Consumer Goods Sustainable Packaging Market Global Size, Regional (NA, Europe, APAC, Latin America, MEA) Breakdown, Trade & Value Chain Analysis

The consumer goods sustainable packaging market is thoroughly assessed in this report with complete statistical coverage of global market size, historical data, and forecasts up to 2034. It explains key growth trends, regulatory drivers, restraints, and opportunities, and provides detailed segmentation by process/type (recyclable, reusable, compostable/biodegradable, degradable, edible), material type, packaging format, function, and end-use industry.

The study includes full regional data for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, along with country-level highlights, company market shares, competitive analysis, value chain mapping, trade flows, and an extensive database of manufacturers and suppliers, supported by comprehensive tables, charts, and statistical indicators.

Key Insights

- Europe dominated the global consumer goods sustainable packaging market in 2024.

- Asia Pacific is expected to grow at a significant CAGR in the market during the forecast period.Build with

- The North American market is expected to grow at a notable CAGR in the foreseeable future.

- By process/type, the recyclable packaging segment dominated the market with the largest share in 2024.

- By process/type, the compostable/biodegradable packaging segment is expected to grow at the fastest CAGR during the forecast period of 2024 to 2034.

- By material type, the paper & paperboard segment dominated the market in 2024.

- By material type, the biopolymers/bio-based materials segment is expected to grow at the fastest CAGR in the forecast period.

- By packaging format, the flexible packaging segment held the largest share in 2024 and is seen to grow at the fastest rate during the forecast period.

- By end-use industry, the food & beverage segment dominated the market in 2024.

- By end-use industry, the e-commerce & retail segment is expected to grow at the fastest CAGR in the forecast period.

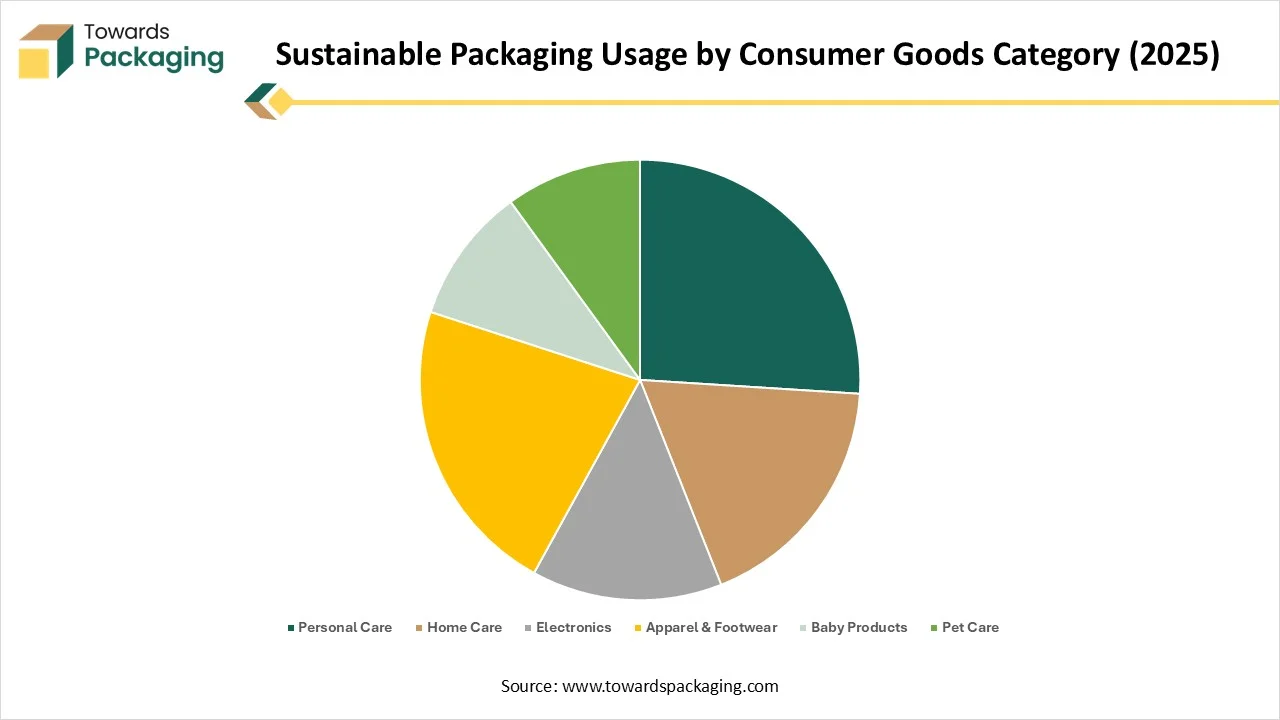

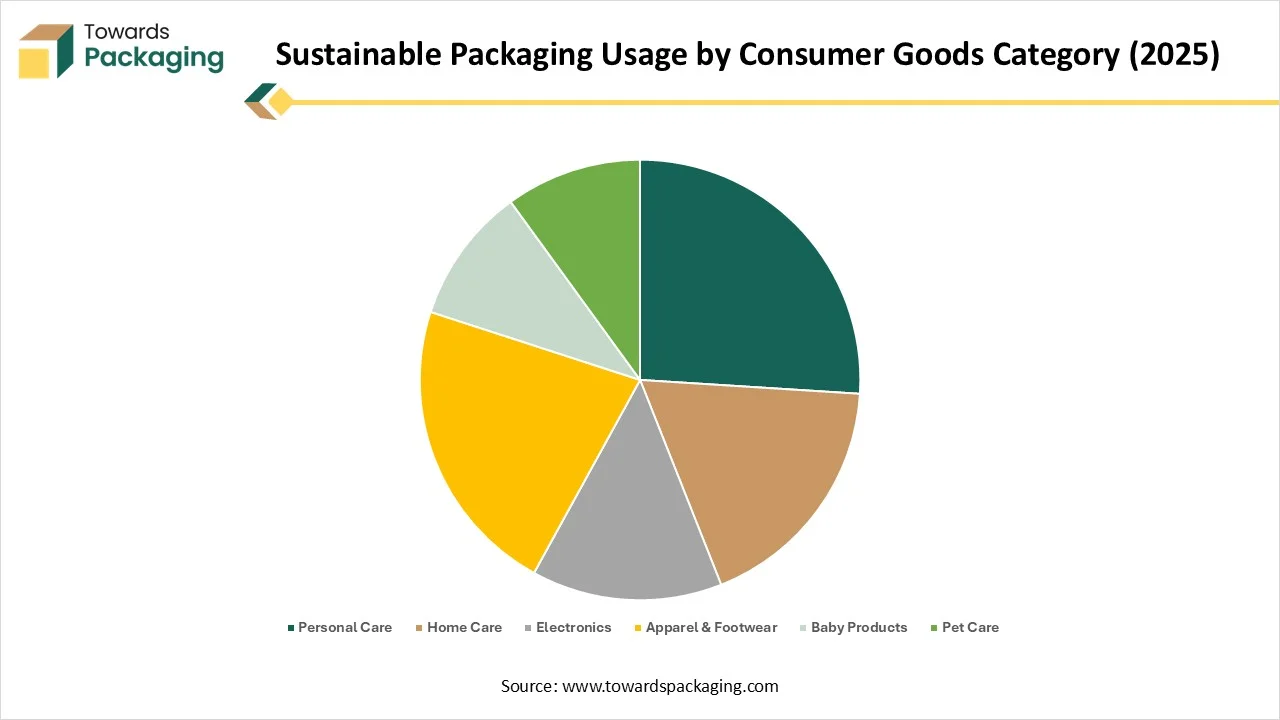

Sustainable Packaging Usage by Consumer Goods Category

| Category | Usage Share % |

| Personal Care | 26% |

| Home Care | 18% |

| Electronics | 14% |

| Apparel & Footwear | 22% |

| Baby Products | 10% |

| Pet Care | 10% |

The category usage share highlights how consumer spending is distributed across different segments. Personal care leads with 26%, showing a strong focus on health and grooming products. Apparel & footwear follow closely at 22%, indicating sustained demand for fashion and lifestyle items. Home care and electronics hold 18% and 14% respectively, reflecting steady adoption of household essentials and gadgets. Baby products and pet care each account for 10%, pointing to niche but consistent markets driven by family and pet-related needs.

What is Meant by Consumer Goods Sustainable Packaging?

Consumer Goods Sustainable Packaging refers to packaging solutions designed to minimize environmental impact while maintaining functionality, protection, and appeal for fast-moving consumer goods (FMCG) such as food, beverages, personal care, home care, and electronics. These packaging methods focus on using eco-friendly materials, reducing waste, and improving recyclability throughout the product lifecycle from sourcing and production to disposal and reuse.

The Consumer Goods Sustainable Packaging Market is experiencing significant transformation driven by increasing consumer awareness, stringent environmental regulations, and corporate sustainability initiatives. Companies across various sectors, such as food and beverages, personal care, and household products, are shifting towards environmentally friendly packaging alternatives to meet regulatory and consumer demands.

The market is characterized by innovation in materials and packaging design, with a strong focus on biodegradable, compostable, and recyclable options. Governments and international organizations are promoting circular economy practices, encouraging manufacturers to adopt closed-loop packaging systems. Additionally, the rise of e-commerce and urbanization is influencing sustainable packaging formats, with increased emphasis on durability, lightweighting, and space efficiency.

Technological advancements in material science and digital printing are supporting the growth of customizable and smart, sustainable packaging. The adoption of eco-labels and transparent supply chain practices further enhances consumer trust. Despite challenges like cost, performance parity, and recycling infrastructure, the market is poised for robust growth, with key players investing in R&D and partnerships to develop next-generation sustainable solutions.

Material Composition for Sustainable Packaging (Consumer Goods Avg.)

| Material | Weight % |

| Post-Consumer Recycled (PCR) Plastic | 27% |

| Virgin Bio-based Plastics | 13% |

| Traditional Recyclable Plastics | 21% |

| Paper/Fiber | 28% |

| Additives/Coatings | 4% |

| Others | 7% |

The material usage distribution shows a growing emphasis on sustainable packaging solutions. Paper and fiber lead at 28%, highlighting a shift toward renewable materials. Post-consumer recycled (PCR) plastics account for 7%, reflecting efforts to reuse existing plastic waste. Traditional recyclable plastics make up 21% while virgin bio-based plastics contribute to 13%, indicating emerging interest in eco-friendly alternatives. Additional coatings and other materials represent 11%, used to enhance the functionality and durability of packaging.

What are the Key Trends Shaping the Consumer Goods Sustainable Packaging market in 2025?

Biodegradable, Compostable & Plant‑Based Materials

- Packaging made from plant sources like corn-starch, sugarcane bagasse, seaweed, bamboo, algae, and mushroom mycelium is rapidly expanding. These options decompose naturally and reduce dependency on fossil‑fuel plastics. Innovations now include edible packaging from seaweed, rice, or even millet to eliminate waste altogether. Home‑compostable mushroom packaging (e.g., from Ecovative) and IIT Roorkee’s kodo‑millet edible cups are notable breakthroughs.

Reuse & Circular‑Economy Packaging Systems

- Refillable, returnable, and reusable packaging models (Loop, RPCs, deposit systems) are surging, especially under extended producer responsibility (EPR) rules in Europe, the UK, and the US. Platforms like Reusable are introducing tech‑based reuse systems for glass bottles, pallets, wrap materials, and more, reducing waste and costs significantly. While recycling remains crucial, reuse models can cut packaging production by up to 90% and emissions by 80%.

Smart & Active Packaging

- Smart packages with QR codes, NFC, RFID, digital-first printing, and sensors are enabling traceability, freshness monitoring, and easy recycling information. Active packaging incorporates antimicrobial films, oxygen/ethylene scavengers, or desiccants to extend shelf life and reduce food spoilage. Cutting-edge research is introducing battery‑free, stretchable smart packaging that senses spoilage and releases preservatives in real time.

Advanced Recycling & Material Strategy

- Chemical and enzymatic recycling technologies are scaling up to recycle mixed and contaminated plastics (e.g., enzymatic PET recycling), creating high-quality recycled inputs. AI-powered sorting systems further enhance recycling quality and facility efficiency. Transition to mono-material packaging, especially mono-plastic pumps or flexible films, simplifies recycling and improves reprocessability.

Minimalist, Lightweight & Functional Design

- Minimalist aesthetics using natural tones, reduced ink, and fewer materials reflect eco-consciousness and help reduce carbon and material waste. Structural innovations like honeycomb corrugated board offer strength with less material usage. Lightweight and compact formats lower transportation emissions and material cost, increasingly important in e-commerce shipping.

Transparency with Carbon & Impact Labelling

- Carbon labelling on packaging has emerged as a strong consumer-facing sustainability tool, signalling the product’s life‑cycle carbon emissions and pushing brands toward net‑zero goals. Such labels also help companies comply with regulatory frameworks like Extended Producer Responsibility and EU circular-economy rules.

Customization, Personalization & Sensory Engagement

- Digital printing, variable data labels, and customization allow brands to personalize packaging to consumers without large print runs or waste. Brands are incorporating sensory features, textured surfaces, embossed finishes, matte aesthetics for tactile appeal, and using sustainable materials or finishes like sand‑blasted recyclable PET.

How Can AI Improve the Consumer Goods Sustainable Packaging Industry?

Artificial Intelligence (AI) integration is significantly transforming the consumer goods sustainable packaging industry by optimizing design, production, supply chains, and recycling systems to reduce environmental impact. One of the most impactful applications of AI is in intelligent packaging design, where AI algorithms analyze large datasets to suggest eco-efficient materials, lightweight structures, and minimalistic layouts that reduce raw material usage without compromising strength or appeal. Through generative design tools, companies can simulate and test different sustainable packaging prototypes virtually, cutting down physical prototyping waste and accelerating innovation.

In manufacturing and logistics, AI-driven automation enhances precision in material usage and minimizes waste during packaging processes. AI also supports smart supply chain management by forecasting demand more accurately, optimizing transportation routes, and reducing carbon footprints through dynamic logistics planning. For instance, AI can identify the most sustainable sourcing routes for biodegradable or recycled materials, considering carbon emissions, lead times, and local environmental regulations.

AI is also playing a pivotal role in smart recycling and waste management. Advanced machine learning models enable better sorting in Material Recovery Facilities (MRFs) by using computer vision to differentiate between complex packaging materials, such as multilayer plastics and composites. This improves recycling efficiency and reduces landfill waste. Additionally, AI-powered consumer engagement tools such as QR code scanning or smart packaging sensors help consumers make better disposal decisions by providing real-time guidance on recycling, reuse, or composting.

Moreover, AI aids in monitoring environmental impact by tracking sustainability KPIs across packaging life cycles. Brands can use AI tools to generate carbon footprint estimates, optimize packaging compliance with global regulations, and ensure transparency through carbon labeling. This enables companies to meet ESG targets and strengthen brand credibility among eco-conscious consumers. Overall, AI is a powerful enabler of circular economy principles in the packaging value chain, helping consumer goods companies enhance efficiency, reduce environmental impact, and innovate faster toward truly sustainable packaging solutions.

Market Dynamics

Driver

Stringent Government Regulations and Policies

Increasing awareness of environmental degradation, plastic pollution, and climate change has led to a global push for sustainable alternatives. Consumers and organizations alike are prioritizing eco-friendly packaging to reduce carbon emissions, marine pollution, and landfill waste. This shift is compelling brands to adopt biodegradable, compostable, and recyclable packaging options. With investors and consumers demanding transparency, brands have an opportunity to align with ESG (Environmental, Social, Governance) standards by adopting sustainable packaging.

Regulatory bodies around the world are enforcing stricter laws on single-use plastics, mandating Extended Producer Responsibility (EPR), and introducing guidelines for recyclable and compostable packaging. Laws like the EU's Packaging and Packaging Waste Regulation (PPWR) and India’s Plastic Waste Management Rules are pushing companies to invest in sustainable solutions.

Restraint

Lack of Recycling and Composting Infrastructure & Limited Material Performance and Availability

The key players operating in the market are facing issues due to a lack of standardization, a lack of recycling infrastructure, and limited material performance. In many regions, waste management and recycling infrastructure are underdeveloped or inconsistent. Even if packaging is recyclable or compostable, the absence of proper collection, segregation, and processing facilities makes it difficult to achieve actual environmental benefits. This disconnect discourages brands from investing in such packaging.

Eco-friendly materials sometimes fall short in terms of barrier properties, durability, and shelf life, especially for food, cosmetics, and pharmaceutical applications. They may not provide the same level of moisture resistance, oxygen barrier, or strength as conventional plastics, limiting their widespread use. Moreover, global supply chain constraints can limit availability. Consumers may lack clarity about how to properly dispose of or recycle sustainable packaging, which undermines its effectiveness.

What are the Opportunities for the Growth of the Consumer Goods Sustainable Packaging Market?

Innovation in Eco-Friendly Materials

Modern consumers, especially millennials and Gen Z, prefer products that align with their values, including sustainability and ethical sourcing. The demand for environmentally responsible packaging is influencing purchasing behaviour, making sustainable packaging a key factor in brand loyalty and product differentiation. The development of novel sustainable materials such as seaweed-based films, mushroom packaging, biodegradable polymers (like PHA), and recycled paper composites offers immense growth potential. These alternatives can provide the necessary performance while minimizing environmental impact, attracting both consumers and businesses seeking to reduce plastic usage.

For instance, in June 2025, ATP Lighting presents its new eco-friendly packaging, a box printed with a single white ink and constructed from uncolored natural cardboard. This calculated action addresses a specific goal: to reduce the environmental impact of each product that is produced and delivered. The new box represents an advancement in ecodesign and material efficiency when compared to the previous model, which was composed of white cardboard with multicolored inks (containing corporate branding and colored accents). The new method streamlines the recycling process and uses fewer resources.

Adoption of Circular Economy Models

As companies shift from linear to circular business models, reuse, refill, and returnable packaging systems are gaining traction. Brands embracing circular packaging, such as refill stations, reusable containers, and closed-loop logistics, have the opportunity to strengthen customer loyalty while reducing long-term packaging costs and waste.

E-Commerce and Direct-to-Consumer Growth

The expansion of e-commerce and D2C models opens opportunities for innovative, sustainable packaging tailored for delivery. Lightweight, compact, and recyclable or compostable shipping materials can differentiate brands and improve last-mile efficiency. This trend is especially promising for subscription-based or custom-packaged consumer goods.

Segmental Insights

Why does the Recyclable Segment Dominate the Consumer Goods Sustainable Packaging Market?

The recyclable packaging segment dominates the consumer goods sustainable packaging market due to its practicality, cost-efficiency, and widespread acceptance. Recyclable materials like paper, cardboard, glass, aluminum, and certain plastics are supported by established recycling infrastructure, making them accessible and scalable for manufacturers. Regulatory policies such as Extended Producer Responsibility (EPR) and plastic bans further drive adoption. Consumers are also more familiar with recyclable packaging, making it easier to promote responsible disposal. Additionally, advancements in monomaterial designs and recycled content improve performance and sustainability. Together, these factors make recyclable packaging the preferred and most widely adopted solution in the market.

The compostable or biodegradable packaging segment is the fastest‑growing within the consumer goods sustainable packaging market due to a convergence of powerful drivers. Rising regulatory pressure and bans on single‑use plastics globally are prompting businesses to transition rapidly to compostable alternatives. Simultaneously, shifting consumer behaviour, especially among millennials and Gen Z, has fuelled strong demand, with many willing to pay a premium for eco‑friendly options and actively choosing brands that offer compostable packaging. Technological innovation in biopolymers like PLA, mushroom‑based materials, and starch blends has significantly enhanced performance, offering water‑ and heat‑resistance with industrial or home compostability, making compostable packaging viable for diverse product categories. Growth in the e‑commerce and food delivery sectors has also accelerated adoption, as compostable mailers, trays, and wraps align with sustainable values and offer effective disposal solutions. Finally, collaborations across the value chain, wider certification schemes (like ASTM D6400, EN 13432), and expanding composting infrastructure are reducing barriers and reinforcing trust in compostable packaging.

CO₂ Reduction Estimate from Sustainable Packaging (2025)

| Category | CO₂ Saved (Million Tons / Year) |

| PCR Plastic Substitution | 8.3 |

| Paper/Fiber Replacements | 5.7 |

| Lightweighting | 3.1 |

| Reusables | 2.2 |

| Bioplastics | 1.4 |

| Total Reduction | 20.7 |

Which Material Type Dominated the Consumer Goods Sustainable Packaging Market in 2024?

The paper and paperboard segment is the dominant material type in the consumer goods sustainable packaging market due to its biodegradability, recyclability, and wide consumer acceptance. These materials are derived from renewable sources and break down naturally, aligning perfectly with global efforts to reduce plastic pollution and support circular economy practices. Paper and paperboard are also versatile and cost-effective, making them ideal for packaging a broad range of consumer goods from food and beverages to cosmetics and electronics. With strong recycling infrastructure already in place in many countries, they offer an easy transition for manufacturers and retailers aiming to adopt sustainable packaging. Additionally, regulatory restrictions on plastic use and increased pressure from environmental groups have pushed businesses toward eco-friendly alternatives, with paper-based solutions being the most accessible. Innovations such as coated paperboard, molded fiber packaging, and water-resistant liners have further enhanced their functionality, making them suitable for both dry and wet product packaging.

The biopolymers or biobased materials segment is the fastest‑growing in the consumer goods sustainable packaging market, propelled by surging regulatory mandates and shifting consumer preferences. Governments worldwide are banning single‑use plastics and promoting renewable alternatives, pushing companies to adopt materials like PLA, PHA, PBS, and starch‑based polymers derived from corn, sugarcane, algae, and cellulose. Meanwhile, eco-conscious consumers, especially younger generations, are actively seeking biobased packaging and are willing to pay more for it. Technological advances in fermentation, synthetic biology, and new feedstocks are making these materials increasingly reliable and functional, with improved barrier and mechanical properties. Driven by these factors, global demand is accelerating across food, personal care, and consumer goods categories.

Recycling Rate (Consumer Goods Packaging, 2025)

| Material | Recycling Rate % |

| Paperboard | 73% |

| PET | 42% |

| HDPE | 36% |

| Glass | 33% |

| Aluminum | 64% |

| Mixed Plastics | 12% |

Why does the Flexible Packaging Dominate & Grow at the Fastest Rate in the Consumer Goods Sustainable Packaging Market?

The flexible packaging format leads both as the dominant and fastest‑growing segment in consumer goods sustainable packaging, driven by multiple compelling factors. Its lightweight nature and high product‑to‑package ratio reduce material use, transportation costs, and environmental footprint, making it highly eco‑efficient. Consumers increasingly demand convenient formats such as resealable pouches and films that offer portability, freshness retention, and ease of use attributes strongly favoured in food, personal care, and e‑commerce sectors. Innovations in mono‑material recyclable and compostable films further enhance sustainability and recyclability. As e‑commerce expands, flexible packaging’s space efficiency, durability in shipping, and compatibility with online retail logistics make it the most attractive choice for sustainable packaging solutions.

Which End-Use Industry Dominated the Consumer Goods Sustainable Packaging Market in 2024?

The food and beverage industry is the dominant end-use segment in the consumer goods sustainable packaging market due to its massive consumption volume and increasing demand for eco-friendly alternatives. Rising consumer awareness about food safety, health, and environmental sustainability has driven brands to adopt recyclable, biodegradable, and compostable packaging solutions. Regulatory pressures on reducing single-use plastics in food packaging further accelerate this shift. Additionally, the industry's high-frequency purchasing cycles and focus on product freshness and shelf life make sustainable packaging innovations essential. With growing trends in organic, clean-label, and ready-to-eat foods, sustainable packaging has become a competitive differentiator in this sector.

The e‑commerce and retail segment is the fastest‑growing end‑use in the consumer goods sustainable packaging market due to booming online shopping, logistics efficiency demands, and eco-conscious consumer expectations. With parcel volumes projected to double by 2026, e‑commerce drives the need for packaging that is lightweight, compact, and protective, minimizing waste and transport emissions. Consumers increasingly favour greener packaging, with a willingness to pay more for sustainability credentials and digital-first experiences such as branded mailers or minimalistic design. Advances in right-size cartonization, recyclable mailers, and optimized returns packaging further accelerate growth across this segment.

Regional Insights

Which Region Dominated in the Consumer Goods Sustainable Packaging Market in 2024?

Europe stands as the dominant region in the consumer goods sustainable packaging market due to its strong regulatory leadership, robust recycling infrastructure, and high consumer environmental awareness. The EU’s Circular Economy Action Plan and directives such as the Packaging Waste Directive, the Single‑Use Plastics Directive, and national anti‑waste legislation in France and Germany set clear mandates like achieving near‑100% packaging recyclability by 2030, forcing businesses to prioritize greener materials and eco‑design. Extended Producer Responsibility (EPR) schemes across member states further incentivize companies to reduce packaging waste and increase recycled content.

European consumers are deeply proactive, with surveys showing over 88% consider environmental impact in buying decisions, and many are willing to pay more for greener packaging. Leading nations like Germany, France, and the Netherlands boast mature sorting systems, deposit‑return schemes, and widespread use of the Green Dot recycling program. Additionally, Europe is home to numerous packaging innovation hubs and multinational brand HQs (e.g., Mondi, Amcor), which invest heavily in bio‑based materials, smart eco‑design, and circular solutions, further accelerating sustainable packaging adoption region‑wide.

Germany Market Trends

Germany is a market leader in sustainable packaging, driven by its advanced waste segregation systems, Deposit Return Scheme (DRS), and the Green Dot system. It was one of the first to implement Extended Producer Responsibility (EPR) laws and has a high recycling rate over 65% for packaging. Major FMCG and packaging firms (e.g., BASF, Henkel, and Mondi) are investing heavily in bio-based and recyclable packaging innovations.

France Market Trends

France has taken bold steps with its Anti-Waste Law for a Circular Economy (AGEC), banning single-use plastics and mandating compostable alternatives in many sectors. The government supports eco-design and labeling requirements, pushing companies toward transparent and sustainable packaging practices. France also leads in home compostable solutions and has introduced mandatory sorting labels to guide consumer disposal behaviour.

Netherlands Market Trends

The Netherlands is a circular economy pioneer, aiming to be 100% circular by 2050. The country promotes closed-loop packaging systems, with strong collaboration between municipalities, companies, and NGOs. Dutch companies are leaders in reusable and refillable packaging in retail and e-commerce, while innovations in bioplastics and recyclable films are gaining momentum.

Sweden Market Trends

Sweden has a high recycling rate and a strong eco-conscious population. The country supports biodegradable and compostable packaging, especially in the food and beverage sectors. Government subsidies and environmental taxes have encouraged manufacturers to adopt sustainable alternatives. Sweden also has robust waste-to-energy systems, further minimizing landfill dependency.

Italy Market Trends

Italy has emerged as a significant player, particularly in bioplastics, led by firms like Novamont. The country supports the use of compostable materials, especially for food packaging and retail carry bags. Italy also implements strong EPR regulations and encourages circularity through public-private partnerships and EU-aligned sustainability targets.

Spain Market Trends

Spain is actively phasing out single-use plastic and enhancing recycling mandates under EU directives. Public awareness campaigns and municipal collection programs support proper sorting and disposal of sustainable packaging. Spanish brands are investing in paper-based, compostable, and mono-material packaging across the FMCG sectors.

What Promotes the Growth of the Asia Pacific Consumer Goods Sustainable Packaging Market?

Asia‑Pacific is the fastest‑growing market for consumer goods' sustainable packaging due to several powerful drivers. Rapid urbanization and the emergence of a vast middle class in countries like China and India have increased consumption and demand for packaged goods, especially in food, personal care, and e-commerce sectors. At the same time, stringent government regulations, including single‑use plastic bans in China and India’s July 2022 plastic ban, are accelerating the shift toward biodegradable, recyclable, and reusable materials.

The rising environmental awareness and strong consumer preference for eco‑friendly packaging, particularly among Gen X, Gen Z, and millennials, drive brand innovation and adoption. Finally, the rapid growth of e‑commerce demands lightweight, protective, and sustainable packaging solutions, further fueling investment in sustainable packaging infrastructure across APAC.

China Market Trends

China is leading Asia-Pacific in sustainable packaging due to its strict regulatory push to curb plastic pollution. The country implemented a nationwide ban on single-use plastic bags and straws, and is promoting biodegradable alternatives like PLA and PBAT. China’s massive e-commerce sector (home to Alibaba and JD.com) is driving demand for lightweight, recyclable, and right-sized packaging. The government is investing in green packaging R&D, and major brands are shifting toward recyclable paper-based and mono-material packaging.

India Market Trends

India is a rapidly growing market driven by government-led initiatives like the Plastic Waste Management Rules and the ban on single-use plastics since July 2022. There is a surge in demand for biodegradable, compostable, and recyclable packaging across food, beverage, personal care, and retail sectors. Startups and local manufacturers are innovating with bagasse, bamboo, and starch-based packaging, while major FMCG players (e.g., Hindustan Unilever, Dabur) are scaling sustainable packaging adoption. India’s large youth population and rising eco-awareness also contribute significantly.

Japan Market Trends

Japan has a long-standing culture of recycling and minimalism, making it a strong adopter of recyclable and paper-based packaging. With government-backed strategies like the Plastic Resource Circulation Act, Japan promotes material reuse, eco-labeling, and design for recyclability. Local companies are investing in molded pulp packaging, biodegradable films, and water-soluble materials. Japan also leads in smart and minimalist packaging solutions, particularly in electronics and personal care segments.

South Korea Market Trends

South Korea is advancing rapidly in sustainable packaging, supported by strong public policy and consumer demand. The government promotes a Zero Waste policy, encouraging biodegradable and compostable materials. Major Korean brands like LG and Lotte are adopting PCR content, bioplastics, and refillable packaging formats. South Korean consumers are highly eco-conscious, pushing retailers and e-commerce platforms to transition to sustainable packaging models, including mono-material pouches and FSC-certified boxes.

Australia Market Trends

Australia’s sustainable packaging momentum is driven by its 2025 National Packaging Targets, which aim to make all packaging reusable, recyclable, or compostable. Brands and retailers are investing in paper-based mailers, compostable films, and closed-loop solutions. Strong government support, public education campaigns, and partnerships with organizations like APCO (Australian Packaging Covenant Organisation) help accelerate progress. Australia is also a hub for bioplastic and molded fiber innovation.

North America’s Growing Demand for Sustainable Packaging to Promote Notable Growth

North America is growing at a notable rate in the consumer goods sustainable packaging market due to several converging factors. Firstly, stringent environmental regulations at both federal and state levels, such as Canada’s nationwide ban on certain single-use plastics and U.S. state-level EPR laws in California, Oregon, and Maine, are pushing brands to adopt recyclable, compostable, or reusable packaging alternatives. These policies not only penalize non-compliance but also incentivize the use of sustainable materials and design innovations.

Strong consumer demand for eco-friendly products is influencing packaging choices across all consumer goods sectors. U.S. and Canadian consumers, particularly millennials and Gen Z, are highly environmentally conscious and willing to support brands with clear sustainability commitments. This trend is driving retailers and FMCG companies to shift towards packaging that reduces waste and carbon footprint, such as paper-based alternatives, bioplastics, and minimalist designs.

Corporate sustainability goals set by large brands like Unilever, PepsiCo, and Walmart are playing a key role in the region’s growth. These companies have pledged to make their packaging 100% recyclable or compostable and are investing in innovations like mono-material packaging, refillable systems, and smart labeling. This corporate push cascades across the supply chain, influencing packaging converters, material suppliers, and technology providers.

Lastly, the rise of e-commerce and direct-to-consumer channels is reshaping packaging needs in North America. Companies are prioritizing lightweight, durable, and recyclable packaging that minimizes return damage and reduces shipping emissions. Startups and tech-driven packaging firms are responding with sustainable mailers, corrugated fiberboard, and molded pulp solutions, accelerating the region's growth in the sustainable packaging space.

Country-Level Production (Approx., 2025) Sustainable Packaging Output (Metric Tons/Year)

| Country | Sustainable Packaging Output (Metric Tons/Year) |

| China | 62,50,000 |

| U.S. | 41,80,000 |

| Germany | 24,20,000 |

| India | 19,60,000 |

| Brazil | 11,20,000 |

| Japan | 13,80,000 |

| U.K. | 9,10,000 |

| Italy | 8,30,000 |

| Indonesia | 7,60,000 |

| Mexico | 7,10,000 |

China dominates sustainable packaging production with 6,250,000 metric tons per year, reflecting its large manufacturing base and focus on eco-friendly materials. The U.S. follows with 4,180,000 metric tons, driven by strong demand for sustainable solutions in consumer goods and industrial sectors. Germany and India produce 2,420,000 and 1,960,000 metric tons, respectively, showing Europe and Asia as key contributors to sustainable packaging. Japan, Brazil, and the U.K. also have significant output, ranging from 1,380,000 to 910,000 metric tons, supporting regional sustainability initiatives. Other countries like Italy, Indonesia, and Mexico produce between 710,000 and 830,000 metric tons, highlighting emerging markets in sustainable packaging adoption.

Top Consumer Goods Sustainable Packaging Market Players

- Amcor Plc

- Sealed Air Corporation

- Smurfit Kappa Group Plc

- Tetra Pak International S.A.

- Mondi Group

- Huhtamaki Oyj

- Sonoco Products Company

- Berry Global Inc.

- WestRock Company

- International Paper

- Ball Corporation

- Crown Holdings, Inc.

- Stora Enso Oyj

- Graphic Packaging International, LLC

- Constantia Flexibles

- Nampak Ltd.

- Plastipak Holdings, Inc.

- Billerud (formerly BillerudKorsnäs AB)

- Alpla Group

Latest Announcements by Industry Leaders

- In June 2025, according to Max Melzer, Head of External Sales Industrial Bags at Mondi, PaperPlus Bag Advanced is a cutting-edge substitute for consumers looking to exceed performance requirements and cut down on plastic without sacrificing effectiveness. At Mondi, salesmen are prepared to assist their clients while taking into account how goods affect the environment at every point of the value chain. The company is working to provide solutions that contribute to a circular economy while being fully tailored to their customers’ needs in line with the company’s own MAP2030 ambitions. (Source: Mondi)

New Advancements in the Market

- On July 16, 2025, Huhtamaki, a packaging company, introduces new ice cream cups that are compostable. Cutting-edge, compostable, and recyclable packaging that adds to Huhtamaki's ice cream offerings. With tremendous consumer appeal and product innovation, Huhtamaki, a leader in sustainable food packaging solutions worldwide, is happy to announce the release of its new ice cream cups. (Source: Huhtamaki)

- In June 2025, Mondi, a leader in environmentally friendly paper and packaging worldwide, is introducing PaperPlus Bag Advanced, a high-performance paper bag that reduces the use of plastic while protecting items that are sensitive to humidity. With its superior moisture barrier performance and support for recyclability, the creative solution is made to safeguard powdered goods. (Source: Mondi)

- In May 2025, Lacerta Group, LLC, a food packaging solutions providing company, announced the launch of Seal N' FlipTM packaging, their newest innovation, as part of their ongoing commitment to environmentally sustainable packaging. The Seal N' Flip design is expected to save packaging costs by up to 25% at a time when food brands and retailers are concentrating on their bottom line. (Source: GlobeNewswire)

Global Consumer Goods Sustainable Packaging Market Segments

By Process/Type

- Recyclable Packaging

- Reusable Packaging

- Compostable/Biodegradable Packaging

- Degradable Packaging

- Edible Packaging

By Material Type

- Paper & Paperboard

- Plastics

- Recycled Plastics (PCR - Post-Consumer Recycled content)

- Bio-based Plastics (e.g., PLA, PHA, starch-based)

- Compostable Polymers

- Glass

- Metal

- Biopolymers / Bio-based Materials

- Films & Coatings

By Packaging Format

- Rigid Packaging

- Flexible Packaging

By Function

- Primary Packaging

- Secondary Packaging

- Tertiary/Transport Packaging

By End-Use Industry

- Food & Beverage

- Personal Care & Cosmetics

- Healthcare & Pharmaceuticals

- E-commerce & Retail

- Consumer Electronics

- Household Care

- Other Consumer Goods

By Region

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- South Africa

- Middle East and Africa (MEA)

- UAE

- Saudi Arabia

- Kuwait

Tags

FAQ's

Select User License to Buy

Figures (4)