Fiber Bale Packaging Market Disruptive Trends and Future Potential

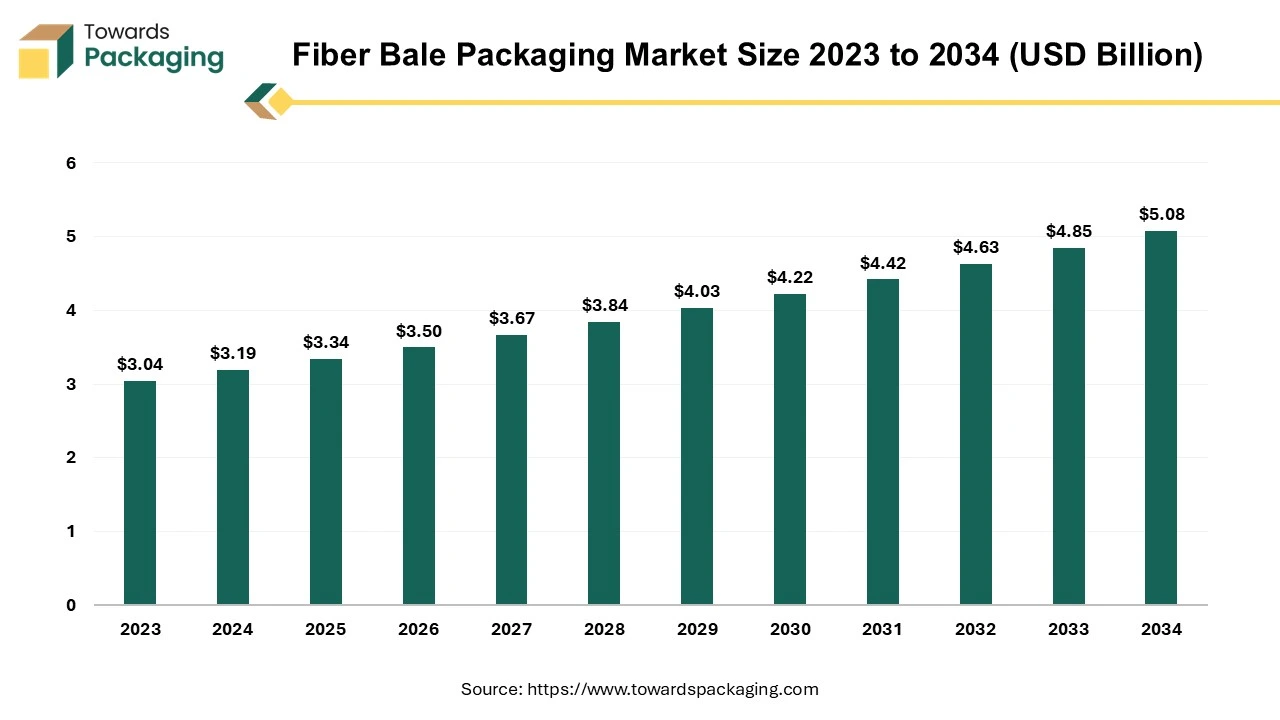

The fiber bale packaging market is forecasted to expand from USD 3.50 billion in 2026 to USD 5.34 billion by 2035, growing at a CAGR of 4.79% from 2026 to 2035. This report covers in-depth market size analysis, detailed segmentation by material types (PE, PET, PP), bale weight categories, and end-use applications such as textiles and agriculture. It also provides regional insights into the growth prospects in North America, Europe, APAC, Latin America, and the Middle East & Africa. Furthermore, we analyze the competitive landscape, key manufacturers and suppliers, as well as the trade dynamics within the market.

The fiber bale packaging market is likely to witness strong growth over the forecast period. Fiber bale packing requires shrinking items into huge, compact bundles that are then securely wrapped and tied with materials like wires or cables. Although this type of packaging is especially useful for bulk goods handled by a variety of industries, it is especially common for commodities such as cotton, hay and clothing materials. Due to its many advantages, this packaging is a top pick for companies looking to improve their shipping handling operations.

