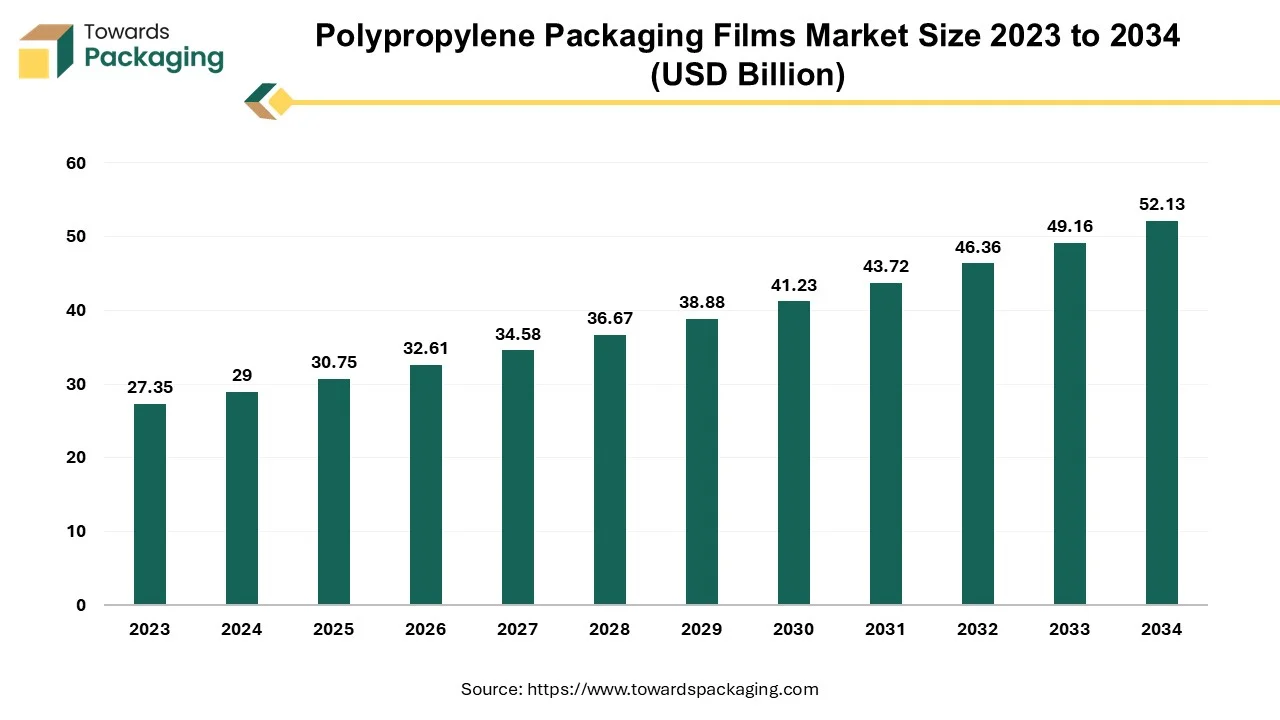

The polypropylene packaging films market is forecasted to expand from USD 32.61 billion in 2026 to USD 55.28 billion by 2035, growing at a CAGR of 6.04% from 2026 to 2035. The report provides an in-depth analysis of BOPP and CPP process types, bags & pouches, wraps, and labels across food & beverages, healthcare, electronics, and industrial applications.

It includes detailed regional coverage across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, highlighting Asia Pacific’s 41.35% share in 2023. The study further offers insights into market structure, competitive landscape, and value chain analysis, including profiles of leading companies such as Amcor PLC, SABIC, Jindal Poly Films, and Borealis AG.

The polypropylene packaging films market is anticipated to witness significant growth during the forecast period. Polypropylene (PP) film serves as a thermoplastic that is both inexpensive and fully recyclable. These films are appropriate for applications requiring sterilization at extreme temperatures since they have good tensile strength, high gloss, high clarity and relatively high melting point. Polypropylene is best suited for use in the food and beverage and packaging industries owing to its special qualities. Due to its excellent chemical resistance, low odor and inertness, polypropylene film is the preferred material for packaging applications which must adhere to the FDA requirements. Polypropylene film is commonly used for tape liners, food wraps, cigarette packing, shrink wrap, candy packaging, diapers and sterile wrap.

The growing demand for packaged foods due to urbanization and changing lifestyles of consumers coupled with the expansion of the e-commerce sector is anticipated to augment the growth of the polypropylene packaging films market within the estimated timeframe. The increasing sustainability initiatives and environmental regulations along with continuous technological advancements in the film production are also expected to support the market growth. Furthermore, the cost-effectiveness of polypropylene films compared to other materials as well as the growing need for custom packaging solutions is also likely to contribute to the growth of the market in the years to come.

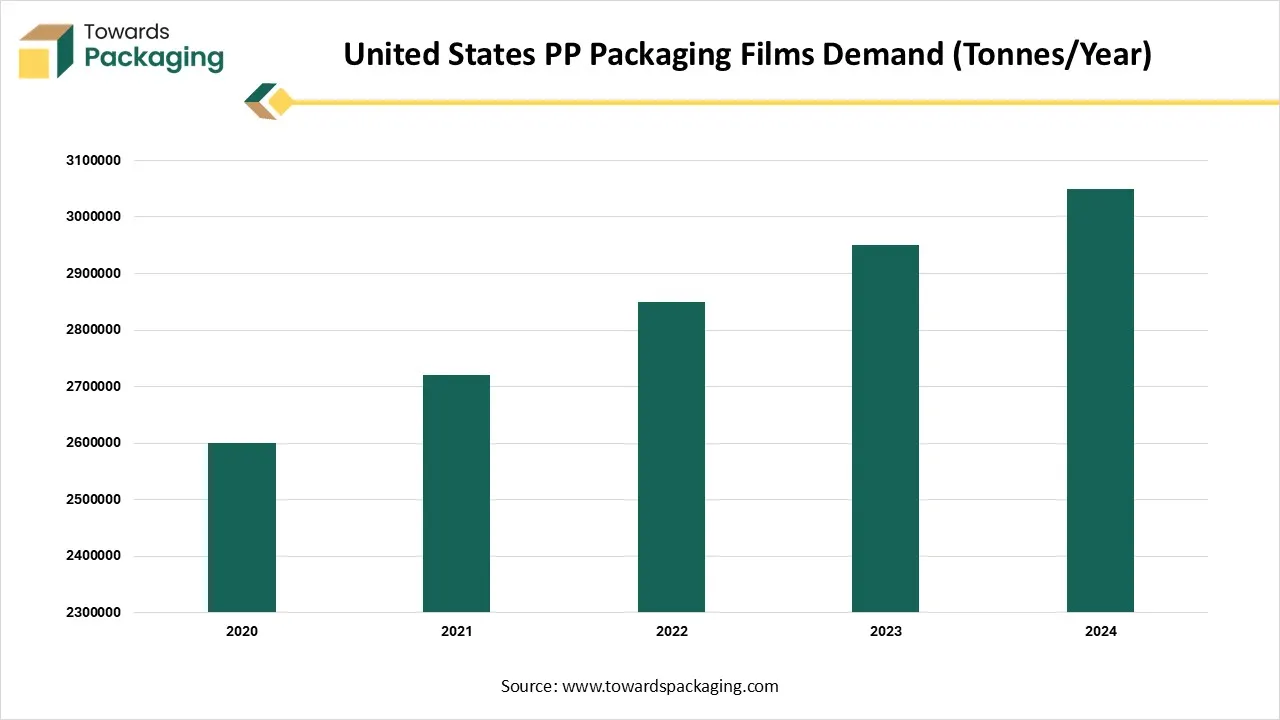

| Year | Demand |

| 2020 | 2600000 |

| 2021 | 2720000 |

| 2022 | 2850000 |

| 2023 | 2950000 |

| 2024 | 3050000 |

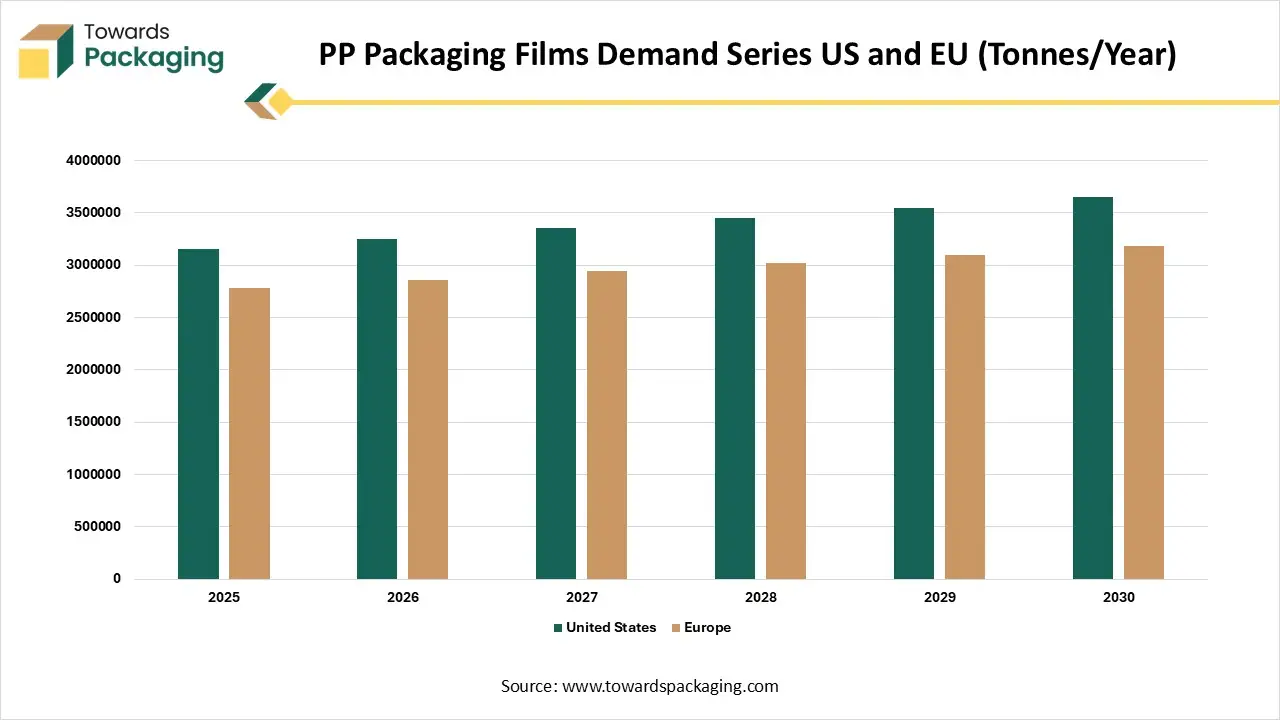

| Year | United States | Europe |

| 2025 | 3150000 | 2780000 |

| 2026 | 3250000 | 2860000 |

| 2027 | 3350000 | 2940000 |

| 2028 | 3450000 | 3020000 |

| 2029 | 3550000 | 3100000 |

| 2030 | 3650000 | 3180000 |

The inclination towards online food & grocery shopping owing to the rise in e-commerce platforms and changing consumer purchasing behaviors is anticipated to augment the growth of the polypropylene packaging films market during the forecast period. Furthermore, the other primary factors for the growth of the online grocery shopping are flexibility, convenience, safety, and affordability. The majority of shoppers do their grocery shopping online these days and they want to continue doing so. Packaged food items, groceries, and various other products can be delivered the same day or the next day by a number of organizations, like Amazon and Big Basket. This is a good idea for preserving their quality as well. In contrast to deliveries that would often arrive a week later, the quality of the requested items is preserved when they are delivered the same day or even the following day.

Additionally, numerous food and beverage supply chain organizations implement measures to provide discounts and incentives to their customers, encouraging them to make online purchases of groceries and other goods. Actually, a lot of companies, including the massive Amazon, provide significant discounts on their grocery products on certain days, much like its Great Shopping Festivals and various other events. Customers purchase a variety of products at significantly lower prices since they are able to find them there. Food and drink is the newest category that customers who enjoy online shopping have added to their shopping lists. This growth in online shopping is likely to create demand for polypropylene packaging films as it is one of the best packaging options available in the market with properties such as improving its resistance, separation or protection against outside agents and guarantee optimal preservation of food.

The raw material price volatility is likely to limit the growth of the market during the forecast period. Polypropylene, like so many others, is derivative of petroleum. Conflicts and political shifts in the Persian Gulf, Venezuela, Libya and the Middle East have recently contributed to the interruptions in the global oil supply, which have pushed up the oil prices. As the one-third of the global seaborne oil traffic originates from the Middle East, the most recent conflict there has increased geopolitical risks for the markets for the commodities. Even though it would be a rare situation, a conflict's escalation might cause significant disruptions to the oil supply, depending on its length and the scope. Also, there exist other potential positive risks associated with the oil market such as the likelihood of the production cuts from Saudi Arabia and Russia being extended or intensified.

Fluctuations in the prices of the crude oil influence the price of its byproducts. It would be nearly difficult to maintain the current global economic structure without oil and its byproducts. An energy crisis, recession or the inflation can be driven by even a little increase in the price of crude oil. This is due to the fact that gas and oil are the foundation of the international trade and are essential to the national growth. Events that could impede the flow of oil and products to market, such as developments in geopolitics or weather, can impact the price of both crude oil and petroleum products. Such occurrences could result in the real disruptions or trigger concerns regarding supply and demand in the future, which could increase price volatility.

Moreover, the cost volatility affects not only the production of the polypropylene films but also the entire supply chain, including suppliers of the additives and processing aids used in the film production. This adds another layer of complexity to managing costs and maintaining profitability.

Novel resin advancement is going on in the area of high melt strength variations for utilization in foamed PP compounds. Foamed PP's end-use sectors include packaging, automotive, construction and industrial. SABIC and Borealis are major resin developers in this field of technology, along with Braskem and Japan Polypropylene. SABIC is working intensively to create a PP with high melt strength. The SABIC PP-UMS HEX17112 Ultra Melt Strength (UMS) PP resins has a remarkable melt flow and power of 65 centimeters Newton (cN). It is enabling previously unattainable degrees of light weighting for automotive applications. With its strong emphasis on part wall down gauging, foaming technology is opening up a wide range of sustainable applications in automobile, building insulation, truck/bus and mass transit, as well as packaging containers of all kinds to help reduce food waste worldwide.

Also, Aaron Industries recently introduced a novel high melt flow recycled polypropylene (PP) compound. Apart from being sustainable, JET-FLOTM Polypro creates new application possibilities by enabling the creation of parts like DVD cases, caps, and closures that have thinner walls as well as more complicated designs. Faster cycle times assist in preventing the molded-in stress, which can lead to warpage, from the processing perspective.

Furthermore, recent advancements in polypropylene (PP) additives have concentrated on two important plastic end-uses worldwide packaging and automotive. In the fiercely dynamic plastic film packaging industry, where performance is the primary consideration at all times, small additions can significantly increase production efficiency.

| Film Type | United States | Europe |

| Standard BOPP | 1350 - 1800 | 1500 – 2050 |

| Heat-sealable BOPP | 1600 - 2200 | 1750 – 2400 |

| CPP | 1450 - 2050 | 1550 – 2150 |

| Specialty PP films | 2200 - 3400 | 2400 - 3600 |

The biaxially oriented polypropylene (BOPP) segment captured largest market share of 64.80% in 2023. In the packaging sector, BOPP bags have become an essential. Highly valued for their clarity, reliability as well as adaptability, they have emerged as a preferred choice for many enterprises in several industries. However, the packaging industry is always changing and BOPP plastic bags continue to keep up with fascinating new developments. Among other factors, the moisture barrier property of the BOPP films is one of the main reasons for its popularity in the food packaging. They can regulate elements including light exposure, moisture permeability and oxygen transfer due to the barrier property. This is especially important when packing fragile goods like food, medicine and electronics. Also, BOPP films can be recycled and this helps them become a sustainable packaging option and also works with the food industry's eco-friendly methods.

The food & beverages segment captured a significant market share of 43.21% in 2023. This is owing to the increasing urban population and growing demand for effective packaging of food to make it easier to store, transport and consume food products. The food and beverage industry is one of the largest users of packaging among all other industries. This competitive industry includes numerous products such as bags, containers, cups, wraps, straws, and boxes created to protect as well as enclose the food. Flexible polypropylene films guarantee the best possible food preservation. It offers a strong defense against heat, light and air while maintaining the product's quality as well as organoleptic qualities like flavor, aroma and taste.

Asia Pacific held largest market share of 41.35% in 2023 and is expected to grow at a fastest CAGR of 7.55% during the forecast period. China is the largest market in the region. This is owing to the surge in the e-commerce activities along with the growth of the logistics and delivery services across the region. Additionally, the growing food and beverage industry due to the increasing demand for ready-to-eat meals, snacks and processed foods is also projected to contribute to the growth of the market across the region. Furthermore, the shift towards the urban lifestyles as well as convenience products and expanding middle class population is also likely to support the regional growth of the market.

North America is expected to grow at a considerable CAGR of 4.80% in during the forecast period. This is due to the increasing awareness of environmental issues along with a growing focus on sustainability across the region. Also, the increasing focus of major industry players in improvements of the PP film properties is further expected to drive the demand for labels in the years to come. Furthermore, the growing demand from the well-established healthcare and pharmaceutical industries and large market for personal care and household products is also expected to support the regional growth of the market in the near future.

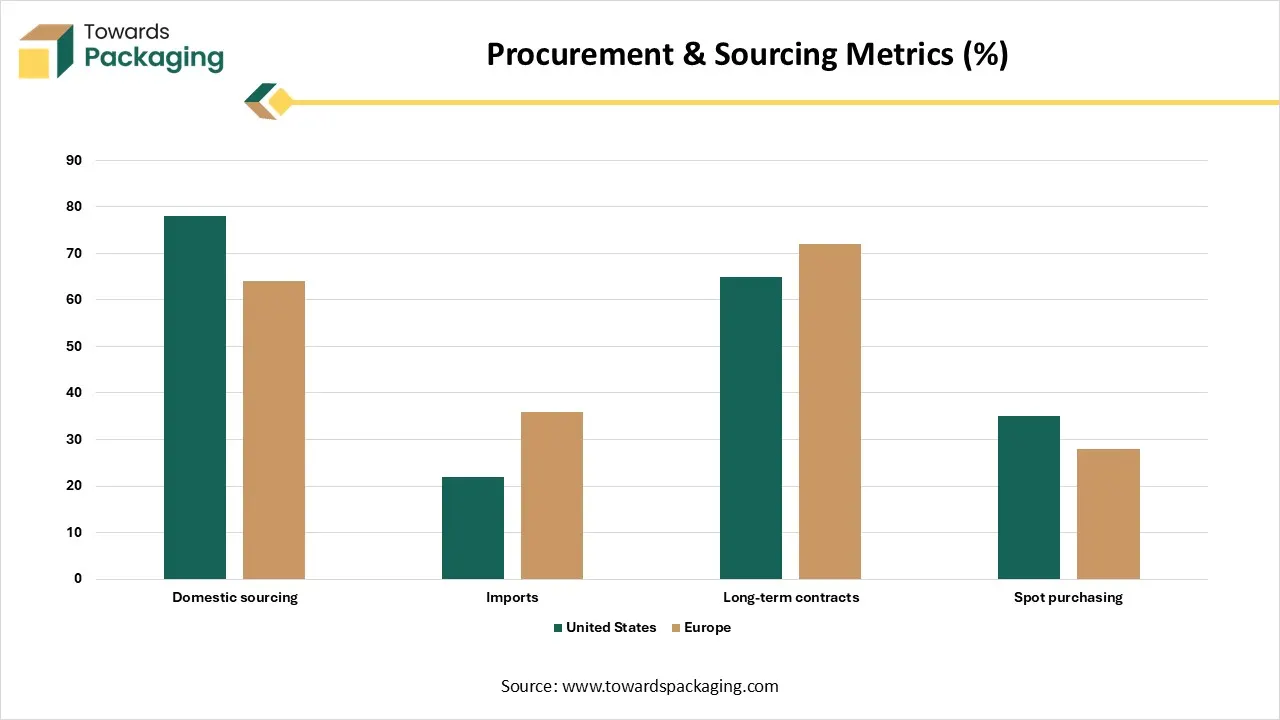

| Metric | United States | Europe |

| Domestic sourcing | 78 | 64 |

| Imports | 22 | 36 |

| Long-term contracts | 65 | 72 |

| Spot purchasing | 35 | 28 |

By Process Type

By Product Type

By Application

By Region

February 2026

February 2026

February 2026

February 2026