Plastic Liner Market Size, Share, Trends and Forecast Analysis

The plastic liner market is anticipated to grow from USD 5.6 billion in 2026 to USD 8.5 billion by 2035, with a compound annual growth rate (CAGR) of 4.75% during the forecast period from 2026 to 2035. The rising number of end-user industries such as e-commerce, food & beverages, and construction has boosted the market to grow significantly. The bulk requirement of excellent quality liners in construction field and rapid infrastructures development has boosted the growth of the market. Huge demand for sustainable products has enhanced the research and development process in this market to meet the demand of the customers.

Major Key Insights of the Plastic Liner Market

- In terms of revenue, the market is valued at USD 5.34 billion in 2025.

- The market is projected to reach USD 8.11 billion by 2034.

- Rapid growth at a CAGR of 4.75% will be observed in the period between 2025 and 2034.

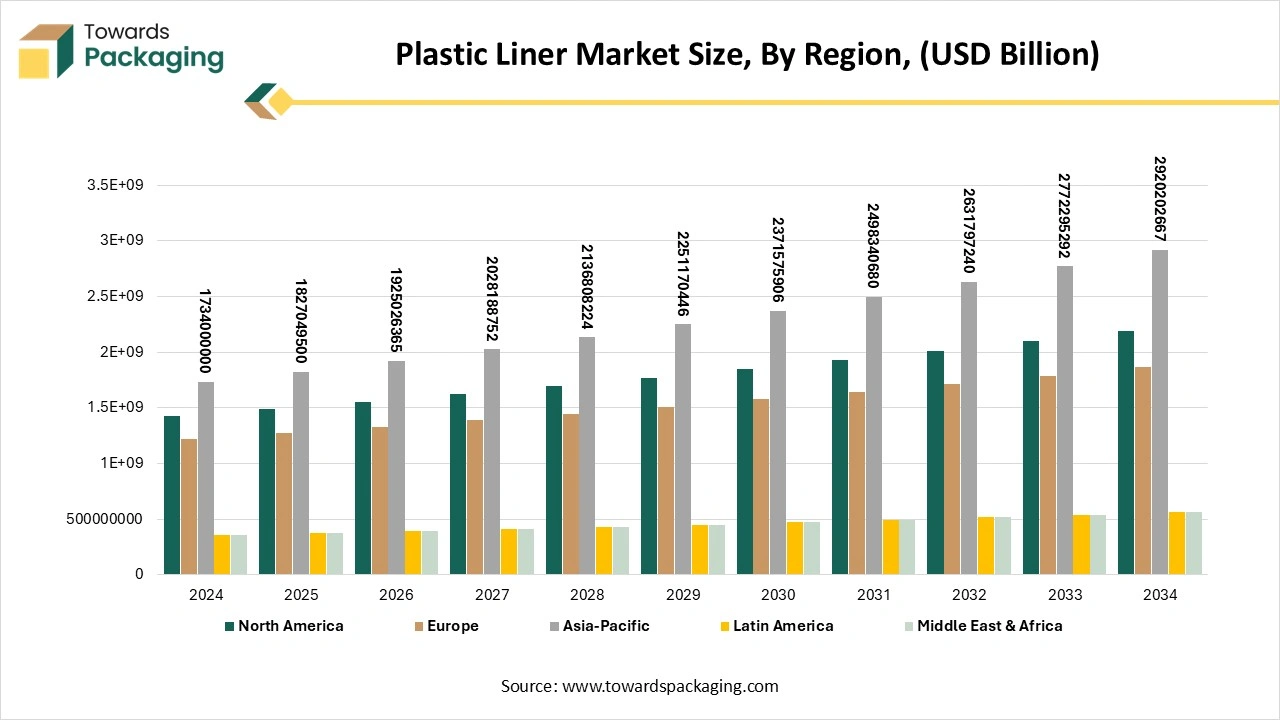

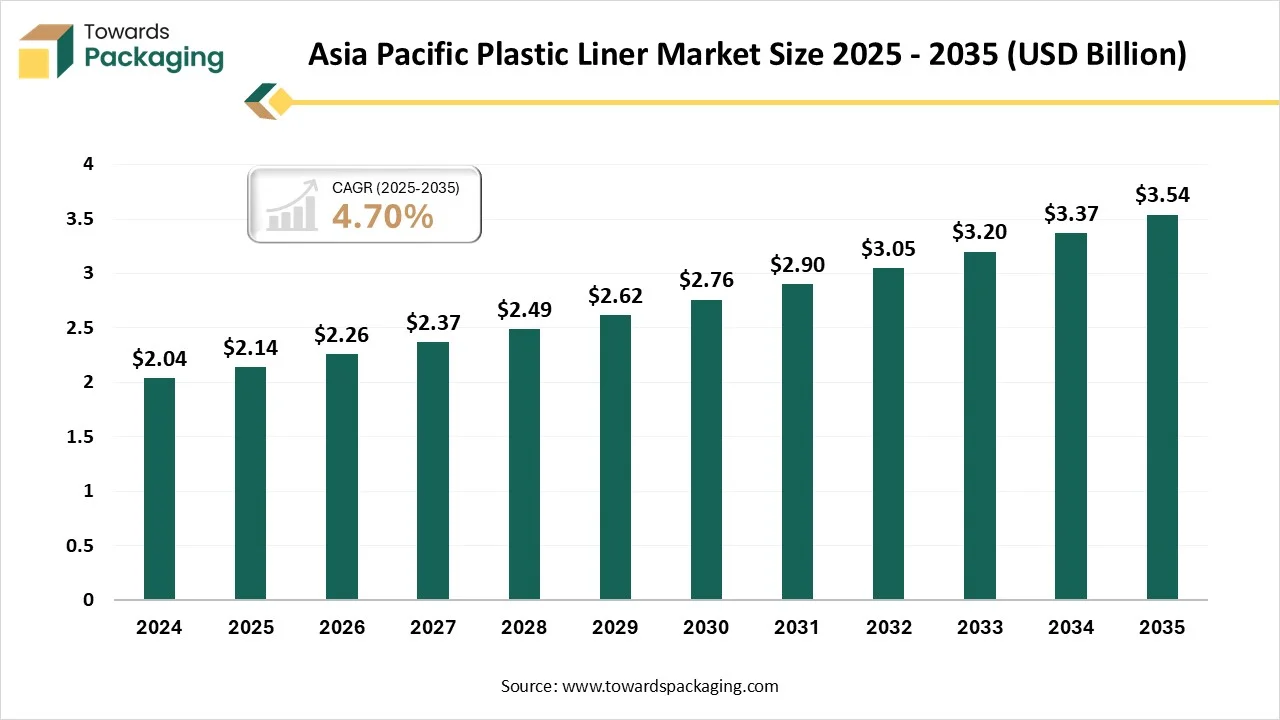

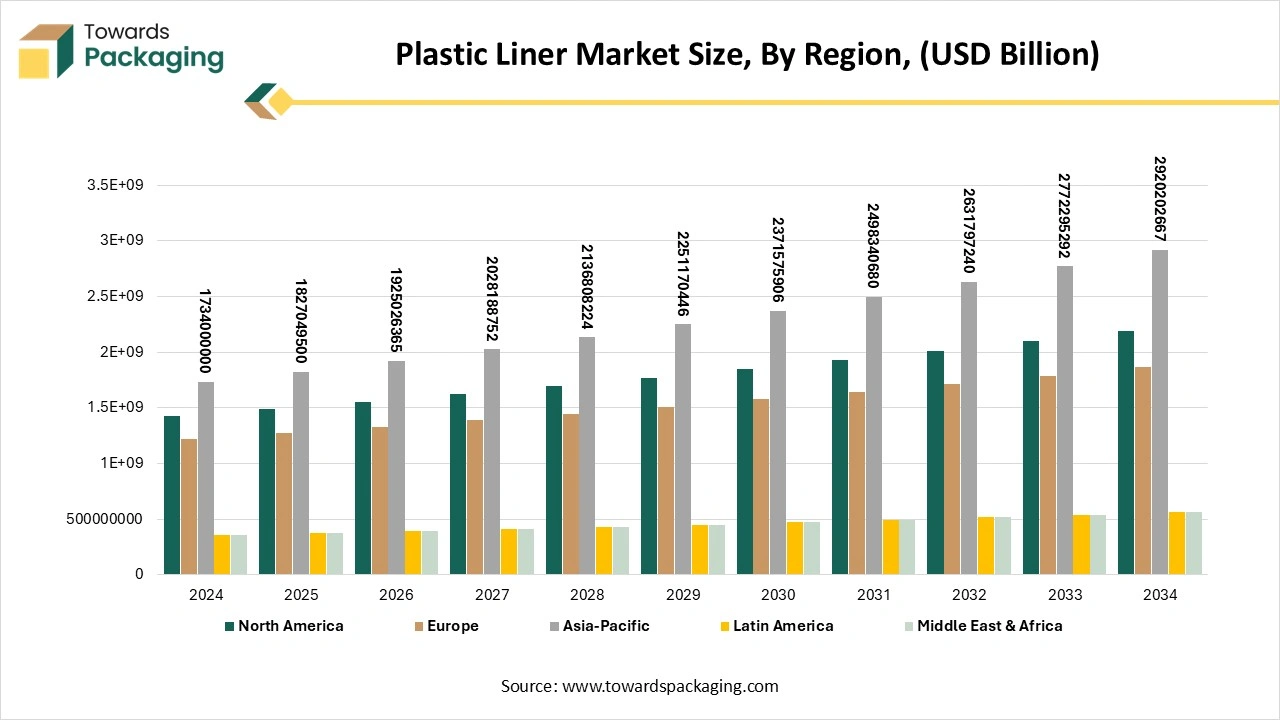

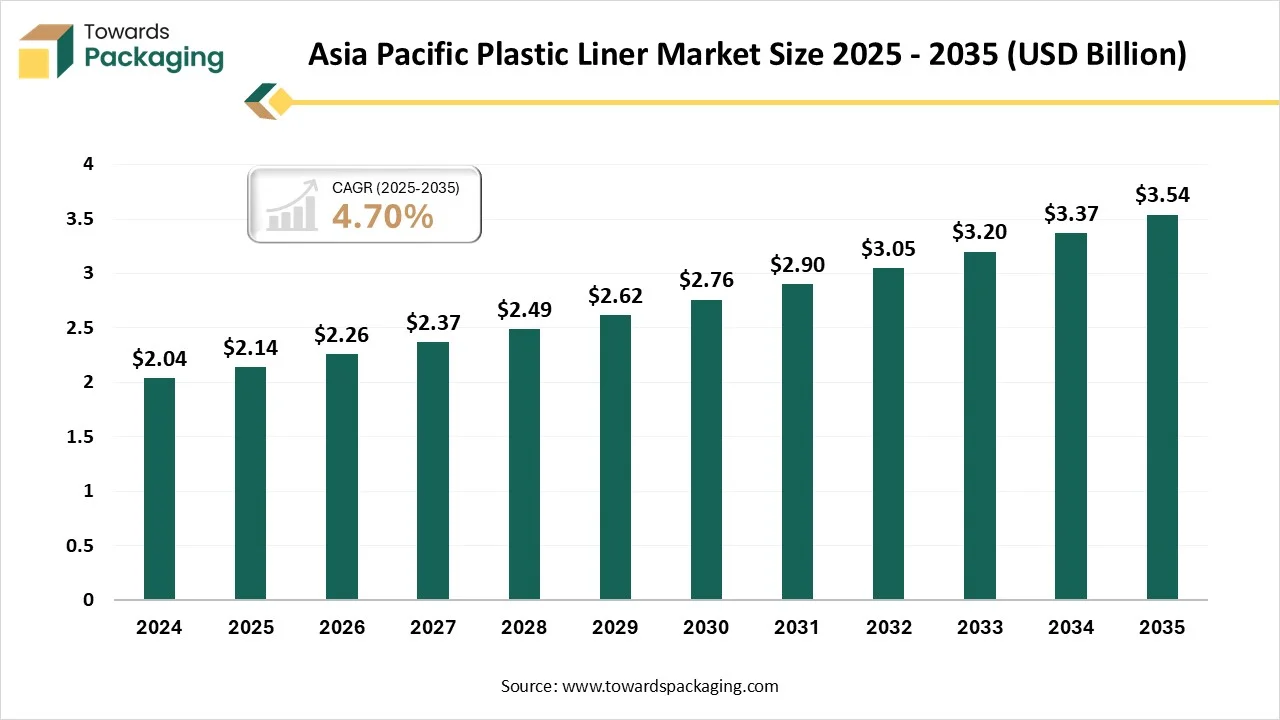

- By region, Asia Pacific dominated the global market by holding highest market share of approximately 40% in 2024.