The increasing global demand for textiles and the population growth along with the rising disposable incomes are expected to augment the growth of the Fiber bale packaging market during the forecast period. Furthermore, the growing sustainability concerns are pushing industries toward eco-friendly packaging options which are further driving its adoption globally. Additionally, the regulatory pressures in both the developed and developing regions as well as the expansion of e-commerce and the rise in the global recycling activities, mainly for textiles is also projected to contribute to the growth of the market in the years to come. The packaging industry size is growing at a 3.16% CAGR.

Key Trends and Findings

- There is a shift towards the sustainable packaging alternatives due to the growing environmental concerns. Fiber bale packaging, which is frequently manufactured from the recyclable materials, corresponds with the worldwide environmental objectives. Companies are also progressively adopting the sustainable methods such as limiting their usage of plastic and switching to the natural or recycled fibers.

- The textile recycling companies is witnessing an increase in demand for fiber bale packaging as the circular economy becomes more prevalent. To guarantee that recycled fibers remain uncontaminated and retain their quality during transit and processing, they must be packaged securely and efficiently.

- Waste management is quickly becoming as a major challenge for the businesses of all sizes. Businesses are searching for the most effective approaches to incorporate recycling into their standards for the circular corporate responsibility. Everyone wants to know ways to handle the waste, including inspectors and customers. Utilizing the balers guarantees that the recyclables in the produce will be recycled.

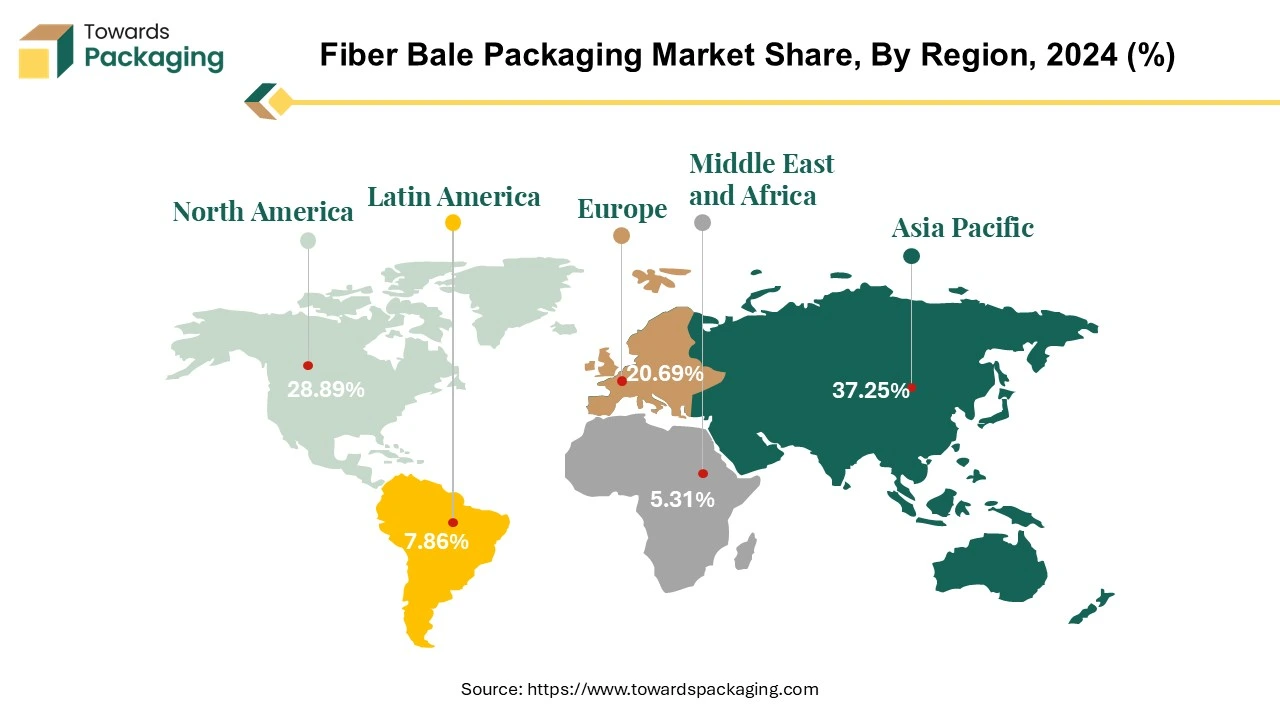

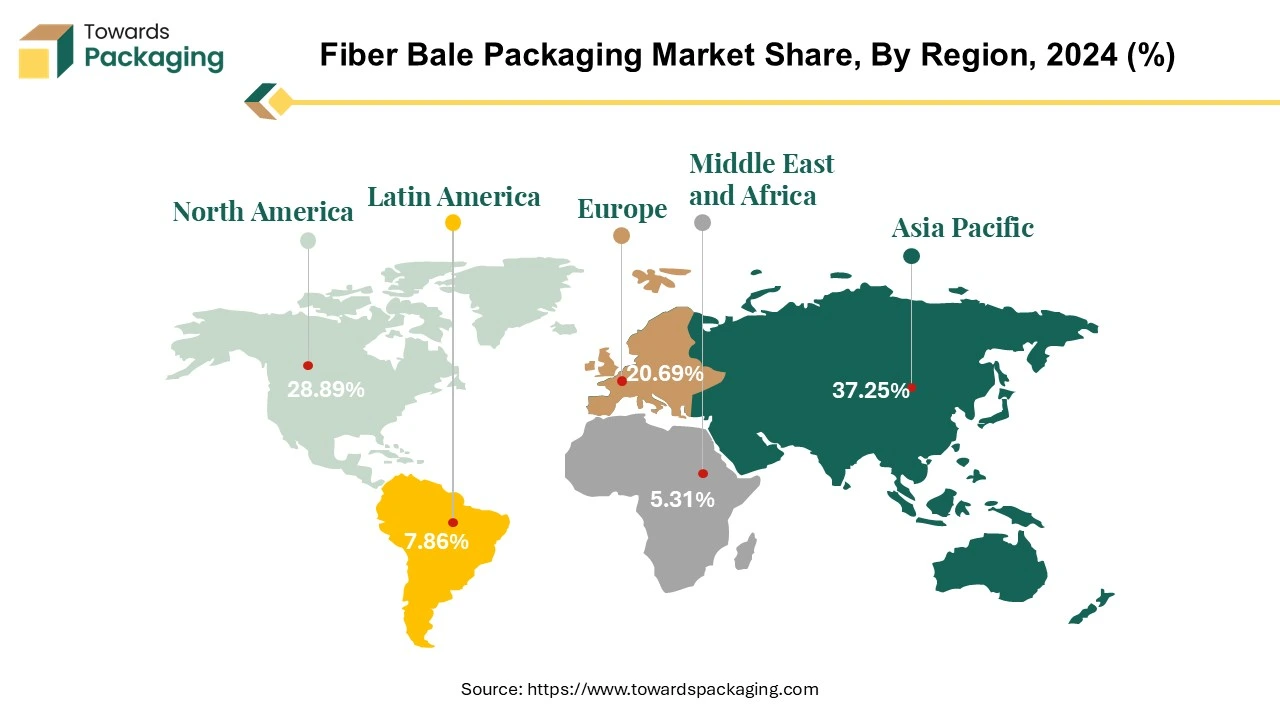

- Asia-Pacific is expected to grow at a fastest CAGR of 6.58% during the forecast period owing to the expansion of the textile industry, the increasing adoption of automation in textile manufacturing and the growing middle class.

- North America held considerable market share of 28.89% in 2024. This is due to the well-established textile industry, regulatory requirements related to environmental protection and recycling and the growing adoption of the sustainable packaging materials.

Market Drivers

Increasing Textile Production

The increasing textile production is projected to support the growth of the fiber bale packaging market during the forecast period. This is owing to the population growth, increase in disposable incomes and changing fashion trends. As per the data by the US Census Bureau, the Manufacturers' Shipments, Inventories, and Orders (M3) survey and the Annual Survey of Manufactures (ASM), the expected value of shipments of U.S. clothes, textiles, and man-made fiber in 2022 was $65.8 billion, up from $64.04 billion in 2021. Correspondingly, according to the U.S. Department of Commerce and U.S. International Trade Commission, In comparison to 2021, US exports increased as well. Fiber, textile and clothing exports totalled $34 billion in 2022 as compared to $28.4 billion in 2021. As per the figures by the US Census Bureau and the Annual Capital Expenditures Survey (ACES), compared to $1.85 billion in 2020, investments in the production of fabric, yarn, clothing and sewn products reached $2.27 billion in 2021.

This increase in the production volumes is likely to increase the demand for efficient fiber bale packaging systems for managing the larger quantities of the raw materials. Furthermore, the need for effective and dependable packaging options to handle the massive volumes of raw fibers such as the cotton, wool and synthetic materials, is rising as economies like China and India keep expanding their textile manufacturing capacities. Due to their substantial manufacturing as well as exporting contributions to the global textile industry, these countries are also driving the demand for the premium packaging that guarantees the secure storage and transit of fibers from suppliers or farms to the manufacturing facilities.

Market Restraints

Availability of Alternatives to Limit the Market Growth

The availability of the various substitute packaging is projected to hinder the growth of the fiber bale packaging market during the forecast period. One of the most significant trends impacting this market is the rising popularity of reusable and returnable packaging systems. Reuse packaging is defined as packaging that is intended to be used more than once. These kinds of packaging are long-lasting, simple to use and easy to keep clean.

These include transport and industrial packaging as well as consumer packaging like containers for beverages and zip-lock bags. By lowering the demand for production, it aids in further reducing the carbon impact. Reducing the frequency of single-use package manufacturing allows businesses to save labor, energy and raw material costs. There are applications of reusable packaging in both residential and commercial sectors. It is frequently employed in the commercial sector for shipping raw materials to the processing unit and to move subcomponents to the assembly location.

Furthermore, the emergence of biodegradable and compostable packaging also acts as is a better alternative. An increasingly popular substitute is the biodegradable packaging, as both the consumers as well as the companies seek out methods that minimize their environmental effect. Packaging that minimizes pollution, decomposes into natural materials and fills landfills with less waste is an attractive concept. Also, compostable packaging is another substitute that, given the proper conditions, will decompose organically. It doesn't leave any hazardous chemicals or dangerous particles behind since it is made up of the organic materials like paper, cardboard or bioplastics. Thus, due to the presence of these popular alternative materials, the demand for the fiber bale packaging is likely to reduce during the forecast period.

Market Opportunities

Expansion of E-commerce Platforms

The rapid growth of the e-commerce is expected to create immense growth opportunities for the fiber bale packaging market in the years to come. There has been a substantial rise in the e-commerce in recent times, following the Covid-19 outbreak. Future generations have an automatic attraction towards the online shopping, particularly the Gen Z and Millennials. Not only is online purchasing convenient, but it is frequently favored as well. The expansion and acceptance of the internet trading is further accelerated by this shift in the customer behavior. Additionally, e-commerce is growing rapidly every day due to the technological advancements, especially in the area of the virtual reality (VR). Furthermore, the significant expansion of various e-commerce platforms and recent launches of online stores by retailers into is also expected to contribute to the growth of the market. For instance

- In August 2024, with an extra investment of ¥1bn ($138m), the e-commerce major firm JD.com from China announced an important expansion of its clothing business, aiming to develop JD Fashion as a premier destination for worldwide fashion. The investment will significantly boost both domestic and international brands by expanding and improving the range of fashion goods available to JD.com consumers through the combination of financial capital and market resources.

- In October 2023, Takko Fashion declared that it would be expanding its e-commerce operations throughout Europe. The company began online sales in France not long after launching an e-commerce site in the Netherlands. The company recently started online sales in Austria as well as in Dutch.

Thus, with the continuous expansion of the online retail, the demand for fiber bale packaging is also likely to increase to guarantee safety of the products during the direct-to-consumer shipping.

Key Segment Analysis

Material Segment Analysis Preview

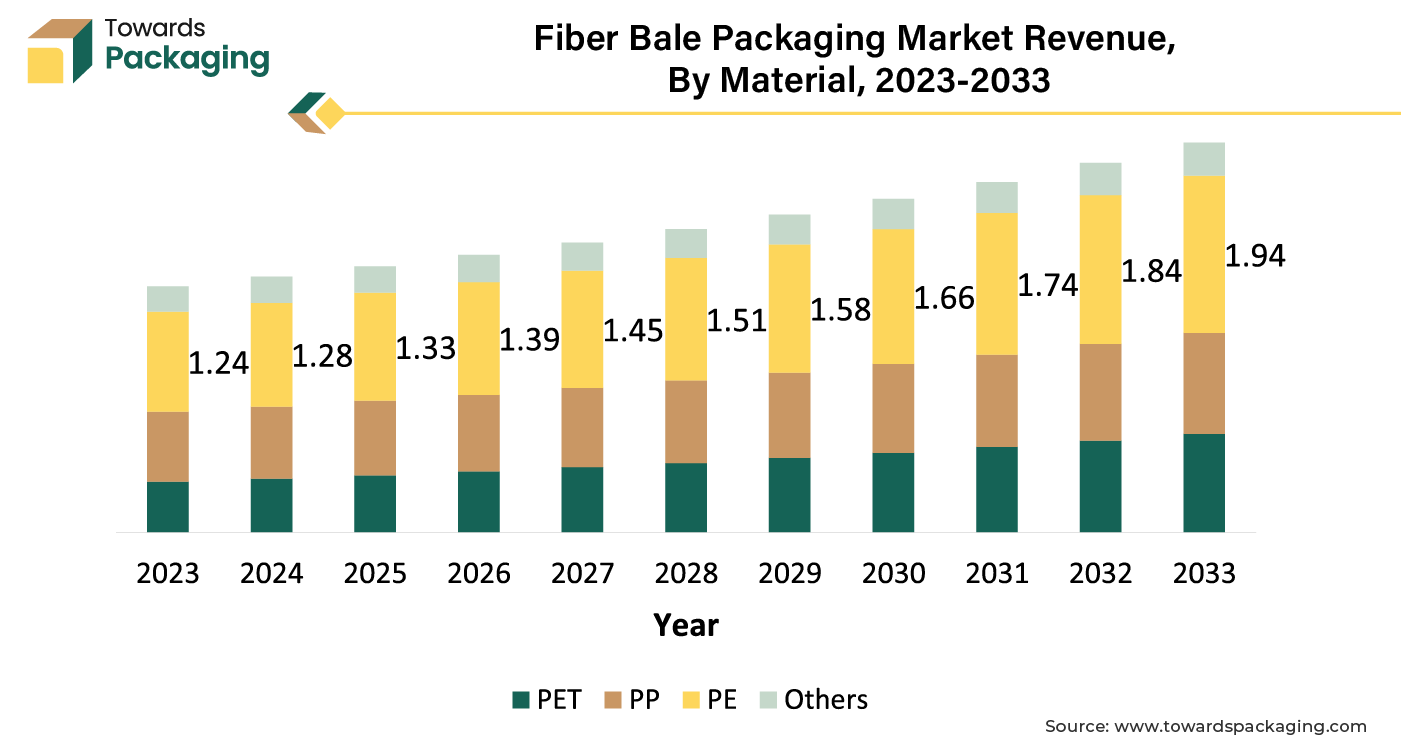

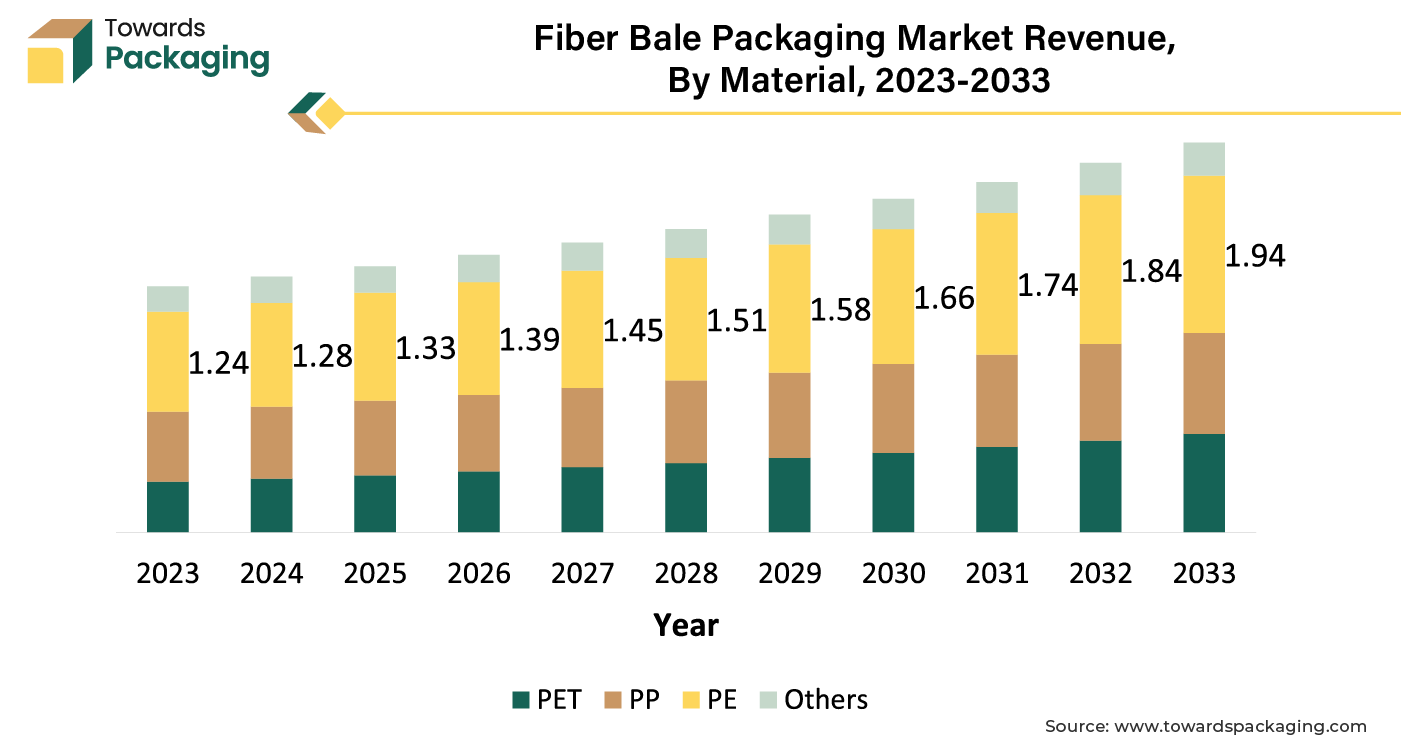

The PE segment captured largest market share of 40.65% in 2024. Polyethylene (PE), especially the high-density form (HDPE), is valued for its remarkable strength, durability and moisture resistance, which makes it a great option for heavy-duty packaging applications. The material's flexibility permits it to be used in a variety of applications, from lightweight agricultural products to more robust industrial and construction materials. PE's affordability and ease of processing further contribute to its widespread adoption, particularly in price-sensitive markets like agriculture and textiles. The growing demand for recyclable and sustainable packaging solutions has further increased the popularity of PE.

End-Use Segment Analysis Preview

The textiles segment held considerable market share in 2024. This is owing to the growing consumer base which has resulted in increase in the consumption of apparel, home textiles and industrial fabrics. Furthermore, the global expansion of the apparel and fashion industries coupled with the growing e-commerce sector is also likely to support the segmental growth of the market. Additionally, availability of large quantity of raw material as well as skilled manpower along with the growing trend in the utilization of the smart textiles is also expected to contribute to the growth of the segment during the forecast period.

Regional Insights

Asia Pacific held is likely to grow at fastest CAGR of 6.58% during the forecast period. This is owing to the ongoing industrialization and urbanization across major economies like China, India and Southeast Asian economies. Additionally, the expanding textile industry is also anticipated to promote the growth of the market in the region in the years to come.

According to the data by the India Brand Equity Foundation, by 2030, the market for clothing and textiles in India is expected to expand at a CAGR of 10% and reach US$ 350 billion. Also, India ranks third globally in terms of textile and apparel exports. India is anticipated to surpass US$100 billion in exports, placing it amongst the top five worldwide exporters in several of textile categories. Furthermore, the high production of cotton, jute and other natural fibers across the region are also expected to support the growth of the market within the estimated timeframe.

North America held considerable market share of 28.89% in 2024. This is due to the presence of leading producers of agricultural commodities including cotton along with the rise of e-commerce across the region. More than 27 million Canadians were using e-commerce in 2022, making up 75% of the country's total population, according to the International Trade Administration. By 2025, this percentage is projected to increase to 77.6%. Retail e-commerce revenues across Canada have surged as a result of an increase in online shoppers. As per the Statistics Canada, e-commerce sales were estimated to be around US$2.34 billion in March 2022. By 2025, online retail sales are projected to reach a total of US$40.3 billion. Also, the well-developed supply chain and logistics infrastructure is further expected to support regional growth of the market in the years to come.

Recent Developments by Key Market Players

- November, 2023: Trioworld unveiled the first Post-Consumer Recyclates (PCR)-based bale wrap at Agritechnica 2019, the world's largest agricultural exhibition. Since then, Trioworld has wrapped more than five million bales successfully using high-performance bale wrap composed of recycled content. At Agritechnica 2023, the company demonstrated complete line of premium goods for baled silage with recycled content on display.

- October, 2021: In order to use its trademark EnviroCan paper containers as a raw material at ten of its paperboard mills to make new paperboard, Sonoco announced that it is increasing post-consumer recovery and recycling prospects for these products in the United States. The ability to accept stiff paper cans in bales of mixed paper from home Material Recovery Facilities (MRFs) has been confirmed by all of Sonoco's paper mills in the United States.

Key Players in the Fiber Bale Packaging Market

- Balemaster

- Lenzing Plastics GmbH & Co KG

- Sonoco Products Company (Conitex)

- Stein Fibers, Ltd.

- Proag Products Ltd.

- ITW Signode India Limited

- Bischof + Klein SE & Co. KG

Fiber Bale Packaging Market Segments

By Material

- PET

- PP

- PE

- HDPE

- LDPE

- Others

By Bale Weight

- Up to 150 GSM

- 151 to 250 GSM

- 251 to 350 GSM

- More than 350 GSM

By End-Use

- Textiles

- Agriculture

- Building & Construction

- Others

By Region

- North America

-

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Tags

FAQ's

Select User License to Buy

Figures (3)