightweight, flexible, and can be used for various products, including cosmetics, pharmaceuticals, and food items. They are generally less expensive to produce compared to other packaging. Increasing launch of the new cosmetics products has risen the demand for the plastic tube. Rising research and development activity to develop polyethylene plastic tubes for cosmetic packaging is expected to drive the growth of the segment over the forecast period.

The 50 to 100 ml segment accounted for a notable share of the market in 2024. This size is portable and easy to use, making it ideal for a range of products from cosmetics to pharmaceuticals. Smaller sizes are increasingly favoured as consumers look for travel-friendly options and trial sizes. Increasing launch of the personal care products in 50-100 ml size range has driven the growth of the segment.

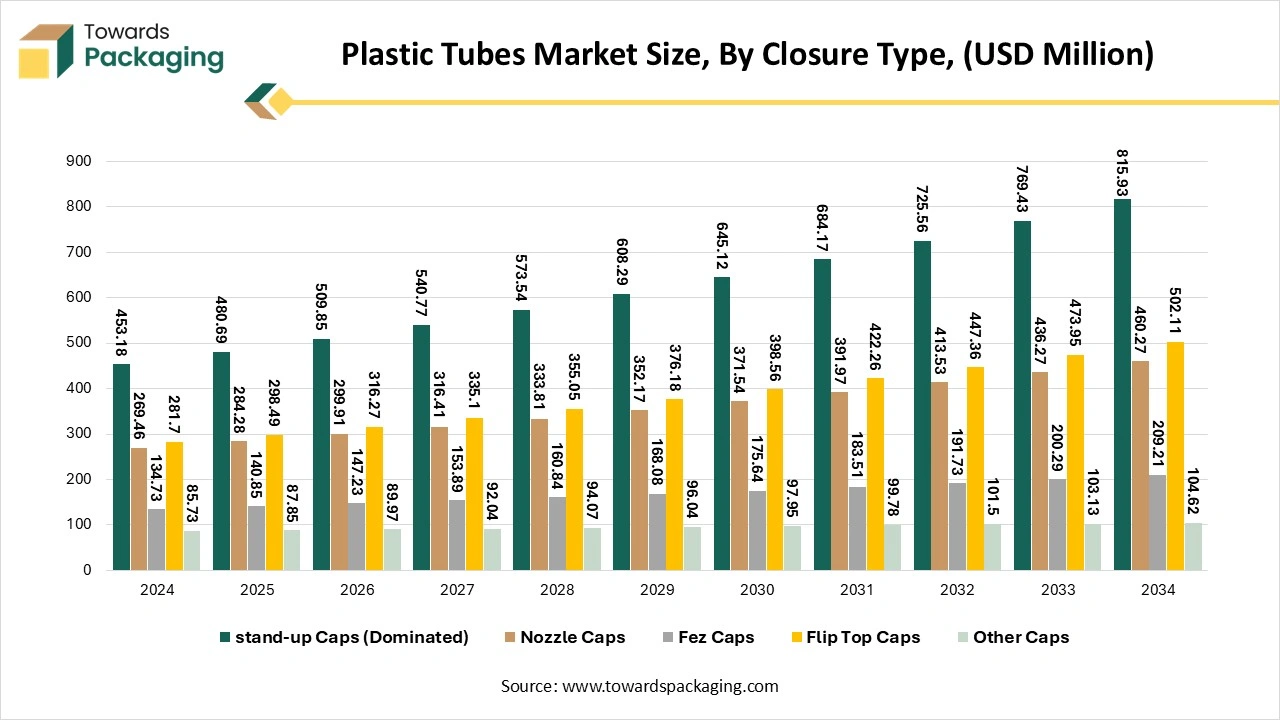

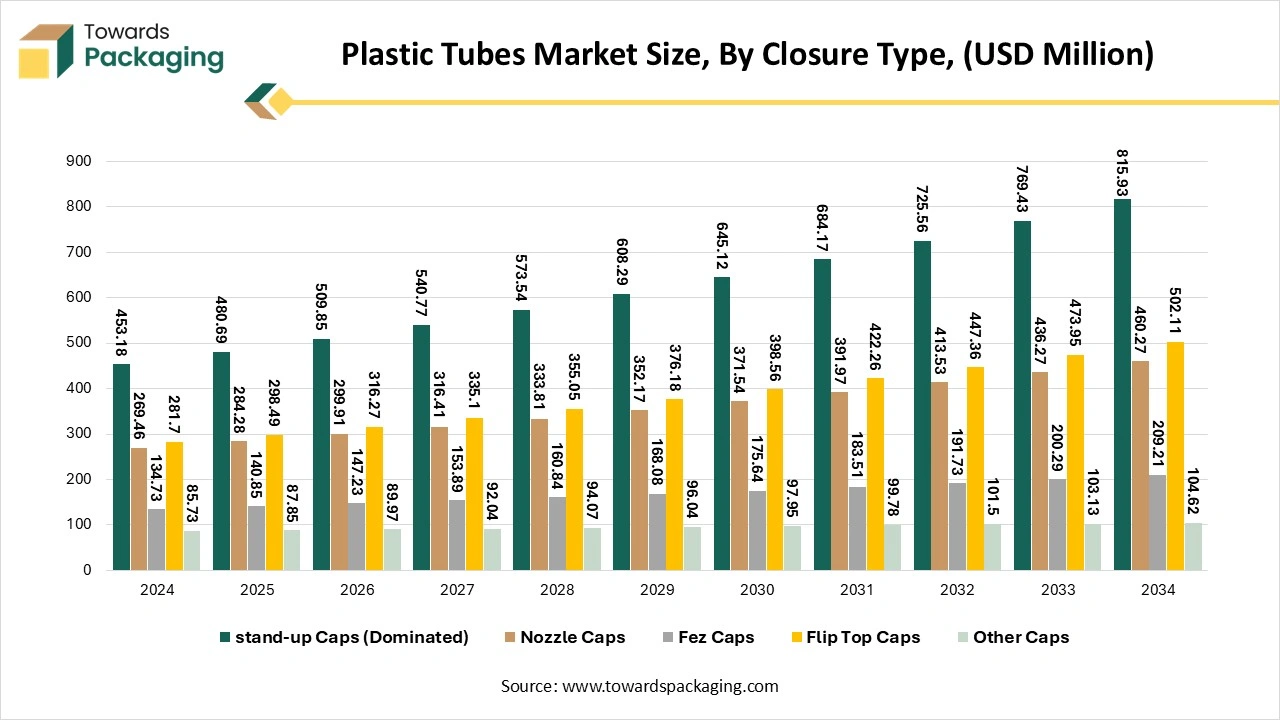

The stand-up caps segment registered its dominance over the global plastic tubes market in 2024. Stand-up caps provide convenient dispensing, allowing for controlled application of products without spills. The design allows tubes to stand upright on shelves, maximizing visibility and accessibility.

The cosmetic segment dominated the plastic tubes market globally. Plastic tubes can accommodate a wide range of cosmetic products, from creams and lotions to gels and ointments, making them an ideal choice for brands. Rising demand for lightweight and portable packaging solutions in the cosmetics industry and personal care industry is estimated to boost sales of cosmetic tubes over the assessment period. Furthermore, it is projected that a growing need for recyclable cosmetic packaging options will support market expansion.

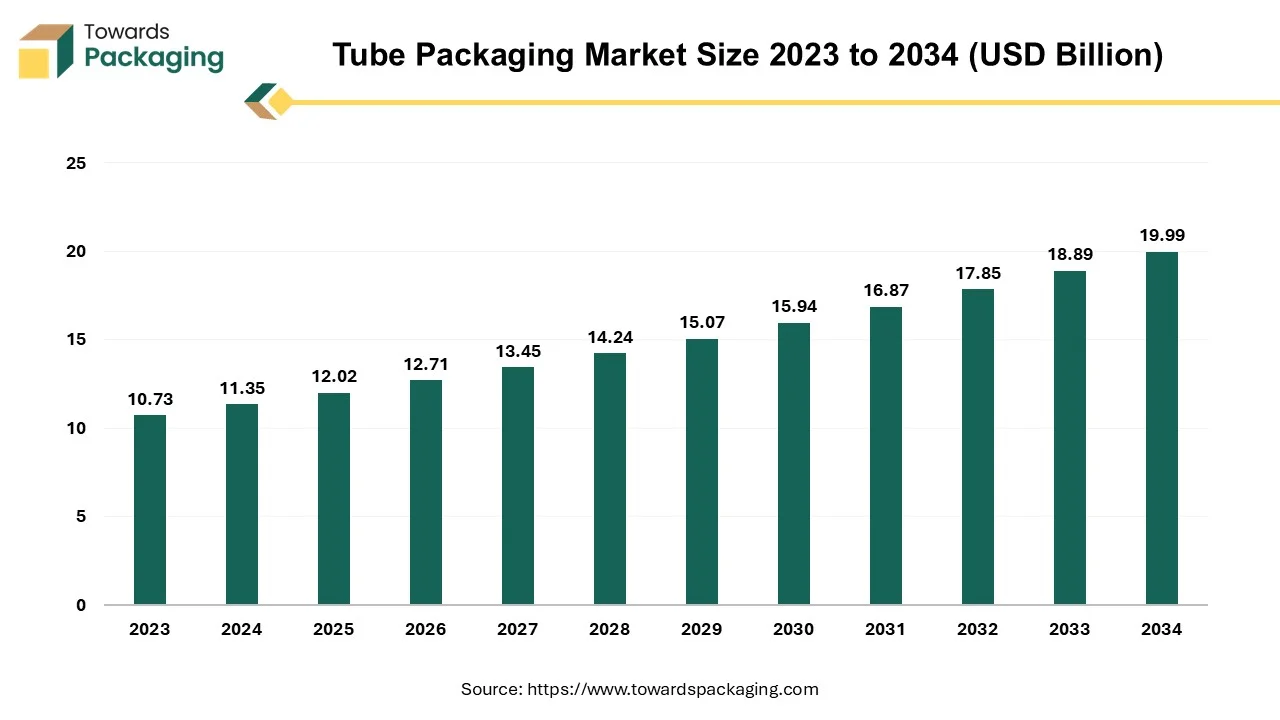

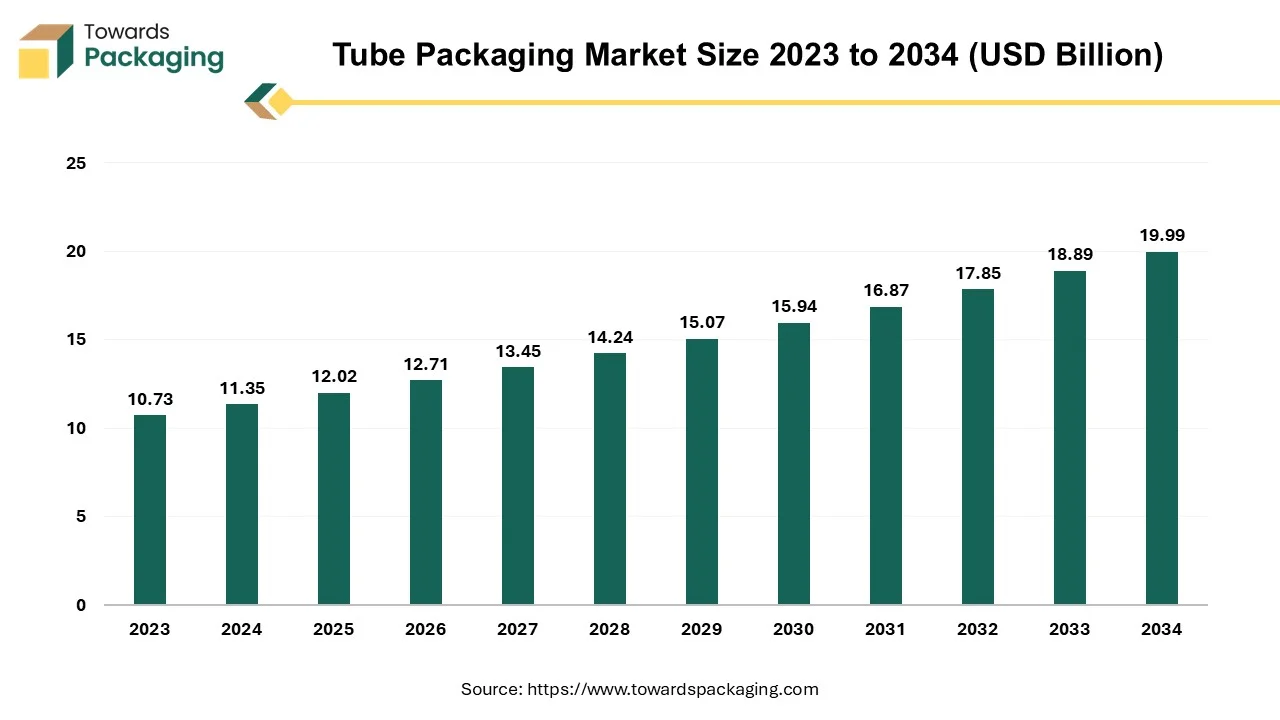

The tube packaging market is projected to reach USD 19.99 billion by 2034, growing from USD 12.02 billion in 2025, at a CAGR of 5.82% during the forecast period from 2025 to 2034.

A number of brands are choosing to package cosmetics and various other items in tubes. It is widely used for thick liquids, gels, ointments and the creams. Since it provides a layer of protection that keeps the contents from breaking, it can also be utilized for solids. Tubes may now store a wider variety of contents due to the development of plastic tubes rather than aluminum ones. Nonetheless, tubes made of cardboard with eco-friendly credentials and aluminum tubes are still widely used. Tubes are increasingly chosen as packing container for many products since tube closures come in a variety of sizes and forms. Apart from their affordability, eco-friendliness, and ability to safeguard active ingredients, they are also highly adaptable and convenient. Thus, the tube packaging market is anticipated to augment with a considerable CAGR during the forecast period.

The clear plastic tube packaging market is an emerging sector, poised for significant revenue growth and expansion. With a notable compound annual growth rate (CAGR), this market is expected to see impressive development during the forecast period from 2025 to 2034.

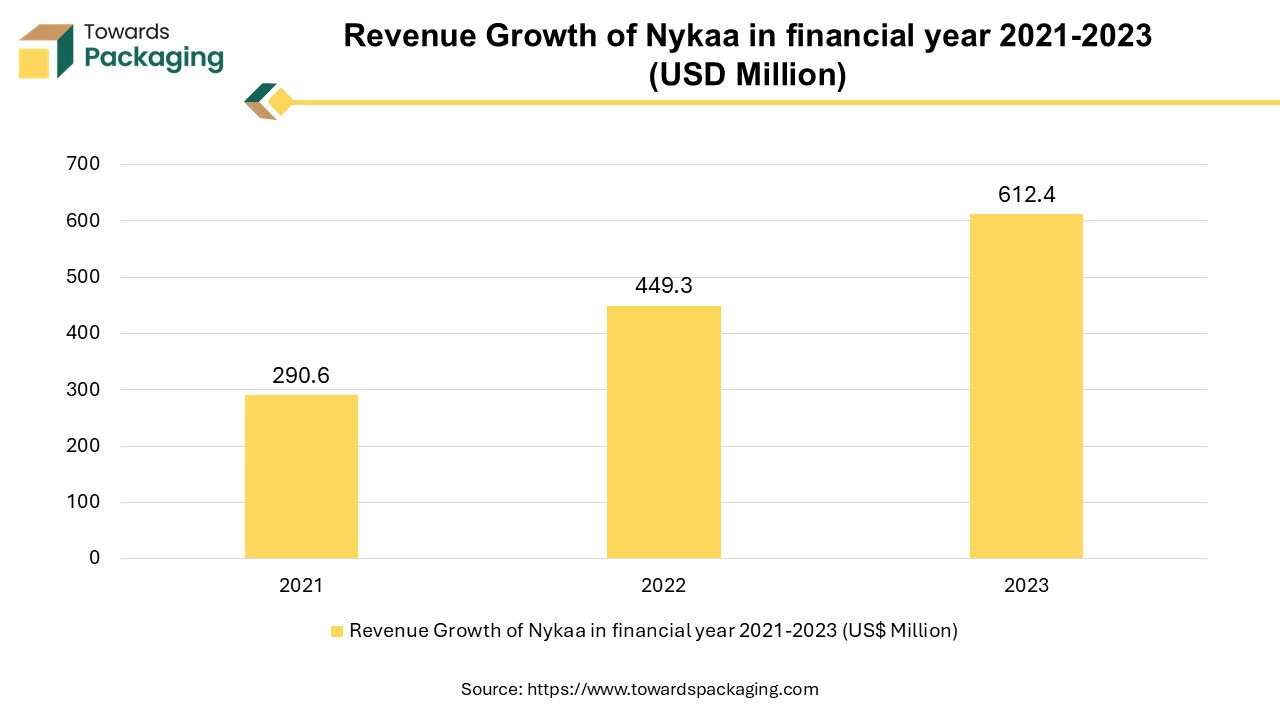

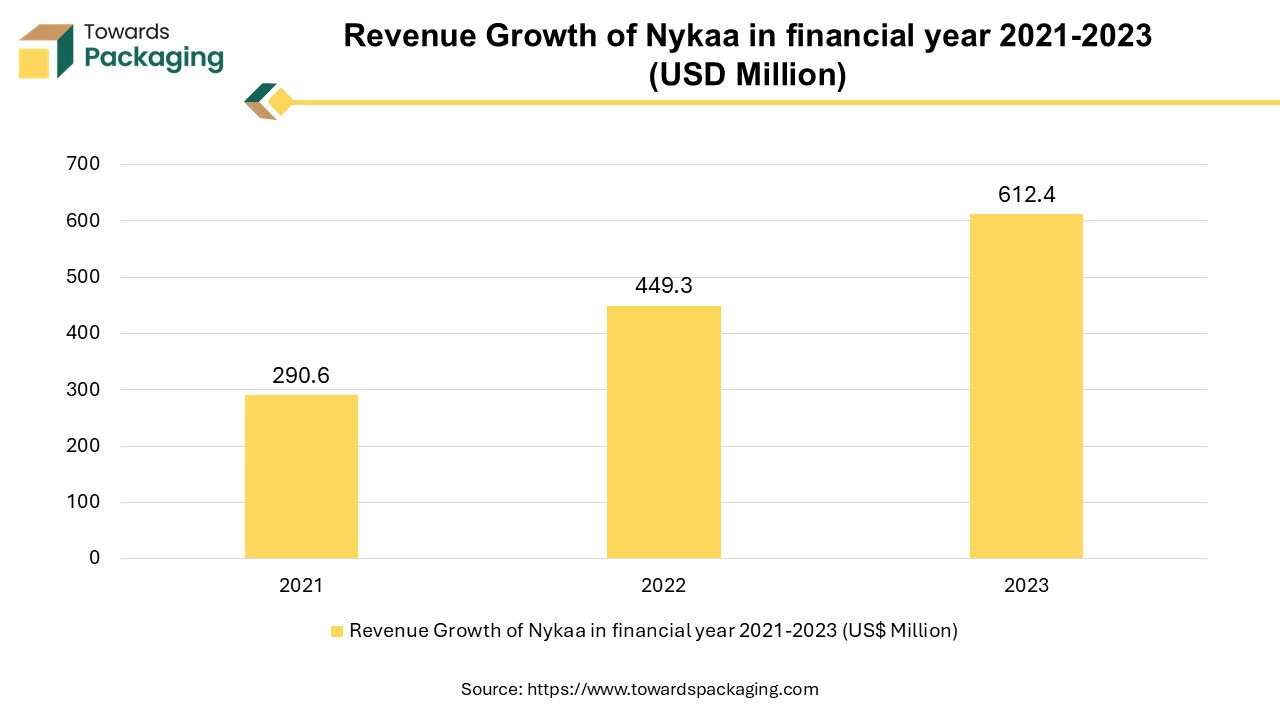

The market is proliferating due to the increasing business of e-commerce, food and beverages, and cosmetics, which require clear plastic tubes for packaging due to sustainability. The growing trend of online ordering facilities is boosting the clear plastic tube packaging market.

Clear plastic tube plays a significant role in the packaging market majorly in the pharmaceutical field, food & beverages market, and personal care product industry. Clear plastic tubes are ideal due to their aesthetic appeal and capability to shield the packaged items from contamination making them suitable for packaging delicate products. Clear plastic tubes are in high demand as they are versatile and cost-effective. These are widely used by personal care brands and food & beverage companies as in such packaging products or food items are visible which attracts many people due to transparency and aesthetic look of the tubes.

Cost-effectiveness has influenced several businesses to use such clear plastic tubes for packaging purposes as these are easy to deliver and beneficial for e-commerce businesses. These plastic tubes are made up of polyethylene, polypropylene and many other raw materials available. These packaging are not only budget-friendly by cutting delivery costs but also reusable for storage purposes, raising their demand in the market. Plastic tubes are durable provide protection from dust, heat, and moisture, and prevent contamination.

The pharmaceutical tube packaging market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The growing demand from the pharmaceutical industry and the rise in healthcare spending are expected to drive the global market over the forecast period.

Pharmaceutical plastic tube packaging offers convenient, flexible, and affordable solutions for products including lotions, creams, and liquids. Pharmaceutical tubes are manufactured by experts using highly developed technology and advanced machines with the utilization of best best-grade raw material to provide maximum satisfaction by catering to the diverse needs of clients. Pharmaceutical tubes come in numerous sizes and are also customized as per the client's needs. The packaging is manufactured to maintain of highest regulatory standards, delivering hygiene, safety, and reliable performance. Pharmaceutical tube packaging solutions mainly come in three forms, which include aluminium tubes, plastic tubes, and laminated tubes, ensuring the protection of products.

The squeeze and semi-squeeze tubes market is booming, poised for a revenue surge into the hundreds of millions from 2025 to 2034, driving a revolution in sustainable transportation. The rising demand for environment-friendly, portable, and lightweight packaging in industries like pharmaceuticals, personal care, and cosmetics has boosted the innovation in the market.

Squeeze and semi-squeeze tubes are flexible packaging solutions primarily used for dispensing viscous liquids and semi-liquids such as toothpaste, creams, gels, ointments, food pastes, and personal care products. These tubes are typically made from plastic, laminated materials, or aluminum and are designed for easy handling, controlled dispensing, and preservation of product integrity. Semi-squeeze tubes have a slightly firmer structure than standard squeeze tubes, allowing for better product protection and shelf appeal while still providing moderate flexibility.

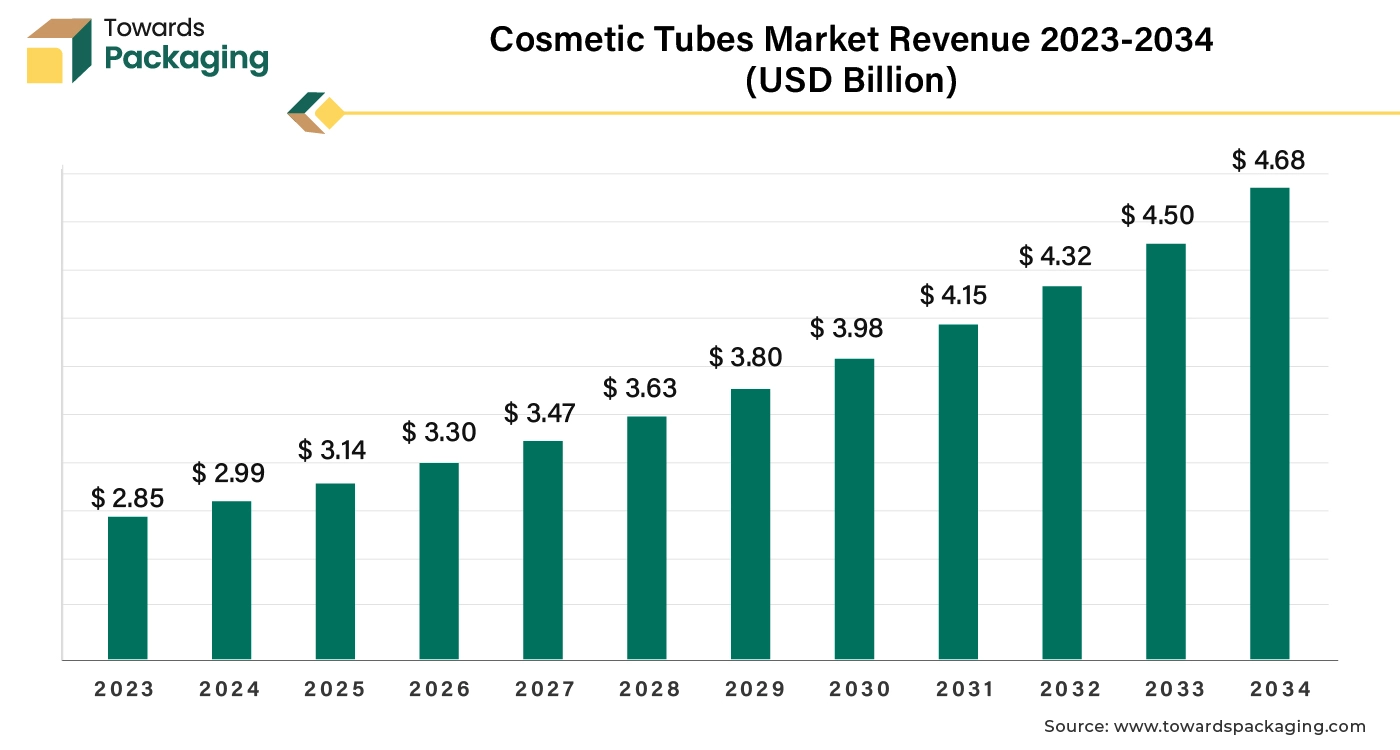

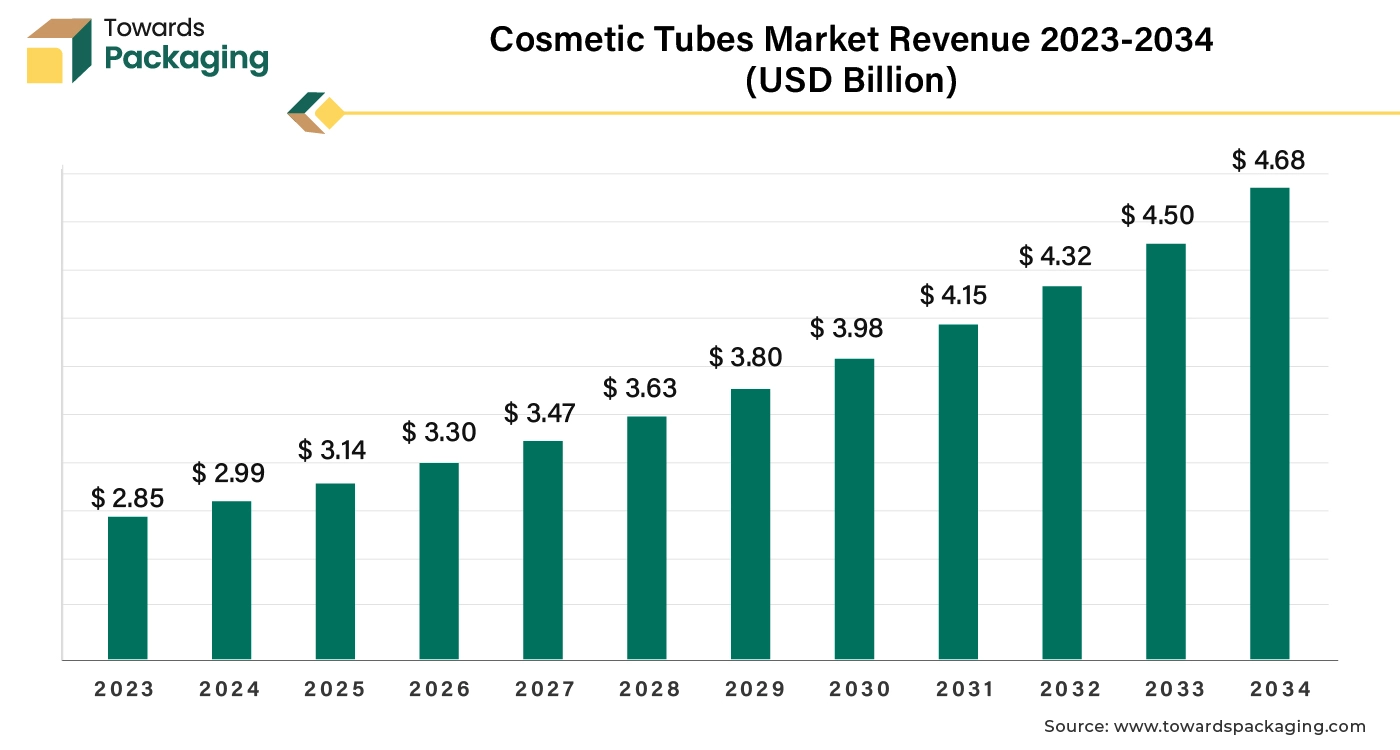

The cosmetic tubes market is projected to reach USD 4.68 billion by 2034, expanding from USD 3.14 billion in 2025, at an annual growth rate of 4.61% during the forecast period from 2025 to 2034.

The market is increasing due to the rising awareness towards personal hygiene, skincare and personal care, and social media influence which require cosmetic tubes for packaging due to safety concerns. The growing trend of social media is boosting the cosmetic tube market.

The cosmetic tubes market plays a significant role in the beauty packaging industry and it is driven due to its eco-friendly, sustainable, and durable properties. These tubes are primarily preferred due to less wastage of products and easy-to-transport quality which is beneficial in delivering products around any corner of the world without any risk of leakage. The cosmetic tubes are attractive because of their designs, colour, pattern, locking quality, and many other according to the preference of customers. Innovation in this packaging industry has enhanced the customer experience significantly due to the market key players customising packaging by analysing the requirements of the customers of specific region. The rising e-commerce market has also influenced sustainable and sturdy cosmetic packaging to reach brands in wider regions.

By Material

By Capacity

By Closure Type

By Application

By Region

February 2026

February 2026

February 2026

February 2026