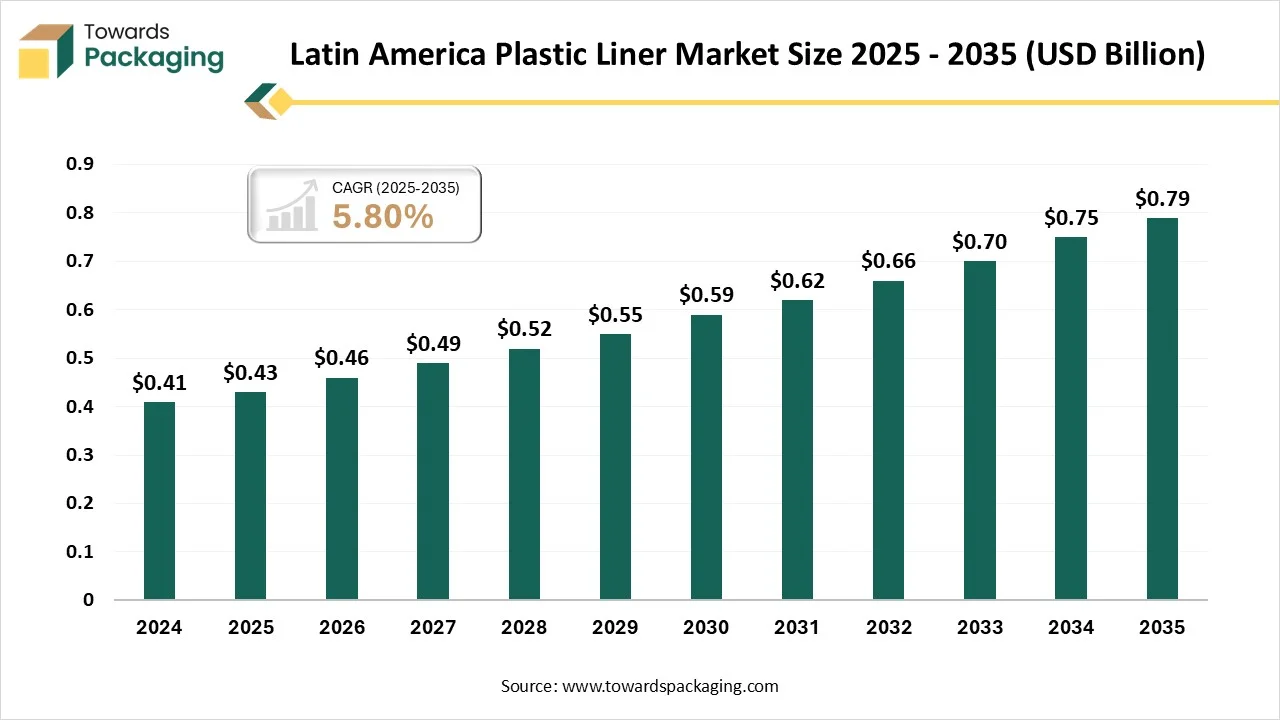

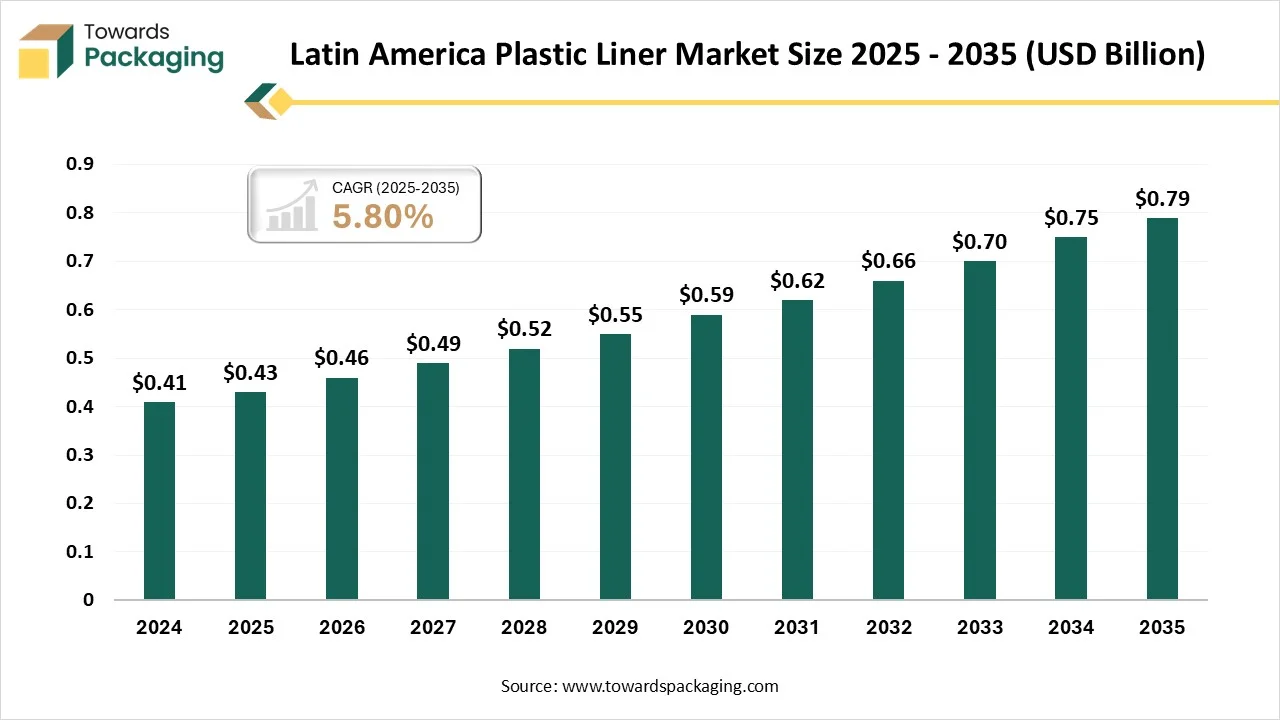

- By region, Latin America is expected to grow at a notable CAGR from 2025 to 2034.

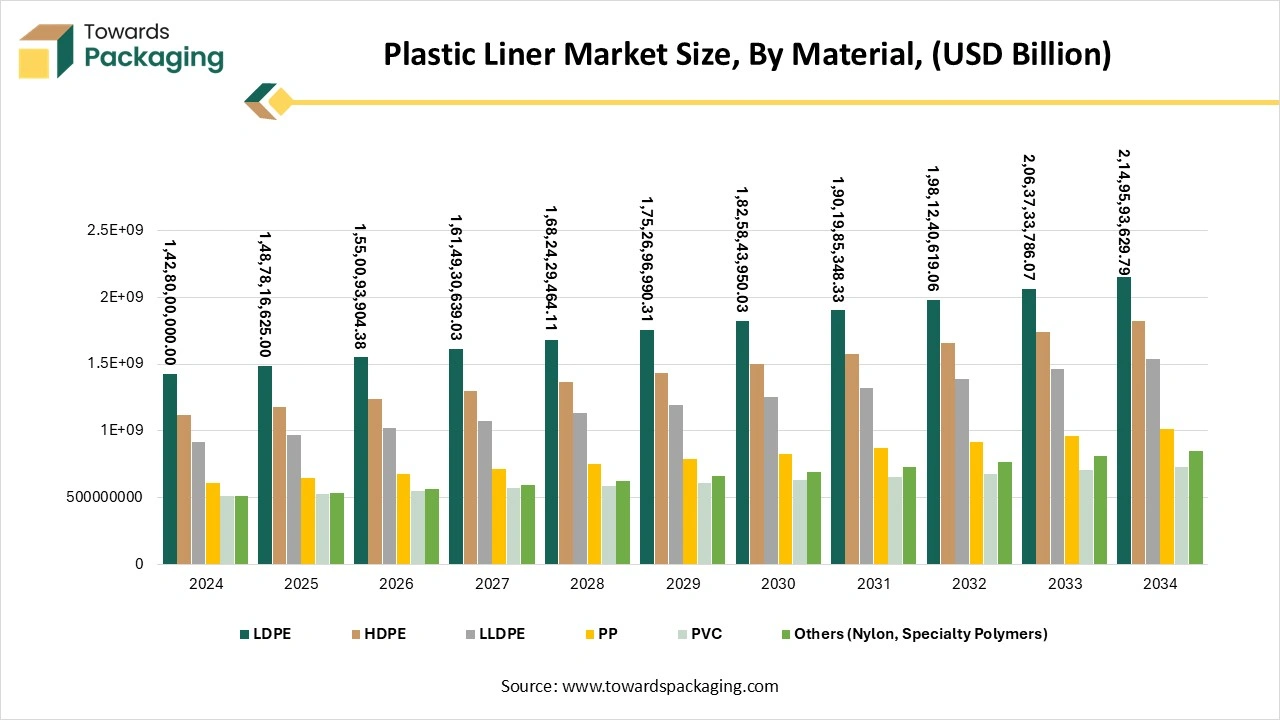

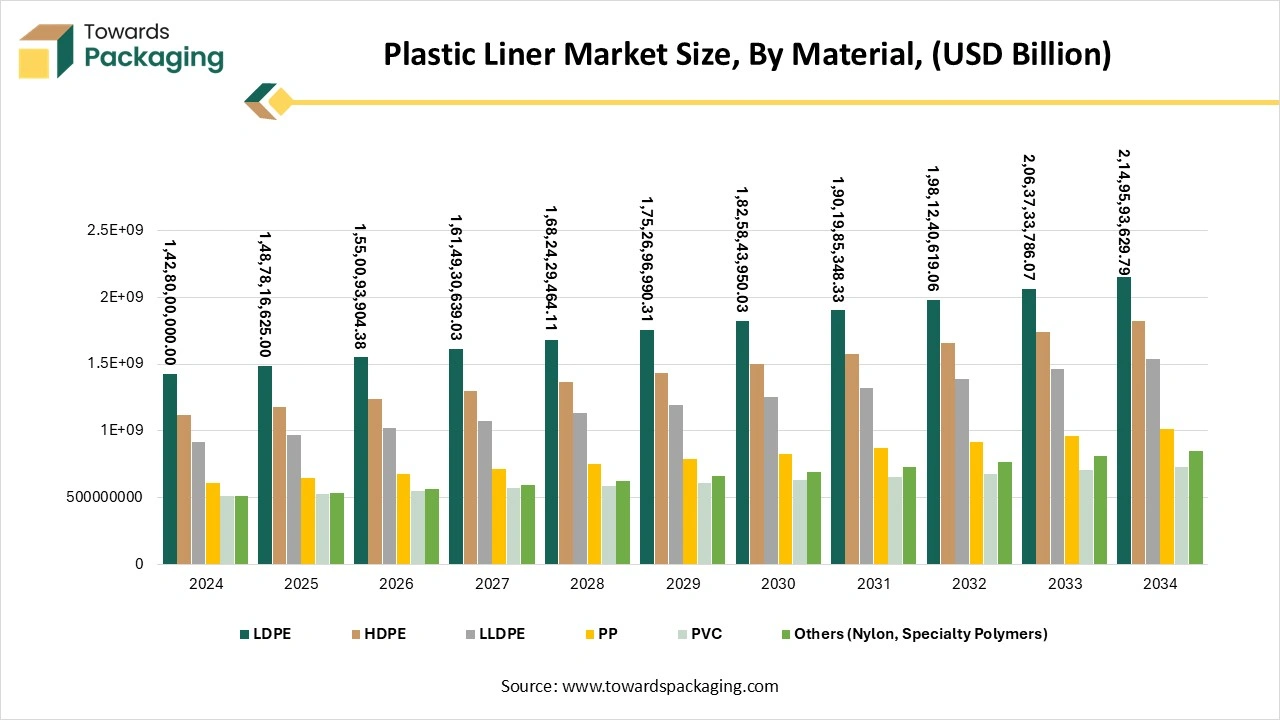

- By material, the HDPE segment contributed the biggest market share of approximately 35% in 2024.

- By material, the LLDPE segment will be expanding at a significant CAGR in between 2025 and 2034.

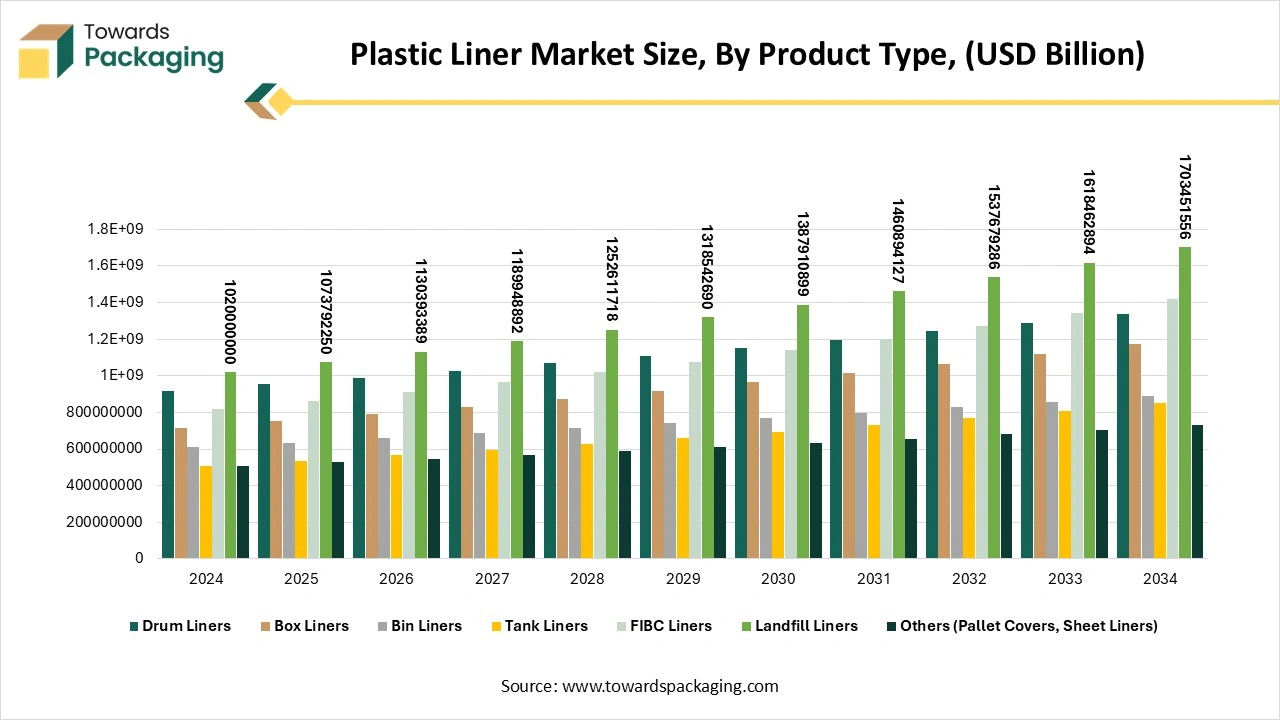

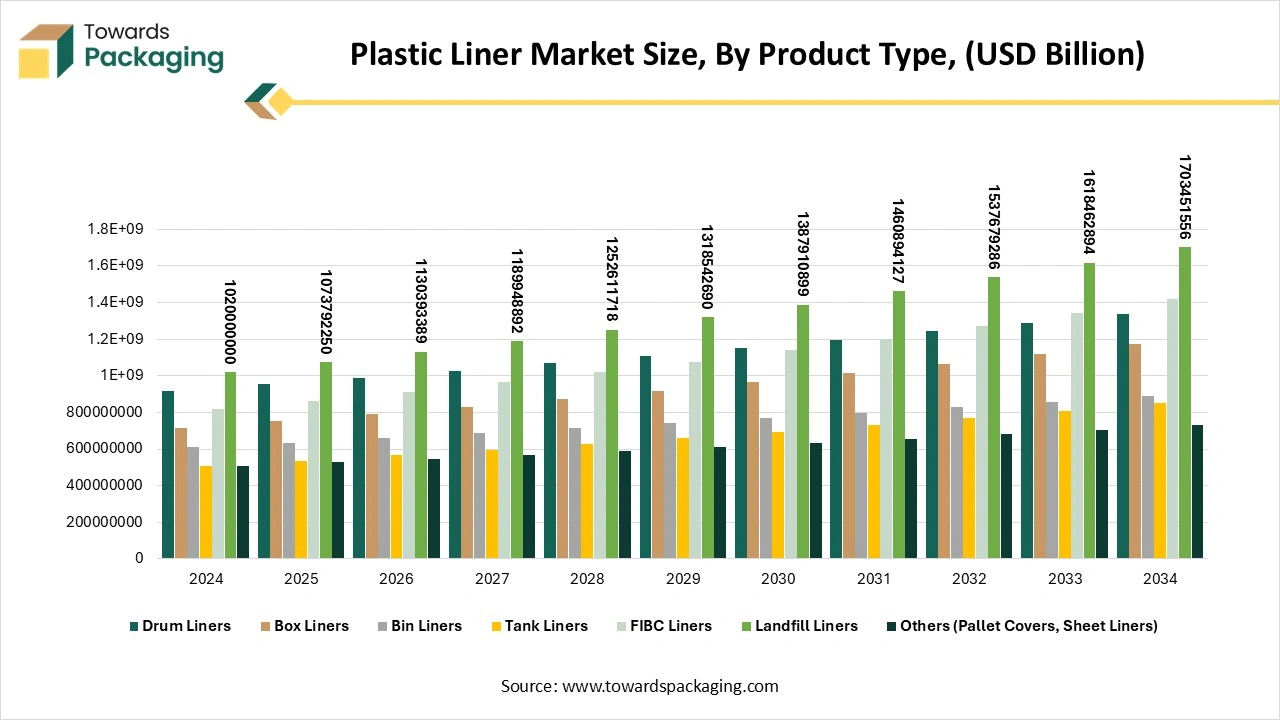

- By product type, the drum & bin liners segment contributed the biggest market share of approximately 40% in 2024.

- By product type, the FIBC & landfill liners segment is expected to expand at a significant CAGR in between 2025 and 2034.

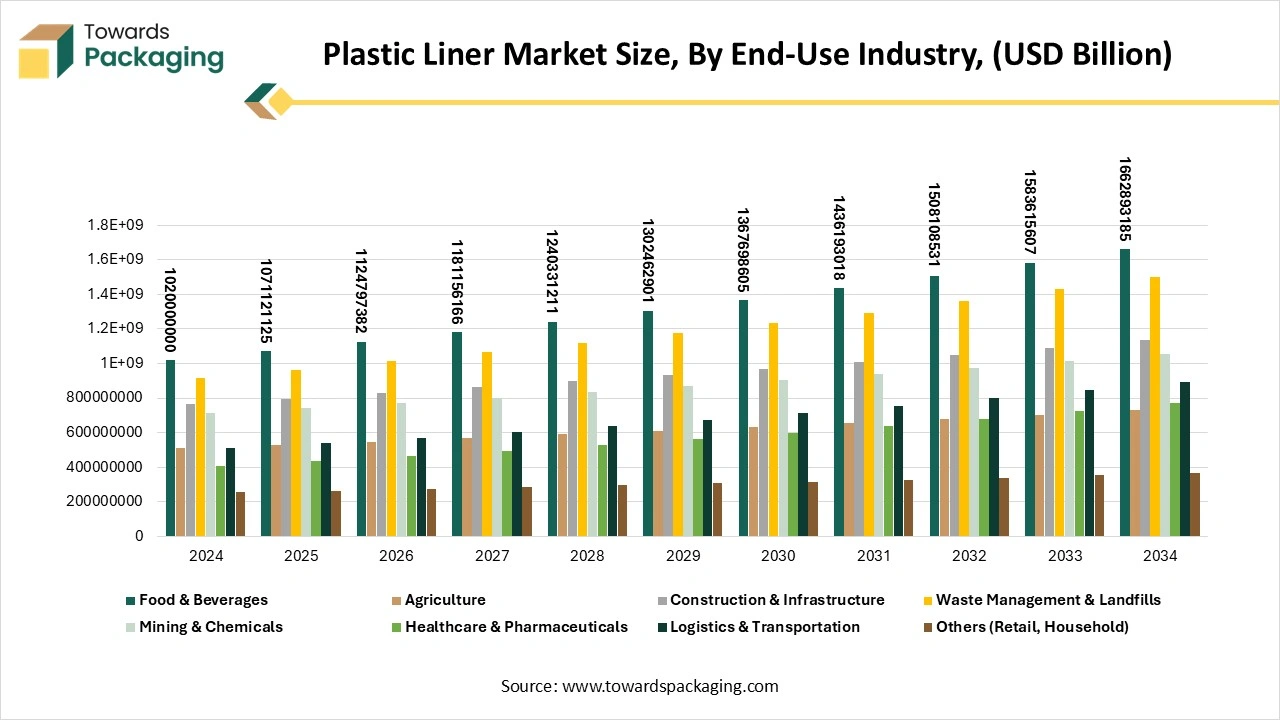

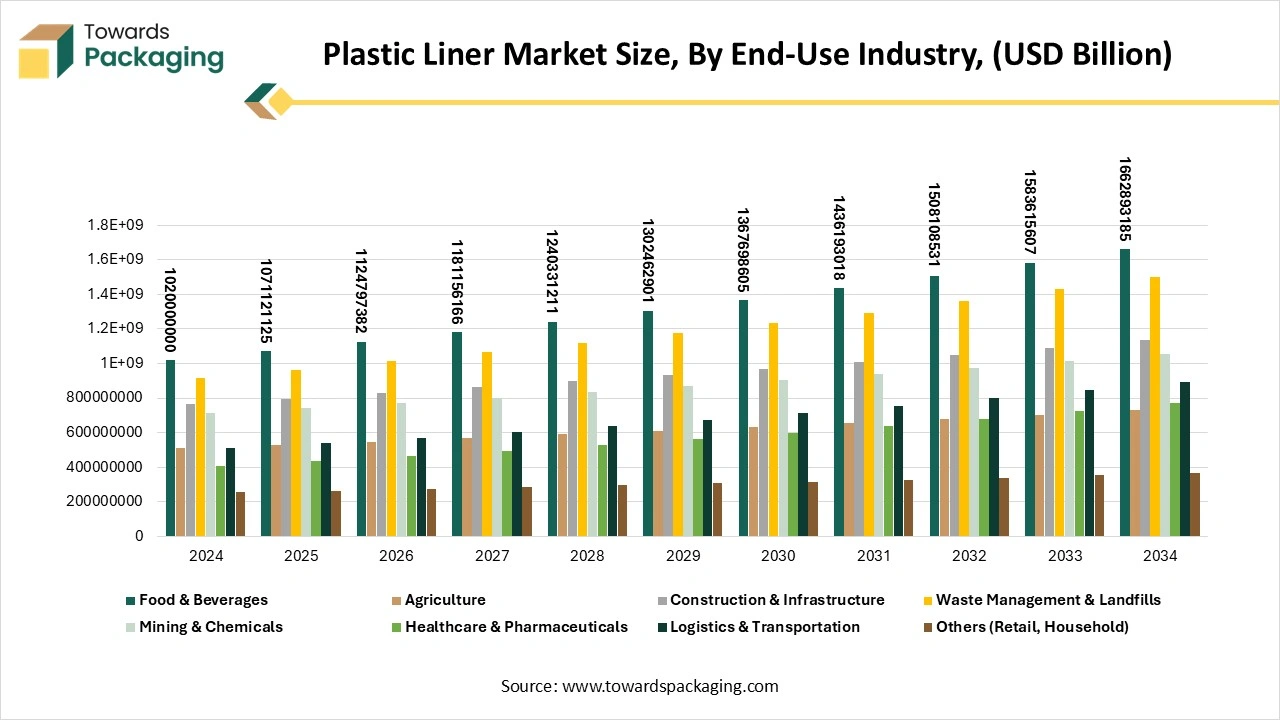

- By end-use industry, the food & beverages segment contributed the biggest market share of approximately 30% in 2024.

- By end-use industry, the waste management & healthcare segment is expanding at a significant CAGR in between 2025 and 2034.

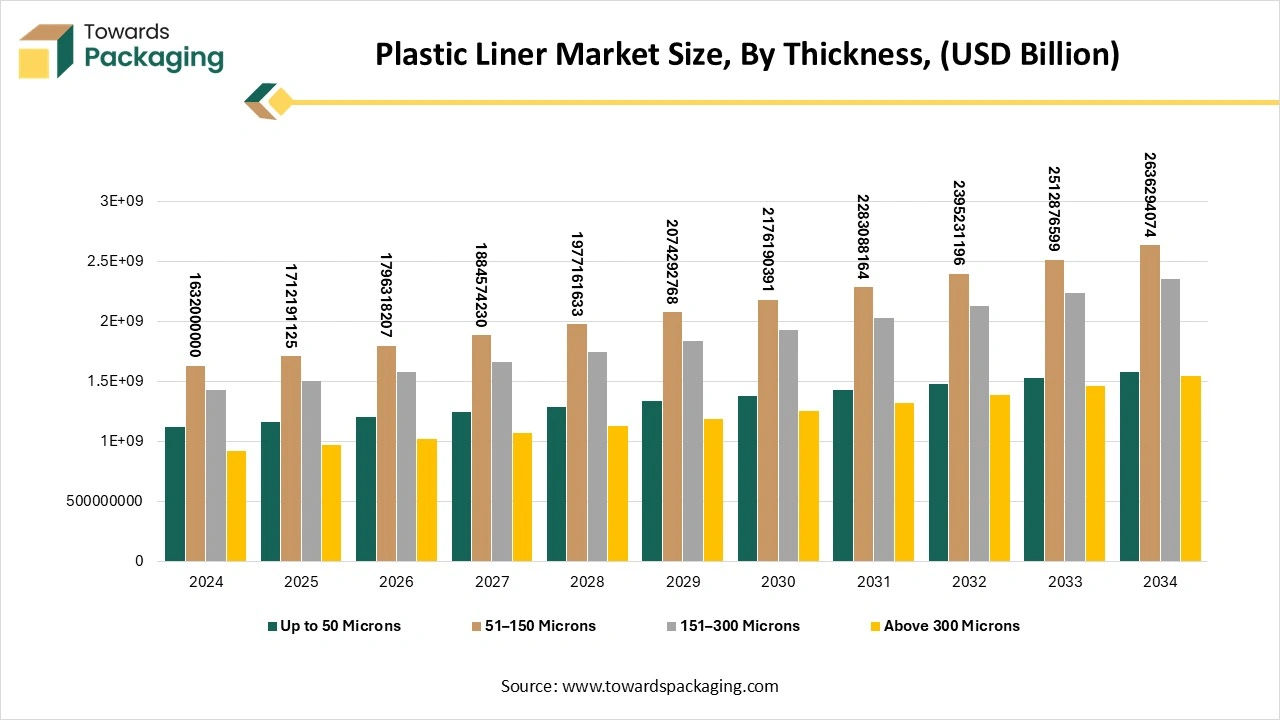

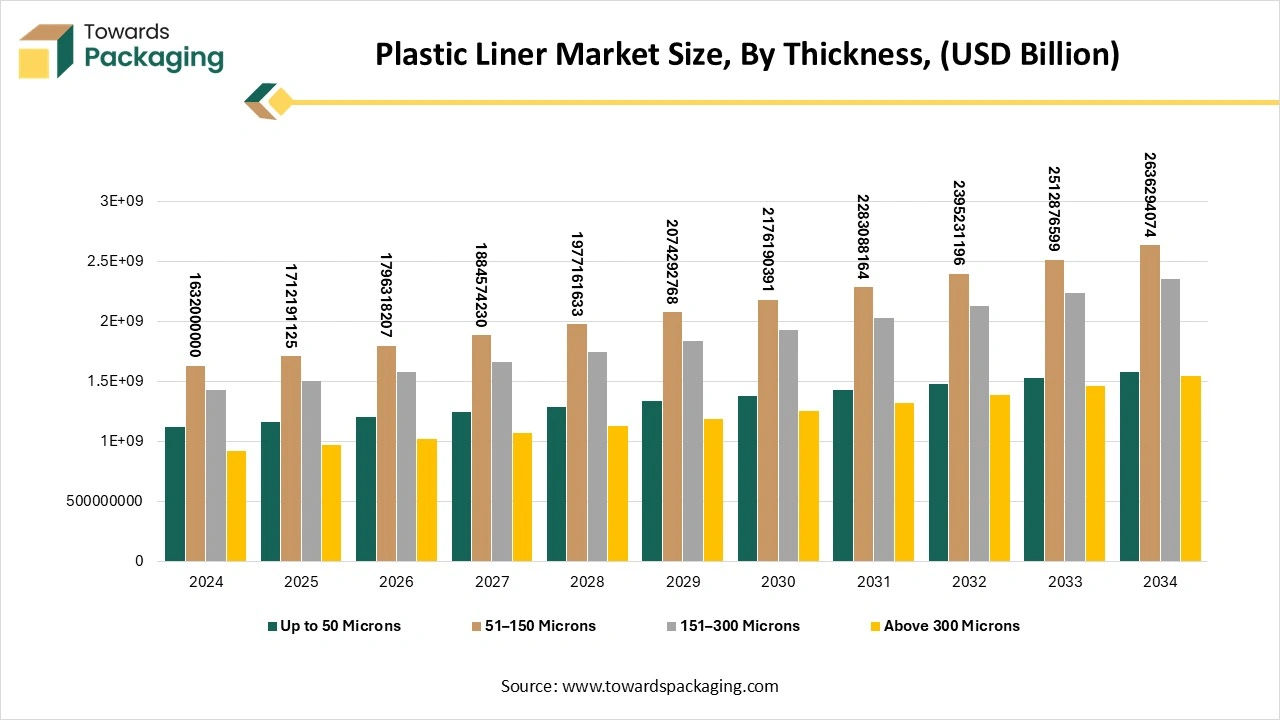

- By thickness, the 51–150 microns segment dominated the market with the share of approximately 45% in 2024.

- By thickness, the above 300 microns segment will be expanding at a significant CAGR in between 2025 and 2034.

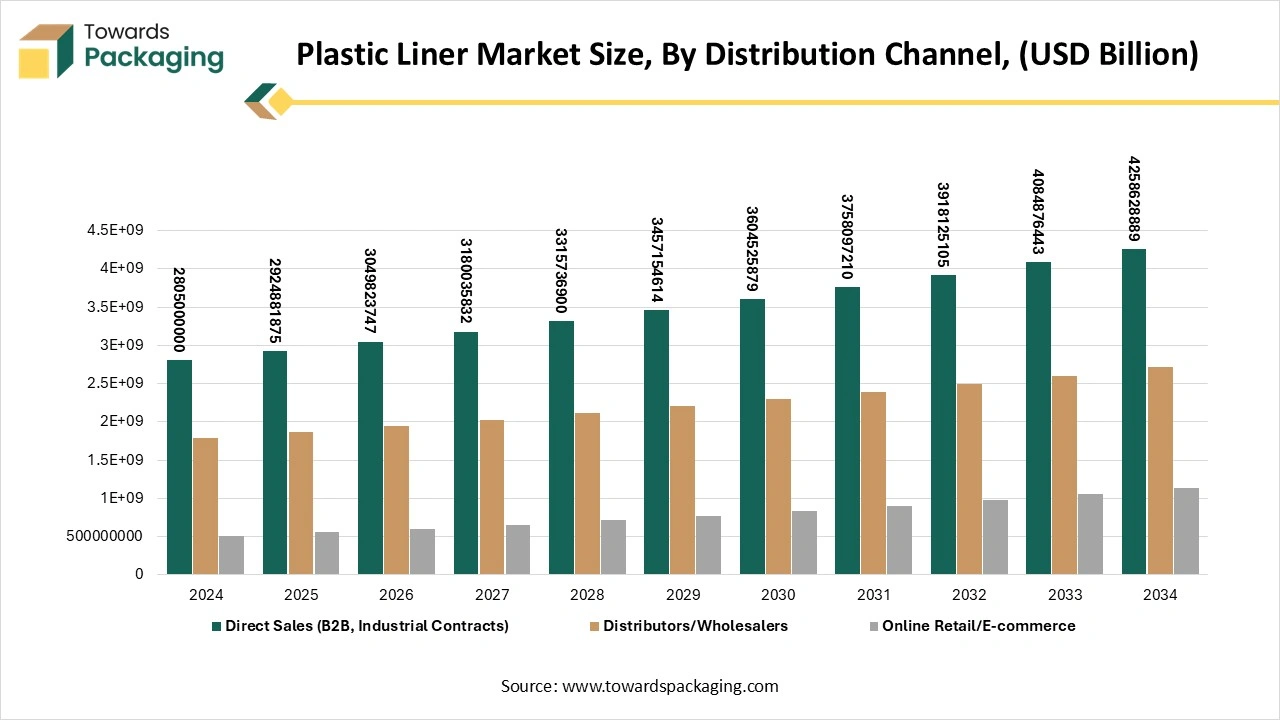

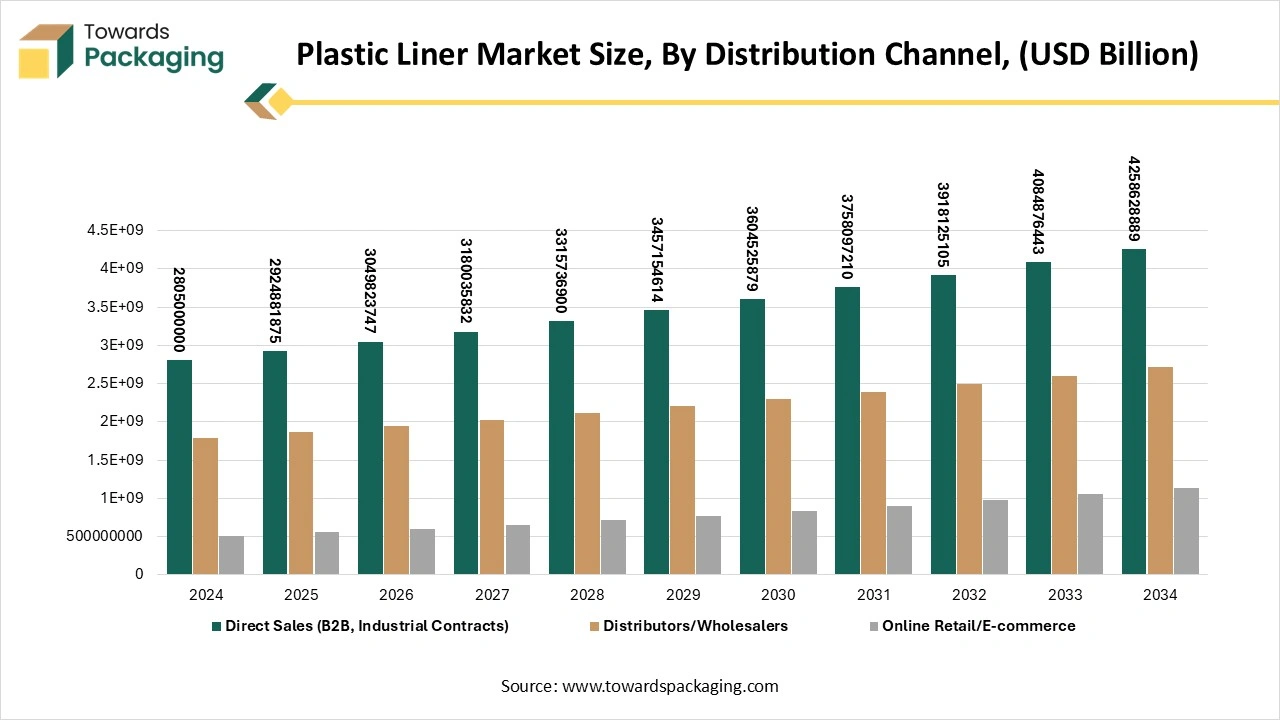

- By distribution channel, the direct sales (B2B) segment contributed the biggest market share of approximately 50% in 2024.

- By distribution channel, the online retail/e-commerce segment is expected to expand at a significant CAGR in between 2025 and 2034.

Market Overview

The plastic liner market refers to protective plastic-based materials used as liners in containers, tanks, bins, packaging, landfills, and industrial equipment to prevent leakage, contamination, and corrosion. These liners are typically made from polyethylene (LDPE, HDPE, LLDPE), polypropylene, PVC, and specialty engineered plastics, providing chemical resistance, moisture barrier properties, durability, and flexibility.

Plastic liners are widely used in waste management, agriculture, food & beverages, construction, mining, chemicals, and logistics. Market growth is driven by increasing demand for safe packaging, rising construction and infrastructure projects, growth in waste management practices, and regulatory compliance for environmental protection.

What are New Trends in the Plastic Liner Market?

Increasing Demand for Scented Plastics

- These are widely used in the homes to cover the smell of waste materials stored.

Different Sizes Availability

- The availability of different sizes of plastic liners has widen the demand for this market.

Reusability Capacity of Plastic Liners

- The potential of these plastic liners of reusing has promoted the demand for this market.

How Can AI Improve the Plastic Liner Market?

The incorporation of AI technology in the plastic liner market plays an important role in regulating supply chain distribution process. It is widely used for material development process to generate high-quality plastic liners in the market. AI help in manufacturing sustainable and advanced formulation for plastic which are recyclable and emit low carbon. It ensures timely production with automation tool support which enhance the reliability in this sector.

Market Dynamics

Market Driver

Rising Focus towards Sustainable Packaging

Increasing emphasis towards development of sustainable packaging has influenced the development of the plastic liner market. With ecological apprehensions gaining importance, industries across businesses are looking for environment-friendly substitutes to traditional packing. Plastic liners provide a durable and lightweight option, decreasing the requirement for extreme packaging resources. Producers are developing to meet the demand for sustainable packaging by inventing with recyclable and recycled materials. As industries manage ecologically responsible choices, the acceptance of plastic liners bring into line with broader company sustainability aim, pushing the market to grow.

Market Challenges and Restraints

Rising Ecological Concern and Packaging Guidelines

The rising concern towards ecological pollution due to plastics and strict guidelines in the packaging sector has hindered the expansion of the market. Governments and supervisory bodies are executing strict guidelines aimed at decreasing single-use plastic liners and reassuring more sustainable substitutes. Plastic liners are a part of the huge plastic ecology, face inspection and calls for substitutes that have lesser ecological influences.

Market Opportunity

Advancement in Recyclable Resources

The continuous advancement in the recyclable resources has raised the opportunities for the market. With the rising emphasis on sustainability raised the demand for plastic liners which are functional as well as ecologically friendly. Investment in study and development to generate recyclable plastic liners materials with improved performance and durability can open new return streams. Producers that effectively present such environment-friendly resolutions can plea to ecologically conscious customers and increase a competitive advantage in an industry progressively shaped by sustainability apprehensions.

Material Insights

Why HDPE Segment Dominated the Plastic Liner Market In 2024?

The HDPE segment dominated the market in 2024 due to its chemical resistance, cost-effectiveness, and durable quality. These capabilities make it ideal for storage and containment in industries such as agriculture and waste management sector. This segment is continuously undergoing innovation process which has developed high-performance and eco-friendly liners. It is well-known for its high strength, strong physical security, and striking tensile strength.

The LLDPE segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to its puncture resistance, excellent strength, and flexibility. The toughness of this material provides safety assurance to fragile substances. These can stretch under pressure without breakage and provide a smooth surface for products.

Product Type Insights

Why Drum & Bin Liners Segment Dominated the Plastic Liner Market in 2024?

The drum & bin liners segment held the largest share of the plastic liner market in 2024 due to rising industrial and household demand for effectual containment solution, safety, and hygiene. These protect from contamination and corrosion of premium drums and allow to reuse it multiple times. These are versatile and used in various sectors which enhance its production process as well as quality of the liners. It helps in keeping waste products segregated in drums and bins which reduce contamination or spoilage of products.

The FIBC & landfill liners segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to its cost-efficacy, strict ecological guidelines, and rising industrialization. It provides safety against contamination, moisture, and static discharge which is ideal for various sectors such as pharmaceuticals, food, and chemicals. Increasing infrastructures enhance the usage of these liners for projects such as water management, and various other.

Thickness Insights

Why 51–150 Microns Segment Dominated the Plastic Liner Market In 2024?

The 51–150 microns segment dominated the plastic liner market in 2024 as it offers flexibility, cost-efficiency, and strength. This thickness is majorly maintained in liners made up of HDPE and LDPE which are utilized for the medium duty requirements in several industries. This thickness is suitable in wide range such as from basic moisture protection to harsh chemicals leakage which enhance its demand in several sectors. These are cost-effective which allow industries to demand high quality liners.

The above 300 microns segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to rising focus on developing durable and high-performance liners. The major driver of this segment is the rapid growth of industrialization, expansion of agricultural sector, and large infrastructures. The expansion of aquaculture industry has also raised the usage of liner with this thickness.

End-use Industry Insights

Why Food & Beverages Ingredients Segment Dominated the Plastic Liner Market In 2024?

The food & beverages ingredients segment dominated the plastic liner market in 2024 due to rising demand for packaging products. This rising safety standard in this industry has influenced the demand for high-quality liners. Plastic liners protect food products from moisture, oxygen, and light which result in extended shelf life of the products. The increasing versatility and product protection concern has raised the demand for this sector. Advancement in the production process of the plastic liners has enhanced its adoption in this sector.

The waste management & healthcare segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to rising concern for plastic waste generation, ecological issues, and specific healthcare requirements. Healthcare sector utilizes plastic liners for disposal of waste generated and waste management is also essential in this industry to reduce the widespread of infectious diseases. These liners are also utilized in labs, clinics, hospitals, and research centres require management of waste.

Distribution Channel Insights

Why Direct Sales (B2B) Segment Dominated the Plastic Liner Market In 2024?

The direct sales (B2B) segment held the largest share of the market in 2024 due to huge requirement for customization and customer relationships. This segment is widely utilized by manufacturers, wholesalers, and distributors to generate high profit margin. It offers huge customization option to meet the demand of the consumers from several industries. It provides excellent technical support and consultation to the customers majorly for high-performance or complex polymers.

The online retail/e-commerce segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to its low-cost transportation, lightweight, and durable properties. The rapid expansion of e-commerce sector and increasing reliance of consumers for home delivery of products has raised the demand for plastic liners in this sector.

Regional Insights

Strong Industrial Output in Asia Pacific Promote Dominance

Asia Pacific held the largest share of the plastic liner market in 2024, due to the presence of strong industrial output and rapid urbanization. The rising demand for plastic liners in industries such as packaging, agriculture, food & beverages, and construction. Huge investment in the infrastructure development raised the construction work in countries like China and India boost the demand for plastic liner with enhanced quality. Government strategies encourage the waste management policies which push the market to develop rapidly.

Huge Manufacturing Capacity Promote Plastic Liner Market in China

Presence of huge manufacturing capacity has raised the expansion of the market in China. The advancement in the technology, manufacturing capacity, and cost-effective production process has pushed the market to develop significantly. China has a large consumer for plastic packaging which drive the production process.

Latin America’s Increasing Export Activities Support Growth

Latin America expects the significant growth in the market during the forecast period. The rising export business of various sectors has enhanced the demand for plastic liners such demand raise the growth of this market. Supervisory changes in the direction of circular economy practices have created opportunities for invention and environment-friendly packaging solution. The rapid expansion of packaged food products demand has enhanced the demand for such liners to preserve food from contamination.

Plastic Liner Market - Value Chain Analysis

Raw Material Sourcing

The raw materials used in this market are majorly Low-Density Polyethylene (LDPE) , High-Density Polyethylene (HDPE), Linear Low-Density Polyethylene (LLDPE), Polypropylene (PP) and Polyvinyl Chloride (PVC).

- Key Players: SABIC, Dow Chemical Company

Component Manufacturing

It comprises a wide range of processes and products starting from industrial transportation bags to special containment process.

- Key Players: Apex Polymers, ASVA Corporation

Logistics and Distribution

It manages the supply chain process that comprises of raw materials procurement, manufacturing and in-plant logistics, and finished goods distribution.

- Key Players: Amcor Plc, Mondi Group

Top Companies in the Plastic Liner Market

- Berry Global, Inc.

- Amcor plc

- Sealed Air Corporation

- Bemis Company, Inc.

- RKW Group

- Greif, Inc.

- Novolex Holdings, LLC

- Winpak Ltd.

- Inteplast Group

- Plastipak Holdings, Inc.

- Uflex Ltd.

- Sigma Plastics Group

- Poly America, L.P.

- Mondi Group

- Huhtamaki Oyj

- Clorox Company (Glad Products)

- Anchor Packaging Inc.

- Allied Plastics, Inc.

- International Plastics, Inc.

- Elkay Plastics Co., Inc.

Latest Announcements by Industry Leaders

- In June 2024, Plastics Mechanical Recycling Strategy Leader EMEA at Dow Packaging & Specialty Plastics, Fabrice Digonnet, expressed, “The recent introduction of Revoloop recycled plastic resins the company is expanding rapidly towards developing sustainable portfolio. The company has worked with recyclers, convertors, and brands to design new patterns to utilize less plastics and help to develop completely recyclable packaging.”

Recent Developments

- In September 2025, SMX collaborated with A*STAR to implement a national plastics passport process to offer tamper-resistant tracking and verification. It has developed a new molecular marking technology which has transformed company’s sustainability verification.

- In June 2024, McDonald’s franchisee Arcos Dorados Holdings is putting ‘all-natural’ barrier coating of J&J Green Paper in its paper food packaging in an offer to time out plastics, PFAS chemicals, and customer waste in the fast-food industry.

Plastic Liner Market Segments

By Material

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Linear Low-Density Polyethylene (LLDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Others (Nylon, Specialty Polymers)

By Product Type

- Drum Liners

- Box Liners

- Bin Liners

- Tank Liners

- Flexible Intermediate Bulk Container (FIBC) Liners

- Landfill Liners

- Others (Pallet Covers, Sheet Liners)

By Thickness

- Up to 50 Microns

- 51–150 Microns

- 151–300 Microns

- Above 300 Microns

By End-Use Industry

- Food & Beverages

- Agriculture

- Construction & Infrastructure

- Waste Management & Landfills

- Mining & Chemicals

- Healthcare & Pharmaceuticals

- Logistics & Transportation

- Others (Retail, Household)

By Distribution Channel

- Direct Sales (B2B, Industrial Contracts)

- Distributors/Wholesalers

- Online Retail/E-commerce

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait