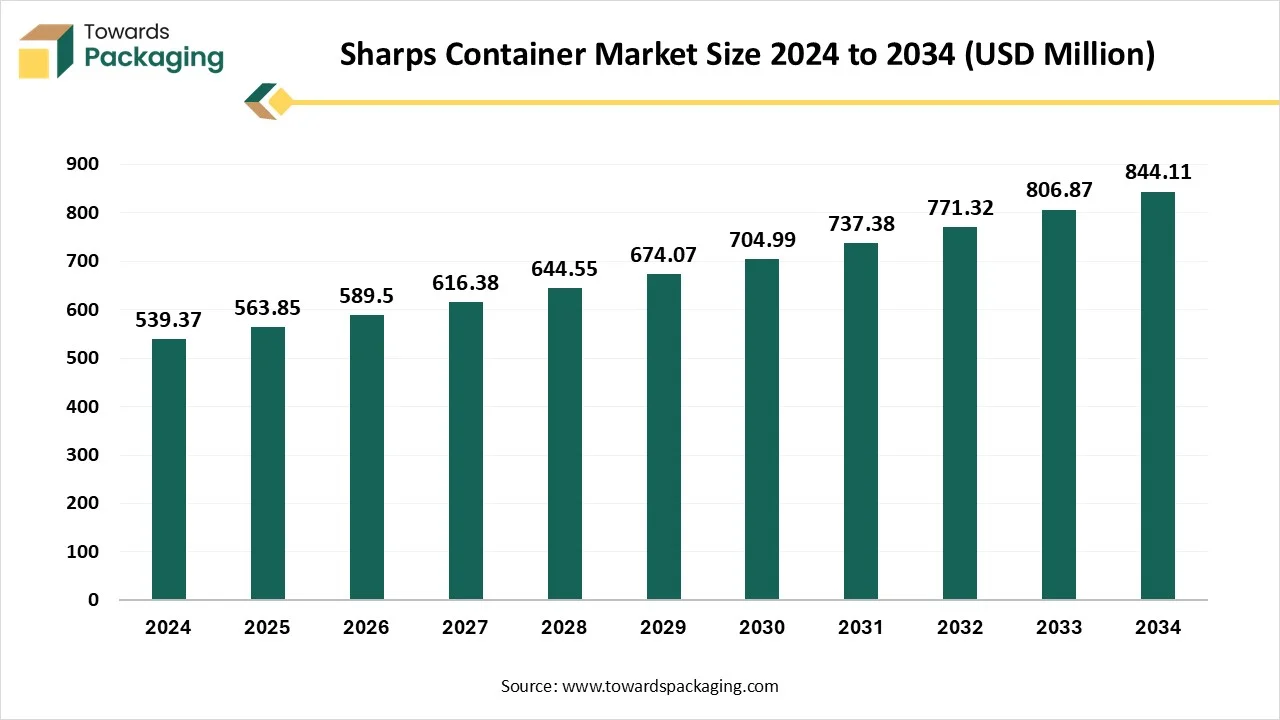

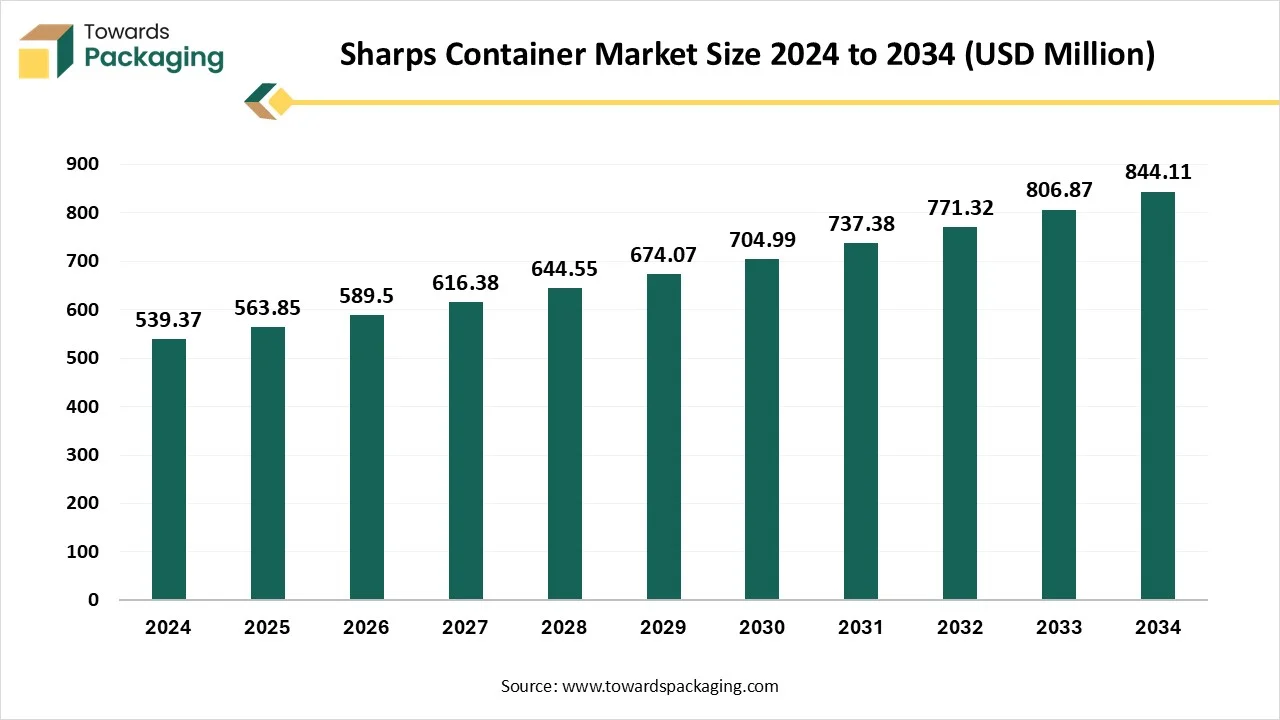

The sharps container market is forecasted to expand from USD 589.34 million in 2026 to USD 878.09 million by 2035, growing at a CAGR of 4.53% from 2026 to 2035.

The reusable container segment accounted for the majority of the market share and continues to dominate due to the rising awareness of environmental sustainability and increasing focus on reducing the usage of single-use plastics. In addition, the market is growing at a significant rate in various developing and developed regions, particularly North America, fuelled by the rising expansion of healthcare infrastructure and stringent regulatory standards.

A sharps container is specially designed to safely dispose of medical syringes, needles, and other sharp objects to prevent the spread of bloodborne diseases. These sharps containers are generally made from puncture-resistant material that has a safe, secure, and tight-fitting lid to prevent contamination as well as needlestick injuries. Proper disposal of sharps medical products is essential for maintaining the utmost safety for healthcare workers, patients, and the community.

| Metric | Details |

| Market Size in 2025 | USD 563.80 Million |

| Projected Market Size in 2035 | USD 878.09 Million |

| CAGR (2026 - 2035) | 4.53% |

| Leading Region | North America |

| Market Segmentation | By Container Type, By Usage, By Container Size and By Region Covered |

| Top Key Players | Thermo Fisher Scientific Inc., Becton, Dickinson and Company, BemishHealthcare, BondTech Corporation, Cardinal Health |

As technology continues to evolve, the integration of AI and IoT in sharps containers holds significant potential to impact the growth of the sharps container market by offering automation in waste management practices and preventing the spread of bloodborne diseases. As healthcare facilities continue to struggle with a surge in waste volumes and complex disposal requirements of regulated bodies, AI emerges as a crucial tool that assists in enhancing both efficiency and compliance.

AI-powered automation systems are continuously focusing on streamlining the waste disposal process, enhancing both safety and efficiency. By integrating the advanced sensors and robotic systems, sorting and handling of waste become faster and more accurate. The use of IoT technology allows for real-time monitoring of fill levels, enables location tracking, and provides automated alerts for timely disposal of waste.

Rising Need for Proper Medical Waste Disposal

The growing need for proper medical waste disposal is expected to boost the growth of the sharps container market during the forecast period. As the medical facilities are expanding in developed and developing regions, the volume of medical waste increases proportionately, due to the rise in chronic diseases and an increase in the number of surgeries. The healthcare services, including clinics, hospitals, outpatient centers, and home healthcare, increase the demand for sharps containers for the proper disposal of sharp waste, which includes items like needles, syringes, and other sharp medical objects.

The adoption of sharps containers by medical facilities can reduce the risk of exposure to bloodborne pathogens such as HBV, HCV, HIV, and many others that may spread due to the contaminated sharps. Additionally, the significant expansion of home-based healthcare services for managing chronic health conditions and elderly care increased the adoption of portable sharps containers. Such factors are propelling the market’s revenue during the forecast period.

Lack of Awareness

The lack of awareness is anticipated to projected to hamper the market's growth. The lack of awareness regarding the proper disposal of medical waste and inadequate training of medical staff about the disposal of medical waste in sharps containers, particularly in lower and middle-income countries. In addition, keeping up with evolving regulations and standards for sharps disposal presents ongoing challenges for various healthcare facilities, which is likely to limit the expansion of the global sharps container market.

Supportive Government Initiatives

The supportive government initiatives and guidelines for medical waste management are projected to offer lucrative growth opportunities to the sharps container market in the coming years. Sharps containers are specifically designed to meet regulatory standards and are essential for compliance. Governments across the globe are increasingly recognizing the significance of proper disposal of medical waste to ensure public health and environmental safety, which has led many countries to implement stringent regulations and guidelines for the collection, segregation, transportation, and disposal of medical waste as it poses significant health risks if not handled and disposed of properly.

Several key government institutions like the FDA, OSHA, DOT, and NIOSH have set specific guidelines and regulations for the safe and compliant disposal of medical waste in sharps containers in healthcare settings. Therefore, government initiatives and guidelines ensure that every healthcare facility must properly manage sharps waste responsibly to prevent the spread of bloodborne diseases.

The accurate disposal of GLP-1 drugs, which are glucagon-like peptides, can be both costly and inconvenient. Sharp containers, necessary for safe disposal, are often not served for free. Patients may demand to buy these containers or pay for specialized disposal services. In areas in which needle drop-off sites or take-back programs are completely unavailable, patients may have to travel reliable distances to safely dispose of their pens.

The multipurpose containers dominated the sharps container market in 2024, owing to their cost-effectiveness benefit for various healthcare facilities, rather than separate containers for the disposal of various types of medical waste. These containers assist healthcare facilities in streamlining their waste management processes by providing a single container for a wide range of medical waste, such as syringes, needles, and other sharp objects. Additionally, the rising use of multipurpose containers aligns with environmental considerations by minimizing the use of separate containers and promotes waste management practices efficiently.

On the other hand, the patient room containers segment is expected to grow at a notable rate during the forecast period. The growth of the segment is majorly driven by the surge in the number of surgeries, rising number of hospital admissions for acute and chronic diseases increases the need for safe medical waste disposal solutions, further spurring the demand for sharp containers. Additionally, the rising awareness of the risk of improperly disposed sharps and the stringent guidelines and safety regulations is expected to boost the segment’s expansion.

The reusable sharps container segment dominated the sharps container market in 2024. The rising concerns about environmental sustainability have led to an increasing demand for reusable containers. Reusable containers can be emptied and sanitized for re-use, providing an eco-friendly option and more cost-effective over time. Several large healthcare facilities prefer reusable sharps containers owing to their ability to manage a high volume of waste and their durability.

On the other hand, the disposable sharp container segment is growing at the fastest CAGR, owing to the growing demand for disposable sharp containers in healthcare facilities such as clinics, hospitals, diagnostic centers, and others. The disposable sharp containers are less costly than reusable containers. Such factors are bolstering the segment’s growth.

The 3 & 5 gallon segment accounted for the highest revenue share in 2024 in the sharp container market. The growth of the segment is mainly driven by the increasing demand for larger containers in healthcare facilities. The 3 & 5 gallon sharp containers are suitable for healthcare facilities with higher patient traffic and increased volume of medical waste generation. The choice of sharps container size generally depends on the volume of medical waste generated in a healthcare setting. The choice of appropriately sized containers is essential to comply with regulations and ensure that sharp waste is disposed of safely.

On the other hand, the 1 & 2 gallon segment is expected to grow at a significant rate, owing to the growing need for small and portable disposal solutions, particularly in healthcare settings such as diagnostic centers, ambulatory surgical centers, clinics, and nursing homes, where there is a need to manage moderate amounts of sharps waste. In addition, the increasing focus on hygiene, safety, and stringent guidelines is likely to drive the growth of these compact containers.

North America held the largest share of the sharps containers in 2024. The growth of the region is mainly attributed to the presence of a well-established healthcare infrastructure, growing awareness of safe medical waste disposal, increasing adoption of eco-friendly and biodegradable sharps containers, rising aging populations, and stringent standards of regulatory bodies such as the FDA. The expanding healthcare sector in the region, driven by increasing disease prevalence of acute and chronic diseases, requiring continuous medical interventions is expected to spur the demand for safe sharps disposal solutions significantly contributes to the market growth. Furthermore, the expansion of home healthcare services and self-injection therapies is expected to accelerate the revenue of the sharps container market in the region.

On the other hand, Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period. The region has the presence of well-established healthcare infrastructure and surge in healthcare expenses which in turn increases the demand for sharps container. The growth of the region is driven by the rising burden of chronic diseases, stringent regulatory standards, growing awareness of sharp waste disposal safely, surge in aging population, increase in the number of surgeries. Additionally, governments are conduct educational programs and awareness campaigns to inform healthcare professionals and the general public regarding the significance importance of proper medical waste disposal to preventing needle injuries, infections, and environmental pollution. These factors are expected to propel the market expansion in the region.

The European Sharp Container market is growing with a rigid focus on regulatory compliance, advanced engineering, and sustainability. Countries like France, Germany, and the UK are front-runners in using green technologies, digital transformation initiatives, and automation, too. The European Union’s sustainability goals and circular economy directives are prompting companies to rethink product designs and accept environmentally responsible solutions. Europe’s industrial landscape assists continuous development, which is being driven by funding in partnership, research, and between organisations and academic colleges, and lastly in market-standardization initiatives.

The Latin American container industry is constantly rising and gaining attention as nations like Mexico, Brazil, and Argentina make development in terms of industrial modernization and technology acceptance. While the region faces issues such as limited infrastructure, policy inconsistency, and rising investment, government support is developing the elements. Crucial sectors like automotive, energy, and construction are driving the acceptance of high-level technologies. Local organizations are heavily investing in sustainable and automation practices to meet worldwide trends and meet growing customer demand.

The development of the sharp container in the Middle East and Africa is primarily driven by the growing awareness about rigid regulations and healthcare safety linked to medical waste management. Growing examples of hospital-merged infections and demand for secure containers. Furthermore, the growth of healthcare departments, including clinics, hospitals, and diagnostic centers, drives the need for effective waste management solutions. The rising importance of chronic disease and the growing number of surgical processes are driving the volume of sharps waste generated, as well as the market demand. Also, the government's initiative goal is to develop public health standards and start environmental initiatives to assist market growth.

By Container Type

By Usage

By Container Size

By Region Covered

February 2026

February 2026

February 2026

February 2026