December 2025

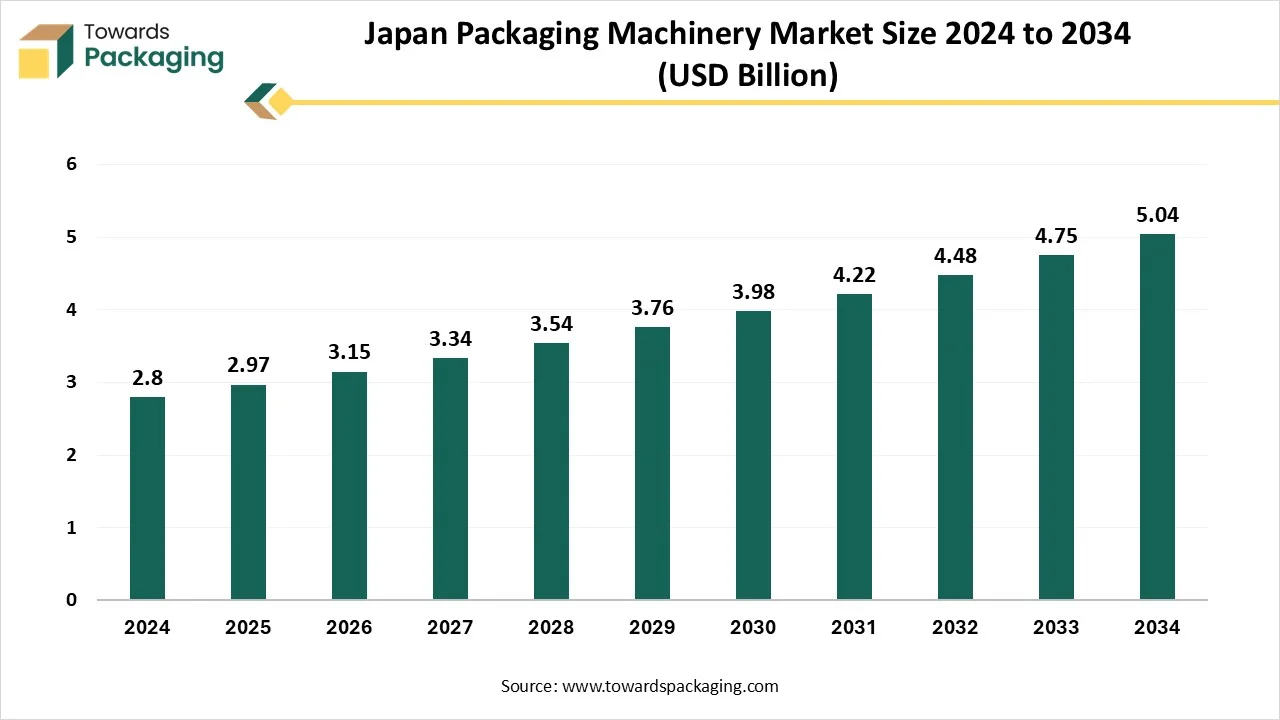

The global Japan packaging machiner market is expected to increase from USD 2.97 billion in 2025 to USD 5.04 billion by 2034, growing at a CAGR of 6.05% throughout the forecast period from 2025 to 2034. The increasing demand for packaged goods, increasing focus on sustainability, rapid industrialization, growing consumer preferences for convenience, and the rising expansion e-commerce sector are expected to drive the growth of the Japan packaging machinery market over the forecast period.

The market is also experiencing significant growth, owing to the rapid technological advancements such as the integration of Industry 4.0 principles, robotics, and automation, enhancing the productivity and efficiency in packaging processes. Several key players are increasingly focused on adopting strategic growth strategies, such as new launches, acquisitions, and collaborations, to develop innovative packaging machinery in the Japan packaging machinery market.

The Japan packaging machinery market encompasses the design, manufacturing, and integration of automated and semi-automated machines used for packaging products across various end-use industries, including food & beverage, pharmaceuticals, personal care, and industrial sectors. These machines serve functions such as filling, wrapping, sealing, labeling, palletizing, and more, contributing to improved production efficiency, product protection, and aesthetic appeal.

In the rapidly evolving technological landscape, the integration of Artificial Intelligence (AI) holds great potential to reshape the entire landscape of the Japan packaging machinery market. Artificial intelligence in packaging machinery has positioned the packaging industry in a different dimension through its advanced capabilities. AI-driven automation is transforming packaging production lines, enhancing both precision and speed.

AI-powered and robotics machinery in manufacturing processes significantly reduces dependence on manual labour and lowers the risk of human errors. AI-powered vision systems can effectively detect defects in packaging at very high speeds, which ensures that flawless products only reach the market. These advancements in systems can identify issues such as misaligned labels and incorrect barcodes, which assist in minimizing the risk of product recalls and improving brand reputation.

How is the Increasing Demand for Packaged and Processed Food Impacting the Growth of the Market?

The rising demand for packaged and processed food is expected to drive the demand for packaging machinery during the forecast period. Japan has a strong presence of food and beverages and increasingly focuses on technological advancements, particularly in automation and robotics, to boost efficiency and productivity. Consumers in Japan are increasingly looking for ready-to-eat and convenience meals, which has led to a spurring of the demand for packaged and processed foods.

The evolving consumer preferences for aesthetic and convenient packaging designs are also significantly fueling the market growth. Additionally, the market is experiencing rapid growth, owing to the increasing focus on sustainability to reduce waste and embrace the use of sustainable materials, aligning with environmental standards and consumer preferences towards eco-friendly packaging solutions. Several end users are increasingly replacing their older or conventional machines with the advanced packaging machine, which can process recycled and biodegradable materials

High Initial Investment

The high initial costs of packaging machinery are anticipated to hinder the market’s growth. The packaging machinery requires a high upfront investment, especially for automation and sustainable solutions, which can often act as a barrier, especially for small and medium-sized companies with limited budgets. Such factors may restrict the expansion of the Japan packaging machinery market.

Rising Expansion of the E-commerce Sector

The surge in online shopping is projected to offer lucrative growth opportunities to the growth of the Japan packaging machinery market in the coming years. Automated packaging machines are significantly revolutionizing the e-commerce landscape by offering faster, customized, and more efficient packaging processes to meet delivery timelines. The rapid expansion of e-commerce platforms has led to an increasing adoption of automated packaging solutions in the country to keep up with high order volumes across the country and meet evolving customer demand.

The medium-speed (50–150 packs/min) segment accounted for the dominating share in 2024. Medium-speed packaging machinery is specifically designed to handle production volumes that range from approximately 50 to 150 packs per minute. This medium speed range offers a good balance between manual or semi-automatic operations and high-speed fully automated lines. Some examples of medium-speed packaging machines include vertical form fill seal machines, tray sealers, sachet machines, blister packaging machines, wrap-around packers, and others.

On the other hand, the high-speed (>150 packs/min) segment is expected to witness a significant share during the forecast period, owing to the rising demand from various industries, including food and beverage, electronics, pharmaceuticals, cosmetics, and others. High-speed packaging machinery is designed for rapid production and efficient handling of large volumes of product without compromising accuracy. These high-speed machines have several important components, such as the feeding system, metering system, sealing unit, and control system.

The conventional packaging segment dominated the market with the largest share in 2024. Conventional packaging generally involves primary, secondary, and tertiary packaging to protect the product from physical damage, contamination, and other environmental factors such as light, oxygen, and air. Conventional packaging ensures secure transport and protects products during handling, storage, and facilitates easier logistics for high-volume orders.

On the other hand, the robotics-enabled packaging machinery segment is expected to grow at a significant rate, owing to the rising need for robotic systems for performing various automated packaging tasks such as filling containers, picking and placing products, sealing packages, labelling, and others. The adoption of robotics is rapidly transforming packaging operations across various industries. Robotics-enabled packaging machinery improves accuracy, efficiency, and speed in packaging lines, which assists in enhancing the overall productivity.

The primary packaging segment held a dominant presence in the Japan packaging machinery market in 2024. The growth of the segment is mainly driven by the rapid advancements in automation, a surge in e-commerce activities, and rising demand for packaged goods such as food & beverages, pharmaceuticals, and other consumer items. Primary packaging directly holds control over the product. Primary packaging efficiently protects the product from contamination and various environmental factors like moisture, oxygen, and light. Primary packaging is also where labels are found with crucial information for the consumer.

On the other hand, the secondary packaging segment accounted for notable growth in the global Japan packaging machinery market over the forecast period, owing to the increasing need for protective packaging solutions. Secondary packaging generally surrounds primary packaging to enhance protection and facilitate improved handling for logistics & transportation. It also adds an extra layer against contamination, damage, and other environmental conditions.

Plastics-compatible segment (PET, PE, PP, PVC) dominated the Japanese packaging machinery market in 2024. Plastic is widely used in the packaging industry owing to its durability, versatility, strength, durability, cost-effectiveness, and stability. Plastics are often used in bottles and food containers. Some specific plastics like PET, PE, PP, PVC) are preferred for their unique properties, such as barrier protection, strength, versatility, transparency, and resistance to heat and the environment.

On the other hand, the paper & paperboard compatible segment is expected to grow at a notable rate during the forecast period, owing to the rising environmental and sustainability concerns. The surge in environmental issues and regulatory pressures is compelling businesses across various industries to adopt paper & paperboard as eco-friendly packaging practices, which significantly reduce packaging waste and promote environmental sustainability. Additionally, rapid advancement in material science and packaging technologies is expected to further fuel the market's expansion in the coming years.

The filling machines segment is expected to dominate the Japan packaging machinery market. Filling machines have become essential tools and play a crucial role across various industries. The filling machines are specifically designed to automate the process of filling containers such as bottles or pouches from pastes to liquids and powders. Filling machines are widely employed in industries like food and beverage, pharmaceuticals, cosmetics, and chemicals. Filling machines are generally classified into semi-automatic and automatic filling machines. The use of the filling machines allows for a predetermined quantity of filling with the desired level of automation.

On the other hand, the palletizing machines segment is growing at the fastest CAGR. Palletizer machines are an automated system used to stack and orient various individual products into a single load for a more economical and convenient method of storage, handling, and shipment. Palletizer machines significantly replace human labor in the process of stacking products onto pallets.

The food & beverage segment is dominating the market over the Japan packaging machinery market in 2024. The growth of the segment is driven by the increasing demand for packaged and ready-to-eat food & beverages in the country. The food and & beverage industry is the largest user of packaging machinery in the country. The market is experiencing an increasing trend toward the consumption of healthy and organic food products, which has led to an increasing demand for specialized packaging to maintain the authenticity and freshness of the food products. Additionally, the rising focus of food & beverage packaging companies to develop artistic packaging to gain a competitive edge and strengthen their position in the market further drives the demand for packaging machinery.

On the other hand, the pharmaceuticals segment is expected to witness remarkable growth during the forecast period. Owing to the rapid expansion of the pharmaceutical industry, coupled with the rising production of drugs. Pharmaceutical companies are increasingly investing in efficient and specialized pharmaceutical packaging to ensure drug safety and efficacy. Packaging protects drugs from contamination, degradation, physical damage, and other environmental factors.

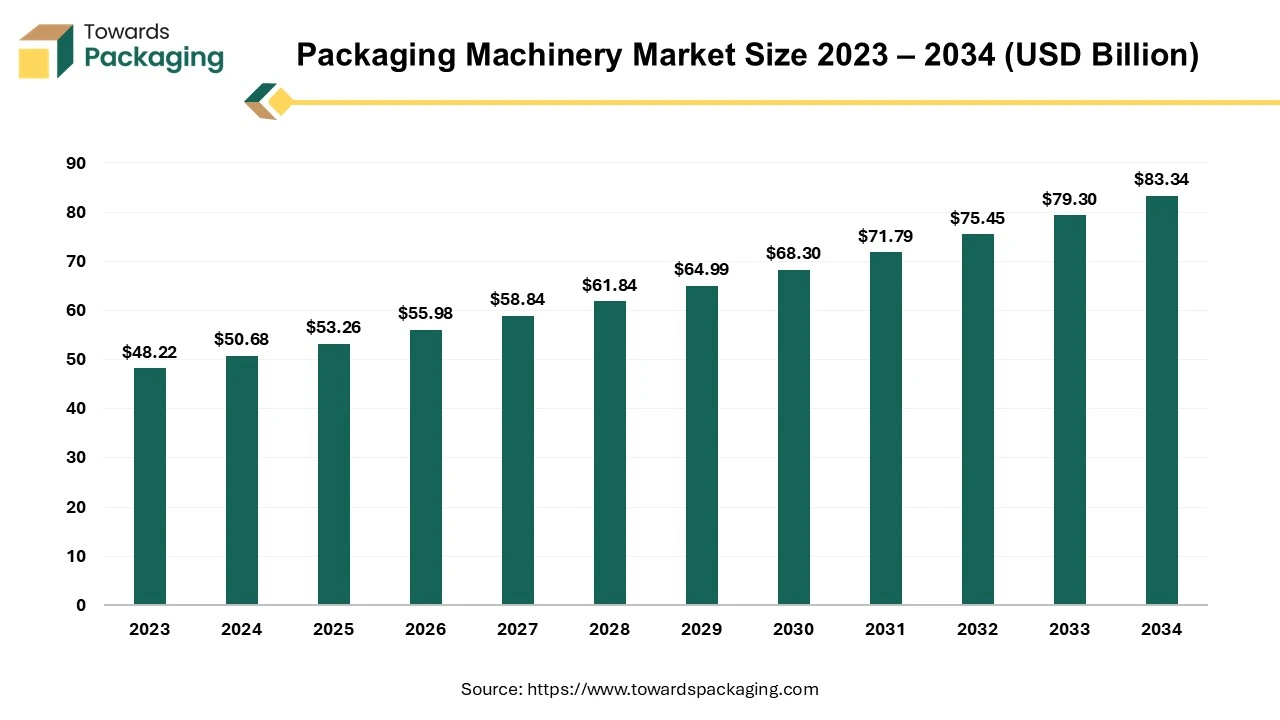

The packaging machinery market is projected to reach USD 83.34 billion by 2034, expanding from USD 53.26 billion in 2025, at an annual growth rate of 5.1% during the forecast period from 2025 to 2034.

Packaging machinery is the machinery used to package and protect goods inside containers to be sold, distributed, shipped, stored, and used. This procedure is essential to marketing because it guarantees that products are displayed appropriately and communicate the intended image and design. "Packaging equipment" refers to the machinery that quickly and effectively places goods into wrappings or containers for protection.

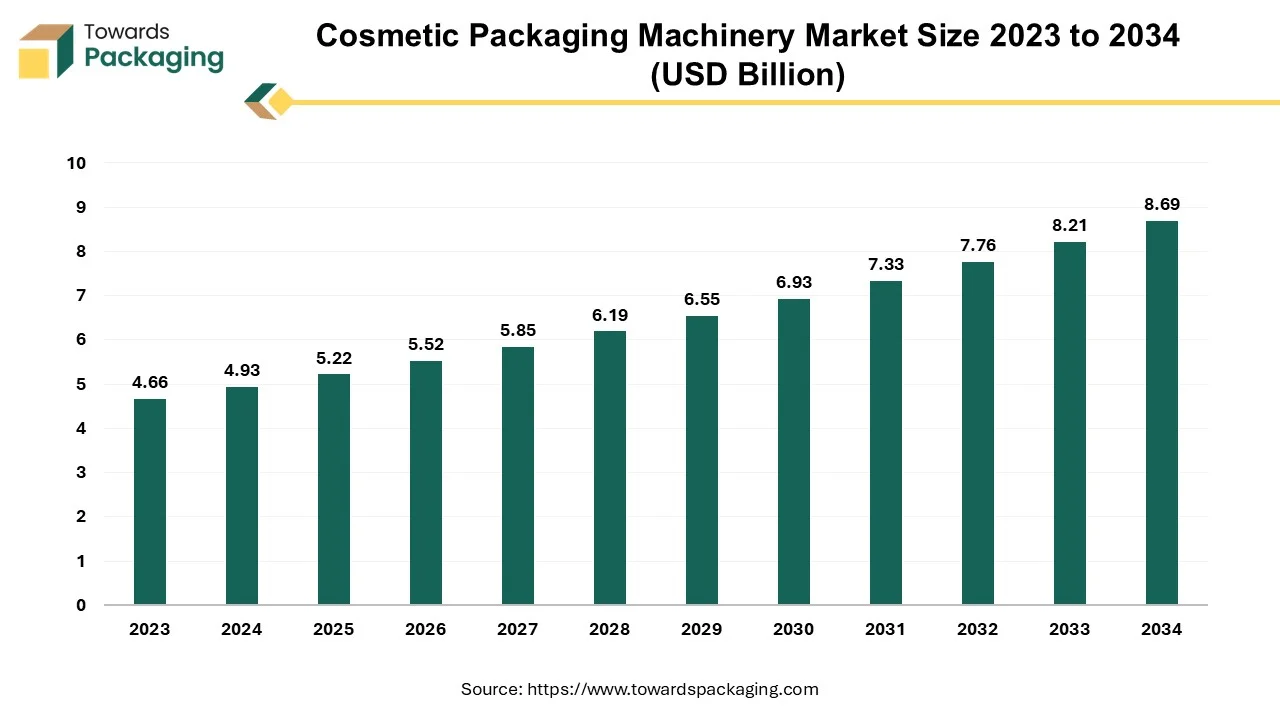

The cosmetic packaging machinery market is expected to grow from USD 5.22 billion in 2025 to USD 8.69 billion by 2034, with a CAGR of 5.83% throughout the forecast period from 2025 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition to develop innovative cosmetic packaging technology which is expected to drive the growth of the cosmetic packaging machinery market over the forecast period. The global packaging market to grow at a 3.16% CAGR between 2025 and 2034.

A product applied to the body to enhance beauty or conceal a flaw is referred to as cosmetics. These goods can include nail polish, face creams, skin lotions, shampoo, and other cosmetics like lipstick and eye shadow. Under a broad definition, even toothpaste and perfumes may be categorized as cosmetic products. The cosmetics sector uses a wide range of packaging machinery to prepare its products for sale, as well as a vast variety of packaged goods.

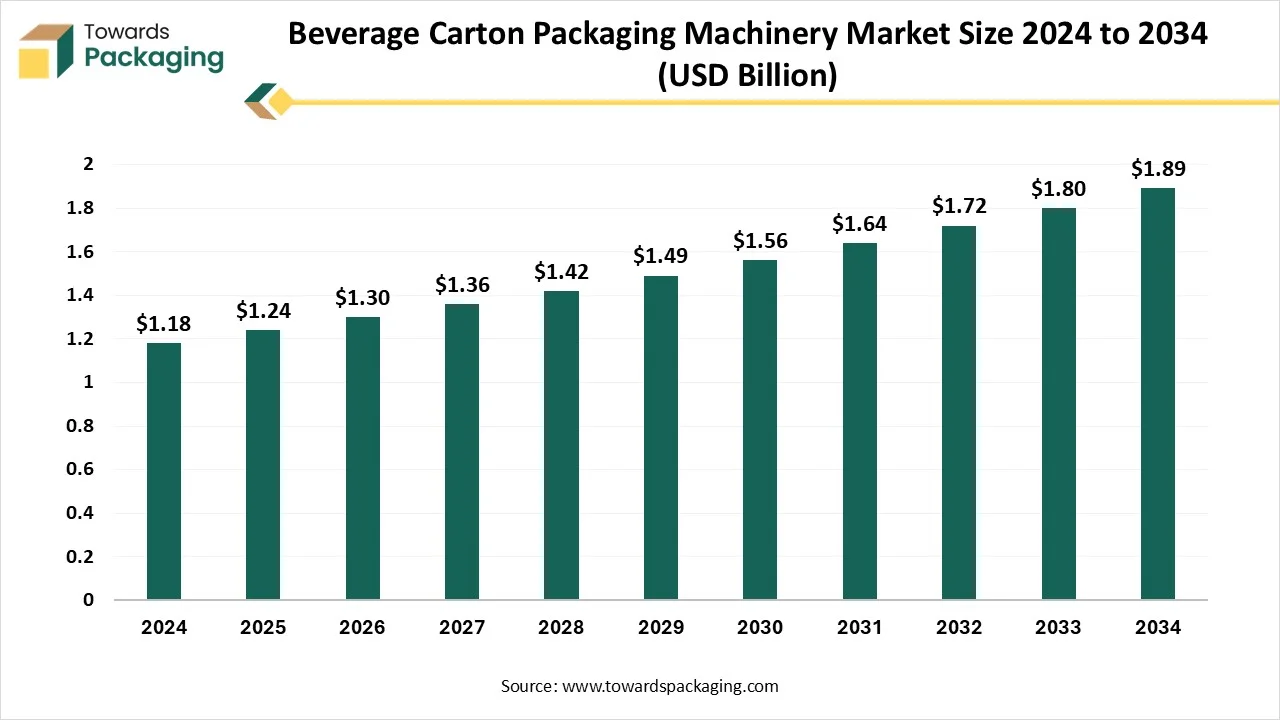

The global beverage carton packaging machinery market is anticipated to grow from USD 1.24 billion in 2025 to USD 1.89 billion by 2034, with a compound annual growth rate (CAGR) of 4.81% during the forecast period from 2025 to 2034.

The increasing awareness of sustainability, growing demand for lightweight packaging, a surge in beverage consumption, rapid expansion of the e-commerce sector, rising environmental concerns, and a shift toward recyclable materials are expected to drive the global beverage carton packaging machinery market over the forecast period. Automation, high-speed systems, and modular packaging lines are key trends shaping the future of this market. Sustainability and environmental consciousness are playing a crucial role in transforming the beverage carton packaging machinery market.

The beverage carton packaging machinery market includes the design, production, and sale of machinery used for forming, filling, sealing, and secondary packaging of beverages in carton-based formats. Beverage carton packaging machinery plays a crucial role in the global food and beverage industry. With the rising consumer demand for packaged beverages, the need for efficient, sustainable, and cost-effective packaging continues to grow. These machines are integral to the processing of dairy products, juices, plant-based drinks, alcoholic beverages, and water in gable-top, brick, and aseptic cartons.

By Machine Type

By Packaging Type

By Automation Level

By End-Use Industry

By Technology Type

By Operation Speed

By Material Compatibility

December 2025

December 2025

December 2025

December 2025