Recycled Polypropylene in Packaging Market Size, Trends, Share and Innovations

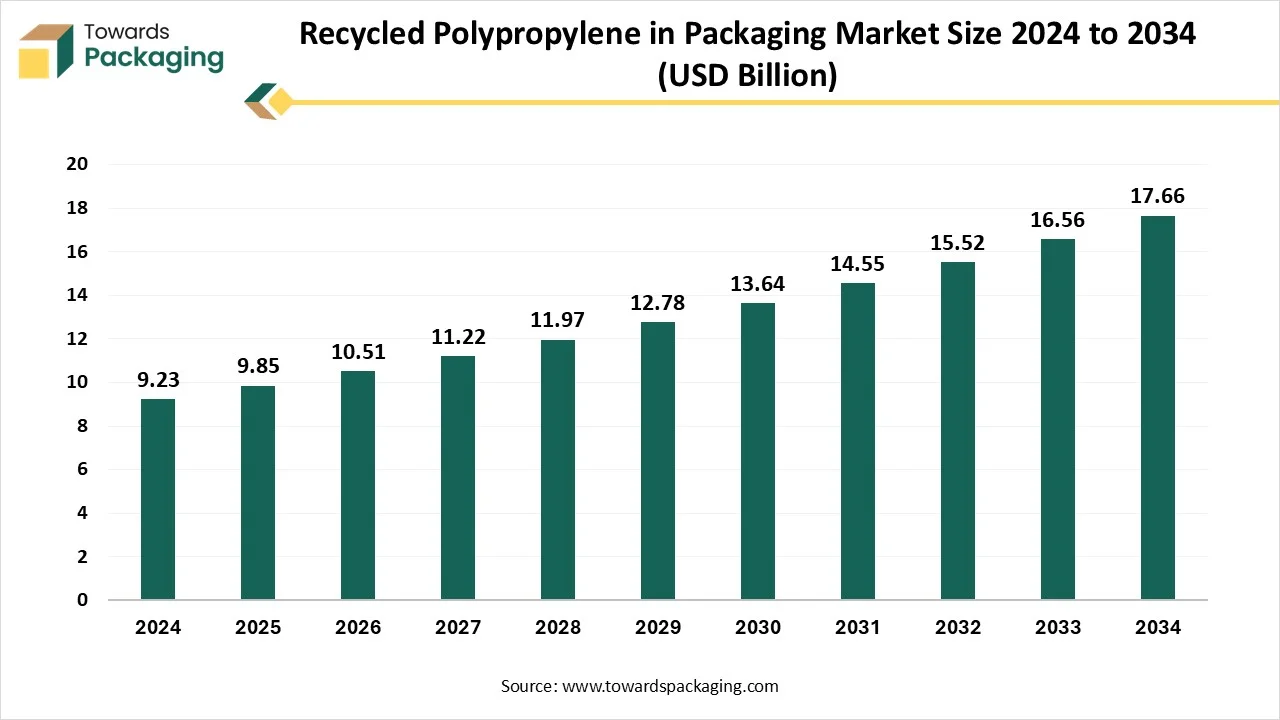

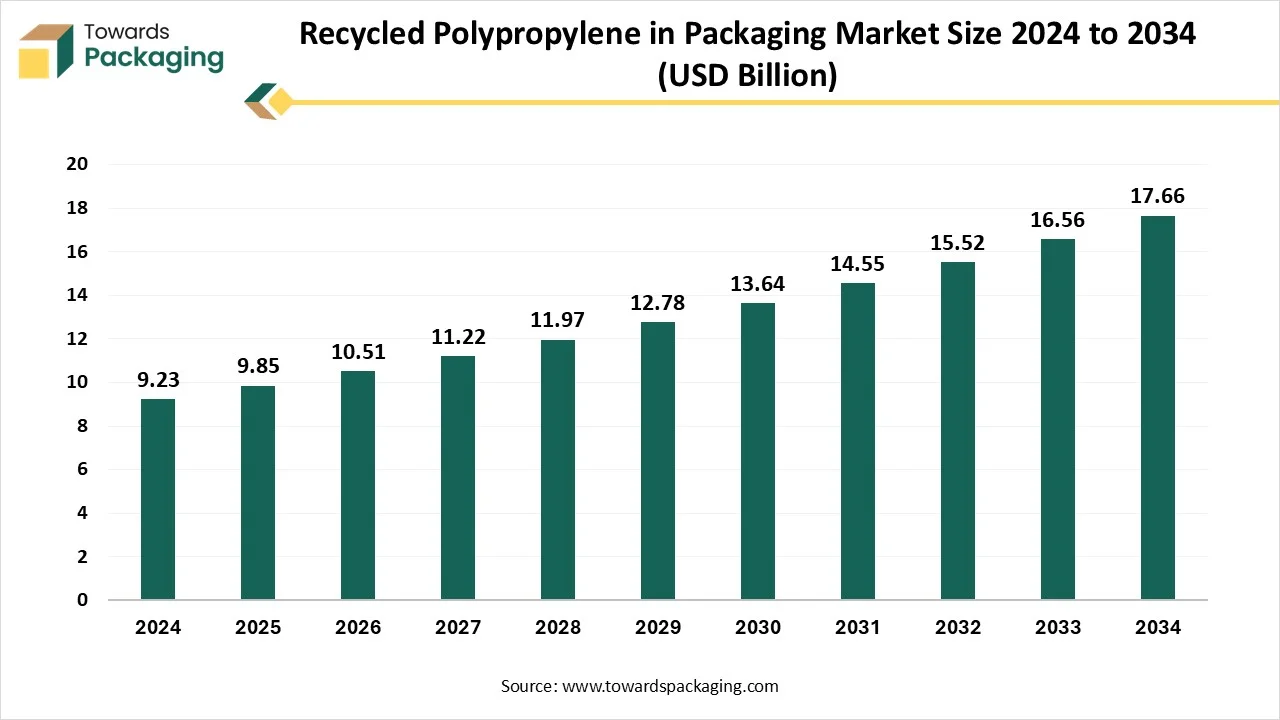

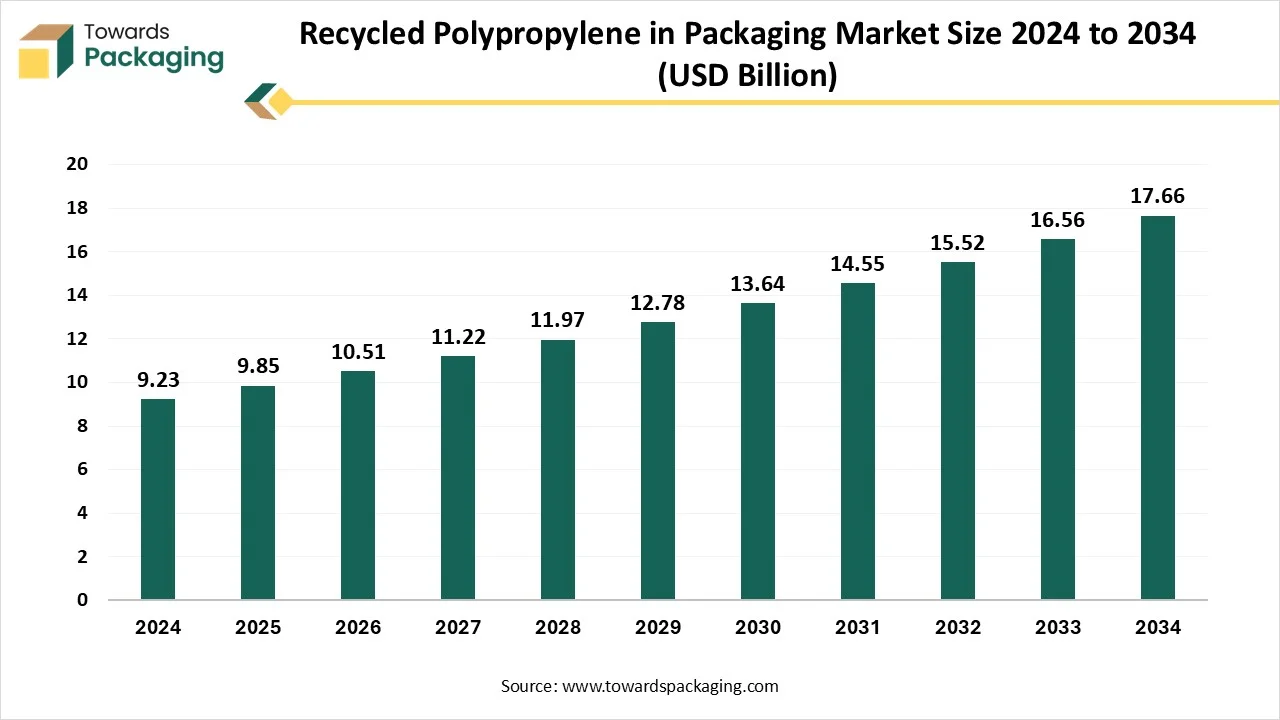

The recycled polypropylene in packaging market is forecasted to expand from USD 10.51 billion in 2026 to USD 18.90 billion by 2035, growing at a CAGR of 6.73% from 2026 to 2035. The report explains key industry trends, demand patterns, packaging segment data, and end-use shifts. It includes regional analysis across North America (market leader), Europe, Asia Pacific (fastest growth), Latin America, and MEA, along with statistics on recycling rates and government targets. It also profiles major companies, evaluates the competitive environment, maps the value chain, and presents trade flows, supplier data, and manufacturing footprints.

Key Insights

- In terms of revenue, the market is valued at USD 9.85 billion in 2025.

- The market is projected to reach USD 18.90 billion by 2035.

- Rapid growth at a CAGR of 6.73% will be observed in the period between 2025 and 2034.

- North America dominated the global market in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By packaging type, the flexible packaging segment contributed the biggest revenue share in 2024.

- By packaging type, the rigid packaging segment is expected to expand at a significant CAGR between 2025 and 2034.

- By end-use, the food and beverage segment dominated the market in 2024.

- By end-use, the personal care and cosmetics segment is expected to expand at a significant CAGR between 2025 and 2034.

Recycled Polypropylene Packaging: Evolving Consumer Preference

Recycled polypropylene in packaging is the polypropylene plastic that is processed and reutilized instead of being discarded as waste. Growing ecological awareness and laws inspiring the usage of recycled plastics, in which rPP is a general resource in several packaging applications, are influencing this market. Both flexible and rigid packaging exist in the industry, and rPP is used for containers, pouches, films, bottles, and other packaging processes. The usage of polypropylene plastic, which has been collected, treated, and transformed into new packaging resources, is called recycled polypropylene in packaging. This process reduces the ecological consequences of creating virgin plastic, saves resources, and reduces plastic waste. Moreover, the driver pushing development is the rising consumer choice and consciousness for environment-friendly packaging. In response, corporations have reshaped their packing to include recycled resources and used labelling to transport these choices.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 9.85 Billion |

| Projected Market Size in 2035 |

USD 18.90 Billion |

| CAGR (2025 - 2035) |

6.73% |

| Leading Region |

North America |

| Market Segmentation |

Packaging Type, End Use and By Region |

| Top Key Players |

Mitsubishi Chemical, ECOPLAS (HK) LIMITED, Pashupati Group of Industries, Formosa Plastics, Banyan Nation |

What are the New Trends in the Recycled Polypropylene In Packaging Market?

- Growing Demand for Recyclable Packaging

The growing demand for recyclable packaging materials has raised the innovation in this market to enhance the consumer experience.

- Rising Ecological Awareness

The increasing awareness towards ecology has influenced the usage of packaging that can reduce waste generation is being adopted by several brands.

- Strict Government Guidelines

Strict guidelines of the government aim to reduce the adverse effects of packaging on the ecology by low emission of carbon emissions.

How Can AI Improve the Recycled Polypropylene in the Packaging Market?

AI plays an important role in the recycled polypropylene in the packaging market by optimizing the quality of the materials utilized for the production process. It analyzes the data gathered and helps to identify the issues that help to bring the required innovation to the market. It helps in enhancing recycling and sorting methods and supports to generate high quality rPP for the usage of the food industry and the design of recycled packages. With the incorporation of advanced technologies, the generation of packaging that can be recycled several times and redesigned in several patterns becomes easy. Artificial intelligence helps to make the recycling process effective and ensure the production of high-quality packages.

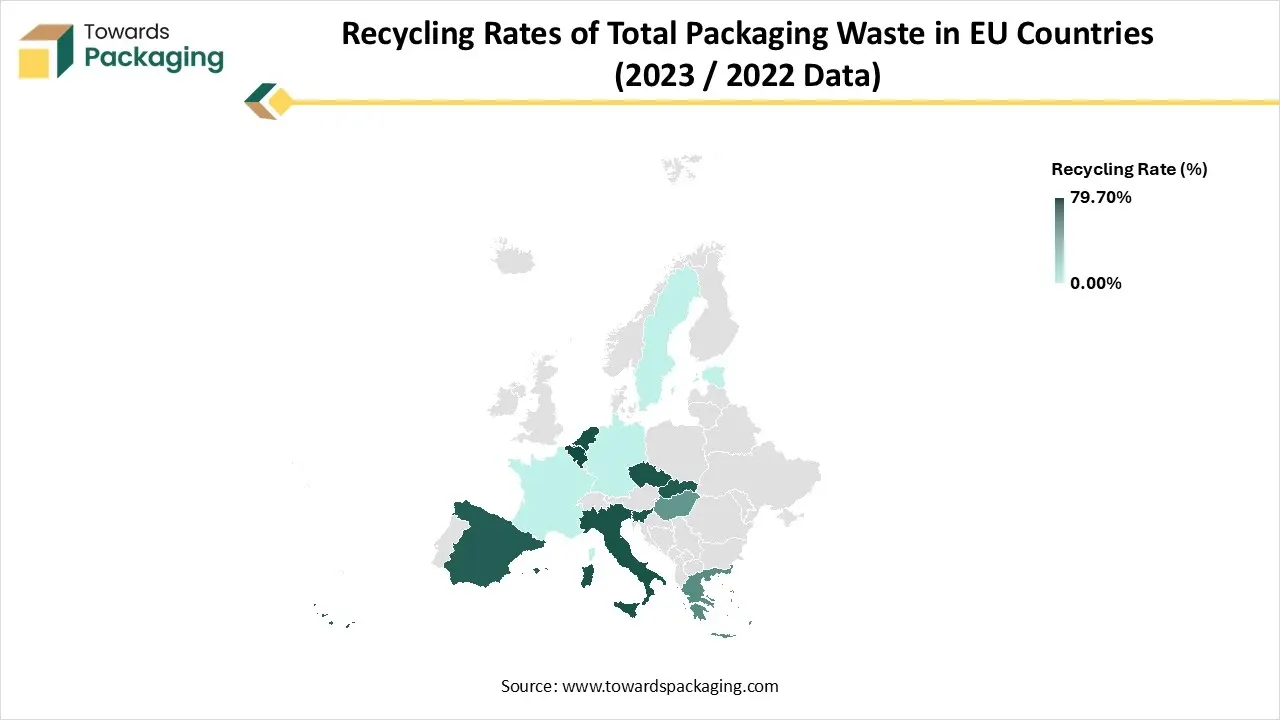

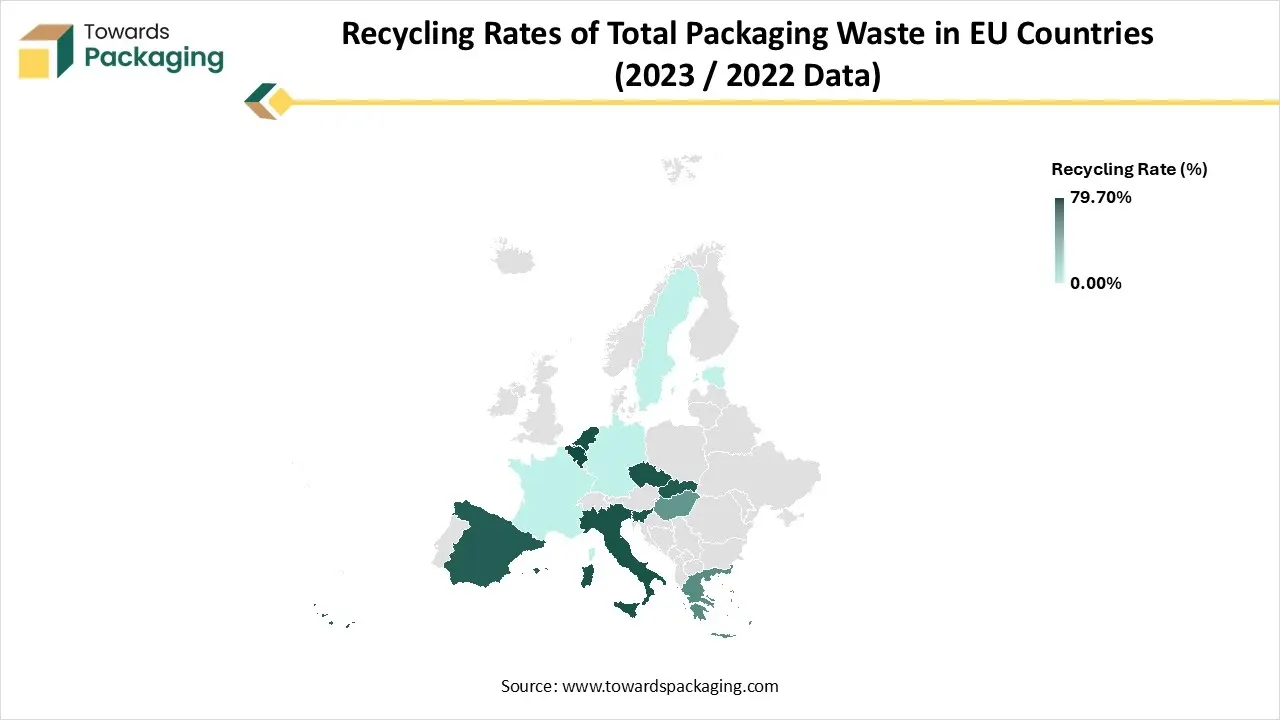

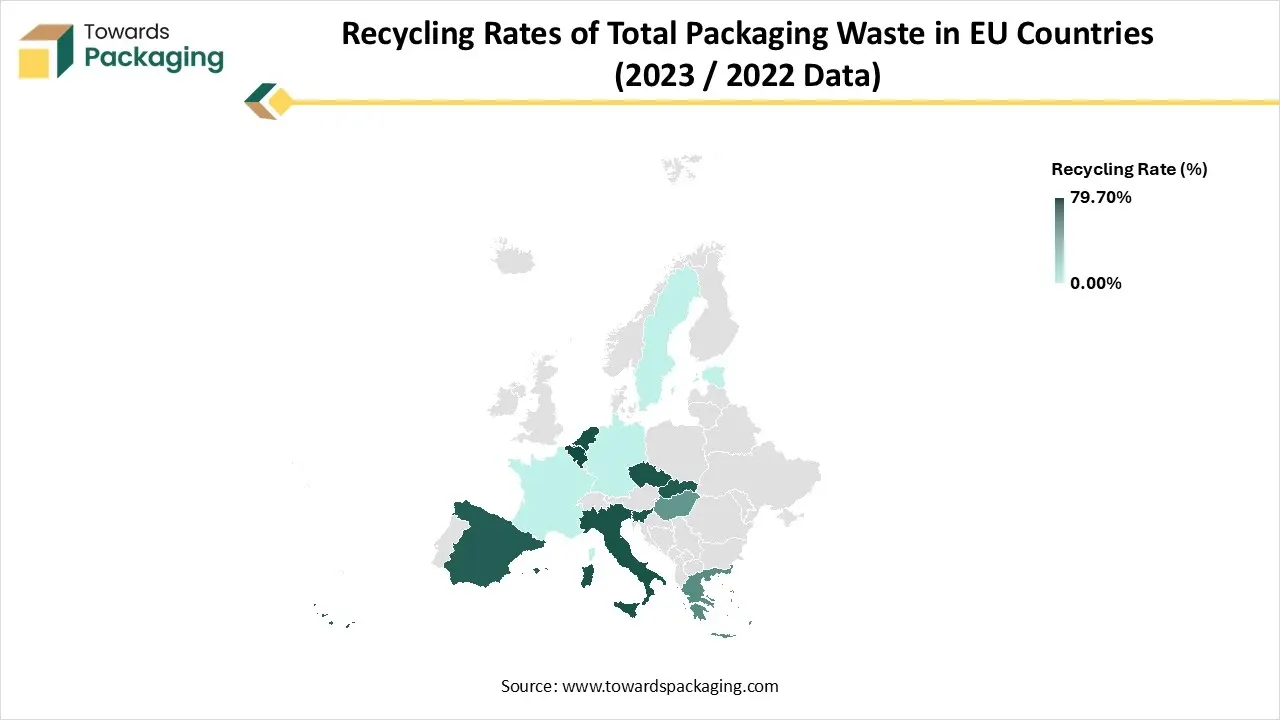

The EU aims to recycle 70% of all packaging waste by 2030, with even higher targets for specific materials like 85% for paper, 75% for glass, and 55% for plastics. In 2023, the EU was close to reaching this goal, achieving a recycling rate of 67.5%.

Seven EU countries have already surpassed the 70% target, including Belgium, Netherlands, Italy, Czechia, Slovenia, Slovakia, and Spain. Many others, such as Germany, France, Estonia, Sweden, and Cyprus, are very close, reporting recycling rates between 68.5% and 69.5%. However, some countries are struggling: Romania, Hungary, Malta, and Greece achieved recycling rates below 50%, far from the EU’s 2030 ambitions.

Market Dynamics

Driver

Demand for Safe Packaging Material

The necessity for recycled resources is growing in several industries, including food and beverage, and consumer goods. Due to the growing demand for food-safe packing resources, the usage of recyclable polymers is escalating in the food and beverage sector. These resources can proficiently replace outdated plastics as a barrier between food products and ecological components, growing market stake. Recycled polyethylene terephthalate is a component that is extensively utilized in the manufacture of bottles for water and beverage packing.

Aside from food and beverage packing, recycled polymers are used in the packing of goods like toys, sports equipment, and fashion accessories, which helps to increase the durability of the product. Because of their non-reactive property, these polymers have experienced increasing demand in the packing of goods such as shampoos, soaps, surfactants, and many other personal care goods. The growing usage of packaging resources in the manufacturing of customer products will influence the expansion of the market.

Restraint

Limited Availability of Materials

Despite the positive development route of the recycled polypropylene market, numerous challenges hinder its extensive acceptance. One of the key restraints is the inadequate availability of enhanced-quality recycled polypropylene. The recycling procedure for polypropylene components can be intricate, and sometimes the recycled resources do not fulfill the same value ideals as virgin polypropylene. Corruption of the waste stream, varied polymer mix can raise issues with the process of sorting and cleaning of the accumulated plastic waste, which can decrease the quality of the recycled polypropylene and make it inappropriate for several applications. This has resulted in unwillingness among some producers to utilize recycled polypropylene, as it may affect the presentation and sturdiness of their goods.

Opportunity

Rising Demand for Sustainable Packaging

The growing shift in the direction of sustainable practices offers several opportunities for the development of recycled polypropylene in the packaging market. One such opening deceit is in the rising trend of using recycled polypropylene in the automotive sector. Auto manufacturers are progressively utilizing recycled resources in vehicle machinery such as under-the-hood applications, bumpers, and interior panels. Additionally, the growth of event stream processing (ESP) in several sectors is correspondingly anticipated to positively influence the recycled polypropylene in the packaging industry. ESP permits corporations to analyse real-time information streams from recycling processes, providing insights into resource flows, waste management efficacy, and recycling charges. By applying ESP arrangements, companies can enhance their recycling procedures, progress quality control, and decrease material waste, making the recycling of polypropylene more effective. As industries progressively accept digital resolutions for sustainable performs, the incorporation of event stream handling can improve the overall worth chain of recycled resources.

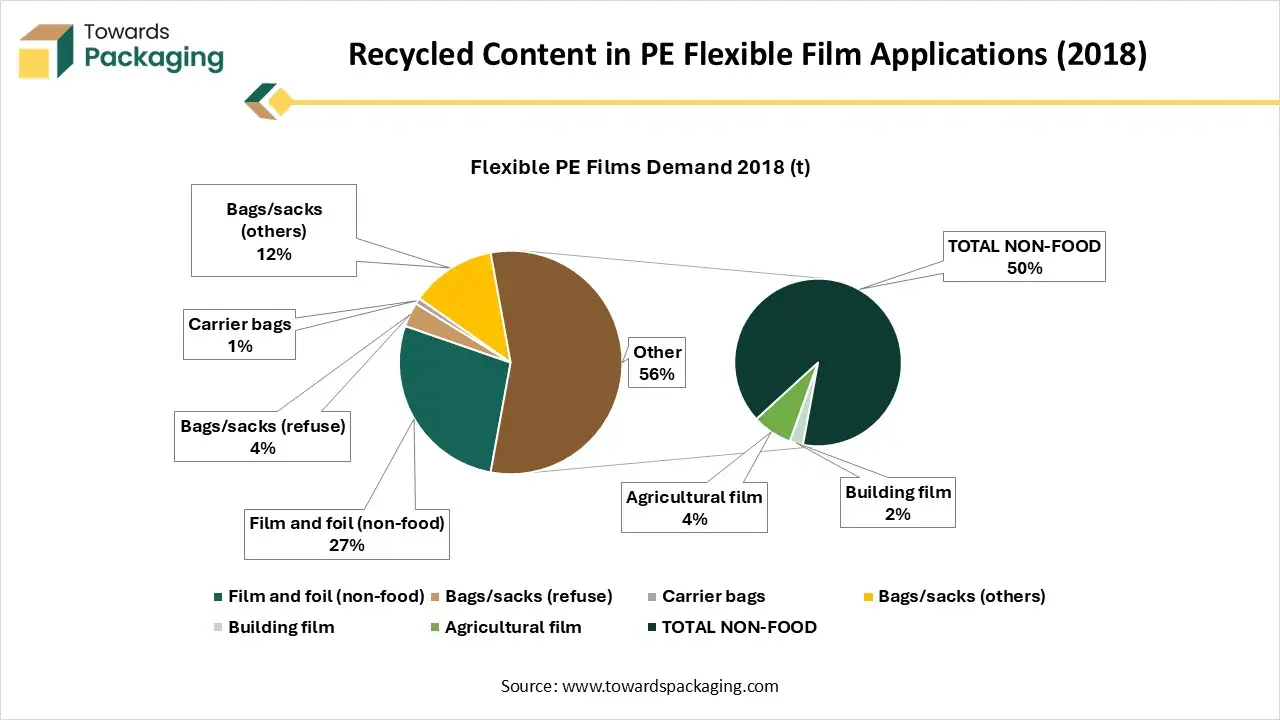

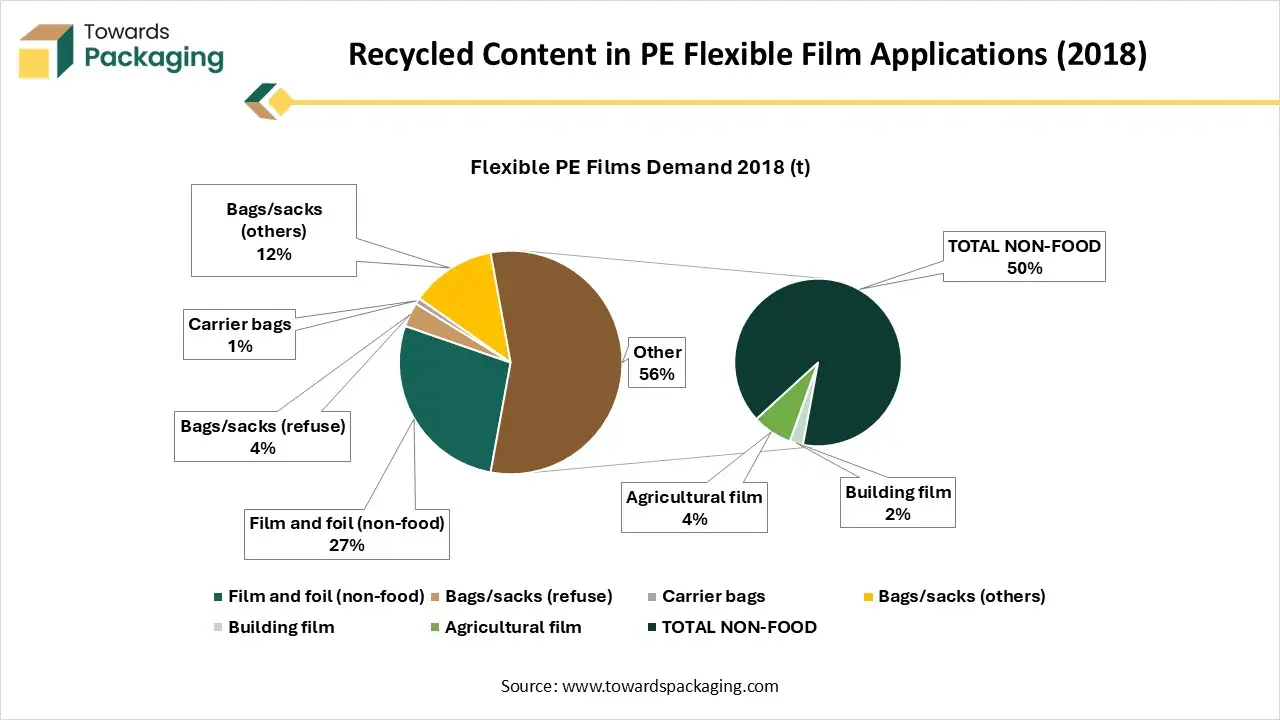

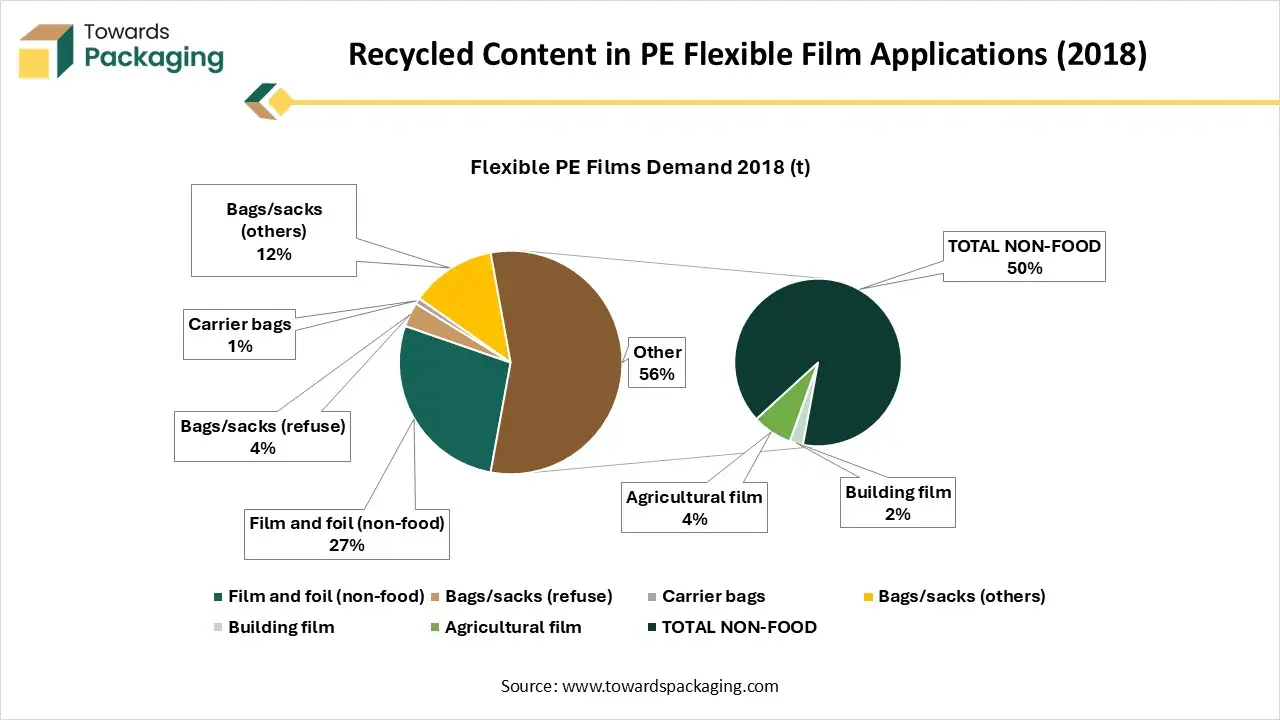

Recycled Content in PE Flexible Film Applications (2018)

In 2018, the European market produced 1.8 million tonnes of recycled PE films, which represented roughly 20% of total PE flexible film demand. Of this, an estimated 1.2–1.3 million tonnes were high enough quality to be reused in film applications again, about 20% of all non-food film demand.

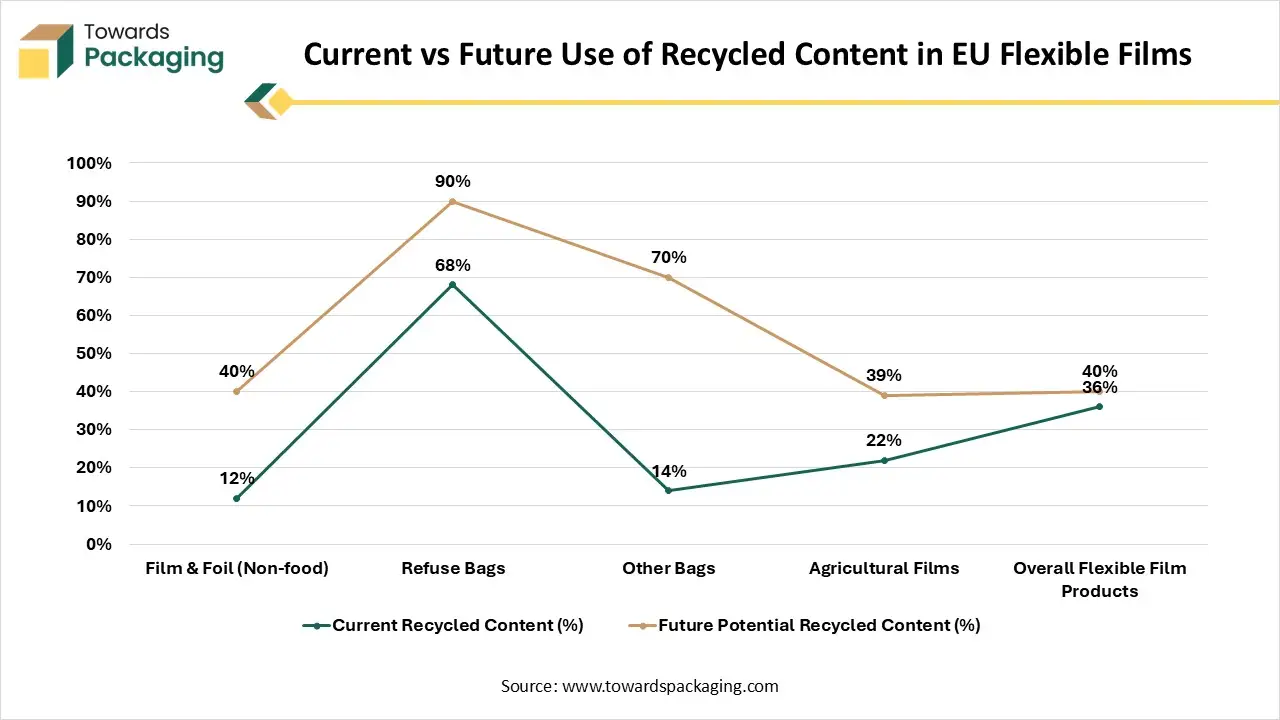

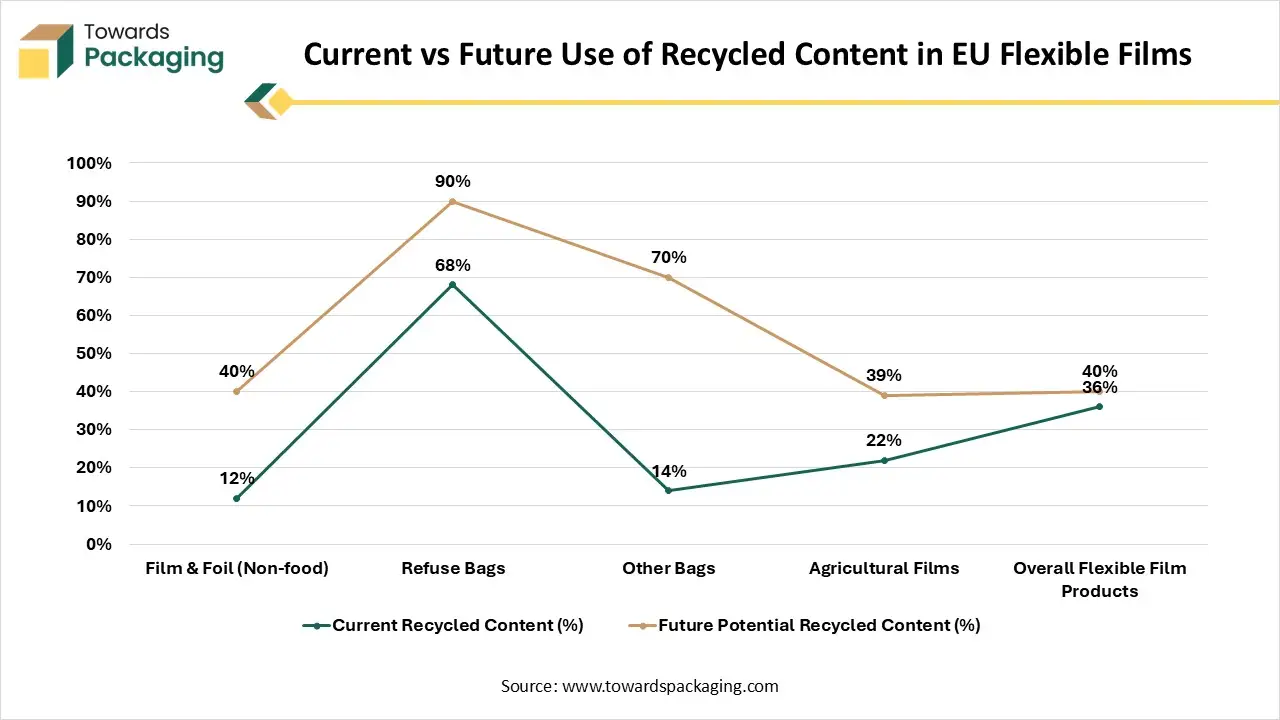

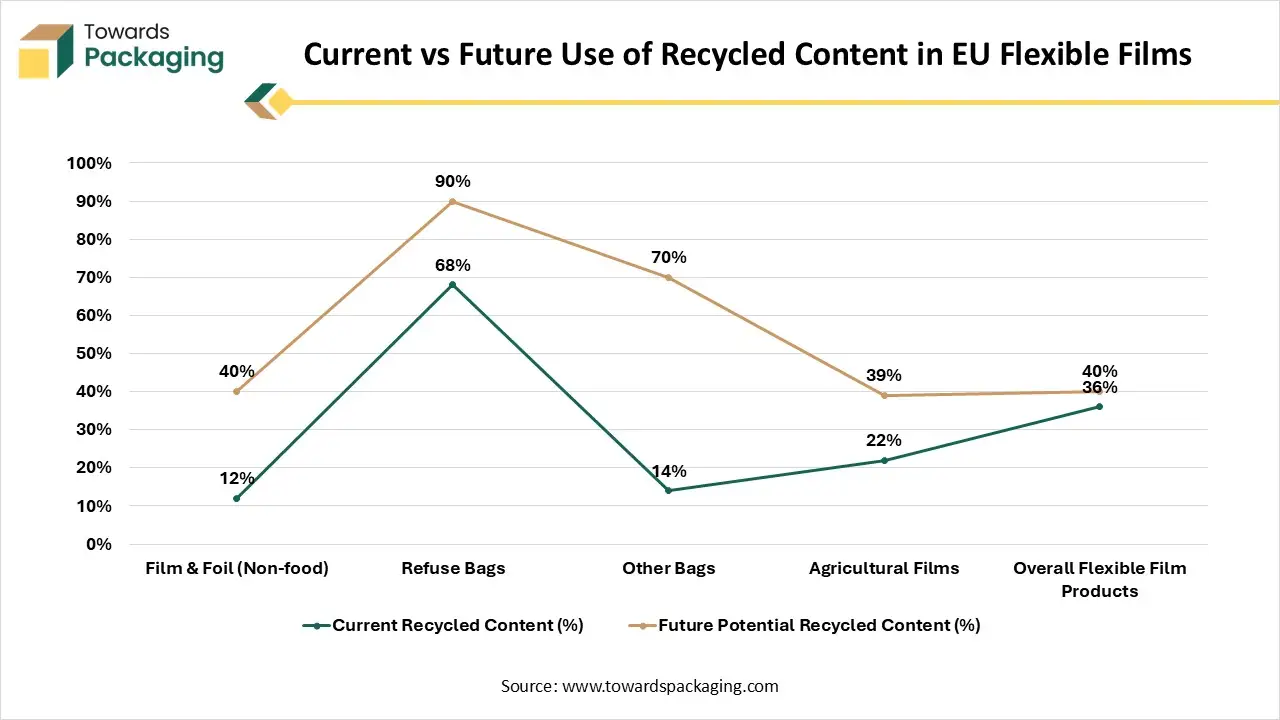

Current vs Future Use of Recycled Content in EU Flexible Films

Recycled PE from films cannot currently be used in food-contact packaging, but there is significant untapped potential in almost all other flexible film sectors.

Refuse bags already use large amounts of recycled material (68%) and could reach 90% in the future.

- Non-food film & foil uses just 12% recyclate today but could scale up to 40% as quality improves.

- Other bags have substantial headroom, rising from 14% today to 70% in the future.

- Agricultural films could increase from 22% to nearly 40%.

| Growth Scenario (PE Film Production) |

Estimated Demand for Recyclate (2030) |

| 1% Annual Growth |

3.6 million tonnes (Mt) |

| 4% Annual Growth |

5.0 million tonnes (Mt) |

| Additional recyclate usable in refuse bags |

Up to 200 kt |

Across all flexible films, recyclate uptake could be dramatically expanded if technical and quality barriers are addressed. By 2030, depending on the growth of PE flexible packaging production, Europe could require between 3.6 Mt and 5 Mt of PE recyclate for flexible film applications alone.

Segmental Insights

Why the Flexible Packaging Segment Dominated the Market in 2024?

The flexible packaging segment is expected to have a considerable share of the recycled polypropylene in the packaging market in 2024 due to the easy customization option, which helps to redesign the product in several ways. Materials such as wraps, films, and pouches, which are easily formed or bent, are utilized in flexible packaging using recycled polypropylene. Products, comprising dry goods, personal hygiene products, snacks, and frozen meals, are often made with it. Recycled polypropylene in packaging is a sustainable alternative for virgin polymers due to its excellent moisture resistance, barrier qualities, and durability.

On the other hand, the rigid packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This is due to the rising demand for the durability of the recycled packages. It includes trays, tubes, containers, caps, and bottles for the maintenance of a fixed shape. The demand for extended shelf life of the packaged products has enhanced the usage of rigid materials.

Why the Food and Beverage Segment Dominated the Market in 2024?

The food and beverage segment is expected to dominant the recycled polypropylene in packaging market in 2024 as it provides superior vapor and moisture barrier protection, and protects the quality of the food products. The strict regulation in the food packaging industry has raised the influence of recycled polypropylene in packaging. These recycled materials are safe for food products as well as the environment. On the other hand, the personal care and cosmetics segment is anticipated to grow at the fastest rate in the market during the forecast period of 2025 to 2034. In this segment, packaging for cosmetic caps, shampoo bottles, and cream jars is included. These packages require an aesthetic look to attract a huge number of people towards them.

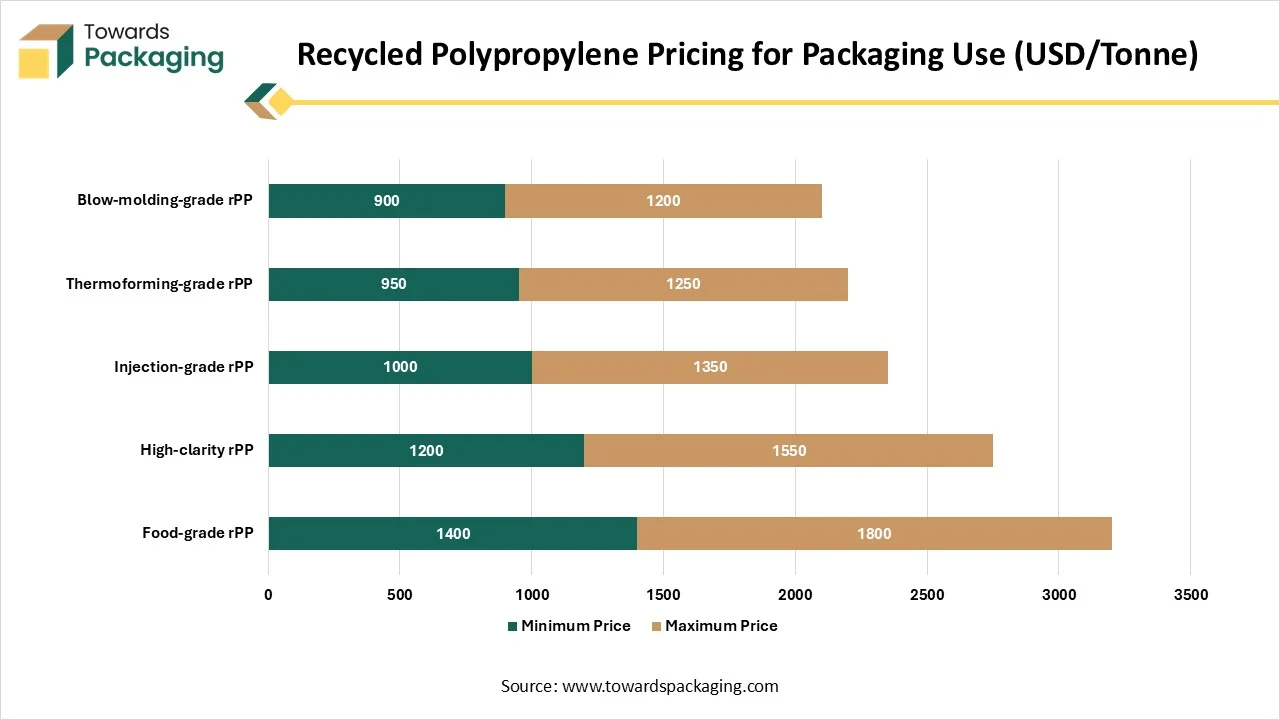

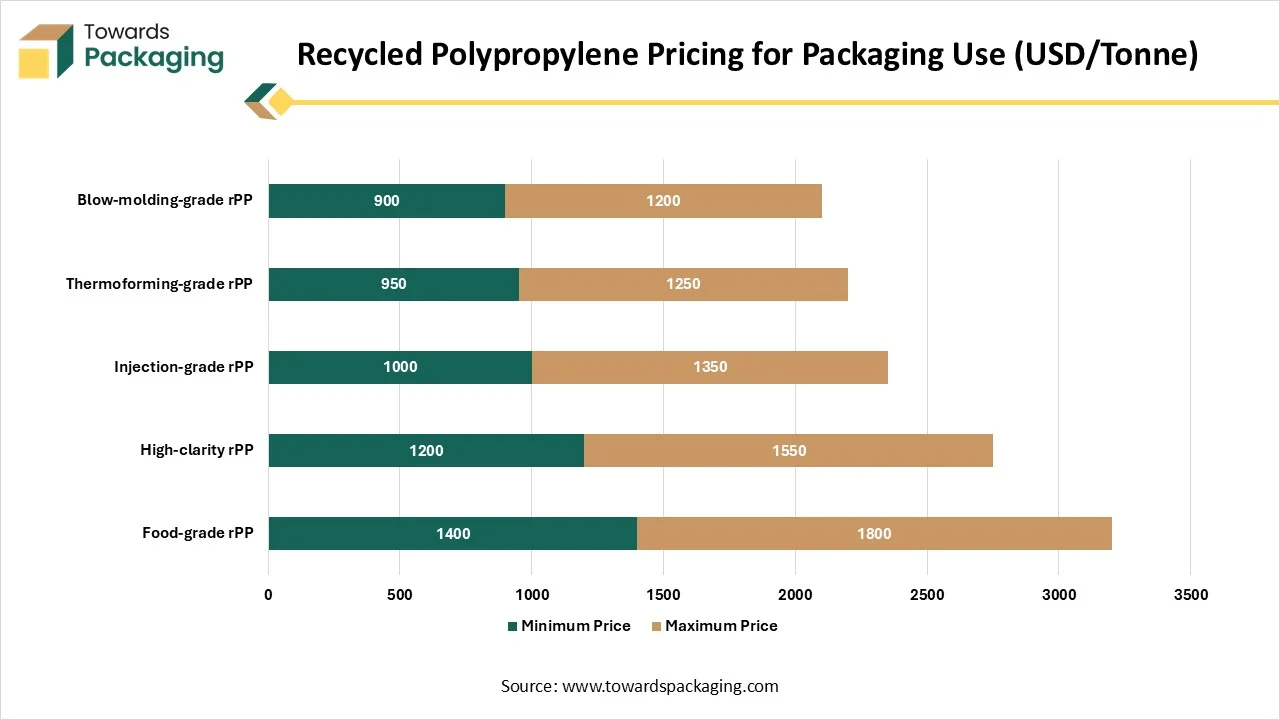

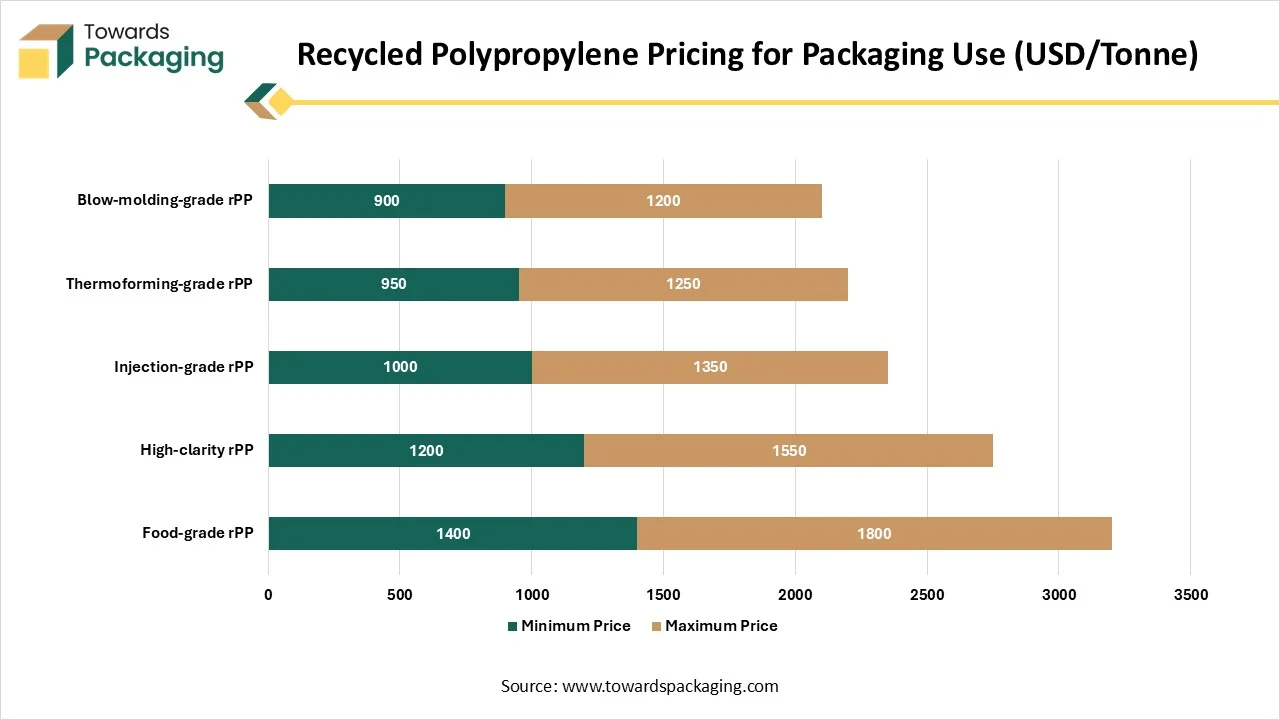

Recycled Polypropylene Pricing for Packaging Use (USD/Tonne)

| rPP Grade |

Minimum Price |

Maximum Price |

| Food-grade rPP |

1400 |

1800 |

| High-clarity rPP |

1200 |

1550 |

| Injection-grade rPP |

1000 |

1350 |

| Thermoforming-grade rPP |

950 |

1250 |

| Blow-molding-grade rPP |

900 |

1200 |

Regional Insights

Presence of Strong Supervisory Frameworks in North America Promotes Dominance

The North America region held the largest share of the recycled polypropylene in the packaging market in 2024, due to the presence of strong supervisory frameworks. Growing consumer consciousness for using eco-friendly packaging has raised the demand for innovation in this market to fulfill the increasing demand of the consumers. Major market players are continuously working for the expansion of this industry by introducing enhanced technology that supports better recycling of the products. Companies such as Berry Global Inc., Procter and Gamble, and Unilever enhanced the demand for recycled polypropylene in packaging in the packaging industry.

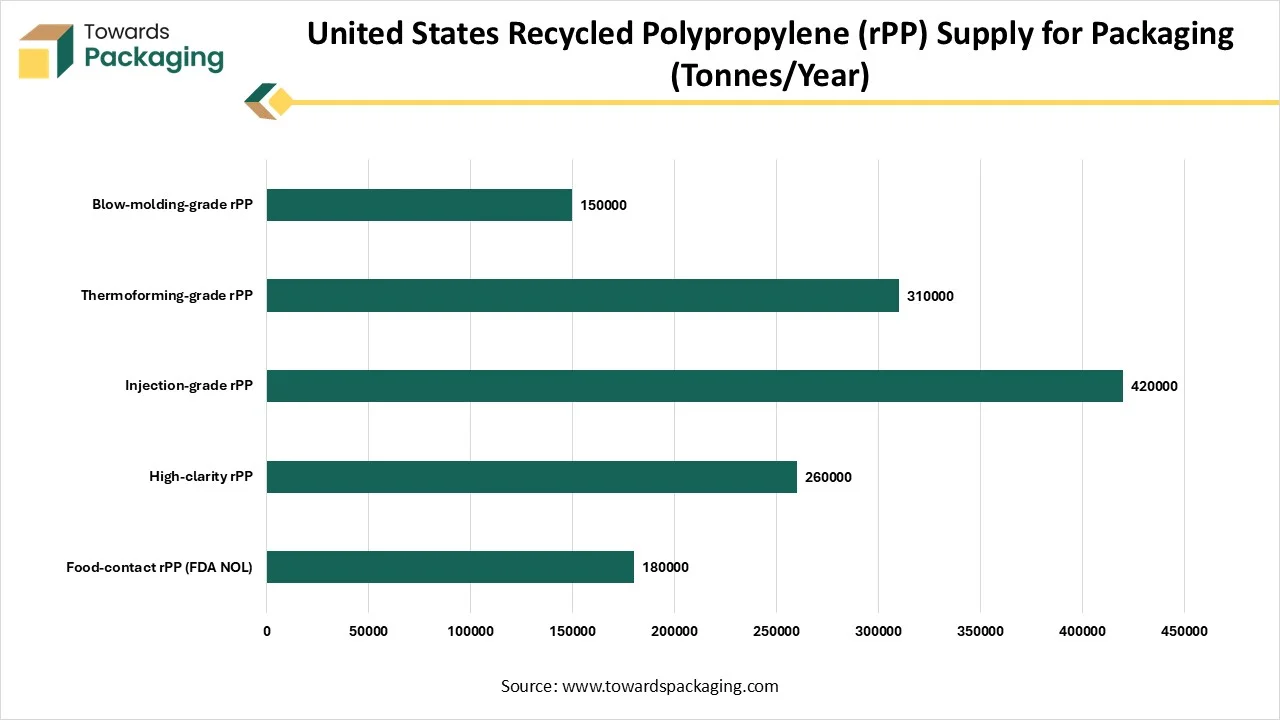

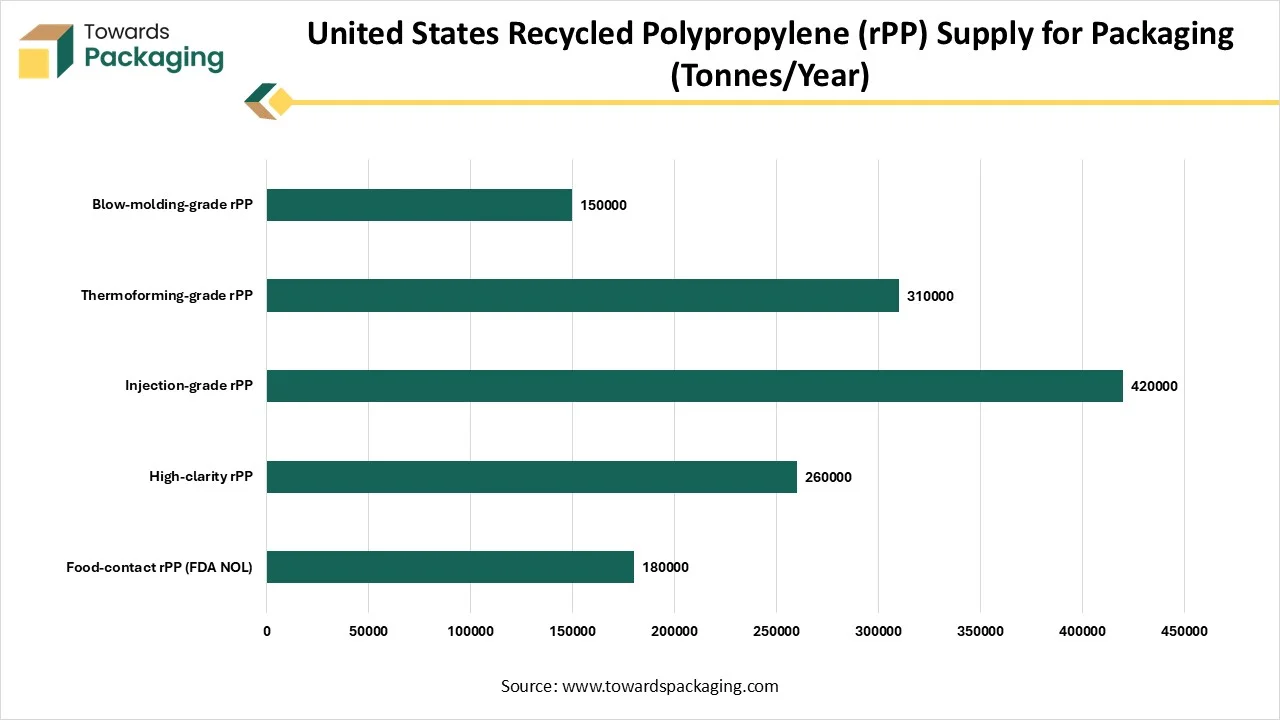

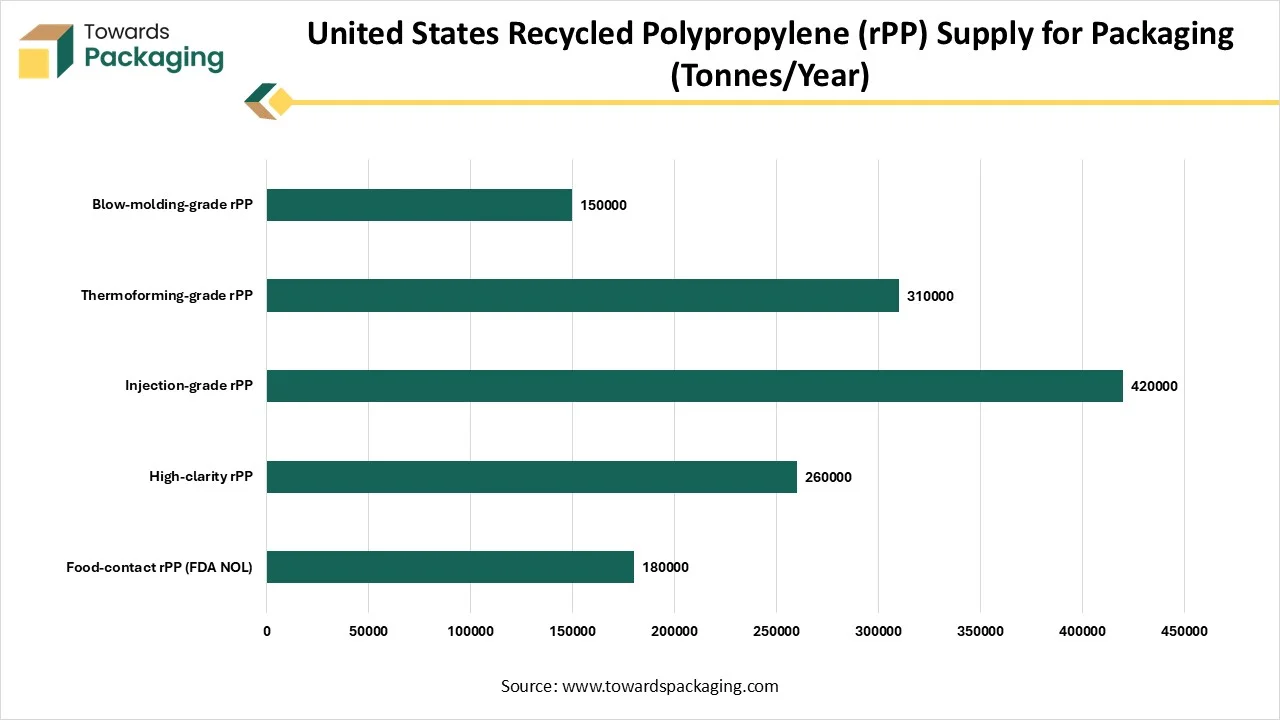

United States Recycled Polypropylene (rPP) Supply for Packaging (Tonnes/Year)

| rPP Grade (Packaging Use) |

Available Supply |

| Food-contact rPP (FDA NOL) |

180000 |

| High-clarity rPP |

260000 |

| Injection-grade rPP |

420000 |

| Thermoforming-grade rPP |

310000 |

| Blow-molding-grade rPP |

150000 |

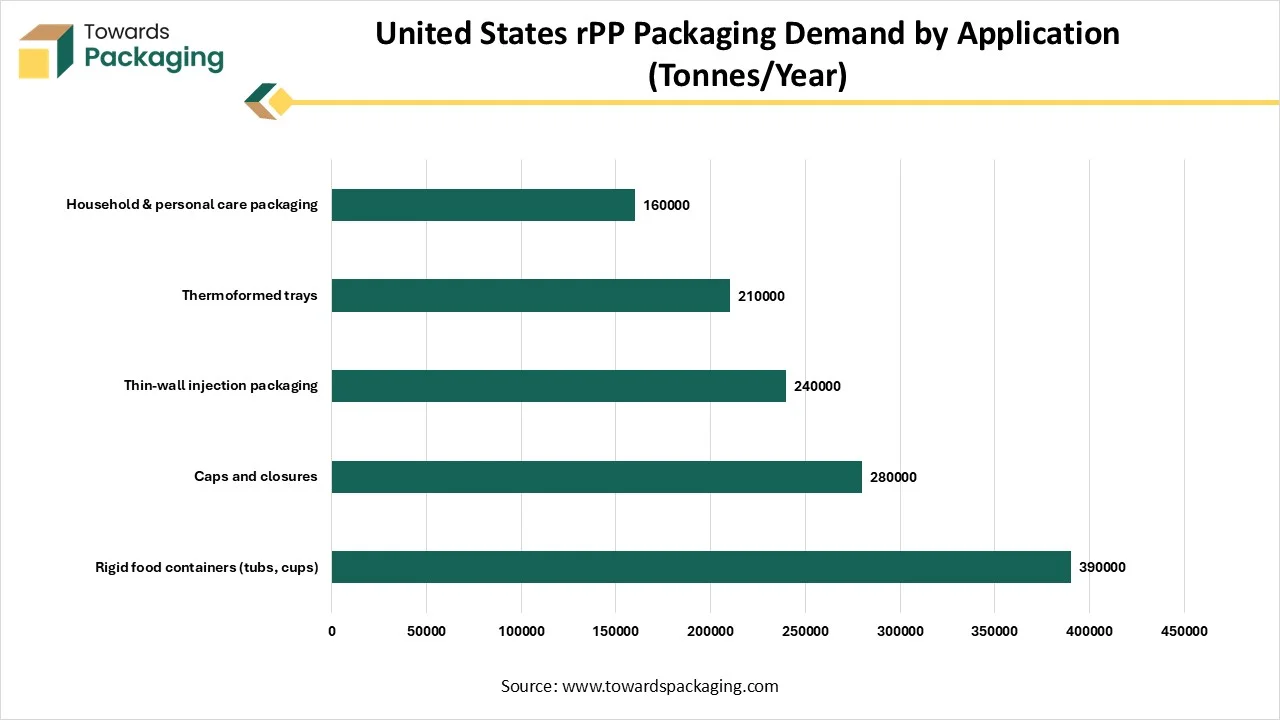

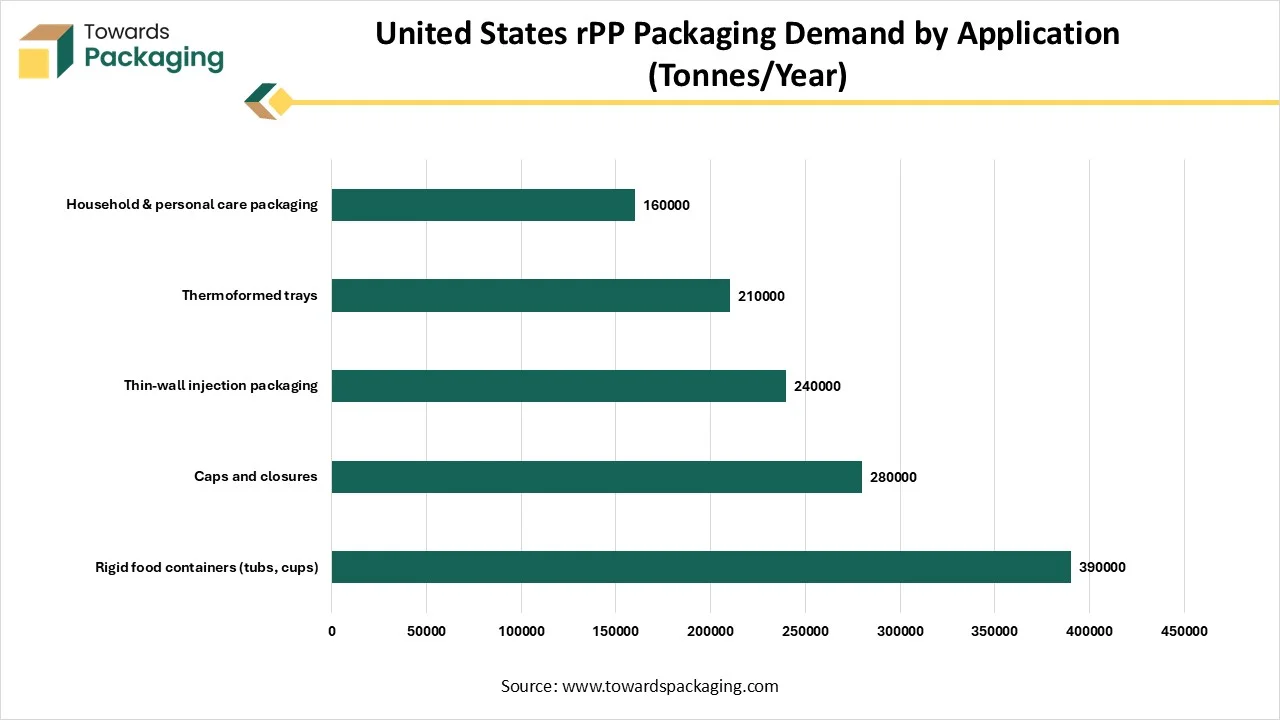

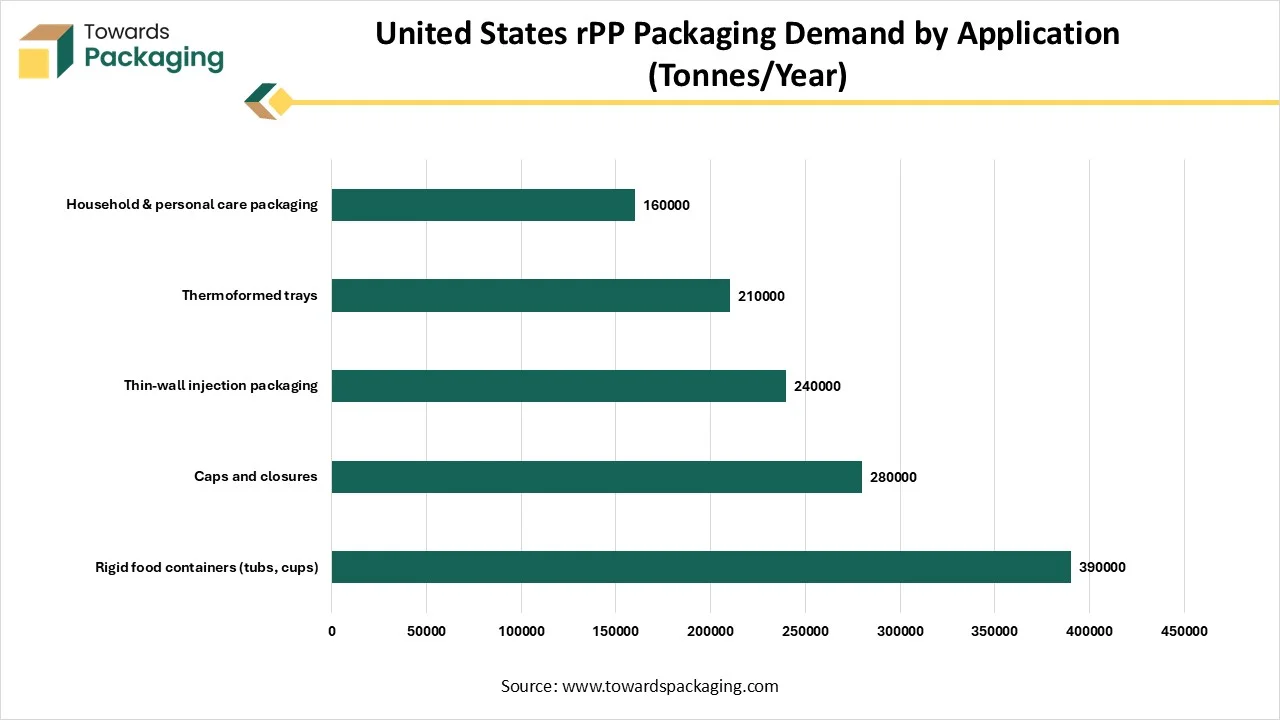

United States rPP Packaging Demand by Application (Tonnes/Year)

| Packaging Application |

Demand |

| Rigid food containers (tubs, cups) |

390000 |

| Caps and closures |

280000 |

| Thin-wall injection packaging |

240000 |

| Thermoformed trays |

210000 |

| Household & personal care packaging |

160000 |

Asia Pacific’s Expanding Packaging Sector Supports Growth

The Asia Pacific region is projected to develop at the fastest rate in the recycled polypropylene in packaging market during the forecast period. It is due to the continuous expansion of the packaging sector. The availability of several companies in countries like India, Japan, China, Thailand, South Korea, and several others has influenced the growth of this market in this region rapidly. The rising awareness towards sustainable packaging in the food and beverages industry has enhanced the expansion of this packaging market.

Top Companies in the Recycled Polypropylene in Packaging Market

rPP Quality Specifications Demanded by Packaging Manufacturers

| Parameter |

Required Value |

| Melt Flow Index (g/10 min) |

12 - 35 |

| Ash content (%) |

0.5 - 2.0 |

| Odor rating (scale 1–5) |

≤ 2 |

| Moisture content (%) |

≤ 0.2 |

| Bulk density (kg/m³) |

450 - 560 |

| Color deviation (ΔE) |

≤ 3.0 |

Latest Announcements by Industry Leaders

- In June 2025, Joint Secretary, Department of Chemicals and Petro-Chemicals, Government of India, Deepak Mishra, expressed, “As a regulatory authority, we recognise the significant progress the industry has made in enhancing recycling capacities, particularly for PET, to align with the objectives of the EPR framework. The recent policy facilitation, including exemptions in cases of technical non-feasibility, has been introduced to support a balanced and pragmatic transition.” (Source: Indian Chemical News)

New Advancements in the Market

- In June 2025, the 6th Plastic Packaging Research and Development Centre (PPRDC) Summit will release a study on safe food-grade packaging from recycled polypropylene. (Source: Indian Chemical News)

- In April 2025, UFlex announced plans to develop a new manufacturing facility in Mexico focused on producing woven polypropylene (WPP) bags for the pet food sector. (Source: Petfood Industry)

Recycled Polypropylene in Packaging Market Segments

Packaging Type

- Flexible Packaging

- Rigid Packaging

End Use

- Food and Beverage

- Personal Care and Cosmetics

- Pharmaceuticals

- Household Products

- Industrial Goods

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait