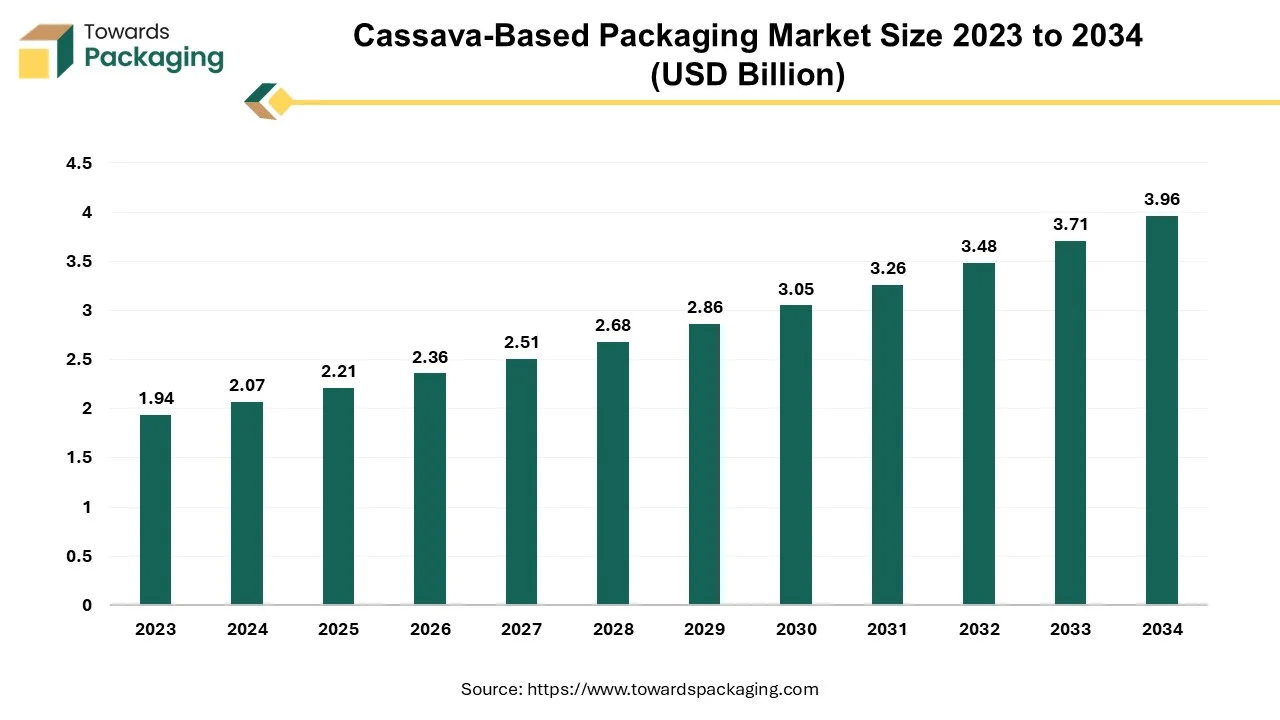

The cassava-based packaging market is forecasted to expand from USD 2.36 billion in 2026 to USD 4.22 billion by 2035, growing at a CAGR of 6.7% from 2026 to 2035. The report provides a detailed breakdown by product type (cups, trays, bowls, plates, containers, cutlery, clamshells) and end-use sectors (food, beverages, cosmetics, pharmaceuticals, agriculture, and household industries).

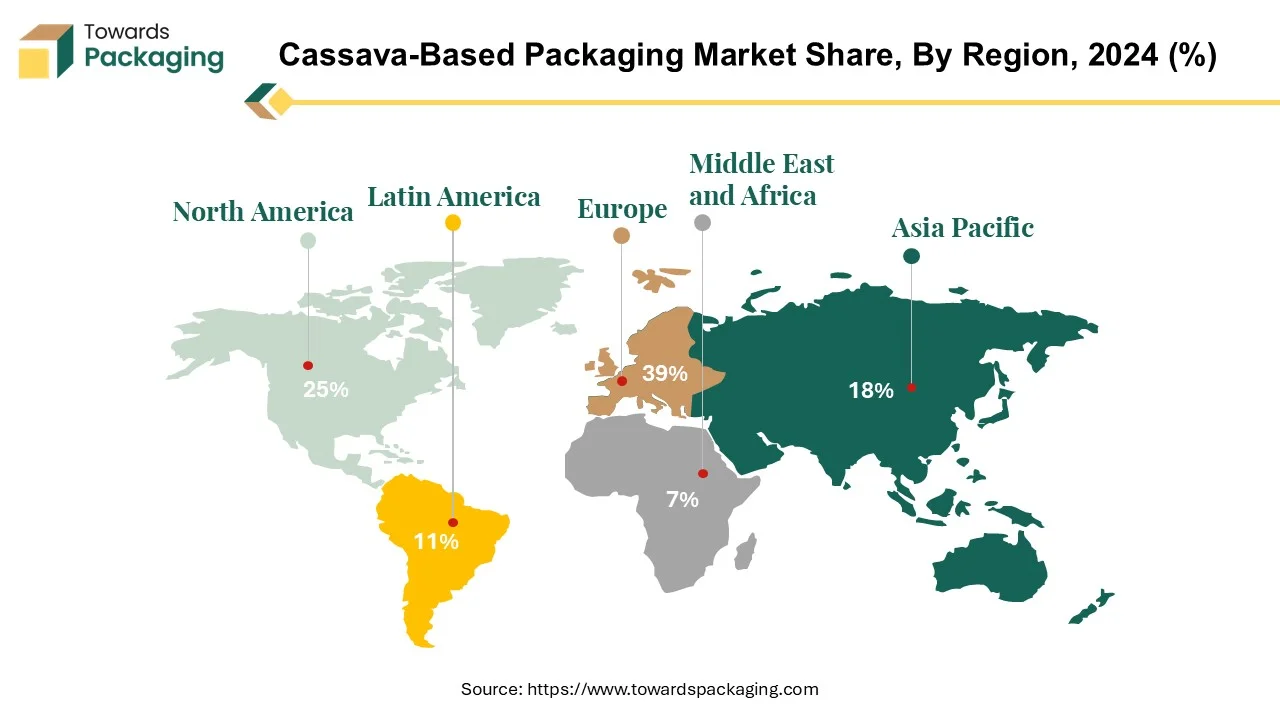

Regional analysis highlights Europe and North America as key markets driving sustainability trends, while Asia Pacific remains a leading supplier hub. The study covers the value chain, raw material sourcing from cassava producers, trade flow data, and profiles of top manufacturers such as Avani Eco Hub, Universal Biopack, BioPak, EcoNest Philippines, and Affinity Supply Co.

The cassava on the market as a substitute for plastic offers a sustainable option that has been spurred on by consumer demand and changing consumer behaviour. Items like palms made from cassava can be used instead of traditional plastic bowls and cups, giving us options that are more environmentally-friendly. The main impacts are rises in production expenses and the government subsidies and consumers’ attention generation. Trends however, can be in either sustainability, bio-based, or outright modern materials. This demand may be substantially met in Europe and North America by the packaging materials ban on non-biodegradable material. The retail store is an important part of the program that aims at solving the cassava problem. Leading businesses thus concentrate on breakthrough and leaving-a-legacy status in order to stay ahead.

Cassava is a biodegradable material which is originated from cassava roots. Varieties of products made from cassava such as cups, glass, plates, bowls and others. These products are used in various industries of food and beverage, cosmetics, pharmaceuticals, household and others. Due to the environmentally friendly and lightweight design of cassava packaging, it has experienced a surge of popularity in developed countries as these fast-paced lifestyles have made food distribution and takeout centres more and more occupied, serving as an adequate protection against air contamination.

Cassava-based packaging, which is reusable and therefore excellent for keeping our environment clean, is the best available option for employing plastic waste packaging. Strict emission interests of government cause packaging of cassava to be a favourite of end customers. The growth in the cassava-based packaging market is supplied mainly by an increase in the demand for eco-friendly packaging. Cassava-based packaging makes it an ideal alternative of the plastic and Styrofoam used by many companies because it biodegrades as well as the growing concern towards the environment. That which makes the cassava packing business a thriving one is the introduction of the food sector as cassava-based packaging facilitates both hot and cold foods and is microwave safe.

The outbreak of COVID-19 has an advantage for packaging business of cassava thanks to concerns over health and environment of end users. There was a conflict that arose during the pandemic among manufacturers of cassava-based packaging which was due to the slow manufacturing and scarcity of raw materials, but the current law has enabled resumption of the production process which shows a positive surge in demand for cassava packaging.

The production of cassava-based packaging is accompanied by high input costs of initial investment, therefore, ultimately leading to high production costs, and users tend to prefer reusable packaging options which limits demand for cassava packaging. Government agencies offer financial incentives to the cassava-based packaging makers, which will result in increasing the industries pool and providing opportunities for new entrants as well.

Cassava-based packaging circulation in the packaging companies has only recently gained traction in Europe, due to public acceptance of environmentally friendly products. While the burden on plastic pollution and traditional packaging materials has increased, so has the focus on environmental issues, prompting European countries to seek sustainable alternatives. Cassava's vacuum-packing qualities are becoming more widely known, making it an ideal candidate given its biodegradability and compostability, which align with the EU's aims to eliminate disposables and ensure a circular economy.

The European customers have turned to the cassava products due to their low environmental footprint. Governments play their part in promoting the use of environmental type of packaging materials through setting up rules and regulations. Improved packaging technology has been singled out as the main factor behind the increased consumption of cassava-based packaging which is being replicated efficiently in other products.

The difference from Asia in market leadership in cassava-based packaging can be brought by the consumers' environmental concern, supportive policy from the government and technological breakthrough in packaging. As the public grasps the seriousness of the environmental crisis that the world is dealing with together and the need for sustainable packaging the trend is expected to grow in this direction.

Cassava-based packaging industry is going through an incredible growth movement in North American because of the government banning on environmentally unfriendly packaging materials. Growing awareness and worries about the threat of plastics to the environment and ecosystems, some of the governments of North America limiting and regulating the use of non-degradable packaging materials. It has in fact created high demand for eco-friendly alternatives like cassava-based packaging.

Another factor contributing to the market growth in North America is that North Americans are found to be more inclined towards eco-friendly products. As environmental problems become more prevalent, people are developing a passion for goods with the smallest ecological footprint including packaging. The use of cassava helps offer a biodegradable and compostable version of traditional plastic packaging that attracts shoppers who are environmentally-conscious.

Innovations in packaging technological area precipitate greater growth of the industry in North America. Through improve of technologies in the manufacturing, plastic packaging from cassava has become even more available and affordable and can meet the particular needs of any business. One of the main factors that have been responsible for great increase of the market value for sustainable packaging solutions in North America has become the combination of government regulations, consumers’ demands and latest technological achievements.

Cassava cups and glass, crafted from tapioca starch, offer a lightweight, heat-tolerant alternative to conventional paper, plastic, and Styrofoam cups and glass. They find application in cafes, beverage outlets, and outdoor activities like camping due to their versatility and eco-friendliness. Their heat tolerance of up to 100°C makes them microwave-safe, catering to modern consumer preferences for convenience.

The market for cassava cups is witnessing robust growth, driven by increasing environmental concerns and the shift towards sustainable packaging solutions. As consumers become more conscious of the environmental impact of single-use plastics and seek alternatives, cassava cups emerge as a viable option. Their ability to biodegrade and compost naturally after use, returning to the soil without requiring commercial composting facilities, resonates with eco-conscious consumers.

Cassava cups are 100% made from tapioca starch, replacing traditional raw materials derived from fossil fuels, further enhances their appeal. Their ability to reduce waste and contribute to soil health by composting at home aligns with the global push towards circular economy practices. The market for cassava cups is expected to continue expanding as businesses and consumers prioritize sustainability in their choices.

The cassava-based packaging as an eco-friendly alternative is great especially for now where traditional packaging have created environmental challenges for us. Employing the starch of cassava as edible packaging, these examples are among the most promising innovations that are in line with the global trend of sustainable practices. While this material presents these advantages, there are some challenges that manufacturers need to be aware of such as the vulnerability of this material to water absorption, the cost aspect, the complicated supply chain, and lastly, which is a bit less obvious the performance standards on which this material is put under survey. The structural stability could show sensitivity to moisture and this will as well affect the sensory or barrier properties of the food product.

Technology solutions are more expensive when compared with old generation materials, which makes their implementation in low-cost areas difficult. A regular cassava supply in the chain makes the chain even much more complex. These issues did not seem to be a hindrance in the growth of the production of food packaging from cassava which was market oriented. Enlarged customer demand for the packing products with low carbon footprint and regulatory requirements for reducing use of plastic are the key states of this development. Research and Development works are in a process to solve challenges, as cassava-based packaging is growing way stronger as it equals other packaging companies in the food packaging industry.

The offline distribution channels, providing the convenience of physical retail outlets and wholesalers, play a key role in expanding the cassava-based packaging industry. These channels deliver immediate customer and business interaction covering the whole range of cassava-based packaging solutions. In retail settings, cassava-based packaging is used in different sectors such as food packaging for fresh fruits, snacks, bakery items and ready-to-eat meals. Majority of supermarkets and grocery shops feature the cassava bags, trays and containers, targeting customers who are inclined to the environment. Specialized retail stores with sustainable products inventory greatly strengthen the market by displaying various cassava-based packaging alternatives.

Retails are essential in the spread of the market by way of providing visibility, accessibility, and educating consumers on the advantages of cassava-made bags thus steering them towards buying green products. Wholesalers are intermediaries that buy the bulk quantities of cassava-based packaging materials from the manufacturers and sell them to retailers on a larger basis. Their well-developed distribution channel provides a good opportunity for the cassava-based products to enter the market and increase the penetration and growth. Retail and wholesale channels are the focus of collaborative efforts towards the promotion of the use of cassava-based packaging as a sustainable substitute for traditional packaging materials.

The competitive landscape of the cassava-based Packaging market is dominated by established industry giants such as Avani Eco Hub, Universal Biopack, EcoNest Philippines, JáFui Mandioca, greenhope, Affinity Supply Co, Garnier, Parchem fine & specialty chemicals (US), UBUNTOO., GBG Indonesia, and Biogreen Bags. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Avani Eco Hub leads the way in developing all-natural packaging materials from cassava roots. Their tactic focuses on innovation and sustainability, therefore, on their eagerness to make the top-notch alternatives to traditional packaging materials.

Affinity Supply Co is an eco-friendly packaging manufacturer, its unique products are made from natural fibers like cassava, but also starch. They highlight the research and development to create and innovate well adapted with environmental friendly approach.

EcoNest Philippines is extraordinary warning on the two words, one contains the green – sustainable and then next conservation, polls in biodegradable packaging solutions, it picks non-plastic stuff like cassava starch. Their strategy is a combination of the lateral thinking with the huge domestic market expansion as well as the development of foreign business opportunities.

BioPack is an innovative company that is devoted to creating eco-friendly packaging using renewable materials such as cassava starch. Their plan can be summed up by their product innovation, which guarantees that the cassava-based packaging is as superior as any in the market. As its main function is to work with food and beverage firms, retailers, and government agencies to create a customer base which will be aware of their eco-friendly packaging methods.

By Product Type

By End Use

By Distribution

By Region

January 2026

January 2026

January 2026

January 2026