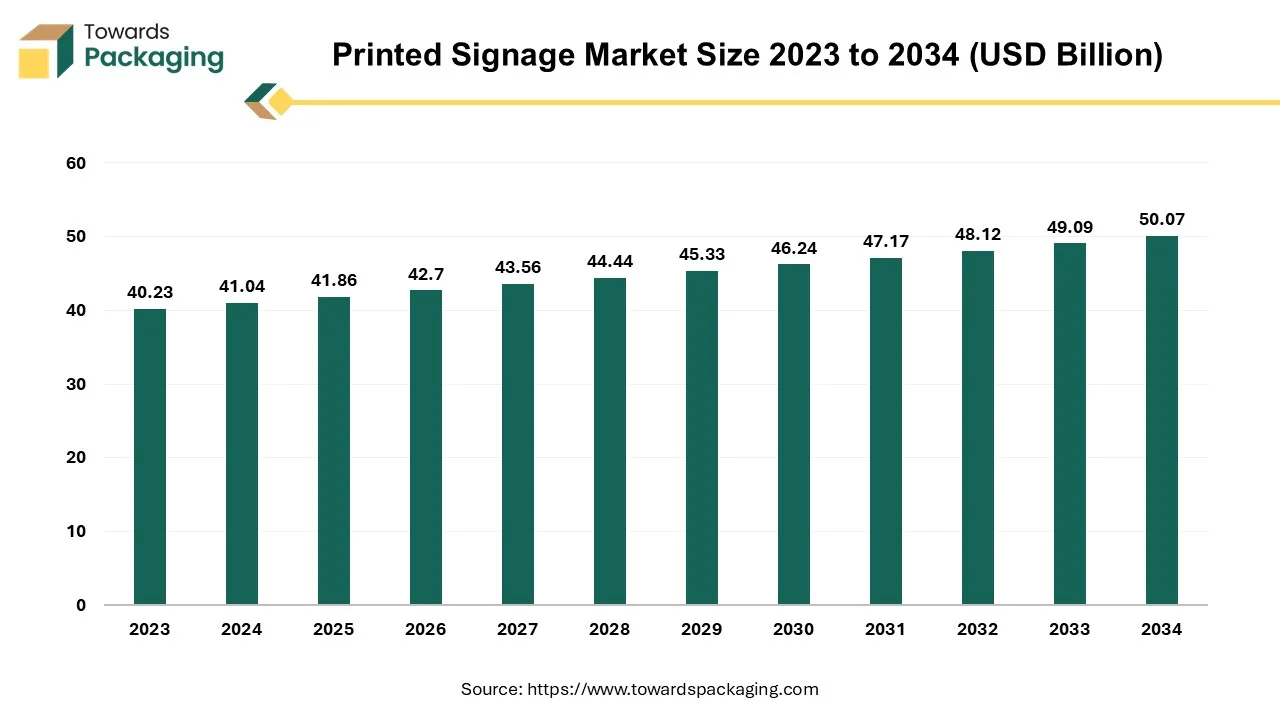

The printed signage market is forecasted to expand from USD 42.71 billion in 2026 to USD 51.08 billion by 2035, growing at a CAGR of 2.01% from 2026 to 2035. The report provides a complete breakdown by type, print technology, end-user vertical, and application, along with regional coverage across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. It delivers insights into top companies such as SGS North America Inc., Crown Packaging Corp., Berry Global Inc., and DHL Group, along with competitive benchmarking, value chain mapping, and trade data. Detailed statistics include segment share, CAGR by region, import–export volumes, and supplier concentration.

The printed signage market is anticipated to witness considerable growth during the forecast period. A necessary method of visual communication for daily life is provided by signage printing. They support in the communication of information that promotes decision-making. Signs are necessary for branding, advertising and business recognition. The kind of signs needed depend largely on the use and duration of the application. It's among the least expensive methods of spreading the word about the company and promoting it that increases its demand among the businesses.

The cost-effectiveness of printed signage as compared to digital signage coupled with the readability and high visibility is anticipated to augment the growth of the market within the estimated timeframe. Furthermore, the rapid growth of the retail sector, along with the urbanization in the developing economies is also likely to support the growth of the market. The market is further driven by the developments in the printing technologies along with the availability of sustainable printing options.

Printed signage is a key element of any business. They attract clients and helps in advertisement of products and services. It is one of the least expensive forms of advertising and hence helps in freeing up the funds for other important areas of the company. It's a simple method to upload the preferred content to a big audience. It has multiple potential benefits for business promotion. Printed signs are visually striking, particularly when they feature vibrant text, pictures, and graphics. The signs that are displayed in restaurants, workplaces, and even building sites can have a significant impact on how customers view the company. People require an attention-grabbing object. Everyone is too busy to read every message that appears on their screen. One excellent method to show pertinent information without opening an app or website is through printed signage.

Furthermore, printed content is likely to be easily readable from a distance; one does not need to be just next to it to understand it. And there are instances when a ton of pictures and graphics break up the text while a printable poster is much easier to notice than a webpage. All the focus a business needs is provided by the printed content. Additionally, the content is easily installable as it is printed and cut to the size needed. Printing and hanging a poster is far simpler than uploading an entire website to the internet. Now that low-cost, high-quality printing is readily available, businesses can gain from these printed marketing materials. These printed marketing materials are now valuable to businesses due to the development of low-cost, high-quality printing.

The increasing popularity of digital signage is likely to limit the growth of the market during the forecast period. An inventive way for businesses to interact with the public is through the digital signage. In contrast to the conventional advertising mediums like print, digital signs can be quickly and readily updated with the most recent information at any time. This saves the companies funds by enabling them to adapt to the shifting consumer demands and trends without having to initiate expensive campaigns or even the redesigns.

Furthermore, viewing a digital screen is more common than looking at the traditional forms of advertising. Companies will gain more from a flashing digital sign that makes an offer to customers. In short, the striking visuals will have a favorable effect on the marketing outcomes. It will provide the highest level of brand awareness by prominently putting the company name and logo in the open. The consumer's perception of this message will endure. Moreover, a lot of digital signs are interactive. This gives companies the opportunity to interact with a target market, pose queries, gather data from them and create new target audiences for more specialized advertising in the future. Thus, this shift towards the digital solutions poses a significant threat to the printed signage market.

For numerous companies, printing is a necessary component of doing business. Firms use printing to distribute their goods and messages to the consumers, whether it is through packaging, the product labels or the marketing materials. However, conventional printing techniques certainly have a negative environmental impact. Deforestation is largely caused by the paper industry and the manufacturing of the solvents and the printing inks releases dangerous chemicals in the water as well as the air. Moreover, new environmentally friendly printing techniques have been developed recently. Digital printing and printing on recycled paper are two examples of these eco-friendly techniques. Utilizing these eco-friendly printing techniques can assist companies in minimizing their environmental effect.

LED UV printing is one of the most environment friendly printing techniques available today. Compared to the traditional drying methods, minimal energy is needed due to the faster drying speed and this quick curing time reduces the carbon footprint. Additionally, the use of the UV Piezo printheads also reduces the amount of plastic waste and CO2 emissions due to the recycling thermal printheads and this printing also eliminates the need of the drying heater, which means that less energy is used. Furthermore, since more and more consumers are inclining towards sustainable solutions, being environment friendly can be a big advantage for any company.

Another sensible and sustainable choice for the small to medium sized enterprises is digital printing. There are fewer mechanical parts and components on the digital print devices that require manual adjustment. As a result, there will be less manufacturing and decrease in the number of repair procedures to handle. Furthermore, very little waste is generated as digital printing transfers the ink onto the paper using an electric charge. Also, if the printing is done on the recycled paper then it lowers the total amount of raw material needed and less materials means lower impact on the environment.

The banner and backdrop segment captured a substantial market share of 34.31% in 2024. Using attractive as well as unique banners for advertising or for on-site signage can help a company stand out from its peers. A high-quality and a well-designed banner helps companies to attract potential clients and it also strengthens their brand's awareness in their minds and this is expected to support the growth of the segment during the forecast period. Furthermore, there is an increase in demand for large-format printed backdrops from various events, occasions, and settings as they come in various materials and sizes, providing a flexible and impactful way to catch the attention and make a specific atmosphere.

The retail segment captured largest market share of 44.97% in 2024. One of the most essential marketing tools used by the retail establishments to promote their goods is signage. Effective signage makes it easier for customers to find what they're looking for and draws them into the store. The target audience must be taken into account when designing a sign in order for it to be effective. Furthermore, printed signage also offers a high return on investment. It's an affordable method of significantly improving the in-store experience. High-quality printed materials are also long-lasting and simple to store for use in subsequent displays. Similar to how they work wonders for boutiques of all sizes, these printed signs are perfect for the large retailers with multiple floors.

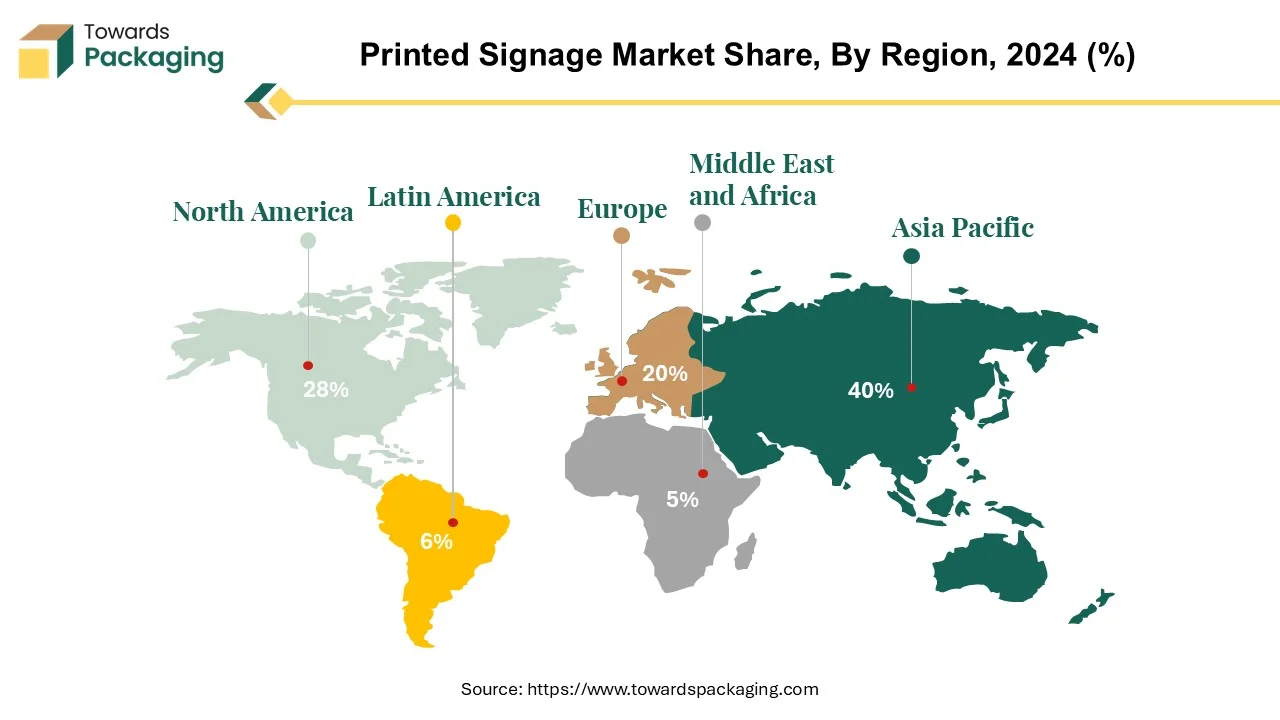

Asia Pacific dominated the market with 40.24% of shares in the global printed signage market. This is due to the growing urbanization across the region. By 2030, almost half of Asia's huge population is predicted to live in urban areas due to the rapid urbanization of the region. This is likely to create demand for signage in commercial areas, transportation hubs and public spaces. Also, the presence of large number of small and medium enterprises (SMEs) operating in various industries is expected to drive the demand for labels in the years to come. Furthermore, the rapidly growing retail industry due to the rising disposable incomes and changing consumer preferences is also expected to support the growth of the market in the years to come.

North America is expected to grow at a considerable CAGR of 0.7% during the forecast period. Despite fierce competition from the rapidly developing digital signage, the printed signage market is being sustained by the lower installation expenses and the longer lifespan of printed signage. In addition, the growing rivalry among the retail outlets as a result of shopping over online channels is driving up the demand for temporary promotional signage in order to draw in customers. However, there is a significant decline in media companies' advertisements in newspapers, magazines, and outdoor spaces; as a result, the printed signage market is anticipated to decline steadily within the estimated timeframe.

By Type

By Print Technology

By End-user Vertical

By Application

By Region

January 2026

January 2026

January 2026

January 2026