Agricultural Films Market Analysis, Size, Regional Growth, Key Players & Value Chain

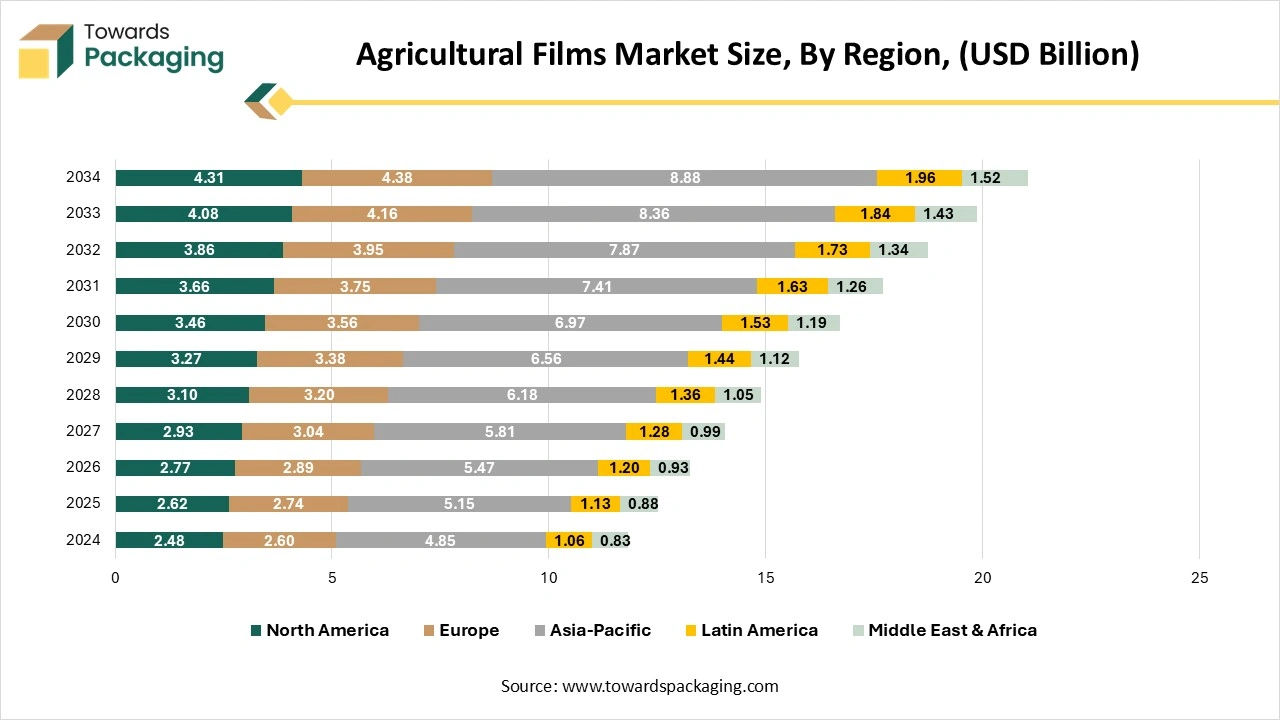

The agricultural films market is forecasted to expand from USD 13.27 billion in 2026 to USD 22.30 billion by 2035, growing at a CAGR of 5.94% from 2026 to 2035. This report provides an in-depth analysis of market trends, material types, and applications, covering LLDPE, EVA, mulch films, greenhouse films, and bale wrapping solutions. Regional insights include North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, highlighting Asia-Pacific’s leading share in 2024 and North America’s fastest CAGR. The study also profiles key players such as RKW Group, Coveris, and Plastika Kritis, offering competitive analysis, value chain assessment, trade data, and manufacturer-supplier insights.

Key Takeaways

- Asia-Pacific led the agricultural films market with the highest share in 2024.

- By region, North America is expected to witness the highest CAGR during the forecast period.

- By material, LLDPE dominated the agricultural films market in 2024

- Mulch dominated the type segment in the agricultural films market in 2024.

- By application, the bale wrapping & ensiling dominated the agricultural films market share in 2024.

Agricultural Films Market Overview

The agricultural films market is driven by the increasing demand for innovative and systematic agriculture methods to enhance crop quality by creating a controlled environment using the films inside the greenhouse. Mulch films are useful in maintaining soil temperature, preventing moisture loss, limiting weed growth, and improving crop yield. It is beneficial in large fruit and vegetable farms to control the quality of fruits and vegetables.

Another type is the tunnel films, which are used for protecting crops by creating a microclimate inside a mini tunnel. This helps protect the crop from adverse weather, pests, and diseases. Polyethylene and other Polymers are primarily used to produce agricultural films. The recent trend is the market shifting towards biodegradable materials due to sustainability practices. Increased awareness regarding environmental concerns is pushing the market towards the adoption of sustainable materials and solutions.

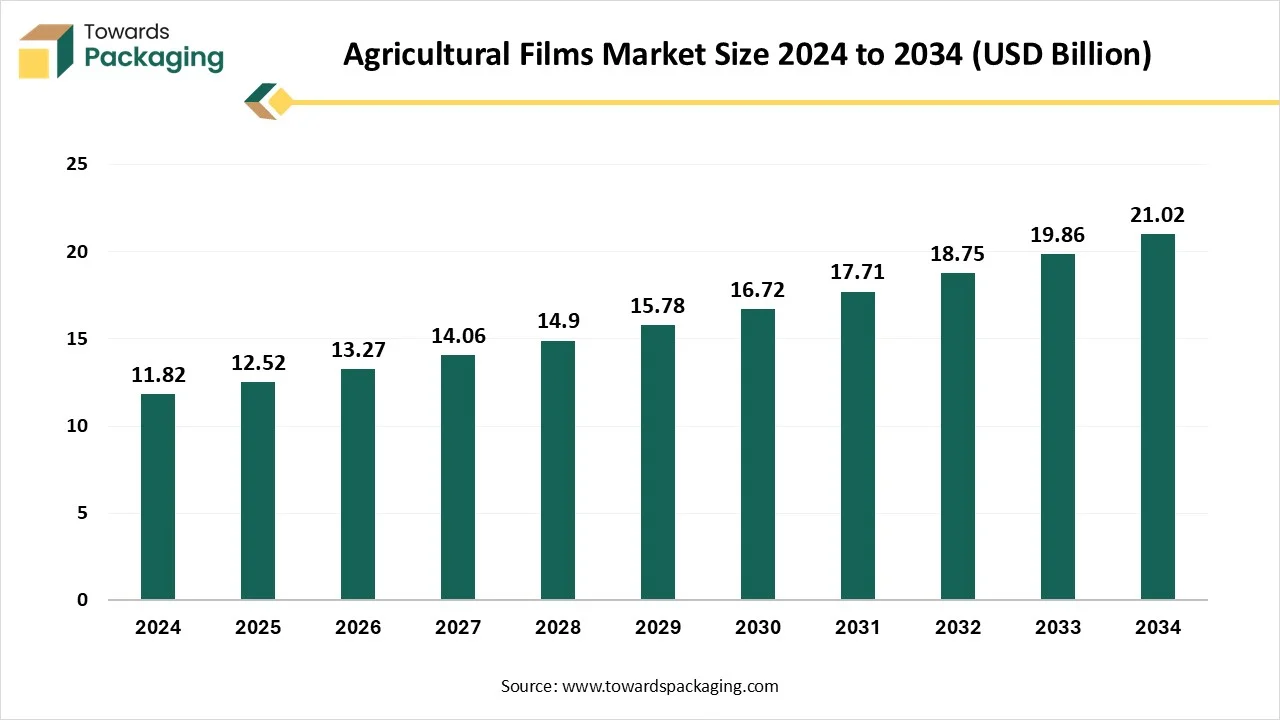

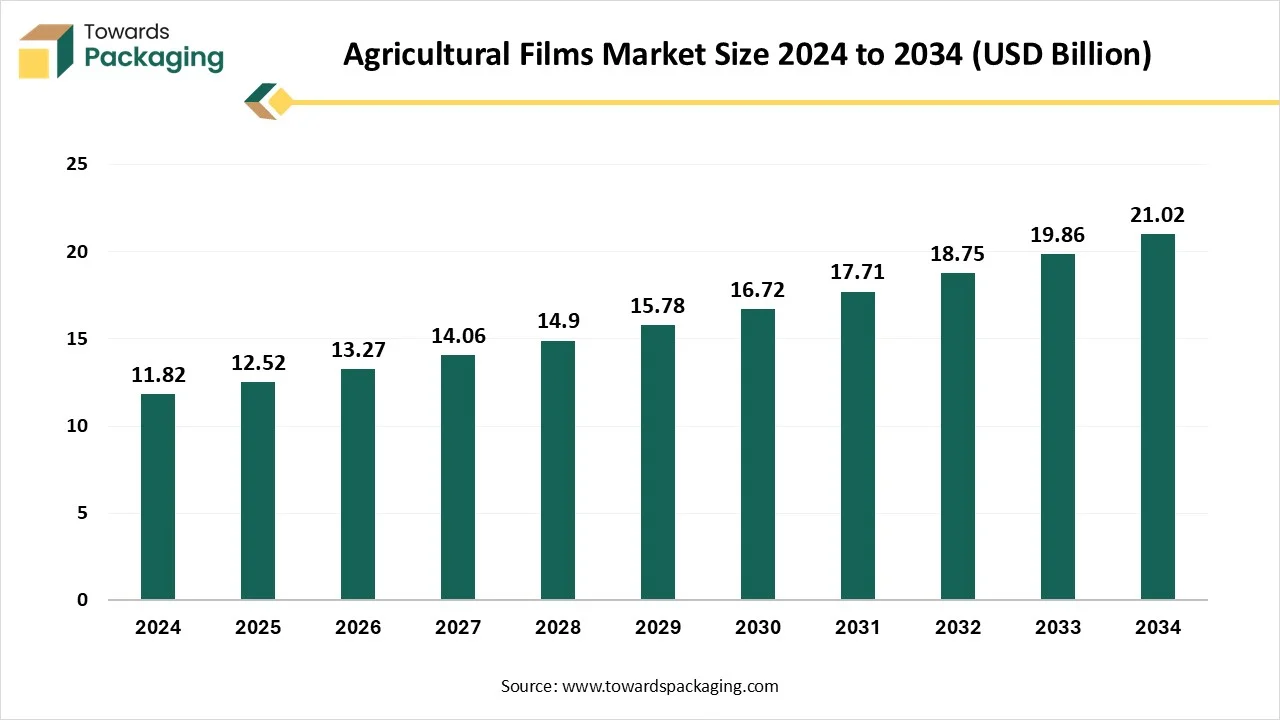

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 12.52 Billion |

| Projected Market Size in 2035 |

USD 22.30 Billion |

| CAGR (2025 - 2035) |

5.94% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Material, By Type, By Application and By Region Covered |

| Top Key Players |

RKW Group, Coveris, Rani Group, Groupe Barbier, Plastika Kritis, Industrial Development Company Sal |

Agricultural Films Market Trends

- Pre-Washing and Dry-Cleaning Plants: Pre-washing and dry-cleaning plants are important steps in recycling agricultural plastics. These facilities remove contaminants like agrochemicals and soil, developing the quality of recycled plastic and making it suitable for subsequent stages. Dry cleaning is totally relevant as it uses water resources and lowers the efficiency of generation.

- Automation and Digitalization: The integration of digitalization and automation technologies in agricultural plastic recycling is mainly changing the industry. These inventions, including artificial intelligence (AI) and blockchain, follow the pre-washing stage and play an important role in updating the recycling procedure, ensuring transparency and growing efficiency.

- Innovation in Depolymerization: Depolymerization is a main trend because it mainly improves the quality of recycled material, which makes it competitive with virgin plastics. Furthermore, it lowers the demand to extract the latest raw materials, marketing environmental sustainability. Organizations and innovators are making high-level depolymerization, which increases the efficiency and economic viability of plastic recycling.

- Advanced Pyrolysis and Gasification: Advanced pyrolysis and gasification broke down the plastic waste into valuable products like biogas, fuels, and bio-oil. These technologies apply to waste that cannot be recycled through depolymerization, serving as sustainable alternatives to fossil fuels and lowering greenhouse gas emissions.

- Bioplastics Materials: The trend toward biodegradable and renewable materials and recycling efforts. Compostable and biodegradable plastics are gaining attention in agricultural uses due to their lower environmental impact as compared to regular plastics. Bioplastics serve as eco-friendly and viable alternatives, as they are created from renewable sources and decompose more quickly in the environment, lowering plastic waste accumulation.

- High demand for increasing crop production is driving the innovative methods in agriculture.

- Use of biodegradable materials in agricultural films is prioritized due to sustainability practices

- Greenhouse agriculture is expanding to do its benefits for agriculture production and enhanced crop quality while doing the proper utilization of available land.

- Technological advancements in agriculture films is improving the quality of greenhouses providing better protection against extreme weather UV light.

- Sustainable practices are being adopted by farmers on a large scale due to rising environmental concerns.

- The use of agriculture films is indicating the increasing emphasis on utilising most of a farm land and produce high quality crop.

AI Integration in the Agricultural Films

AI is creating an impact on the agricultural films market in various ways. AI-driven intelligent systems are capable of regulating the greenhouse climate as per the requirements of the crop, they can handle other aspects such as pest control and disease detection in greenhouse agriculture. In the film production units, AI systems can provide valuable insights regarding the effective use of materials and the development effective agricultural films.

- AI has helped to create effective film recycling and waste management strategies, which have increased the recycling and waste management efficiency.

- Industrial automation has enabled production at a fast pace while reducing labor costs.

- The defect detection accuracy offered by the AI system is unparalleled compared to human-level detection.

This helps to remove the defective units before they reach the market, so that there is no loss of product credibility. Inventory management, raw material orders scheduling, and effective utilization of available resources, these things are now taken care of by intelligent AI systems with utmost operational accuracy.

Agricultural Films Market Dynamics

Driver

Rising Demand for Modern Agriculture Methods

Increasing food demand due to a rising global population is pushing the agricultural market to adopt innovative methods for increasing crop yield. One of the effective methods for increasing crop yield is greenhouse farming, where a greenhouse is created using films which has a controlled climate inside the greenhouse as per the crop requirement. it protects the crop against the extreme environmental conditions and maintains the crop quality. Mulch films are highly used to avoid soil erosion, stop the moisture escape, and prevent the growth of weeds. these are the factors that are driving the growth of the agricultural films market.

Restraint

Challenges of Plastic Waste Management

The majority of agricultural films are manufactured using plastic materials. The government has announced regulations to curb plastic usage due to its harmful impact on the environment and water bodies. This is the major challenge currently faced by the agricultural films market. the market is looking for other innovative solutions, it is focusing on the recycling of the plastic material, use of biodegradable plastics. this approach of using biodegradable materials is one of the effective solutions currently available in the agricultural film market. these biodegradable products are gaining popularity due to their eco-friendliness and effectiveness as agricultural film material.

Opportunity

Use of Plant-Based Biodegradable Plastics Generating New Opportunities

The shifting trend of the market towards sustainable materials due to rising environmental concerns is driving the growth of sustainable materials in the agricultural films market. due to the Various government regulations and the harmful effects of plastic materials, their use is discouraged, and biodegradable materials are preferred. As they help to reduce the carbon footprint. Use of biodegradable material for mulch in farm lands discards the need to remove it as it naturally decomposes.

Future of Agricultural Films and Bonding Market

The agricultural films and bonding market is experiencing remarkable growth, with revenue expected to soar into the hundreds of millions from 2025 to 2034. This expansion is fueled by the increasing demand for sustainable farming solutions and innovative materials that enhance crop protection, soil health, and yield efficiency.

The rising demand for sustainable agricultural solutions in various regions has enhanced this market's demand worldwide. Farmers are adapting new methods to yield more crops, protect crops from pests, and conserve water while irrigation increases demand for agricultural films and bonding markets.

The agricultural films and bonding market is rising rapidly due to the growing demand for sustainable farming choices, technological advancement, UV rays protection, temperature control, and crop protection. These types of films are mainly used in mulch films, irrigation systems, greenhouse covers, and silage films to improve crop yielding and protect from the adverse effects of the environment. These films are clear, transparent, durable, diffusion, and degradation properties are ideal for agricultural purposes.

These inventions play a significant role in enhancing crop yields by allowing better regulation over development conditions, pest management, and soil health, vital for meeting the rising food demands of an escalating worldwide population. Technological improvements are generating prospects for the expansion of advanced agricultural films and bonding resolutions. Films with light transmission, enhanced durability, and eco-friendliness are developing. Bonding solutions that deliver improved weather resistance and joint strength are also fast traction.

Segmental Insights

LLDPE Dominated the Material Segment in the Agricultural Films Market

LLDPE dominated the market due to its high performance and cost-effectiveness. Its abundance in the market makes it easily accessible. The LLDPE's moisture barrier and UV resistance make it an effective material for agricultural films. Its ease of use makes it a popular choice for agricultural films. EVA is the fastest-growing material segment in the agricultural films market, it is due to its unique features like clarity, flexibility, and UV resistance, making it an ideal choice for greenhouses.

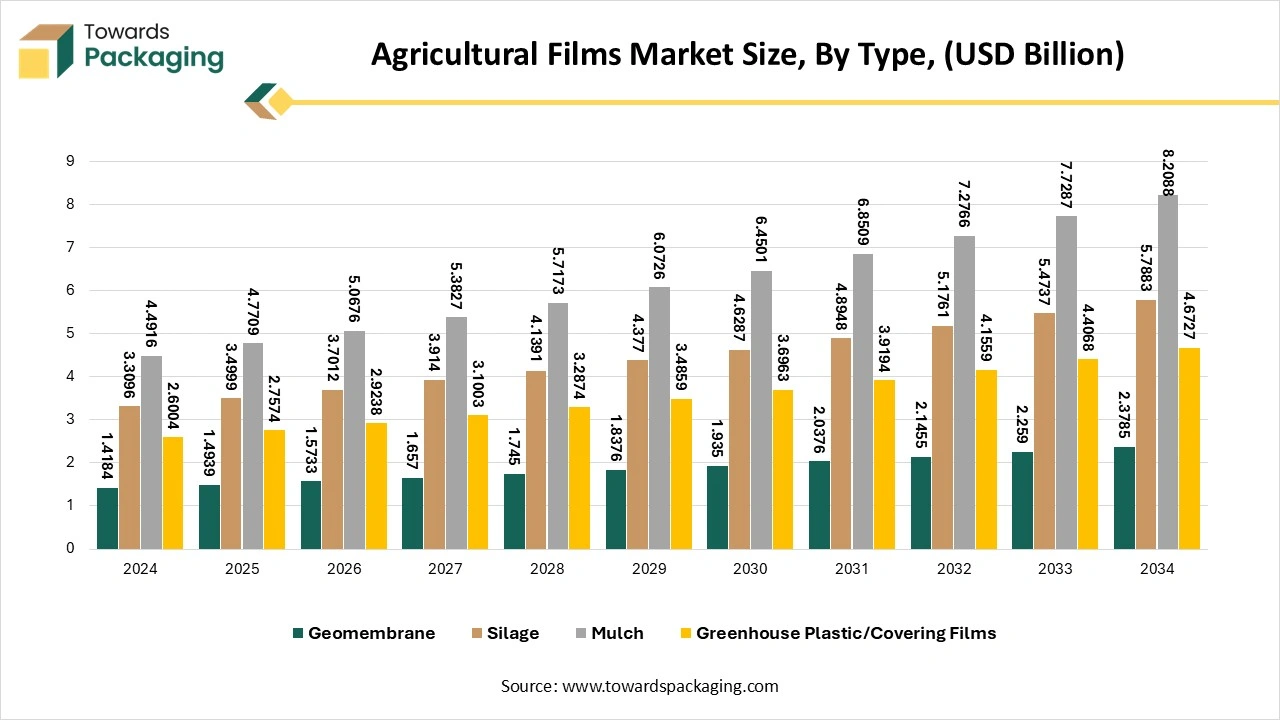

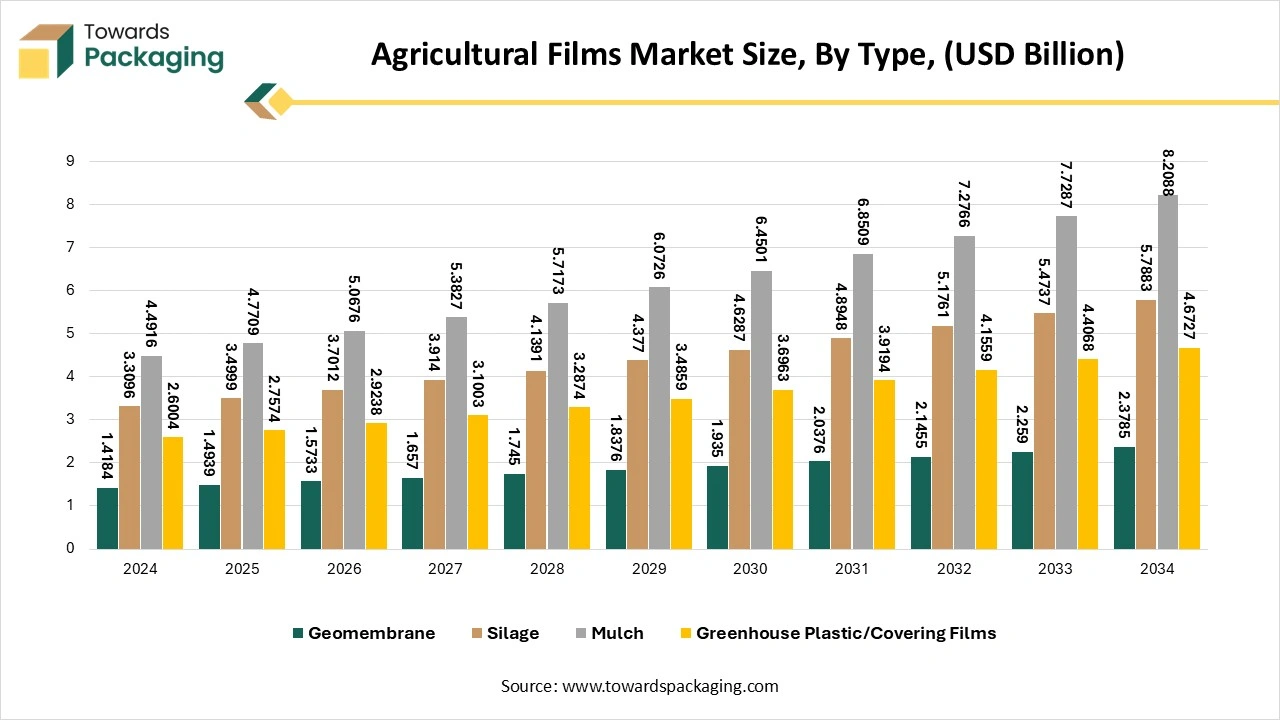

By Type, Mulch Films Dominated the Agricultural Films Market

The mulching films dominated the type segment in the agricultural films market. the various applications of mulching films in agriculture are proving highly beneficial to improve crop yield, reduce water consumption, and reduce weeds in the farmland. Use of mulching films enhanced the utilisation of available resources without wasting them. Greenhouse plastic/covering films are expected to be the fastest growing segment in the agriculture film market. it is due to the rising emphasis on modern agriculture practices. in greenhouse the farming is done in a controlled environmental conditions. Controled moisture and humidity is ensured. Increasing focus on organic farming and advance technology is generating growth in this particular segment.

By Application Bale Wrapping & Ensiling Dominated the Market

Bale wrapping & ensiling dominating the application segment in the agriculture films market due to its quality of application in the wrapping. It is highly used in wrapping the round bales of foder. Which are used for creating airtight barriers for preservation of silage. Silo Bag Manufacturing is the fastest growing application segment in the agricultural film market due to its increasing demand for food storage such as grains due to its high efficiency and durability.

Regional Insights

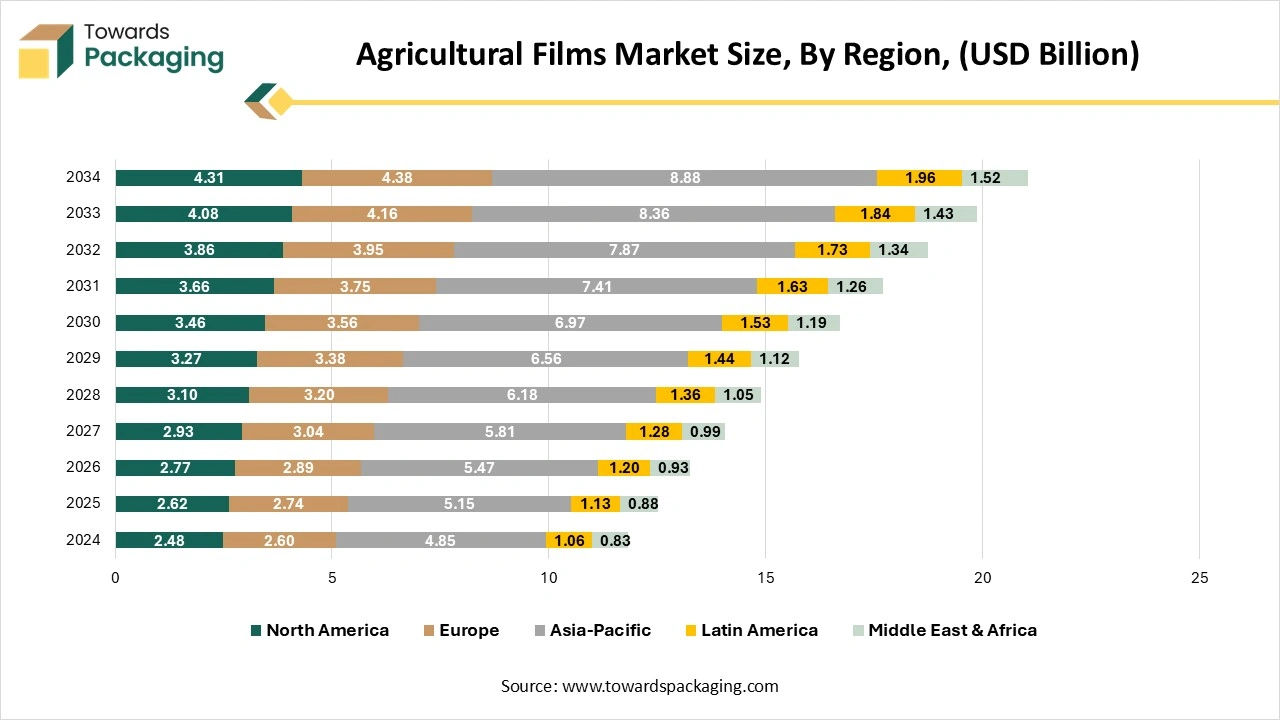

Largest Production of Agri Products: Asia Pacific Dominated the Market in 2024

Being situated with a country like India where majority of its land around 50% is under the agriculture, has a huge requirement for agriculture films for various applications. this region is also has a huge population and huge food requirement in countries like China and India. which creates the necessity to find various innovative ways to produce high quality crop in high amount with natural ways. as the pesticides and chemical fertilizers are damaging the land which is gradually reducing the ability to produce good quality food as the time passing. this requirement is shifting the agriculture market towards the greenhouse farming and other innovative solutions to increase the crop quality and quantity while maintaining the health of soil.

North America Fastest Growing: Tech Adoption to Grow Rapidly

North American market is expected to be the fastest growing region in the agricultural film market, due to its rising emphasize on modern agriculture practices. in this region the shifted trend and increased demand for organic food is driving the growth of greenhouse farming. which is making it one of the fastest growing regions in agriculture film market. technological advancements and various technology infusion such as AI and IoT in the agriculture has completely changed the agriculture methods in the North American region. which is driving growth and expected to continue the fastest growth in this region for agriculture film market.

Promotion of Greenhouse Farming: Europe to Grow Notably

Notable growth is observed in the European region for agriculture film market due to increasing modern agriculture and greenhouse farming for producing various types of crops under controlled environment. with the help of technology and AI. The health-conscious consumer base is creating huge demand for organic food instead of produced using pesticides and chemical fertilizers. organic farming is booming in this region which is creating a huge opportunity for the greenhouse farming and use of natural methods to produce high quality crop yield.

Middle East and Africa Agricultural Films Market Trends

The MEA agricultural films market is driven by the growing use of protected farming methods and the scarcity of water. In hot climates, mulch and greenhouse films help increase crop yields and lower evaporation. Market expansion is supported by government assistance for modern agriculture and food security. Infrastructure for recycling and collection is still lacking in many nations. Rising population and food demand are encouraging investments in modern farming inputs. Import dependence for advanced films continues to shape market dynamics.

In the UAE, greenhouse farming, the use of agricultural films is growing to support regional food production. The demand for high-performance films has increased due to climate-controlled agriculture and smart farming initiatives. Mulch film adoption is supported by the growing emphasis on water-efficient farming. Interest in biodegradable agricultural films is growing due to sustainability concerns. Government-backed agriculture projects further support market expansion. High purchasing power enables the adoption of premium film solutions.

Latin America Agricultural Films Market Trends

The Latin America market benefits from large-scale farming and strong agricultural exports. Mulch and silage films are used to lower crop losses and increase productivity. Adoption of films in major agricultural economies is supported by growing awareness of modern farming techniques. Material choices are gradually being impacted by environmental regulations. Expansion of commercial agriculture continues to drive demand, cost sensitive farmers still prefer conventional plastic films.

Brazil dominates the Latin American agricultural films market because of its extensive agricultural foundation. The production of crops and livestock is supported by the high demand for silage and greenhouse films. Stable growth is fueled by increased investments in agribusiness and commercial farming. Used agricultural film is still a major issue. Commercialization of high-yield crops further drives film usage. Government incentives promote the adoption of modern agricultural technologies.

Value Chain Analysis

Raw Materials Sourcing

Agricultural films are mainly produced from polyethylene resins, with increasing use of biodegradable and recycled polymers.

Key players: Dow, ExxonMobil, LyondellBasell, BASF.

Logistics and Distribution

Distribution depends on seasonal agricultural demand, with strong regional supply networks supporting farms and agri-input distributors.

Key players: Berry Global, RKW Group, Armando Alvarez Group.

Recycling and Waste Management

Recycling is challenged by soil contamination, driving interest in collection programs and bio-based alternatives.

Key players: BASF, Novamont, and local agri-plastic recyclers.

Agricultural Films Market Key Players

Recent Development

- On 3 June 2025, Gromax Agri Equipment, a joint venture between Mahindra and Mahindra Ltd and the Government of Gujarat, revealed its first digital video under the #Sabsesahichunaav campaign.

- On 3 July 2024, The Prairies, which is an agricultural powerhouse and innovator across Alberta, announced the latest possibilities to make and commercialize technologies that advantage both the environment and economy. Alberta is already a national and global leader across various industries, which contribute to Canada’s prosperity from environment, energy, and aerospace to digital, clean technology, and life sciences.

- In January 2024 RKW group announced nonwoven film and net solutions for the entire supply chain at Logistica Expo Berlin.

- In March 2024, Kuraray Co. Ltd invested in the EVAL EVOH plant in Singapore to expand the business and to contribute to sustainability initiatives

Agricultural Films Market Segments

By Material

- Ethylene Butyl Acrylate

- Ethylene-Vinyl Acetate

- Low-Density Polyethylene

- LLDPE

- Polypropylene

- Polyamide

- Ethylene Vinyl-Alcohol Copolymer Resins

- PVC

- Others

By Type

- Geomembrane

- Silage

- Mulch

- Greenhouse Plastic/Covering Films

By Application

- Bale Wrapping & Ensiling

- Silo Bag Manufacturing

- Tunnel Covers

- Bunker Ensiling

- Other

By Region Covered

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- South Africa

- Middle East and Africa (MEA)