December 2025

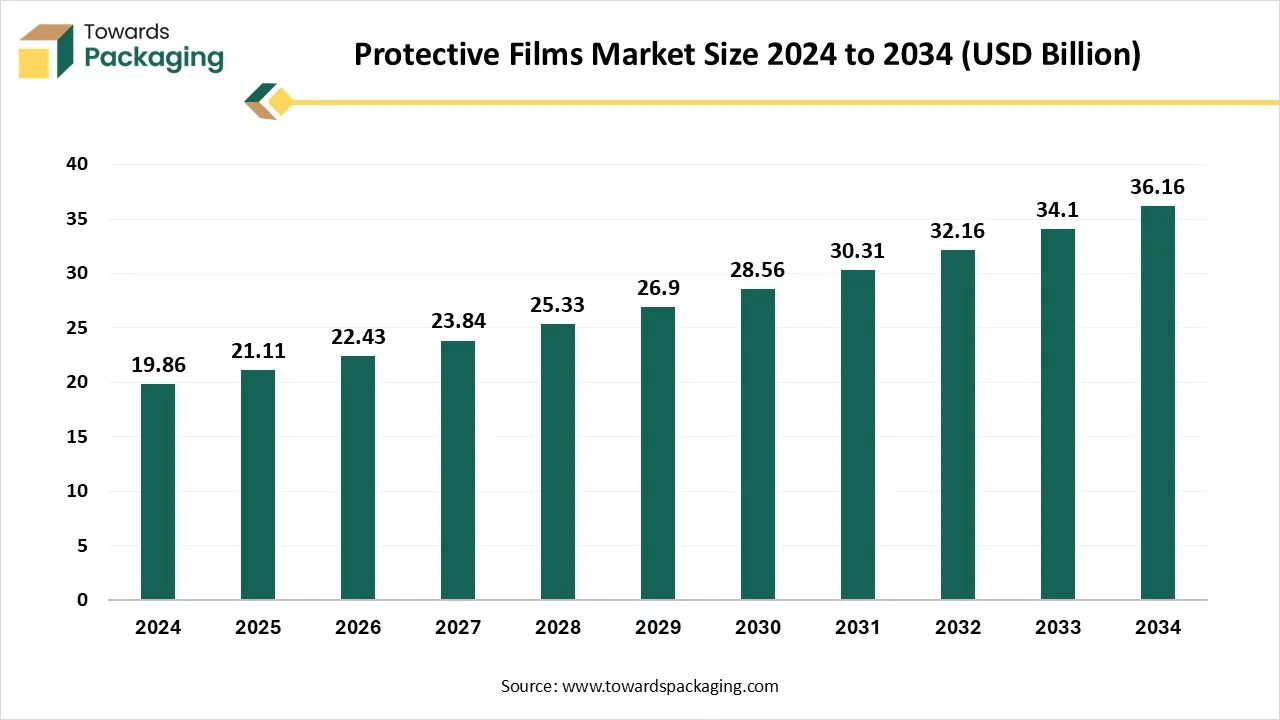

The protective films market delivers an in-depth analysis of global market size, which is projected to rise from USD 21.11 billion in 2025 to USD 36.16 billion by 2034 at a 6.27% CAGR. The report covers detailed segment-wise insights across class, type, and end-use industries, along with extensive regional data for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. It evaluates competitive strategies of leading companies like 3M, XPEL, Avery Dennison, Garware, and Saint-Gobain, while also presenting value chain analysis, import–export statistics, production capacity mapping, and supplier–manufacturer networks to support strategic decision-making.

Protective films are important materials utilized across different industries to protect surfaces during storage, manufacturing, installation, and transportation. These films are crafted to prevent scratches, stains, and different kinds of damage, which ensures that products maintain their functional and aesthetic integrity. They are even known as surface protection film or temporary protective film, which is a thin layer of protective material applied to surfaces to protect them from different damage.

There is a new kind of protective film available on the market known as Low Tack protective film, which delivers an easily removable layer of added prevention. Its mild bonding power allows it to clean the adhere the surfaces while still being easily removable, which makes it perfect for temporary uses and automation. When a protective film carries a die-cut part, it becomes a carrier. Material adhesion is encouraged by surface energy communication, so choosing a low-tack carrier for the project will rely totally on the composition of other materials.

| Metric | Details |

| Market Size in 2024 | USD 19.86 Billion |

| Projected Market Size in 2034 | USD 36.16 Billion |

| CAGR (2025 - 2034) | 6.27% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Class, By Type, By End-use Industry and By Region Covered |

| Top Key Players | XPEL, 3M, 3M Scotchgard Pro Series, Avery Dennison Corporation, Baroda Packaging |

Artificial Intelligence is specifically changing the protective film industry by growing accuracy, efficiency, and product quality across production procedures. In manufacturing, AI-driven systems allow real-time tracking of tensile power, film breadth, and consistency, which ensures constant quality and reduces material waste. Machine learning algorithms can examine production data to detect anomalies at an early stage, forecast equipment maintenance demands, and update operating conditions for the best output.

AI also plays a complicated role in tailoring protective films for different uses, such as automotive, electronics, and packaging. By analyzing customer demand and product usage data, AI can suggest particular film characteristics -like anti-scratch capabilities, UV resistance, or heat tolerance -tailored to every application. Additionally, AI grows inventions in smart protective films by mixing sensors or responsive elements that adjust to surrounding conditions.

Rising Utilization of High-value Elements

The rising usage of high-value elements such as displays, touchscreens, and painted surfaces in electronics and vehicles drives the demand for scratch-resistant, dust-proof, and UV -UV-protective films during production, end-use -use, and transformation in terms of the protective films market. The fast growth of E-commerce has boosted the demand for protective packaging that can protect products during long-distance shipping and handling. Consumer and regulatory pressure for eco-conscious packaging material has encouraged producers to develop biodegradable, recyclable, or reusable protective films that create the latest growth opportunities. Protective films are heavily utilized in architectural solar panels, glass, and other construction materials to enhance durability and environmental resistance.

Environmental Concerns

The protective film industry, while rising fast, experiences many challenges that affect its growth and acceptance. One of the primary limitations is the environmental issue linked with plastic-based films, as most protective films are made from non-biodegradable materials like polyethylene, which contribute to plastic pollution. Regulatory pressures and rising demand for sustainable alterations are pushing producers to search for eco-friendly solutions that can be costly and technically challenging. Furthermore, fluctuating raw material costs, especially for petroleum-based inputs, cause volatility in production costs. Another restraint lies in the technical limitation of protective films, such as residue left on surfaces after removal or difficulty in adhering to particular materials, which affects customer experience and limits the scope.

Expansion of End-users

The protective films market has significant growth opportunities driven by advancements in material science, growing demand across several sectors, rising demand across multiple sectors, and increasing awareness of product longevity. One of the main opportunities lies in the rising electronics and automotive sectors, where the urge to prevent high-value surfaces from scratches, dust, and environmental damage is complicated. The growing construction and renovation industry also opens the latest avenues for protective films to protect flooring, glass, and other materials during transportation and installation. Furthermore, the worldwide move towards sustainability presents a major opportunity for producers to discover biodegradable and recyclable protective films that match with eco-conscious consumers and regulatory demands.

The adhesive-coated segment dominates the market firstly due to its rigid bonding potential, ease of application, and a long series of use cases across sectors. These films serve reliable surface protection by adhering securely to different materials such as metal, glass, plastic, and painted surfaces without causing damage upon removal. This makes them perfect for temporary protection during transportation, manufacturing, storage, and installation procedures. Industries like automotive, electronics, construction, and appliances select adhesive-coated films due to their constant protection against dust, scratches, moisture, and chemical exposure.

Self-adhesive is the fastest-growing material in the protective films market. The self-adhesive class in the protective film sector refers to films that come pre-coated with an adhesive layer that enables them to stick directly to surfaces without the need for external adhesives, water, or heat. This class of films is widely used due to its versatility, ease, and clear removability. One of the main benefits is their easy application and removal -they adhere effortlessly without leaving residue, protecting the surface quality.

These films are available in various adhesion powers (medium, low, and high track ) to match different surface types and durations of usage. Because of their user-friendliness, cost-effectiveness, and acceptability, the self-adhesive class is constantly rising and is a selected segment in the overall protective films market.

Polyethylene is the most highly utilized material in the protective film industry due to its durability, flexibility, cost-effectiveness, and excellent barrier characteristics. Available in forms such as LDPE (Low-density Polyethylene) and HDPE(High-density Polyethylene). Furthermore, it serves personalized solutions for a wide range of surface protection demands. It can be easily customized in terms of tack level, thickness, color, and printing, which makes them suitable for branding and labeling applications as well. Their recyclability further adds to their eco-consciousness. Due to these advantages, polyethylene remains a dominant type in the protective films market, widely accepted across sectors like construction, automotive, appliances, and packaging.

Polypropylene is the fastest-growing type in the protective films market. It plays a crucial role in the protective film industry due to its clarity, high strength, heat resistance, and rigidity. As compared to polyethylene, it has better tensile strength and higher temperature tolerance, making it perfect for uses requiring enhanced durability and dimensional stability. Also, polypropylene films are recyclable, aligning with rising sustainability demands in the packaging and protection sectors. Their optical clearness and printability also make them suitable for uses where branding or instructions need to be visibly displayed on the protective layer. Overall, polypropylene offers a balanced combination of strength, performance, and environmental compatibility, which makes it a preferred material in high-performance protective film uses.

Protective film plays an important role in the building and construction sector by protecting materials and surfaces during stages of transportation, construction, and installation. These films assist in maintaining the integrity, functionality, and aesthetics of complicated construction elements by preventing dust, scratches, accumulation, paint splatters, abrasions, moisture, and UV Damage. Furthermore, protective films offer UV resistance and weatherproofing for exterior applications, which allow materials to be stored or installed in open surroundings without degradation.

Transportation is the fastest-growing end-user in the protective films market. They are extensively utilized in the transportation sector to protect vehicles and elements during production, storage, and final delivery. These films act as an obstacle against dust, scratches, dirt, UV rays, and weather-related damage, which makes sure that surfaces remain pristine and damage-free throughout the logistics chain.

Their easy peel-off pattern makes sure that films can vanish without leaving adhesive residue, streamlining the final outcome and customer handover procedure. Overall, protective films contribute to reduced damage claims and grow brand reputation by making sure of high-quality delivery in the transportation industry.

Asia Pacific has grown as the dominant region in the protective films market due to fast industrialization, growing construction activities, and growth in the automotive and electronics industries. Countries like India, China, Japan, and South Korea are undergoing major infrastructure growth, which fulfills the urge for protective films to protect surfaces during renovation and construction. Furthermore, the booming appliance and electronics manufacturing sectors in the region depend heavily on protective films to ensure scratch-free delivery of products. Also, favorable government policies, low production costs, and the presence of various major manufacturers contribute to Asia Pacific’s leading position in the worldwide protective films market.

In North America, including Canada, the protective film industry is driven by perfectly established electronics, automotive, and construction sectors. The region has a big demand for surface protection solutions in both commercial and residential construction projects to protect against damage during transportation and installation. In the United States, the presence of main electronics and appliance brands contributes to the constant demand for protective films that ensure product safety and aesthetics. Canada’s development is also assisted by growing housing projects, infrastructure development, and the importance of sustainable packaging. Furthermore, strict quality standards and consumer choices for luxury products further boost the usage of high-performance protective films across different uses in North America.

By Class

By Type

By End-use Industry

By Region Covered

December 2025

November 2025

November 2025

November 2025