Paper Tubes Market Size, Share and Trends, Import & Export Analysis

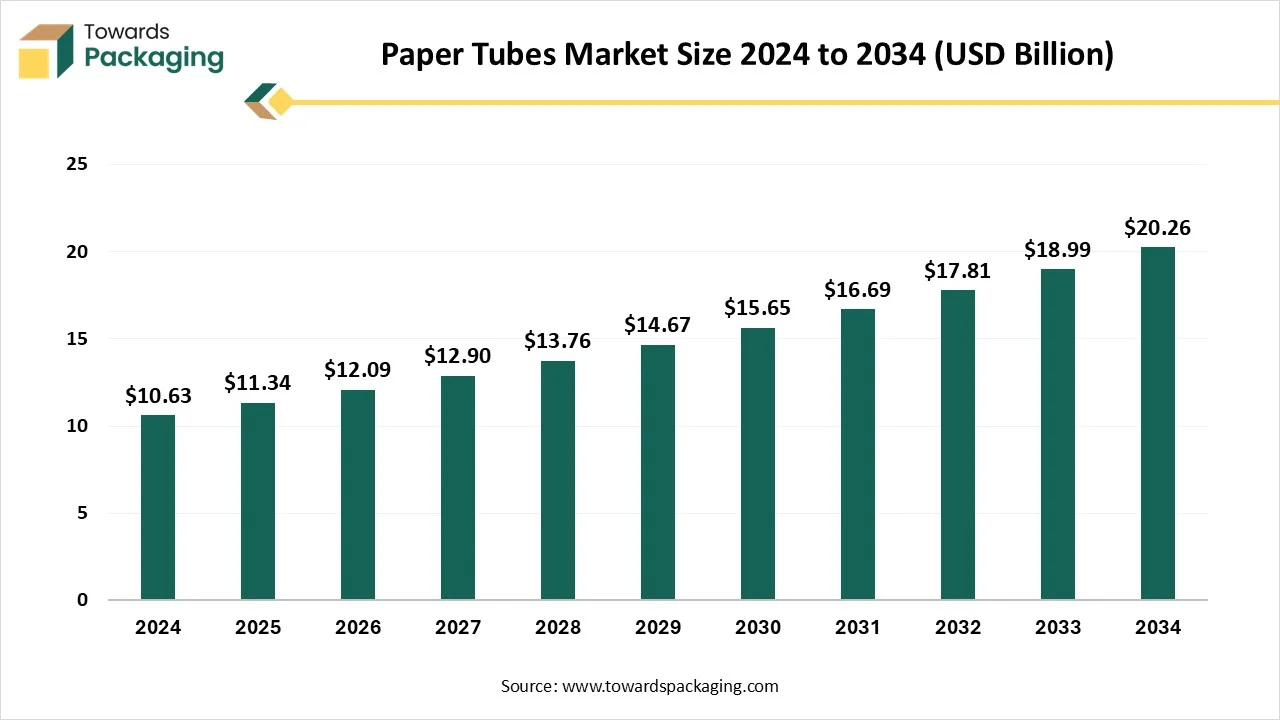

The paper tubes market is expanding steadily, projected to grow from USD 12.09 billion in 2026 to USD 21.61 billion by 2035, supported by a CAGR of 6.66%. Our report covers every essential part of the industry—from market size and growth rate to segment-level insights such as spiral wound tubes leading the type segment and composite tubes rising fast. It also includes regional coverage (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), detailed competitive analysis, value chain evaluation, and updated trade, manufacturer, and supplier data across the global paper tubes ecosystem.

Key Takeaways

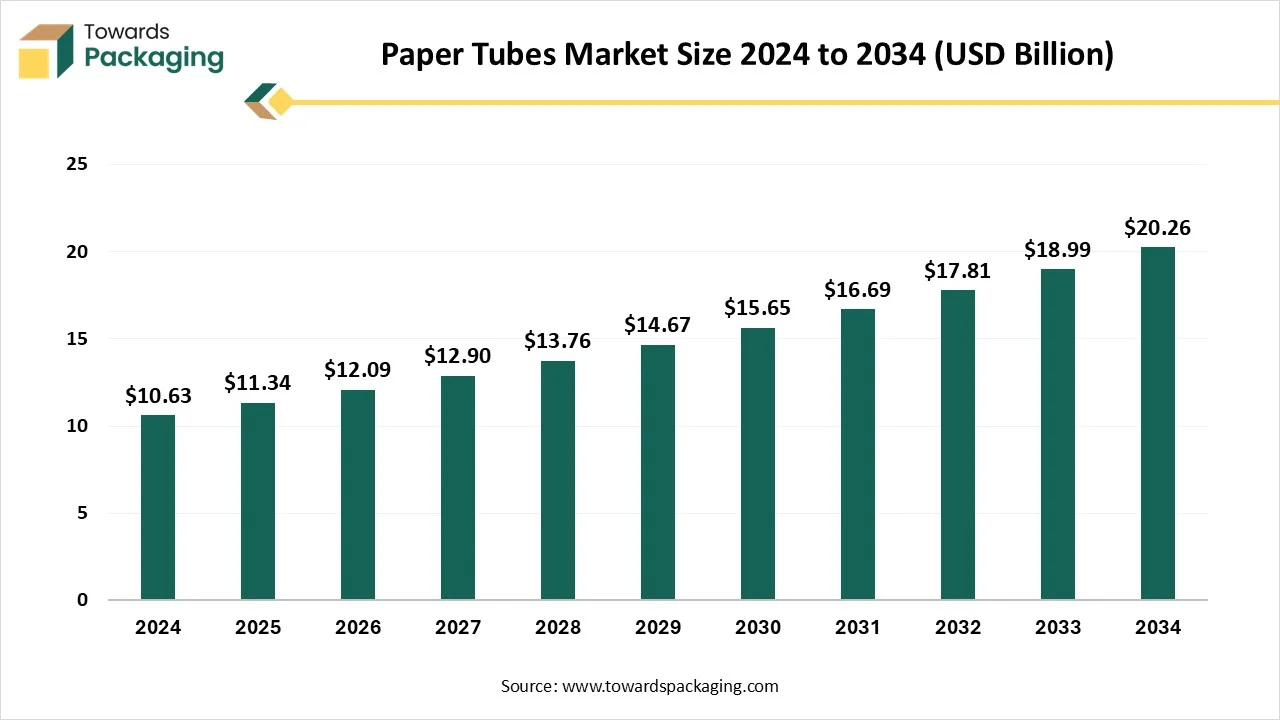

- In terms of revenue, the market is valued at USD 11.34 billion in 2025.

- The market is projected to reach USD 20.26 billion by 2034.

- Rapid growth at a CAGR of 6.66% will be observed in the period between 2025 and 2034.

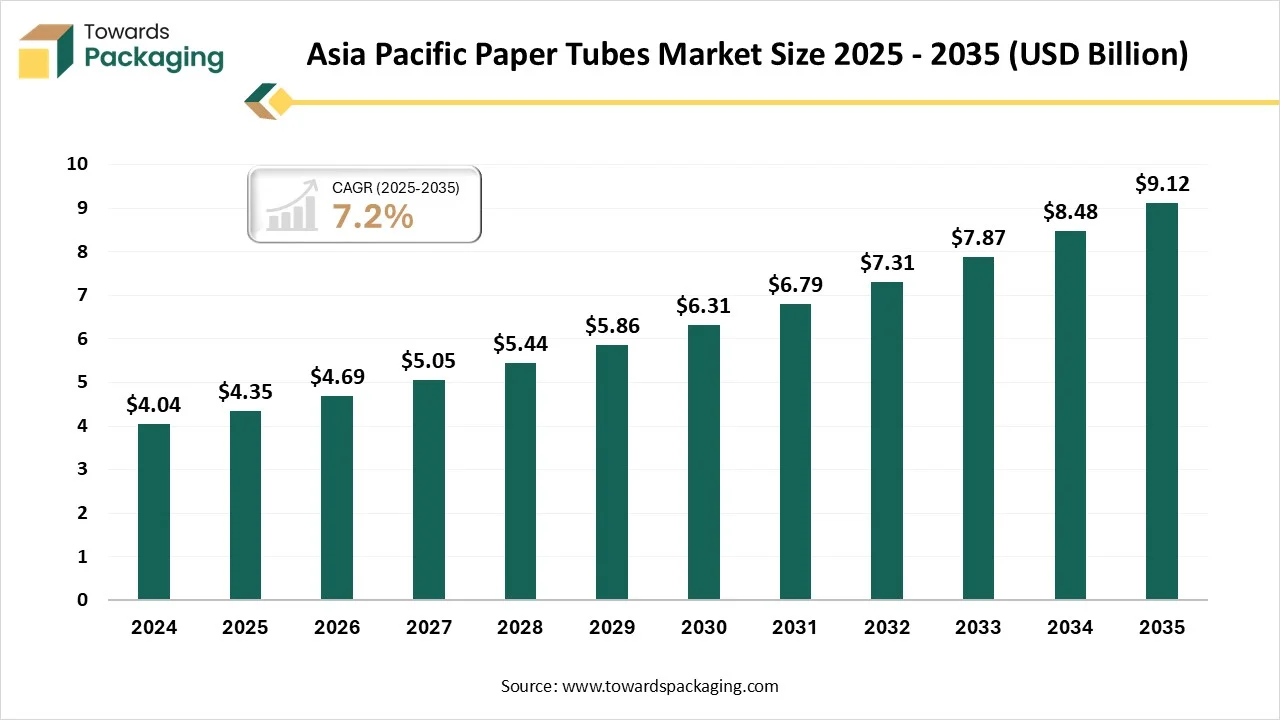

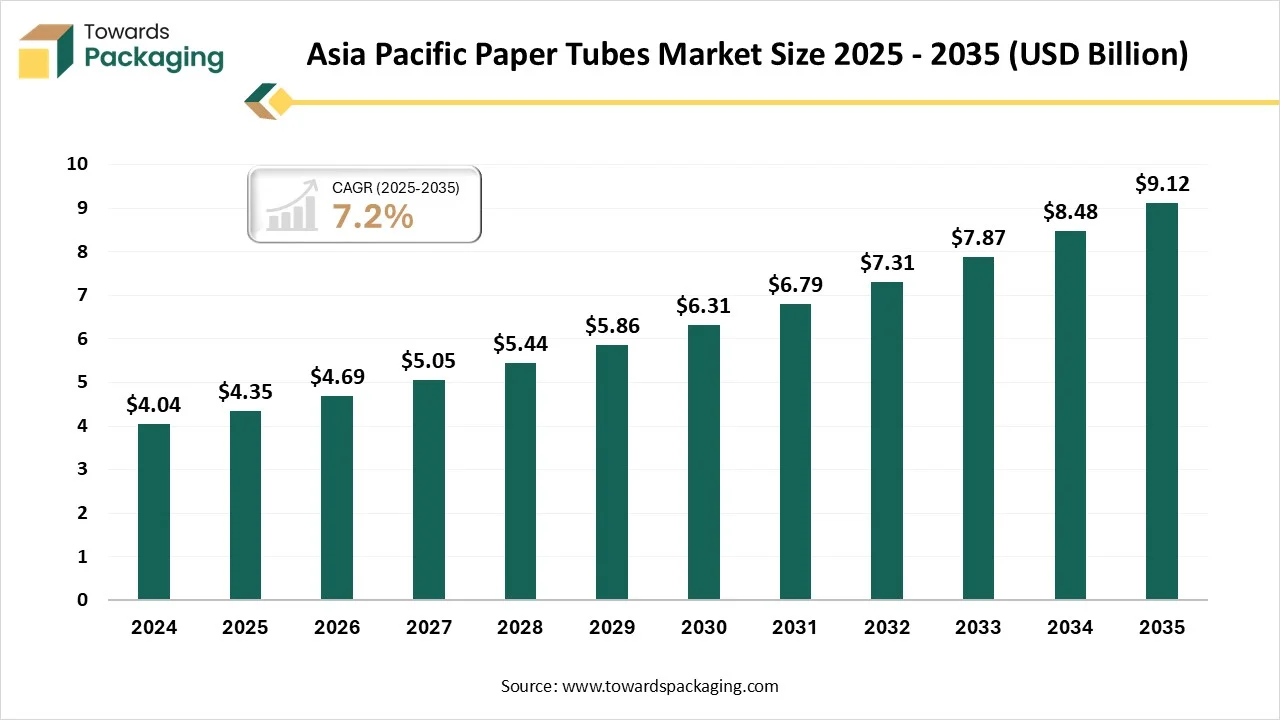

- Asia Pacific dominated the global market with the largest revenue share in 2024.

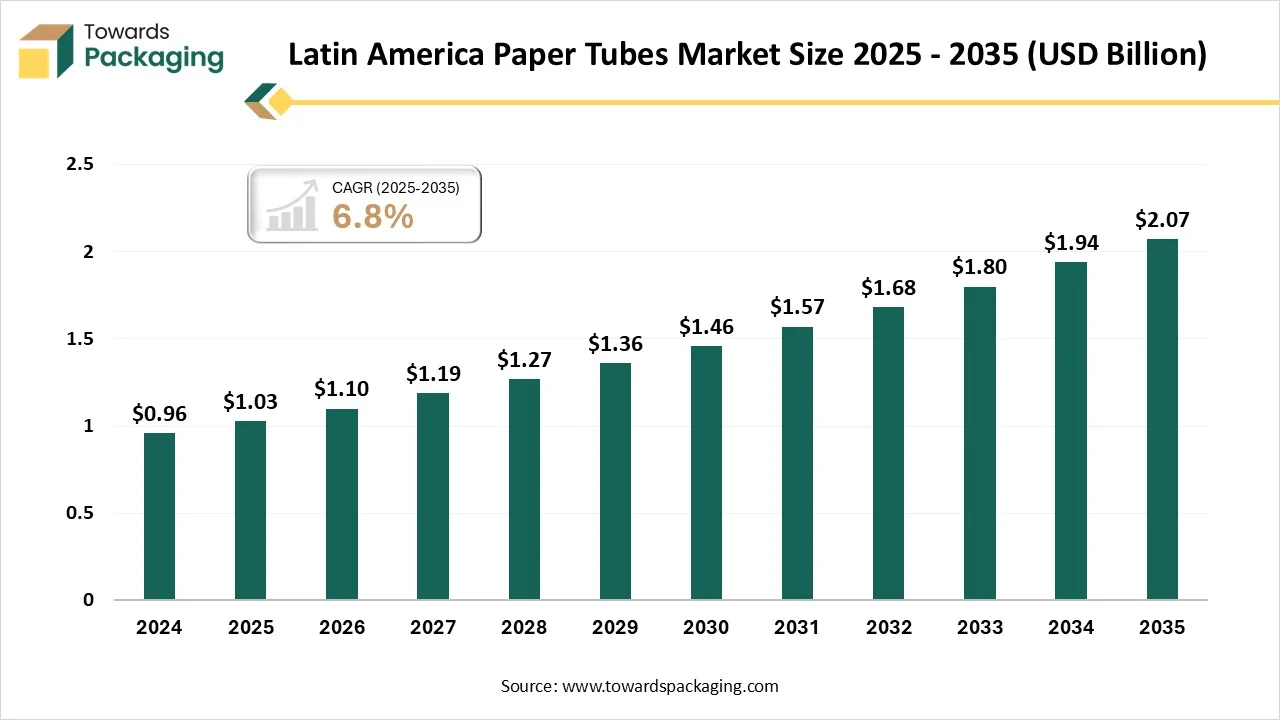

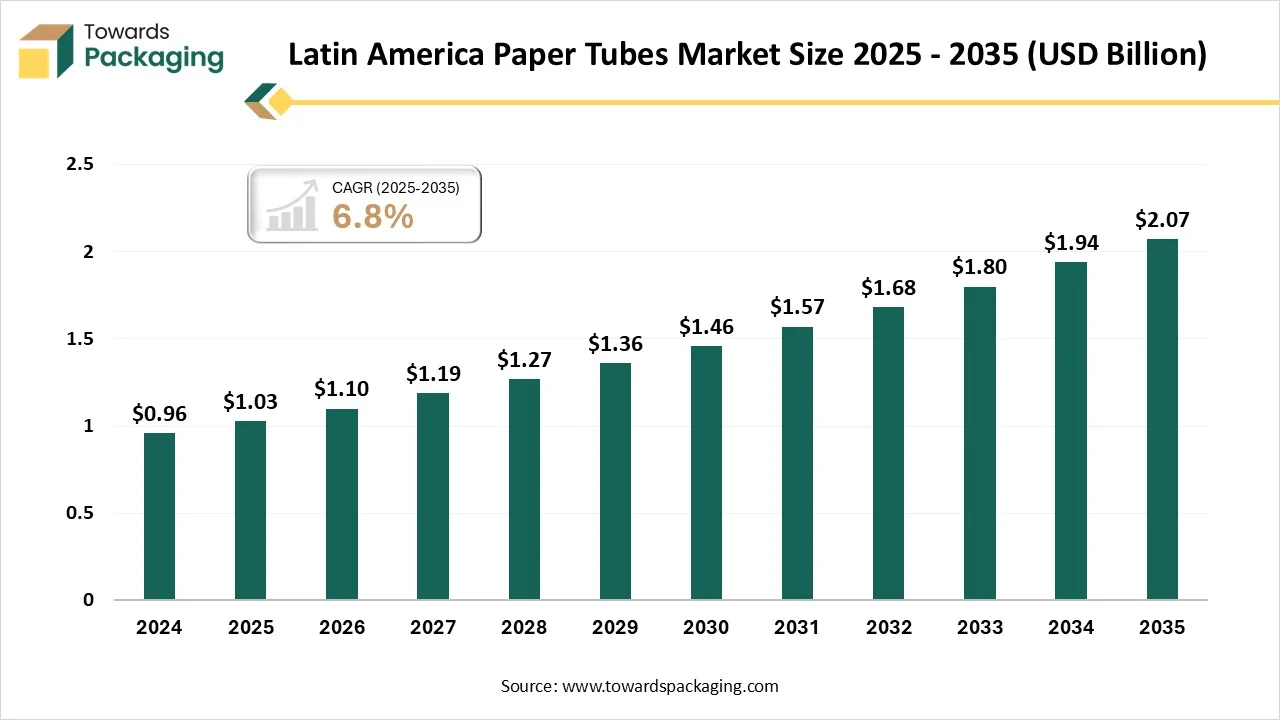

- Latin America is expected to grow at a notable CAGR from 2025 to 2034.

- By type, the spiral wound paper tubes segment contributed the biggest revenue share of 45 % in 2024.

- By type, the composite paper tubes segment will expand at a significant CAGR between 2025 and 2034.

- By material origin, the recycled paper segment contributed 58% revenue share in 2024.

- By material origin, the virgin paper corrugated segment is expected to grow rapidly in the coming years.

- By paper type, the kraft paper segment dominated the market in 2024 with a 43% share.

- By paper type, the paperboard segment is expected to grow significantly over the studied period.

- By end-use industry, the packaging and shipping segment dominated the market in 2024, with a share of 39%.

- By end-use industry, personal care and cosmetics are expected to grow significantly over the studied period.

- By distribution, the direct sales segment had dominated the market by share 65% in the year 2024.

- By distribution channel, online retail is the fastest-growing segment over the upcoming years.

Development of Paper Tubes in the Packaging Sector

The paper tubes market encompasses the production, design, and supply of cylindrical paper-based tubes widely used across industries for packaging, storage, structural applications, and product dispensing. Made predominantly from renewable or recycled materials, paper tubes offer a sustainable alternative to plastic and metal counterparts. These tubes serve diverse end-use sectors including textiles, cosmetics, construction, and food & beverages.

Paper tubes are cylindrical and created from high-quality materials in different thicknesses to keep the powdered products protected throughout their space. These tubes also serve many purposes, whose goal is branding, like presentation, while carrying, showcasing, and shipping powdered products. Round paper tube packaging is the accurate candidate when it comes to load-bearing capacity, stackability, and structural integrity during transit and storage. It is completely cylindrical in shape, which serves continuity and an attention-grabbing, unique presentation for different products like food, cosmetics, and luxury items.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 11.34 Billion |

| Projected Market Size in 2034 |

USD 20.26 Billion |

| CAGR (2025 - 2034) |

6.66% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Type, By Material Origin, By Paper Type, By Diameter, By End-Use Industry, By Distribution Channel and By Region |

| Top Key Players |

Sonoco Products Company, Smurfit Kappa Group, Valk Industries, Inc., CBT Manufacturing, Western Container Corporation, Ace Paper Tube Corp. |

Paper Tubes Market Trends

- User-centric design: Functionality meets excellence: User-centric design is at the centre of current tube packaging. Whether it's packaging supplies for food, the concentration is on making solutions that are easy to utilize and attention-grabbing. For instance, cardboard storage tubes and shaker lids make them ideal for keeping supplements and spices, while 3*5 steel tube patterns ensure durability for industrial uses.

- An eco-friendly option for organizations: Recyclable packaging is the latest trend in the sector for earth-friendly purposes. Kraft paper tubes are the most sustainable packaging solution, which appeals to environmentally friendly users. Paper packaging tubes are 100% eco-friendly and an environmentally friendly option.

- Tactile experience: One of the unique features of cardboard tube packaging is its tactile appearance. The pattern of cardboard cylinders serves a different sensory experience, which develops the unboxing experience. For example, cardboard chapstick tubes serve a smooth yet rigid feel, which makes them a favourite among custom tube production. Likely, wine in tubes serves a luxury tactile experience, attractive to wine enthusiasts who value both functionality and aesthetics.

- Lightweight and easy to ship: Custom paper tubes are easy, lightweight, and helpful for shipping long products to various places. Kraft paper is lighter than materials that include wood, plastic, and other materials. Paper tube packaging can be a convenient and space-saving solution, which will save more storage area and make shipping easier.

- Cost-efficient solution: It is a more cost-effective and efficient solution than the other options. Kraft is an inexpensive material compared to other materials, and paper tube production is easier for manufacturers. The lower cost of packaging reduces the total cost of production.

AI Integration in Paper Tubes Market

AI assists the rising demand for EPR Laws and sustainability efforts. These systems have automated data extraction from production, particulars, miniature product-lifecycle effects, and support in creating jurisdiction-specific compliance reports. AI's acceptance of dynamic reporting frameworks lowers the burden on internal teams and reduces the risk of human error. Sustainability modelling is another space in which AI adds more value. Algorithms estimate a package's complete lifecycle, from sourcing to end-of-life, and mimic alternative formats to lower environmental effects without compromising performance.

On the other hand, AI is also developing packaging lines and machinery by improving quality control, overall efficiency, and maintenance. AI-driven machine vision systems allow for caps, labels, and fill levels. These systems develop consistency and reduce waste by precisely detecting defects or mislabels. Their potential to accept abnormally like water droplets or slight color differentiation that lowers false rejects, hence developing overall quality control.

Nestle's research and development will collaborate with IBM Research to make new tools that develop the power of Artificial Intelligence and deep tech to bring cutting-edge inventions to life. This research partnership has paved the way to a generative AI tool that can be identified as novel through high-barrier packaging materials.

Market Dynamics

Driver

Paper-based tube packaging can be tailored to fit different sizes and flexible quantities, making it perfect for limited edition and seasonal packs. It serves as a flexible way and attention-grabbing packaging for your products, helping them to distinguish themselves from the competition. This flexibility allows you to generate smaller quantities for the latest releases, which adds a sense of uniqueness and drives consumer demand. Utilising paper-based tube packaging can develop the appearance of products and make a premium unboxing experience that users are sure to love.

Restraint

Paper tube packaging experiences many challenges, like consumer behaviour that favors convenience over eco-friendly selections, the alteration in recyclability because of mixed material composition, and higher primary costs for small organizations. Hence, the environmental effects of paper production, which include deforestation and water usage, cannot be overlooked. However, technological advancements, like the application of nanocomposites to develop durability, and rising consumer demand for sustainable products, suggest an encouraging future for paper tube packaging in the animal supplements industry.

Opportunity

The usage of paper production technologies is marked by the addition of nanotechnology, which shows the changes in the field. As it becomes feasible to actively make materials with wanted properties, nanotechnology is thus changing the spectrum of industries that include paper- publishing, packaging, etc, as well as electronics. For instance, nanotechnology defines the classification of food packaging that is biodegradable and antimicrobial in order to develop the food shelf life. The use of nanotechnology in the paper industry is revolutionary and versatile. In addition to food packaging, other specialty paper counts on nanotechnology in filters, barrier coating, and even conductive paper for electronics usage. Additionally, nanotechnology plays a crucial role in updating other aspects of paper manufacture, such as reducing the usage of toxic substances and updating recycling operations.

- On 18 January 2024, Pringles revealed a new crisp tube created from recycled paper with a paper base, allowing the company to recycle the tubes from home collection. The tube also has a plastic lid, which can also be recycled. The eco-packaging, which has been tested by the organization's packaging experts to make sure it safeguards the load-shaped chips and keeps them alive for 15 months, as they can be previously used.

Segmental Insights

Why did the Spiral-Wound Segment Dominate the Paper Tubes Market?

Spiral-wound paper tubes are popular as they offer extraordinary stability and power, which makes them perfect for uses in packaging, textiles, construction, and more. These tubes are created by making a tight winding of a continuous strip of paper in a spiral pattern around a mandrel. Spiral paper tubes are prevalently used as cores for winding materials like textiles and plastic films. Their spiral designs ensure stress distribution, facilitating easy unwinding during generation and usage. They serve as a reliable storage, protection, and transportation solution for cylindrical components like wires, rods, tool handles, and tubing, too. Spiral paper tubes, on the other hand, are created by using winding sheets of paper, one on top of the other at a specific angle, onto a mandrel in a constant spiral. The paper is generally thinner than that utilized for complicated paper tubes and can be created from different materials, including recycled paper, kraft, and coated paper.

Composite Paper Tubes Gaining Popularity

A composite paper tube is a cylindrical kind of packaging made initially from paper or cardboard materials. It is an eco-friendly and versatile option for packaging a variety of products. Composite tube containers are known for their durability, sustainability, and strength, which make them a perfect selection for industries like cosmetics, food, and personal care. Furthermore, composite paper tubes are a perfect choice for organisations and users seeking an eco-conscious packaging option which are both visually appealing and functional. Composite paper tube integrates the perfect mixture of sustainability and stability. As sectors face growing pressure to accept eco-friendly practices, these core serves as an inventive, practical solution which does not compromise on performance.

Why did the Recycled Paper Segment Dominate the Paper Tubes Market in 2024?

Recycled paper has dominated the paper tube market because of 100% recyclable materials, having biodegradable linings as an alternative to plastic coatings. Paper tubes are created from renewable resources, specifically recycled paperboard. As per the USDA, paper production needs 25% less energy than plastic production. Hence, paper tubes can be recycled several times, up to seven cycles. -Formerly, their fibers became too short for future usage. This not only lowers the demand for virgin materials but also meets with circular economy principles, marketing reuse, and minimizing waste.

Virgin Paper Segment Growing Rapidly

Freshly made fiber paper is created from pulp. The fibers for these are being imported from other parts of the world, and in some cases, also come from rainforest areas. Virgin paper is responsible for the subordinate share of paper manufacturing. Hence, this does not mean that the paper sector can currently perform without virgin paper completely. After all, the manufacturing of virgin fiber paper utilises as much energy as the production of one ton of steel. Likewise, the water consumption for paper made from virgin paper is much higher than for the manufacturing of recycled paper.

By Paper Type

Kraft paper is generated through the kraft process, a production technique that differentiates wood fibers through a chemical treatment. This procedure utilises chemicals to remove lignin, the element that makes wood strong, leaving behind pure cellulose fibers, which are stronger and longer than those obtained by other paper manufacturing techniques. The most widespread usage of Kraft paper is in the packaging and wrapping sector. This paper is used to make boxes, bags, and envelopes employed to protect and travel every kind of product. Kraft paper is extensively used in retail stores and supermarkets for its ease of use and durability. Hence, several luxury brands have decided to use tailored kraft paper bags, adding a layer of sustainability and design to packaging.

Paperboard is the Fastest-Growing Segment

Paperboard packaging is created from lightweight yet strong material derived from paper pulp. It is broader than regular paper and crafted to provide structural assistance from a huge range of products, from cosmetic packaging to cereal boxes. Paperboard is specifically sourced from sustainably managed forests, which ensure that raw materials are renewable. The production procedure includes pulping wood fibers, pressing them into sheets, and then drying them. This process results in an evergreen material which we can conveniently fold, cut, and shape into different designs. Whether the goal is simplicity or a more expanded presentation, paperboard gives brands the flexibility to make packaging that aligns with their vision.

Packaging and Shipping Dominates the Market

Many shipping tubes serve superior protection from the bumping, denting, and dropping that often come during shipping, since shipping tubes are more challenging to dent than regular cardboard boxes. Shipping tubes- also known as postal tubes, making tubes, or cardboard tubes- are specifically constructed with thicker, denser, and stronger walls than standard cardboard boxes. This durability is further developed when a strengthening adhesive or bonding material is used. They are fundamentally more resistant to branding and crushing forces as compared to rectangular or square packaging solutions. This makes them a perfect choice for protecting sensitive, valuable, or clumpy-shaped items during transit, and positions them as a main player in the shipping and Packaging industry.

Print-on-demand company Prodigi has revealed its one-of-a-kind moulded fibre end cap for cardboard tubes. Revealed under the Ecocaps brand, the completely compostable and biodegradable caps were created by Prodigi after the firm realised there were no plastic-free alternatives to regular plastic end-caps available in the industry.

Personal Care and Cosmetics: Growing Demand

Paper tubes are popular for products like deodorants, lip balms, and solid lotions due to their recyclability, portability, and often biodegradable properties. These qualities align with the eco-friendly image many personal care brands aim to promote. Small cosmetic items like balms and serums are frequently packaged in paper tubes, which are often coated with plant-based layers to maintain product quality. Secondary packaging surrounds the primary container and serves to organize, protect, or promote the product. In beauty products, primary packaging refers to the container holding the product itself, such as foundation tubes, perfume bottles, or moisturizer jars.

- On 28 January 2025, Albea Tubes revealed the launch of its "Metamorphosis "paper-based cosmetic tube, paired with the EcoFusion Top, at its Queretaro plant in Mexico. The goal of this strategic move is to meet the growing demand for local sustainable packaging solutions.

By Distribution Channel

Paper tubes are sold directly through various channels such as direct outreach to customers, online marketplaces, and partnerships with companies that incorporate tubes into their products. This approach includes custom solutions where paper tubes are personalized, and organizations can enhance visibility by adding custom labels, full-color prints, or logos. These modifications transform the tube into a promotional tool that promotes your brand throughout the shipping process, from warehouse handling to last-mile delivery. Custom-printed shipping tubes are especially popular for promotional campaigns, direct mail marketing, and limited-edition product launches, where visual appeal and brand recognition are key.

Online Retail Segment Expanding Rapidly

Online retailers significantly use shipping tubes for sending out a variety of products, from clothing items rolled to prevent wrinkles to home decor. The rigidness of tube packaging ensures items are secure in transit. Users are totally encouraged by the appearance of a product on shop shelves and on screens, but they are not the only folk when we are directing paper-based tube packaging. Competition from shelf area is at an all-time high, and the retail sector is becoming more competitive. Solutions like cylindrical cardboard packaging play a huge part in this by serving different, visually appealing, and tactile backgrounds such as foiling, embossing, inside print, and communicative elements which add allure, catch your consumer's attention, and serve an unparalleled unboxing experience.

By Region

Why does Asia Pacific Dominate the Paper Tubes Market?

Asia Pacific dominates the paper tubes market as the digital economy is developing, while mobile-first consumer behaviour and heavy internet usage are allowing tailored marketing and AI-driven analytics. Globalized consumer choices and rigid cultural nuances need hyper-targeted market intelligence. ESG considerations and sustainability are also growing across APAC, especially in countries like South Korea, Japan, and Australia, in which regulatory frameworks heavily demand compliance. Government-led digital transformation programs further change market research demands.

Latin America Hosts the Fastest-Growing Market

The demand for paper tubes in Latin America is growing constantly, fueled by the growth in sustainable packaging, especially in food and beverages, cosmetics, textiles, and industrial sectors. Countries like Mexico, Brazil, and Argentina are looking to increase acceptance due to the transformation towards eco-friendly and recyclable alternatives to plastic. Paper tubes are being widely utilised for product protection, premium appeal, and branding, too. The government assists green packaging and initiatives, and rising consumer awareness are further boosting the field. The region's growing retail and e-commerce sectors are also playing a crucial role in driving demand for inventive paper-based packaging like tubes.

Top Players in the Paper Tubes Market

Industry Leader Announcement

- On 8 April 2025, Dickinson Williams and Company is delighted to announce that it has served as the latest financial advisor to Paper Tubes and Sales Co. in its sale to Pacific Paper Tube, a portfolio company of Sky Island Capital.

- On 18 March 2025, Grief, a top company in industrial packaging of products and services, revealed that it is implementing a price increase between USD 50 and USD 70 per short turn for all grades of uncoated recycled paperboard products and a minimum 7.5 % growth on all tube and core and protective packaging products.

Recent Developments

- On 26 November 2024, DIZPOT, a top company in branding, packaging, and logistics services for the Cannabis and hemp industries, is delighted to reveal that the company has been granted U.S Patent No. 46623 for its in-house created child-resistant paper tube, marking a landmark in cannabis packaging solutions.

- On 14 January 2024, the iconic Pringles company invested USD 86MIllion in the latest technology as the paper tubes are available exclusively in Tesco stores and online too.

Segmentation of the Paper Tubes Market

By Type

- Spiral-Wound Paper Tubes

- Convolute Paper Tubes

- Composite Paper Tubes

- Telescopic Paper Tubes

- Others

By Material Origin

- Virgin Paper

- Recycled Paper

By Paper Type

- Kraft Paper

- Paperboard

- Linerboard

- Duplex Board

By Diameter

- Less than 30mm

- 30mm to 60mm

- 60mm to 100mm

- More than 100mm

By End-Use Industry

- Packaging & Shipping

- Textiles

- Food & Beverages

- Personal Care & Cosmetics

- Construction

- Arts & Crafts

- Others

By Distribution Channel

- Direct Sales (Manufacturers)

- Distributors & Wholesalers

- Online Retail

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa