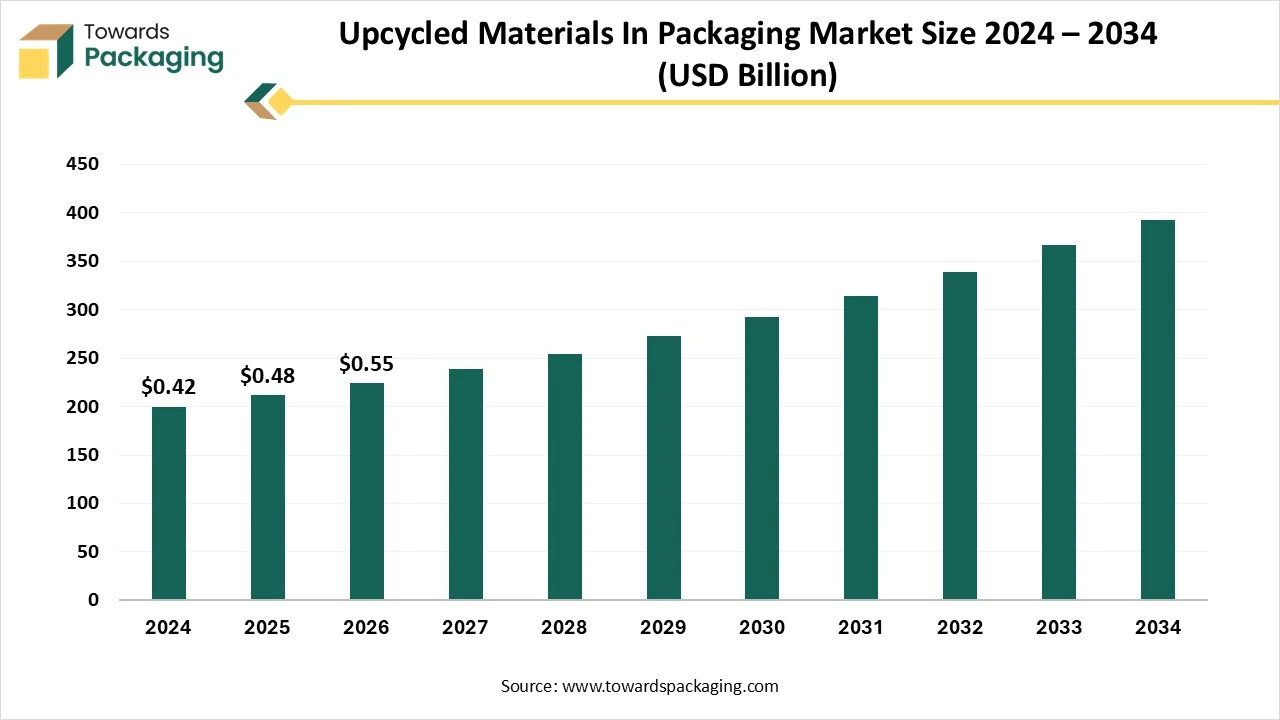

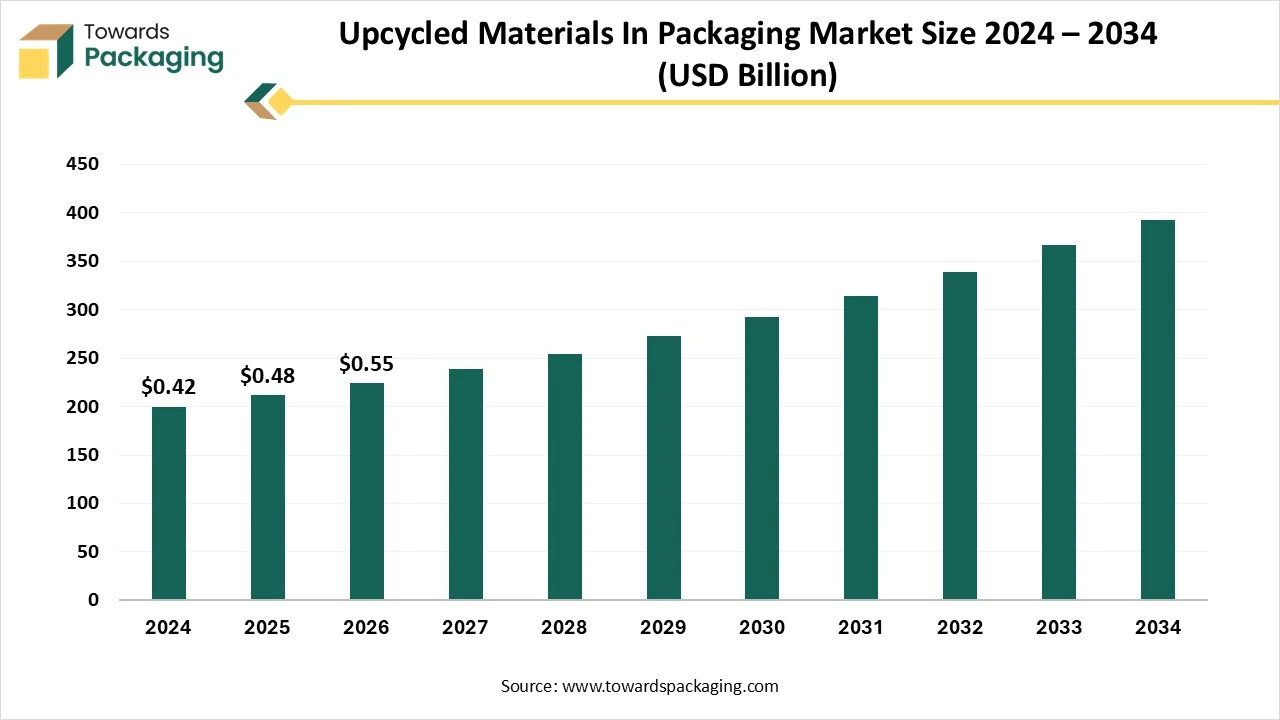

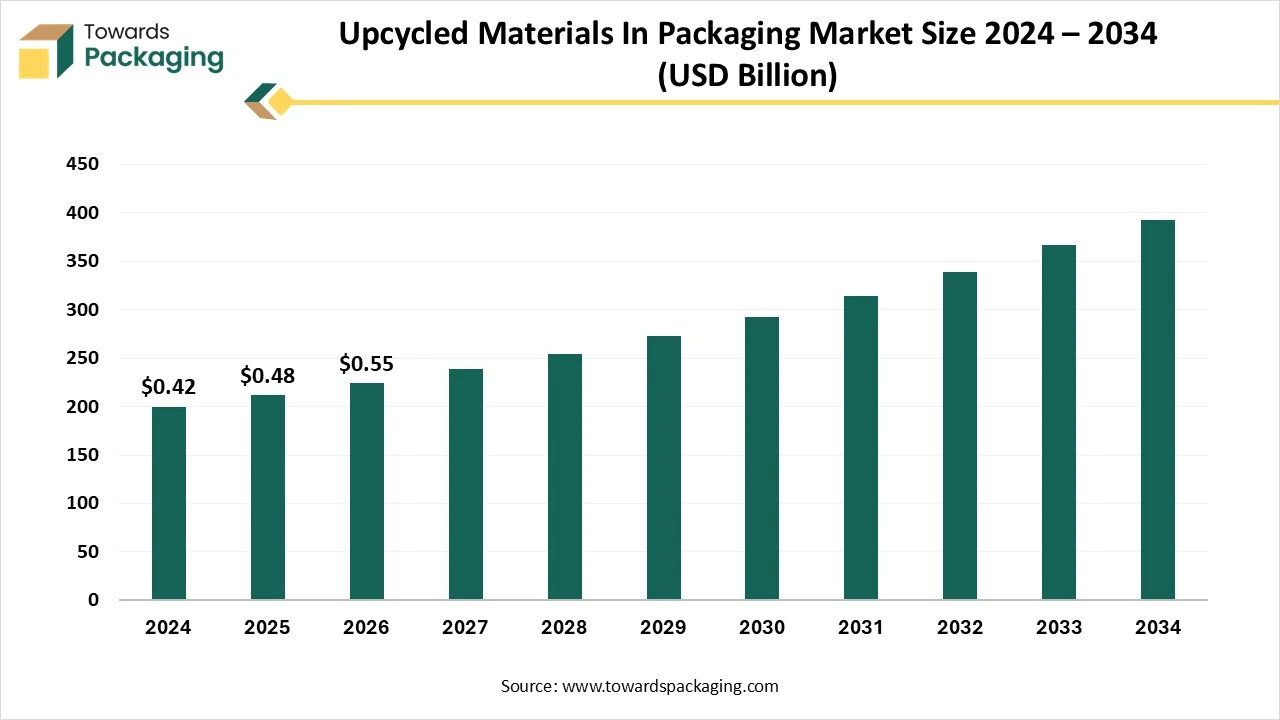

Upcycled Materials In Packaging Market Global Forecast, Growth Indicators, Segmental Insights, Regional Breakup, Company Profiles and Competition Benchmarking

The upcycled materials in packaging market provides a full analytical overview covering market size, growth forecasts, trends, and all statistical insights across material types, packaging forms, and end-use sectors. This report includes detailed regional coverage for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, along with company profiles, competitive analysis, value chain assessment, and global trade data. It also maps key manufacturers, suppliers, and industry stakeholders to give readers a complete data-backed understanding of the market.

Major Key Insights of the Upcycled Materials in Packaging Market:

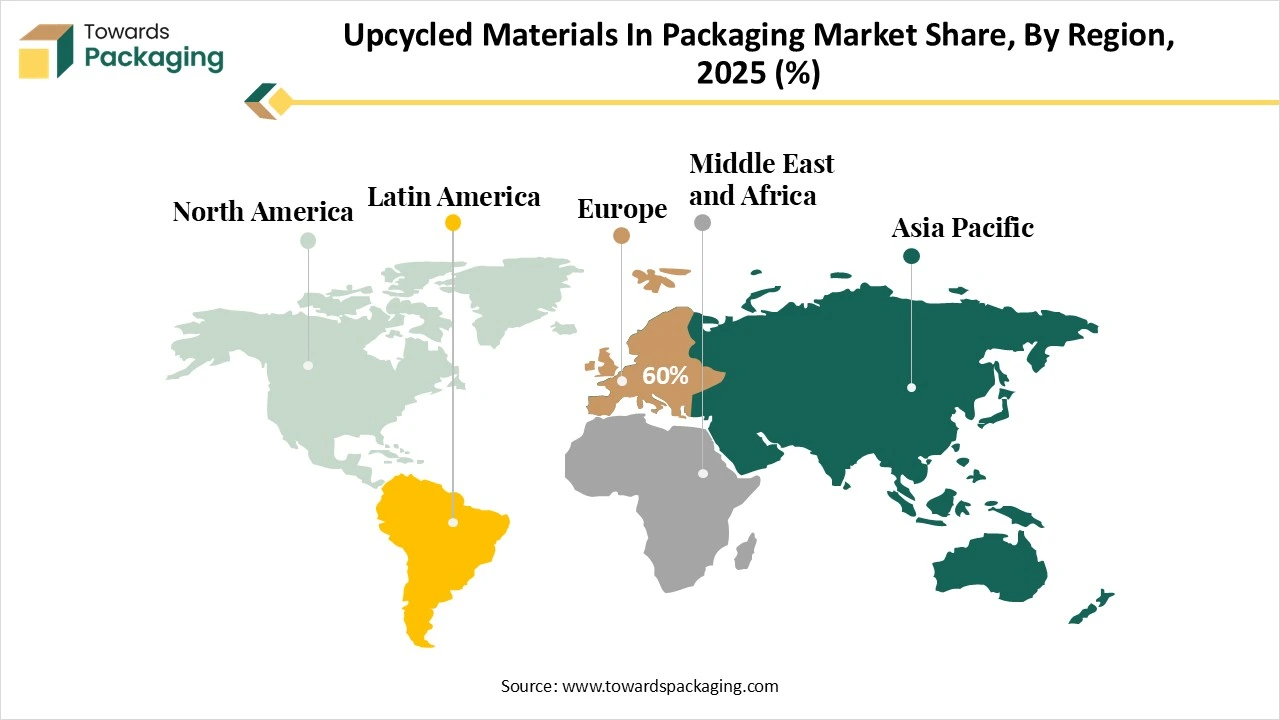

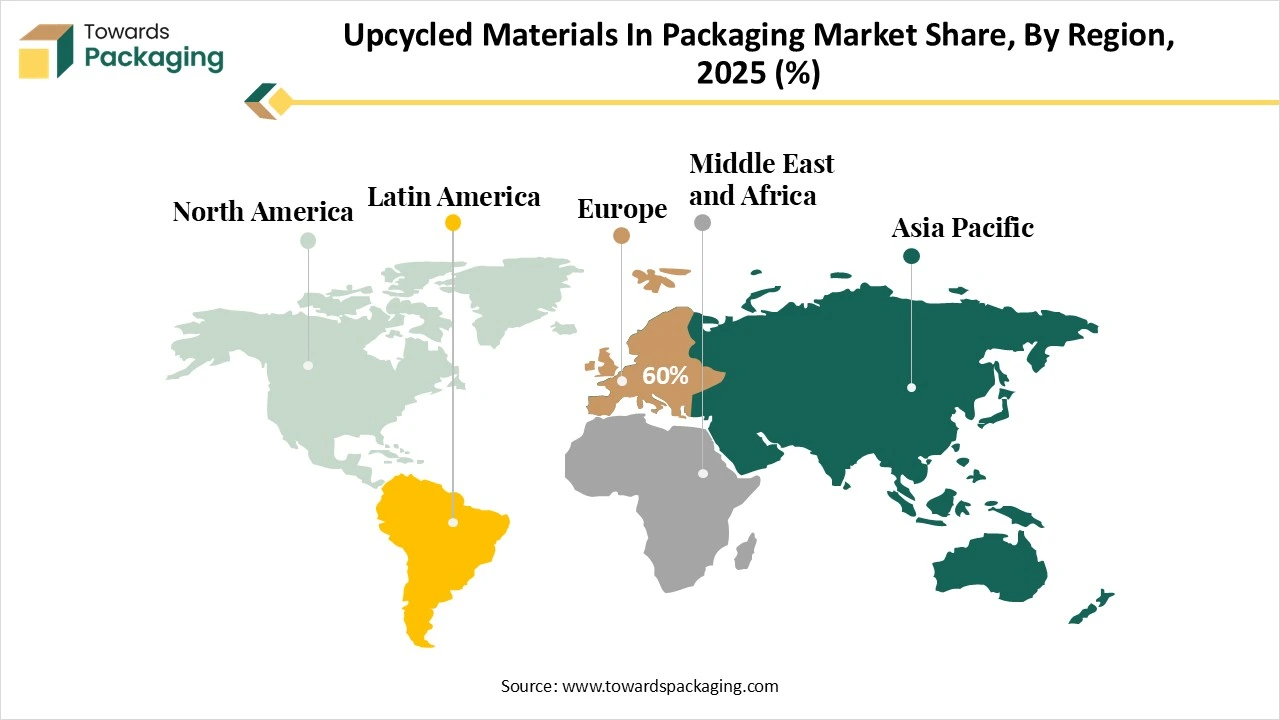

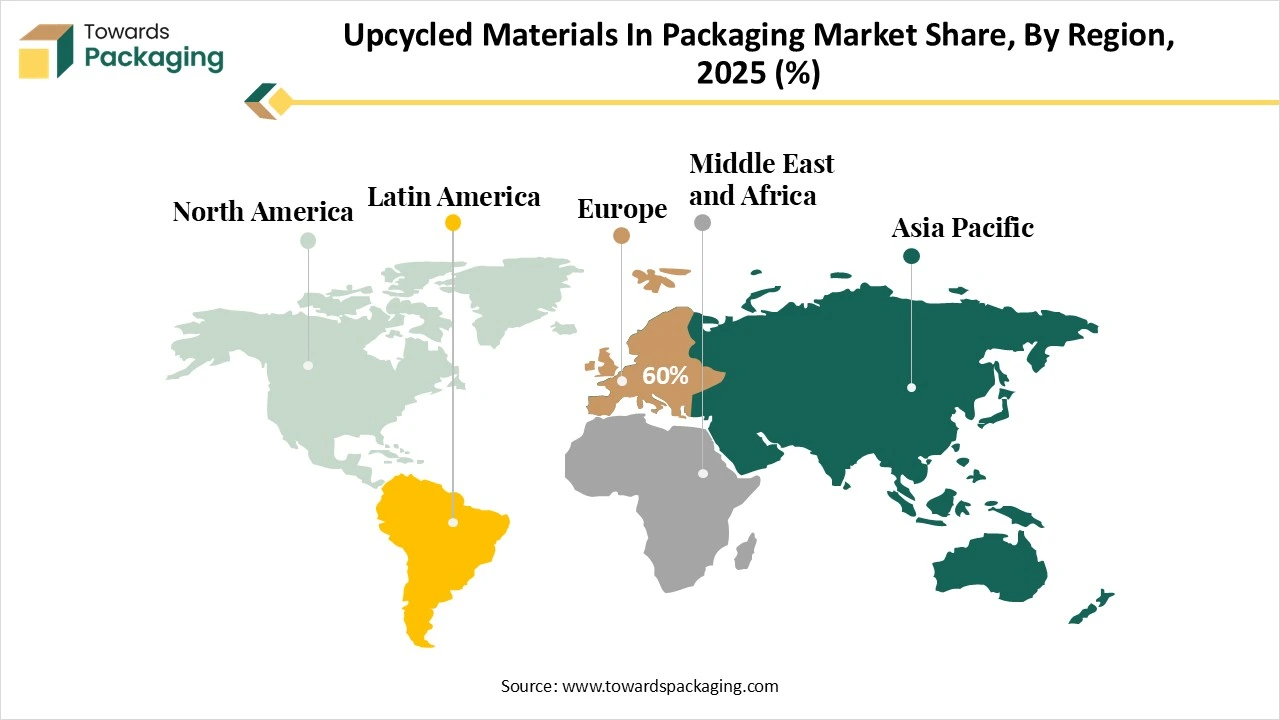

- Europe dominated the global market in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By material type, the plastic segment held the major market share in 2024.

- By material type, the paper segment is projected to grow at a CAGR between 2025 and 2034.

- By packaging form, the boxes & cartons segment contributed the biggest market share in 2024.

- By packaging form, the paper bags & sacks segment is expanding at a significant CAGR in between 2025 and 2034.

- By end use, the food & beverage segment dominated the market in 2024.

- By end use, the agriculture segment is expected to grow at a significant CAGR over the projected period.

Upcycled materials in Packaging Market: Repurposed Packaging

Upcycled materials in packaging refer to packaging solutions created from waste materials that have been repurposed or transformed into higher-value products, rather than being discarded. Unlike traditional recycling, which often results in a degradation of material quality, upcycling retains or enhances the original material’s value. Common sources include post-consumer products, scrap textiles, and agricultural byproducts. The primary attributes of upcycled packaging are waste reduction, environmental sustainability, and innovation. This approach not only diverts waste from landfills but also lowers the environmental footprint of packaging production by substituting virgin materials with renewable or repurposed inputs. According to the Sustainable Packaging Coalition, upcycling contributes significantly to circular economy goals by converting discarded materials into functional, high-quality packaging solutions.

Key Metrics and Overview

| Metric |

Details |

| Market Drivers |

E-commerce growth

Environmental awareness

Regulatory support |

| Leading Region |

Europe |

| Market Segmentation |

By Material Type, By Packaging Form, By End-Use Industry and By Region |

| Top Key Players |

Amcor Plc, Mondi Group, Berry Global Inc., Smurfit Kappa, Ball Corporation, Mauser Packaging Solutions. |

What are New Trends in the Upcycled Materials in Packaging Market?

Rising Use of Agricultural and Industrial Waste

- Brands are integrating upcycled materials like fruit peels, coffee grounds, spent grains, and textile scraps into packaging.

- This supports circular economy goals by reducing landfill waste and raw material extraction.

Consumer Demand for Eco-Certified Packaging

Material Innovation and Biocomposite Development

- Companies are blending upcycled inputs with bioplastics and recycled fibers to create strong, biodegradable packaging.

- Examples include mushroom mycelium packaging, banana fiber wraps, and bagasse-based containers.

Increased Adoption Across Key Industries

- Food & beverage, personal care, and cosmetics sectors are leading in adopting upcycled packaging solutions.

- Demand is driven by both environmental goals and consumer preference for sustainable products.

Regulatory Push and Government Incentives

- Governments in the U.S., EU, and Asia are introducing policies that mandate recycled content and waste reduction.

- Subsidies and tax incentives are encouraging companies to adopt upcycled materials.

Corporate ESG Integration

- Major companies are including upcycled packaging in their Environmental, Social, and Governance (ESG) strategies.

- Disclosure of upcycled content is becoming part of sustainability reporting frameworks.

Premium Positioning and Niche Appeal

- Upcycled packaging is gaining traction in premium product lines where eco-conscious consumers are willing to pay more.

- Startups and sustainable brands are leveraging this trend to differentiate themselves in competitive markets.

Supply Chain Collaboration and Innovation Hubs

- Partnerships between packaging firms, material innovators, and waste management companies are driving R&D.

- Innovation hubs and circular labs are emerging to scale up the commercialization of upcycled materials.

(Source: Sustainable Packaging Coalition, 2024)

How Can AI Improve the Upcycled Materials in Packaging Industry?

Artificial Intelligence (AI) is playing a transformative role in advancing the upcycled materials in packaging industry by enhancing material discovery, design optimization, and environmental assessment. AI algorithms can analyze vast datasets of chemical compositions, molecular structures, and functional properties to identify upcycled material candidates with ideal attributes such as biodegradability, tensile strength, and barrier performance. This accelerates the development of innovative, eco-friendly packaging solutions.

AI-driven design tools further optimize the formulation, structure, and processing parameters of upcycled packaging materials, enabling manufacturers to reduce material usage while enhancing functionality and sustainability across the product lifecycle. Additionally, AI-powered life cycle assessment (LCA) platforms evaluate environmental impacts from raw material extraction to end-of-life, helping stakeholders make data-driven decisions for greener packaging.

Moreover, AI enhances packaging circularity by optimizing designs for reusability, recyclability, and compostability, thus aligning with the principles of the circular economy. According to the Ellen MacArthur Foundation, leveraging AI technologies in sustainable design and material innovation is essential for driving circular solutions in the packaging sector.

Key Industry Driver: E-Commerce Growth and Environmental Sustainability Fuel Demand for Upcycled Packaging

One of the key drivers of the upcycled materials in packaging industry is the convergence of rising environmental concerns and the rapid expansion of e-commerce. Increasing awareness about climate change, plastic pollution, and resource depletion has led consumers and businesses to demand more sustainable packaging solutions. Upcycled materials provide a low-impact alternative by diverting waste from landfills and minimizing dependence on virgin raw materials.

The growth of e-commerce platforms such as Amazon, Shopify, and Flipkart has significantly increased the demand for shipping and secondary packaging—boxes, fillers, pouches, and labels—creating a substantial opportunity for the integration of upcycled materials like post-consumer cardboard, agricultural waste-based paper, and biodegradable fillers. According to the Ellen MacArthur Foundation, aligning packaging strategies with circular economy principles—such as reuse, recycling, and upcycling—is essential for reducing environmental harm and promoting sustainability.

E-commerce platforms can play a pivotal role by mandating or incentivizing the use of upcycled packaging among sellers, offering sustainability certifications or badges, and incorporating eco-friendly filters in product search tools. These initiatives not only encourage vendors to adopt upcycled materials but also cater to the growing segment of environmentally conscious consumers. Additionally, reverse logistics models that support take-back or reuse of packaging further strengthen the circular value chain, turning delivery waste into raw material for future packaging.

Key Market Restraint: Inconsistent Raw Material Supply and Regulatory Uncertainty Hinder Upcycled Packaging Growth

A significant restraint in the upcycled materials in packaging market is the limited and inconsistent supply of raw materials, coupled with complex regulatory challenges. Upcycled packaging relies heavily on post-consumer and industrial waste streams such as agricultural byproducts, food scraps, and textile remnants. These inputs can be seasonal, variable in quality, and prone to contamination, resulting in supply chain disruptions and difficulties in maintaining consistent material standards.

Moreover, regulatory compliance poses additional barriers. Ensuring food safety and meeting packaging standards with upcycled materials can be difficult due to inconsistent composition and potential contamination risks. Many regions also lack clear regulatory frameworks or certifications specific to upcycled materials, which creates uncertainty for manufacturers and limits market scalability. According to the U.S. Environmental Protection Agency (EPA), the absence of standardized guidelines and reliable supply chains is a key challenge in integrating upcycled content into mainstream packaging solutions.

Upcycled Materials in Packaging Market Opportunity: Innovation in Material Science

A major opportunity in the upcycled materials in packaging market lies in the rapid advancements in material science. Ongoing research and development have enabled the transformation of agricultural residues, food by-products, and textile waste into high-performance packaging materials. Innovations in areas such as bio-binders, biopolymers, and fiber reinforcements have significantly enhanced the structural integrity, safety, and visual appeal of upcycled packaging, making it more commercially viable and competitive with conventional materials.

The continuous introduction of novel materials is unlocking new market segments and applications. For example, according to data published in October 2024, RM Tohcello Co., Ltd., TOPPAN Inc., and Mitsui Chemicals, Inc. launched a collaborative pilot project for the horizontal recycling of printed BOPP (biaxially oriented polypropylene) flexible packaging films. This initiative successfully developed a recycled BOPP film capable of being produced at scale, demonstrating how technical innovation can drive the practical implementation of upcycled solutions in mainstream packaging.

(Source: TOPPAN Holdings Inc., October 2024)

Segmental Insights: Plastic Segment Led in 2024; Paper to Witness Fastest Growth

Plastic Segment Led the Market in 2024

The plastic segment accounted for the largest share of the upcycled materials in packaging market in 2024. This dominance is primarily due to the vast and consistent availability of plastic waste, which serves as a reliable feedstock for upcycled packaging. Plastics such as PET (polyethylene terephthalate), HDPE (high-density polyethylene), and LDPE are commonly collected, cleaned, and reprocessed into new packaging materials.

- PET is particularly notable for being widely recycled into bottles, containers, and flexible packaging products.

- Many global regions have established infrastructure for plastic waste collection and processing, supporting mechanical and chemical recycling.

- Brands increasingly use recycled plastics like rPET or ocean-bound plastics, often blended with virgin material to balance performance and sustainability.

Paper Segment Expected to Grow at the Fastest Rate (2024–2034)

The paper segment is projected to exhibit the highest growth rate during the forecast period. Recycled paper is favored for its ease of reuse (up to 5–7 cycles), biodegradability, and lower carbon footprint compared to plastic or metal.

- The global push to phase out single-use plastics is driving demand for upcycled paper packaging.

- Applications include corrugated boxes, cartons, molded pulp trays, paper bags, sleeves, and wrapping paper.

- Upcycling paper consumes significantly less water and energy than producing virgin paper pulp, aligning with sustainable production practices.

Segmental Insights: Boxes & Cartons Dominated in 2024; Paper Bags & Sacks to Grow Fastest

Boxes & Cartons Segment Held a Significant Market Share in 2024

In 2024, the boxes & cartons segment accounted for a major share of the upcycled materials in packaging market. These formats are essential across industries such as e-commerce, food & beverages, electronics, retail, and consumer goods, making them an ideal application for upcycled materials.

- Paper-based materials like cardboard and kraft paper, commonly used in boxes and cartons, are among the most widely recycled and upcycled materials globally.

- These materials can be reused multiple times while maintaining structural integrity, especially when reinforced with virgin fibers.

- The presence of well-established infrastructure for collecting and processing post-consumer corrugated board and industrial paper waste ensures a reliable and cost-effective supply chain for upcycled box production.

Paper Bags & Sacks Segment to Register Highest CAGR (2024–2034)

The paper bags & sacks segment is expected to grow at the fastest rate during the forecast period. This growth is driven by rising consumer preference for biodegradable, recyclable, and upcycled alternatives to single-use plastic bags.

- Upcycled paper bags made from post-consumer recycled paper or agricultural waste are gaining popularity due to their alignment with “zero waste” and “circular economy” values.

- Regulatory pressures, including plastic bans and environmental taxes, are accelerating the shift toward paper-based options in retail, grocery, and foodservice sectors.

- Younger and urban consumers are particularly supportive of eco-friendly alternatives, enhancing market demand for upcycled paper bags and sacks.

Segmental Insights: Food & Beverage Segment Dominated the Market in 2024

The food & beverage segment led the global upcycled materials in packaging market in 2024, driven by increasing environmental pressures and evolving consumer preferences. This industry is actively seeking sustainable packaging solutions to minimize its environmental impact, and upcycled materials provide a low-waste, resource-efficient alternative.

- Upcycling allows the conversion of by-products and waste—such as agricultural residues, used paper, and food industry side streams—into packaging that supports zero-waste and circular economy initiatives.

- Modern consumers, particularly Millennials and Gen Z, prioritize sustainability and are more likely to support brands with transparent and eco-friendly practices. Packaging made from upcycled materials resonates with this demographic by showcasing environmental responsibility.

- Government regulations, including plastic bans and Extended Producer Responsibility (EPR) frameworks, are pushing companies to incorporate recycled or upcycled content to remain compliant and avoid penalties.

- Technological advancements have also improved the performance and safety of upcycled materials, making them suitable for direct food contact and enabling their broader adoption in the food & beverage sector.

Upcycled Materials in Packaging Market Regional Leader: Europe

Europe held the largest share of the upcycled materials in packaging market in 2024, primarily driven by stringent environmental regulations and proactive sustainability initiatives. The European Union’s Green Deal and Circular Economy Action Plan mandate sustainable production and consumption practices, while comprehensive waste management laws and bans on single-use plastics push companies toward adopting upcycled packaging materials. Extended Producer Responsibility (EPR) regulations further enforce accountability, requiring manufacturers to manage the full lifecycle of their packaging products.

European consumers are among the most eco-conscious globally, significantly influencing market demand. This has prompted businesses to adopt innovative upcycled packaging solutions to meet consumer expectations for transparency, sustainability, and ethical production.

Europe’s advanced recycling infrastructure ensures efficient collection and processing of recyclable materials, providing a consistent supply of high-quality feedstock for upcycled packaging. Additionally, the region is home to numerous sustainability-focused startups and packaging firms, along with reputable certification bodies such as Cradle to Cradle, FSC, and the EU Ecolabel, which enhance market credibility and consumer trust.

According to the European Commission, these combined factors make Europe a global leader in circular economy practices, accelerating its dominance in the upcycled packaging market.

Asia Pacific: Fastest-Growing Region in the Upcycled Materials in Packaging Market

The Asia Pacific region is projected to experience the fastest growth in the upcycled materials in packaging market during the forecast period (2025–2034), driven by regulatory reforms, booming e-commerce, and rising consumer demand for sustainable products. Governments across the region are enacting stringent policies to curb plastic waste and promote eco-friendly alternatives. For instance, China’s “Plastic Ban 2021” restricts the use of non-biodegradable plastics in major cities, while India’s amended Plastic Waste Management Rules (2021) are accelerating the shift to sustainable packaging. Thailand has also announced a complete ban on plastic waste imports by 2025.

The rapid expansion of e-commerce—expected to grow at over 20% annually in the region—is increasing demand for durable yet sustainable packaging solutions. Fast-growing sectors such as food delivery and pharmaceuticals are adopting upcycled materials like molded pulp and recycled paperboard to comply with evolving regulations and sustainability targets.

Consumer preferences are also shifting. A Nielsen report revealed that more than 70% of consumers in Australia and Japan are willing to pay a premium for products in sustainable packaging, incentivizing companies to invest in upcycled solutions. Furthermore, economic growth in countries like India and China has led to increased consumption of packaged goods, amplifying the demand for low-impact, recyclable, and upcycled packaging options.

(Source: Nielsen Global Survey on Corporate Social Responsibility and Sustainability, 2024)

India: Emerging Growth Hub in the Upcycled Materials in Packaging Market

India’s upcycled materials in packaging market is gaining momentum, driven by rising demand for sustainable packaging solutions and increasing regulatory and corporate initiatives. Major brands like PepsiCo India and Amul have committed to 100% sustainable or upcycled packaging as part of their environmental goals, aligning with India’s broader national targets for reducing plastic waste and promoting circular economy practices.

Government policies under the Plastic Waste Management Rules (amended 2021) mandate the use of recycled or biodegradable materials, further encouraging the adoption of upcycled packaging across industries. In addition to top-down corporate commitments, grassroots innovation is playing a vital role. In Dharavi, Mumbai, local artisans are transforming discarded plastic waste into reusable items such as woven bags and mats. These initiatives support both environmental sustainability and local economic empowerment, showcasing the potential for scalable, community-led circular solutions.

According to the Central Pollution Control Board (CPCB), India generates over 3.5 million metric tons of plastic waste annually, highlighting the urgency and market potential for upcycled packaging alternatives in both urban and rural sectors.

North America: Strong Growth Outlook in the Upcycled Materials in Packaging Market

North America is expected to witness notable growth in the upcycled materials in packaging market, driven by robust corporate sustainability commitments, expanding recycling infrastructure, and increasing consumer demand for eco-friendly products. Major corporations such as Unilever, Nestlé, Walmart, and PepsiCo have pledged to transition to 100% reusable, recyclable, or compostable packaging by 2025–2030, catalyzing the adoption of upcycled materials across the supply chain.

The region’s well-established recycling infrastructure—with over 2,800 facilities—supports the processing of recyclable and upcyclable materials, helping divert 2.1 million tons of packaging waste from landfills annually. Companies like International Paper are leading investments in sustainable packaging innovations, including fiber-based and biodegradable solutions derived from agricultural or industrial waste.

Consumer behavior further supports this trend, with 82% of North American consumers, and 90% of Gen Z, willing to pay more for products packaged sustainably. Additionally, the region is expanding its use of plant-based and biodegradable packaging, with 1.5 million tons of such materials traded annually, and growing interest in edible packaging—over 500,000 units sold to date.

According to the Sustainable Packaging Coalition (2024), the eco-friendly packaging industry in North America has also become a key employment driver, contributing to over 85,000 jobs, underlining its economic and environmental impact.

United States and Canada: Key Drivers of Upcycled Materials in Packaging Market Growth in North America

Both the United States and Canada play critical roles in supporting the steady growth of the upcycled materials in packaging market in North America, through progressive legislation and sustainability mandates.

In the United States, states like California are leading the charge with some of the strictest packaging regulations in the country. California’s SB 54 law, enacted in 2022, mandates a 25% reduction in single-use plastic packaging by 2032 and requires that at least 30% of plastic packaging be recyclable or compostable by 2028. These regulatory actions are directly encouraging the shift toward upcycled and sustainable packaging alternatives.

Canada has also implemented national-level strategies to tackle plastic pollution. The Canadian government’s Zero Plastic Waste Agenda includes bans on several single-use plastic items and mandates the use of minimum recycled content in plastic packaging. These efforts aim to foster a circular economy and accelerate the adoption of upcycled materials across various industries.

According to Environment and Climate Change Canada (ECCC), these measures are essential to achieving national climate targets and have positioned both countries as leaders in North America’s transition to sustainable packaging.

Upcycled Materials In Packaging Market Key Players

- Amcor Plc

- Mondi Group

- Berry Global Inc.

- Smurfit Kappa

- Ball Corporation

- Mauser Packaging Solutions

- WestRock Company

- Schütz GmbH & Co. KGaA

- International Paper

- Huhtamaki Inc.

- Tetra Pak

- SIG Group

- ALLTUB GROUP

- Albéa Group

- Stora Enso

- AptarGroup, Inc.

- Silgan Holdings Inc.

- Sealed Air Corporation

- DS Smith

- Crown Holdings, Inc.

Latest Announcements by Upcycled Materials in Packaging Industry Leaders:

- In March 2025, According to Peter Voortmans, Commercial Director of Consumer Products Flexibles at Borealis, this new rLLDPE grade is a significant step towards a circular economy for plastics because of its remarkable 85% post-consumer recyclate content. As part of Borealis AG company efforts to reinvent necessities for sustainable living, Borcycle M CWT120CL will assist company’s clients in reaching their sustainability goals while upholding the high performance standards necessary for demanding flexible packaging applications. To promote circularity in non-food flexible packaging, Borealis presents Borcycle M CWT120CL, a high-performance, recycled linear low density polyethylene grade (rLLDPE). Produced with 15% LLDPE booster and 85% post-consumer recycle (PC), it is perfect for high-end applications where circularity and sustainability are important. [Source: Borealis ]

New Advancements in Upcycled Materials in Packaging Industry

- In April 2025, DePoly, leading sustainable PET-to-raw-material recycling firm, will open a 500-tonne-per-year showcase plant in Monthey, Switzerland. This marks a significant milestone in the company's development from lab breakthrough to large-scale deployment. DePoly's exclusive method of turning PET and polyester waste into virgin-grade raw materials devoid of fossil fuels will be showcased at the plant. Imagine living in a society where recycled materials, such as water bottles and polyester shirts, are used to create new things instead of being throwaway. [Source: GlobeNewswire]

- In May 2025, Green Recycle USA LLC, a start-up firm that will process and recycle industrial plastic trash, is investing $4.3 million to launch in an existing warehouse in Pittsylvania County, Governor Glenn Youngkin announced today. Reducing the quantity of industrial plastic waste dumped in landfills and developing a more sustainable solution for plastic trash are the company's objectives. 28 new employment will be created by the initiative. [Source: Governor Youngkin]

- In December 2024, An international sustainable chemical firm, Indorama Ventures Public firm Limited, declared the start of its RECO Collective 2025 project. This cutting-edge platform seeks to promote the adoption of recycled materials by SMEs in industries like fashion and furniture while educating them on recycling and upcycling techniques. The program emphasizes the production of sustainable products using PET fibers from recycled PET bottles. Along the value chain, Indorama Ventures is also working with top partners who share this goal of sustainable business. [Source: Indorama Ventures]

- In February 2025, Tetra Pak, the first firm in India's food and beverage packaging sector to do so, stated that they will be providing packaging materials made of certified recycled polymers. Its carton containers combining recycled polymers are certified by ISCC PLUS (International Sustainability & Carbon Certification), an internationally relevant sustainability certification method. According to the Plastic Waste Management (Amendment) Rules 2022, which are enforced by the Ministry of Environment, Forests & Climate Change, the packaging material incorporates 5% certified recycled polymers. The date of this mandate's implementation started from April 1, 2025. [Source: Tetra Pak India Private Limited]

Global Upcycled Materials in Packaging Market Segments

By Material Type

- Plastic

- Paper

- Glass

- Metal

- Textile

- Others

By Packaging Form

- Boxes & Cartons

- Paper Bags & Sacks

- Bottles

- Pouches

- Wrappers

- Trays

By End-Use Industry

- Food & Beverage

- Agriculture

- Personal Care & Cosmetics

- Pharmaceuticals

- Industrial

- Household Products

- E-commerce

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait