Aseptic Bag-in-Box Market Size, Share, Trends and Growth Forecast

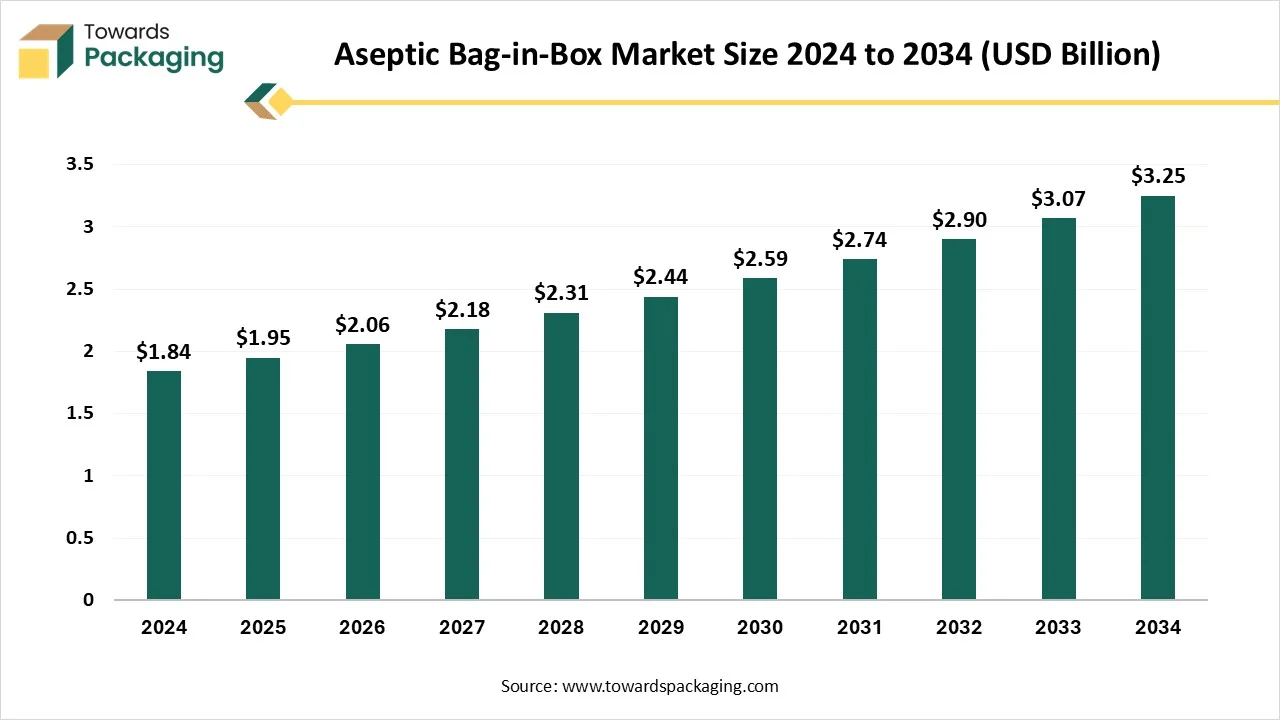

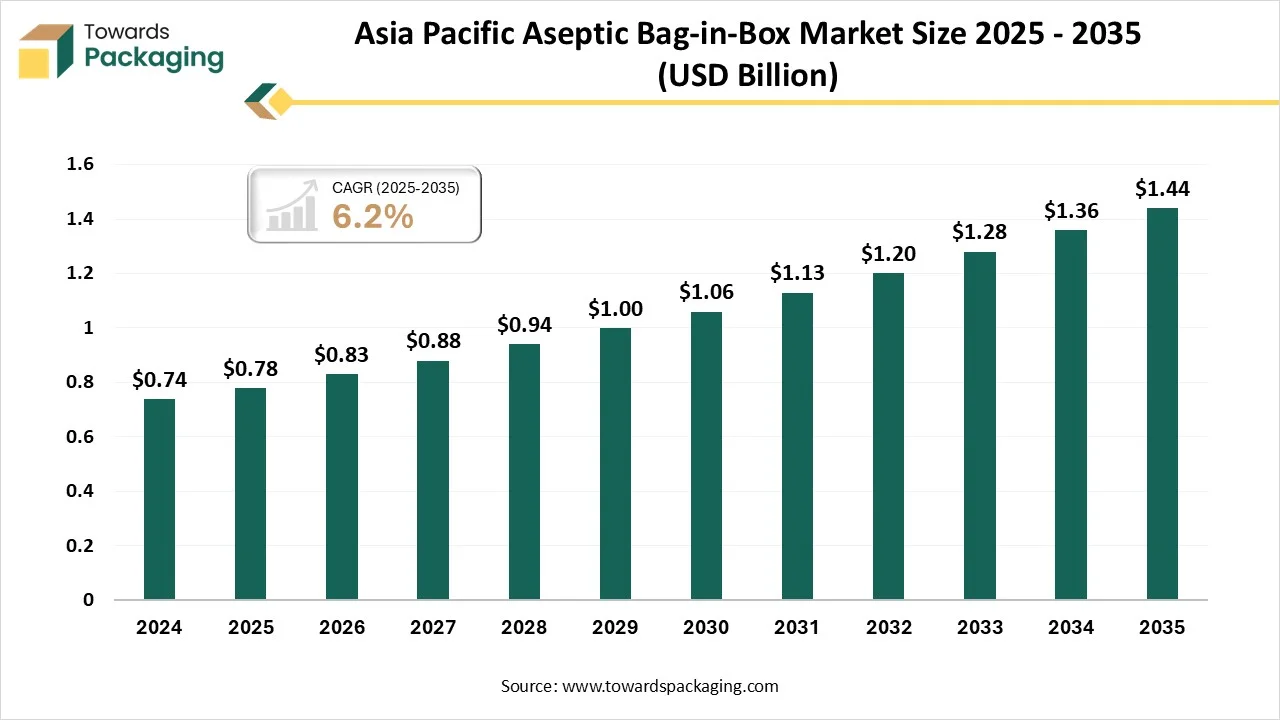

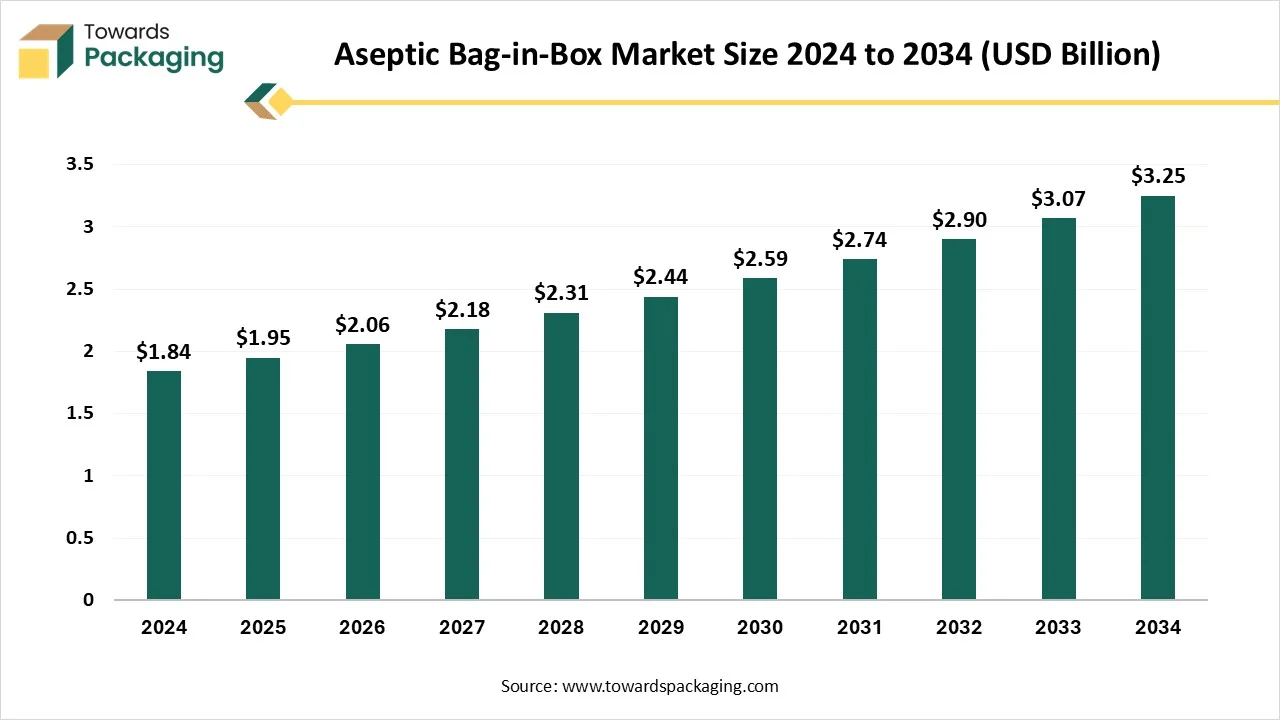

The aseptic bag-in-box market is projected to grow from USD 2.06 billion in 2026 to USD 3.44 billion by 2035, expanding at a robust CAGR of 5.85%. Key market segments include various capacities, with the 20-200 liters segment holding a dominant share of around 45%. Asia Pacific led the global market in 2024, accounting for 40% of the market share. The food and beverage industry represented approximately 50% of the market in 2024, while North America is expected to see significant growth during the forecast period.

Major Key Insights of the Aseptic Bag-in-Box Market

- In terms of revenue, the market is valued at USD 2.06 billion in 2026.

- The market is projected to reach USD 3.44 billion by 2035.

- Rapid growth at a CAGR of 5.85% will be observed in the period between 2025 and 2034.

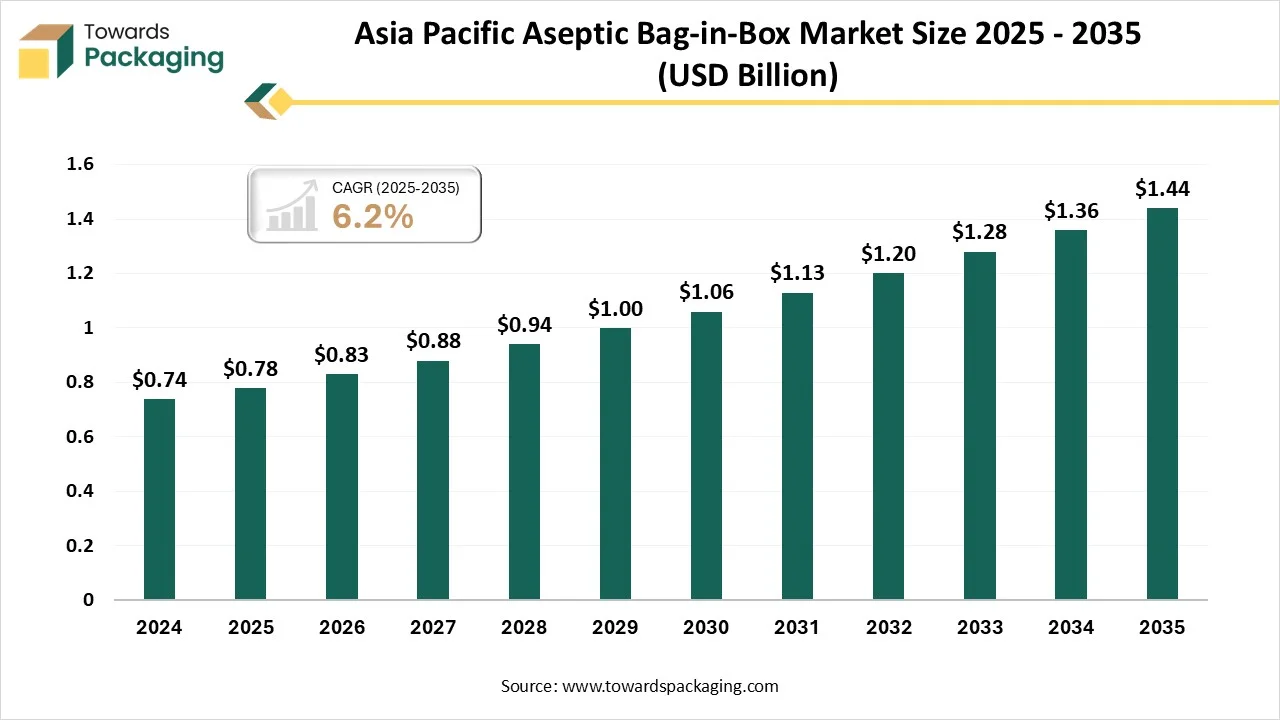

- By region, Asia Pacific dominated the global market by holding highest market share of approximately 40% in 2024.

- By region, North America is expected to grow at a notable CAGR from 2025 to 2034.

- By capacity type, the 20–200 liters segment contributed the biggest market share of approximately 45% in 2024.

- By capacity type, the 5–20 liters segment will be expanding at a significant CAGR in between 2025 and 2034.

- By material, the plastic films (PE & EVOH) segment contributed the biggest market share of approximately 55% in 2024.

- By material, the multilayer barrier films segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By bag type, the with spout segment contributed the biggest market share of approximately 60% in 2024.

- By bag type, the without spout segment is expanding at a significant CAGR in between 2025 and 2034.

- By filling technology, the aseptic filling segment contributed the biggest market share of approximately 70% in 2024.

- By end-use industry, the food & beverage processing segment contributed the biggest market share of approximately 50% in 2024.

- By end-use industry, the wineries & alcoholic beverage companies segment is expanding at a significant CAGR in between 2025 and 2034.

What is Aseptic Bag-in-Box Market?

The aseptic bag-in-box includes sterile flexible packaging systems designed to safely store and transport liquid and semi-liquid products without refrigeration or preservatives. These systems consist of multi-layer barrier bags housed within protective outer boxes, filled and sealed under aseptic conditions to maintain product integrity and shelf life. Used widely in beverages, dairy, liquid foods, pharmaceuticals, and industrial fluids, aseptic bag-in-box formats minimize contamination risk and environmental footprint compared to rigid containers. Growth is supported by the rising adoption of sustainable and lightweight bulk packaging, expanding use in food service and e-commerce, and technological improvements in aseptic filling machines, spout design, and high-barrier film materials.

Aseptic Bag-in-Box Market Outlook

- Advanced Technologies: The rapid advancement in the material science while manufacturing bag-in-box market. Development of sustainable, bio-based, and recyclable packaging.

- Smart Packaging Incorporation: Incorporation of IoT technology which help in monitoring the condition of the product promote the adoption of packaging boxes.

- Digitalization: The transformation of boxes by enhancing consumer experience, efficacy, and transparency.

- Startup Ecosystem: The major focus towards developing sustainable materials, e-commerce logistics, customization and branding, smaller-format application has influenced the demand.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 1.95 Billion |

| Projected Market Size in 2035 |

USD 3.44 Billion |

| CAGR (2026 - 2035) |

5.85% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Capacity, By Material Type, By Bag Type, By Filling Technology, By End-Use Industry and By Region |

| Top Key Players |

Berry Global, Mondi Group, Huhtamaki, Smurfit Kappa Group, ProAmpac, Elopak ASA, Schur Flexibles Group, GEA Group, KHS Group, Arlington Packaging (UK) Ltd., Gualapack Group |

Key Technological Shifts in Aseptic Bag-in-Box Market

The aseptic-bag-in-box market is experiencing major technological shift due to enhanced demand for improved performance, transparency, and sustainability across several sectors. Advancement such as high-speed roll-to-roll processing, nanocoating technology, AI-based quality control, and enhanced plasma treatment has enhanced the demand of the market. Integration of nanoparticles with enhanced mechanical strength and barrier potential. The expansion in the production of recyclable and eco-friendly packaging has influenced the development of the market.

Trade Analysis of Aseptic Bag-in-Box Market: Import & Export Statistics

- China is considered as the largest manufacturer, user, and exporter of packaging. The Chinese National Standards on Packaging and the Environment (CNSPE) has shared the export market from January to March 2022 was USD 1.999 billion.

- Europe has Circular Economy Action Plan have set an aim for 90% of plastic bottles to be recycled by 2029, and that these be need to contain a minimum of 30% recycled plastic by 2030.

Aseptic Bag-in-Box Market- Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are Low-Density Polyethylene (LDPE) and Linear Low-Density Polyethylene (LLDPE).

- Key Players: Aran Group, CDF Corporation

Component Manufacturing

The major components used in this market are bags, boxes, and fitments.

- Key Players: Amcor Plc, Rapak

Logistics and Distribution

This segment is highly focused towards product processing, filling, boxing, and distribution procedure.

- Key Players: NLX Beverages, Intercity Logistics

Packaging Waste Generated in Europe

| Substances |

Percentage |

| Paper & Cardboard |

40.8% |

| Plastic |

19.4% |

| Glass |

18.8% |

| Wood |

16.0% |

| Metal |

4.9% |

| Other |

0.2% |

Market Opportunity

Demand for Preservatives-Free Packaging

The growing demand for preservatives-free packaging of food products has enhanced the innovation process and raised several opportunities in the aseptic bag-in-box market. The rising concern towards health issues has enhanced the demand for preservative-free packaging with longer shelf-life of the products promote innovation in this market to meet the demand of the consumers. The lightweight characteristics of bag-in-box packaging has influenced the demand for these packaging which are easy to carry and transport. It gives a premium look to products which attract huge consumers towards this market.

Market Challenges and Restraints

Huge Capital Investment

Huge investment of capital has restricted the expansion of the market. There is several equipment required for handling, sealing, and filling in the bag-in-box process which is high in charge and hindered the adoption of this business.

Capacity Insights

Why 20–200 Liters Segment Dominated the Aseptic Bag-in-Box Market In 2024?

The 20–200 liters segment dominated the market with approximately 45% share in 2024 due to huge demand for convenient and sustainable packaging. Some of the major factors influencing the growth of this segment are enhanced adoption of bag-in-box packaging, the rising e-commerce sector, and advancement in barrier films. These bags provide excellent protection to the products from external factors such as oxygen, moisture, and light. The rapid expansion of e-commerce sector has enhanced the demand for this segment.

The 5–20 liters segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its sustainability and cost-effectiveness of the small packages. The increasing demand for convenience and rapid urbanization has influenced the demand for small packaged boxes. It is majorly used for packaging of beverages, sauces, and dairy products.

Material Type Insights

Why Plastic Films (PE & EVOH) Segment Dominated the Aseptic Bag-in-Box Market In 2024?

The plastic films (PE & EVOH) segment dominated the market with approximately 55% share in 2024 due to its gas barrier properties and excellent strength. It is majorly utilized during construction work for its durability and sealing properties. It is flexible, cost-efficient, and suitable for bulk material handling. It prevents from loss of natural aroma and external odours. These are also extensively utilized for packaging of liquid products.

The multilayer barrier films segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to its safe and sustainable packaging solution. The major driver of this segment is increasing consumption for packaged food products. It maintains the freshness of the products and preserve nutritional value of the packaged products. It is extensively useful during handling and transportation of the products.

Bag Type Insights

Why With Spout Segment Dominated the Aseptic Bag-in-Box Market In 2024?

The with spout segment dominated the market with approximately 60% share in 2024 due to its ability to extend shelf life of the products. It offers hygienic and easy dispensing for both commercial and consumer use. It utilizes less material from rigid packaging which enhance its demand in this market. This segment is widely utilized in industrial use, beverages, pharmaceuticals, and food products.

The without spout segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to superior protection, cost-effectiveness, and reduced waste. The ongoing demand in the biopharma sector has boosted innovation process in this segment. It has strong barrier from light, moisture, and oxygen.

Filling Technology Insights

Why Aseptic Filling Segment Dominated the Aseptic Bag-in-Box Market In 2024?

The aseptic filling segment dominated the market with approximately 70% share in 2024 due to sterilized packaging demand. It is widely used in the pharmaceutical and healthcare sector. There is a rapid advancement going on in the pharmaceutical industry with the research and development of the equipment as well as drugs. The enhancement in the medical facilities required long-term storage and hygiene which raise the adoption of these types of packaging. The major factors influencing the growth of this segment are hygiene, safety, and preservation of products’ quality.

End-Use Industry Insights

Why Food & Beverage Processing Segment Dominated the Aseptic Bag-in-Box Market In 2024?

The food & beverage processing segment dominated the market with approximately 50% share in 2024 due to increasing consumption of packaged food and rising health concern. The increasing awareness towards health has raised the demand for preservatives-free packaging of the food products. The increasing demand for natural packaging with enhanced shelf life has raised the production process of the BIB packaging. It reduced food wastage and decrease carbon footprints. Continuous innovation in the sterilization process has influenced the adoption of this packaging type in this segment.

The wineries & alcoholic beverage companies segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to increasing consumption of such products. There is a huge demand for convenient packaging of these beverages has influenced the acceptance of BIB packaging. The adoption of convenient, eco-friendly, and economical packaging option has raised this segment in the market.

Regional Insights

Rapid Urbanization and Disposal Earning in Asia Pacific Promote Dominance

Asia Pacific held the largest share of approximately 40% in the aseptic bag-in-box market in 2024, due to rapid urbanization and disposal earning. Rising population and changing lifestyle has enhanced high quality packaged products. Such bulk demand has raised the innovation and production process of this industry. The increasing investment of the companies for research and development process has boosted the growth of this market. The expansion of food & beverages and personal care products has also influenced the growth of this market.

Major Innovators Enhance the Aseptic Bag-in-Box Market in Japan

Presence of huge investors has improved the innovation process and promote the acceptance of the market. The rapid growth in the packaging technology has boosted the development of the market. It is utilized for a wide range of packaging such as from juice and wine to industrial fluids and chemicals. It is placed as a highly significant, quality-focused, and technologically advanced market in Japan. It is widely used for the packaging of liquid food such as dairy products and many more.

North America’s Rising Beverage Sector Enhance Market Demand

North America expects significant growth in the market during the forecast period. This market is growing due to rising beverages sector and its consumption in this region. There is a huge demand for cost-efficient, sustainable, and lightweight packaging has promoted the growth of this segment. Improvement in barrier film technology and enhanced shelf-life products’ demand has raised the adoption of these packaging. Increasing awareness towards usage of eco-friendly and sustainable packaging has improved the demand for this segment.

Rising E-commerce Industries in the U.S. Promote Aseptic Bag-in-Box Market

Rising e-commerce industries in the U.S. has promoted the demand of the market. Development of robust institutional food service and beverages sector has enhanced the usage of BIB packaging. Rising disposable earning has enhanced the utilization of bag-in-box packaging.

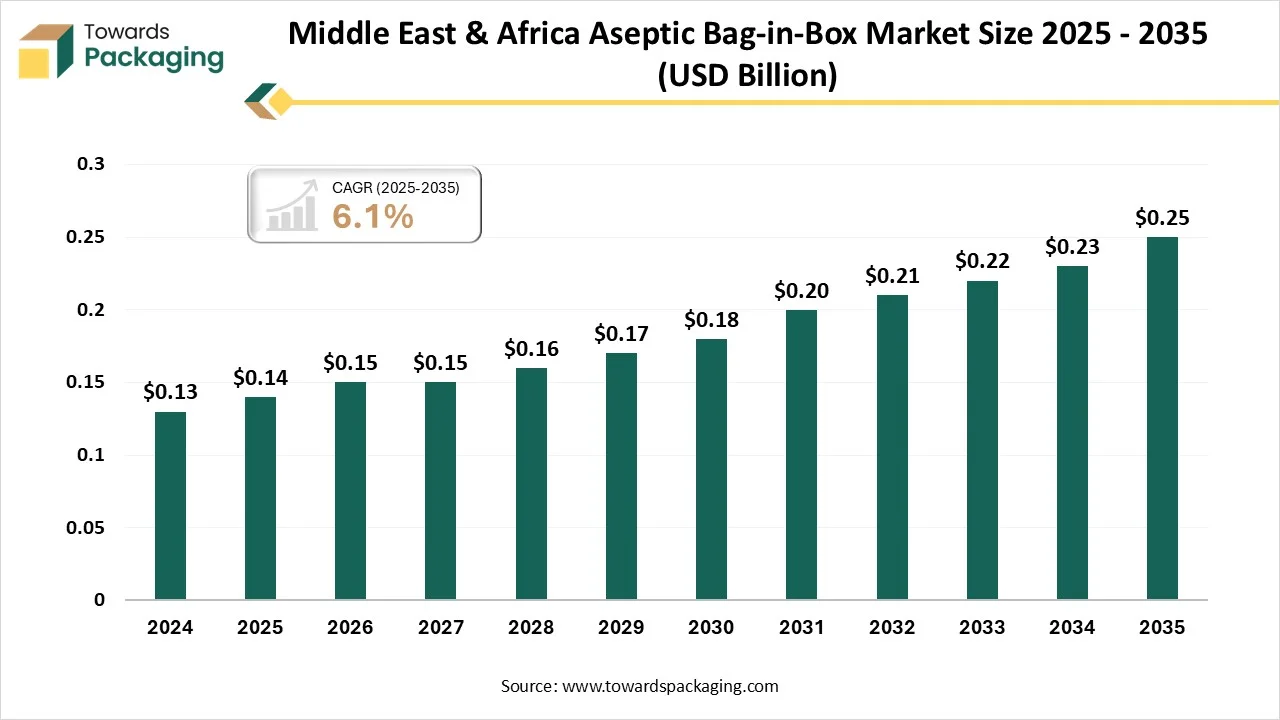

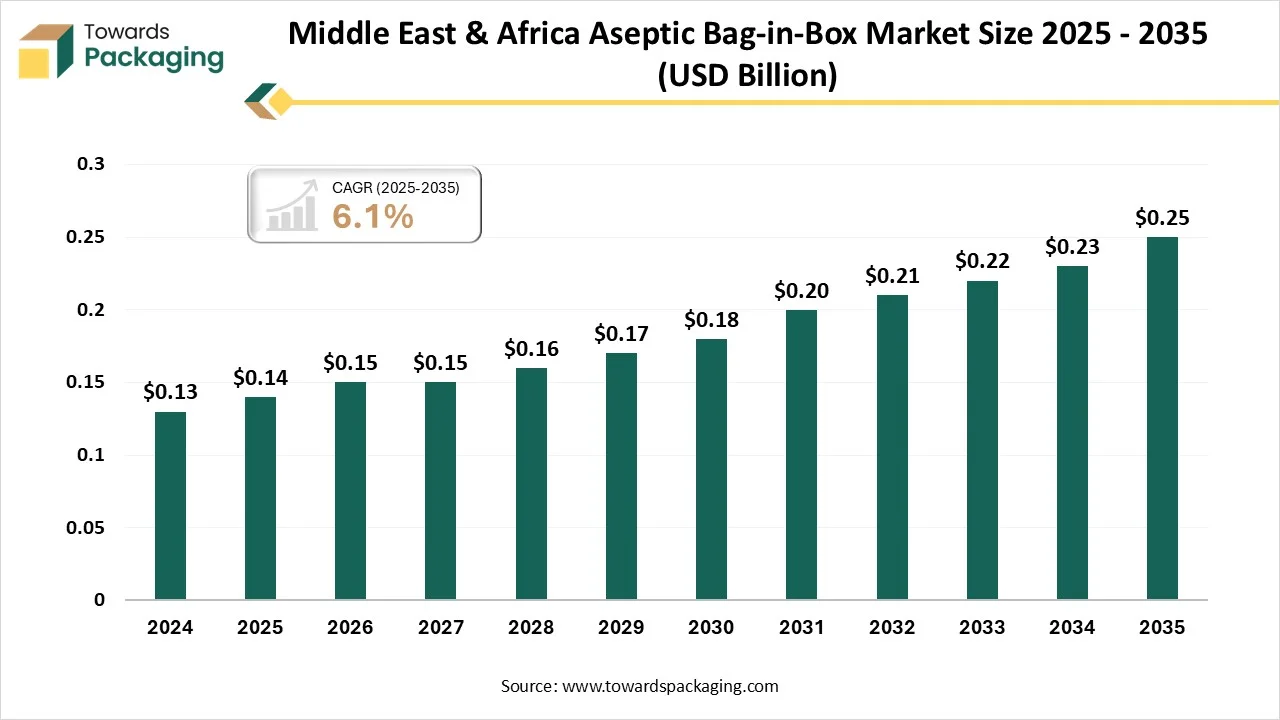

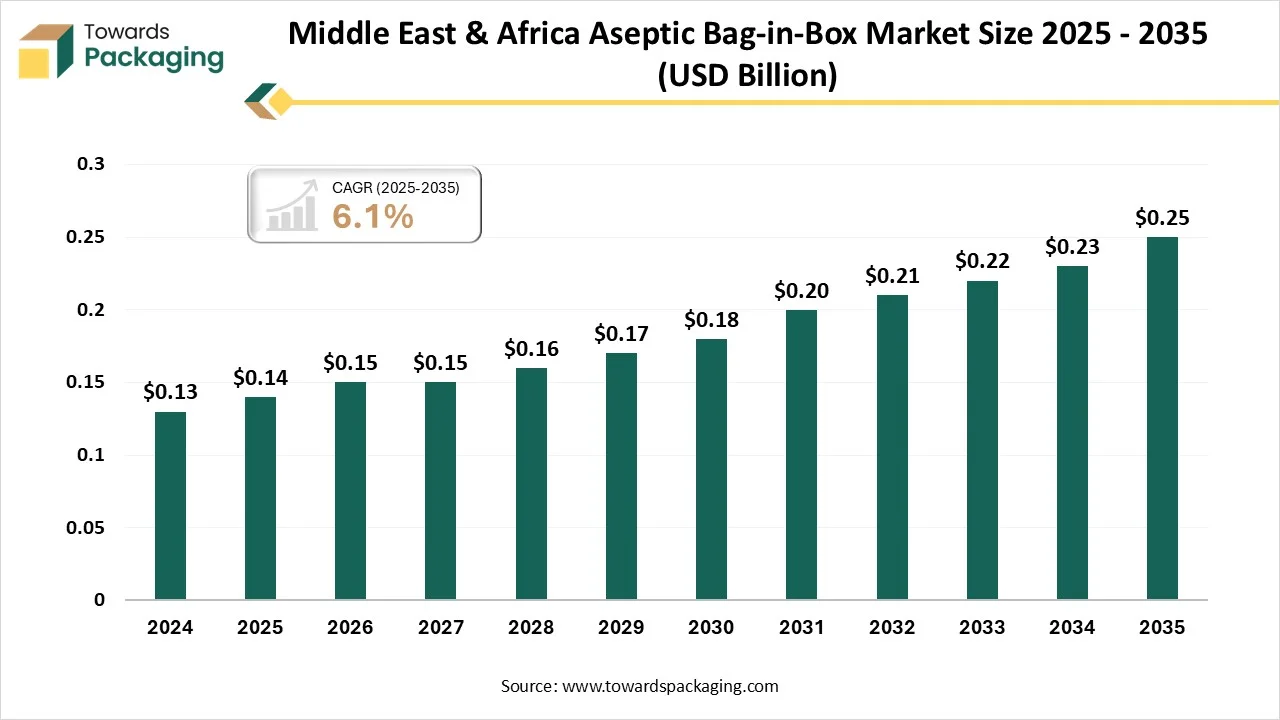

Middle East & Africa Aseptic Bag-in-Box Market Size 2025 - 2035 (USD Billion)

Recent Developments

- In November 2024, Smurfit Westrock announced the launch of new packaging for product to address the future needs of the European Union’s Packaging and Packaging Waste Regulation (PPWR). When Smurfit Westrock’s EasySplit Bag-in-Box parts are appropriately distinguished, its recyclability rate can surpass 90%.

- In August 2025, SIG has announced the launch of Australia’s first recycle-ready bag-in-box packaging for wine, advanced and produced at its Adelaide capability, in partnership with important wine manufacturers DeBortoli Wines, Hill-Smith Family Estates, Vinarchy and Calabria Family Wines.

Top Companies in the Aseptic Bag-in-Box Market

- Scholle IPN: It is a major packaging innovator and a global leader of spouted pouch and bag-in-box packaging.

- Liqui-Box: It is a major manufacturer of flexible packaging, dispensing and filling solutions.

- Tetra Pak: It offers a wide range of packaging solution of beverages such as juices, dairy products and several other liquid foods.

- SIG Combibloc: It has expanded flexible packaging choices with continuous innovation process.

- Amcor plc: It is a worldwide leader of flexible as well as rigid packaging of the products.

Aseptic Bag-in-Box Market Key Players

Tier 1

- Berry Global

- Mondi Group

- Huhtamaki

- Smurfit Kappa Group

- DS Smith Plc

- Sealed Air Corporation

- Amcor Plc

- SIG Group AG

- Tetra Pak International S.A.

- Scholle IPN (part of SIG Group)

Tier 2

- ProAmpac

- Elopak ASA

- Schur Flexibles Group

- GEA Group

- KHS Group

- Krones AG

- Serac Group

- Aseptic Technologies

- SPX FLOW, Inc.

- Liqui-Box Corporation (part of SEE / Sealed Air)

- Ecovative Packaging

- Aran Group

- CDF Corporation

- Rapak (part of DS Smith’s liquid packaging division)

Tier 3

- Arlington Packaging (UK) Ltd.

- Gualapack Group

- SteriPack Group

- Optopack Ltd.

- Maverick Packaging

- Cheertainer (Changzhou) Packaging Co., Ltd.

- Qbig Packaging

- Cryovac (regional SEE division)

- Bevera AG

- Central Packaging Ltd.

Aseptic Bag-in-Box Market Segments Covered

By Capacity

- Up to 5 Liters

- 5–20 Liters

- 20–200 Liters

- Above 200 Liters

By Material Type

- Plastic Films

- Polyethylene (PE)

- Ethylene Vinyl Alcohol (EVOH)

- Polyamide (PA)

- Others

- Aluminum Foil

- Paperboard Laminates

- Multilayer Barrier Films

By Bag Type

By Filling Technology

- Aseptic Filling

- Non-Aseptic Filling

By End-Use Industry

- Food & Beverage Processing

- Dairy & Juice Producers

- Wineries & Alcoholic Beverage Companies

- Pharmaceutical Manufacturers

- Industrial Chemical Companies

- Household Product Manufacturers

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait