Sauces, Dressings and Condiments Packaging Market Size, Trends, Share and Innovations

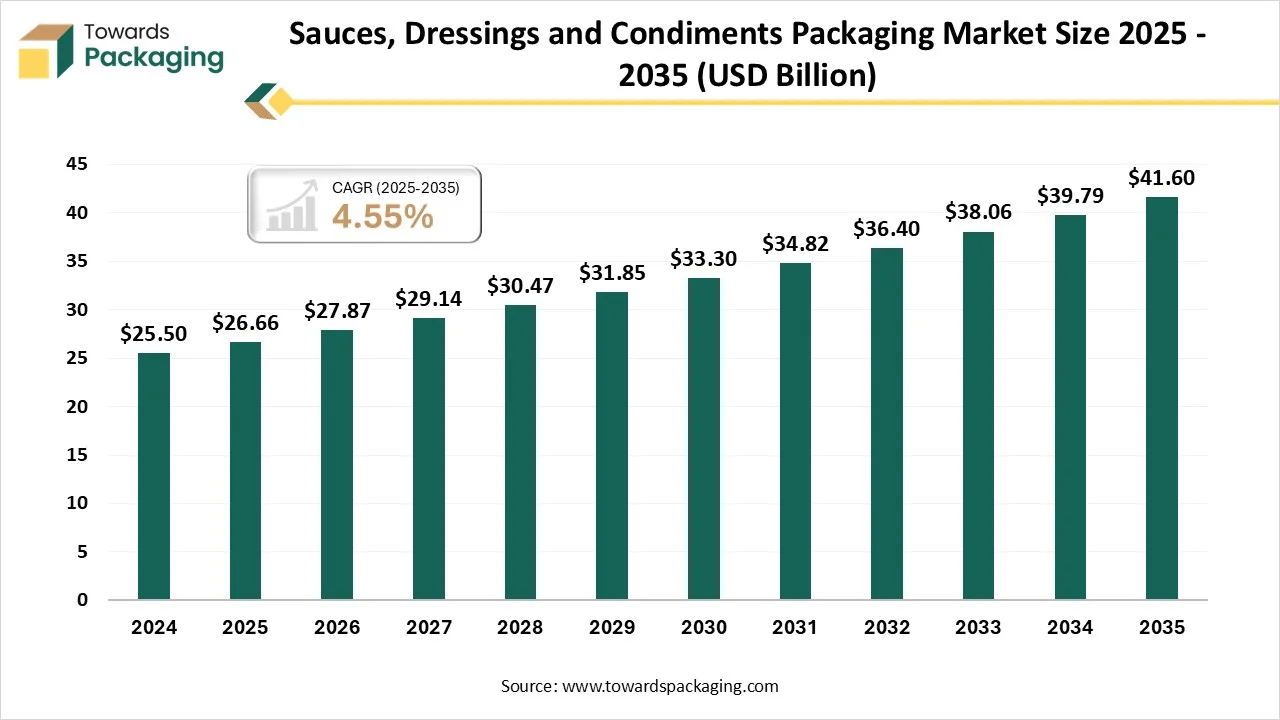

The sauces, dressings and condiments packaging market is expected to grow from USD 27.87 billion in 2026 to USD 41.60 billion by 2035, with a CAGR of 4.55%. The market is divided into several segments, including cooking sauces, salad dressings, salsas, condiments, and marinades. In terms of packaging material, glass and plastic are the major contributors, with glass dominating in 2024. By region, North America led the market in 2024, while Asia Pacific is forecasted to experience rapid growth. Leading manufacturers like Amcor, Sealed Air, and Berry Global are driving innovations in the sector, especially with an increasing focus on sustainability and health-conscious products.

Key Highlights

- In terms of revenue, the market is valued at USD 25.5 Billion in 2024.

- The market is predicted to reach USD 39.79 Billion by the year 2034.

- Rapid growth at a CAGR of 4.55% will be officially experienced between 2025 and 2034.

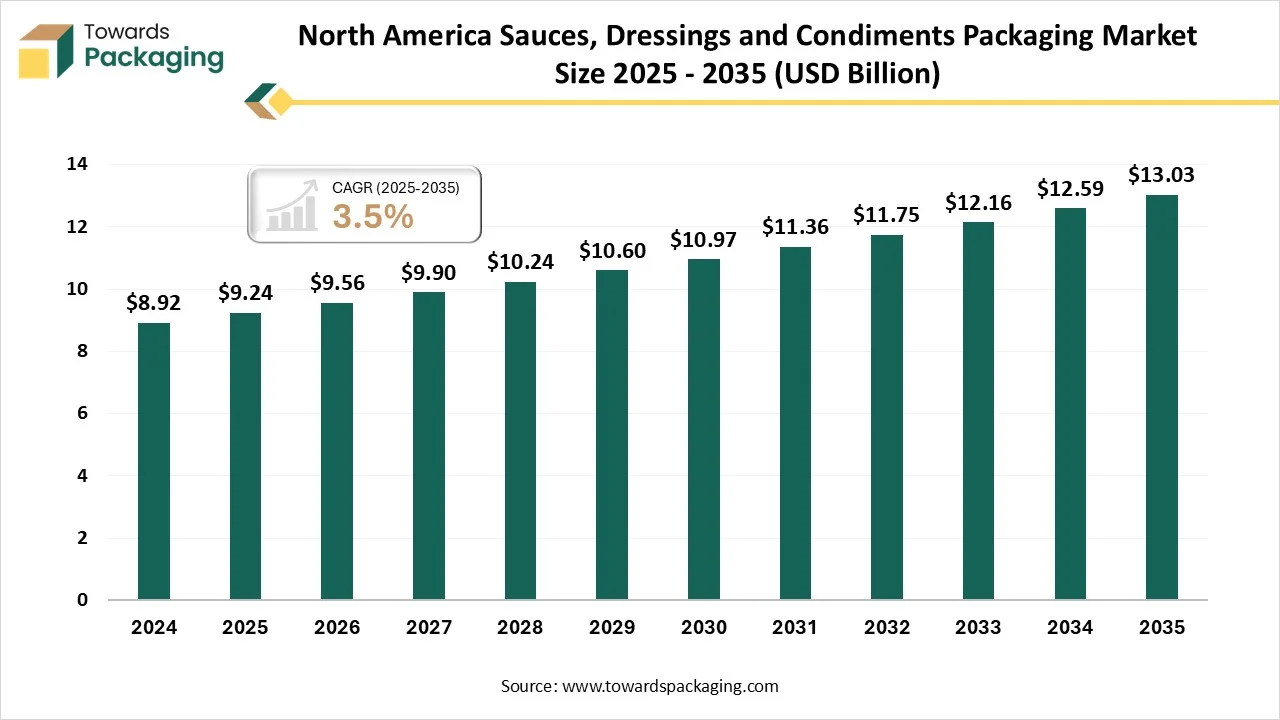

- By region, North America has dominated the market with the biggest share in 2024.

- By region, Asia Pacific is expected to rise at a notable CAGR between 2025 and 2034.

- By product type, cooking sauces segment dominated the market with the largest share in 2024.

- By product type, condiments segment are predicted to grow at a notable CAGR between 2025 and 2034.

- By packaging material, glass segment dominated the market that have the largest share in 2024.

- By packaging material, plastic segment is expected to grow at a notable CAGR between 2025 and 2034.

- By packaging type, bottles segment dominated the market and have the largest share in 2024.

- By packaging type, dispensing containers segment are expected to rise at a notable CAGR between 2025 and 2034.

- By distribution channel, supermarkets and hypermarkets segment dominated the market with the biggest share in 2024.

- By distribution channel, online retail segment is predicted to grow at a notable CAGR between 2025 and 2034.

What Do You Mean By The Sauces, Dressings and Condiments Packaging Market?

In the culinary world, sauces, condiments, and dressings are important for developing flavors and adding variety to dishes. They provide as finishing touches, flavor enhancers, or even initial ingredients in several recipes. From mayonnaise and ketchup to soy sauce and vinaigrettes, these products are important to both professional kitchens and home cooking. Their reliability makes them famous across various cuisines and dining establishments, too.

As users choose include and new ingredients that develop, the sector surrounds dressings, sauces, and condiments, which continue to expand and develop.

Sauces, Dressings and Condiments Packaging Market Outlook

- Industry Growth overview: There is a move towards packaged and ready-to-use food, which is fulfilled by busy and urban lifestyles, with ready-to-use sauces that serve as a fast meal option. Users are heavily finding healthier alternatives, including low-fat, organic, plant-based options. This drives the urge for" label” items with fewer additives.

- Sustainability Trends: Sustainability has shifted from being a buzzword to a main element of brand identity. Packaging inventions, such as biodegradable sachets and recyclable bottles, have become a common point. Furthermore, several companies have invested in sustainable sourcing of ingredients, which ensures supply chains are both environmentally and ethically friendly.

- Global Expansion: Global expansion for the sauces, dressings, and condiments is being driven by the growing consumer demand for different and exotic flavors, and a developing trend towards healthy, convenient, and clean-label products. Also, apart from this, the developing popularity of ethnic cuisines is also a factor.

- Major Investors: Main investors in dressings, sauces, and condiments include big global food and beverage corporations, venture capital funds, and private equity firms.The investment activity changes by the stage and size of the focused company, from multinational collaborations and partnerships in order to seed investment for cutting-edge food startups.

Key Technological Shifts in the Sauces, Dressings and Condiments Packaging Market

- AI-powered urge foretelling can assist food and beverage organisations that forecast user demand with groundbreaking precision. Regular methods often depend on historical data, but artificial intelligence can manage market trends, consumer behaviours, and seasonal fluctuations, and even actual events like economic transformation and weather changes. Infor’s AI-driven forecasting tools enable organizations to adjust manufacturing schedules periodically, which prevents shortages and overproduction. This results in smoother operations, higher profitability, and reduced waste.

- Quality is non-negotiable in the food and beverage sector. AI is updating how organizations track and maintain product quality. It consists of tools like A in order to track data from manufacturing lines in real-time, which classifies potential problems like product defects and pollutants before they move and shift.

- Furthermore, technological advancements in the sauces, condiments, and dressings sectors are driven by user demand for more authentic, healthier, and sustainable products. Inventions concentrate on developing production smoothness, which develops food safety, making new and exotic flavors.

Trade Analysis of Packaging for Sauces, Dressings and Condiments Packaging Market: Import and Export

According to global data, the globe has exported 19,720 shipments of the Sauce packaging from the period June 2024 to May 2025. These exports were created by 2,059 exporters to 2,363 buyers, marking an industry rate of 29% as compared to the previous twelve months.

During this time, in May 2025 alone, 991 Sauce Packaging has exported shipments that were made globally. This marks a year-on-year development of 0% as compared to May 2024, and a 0% series growth from April 2025.

Several of the Sauce packaging that have been exported from the globe have been classified in the top three exporters, like Russia, China, and the United States. Russia has topped the globe in the Sauce Packaging that exports with 11,707 shipments, followed by China with 5,898 shipments, and the United States, which takes the third position with 5,860 shipments.

Value Chain Analysis of the Sauces, Dressings and Condiments Packaging Market

- Material Processing and Conversion: The packaging and processing of dressings, sauces, and condiments include particular material choices and transformation procedures in order to ensure product quality, safety, and shelf life. Packaging should protect the product from moisture, oxygen, and pollutants, while also opposing the pasteurisation and sterilisation procedures.

- Package Design and Prototyping: Package design and prototyping for dressings, sauces, and condiments need to balance functional demands and aesthetics like freshness, product protection, and dispensing, too. This counts as making a physical sample of the packaging for evaluation and testing before mass manufacturing.

- Logistics and Distribution: Logistics, packaging, and distribution of dressings, sauces, and condiments need careful counting of material characteristics, transportation conditions, and product safety. A series of challenges, right from preventing sensitive glass to track temperature, fragile items, should be solved in order to ensure product quality and a positive user experience.

Sauce Container Sealing Machine

| Sealing Technology |

Suitable Packaging Material |

Sealing Features |

Suitable packaging Type |

| Heat Sealers |

Flexible films and pouches |

Airtight seal, different technologies |

Pouches, sachets |

| Seaming Machines |

Metal cans |

Airtight double seam, robust closure |

Metal Cans |

| Capping Machines |

Bottles, Jars |

Secure closure, different cap types |

Bottles, jars |

| Vacuum Sealers |

Various Containers |

Removes air before sealing, develops protection |

Various |

Emerging Trends in the Sauces, Dressings and Condiments Packaging Market

- Need for health-conscious products: Currency users are becoming increasingly health-conscious and are seeking sauces with natural ingredients, lower sodium content, and lower sugar, also with clean labels. Non-GMO, organic, and gluten-free sauces are popular, and producers are rebranding their items in order to meet these tastes.

- Personalization and customization: Tailored food experiences are becoming popular, and hence, there is more demand for custom sauces. Organizations are now releasing small-batch production, DIY sauce kits, and mix-and-match flavor integrations in order to give consumers more autonomy over what they consume.

- Emergence of global and ethnic flavors: With users entering into international foods, worldwide sauces have seen a sharp development in demand. Latin American, asian, and Middle Eastern sauces like chimichurri, sriracha, and harissa are gaining attention from status, and these are the top brands in order to reveal more servings to align with various tastes.

- Technological Integration: Digital technology has played a crucial role in updating the sector in 2024. From AI-driven flavor optimization to blockchain for ingredient traceability, the involvement of technology has developed transparency and product innovation. Smart packaging that serves QR codes for in-depth product information has also become a main tool for developing tech-savvy users.

- E-commerce Expansion: The move towards online shopping, developed by the pandemic, will continue to develop in the current year. Direct-to-consumer channels and collaborations with main e-commerce platforms will become important for reaching users. Augmented reality and virtual tastings enable users to try products even before they make a purchase decision.

- Globalization and Localization: The globalization of flavors has begun to encourage product growth. Harissa, sriracha, and gochujang, for instance, have become staples in Western kitchens. At the current time, organizations are concentrating on localization strategies, personalising their services in order to align with the particular tastes of regional markets.

Product type Insights

How Did The Cooking Sauces Segment Dominate The Sauces, Dressings and Condiments Packaging Market?

The cooking sauces segment has dominated the market in 2024 as cooking sauces like stir-fry blends and marinara are often sealed in pouches for convenience. With these machines, home chefs can conveniently pour just the correct amount into their dishes, which lowers waste. So, sauce packaging is more than a container for a condiment than anyone might think. In the worldwide industry, it is necessary for food product packaging, from the little sachets to the standard bottles.

A packaging is a representative of a brand, the initial contact the user has with the bought products, and a determinant of taste too.

The condiments segment is predicted to be the fastest-growing in the market during the forecast period. Condiment packaging is one element of the food sector which do not get the kind of attention it needs. From soy sauce to mustard and chilli sauce, the flavors that every condiment brings to the table add spice to every life. Condiments are a mixture of marketing, engineering, and artistry, which is all covered in one. The perfect option for sustainable condiment packaging is the use of compostable and biodegradable materials.

These metals assist in lowering the build-up of plastic waste because they break down naturally over time. These materials, hence, might not always be smooth and economical, which depends on the shelf life and the condiment, too.

Packaging Material Insights

How Did The Glass Segment Dominate The Sauces, Dressings and Condiments Packaging Market?

The glass segment has dominated the sauces, dressings and condiments packaging market in 2024 as they are chosen as they do not meet the sauces and hence store the smell and taste of the sauces. They are being supplied in luxury sauce products, other products, and hot sauces in which the usage of natural materials is important.

Glass serves as perfect protection against moisture and oxygen, which assists in developing the shelf life of the product. Although in comparison to plastic material, glass is heavier and more sensitive, which means that it is costly to break easily and transport.

The plastic segment is observed to grow at a notable rate during the forecast period. The recyclable options, such as HDPE and PET, are gaining a huge deal of popularity. Making sure that constituents can be smoothly classified and grouped for recycling is an important consideration in rafting recycling packaging. Hence, they are also utilising plastic, which contains post-consumer recycled content (PCR) to lower the dependency on virgin resources.

Even plastic bottles are currently famous as they are durable, lightweight, and economical for use with a huge series of liquid and semi-viscous products, such as mustard, ketchup, hot sauces, and salad dressing, too.

Packaging Type Insights

How has the Bottles Segment Dominated the Sauces, Dressings and Condiments Packaging Market?

The bottles segment has dominated the market in 2024 as the sauce bottle or posturing bottle is a flexible food-grade plastic bottle that is utilised as a kitchen utensil and accessory, which is used for seasoning, cooking, or decorating plates before delivering, with “homemade” sauces, ketchup, mustard, or oil. The various kinds of colours are available that enable us to identify the ingredients in it.

They can also be served at the table, particularly in fast food restaurants. Even the bartenders use squeeze bottles to make cocktails. Close to barbecue, it can be used to scold grilled meats while they are cooking. While making pastry, it can be used to make an accurate decoration.

The dispensing containers segment is predicted to be the fastest in the market during the forecast period. These kinds of dispensers are crafted to carry a variety of sauces, condiments, and toppings that serve efficiency and convenience in food preparation and service. From mustard to ketchup to salad dressings and salsa, condiment containers play an important role in developing the dining experience for the customers.

There is a huge variety of condiment containers that are available, as each one is made with various materials and serves different advantages in terms of appearance, reliability, and convenience of handling.

Distribution Channel Insights

How Has The Supermarkets And Hypermarkets Segment Dominated The Sauces, Dressings and Condiments Packaging Market?

The supermarkets and hypermarkets segment has dominated the market in 2024 as supermarkets utilise strategic placement, targeted marketing, and various kinds of packaging to sell sauces and condiments. Their methods are crafted to attract a huge series of customers, from those finding ease to those searching for healthy and different options. Supermarkets even develop impulse buys by placing sauces in several locations throughout the store. For instance, pasta sauces may be showcased near seafood, fresh meat, and cheese, while hot sauces should be marketed with tortilla chips. Also, the main stock of sauces is being searched in the packaged foods or "center store" aisles, which are frequently placed near complementary products like rice, dry pasta, and other meal ingredients too.

The online retail segment is predicted to be the fastest in the market during the forecast period. Online shopping patterns often count sophisticated product descriptions and user feedback, which help you with a precise idea of what to expect. This transparency is important in making sure that we receive products that align with our requirements and decorate any culinary creations. One of the huge advantages of seeking sauce online is the ease it serves. Now it's a trend that one can select the correct choice of sauce that is being delivered at the doorstep.

Online purchasing allows us to track costs, read critiques, and make knowledgeable decisions from the comfort of our homes. Whether we are busy exporting or seeking a home-made dinner, the convenience of shopping online is unmatched.

Regional Insights

How Has The North America Region Dominated The Sauces, Dressings and Condiments Packaging Market?

North America dominated the market in 2024 as the demand for health-conscious eating habits is driving the North America sauces industry, with a notable development in the urge for low-sodium, sugar-free, and organic sauces. As users become more aware of the effect of food on their health, they are using sauces that match their dietary demands. This move is specifically proven among younger generations who are seeking healthier and more transparent food options. Producers are giving feedback by growing sauces with cleaner ingredients, lower sugar content, and fewer preservatives, thus confirming that a healthier alteration in their product servings.

Top Canada insights for the Sauces, Dressings and Condiments Packaging Market

Canada holds six basic kinds of chilli sauce, ketchup, soy sauce, barbecue, and mustard sauce. Each one is utilised in its path to flavor the various kinds of foods. It is usually among the fries and burgers, and ketchup is also used with poutine, which is a Canadian type of food created from cheese curds, fries, and gravy. Yet another perfect partner with barbecue sauce is grilled food, such as barbecue chicken or ribs, a necessary barbecue fare. The soy sauce is still not Canadian, but it usually gives a savoury flavour to the stir-fries and dishes.

Asia Pacific is predicted to be the fastest-growing market during the forecast period. This region is witnessing the main development, which is being driven by the changing user choices and the developing demand for convenience in food making. With developing urbanization, there is a growing tendency towards ready-to-use sauces and condiments, which leads to a move from traditional procedures of preparation to packaged options. Furthermore, the growth of fast food and fast-service restaurants in the region is also contributing to market development. The market is expected to rise substantially, which is being filled by inventions in flavor packaging and profiles. That attracts a huge consumer base.

As demand develops, organizations are concentrating on different product profiles that align with health-conscious users and those who find exotic flavors too.

Top India insights for Sauces, Dressings and Condiments Packaging Market

India is well-known across the globe for its spices. From kitchens in little villages to seven-star restaurants, spices are at the core of Indian cooking. It has the correct soil and climate to develop chillies. States like Telangana, Andhra Pradesh, Maharashtra, and Madhya Pradesh are top in terms of chilli farming. Indian chillies are being sold as dried spices or raw ones. So, only a small space is transferred into sauces or value-added products, too.

The globe is shifting towards new flavors, and spicy food is on top more than ever before. The worldwide spicy sauce industry is developing due to people's love of rich tastes, fast food, and international dishes, too. So, due to this, there is a rising demand for healthy, natural, and organic hot sauces.

Country-Level Investments & Funding Trends for Sauces, Dressings and Condiments Packaging Market

- In November 2024, Graham partners revealed a partnership with Tulkoff Food Products, which is a Baltimore-based maker of tailored sauces, dressings, and dips that might primarily seem like an agreement anomaly for the company that was given by its concentration on organization in the tech-driven high-level production sector.

- In May 2025, the Nutri-Grade labelling scheme will transform its food palates for them in order to choose less saturated fats and sodium when producers reformulate their products in order to have less of these nutrients.

- In March 2025, Epik Foods, which is a unique UAE-born F&B Group, revealed the merger of Sauce Capital, a top Abu Dhabi food group with a rigid presence in Saudi Arabia. This achievement acquisition serves 15 of the latest brands under the Epik Foods umbrella, which rejoins the group’s loyalty in order to expand its regional footprint and reveal various dining experiences.

Recent Developments

- In October 2024, VRB Consumer Products revealed WokTok, which is powered by Veeba. The product series includes Chinese and Pan Asian Sauces, five instant cup noodles, and dressings that are crafted for the Indian market.

- In February 2025, in the current scenario, HEINZ Brand, the initial one worldwide player in sauces, has penetrated its Flavor Tour Line of condiments, which includes three sauces that are inspired by flavors from around the globe.

- In June 2025, Trillium Foods, a luxury liquid food and beverage company that concentrates on production and invention, announced its official launch. The family-owned, privately held company is a scale North American stage with different product potential across sauces, dressings, syrups, beverage mixes, and mayonnaise for processing channels.

- In July 2025, in collaboration with Buffalo Wild Wings, The Marzetti Company has stretched its retail profile with the revelation of four new hot sauces, that is made with the bold, inventive flavors that users predict from the Buffalo Wild Wings brand.

- In March 2024, Chick-fil-A is serving more inventive, bold flavors to home kitchens globally with the revelation of an all-new 12-ounce bottled Parmesan Caesar Dressing, which is available in retail stores and select grocery stores.

Top Vendors In The Sauces, Dressings and Condiments Packaging Market And Their Offerings

- Berry Plastics Corporation: As a top leader in packaging solutions for users and healthcare products, our sector is one of the top areas of invention potential, with our goal to scale and technical experts that assist our users and align with the demands of millions of users each day.

- Aptar Group: Aptar Group Inc. is a United States company that is dependent on global producers of user dispensing packaging and drug delivery procedures. The group has produced operations in 18 different countries.

- Linpac Packaging: LINPAC Packaging serves flexible and rigid packaging solutions to users throughout the globe in the catering, retail, and food manufacturing and packaging sectors. This UK-dependent company makes fresh food packaging and services that deliver a lower level of improved standards of hygiene, food waste, and easy packaging solutions.

- Combi-Pack: Combipack Company Limited was founded in the year 1991, as a subsidiary of Imcopack Corporation, a top producer of different consumer products, such as conditioner, shampoo, body lotion, and facial foam too. It has a main sales development that meant Combipack had to continuously develop manufacturing potential, and in 2000, the organization moved its head office and manufacturing facility from Wellgrow Industrial Estate.

- Scholle IPN: Scholle IPN is a top leader in terms of flexible packaging, which is known for developing bag-in-box and spouted pouch systems before being acquired by SIG in June 2022.

Sauces, Dressings and Condiments Packaging Market Key Players

Tier 1

- Amcor plc

- Sealed Air Corporation

- Crown Holdings, Inc.

- Mondi Group

- Ardagh Group S.A.

- Huhtamaki Oyj

- Sonoco Products Company

- Berry Global Inc.

- Ball Corporation

- Smurfit Kappa Group plc

Tier 2

- ProAmpac LLC

- Coveris Holdings S.A.

- Winpak Ltd.

- Constantia Flexibles

- Greif, Inc.

- Stora Enso Oyj

- Tetra Pak International S.A.

- ALPLA Group

- DS Smith plc

- Printpack Inc.

Tier 3

- Foxpak Flexibles Ltd.

- Novel Packaging

- AVECO Packaging

- RPC Group

- FlexPak Services LLC

- Gualapack Group

- Liquibox (a part of Sealed Air but notable in this niche)

- Essel Propack (now EPL Limited)

- Uflex Ltd.

- Pouch Direct Europe

Sauces, Dressings and Condiments Packaging Market Segmentation

By Product Type

- Cooking sauces

- Salad dressings

- Salsas

- Condiments

- Marinades

By Packaging Material

- Glass

- Plastic

- Metal

- Composite materials

- Flexible packaging

By Packaging Type

- Bottles

- Jars

- Pouches

- Dispensing containers

- Tubs

By Distribution Channel

- Supermarkets and hypermarkets

- Convenience stores

- Direct sales

- Online retail

- Specialty stores

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait