December 2025

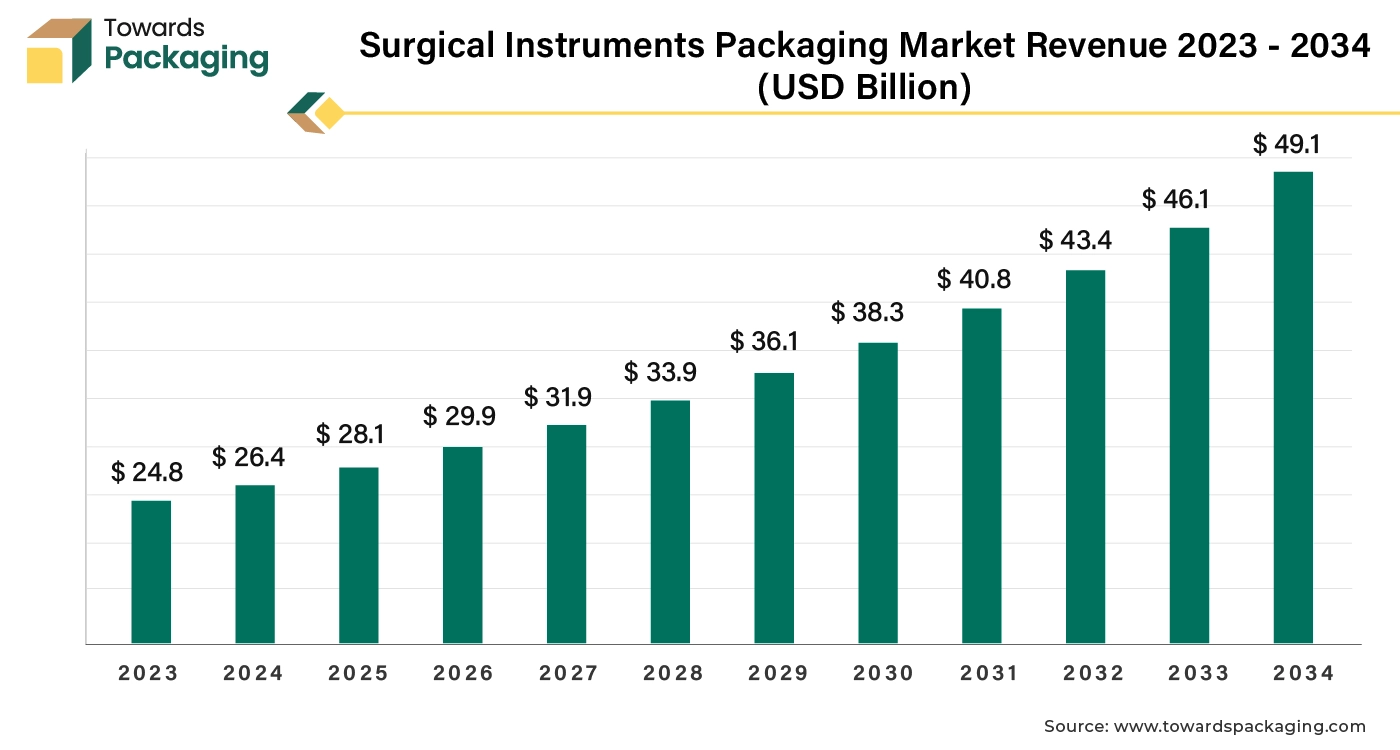

The surgical instruments packaging market is forecasted to expand from USD 28.1 billion in 2025 to USD 49.1 billion by 2034, growing at a CAGR of 6.55%. This report offers an in-depth analysis of the market's size, segments, and growth potential. It provides insights into key regions such as North America, Europe, APAC, LATAM, and MEA, with detailed competitive analysis, value chain evaluation, trade data, and profiles of leading manufacturers and suppliers driving the market forward.

Rising demand of healthcare units in developing as well as developed countries has increased the demand for the surgical instruments. The key players operating in the market are focused on adopting inorganic growth strategies like merger to develop surgical instruments packaging to meet the rising demand of it, which is estimated to drive the global surgical instruments packaging market over the forecast period. The global packaging market size is growing at a 3.16% CAGR.

Surgical instrument packaging refers to the methods and materials used to prepare and protect surgical instruments for sterile storage and use. This process is crucial to ensure that instruments remain free from contamination and are safe for use during medical procedures. The primary goal is to maintain the sterility of instruments from the time they are sterilized until they are used in surgery. Proper packaging prevents contamination. Packaging safeguards instruments from physical damage, moisture, and environmental factors that could affect their functionality or safety. Clear labeling helps in easy identification and organization of instruments, ensuring that the correct tools are used for specific procedures.

Various different sterilization methods are used for sterilization of surgical instruments packaging which have been mentioned here as follows: autoclaving, ethylene oxide (EO) gas, and radiation among others. Instruments are inspected and cleaned to remove any debris or residues before packaging. Instruments are placed into the chosen packaging material, ensuring that they are not in contact with each other or with the packaging itself.

AI integration can significantly enhance the surgical instruments packaging market in various ways, improving efficiency, accuracy, and safety. The integration of artificial intelligence assists in improving surgical instrument packaging industry by providing predictive analytics, improving design, providing automated inspection facility, inventory and logistics management. AI can analyze trends and data to predict the most effective packaging designs and materials based on factors like sterility, durability, and environmental impact.

AI-driven simulations can test different packaging designs to find optimal solutions for protecting and sterilizing instruments. AI-powered vision systems can inspect packaging for defects, ensuring that every package meets quality standards and reducing the likelihood of contamination or damage. AI algorithms can monitor and ensure consistent packaging processes, maintaining high standards across all production batches.

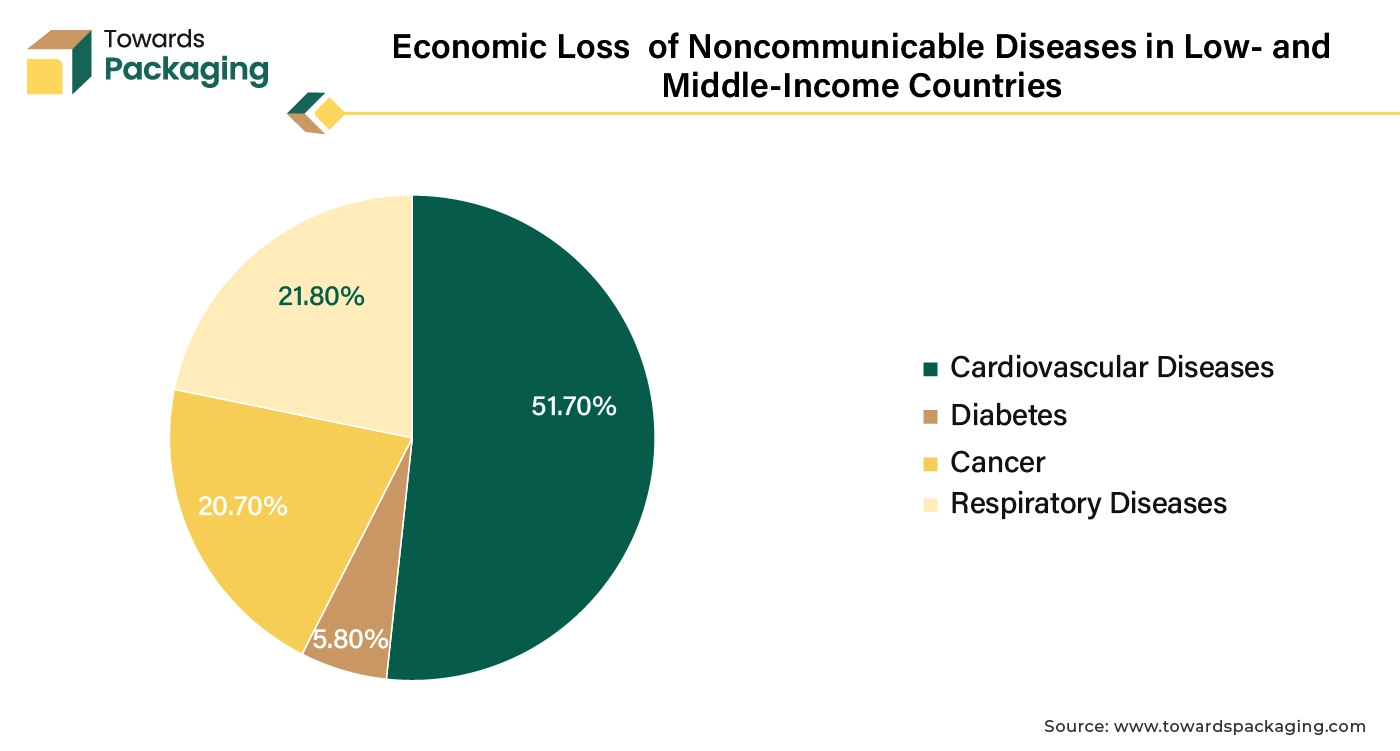

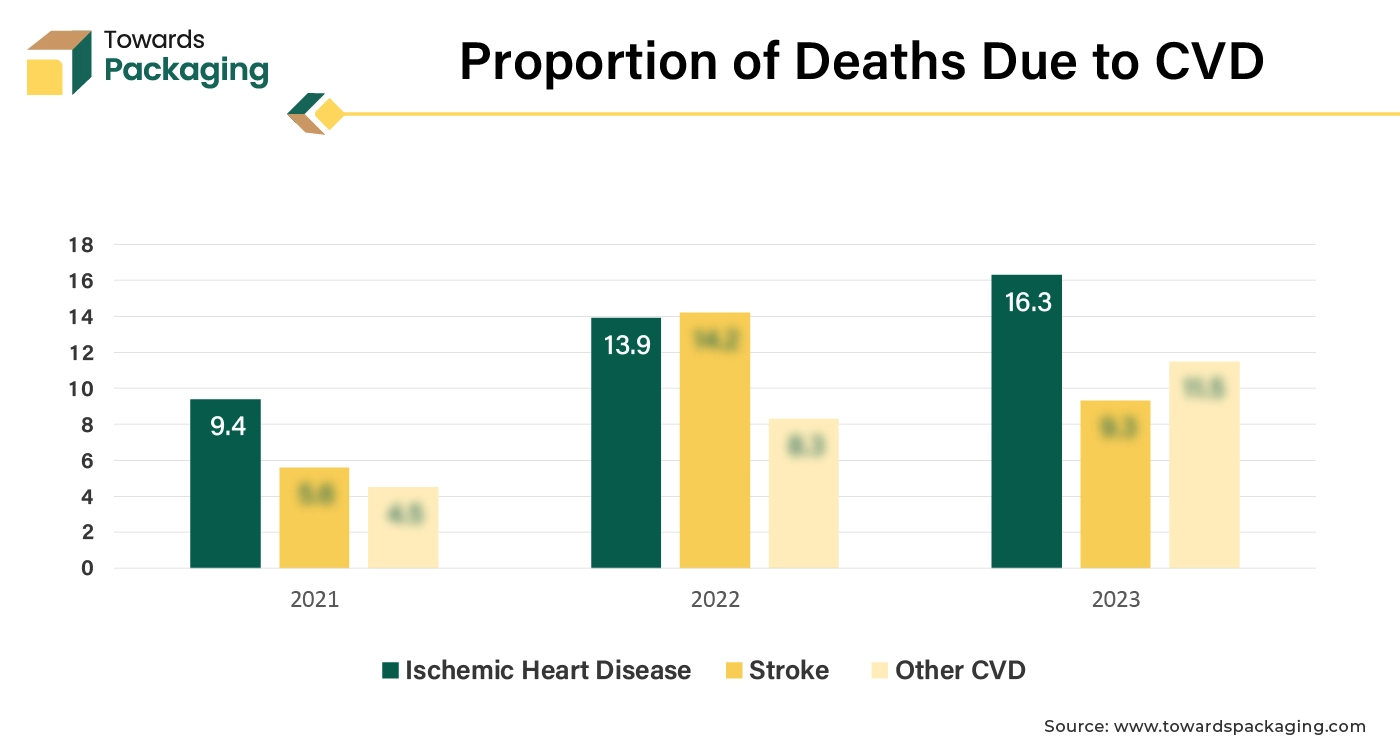

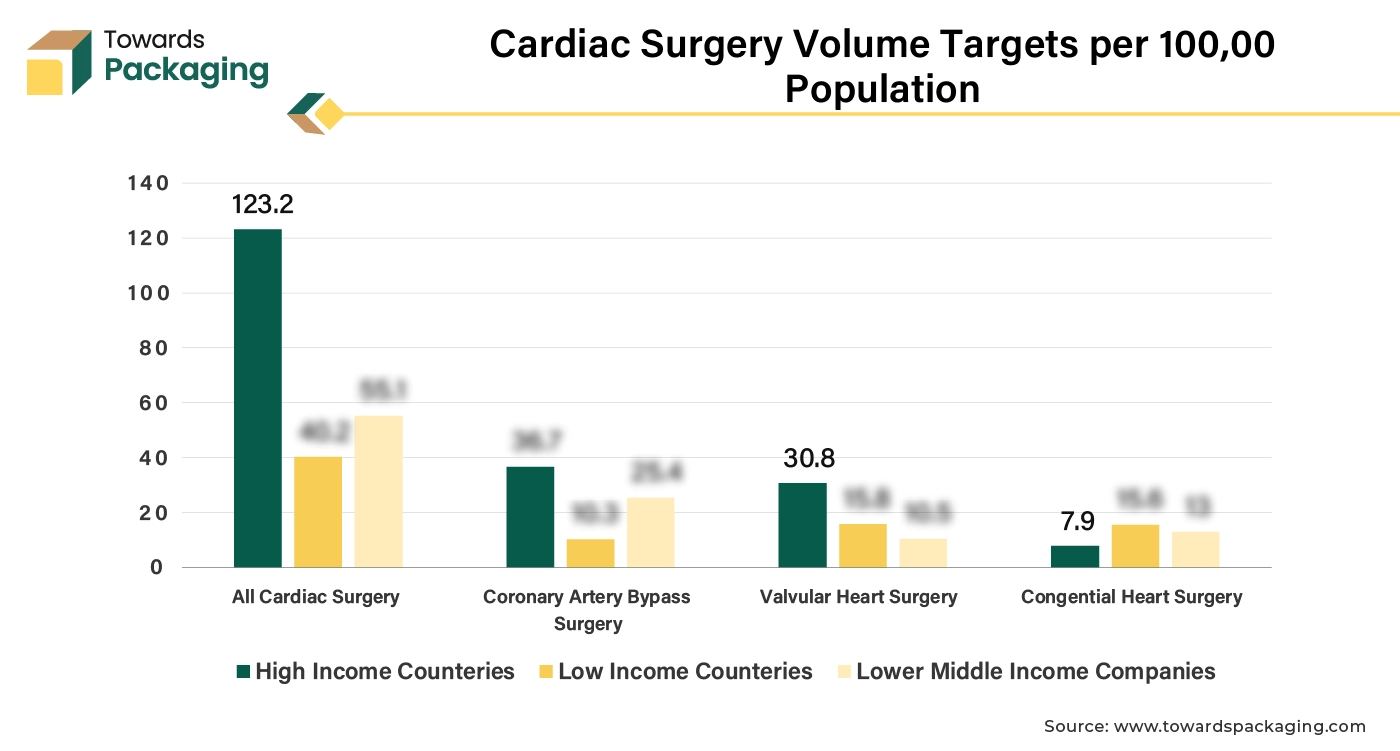

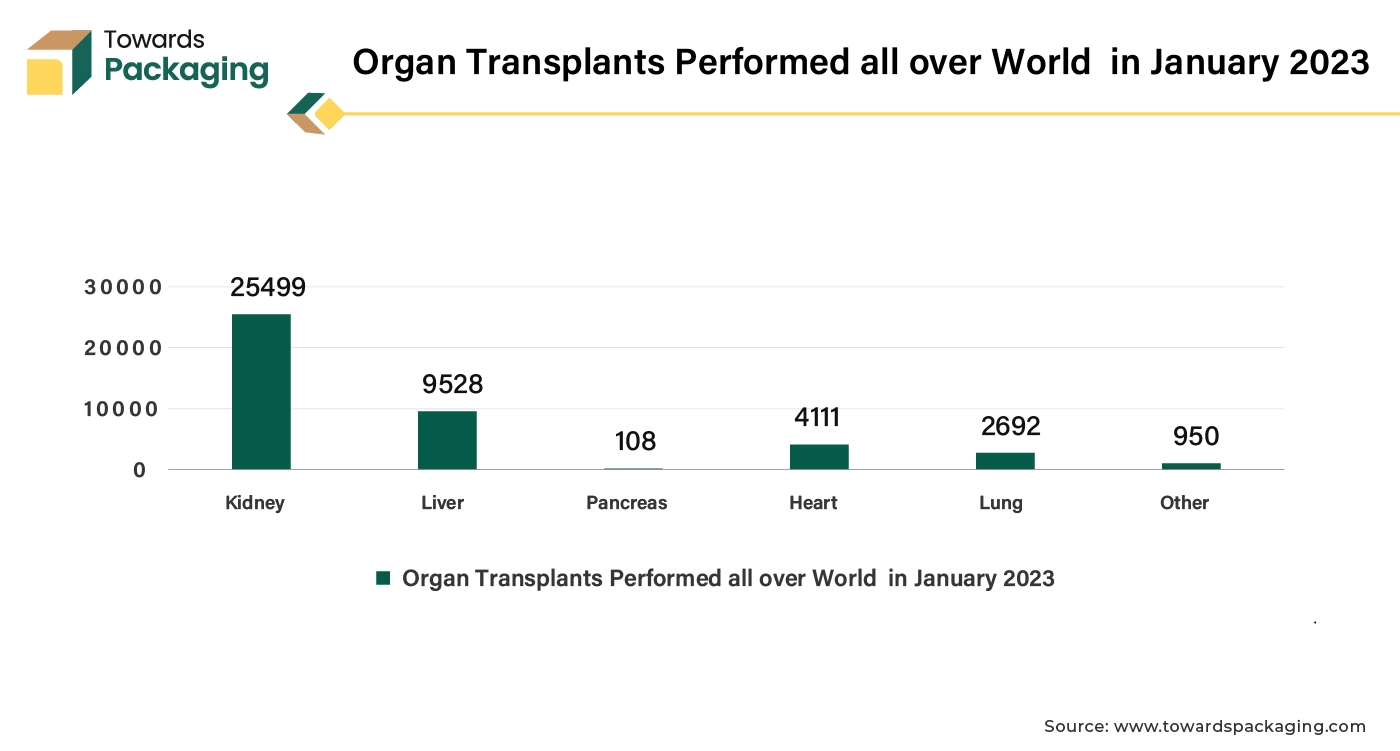

Growing patient populations and the prevalence of chronic diseases are leading to an increase in surgical procedures, which drives demand for effective surgical instruments packaging. For instance, according to data published by the World Health Organization, it is reported that approximately 17.9 million death occur due to cardiovascular disease each year.

The high expense of treating cardiovascular disorders results from their comprehensive treatment regimen, which exceeds US$351 billion annually. About US$214 billion of this large financial commitment is earmarked for the direct treatment of heart disease patients, while an additional US $137 billion is linked to lost productivity.

The key players operating in the market are facing regulatory issues and complexity of packaging, which is estimated to restrict the growth of the surgical instruments packaging market in the near future. The cost of advanced packaging materials and technologies can be significant, impacting the overall cost structure for manufacturers and healthcare providers. Stringent regulations and compliance requirements related to safety and sterilization can complicate packaging processes and increase costs.

The need for packaging solutions that ensure sterility, prevent contamination, and provide ease of use can be technologically challenging and costly. Increasing scrutiny on plastic use and the environmental impact of packaging materials is driving demand for sustainable solutions, which may involve higher costs and technological adaptation.

The adoption of minimally invasive and robotic surgeries requires specialized packaging to ensure sterility and protect delicate instruments. Minimally invasive techniques typically lead to shorter recovery periods compared to traditional open surgeries. This is crucial for transplant patients who may already be in a weakened state. Robotic surgery allows for greater precision and control, which is important for the delicate and intricate work involved in organ transplantation. Advanced imaging and robotic systems provide enhanced visualization of the surgical field, allowing for more accurate and efficient procedures. Increasing adoption of advanced surgical techniques has risen the need for surgical instrument, and sterile packaging for same which is estimated to create lucrative opportunity for the growth of the surgical instruments packaging market in the near future.

The plastic segment held the dominating share of the surgical instruments packaging market in 2024. Plastic packaging provides a sterile barrier that protects instruments from contamination during storage and transportation. This is crucial for maintaining the sterility of surgical tools until they are used. Many plastic packaging solutions include tamper-evident features, ensuring that any tampering or breaches in the packaging are easily detectable. Clear plastic packaging allows for easy visualization of the contents without opening the package, facilitating quick and accurate identification of instruments.

Moreover, the healthcare sector’s increasing emphasis on infection control and sterility drives demand for plastic packaging solutions that ensure surgical instruments remain uncontaminated. Innovations in plastic materials and packaging technologies, such as tamper-evident and antimicrobial features, present opportunities for differentiation and added value.

With advancements in recyclable and biodegradable plastics, there is potential for aligning with sustainability goals, appealing to environmentally conscious consumers and organizations. The expanding healthcare industry and increasing number of surgical procedures contribute to a growing market for high-quality, reliable packaging solutions.

The thermoform trays segment held a dominant presence in the surgical instruments packaging market in 2024. Thermoform trays provide a secure and protective environment for surgical instruments, preventing damage and contamination during transport and storage. These trays can be custom-designed to fit specific instruments perfectly, reducing movement and potential damage.

The clear plastic of thermoform trays allows for easy visual inspection of the contents without opening the package, which helps in quick identification and inventory management. Thermoform trays are typically made from materials that can withstand sterilization processes, such as autoclaving, ensuring that the instruments remain sterile until use. These features make thermoform trays a practical choice for maintaining the safety and efficacy of surgical instruments.

The chemical sterilization method segment accounted for a considerable share of the surgical instruments packaging market in 2024. Chemical sterilization methods, such as those using ethylene oxide (EtO) or hydrogen peroxide gas plasma, can be less expensive to implement and maintain compared to radiation sterilization systems, which often require specialized equipment and facilities. Chemical sterilization is suitable for a wider range of materials and complex instruments, including those sensitive to radiation, such as plastics and certain delicate devices. This flexibility makes it a preferred choice for sterilizing a variety of surgical instruments. Chemical sterilization processes can be quicker and more adaptable to different types and sizes of instruments, allowing for more efficient turnaround times in busy hospital environments.

Chemical sterilants can penetrate complex instrument designs and packaging materials more effectively than radiation, ensuring thorough sterilization of all surfaces and crevices. Overall, these advantages make chemical sterilization methods a practical choice for many hospitals, aligning with their needs for cost control, material compatibility, and efficiency in sterilizing surgical instruments.

North America region held a significant share of the surgical instruments packaging market in 2024. Due to modern and busy life style in North America the prevalence of the chronic disease is at greater number. The prevalence of chronic diseases such as diabetes, heart disease, and obesity requires ongoing medical management and treatment, contributing to higher healthcare costs. Complex healthcare systems in North America and administrative processes can lead to higher overhead costs in managing insurance, billing, and compliance. New medical technologies and treatments, while improving outcomes, often come with high costs for development, implementation, and maintenance.

Moreover, the key players operating in the North America market are focused on innovation of new surgical tools which has risen the demand for surgical instruments packaging and estimated to drive the market growth over the forecast period.

Asia Pacific region is anticipated to grow at the fastest rate in the surgical instruments packaging market during the forecast period. Rapid economic development in countries like China, India, and Southeast Asian nations has increased disposable incomes and funding for healthcare infrastructure and services. Growing awareness about health and wellness, coupled with an increase in chronic diseases, has led to higher demand for quality healthcare services and products. The Asia-Pacific region has become a popular destination for medical tourism due to its high-quality, cost-effective healthcare services, attracting patients from around the world.

Rapid urbanization in Asia Pacific has led to higher concentrations of populations in cities, which drives demand for better healthcare facilities and services. Furthermore, the key players operating in the market are focused on launching new surgical instruments packaging solutions, which is estimated to drive the growth of the surgical instruments packaging market in Asia Pacific region.

By Material Type

By Product Type

By Sterilization Methods

By Region

December 2025

December 2025

December 2025

December 2025