PTFE Tapes and Films Market Size, Share, Trends and Forecast Analysis

The PTFE tapes and films market is expected to increase from USD 1.13 billion in 2026 to USD 1.84 billion by 2035, growing at a CAGR of 5.56% throughout the forecast period from 2026 to 2035. This report covers the market's segmentation by product types, including PTFE adhesive tapes (40% share in 2024) and expanded PTFE films, which are expected to experience rapid growth. Key regions such as Asia Pacific, North America, and Europe show significant market activities. The report includes comprehensive competitive analysis, trade data, and manufacturers like 3M, Saint-Gobain, and Nitto Denko, providing insights into key growth areas.

Key Highlights

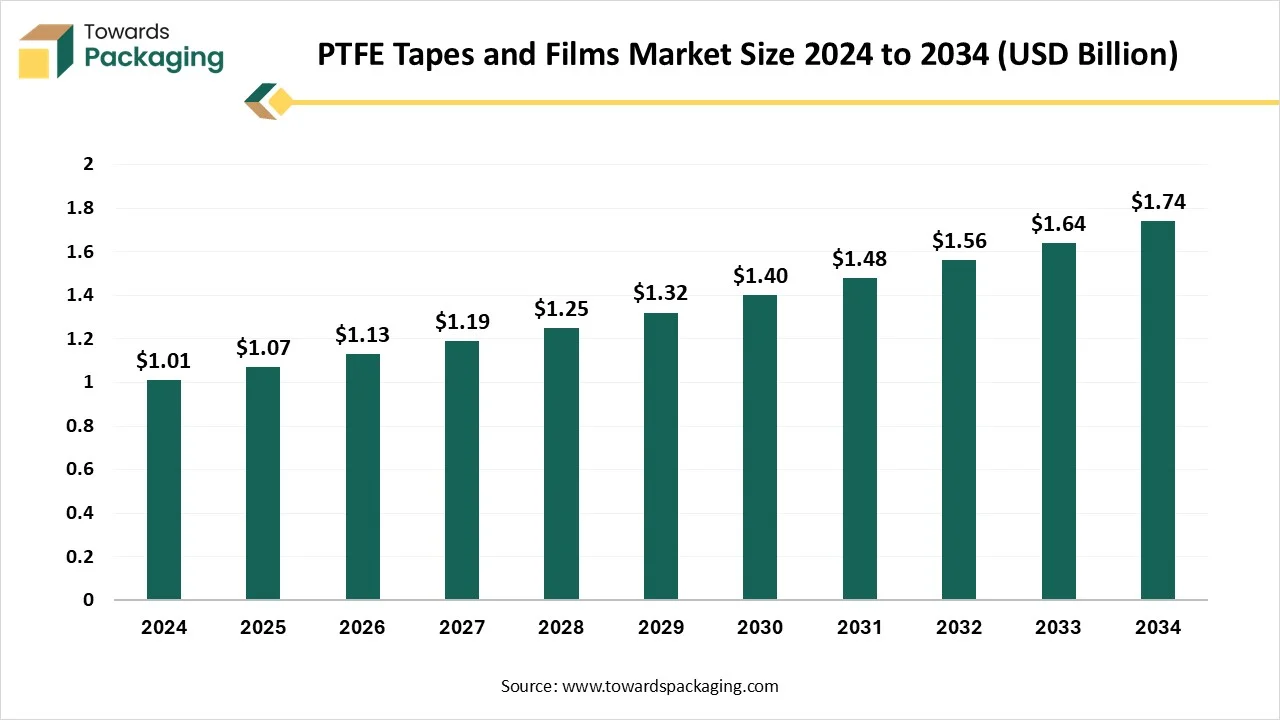

- In terms of revenue, the market is valued at USD 1.01 Billion in 2024.

- The market is predicted to reach USD 1.74 Billion by the year 2034.

- Rapid growth at a CAGR of 5.56% will be officially experienced between 2025 and 2034.

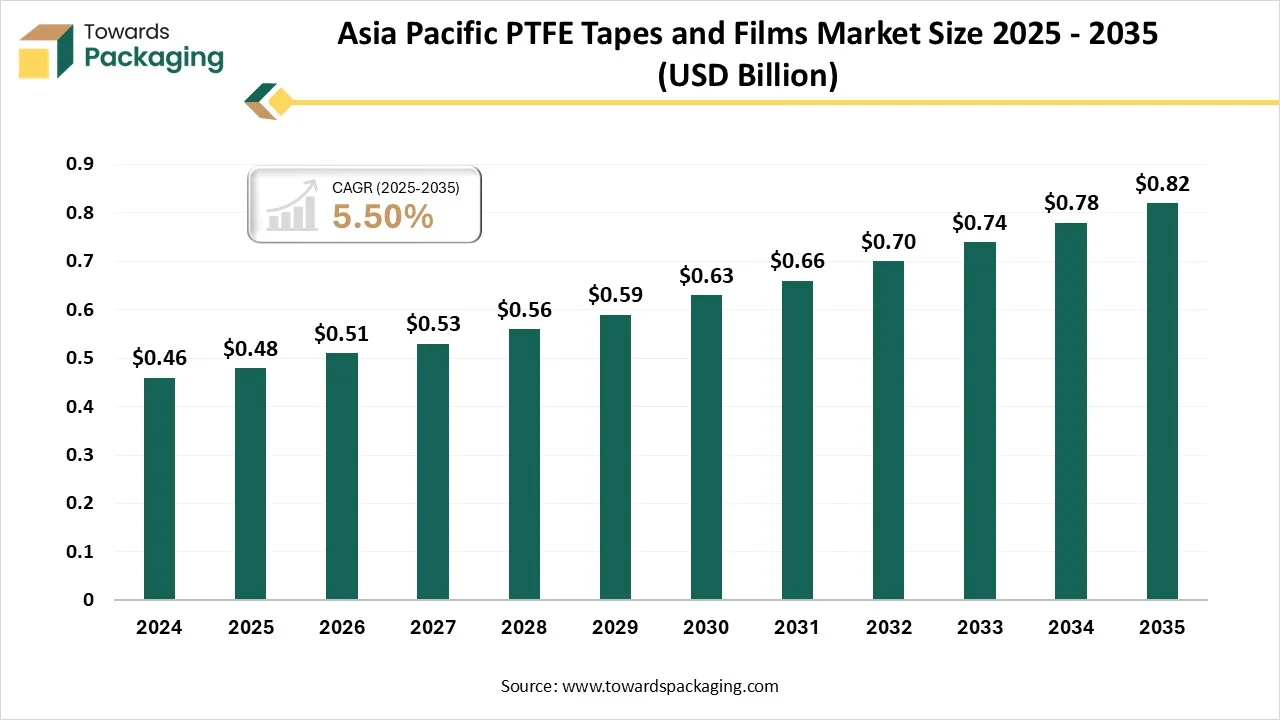

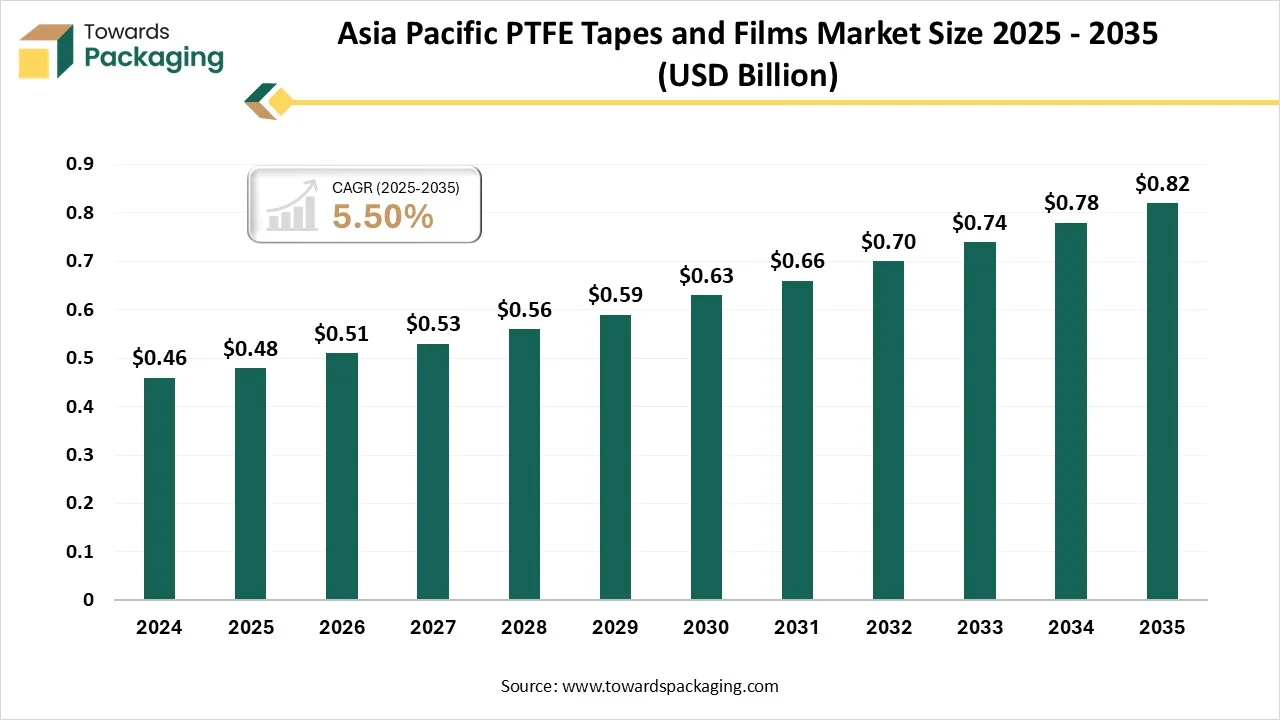

- By region, Asia Pacific dominated the market having the biggest share of 45% in 2024.

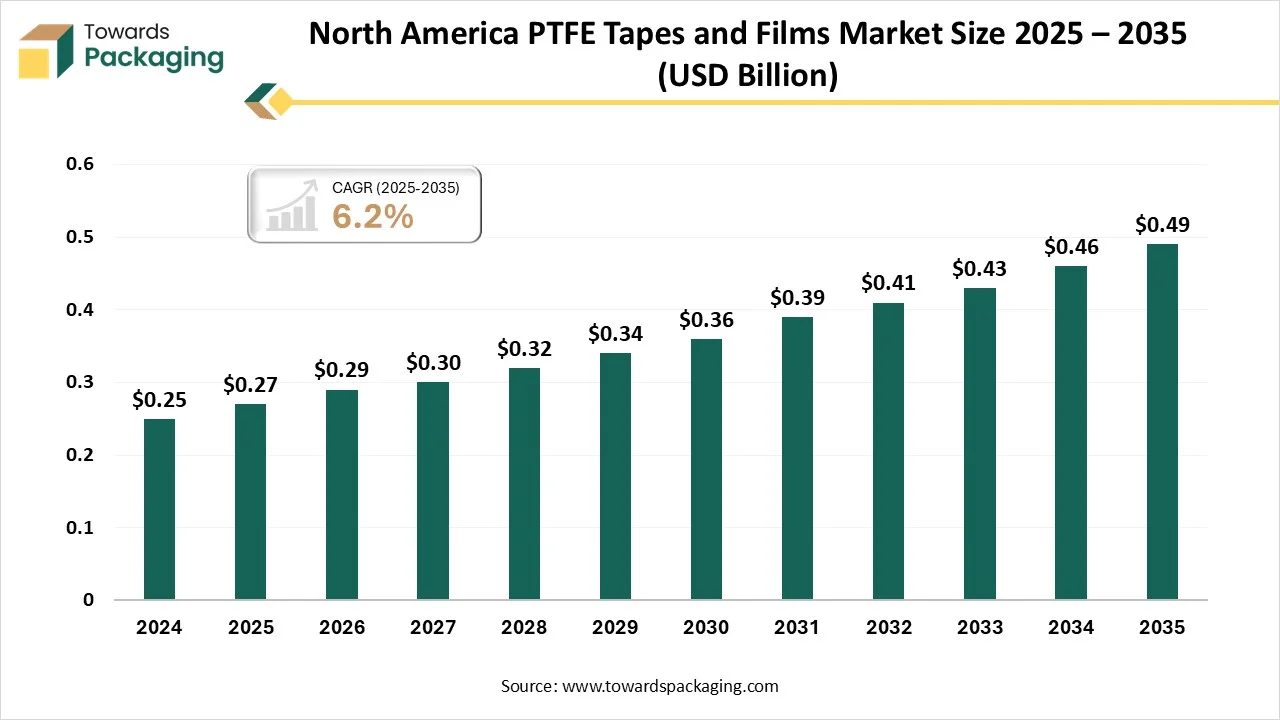

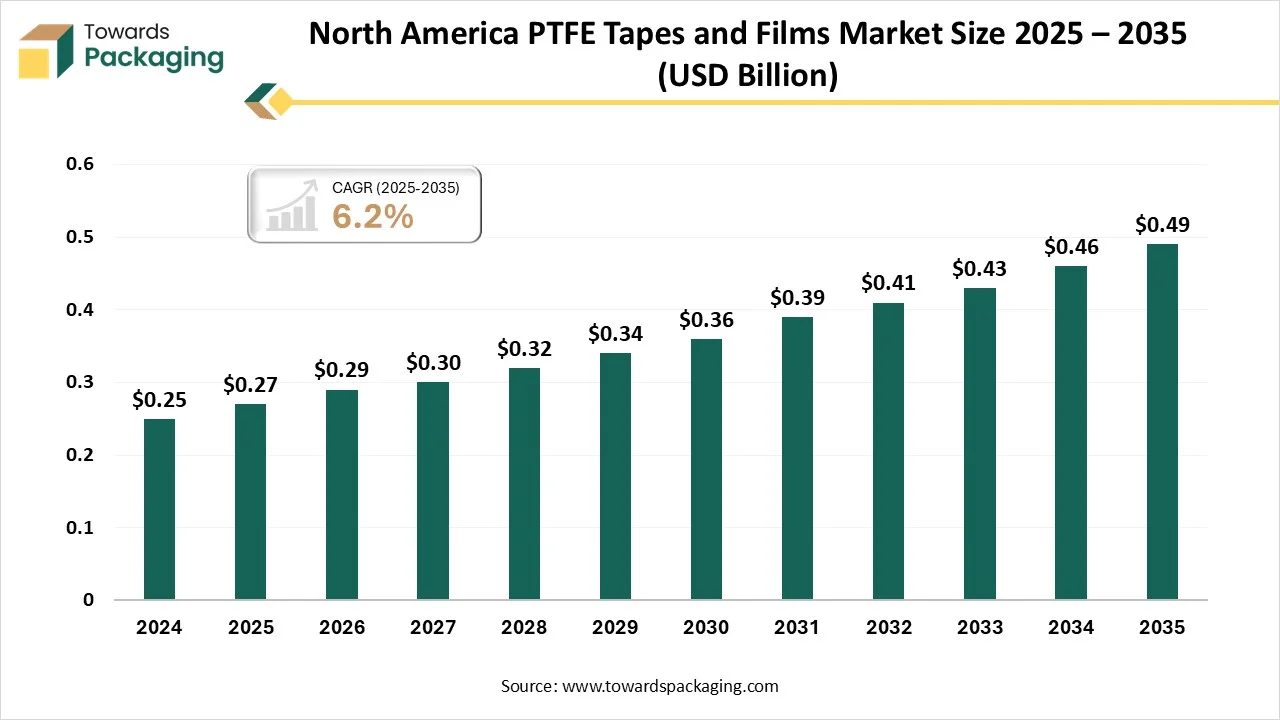

- By region, North America is expected to rise at a notable CAGR between 2025 and 2034.

- By product type, PTFE adhesive tapes segment contributed to the biggest share of 40% in 2024.

- By product type, Expanded PTFE films segment will rise at a notable CAGR between 2025 and 2034.

- By thickness, 0.05mm-10mm segment contributed to the largest share of 35% in 2024.

- By thickness, below 0.05mm segment will grow at a notable CAGR between 2025 and 2034.

- By application, electrical insulation and cable wrapping segment dominated the market with 30% share in 2024.

- By application, medical devices and implants segment will rise at a notable CAGR between 2025 and 2034.

- By the industry, electronics and electricals segment contributed to the biggest share with 32% in 2024.

- By the industry, healthcare and medical segment will rise at a notable CAGR between 2025 and 2034.

What Do You Mean By The PTFE Tapes And Films Market?

The PTFE (Polytetrafluoroethylene) Tapes and Films Market comprises products used for sealing, insulation, lubrication, and surface protection across industries such as electronics, automotive, aerospace, chemical processing, and construction. Known for their exceptional non-stick properties, high chemical resistance, dielectric strength, and wide temperature tolerance, PTFE tapes and films are widely adopted in applications requiring durability and reliability under extreme operating conditions.

PTFE Tapes and Films Market Outlook

- Industry Growth Overview: The Market is rising at a medium CAGR due to the demand in electronics, chemical processing, automotive, and chemical applications.

- Sustainability Trends: Growing scrutiny over fluoropolymers is encouraging manufacturers towards waste management, lifecycle controls, recycling research and development, and less-impact processing.

- Global expansion: Manufacturing and sales are growing fastest in North America, Europe, and China as big manufacturers scale potential and new specialty grades are commercialized.

- Major Investors: The sector is being dominated by strategic corporate investors and big chemical manufacturers (3M, Saint-Gobain, Rogers, Nitto Denko, W.l Gore, Taconic) who fund capacity, R&D, and M&A instead of pure-play VCs.

Key Technological Shifts in the PTFE Tapes and Films Market

Artificial Intelligence and high-level manufacturing technologies are updating the PTFE tapes and films sector. AI-driven quality control systems now detect micro-defects and optimize production parameters in real time, developing product consistency and reducing waste. Automation and digital twin technology develop accuracy during stretching processes and extrusion, ensuring uniform thickness and strength. At the same time, advancements in surface modification, nanocoatings, and hybrid composites are broadening PTFE’s uses in aerospace, electronics, and medical fields. These inventions are assisting manufacturers to boost efficiency, lower costs, and meet the rising demand for high-performance, sustainable PTFE materials.

Trade Analysis of PTFE Tapes and Films Market: Import & Export Statistics

- As per the global data, world exported 355 shipments of PTFE Tapes Films from Jun 2024 to May 2025. These exports were created by 144 exporters to 144 buyers, which marks a development rate of 51% as compared to the previous twelve months.

- Several of the PTFE tapes and films are exported from Vietnam, Russia, and India. Globally, the leading three exporters of these tapes and films are China, the United States, and Vietnam.

- The United States is at the forefront with 239 shipments, which is being followed by China with 202 shipments, and Vietnam taking the third spot with 155 shipments.

Future Demands

| Region |

Future Demand |

Key Demand |

| Latin America |

Demand is expected to grow steadily over the forecast period, supported by industrial expansion and infrastructure development. |

Oil & gas activities, chemical processing, construction, and sealing applications |

| Brazil |

Future demand is projected to remain strong due to its dominant industrial base and energy sector investments. |

Petrochemicals, power generation, automotive manufacturing |

| Middle East & Africa |

The market is anticipated to witness robust demand driven by harsh operating environments requiring high-performance materials. |

Oil & gas, desalination plants, chemical industries |

| UAE |

Demand is expected to increase rapidly as industries prioritize reliability, safety, and long-term performance. |

Industrial maintenance, construction, energy sector |

Emerging Trends in PTFE Tapes and Films Market

- Rising demand from aerospace, electronics, and medical sectors for high-performance insulation and protection materials.

- Nanotechnology integration allows for high-level PTFE grades with perfect flexibility, conductivity, and surface strength.

- AI-driven production has developed accuracy, reduced defects and updating material usage.

- Sustainability Focus with rising R&D in recyclable or less-impact PTFE formulations.

- Automation and Digital manufacturing: It is a growing process of efficiency and quality consistency.

- Customization trend: It is for PTFE films with particular properties like high-heat tolerance, anti-friction, and chemical resistance, too.

- Global Expansion: It is led by North America and the Asia Pacific, driven by industrial and automotive applications.

- Innovation in coatings and Hybrid composites to stretch the PTFE’s usage in rising technologies.

Market Opportunity

Research And Development Of PTFE Films

The future of PTFE tapes and films lies in intelligent, greener, and more specialised applications. With current R&D in nanocomposites and functional coatings, PTFE is expected to receive greater thermal stability, conductivity, and flexibility. The integration of AI-based manufacturing will allow ultra-precise customization for aerospace, electronics, and medical sectors. Moreover, the encouragement towards sustainability will drive innovations in recyclable and eco-modified PTFE formulations. As industries move towards miniaturization and high-performance materials, PTFE tapes and films will play an important role in next-generation technologies, from flexible electronics to high-level medical devices.

Market Restraint

Restrictions Linked To PTFE Tapes And Films

Despite their perfect chemical opposition and durability, PTFE tapes and films face many limitations. They have relatively big manufacturing costs and complicated processing needs and demands, making large-scale manufacturing expensive. PTFE’s lower surface energy also limits adhesion to other materials, requiring additional surface treatments. Environmental issues over fluoropolymer waste and non-biodegradability pose sustainability challenges. Additionally, PTFE has limited mechanical power at high temperatures and can deform under heavy load, restricting its usage in certain structural applications.

Product Type Insights

How Did The PTFE Adhesive Tapes Segment Dominate The PTFE Tapes And Films Market?

The PTFE adhesive tapes segment has dominated the market with a 40% share in 2024, as polytetrafluorethylene ( PTFE) is an increasingly specialised polymer and high-performance material with unique and anti-stick properties and temperature resistance. It is a go-to product for uses within the chemical, industrial, electrical, aerospace, or automotive industries that need high-temperature durability and stability. It is linked with a silicone adhesive machine; every PTFE tape is comfortable, has high tensile strength, and great chemical resistance. They are perfect for uses that have high exposure to chemicals, solvents, and acids. PTFE can develop manufacturing capabilities in a variety of uses, such as within cable and wire insulation, as well as electrical insulation.

The expanded PTFE films segment is expected to grow at the fastest CAGR during the forecast period. The expanded PTFE films are microporous, lightweight materials which is made by expanding standard PTFE to create a network of micro-fibrils and nodes. This serves them excellent chemical resistance, thermal stability and low friction along with gas and moisture permeability. ePTFE films are greatly sued in filtration systems, medical implants, industrial gaskets and seals and protective barriers, offering an integration of the breathability, durability and flexibility that standards PTFE films cannot serve with. Their versatility and performance make them increasingly popular in industrial, medical and high-tech applications.

Thickness Insights

How Did The 0.05mm -0.10mm Segment Dominate The PTFE Tapes And Films Market?

The 0.05mm -0.10mm segment dominated the PTFE tapes and films market with a 35% share in 2024, as they are ultra-thin but durable solutions, greatly used for insulation, surface protection, and sealing too. Their thin profile enables flexible packaging, tight sealing in small gaps, and easy application in electronics, industrial machinery, and aerospace, too. Despite their reduced thickness, they retain PTFE’s chemical resistance, thermal stability, and low-friction properties, making them perfect for applications needing precision, lightweight materials, and reliable performance in challenging surroundings.

The below 0.05mm segment are predicted to be the fastest to rise at the fastest CAGR during the forecast period. PTFE films and tapes having a thickness below 0.05mm are ultra-thin, flexible, and lightweight materials crafted for accurate uses. They are perfect for micro-insulation, delicate surface protection, and high-performance layering in medical devices, electronics, and specialised industrial equipment. Even at such a low thickness, they track PTFE's hallmark chemical resistance, low friction, and thermal stability that allows tier usage in which space is restricted and high-performance material is complicated. Their thickness allows easy conforming to complex shapes and tight gaps without compromising durability.

Application Insights

How Did The Electrical Insulation And Cable Wrapping Segment Dominate The PTFE Tapes And Films Market?

The electrical insulation and cable wrapping segment has dominated the market with a 30% share in 2024, as it has perfect thermal and electrical insulation characteristics, which make it ideal for applications in the electrical industry. They are utilised to serve electrical insulation, which can use up to 500 volts per mil. It is often used to wrap electrical cables and wires. Furthermore, it is utilised to classify conductive plates in capacitors. The virgin PTFE( polytetrafluoroethylene) film has a wide range of thickness, beginning at 1 mil(0.01) and going up to 10 mil (0.1). Material can be delivered on a sheet, roll, or die-cut to a particular shape. It has the biggest level of electric insulation for any plastic. Hence, it can be used as an insulation spacer or an insulation coating for wire links.

The medical devices and implants segment is expected to grow at a notable CAGR during the forecast period. PTFE tapes and expanded PTFE are greatly used in medical devices and implants because of their chemical inertness, biocompatibility, and low-friction properties. While PTFE tape is utilised for temporary uses like sealing in dental restorations, the PTFE material is frequently used for permanent surgical patches and implants. PTFE and ePTFE are utilised to make synthetic grafts for bypass surgery and repairing damaged blood vessels. Also, PTFE is utilised in the production of artificial heart valves, and to wrap stents used in the coronary artery process.

End-Use Industry Insights

How Did Electronics And Electricals Segment Dominate The PTFE Tapes And Films Market?

The electronics and electricals segment dominated the market with a 32% share in 2024, as acetate cloth tapes are utilised only for medium applications, since they cannot go beyond 120 degrees Celsius, 9248 degrees Fahrenheit. Among the main types of electrical tapes, cloth tape is usually less linked with strong dielectric properties, meaning it’s not the perfect choice for uses in which the application is the main factor. Hence, it is prized for its mechanical properties. Acetate silk cloth electrical tapes are ideal, hand-tearable, and flexible too, which is perfect for varnish impregnation. It is due to the potential to oppose chemicals that PTFE tape is prevalently used in electrical applications as insulation or for wrapping wires.

The healthcare and medical sectors segment are expected to grow at a notable rate during the forecast period. They are utilised in medical technologies due to their integration of different characteristics, including but not restricted to heat resistance, chemical resistance, lubricity, durability, rigidity, and low friction coefficient. They are utilised in a huge range of medical devices like pacemakers, catheters, and wire coatings in radiological machinery, surgical sutures, ophthalmic products like contact lenses, medical tapes and wound dressings, medical device packaging, and blood bags too.

Regional Insights

How Has The Asia Pacific Dominated The PTFE Tapes And Films Market?

Asia Pacific dominated the PTFE tapes and films market with 45% share in 2024 as the demand for PTFE tapes and films is growing rapidly, which is being driven by stretching electronics, automotive, chemical processing, and industrial sectors. Countries like India, China, Japan, and South Korea are on top due to technological adoption, industrialization, and supportive government policies. The region favors high-performance, durable PTFE materials for sealing, insulation, and protective applications, and growth is further fueled by growing manufacturing capacities and inventions in manufacturing technology.

China PTFE Tapes And Films Market

The market for PTFE tapes and films in China is witnessing robust growth, anchored by rapid industrialisation in sectors like electronics, automotive and chemical-processing. Key drivers include expansion of infrastructure, build-out of electric vehicles and large electronics manufacturing base requiring high-performance insulation and sealing materials.

North America is expected to be the fastest-growing in the market during the forecast period. This region has a rigid and constant demand for PTFE tapes and films, driven by high acceptance in automotive, electronics, aerospace, and medical industries. Canada and the U.S. are top markets due to high-level manufacturing infrastructure, rigorous quality standards, and current invention in high-performance materials. Growth is fueled by the demand for chemically resistant, low-friction materials and heat-stable materials in uses like sealing, insulation, and protective layers. Increasing industrial automation and technological upgrades in manufacturing processes are further assisting in the region's market expansion, while tailored PTFE solutions for specialized applications are becoming more prevalent.

United States PTFE Tapes And Films Market

The U.S. market for Polytetrafluoroethylene (PTFE) tapes and films is experiencing steady growth, driven primarily by demand in high-performance sectors such as electronics, automotive (including EVs), aerospace and chemical processing. Key growth factors include stricter performance and safety requirements in industrial applications and increasing use of PTFE for insulation, sealing and protective layers in electronics and infrastructure.

Europe expects the notable growth in the market during the forecast period. Europe displays constant growth, driven by its rigid industrial base and a concentration on sustainability and high-level manufacturing. Strict environmental regulations, specifically the European Green Deal, are pushing investments in eco-friendly PTFE alterations and procedures. The UK and Germany are the main players, with investments focused on high-performance materials and aligning with regulatory requirements.

Germany PTFE Tapes And Films Market

The market for Polytetrafluoroethylene (PTFE) tapes and films in Germany is growing modestly, reflecting the country’s mature industrial landscape. This steady growth is largely driven by the automotive, machinery and electronics sectors, where demand for PTFE’s high-temperature, low-friction and chemical-resistant properties remains strong.

Latin America PTFE Tapes and Films Market Trends

The PTFE tapes and films market in Latin America is witnessing steady growth, bolstered by growing construction, electrical, and industrial activity. The demand for high-performance sealing and insulation materials is being driven by growing investments in infrastructure projects, chemical processing, and oil and gas because of its durability and chemical resistance PTFE is becoming increasingly popular in challenging operating environments throughout the region.

Brazil is seeing a rising demand for the market, backed by its robust industrial and energy sectors. Applications in power generation, petrochemicals, and automotive manufacturing drive demand. PTFE consumption is further supported by ongoing maintenance of outdated infrastructure and modernization of industrial facilities.

MEA PTFE Tapes and Films Market Trends

In the MEA region, growth of the PTFE tapes and films market is closely linked to oil & gas desalination and chemical industries. LTFE material is widely used for sealing, gasketing, and insulation in high temperature and corrosive conditions. Infrastructure development and increasing industrialization in select African economies are also contributing to market expansion.

UAE is growing in the PTFE tapes and films market because of the robust demand in the construction, oil and gas, and industrial maintenance sectors. The use of cutting-edge PTFE-based sealing and insulation solutions is encouraged by high standards for performance, safety, and dependability. The UAE is a regional center for trade and industry also contributes to the steady demand for PTFE goods.

Recent Developments

- In January 2025, Zeus, a top leader in high-level polymer solutions and catheter production, revealed its plans to reveal the StreamLiner NG, the current addition to the organisation's StreamLiner Series of ultra-thin-walled catheter liners.

- In February 2025, Igus disclosed an aluminum version of its dryline NT-60 telescopic rail that eliminates the usage of polytetrafluorethylene and over 100 percent of polyfluoroalkyl substances (PFAS) too. It is a perfect choice for the rail systems that stretch up to 2 meters and is suitable for several applications, including furniture, vehicles, and medical technology.

Top Players in the PTFE Tapes and Films Market

- 3M Company: 3M is an American multinational conglomerate founded as the Minnesota Mining and Manufacturing organization that uses science to improve lives daily through a variety of technologies and products.

- Saint-Gobain Performance Plastics: Saint-Gobain is the leading manufacturer of engineered high-performance polymer items for the online industry around the world, including medical, automotive, chemical, food, and beverage.

- Nitto Denko Corporation: It is an organization that globally serves different products in areas such as automobiles, electronics, the environment, and medicine. The Nitto Group strives to become a main organisation that is always trusted by customers, encouraged by employees with pride, and that makes an active contribution to society.

Value Chain Analysis of PTFE Tapes and Films Market

- Material Processing and Conversion: For material processing and conversion, PTFE tapes and films are manufactured initially through skiving or paste extrusion, with further post-processing steps like stretching, calendering, etching, and coating to receive the final properties. Just like most thermoplastics, PTFE cannot be conveniently melt-processed due to its high viscosity, so alteration methods are being used.

- Package Design and Prototyping: Packaging design and prototyping for Polytetrafluoroethyne tapes nd films must solve their different chemical resistance, non-stock properties, and varying end uses. The packaging must protect the product, ensuring safety, and can be updated for the particular context, whether for a retail plumbing tape or an industrial-grade film.

- Logistics and Distribution: A tape and film distributor plays an important role in the supply chain, providing access to a huge variety of tapes for industrial applications. Their importance lies in their potential to serve specialised knowledge, supply chain management, and tailored solutions that assist businesses in different industries in optimizing their operations. PTFE tapes and films distributors track the extensive inventories of different types of tapes, including adhesive, non-adhesive, custom tapes, nd specialty.

PTFE Tapes and Films Market Top Companies

- Rogers Corporation:

- Daikin Industries, Ltd.

- The Chemours Company

- Dixon Valve & Coupling Company, LLC

- Jiangsu Taifulong Technology Co., Ltd.

- Chukoh Chemical Industries, Ltd.

- Toray Industries, Inc.

- Technetics Group (EnPro Industries)

- Polyfluor Plastics BV

- FluoroTape, Inc.

- CS Hyde Company

Segmentation of the PTFE Tapes and Films Market

By Product Type

- PTFE Adhesive Tapes

- PTFE Non-Adhesive Tapes

- Skived PTFE Films

- Extruded PTFE Films

- Expanded PTFE Films

By Thickness

- Below 0.05 mm

- 0.05 mm – 0.10 mm

- 0.10 mm – 0.50 mm

- Above 0.50 mm

By Application

- Electrical Insulation & Cable Wrapping

- Sealing & Gasketing

- Pipe Thread Sealing

- Surface Protection & Release Liners

- Thermal Insulation

- Medical Devices & Implants

- Aerospace Components

By End-Use Industry

- Electronics & Electricals

- Automotive & Aerospace

- Chemical Processing

- Construction

- Healthcare & Medical

- Energy (Renewables, Oil & Gas)

- Industrial Machinery

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait