Boxboard Packaging Market Outlook Scenario Planning & Strategic Insights for 2034

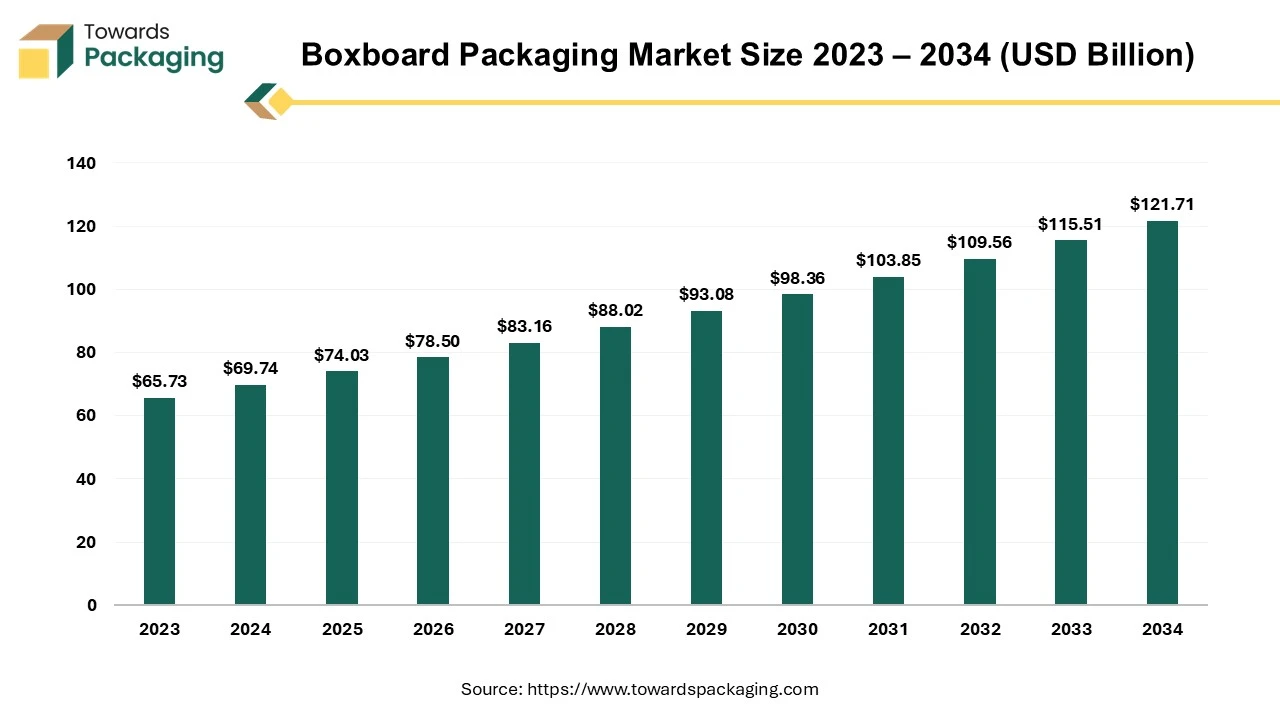

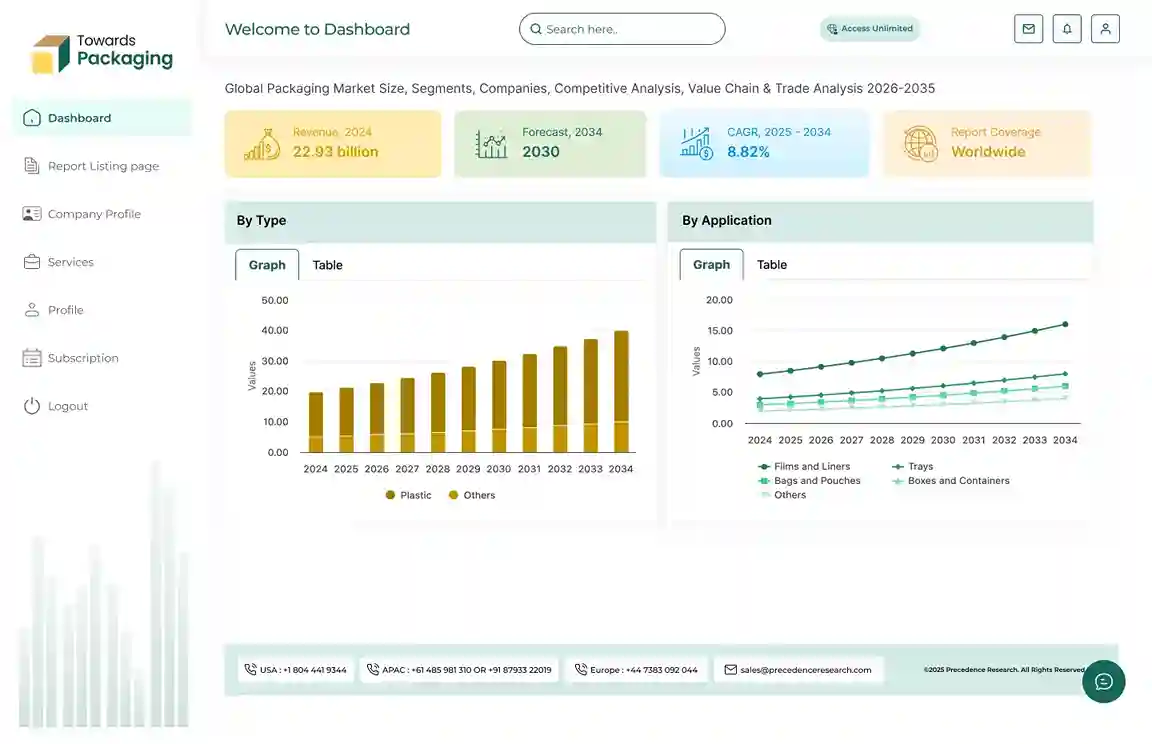

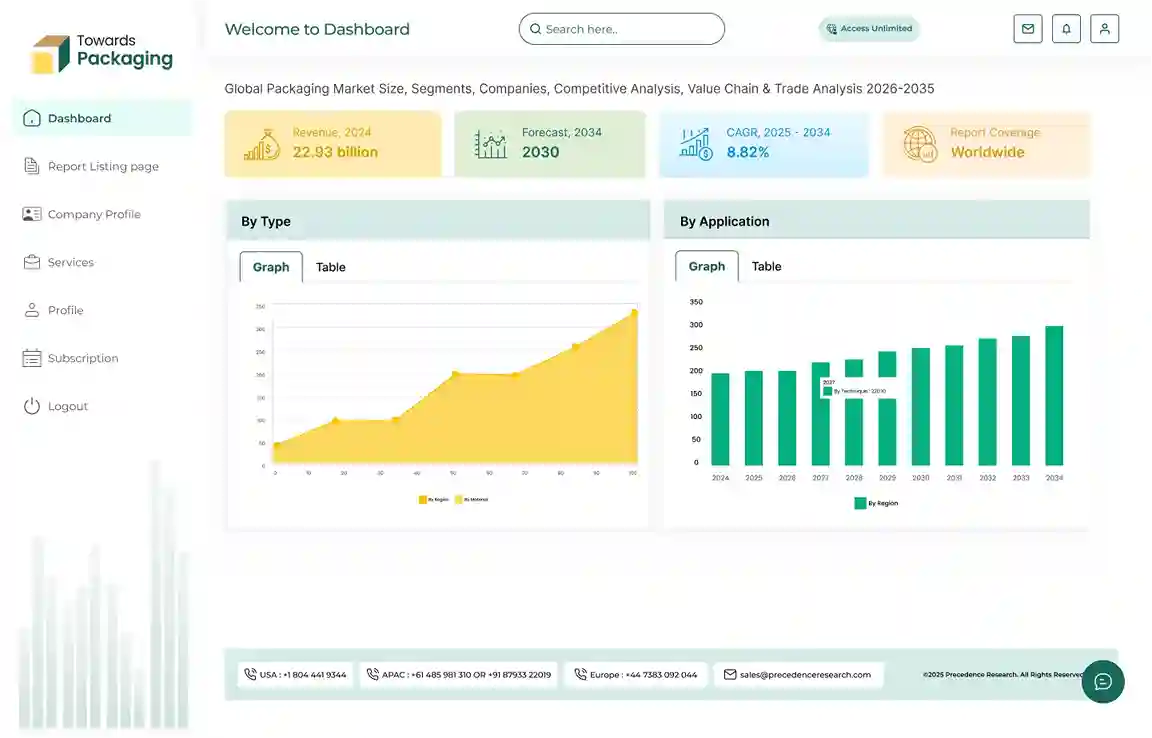

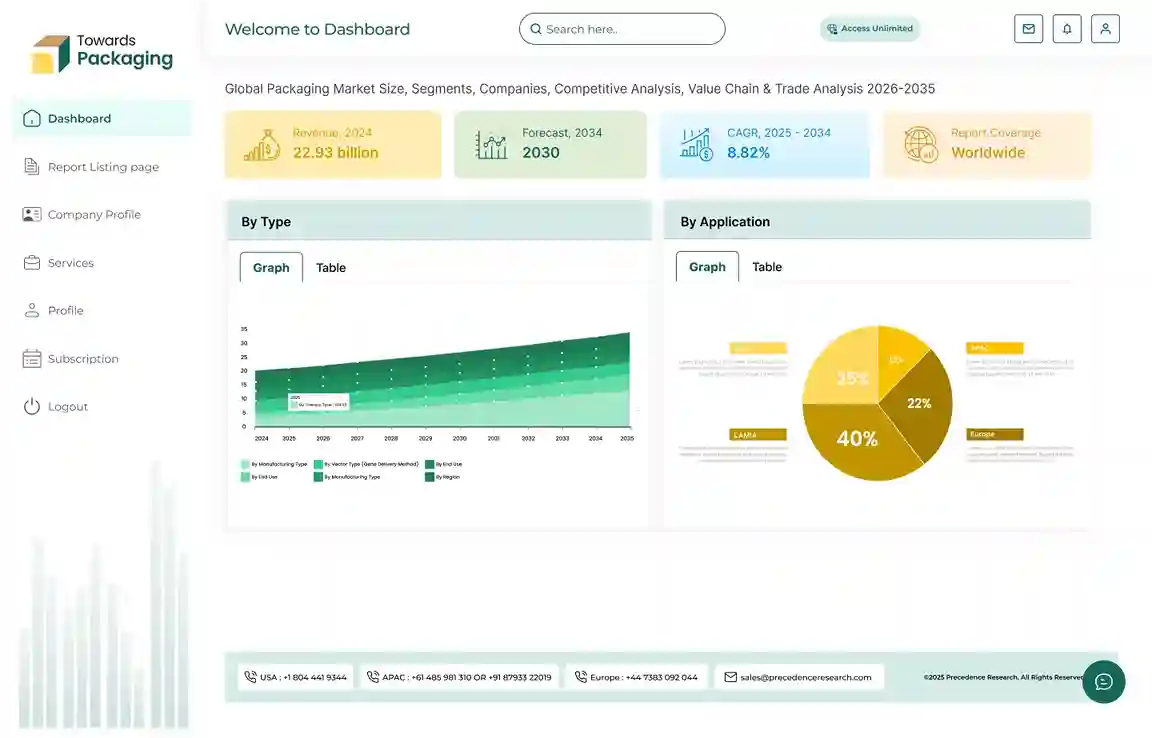

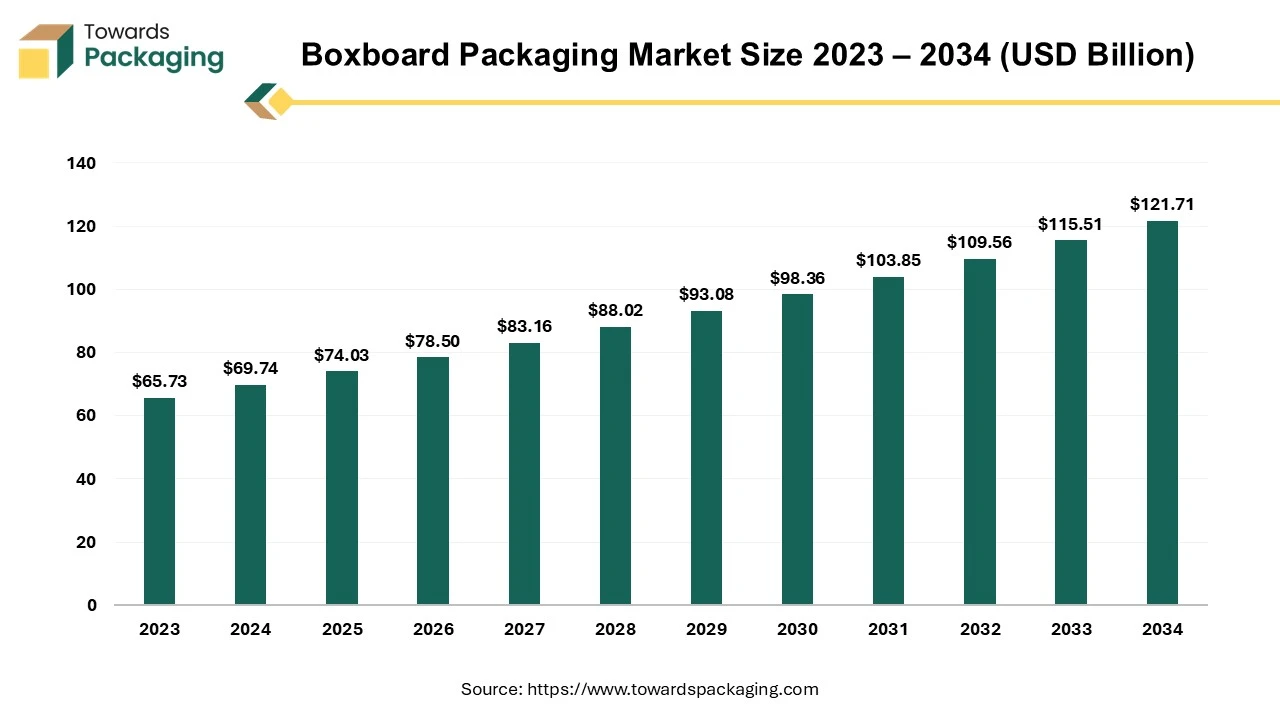

The boxboard packaging market is forecasted to expand from USD 78.54 billion in 2026 to USD 134.05 billion by 2035, growing at a CAGR of 6.12% from 2026 to 2035. The study comprehensively covers market segmentation by material (virgin, recycled), product type (boxes, trays, dividers, others), and end-use industries (food & beverage, pharmaceuticals, cosmetics, electronics).

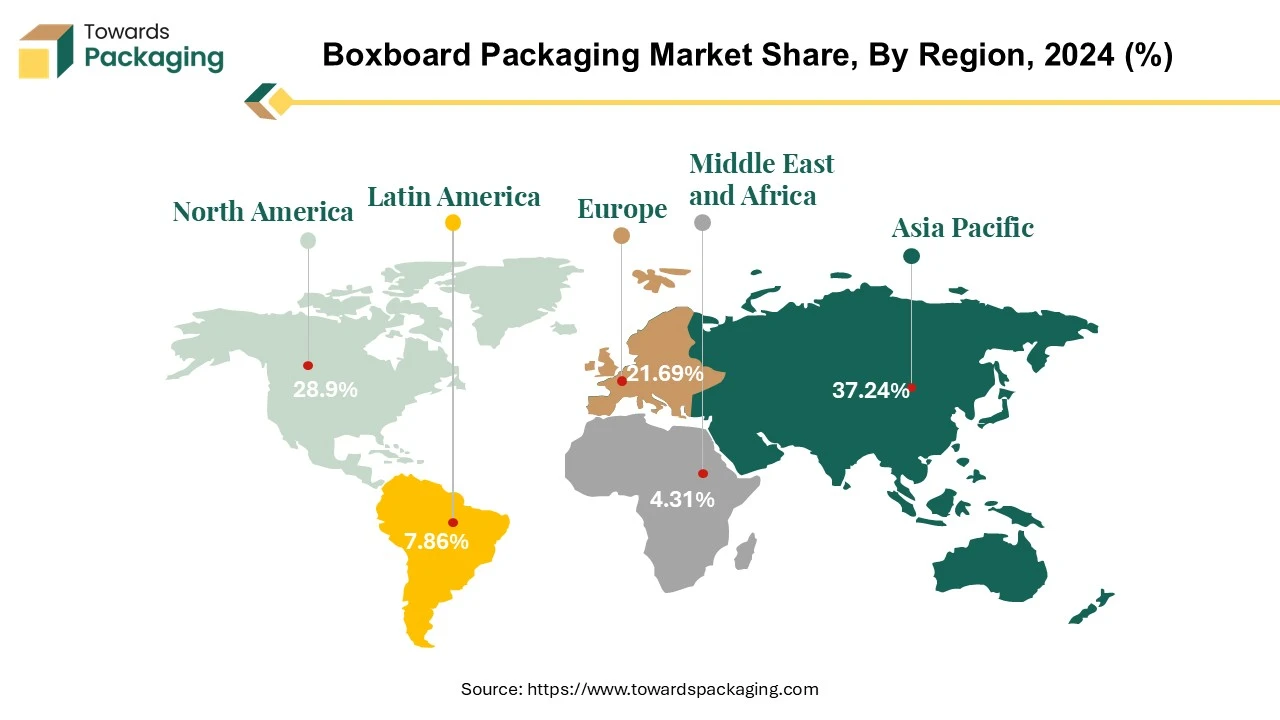

It provides detailed regional insights across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, along with analysis of key players such as International Paper, WestRock, Mondi, and Stora Enso. The report further evaluates trade statistics, import–export flows, and supplier networks, supported by a detailed value chain and competitive analysis.

The boxboard packaging market is likely to witness strong growth over the forecast period. The thin, lightweight carton known as boxboard is frequently used to transport a single item, like a toy, crackers, pair of shoes and luxury products, among others. Unlike corrugated boxes, it lacks the wavy corrugating medium intermediate layer. In addition, cardboard is utilized for the arts and crafts, displays, graphic board, partitions, cores and tubes for the gypsum wallboard items. When boxboard leaves the mill, it contains primarily recycled material and does not require strong paper fibers. It is constructed from a combination of used boxboard, used writing and printing paper, old newspapers, and corrugated boxes.

The increasing consumer preference for sustainable packaging and the rapid growth of the e-commerce sector are expected to augment the growth of the boxboard packaging market during the forecast period. Furthermore, the advancements in the printing technologies coupled with the food and beverage industry's focus on the eco-friendly and convenient packaging options are also likely to support the growth of the market. Additionally, the rise in urbanization and changing consumer lifestyles and expanding pharmaceutical and cosmetics industries as well as the government regulations and policies promoting sustainable packaging is also projected to contribute to the growth of the market in the years to come. The global packaging market size is growing at a 3.16% CAGR.

Boxboard Packaging Market Key Trends and Findings

- The market for sustainable packaging has grown substantially. The packaging sector is moving away from the plastic and towards the sustainable raw materials including the cardboard, plant-based papers and even cardboard derived from agricultural waste. In addition, clever designs also aid in minimizing material usage.

- Customers nowadays are more aware of the environment than in the past. They are prepared to spend more for goods that are packed sustainably. Organizations are being forced to implement eco-friendly packaging solutions by this change in the consumer behavior.

- A growing number of manufacturing processes are evolving into more ethical with efficient in terms of energy and sustainable production, CO2 emission reduction, ethical resource and human resource management and certified sustainability management are now industry norms.

- Globally, the proportion of the senior adults is expected to increase as the population ages. This also affects the handling and design of the packaging. Convenience features will respond to people's requirements and gain importance over the time. Changes in packaging handling will also result from things like diminished strength and dexterity and decreased fine motor skills.

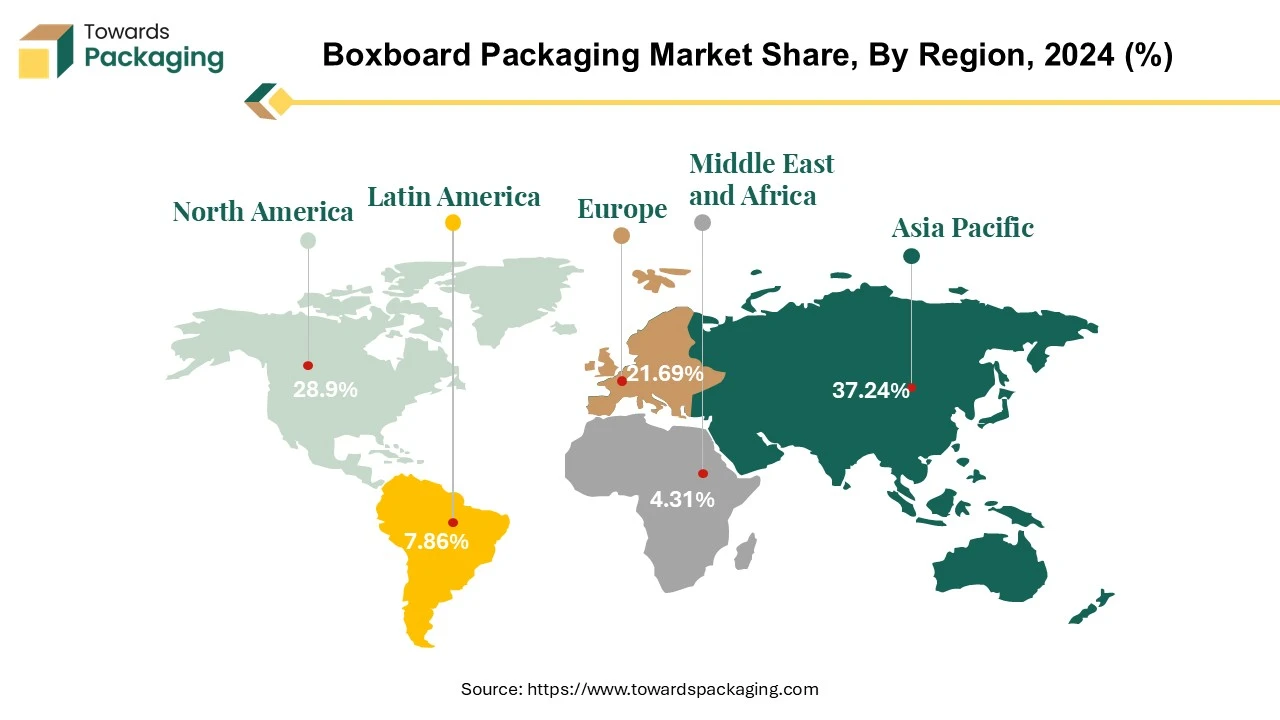

- Asia-Pacific is expected to grow at a fastest CAGR of 8.04% during the forecast period owing to the rising consumerism and the booming e-commerce sector as well as the increasing demand for packaged goods.

- North America held considerable market share of 28.90% in 2023. This is due to the high consumer awareness of sustainability and strong regulatory frameworks promoting eco-friendly packaging.

Boxboard Packaging Market Drivers

Rapid Growth of Online Retail

The increasing online retail is projected to support the growth of the boxboard packaging market during the forecast period. As per the data by the International Trade Administration, by 2027, it is projected that the worldwide B2C e-commerce revenue would reach USD$5.5 trillion, growing at a consistent 14.4% CAGR (compound annual growth rate). The consumer electronics segment is the leading segment followed by the fashion segment. This is owing to the increasing penetration of the internet and the widespread use of the smartphones.

According to the International Telecommunication Union, presently, almost 5.4 billion people, or roughly 67% of the world's population, use the internet. This is a rise from the 3.5% growth observed between 2021 and 2022 to 4.7% growth since 2022. In 2023, there was a 33% decline in the total number of people offline, with an expected 2.6 billion people living offline.

For customers around the globe, this has increased the accessibility and the convenience of online shopping. With only a few clicks, customers may now purchase whenever and wherever they choose, changing their expectations and tastes substantially. It is now essential to use packaging that can survive the rigorous conditions of the shipping and handling as online retail continues to grow at an unprecedented rate. Packaging for e-commerce needs to withstand several touch-points such as the warehouses, delivery vans and finally the customer doorsteps. Due to its strength, stiffness as well as the adaptability, boxboard is quickly taking the lead as the preferred material for e-commerce packaging. Its strong structure guarantees that products are protected against the damage during transit, reducing the likelihood of the returns and improving the customer satisfaction.

Boxboard Packaging Market Restraints

Environmental Concerns and Threat from Substitute Packaging Materials

The growing environmental concerns and threat from substitute packaging materials is anticipated to hamper the growth of the boxboard packaging market within the estimated timeframe. As per the data by Eurostat, in the EU, paper and cardboard packaging waste accounted for 34.0 million tonnes (40.3%) in 2021 followed by plastic packaging waste with 16.1 million tonnes (19.0%) and glass packaging waste with 15.6 million tonnes (18.5%). Also, the energy required to make paper is considered to be three times higher than that of the plastic, while exact figures are unknown. Compared to plastic, it is also more difficult to carry. According to PAC Worldwide, a conventional corrugated package weighs 0.7 pounds whereas a bubble mailer weighs 0.05 pounds. This difference results in increased fuel expenses as well as the vehicle emissions.

Furthermore, flexible packaging and plastics has gained popularity. Due to its reduced weight and resource consumption, flexible packaging generates smaller amount of waste products with less energy consumption. Since it can be built on site using roll materials, it substantially decreases the transportation expenses. It appears to the customer to take up less room when empty.

Additionally, retailers and product brands are collaborating to switch to the bio-plastic packaging from traditional petroleum-based plastics to reduce their greenhouse gas emissions and achieve environmental goals. The significant competition from these alternatives are frequently viewed as more practical and cost-effective, increases pressure on the boxboard manufacturers to innovate and improve the functionality as well as appeal of their products to maintain market share in an increasingly competitive environment.

Boxboard Packaging Market Opportunities

Government Regulations Favoring Eco-Friendly Packaging

The increasing government initiatives and regulations towards sustainable options are expected to create opportunities for the growth of the boxboard packaging market in the near future. Many governments worldwide are implementing stringent regulations and policies aimed at reducing the environmental impact, particularly concerning the use of the non-recyclable and the single-use plastics. The implementation of sustainable packaging practices is greatly aided by the regulations. They act as rules and requirements that companies have to follow, which promotes the responsibility along with the transparency in the packaging industry.

For instance,

- In March 2024, a tentative agreement was achieved by the Parliament and Council on revised regulations aimed at decreasing, reusing and recycling packaging, improving safety, and advancing the circular economy. By mandating that all packaging be recyclable, lowering the amount of dangerous materials present, eliminating needless packaging, increasing the use of recycled content and improving collection and recycling, the new regulations seek to make packaging that is utilized across the EU safer as well as environmentally friendly. The agreement mandates EU countries to minimize packaging, namely the quantity of plastic waste it produces. It sets package reduction targets of 5% by 2030, 10% by 2035 and 15% by 2040.

- In March 2024, In an effort to decrease the amount of single-use plastic waste generated in California, the California Department of Resources Recycling and Recovery (CalRecycle) proposed new recycling laws, financing and changes. According to this regulation, producers must make all single-use plastic food ware and packaging recyclable or compostable; sell 25% less single-use plastic food ware and packaging in the state by 2032; and recycle 65% of the single-use plastic food ware and packaging.

Due to this, companies are looking for packaging options that meet these regulations, which are growing the demand for the environmentally friendly substitutes like boxboard, which is often comprised of renewable materials and is recyclable.

Boxboard Packaging Market Key Segment Analysis

Material Segment Analysis Preview

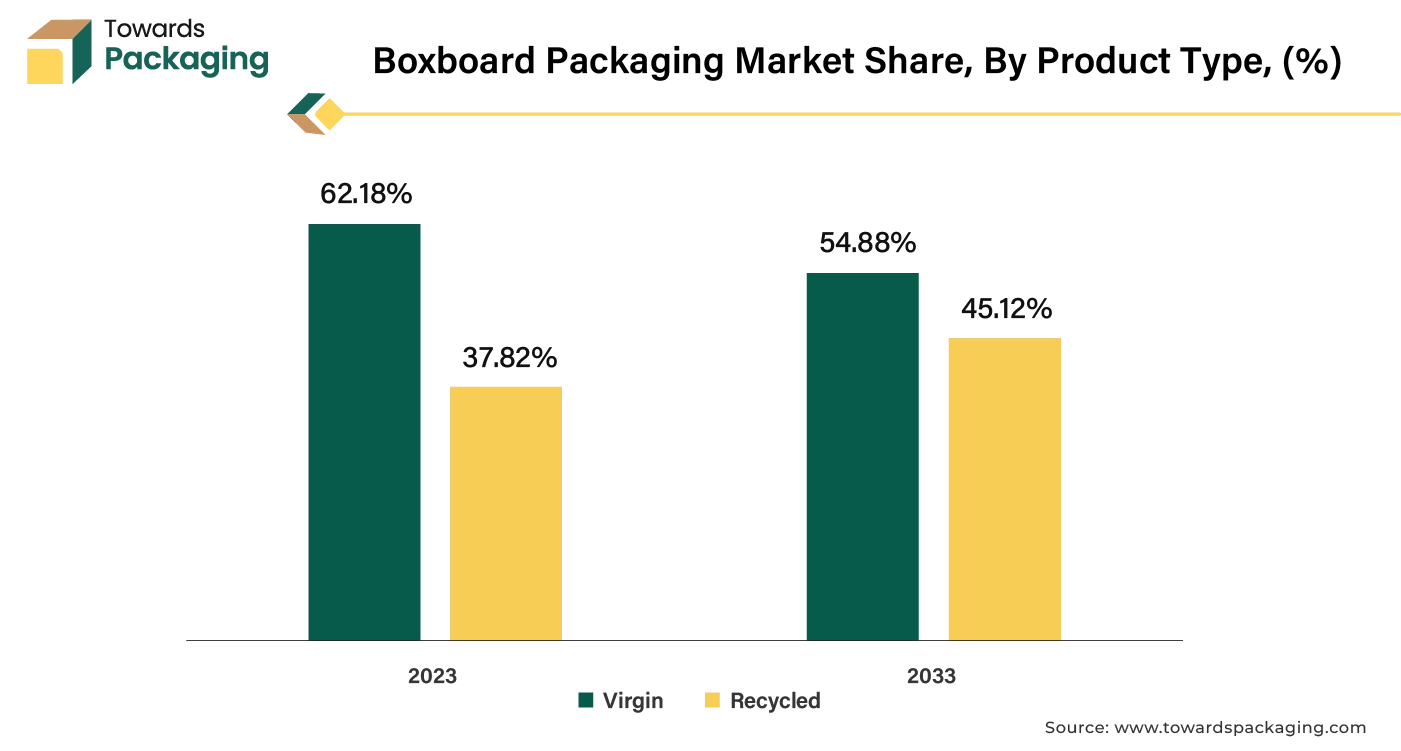

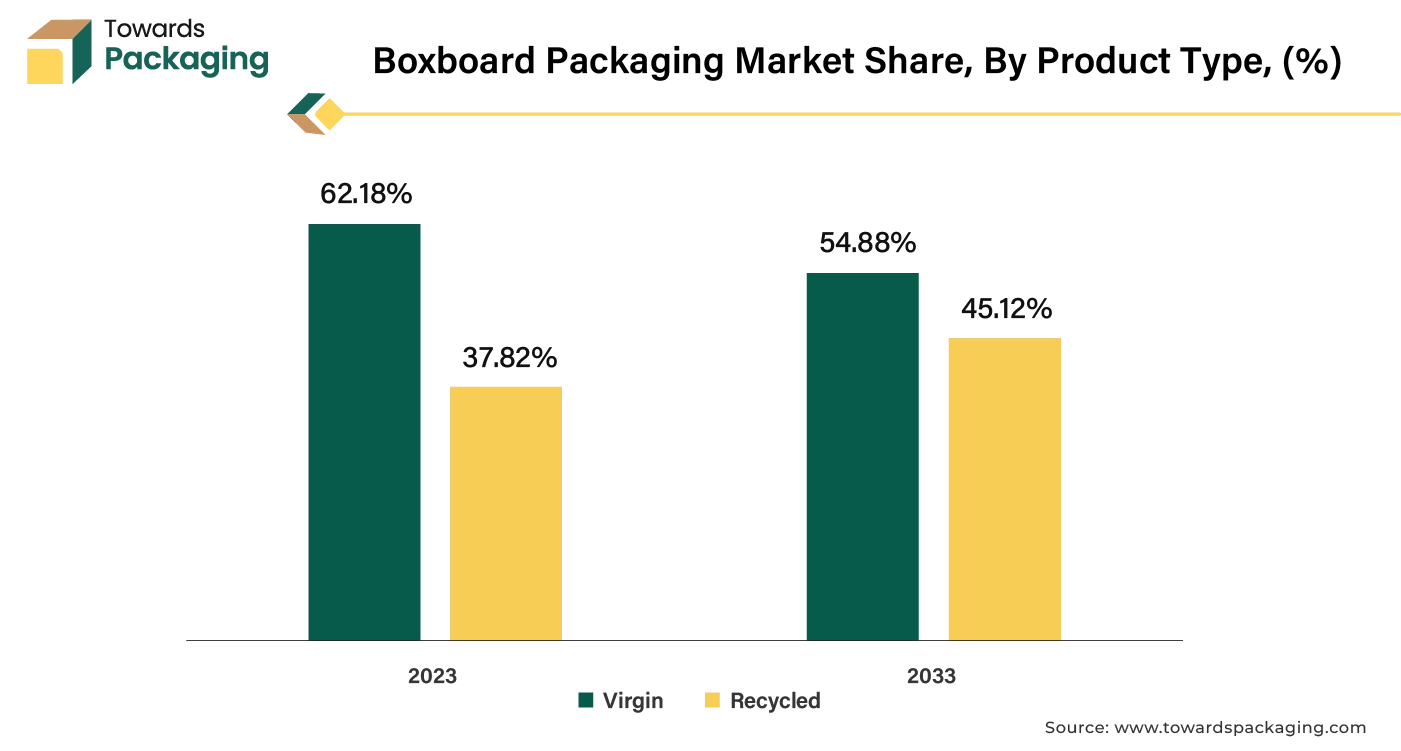

The virgin segment captured largest market share of 62.18% in 2023. Virgin fibers outlast their recycled counterparts in length and strength. They are therefore a better choice for bulky items or rough transit routes. Virgin boxboard is made from fresh, high-quality fibers, giving it the structural integrity needed to protect products, especially in sectors where packaging must endure rigorous handling and transport, such as the electronics and pharmaceuticals. Furthermore, virgin boxes provide better protection for goods kept in humid environments since they are more resilient to temperature fluctuations and dampness than recycled cardboard. After its initial usage, even virgin cardboard can be repurposed by the end consumer. Virgin fibers are undoubtedly better when it comes to of feel, look as well as functionality. These factors are likely to support the segmental growth of the market during the forecast period.

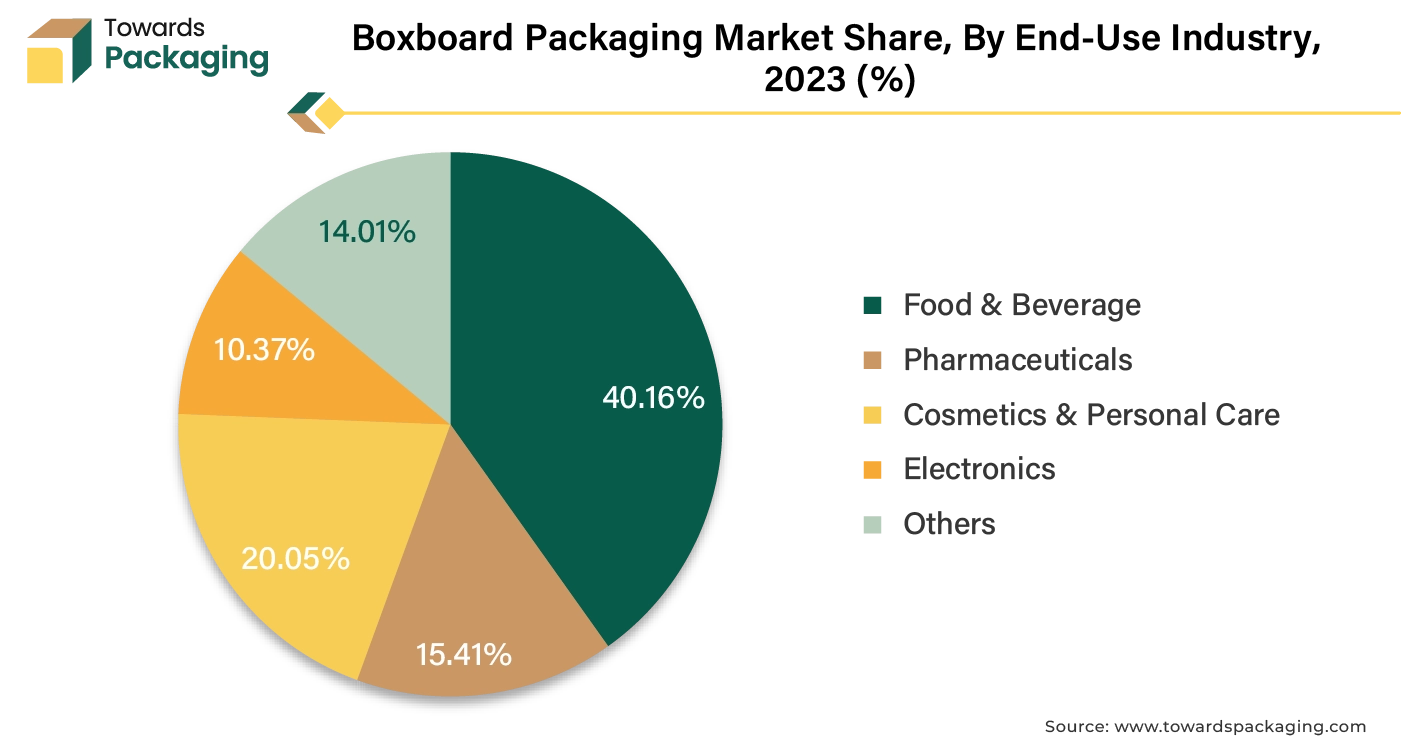

End-Use Industry Segment Analysis Preview

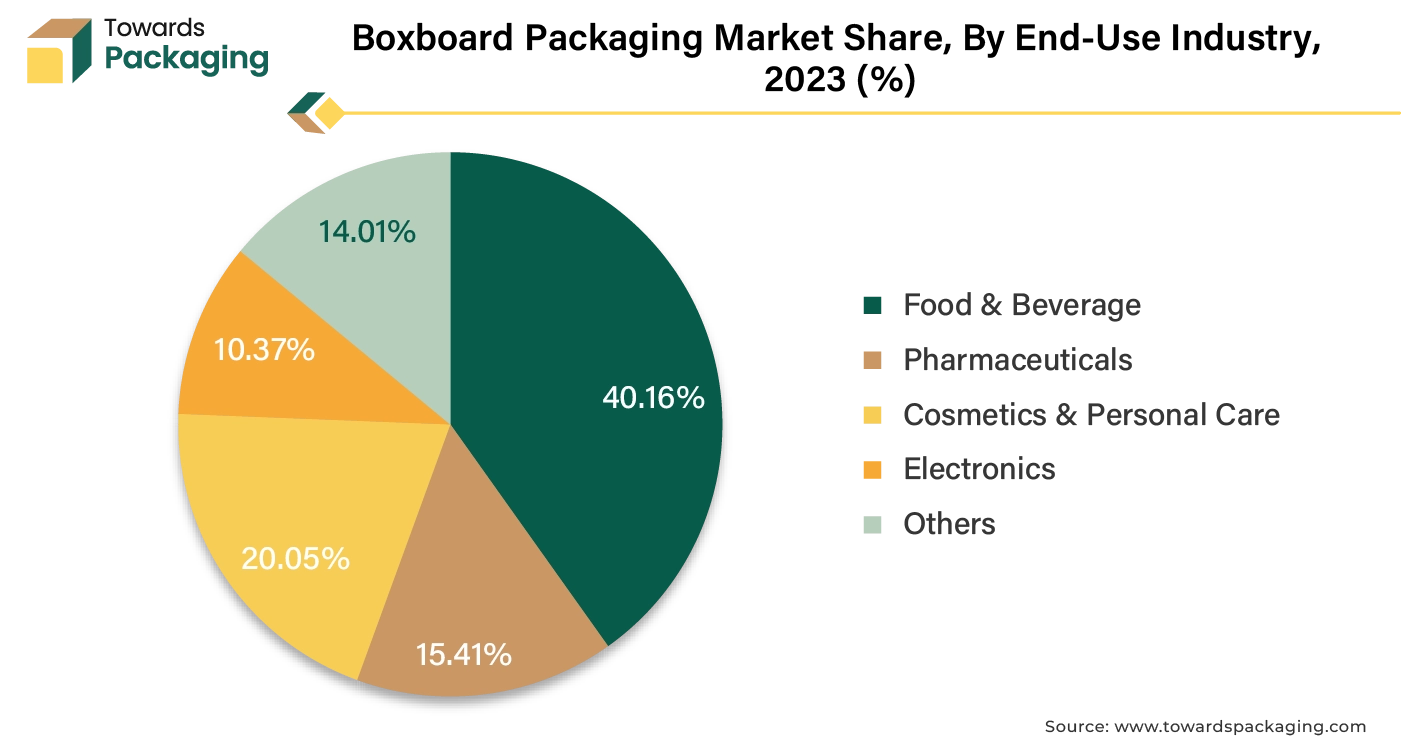

The food and beverage industry segment held largest market share of 40.16% in 2023. This is owing to the increasing demand for packaged and processed foods fueled by the rapid urbanization across the globe. Furthermore, the busy lifestyles, and a growing preference for convenience is also likely to support the growth of the segment in the years to come. The growing direct-to-consumer food delivery services and widespread use of mobile apps which has made ordering food online incredibly easy and accessible is also expected to contribute to the segmental growth of the market.

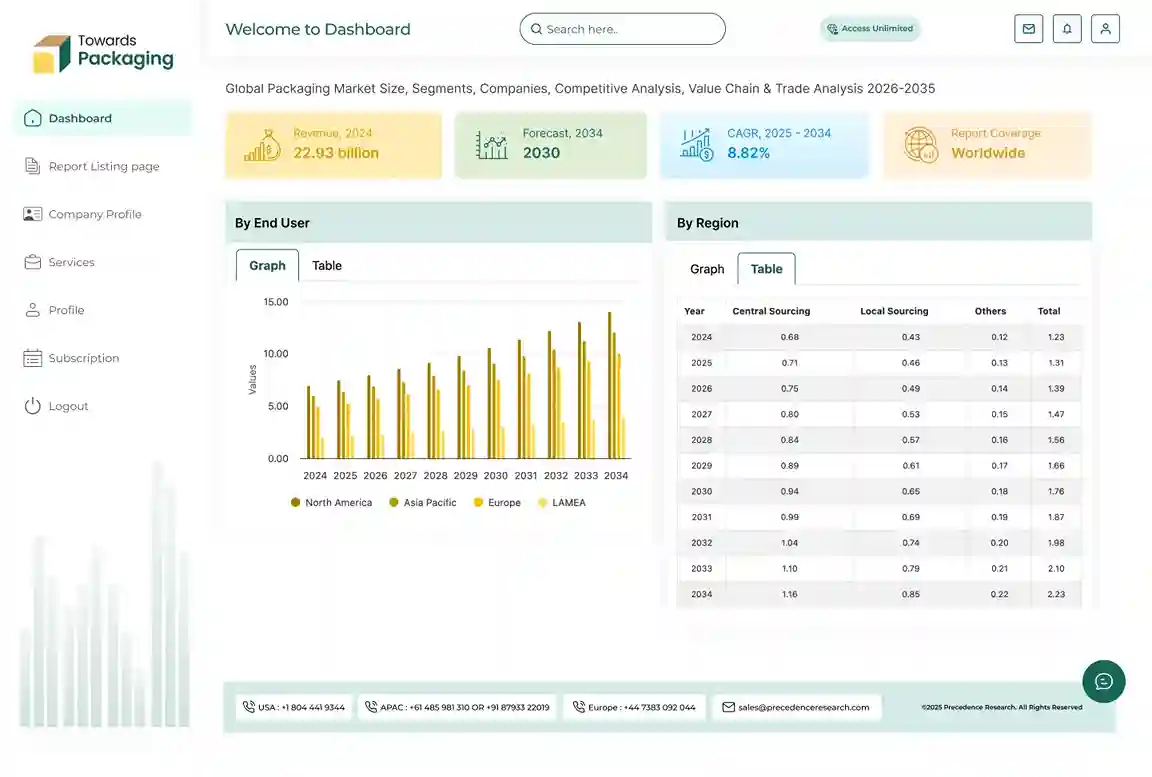

Regional Insights

Asia Pacific held is likely to grow at fastest CAGR of 8.04% during the forecast period. This is owing to the rapid urbanization and economic expansion in countries like China, India, and Southeast Asian nations. As per the statistics by the United Nations, over 2.2 billion people, or 54% of the world's urban population, reside in Asia. Asia's urban population is predicted to increase by 50% by 2050, adding 1.2 billion new residents. Additionally, the increasing internet penetration, smartphone usage and a growing middle class along with the growth of the e-commerce industry are also anticipated to promote the growth of the market in the region in the years to come.

China Market Trends

China boxboard packaging market is driven by the growth in the e-commerce platform in the country. China's e-commerce sector has seen unprecedented growth, with over 884 million online shoppers by June 2023. This surge has significantly increased the demand for corrugated and paper-based packaging solutions to ensure product protection during transit and to enhance the unboxing experience. Rapid urbanization and the expansion of the middle class have led to increased consumption of packaged goods. Urban living has prompted innovation in convenient food packaging, while the aging population requires senior-friendly designs, especially for pharmaceutical products.

China is integrating advanced technologies such as artificial intelligence (AI), blockchain, and the Internet of Things (IoT) into packaging solutions. These innovations enhance supply chain transparency, optimize inventory management, and improve product safety. Environmental concerns are driving the adoption of sustainable packaging practices. In 2022, China recycled 65.85 million tons of domestic waste paper, achieving a recovery rate of 53.1%. The government aims to establish a green standard system for courier packaging by 2025, promoting the use of recycled materials and eco-friendly designs.

The "Made in China 2025" initiative focuses on upgrading manufacturing capabilities, including the packaging industry. This policy encourages the development of high-tech, value-added packaging solutions, positioning China as a leader in advanced manufacturing.

North America held considerable market share of 28.90% in 2023. This is due to the increasingly prioritizing sustainability which is driving the demand for eco-friendly packaging options across the region. Also, the stringent environmental regulations in the U.S. and Canada aimed at reducing the plastic waste and promoting recycling is further expected to support regional growth of the market in the years to come.

For instance,

- In June 2022, The Single-use Plastics Prohibition Regulations were established by the Canadian government (SUPPR). Six kinds of single-use plastic products that are frequently discovered in trash and waste streams that are challenging to collect and recycle, and have minimal commercial value for recyclers are prohibited by the regulations from being made, imported, or sold. Furthermore, the growth of the food and beverage industry as well as the cosmetics industry is also expected to support the regional growth of the market in the near future.

U.S. Market Trends

U.S. boxboard packaging market is driven owing to innovation leadership and strong consumer base in the country. Companies like Amazon are leveraging AI to optimize packaging, reducing material usage and improving efficiency. For instance, Amazon's AI-driven Package Decision Engine has helped save an estimated 60,000 tons of cardboard annually in North America. Automation in packaging processes is enhancing productivity. Ranpak, a sustainable packaging company, has integrated AI and automation to streamline box filling operations, resulting in a 10% revenue growth in 2024.

Environmental concerns are prompting shifts toward sustainable packaging. The U.S. has a robust recycling infrastructure, with old corrugated containers (OCC) being one of the most recycled materials. Legislative actions, such as California's Senate Bill 54, mandate reductions in single-use plastic packaging, encouraging the adoption of recyclable and compostable materials. Brands are focusing on enhancing the unboxing experience through customized packaging, which not only protects the product but also serves as a marketing tool. This trend is particularly prominent in sectors like fashion, electronics, and cosmetics.

The U.S. boasts a well-developed logistics and supply chain infrastructure, facilitating efficient packaging and distribution processes. U.S. companies are at the forefront of packaging innovation, integrating technologies like AI, machine learning, and smart packaging solutions to meet evolving consumer demands. A large and diverse consumer base with high purchasing power drives continuous demand for packaged goods, reinforcing the need for advanced packaging solutions. Supportive regulations and policies encourage sustainable practices and innovation in packaging, providing a conducive environment for market growth.

Europe’s Stringent Government Regulations to Support Steady Growth

Europe region is seen to grow at a notable rate in the foreseeable future. The European Union's stringent environmental regulations are propelling the shift from plastic to sustainable packaging materials like boxboard. The EU's Single-Use Plastics Directive and recent agreements aim to reduce packaging waste by setting ambitious recycling and reduction targets, encouraging the adoption of recyclable and biodegradable materials. Europe boasts some of the highest paper and board recycling rates globally, with countries like Germany recycling over 80% of their paper and board waste. This commitment to a circular economy enhances the appeal of boxboard packaging, which aligns with sustainability goals and consumer expectations. The surge in e-commerce and the growing demand for premium, customizable packaging solutions are fueling the boxboard market.

Consumers increasingly seek aesthetically pleasing and eco-friendly packaging, prompting brands to adopt advanced printing technologies and innovative designs in boxboard packaging. The European boxboard packaging industry is experiencing consolidation, with major players like Mondi acquiring assets to enhance their market presence. Such strategic moves aim to expand operations, improve environmental footprints, and capitalize on the growing demand for sustainable packaging solutions. Germany leads in environmental sustainability and recycling infrastructure, driving demand for recyclable boxboard packaging, especially in food and pharmaceuticals.

France is the Anti-Waste Law for a Circular Economy promotes recyclable alternatives like boxboard, boosting its usage in food, beverage, and luxury goods sectors. The U.K. is the Plastic Packaging Tax incentivizes the use of recycled materials, encouraging the adoption of paperboard packaging solutions.

Boxboard Packaging Market Recent Developments by Key Players

- In April 2025, Stora Enso announced the launch of the Performa Nova, a next-generation folding boxboard (FBB) that combines outstanding performance and high yield, as part of its expansion of its core packaging material offering. With a focus on dry, frozen, and chilled food, chocolate, and confections, the new board is made to satisfy the increasing demand for packaging solutions that are efficient, recyclable, and ecological. Customer orders for Performa Nova are now being accepted after Stora Enso's cutting-edge consumerboard production line in Oulu, Finland, went online. The introduction, which is the consequence of a significant investment in fiber-based materials, demonstrates Stora Enso's sustained dedication to packaging innovation and sustainability.

- In March 2025, Hinojosa Packaging Group introduces the ground-breaking "Bottle Clip Carrier" system in partnership with KHS Group, one of the top producers of filling and packaging systems for the beverage and liquid food industries worldwide. This innovative environmentally friendly packaging option ensures bottle safety and convenience during transportation by substituting 100% recyclable and biodegradable cardboard for plastic film. In addition to cutting down on plastic usage, this approach lowers energy consumption during production and opens the door for the adoption of more ecologically friendly and sustainable packaging and transportation options. The Bottle Clip Carrier is a solution to the problem of lessening the beverage and packaging industries' environmental impact, and the way this useful design is presented demonstrates both businesses' dedication to sustainable innovation.

- June, 2023: A novel new rapid box assembly method from Macfarlane Packaging was introduced, enabling packers to quickly construct cardboard boxes and achieve up to a 70% boost in packing efficiency. The one-of-a-kind packaging machinery will be manufactured just for Macfarlane clients. It utilizes box designs that are only available through Macfarlane and have been optimized to offer greater performance strength with less material, improving the pallet fill and lowering the transportation costs and CO2 emissions.

- March, 2022: At its Claremont consumer packaging facility, WestRock Company started construction on a 285,000 square foot expansion. The One North Carolina Fund provided a performance-based grant to support the $47 million project, which was anticipated to generate 50 new employments. WestRock will be able to produce sustainable, fiber-based packaging for some of the top food, beverage, and food service brands in the world due to the expanded plant and its staff.

Boxboard Packaging Key Market Top Players

- International Paper Company

- WestRock Company

- Mondi Group

- Smurfit Kappa Group

- Stora Enso Oyj

- Nippon Paper Industries Co., Ltd.

- Cascades Inc.

- Graphic Packaging International, LLC

- Metsa Board Corporation

- Georgia-Pacific LLC

Boxboard Packaging Market Segments

By Material

- Virgin

- Recycled

By Product Type

- Boxes & Cartons

- Inserts & Dividers

- Trays

- Others

By End-Use Industry

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Electronics

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Tags

FAQ's

Select User License to Buy

Figures (4)