Premium Paper Packaging Materials Market Forecast with Segment Data, Regional Breakdown (NA, EU, APAC, LA, MEA), Value Chain & Competitive Intelligence

The premium paper packaging materials market presents an in-depth evaluation of global revenue performance, growing from a multibillion opportunity in 2024 toward significant expansion by 2034. This report covers market size, share, CAGR, segment-level data (material type, packaging format, finish, printing technology, end-use industry) along with regional insights across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. It includes competitive analysis of key players like Mondi, Sappi, WestRock, Stora Enso, Nippon Paper, and others, alongside value chain assessment, raw material mapping, import–export trends, and supplier/manufacturer benchmarking.

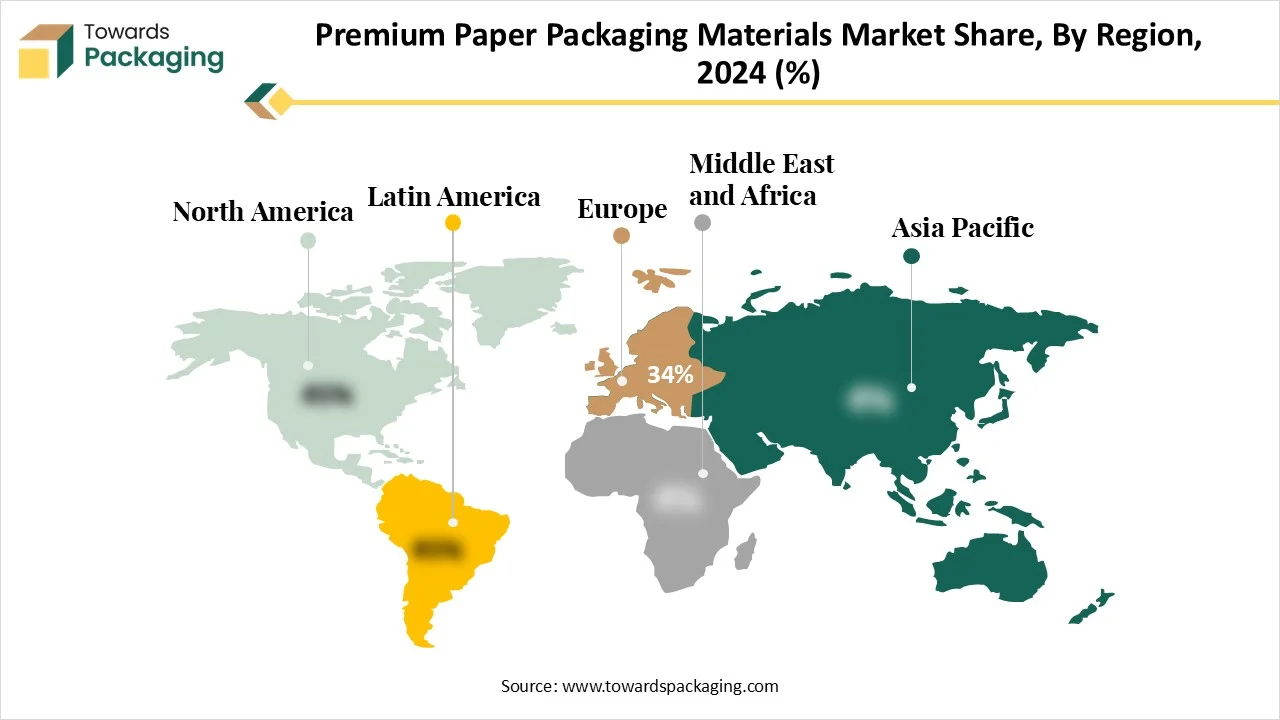

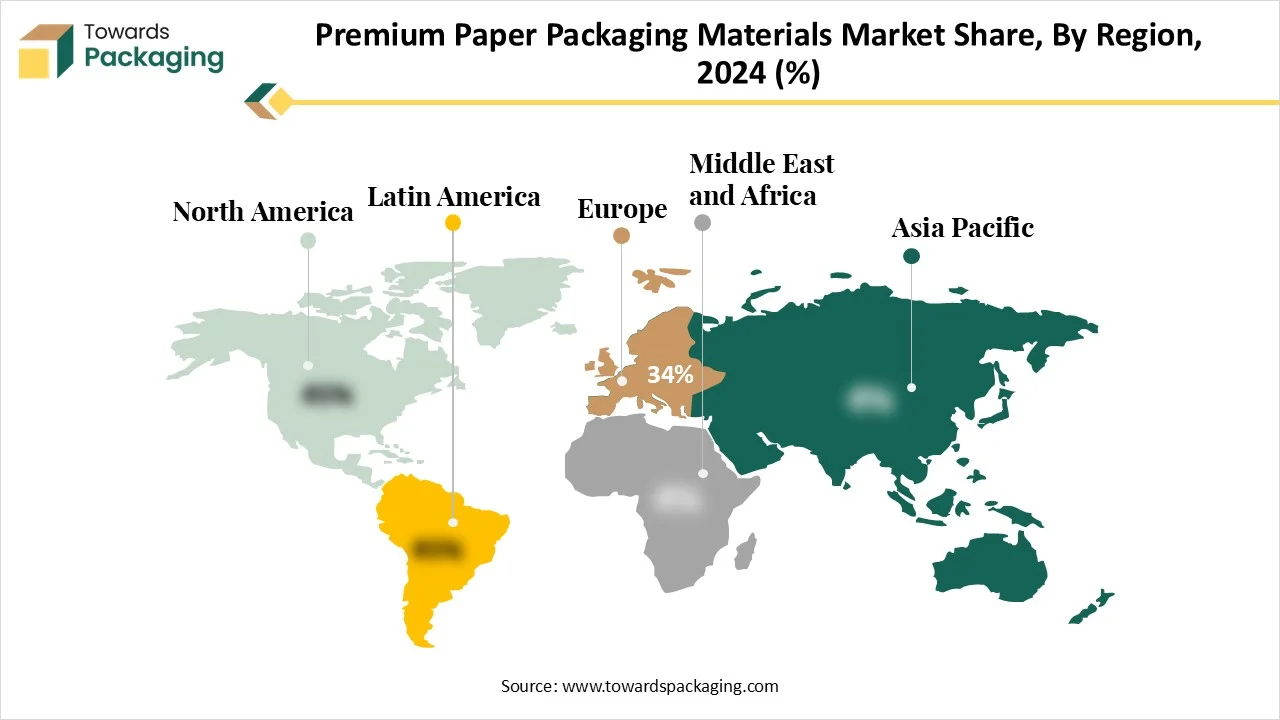

Statistical data includes 34% European share (2024), 44% dominance of boxes & cartons, 32% share for coated paperboard, 21% share for foil-stamping, 57% share for virgin fiber paper, and 28% contribution from personal care & cosmetics.

Key Insights

- Europe held the largest share of 34% in the premium paper packaging materials market in 2024.

- Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By material type, the coated paperboard segment accounted for the dominating share of 32% in 2024.

- By material type, the specialty papers segment is expected to witness a significant share during the forecast period.

- By packaging format, the boxes & cartons segment held a dominant presence in the market in 2024, with 44%.

- By packaging format, the tubes & cylindrical packaging segment accounted for considerable growth in the global premium paper packaging materials market over the forecast period.

- By finish/feature type, the foil-stamped segment held the major market share of 21% in 2024.

- By finish/feature type, the soft touch segment is projected to grow at a CAGR between 2025 and 2034.

- By paper source, the virgin fiber paper segment registered its dominance with 57% over the global premium paper packaging materials market in 2024.

- By paper source, the recycled paper segment is expected to grow significantly during the forecast period.

- By printing technology, the offset lithography segment accounted for the highest growth rate of 38% premium paper packaging materials market.

- By printing technology, the digital printing segment is expected to witness remarkable growth during the forecast period.

- By end-use industry, the personal care & cosmetics segment contributed the biggest market share of 28% in 2024.

- By end-use industry, the home fragrances & candles segment is expanding at a significant CAGR during the forecast period.

Market Overview

The premium paper packaging materials market refers to high-quality, aesthetically appealing, and often sustainable paper-based materials used in packaging applications that emphasize luxury, branding, and product protection. These materials are characterized by superior printability, texture, finish, and durability and are predominantly used in high-end sectors such as cosmetics, gourmet food, electronics, fashion, wine & spirits, and gifting. They include virgin fiber-based, recycled, and specialty-coated paperboards and papers, often combined with embossing, foiling, lamination, or other value-added features.

What Are the Latest Trends in the Premium Paper Packaging Materials Market?

- The rising focus on improving brand image and unboxing experience is expected to contribute to the overall growth of the premium paper packaging materials market.

- The rising shift away from single-use plastics, along with the rising focus on sustainability, is anticipated to promote the growth of the premium paper packaging materials market.

- The rapid expansion of e-commerce platforms in emerging economies is expected to drive the market’s growth during the forecast period.

- Several prominent market players are actively participating in R&D activities to develop premium paper packaging materials, which will significantly fuel the expansion of the premium paper packaging materials market in the coming years.

- The rising consumer demand for customized, interactive, and visually appealing packaging materials is expected to accelerate the market’s revenue during the forecast period.

- The market is experiencing substantial investment in smart packaging technologies to improve the consumer engagement experience and strengthen brand loyalty.

- The rising disposable incomes along with high consumer spending, particularly in emerging economies is are expected to spur the demand for premium paper packaging materials across various industries, including food and beverages, fashion & apparel, cosmetics, jewellery & watches, home fragrances & candles, electronics, and others.

How Can Artificial Intelligence Improve the Paper Packaging Industry?

In today's rapidly evolving technological landscape, the integration of Artificial Intelligence (AI) emerges as a game-changer and holds significant potential to revolutionize the industry by optimizing the supply chain, reducing material waste, enhancing customer experience, and improving sustainability. AI in paper packaging monitors and adjusts parameters in real time to maximize energy efficiency and reduce waste generation. It can alert and prevent the quality issues that lead to rejected products. AI-driven automation has significantly streamlined packaging operations, enhancing speed and precision in sorting, labelling, and packing tasks. Therefore, the AI integration in the paper packaging industry marks a significant shift towards more efficient, sustainable, and personalized packaging.

Market Dynamics

Driver

How is the Rising demand for Premium Paper Packaging Materials Impacting the Market’s Growth?

The increasing demand for premium paper packaging materials across various industries is expected to boost the growth of the premium paper packaging materials market during the forecast period. Premium paper packaging materials are specifically designed with sustainability and longevity at their core. These packaging materials are used to enhance the perceived value of products, foster brand loyalty, and offer excellent printability and visual appeal across various industries, such as personal care & cosmetics, food & beverage, fashion & apparel, jewelry & watches, home fragrances & candles, corporate & luxury gifting, and others. Several companies are increasingly embracing premium paper packaging materials to differentiate their product packaging and improve the customer experience with high-quality printing, customizable designs, and luxurious finishes.

- In June 2025, Fedrigoni Self-Adhesives North America (FSA) launched Brillante White Felt, a North American-made felt-marked paper developed in collaboration with Mohawk Fine Papers, part of The Fedrigoni Group, offering a 30 percent post-consumer waste content. Crafted with high-quality and innovation, Brillante White Felt offers brand owners and designers a refined label material that elevates visual impact and tactile experience. (Source: Labels & Labeling)

Restraint

Limited Availability and High Cost of Raw Materials

The limited availability and high cost of raw materials are anticipated to hamper the market's growth. The market often faces shortages and price volatility of raw materials, which can lead to high production costs and adversely impact the profitability of manufacturers. Premium paper packaging materials generally offer less resistance to light, air, and contaminants than plastic or metal alternatives. These packaging materials often lose considerable strength when exposed to water or moisture. Such factors are likely to limit the expansion of the global premium paper packaging materials market.

Opportunity

Increasing Focus on Sustainability

The increasing focus on sustainability is projected to offer lucrative growth opportunities to the premium paper packaging materials market during the forecast period. Premium paper packaging materials align with environmental goals and create a positive impression of luxury brands and their products among consumers. They are fully recyclable and are capable of undergoing up to six cycles of recycling while retaining high quality. It offers an excellent way to extend the lifecycle of paper products, preserve natural resources, and minimize wastage.

Businesses across various industries are under pressure to adopt sustainable packaging practices and are shifting to paper packaging material as a more environmentally friendly option. Several governments are actively involved in promoting eco-friendly packaging materials, which results in accelerating the adoption of premium paper packaging materials. Therefore, the rising sustainability concerns are anticipated to propel the growth of the premium paper packaging materials market during the forecast period.

- In June 2025, Awfully Posh re-launches premium peanuts in a ‘fully recyclable paper’ wrapper. The relaunch is initially planned in partnership with RedCat Hospitality – the operator behind the Coaching Inn Group and RedCat Independent Pubs. Developed by paper packaging manufacturer EvoPak, the new paper wrapper incorporates a layer of Aquapak’s Hydropol, which claims to make unrecyclable packaging recyclable because it is ‘dissolvable and biodegradable’. (Source: Packaging News)

Segment Insights

Which Segment Dominates the Premium Paper Packaging Materials Market by Material Type?

The coated paperboard segment registered its dominance over the global Polyhydroxyalkanoates films market in 2024. The growth of the segment is driven by the rising demand for high-quality printing and attractive packaging solutions across various industries. Companies operating in the premium paper packaging materials market are increasingly leveraging coated paperboard like Art Paper (both C1S and C2S) and Solid Bleached Sulfate (SBS) paperboard for their products requiring an attractive look and premium feel.

On the other hand, the specialty papers are expected to witness remarkable growth during the forecast period, owing to the growing demand for sustainable, customizable, and high-performance packaging materials. Specialty papers include textured, metallic, transparent, thermal, and scented. Specialty paper manufacturers are increasingly focusing on innovations in compostable and biodegradable paper, often using sustainable sources like recycled fibers.

By Printing Technology

The offset lithography segment held the largest share of the premium paper packaging materials market in 2024. Offset lithography plays a crucial role by offering high-quality printing, cost-effectiveness for large volumes, and versatility for brands focusing on creating premium and appealing packaging solutions. This technique is highly preferred for its ability to produce sharp details and vibrant colors for premium paper packaging.

On the other hand, the digital printing segment is expected to grow significantly during the forecast period. Digital printing assists brands in creating customized packaging solutions, enhancing brand visual appeal, and improving consumer engagement services. Digital printing technology adds unique designs and information to paper packaging, which makes it ideal in various prominent in food and beverage, personal care, cosmetics, e-commerce, and others.

By Finish/Feature Type

The foil-stamped segment accounted for the dominating share in 2024. Foil stamping is gaining immense popularity in packaging for cosmetics, candles, perfumes, spirits, and other high-end products, which creates a sense of luxury. Foil stamping applications add a touch of elegance, exclusivity, and sophistication to various items.

On the other hand, the soft touch segment is expected to witness a significant share during the forecast period, owing to the increasing consumer inclination for premiumization. Consumers often seek for soft touch finish, which encourages leading prominent brands to invest heavily in premium paper packaging materials packaging solutions to enhance the perceived value of their products. In addition, rapid innovations in coating technologies, which enhanced soft touch with improved performance, bolster the expansion of the segment in the coming years.

Boxes & Cartons Dominated the Premium Paper Packaging Materials Market in 2024

The boxes & cartons segment is expected to dominate the market with the largest share in 2024, owing to the rising environmental concerns and growing demand for premium packaging solutions. Boxes & cartons are increasingly preferred in the market for their lightweight nature, recyclability, and durability, especially crucial for e-commerce and logistics.

On the other hand, the tubes & cylindrical packaging segment is anticipated to grow at the fastest CAGR. The segment’s growth is driven by the rising consumer demand for aesthetically pleasing packaging solutions and the surge in e-commerce activities. Paper-based cylindrical packaging can be customized with several printing techniques and finishes to enhance visual appeal as well as create a premium feel for luxury brands.

What Causes the Virgin Fiber Paper Segment to Dominate the Premium Paper Packaging Materials Market?

The virgin fiber paper segment held a dominant presence in the premium paper packaging materials market in 2024, owing to the rising emphasis on sustainable sourcing and eco-friendly practices. Virgin fiber paper is increasingly preferred for its superior strength, quality, sustainability, and ability to maintain product integrity. Moreover, the rising expansion of e-commerce platforms has substantially spurred the demand for robust and sustainable packaging solutions, further driving the segment’s growth.

On the other hand, the recycled paper segment is expected to grow at a notable rate. The growing demand for recycled packaging materials across various industries, owing to rising environmental awareness, is bolstering the segment’s expansion in the coming years. The utilization of recycled paper offers sustainability benefits by offering a cost-effective alternative, reducing deforestation, conserving natural resources, and reducing wastage. The quality and smoothness of recycled paper for premium uses are highly preferred for a wide range of applications.

How Will the Personal Care & Cosmetics Segment Dominate the Premium Paper Packaging Materials Market in 2024?

The personal care & cosmetics segment held the majority of the market share in 2024, owing to the increasing need for premium and customized packaging solutions, along with increasing focus on aligning with the circular economy. The adoption of premium paper packaging materials in the personal care & cosmetics sector, offering a premium aesthetic and versatility in design. The durable and aesthetically pleasing packaging of personal care & cosmetics products provides a positive "unboxing experience" among customers. In addition, the growth in e-commerce and online retailing is anticipated to drive the segment’s growth during the forecast period.

On the other hand, the home fragrances & candles segment is projected to grow at a CAGR between 2025 and 2034. Premium paper packaging materials offer an excellent choice for the packaging of home fragrances and candles, as these packaging solutions can enhance the brand image and efficiently protect the delicate products. These packages offer customization options available in various sizes, colors, shapes, and printing, allowing brands to offer a unique visual aesthetic appeal. Recycled and biodegradable paper materials are increasingly preferred for the packaging of home fragrances and candles to meet sustainability goals and meet the evolving consumer demand.

- In January 2025, Delfort launched its thin barrier 302 specialty paper. The paper ensures premium protection for ice cream, chocolates, candies, and other temperature-sensitive items. With industry-leading barrier properties including moisture, oxygen, aroma, and fat resistance, brands have a reliable paper packaging solution that ensures products remain fresh and protected. The innovative paper is a smart alternative to traditional materials, aligning perfectly with consumer preferences and industry trends. (Source: Packaging Strategies)

Regional Insights

Europe is Dominating the Market with the Majority Share

Europe held the dominant share of the premium paper packaging materials market in 2024. Europe has a well-established presence of brands in industries like personal care & cosmetics, food & beverage, fashion & apparel, consumer electronics, jewelry & watches, home fragrances & candles, corporate & luxury gifting, and stationery & publishing, which are major users of premium paper packaging materials.

European countries, such as the UK, the Netherlands, Germany, Norway, and France, are leading the way with Extended Producer Responsibility (EPR) policies, and other robust recycling measures are encouraging paper packaging businesses to invest more in eco-friendly packaging solutions. This region represents the considerable potential for the premium paper packaging materials market owing to the various combinations of factors such as the improved recycling infrastructure, stringent regulations on single-use plastics, increasing consumer awareness of plastic pollution, growing consumer preference for paper-based premium packaging solutions, rising innovation in packaging technology, and increasing government focus on lowering the carbon footprint.

The rising innovations in biodegradable and water-resistant coatings in the region are significantly expanding the applications of premium paper packaging materials in products that require enhanced protection against moisture and other external environmental factors. Additionally, the rising expansion of e-commerce platforms and the growing demand for sustainable packaging solutions, particularly in the luxury goods sector, are expected to accelerate the revenue of the premium paper packaging materials market during the forecast period.

On the other hand, Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. The fastest growth of the region is mainly fuelled by the availability of raw material, increasing consumer demand for aesthetically pleasing packaging products, rising restrictions on single-use plastics, rapid innovations in coating technologies, and increasing sustainability trends. The region's high per capita income drives consumer demand for luxury goods across multiple industries, including personal care & cosmetics, confectionery, beverages, fashion & apparel, jewelry & watches, home fragrances & candles, corporate & luxury gifting, and others.

The expansion of the e-commerce sector, particularly in developing economies, and the increasing adoption of biodegradable and recycled packaging solutions are expected to boost the market’s expansion during the forecast period. Several brands in the region are actively investing in developing premium paper packaging materials to offer a premium and aesthetic visual appeal for enhancing the overall customer unboxing experience.

- According to an article published by the IBEF in March 2024, the paper packaging industry makes a significant contribution to India’s economic growth. India currently ranks as the 15th largest paper manufacturer globally, comprising over 600 paper mills that contribute significantly to the country's emerging economy. India's paper packaging industry is increasing its presence in export markets, particularly in the Middle East, Africa, and Southeast Asia. Export of paper, paperboard, and newsprint has increased almost 3 times from 532.7 thousand tonnes in 2010-11 to 1,560.2 thousand tonnes in 2023-24.

Asia-Pacific Export Statistics for Cartons, Boxes, Cases, Bags & Other Packing Containers of Paper/Paperboard - 2024

| Country |

Trade Value (US$) |

Net Weight (kg) |

| China (Hong Kong SAR) |

135,701,959 |

17,627,822 |

| China (Macao SAR) |

3,839 |

1,431 |

| India |

321,795,607 |

191,810,012 |

| Indonesia |

168,502,081 |

76,320,824 |

| Japan |

50,554,684 |

9,833,858 |

| Kazakhstan |

31,747,817 |

8,993,699 |

| Korea, Republic of |

195,092,423 |

84,525,733 |

| Kyrgyzstan |

1,571,574 |

2,971,510 |

| Malaysia |

207,363,482 |

0 |

| Other Asia, nes |

127,820,144 |

45,276,807 |

| Pakistan |

17,988,443 |

12,120,052 |

| Philippines |

37,584,094 |

13,251,110 |

| Singapore |

131,378,428 |

32,852,622 |

| Thailand |

303,375,936 |

0 |

| Türkiye |

808,828,969 |

416,609,138 |

| Uzbekistan |

5,726,836 |

3,308,575 |

| New Zealand |

21,012,304 |

8,189,913 |

| Mongolia (not included) |

— |

— |

North America Export Export Statistics for Cartons, Boxes, Cases, Bags & Other Packing Containers of Paper/Paperboard - 2024

| Country |

Trade Value (US$) |

Net Weight (kg) |

| USA |

2,300,965,655 |

0 |

| Mexico |

721,959,085 |

0 |

Latin America & Caribbean Export Statistics for Cartons, Boxes, Cases, Bags & Other Packing Containers of Paper/Paperboard - 2024

| Country |

Trade Value (US$) |

Net Weight (kg) |

| Costa Rica |

62,335,922 |

30,711,636 |

| Dominican Republic |

56,596,504 |

31,393,031 |

| Ecuador |

18,487,374 |

11,680,068 |

| El Salvador |

111,269,221 |

56,863,435 |

| Guatemala |

202,677,349 |

206,482,985 |

| Honduras |

64,933,755 |

70,111,442 |

| Nicaragua |

1,128,800 |

995,161 |

| Panama |

3,753,795 |

2,319,730 |

| Paraguay |

1,745,597 |

1,166,069 |

| Peru |

17,847,687 |

0 |

| Suriname |

18,891 |

10,322 |

| Uruguay |

14,440,707 |

5,361,886 |

| Argentina (not included) |

— |

— |

| Brazil (not included) |

— |

— |

Europe Export Statistics for Cartons, Boxes, Cases, Bags & Other Packing Containers of Paper/Paperboard - 2024

| Country |

Trade Value (US$) |

Net Weight (kg) |

| Croatia |

143,735,117 |

75,369,869 |

| Cyprus |

1,875,226 |

764,632 |

| Czechia |

728,281,304 |

0 |

| Denmark |

312,585,130 |

0 |

| Estonia |

42,663,571 |

23,392,080 |

| Finland |

38,926,872 |

10,112,763 |

| France |

739,473,962 |

0 |

| Germany |

3,453,648,291 |

1,502,849,918 |

| Greece |

157,332,010 |

51,768,631 |

| Hungary |

426,776,081 |

0 |

| Iceland |

655,865 |

193,876 |

| Ireland |

180,752,969 |

45,838,424 |

| Italy |

1,503,887,683 |

0 |

| Latvia |

43,224,253 |

0 |

| Lithuania |

106,618,215 |

46,343,304 |

| Luxembourg |

3,876,956 |

2,051,411 |

| Malta |

1,253,867 |

711,731 |

| Netherlands |

1,212,058,132 |

544,743,538 |

| Norway |

28,362,283 |

16,425,823 |

| Poland |

1,795,863,577 |

778,523,634 |

| Portugal |

274,519,723 |

117,656,326 |

| Romania |

229,725,203 |

0 |

| Serbia |

150,940,161 |

73,051,799 |

| Slovakia |

161,924,356 |

0 |

| Slovenia |

97,564,584 |

30,701,666 |

| Spain |

795,779,870 |

370,239,822 |

| Sweden |

227,377,500 |

76,218,083 |

| Switzerland |

179,143,818 |

49,584,504 |

| United Kingdom |

445,495,973 |

0 |

Key Premium Paper Packaging Materials Market Players

- Mondi Group

- Sappi Limited

- International Paper

- Nippon Paper Industries

- Stora Enso

- Smurfit Kappa Group

- WestRock Company

- UPM-Kymmene Corporation

- Oji Holdings Corporation

- Georgia-Pacific LLC

- Asia Pulp & Paper (APP)

- Twin Rivers Paper Company

- Glatfelter Corporation

- Arjowiggins

- Fedrigoni Group

- Neenah Inc.

- Kotkamills Oy

- Burgo Group S.p.A.

- ITC Limited (Paperboards & Specialty Papers Division)

- Shandong Sun Paper Industry

Latest Announcement by Industry Leader

- In May 2025, Sappi North America, Inc., a leading producer and supplier of diversified paper, packaging products, and pulp, announced the release of “The Touch Advantage,” a study with Clemson University exploring how touch affects our purchasing decisions and perceptions in the paper and packaging industry. The research study analyzes how multisensory packaging, especially the tactile elements, can significantly affect purchasing decisions, brand perception, and customer satisfaction. (Source: Business Wire)

Recent Developments

- In March 2025, Mondi geared up to showcase its premium range of papers tailored for luxury packaging at LUXE PACK Shanghai 2025 in China. Partnering with ROXCEL Trading, Mondi aims to highlight how paper-based packaging can help luxury brands meet their sustainability commitments without compromising on elegance and quality. (Source: Trendhunter)

- In September 2024, Diageo, the maker of Guinness, Don Julio Tequila, and Smirnoff Vodka, announced a first-of-its-kind 90% paper-based bottle trial for Johnnie Walker Black Label exclusively at Johnnie Walker Princes Street's 1820 bar in Edinburgh. Created in partnership with PA Consulting, as part of the Bottle Collective with PA and PulPac, this is Diageo’s first paper-based 70cl bottle trial in the on-trade. (Source: Diageo)

Premium Paper Packaging Materials Market Segments

By Material Type

- Coated Paperboard (Art Paper, SBS, C1S/C2S)

- Uncoated Paperboard (Kraft Board, Recycled Board)

- Specialty Papers (Textured, Metallic, Transparent, Thermal, Scented)

- Molded Pulp Paper

- Corrugated Paperboard (Premium-grade)

- Virgin Fiber Paper

- Recycled Paper

By Packaging Format

- Boxes & Cartons (Rigid Boxes, Folding Cartons, Setup Boxes)

- Pouches & Sachets

- Paper Bags & Carriers

- Wrapping & Tissue Paper

- Labels & Tags

- Tubes & Cylindrical Packaging

- Sleeves & Wraps

- Inserts, Dividers, and Liners

By Finish/Feature Type

- Embossed/Debossed

- Foil Stamped

- UV Coated

- Laminated (Glossy/Matt)

- Soft Touch

- Water-resistant/Oil-resistant

- Recyclable/Biodegradable

- Anti-counterfeit Embedded

- Windowed Packaging

By Paper Source

- Virgin Fiber Paper

- Recycled Paper

- Hybrid (Mix of Virgin & Recycled)

By Printing Technology

- Offset Lithography

- Digital Printing

- Flexographic Printing

- Gravure Printing

- Screen Printing

- Hybrid Printing

By End-Use Industry

- Personal Care & Cosmetics

- Food & Beverage (Gourmet, Premium, Confectionery, Tea, Coffee, Alcoholic Beverages)

- Fashion & Apparel

- Consumer Electronics

- Jewelry & Watches

- Home Fragrances & Candles

- Corporate & Luxury Gifting

- Pharmaceuticals & Nutraceuticals

- Stationery & Publishing

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait