Corrugated Bubble Wrap Market Segments, Trade Data, Manufacturers and Supplier Insights

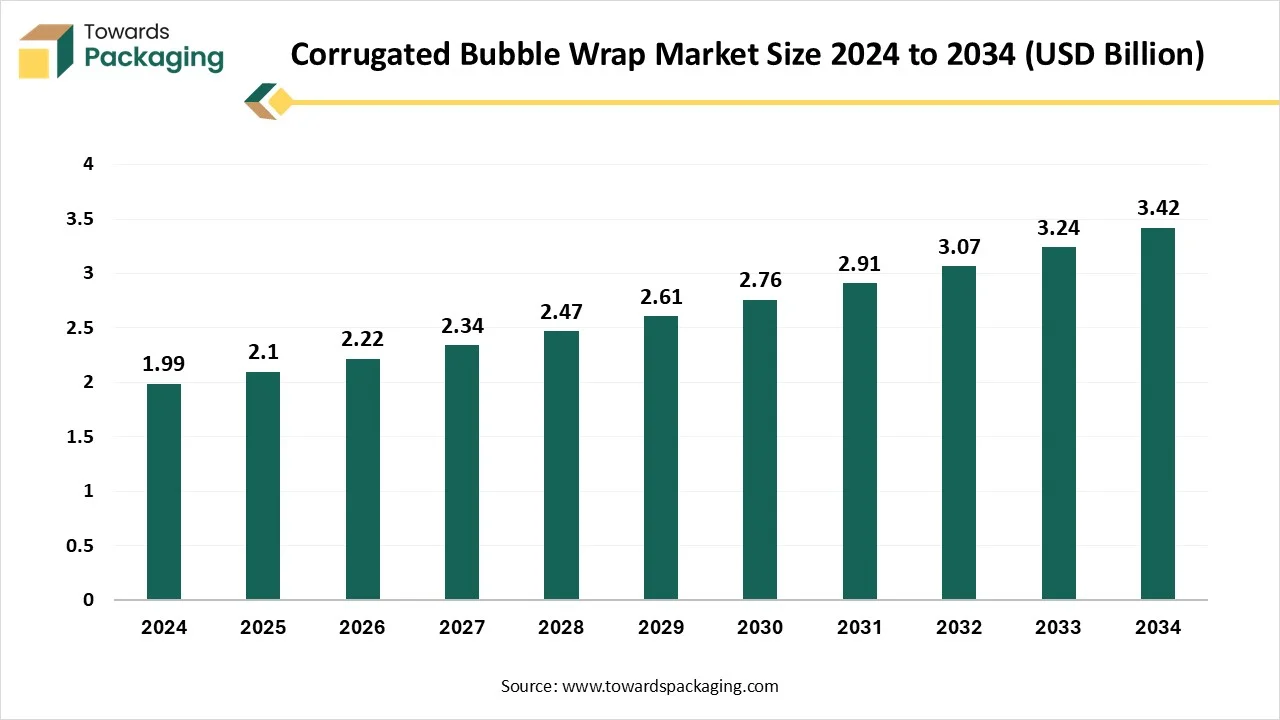

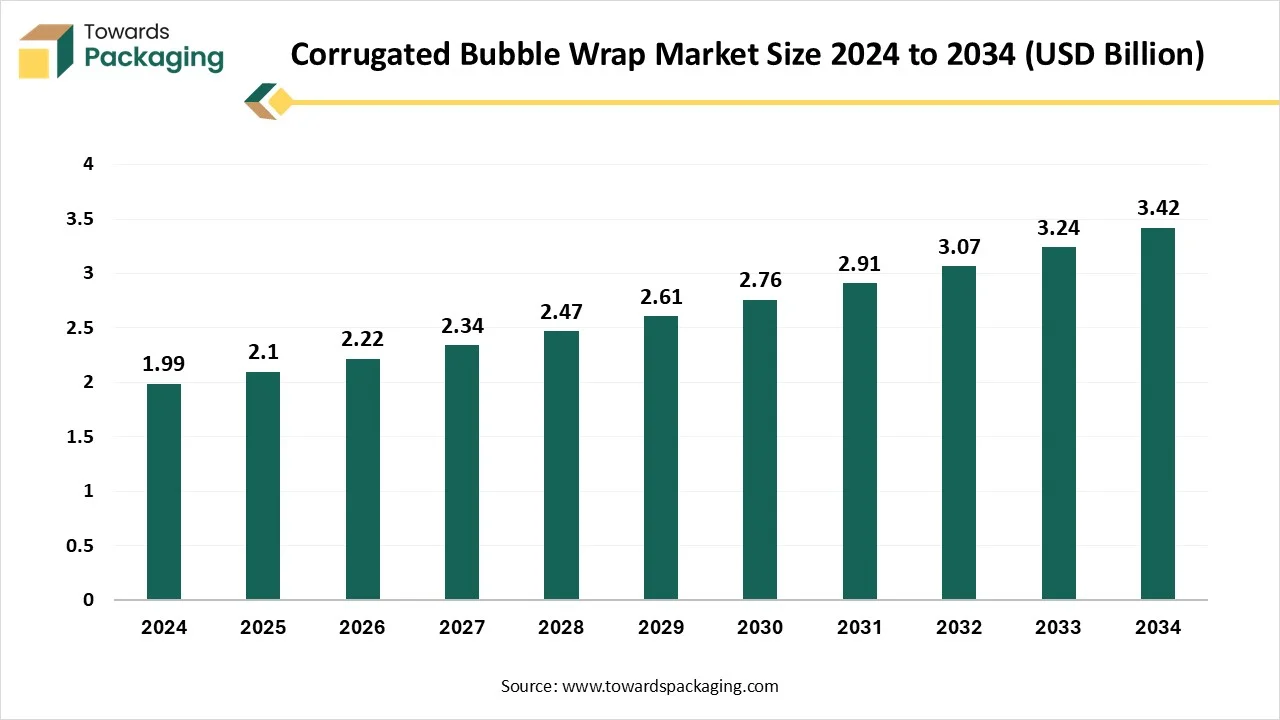

The corrugated bubble wrap market is forecasted to expand from USD 2.21 billion in 2026 to USD 3.56 billion by 2035, growing at a CAGR of 5.44% from 2026 to 2035. This market report covers key trends such as the rising demand for sustainable and eco-friendly packaging solutions, innovations in protective packaging design, and the growing role of AI in manufacturing and supply chain optimization. Segmentation analysis includes corrugated bubble sheets and corrugated bubble bags/mailers. Regional insights encompass North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, highlighting growth drivers and market dynamics. Competitive analysis covers top players such as Delux Packaging, Conitex Sonoco, Larsan Packaging, and Western Container Corp., including company profiles, product portfolios, and market capitalization.

It offers strong cushioning and shock-absorbing properties, making it ideal for protecting fragile goods during transportation. The e-commerce, electronics, and consumer goods sectors are key end-users, driving consistent adoption. Innovations in packaging design and a global push toward reducing plastic waste have further boosted its appeal. Manufacturers are focusing on enhancing durability and cost-effectiveness to remain competitive. Regulatory support for green packaging and rising consumer awareness around sustainability continue to be significant drivers shaping the future of this market.

Key Insights

- In terms of revenue, the market is valued at USD 2.10 billion in 2025.

- The market is projected to reach USD 3.56 billion by 2035.

- Rapid growth at a CAGR of 5.44% will be observed in the period between 2025 and 2035.

- Asia Pacific dominated the global corrugated bubble wrap market in 2024.

- North America is expected to grow at a significant CAGR during the forecast period.

- The European market is expected to grow at a notable CAGR in the foreseeable future.

- By product type, the corrugated bubble sheets segment dominated the market in 2024.

- By product type, the corrugated bubble bags/mailers segment is expected to grow at the fastest CAGR in the forecast period.

- By end-use industries, the electronics and electrical segment dominated the market with the largest revenue share in 2024.

Corrugated Bubble Wrap Market Overview

Corrugated bubble wrap is a type of protective packaging material that combines the cushioning properties of traditional bubble wrap with the structural strength of corrugated materials, such as corrugated cardboard or paper. This term can refer to a few variations depending on the specific design. One common form includes bubble wrap with a corrugated outer layer, where a layer of corrugated cardboard is attached to one side of the bubble wrap. This design offers both shock absorption from the bubbles and added rigidity and impact resistance from the corrugated layer, making it ideal for shipping delicate or heavy items.

Another variation uses corrugated kraft paper shaped to mimic the cushioning effect of plastic bubble wrap. This version is often marketed as an eco-friendly alternative, providing a sustainable option for protective packaging. In some cases, the plastic itself in bubble wrap may be manufactured with a corrugated-like structure, incorporating ridges or folds for added strength. Overall, corrugated bubble wrap is valued for combining flexibility and cushioning with enhanced surface protection and stacking strength, and it is commonly used in packaging electronics, glassware, and industrial components.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 2.10 Billion |

| Projected Market Size in 2035 |

USD 3.56 Billion |

| CAGR (2025 - 2035) |

5.44% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Product Type, By End-Use Industries and By Region |

| Top Key Players |

Delux Packaging, Inc., Conitex Sonoco, Larsan Packaging Products, Inc., Western Container Corp., Cougar Packaging Solutions, Albert Paper Products, Alpha Packaging Inc. |

What are the New Trends in the Corrugated Bubble Wrap Market?

- Sustainability Goals: Sustainability and environmental, social, and governance goals remain heavy on the goals of several businesses. For the packaging sector, this is transforming into customers choosing corrugated and paper-based packaging over other materials, intuitive packaging designs, and expecting intelligent and material-effective solutions too.

- EPR Regulations: The Extended Producer Responsibilities legislation will come into effect in the upcoming period, when qualifying organizations will primarily become liable for fees. These fees are directly linked to the amount of packaging they generate for the market, with recyclability and the type of packaging and material being counted too and will be featured to producers for packaging.

- Local Supply Chains: For all the developments in technology, there is also a rising appetite for business to locate their packaging from a local or regional supplier, thus lowering packaging miles and further assisting sustainability and environmental aims.

- Surge in Sustainable Packaging: The packaging industry is changing due to environmental concerns, and corrugated materials are well-positioned to satisfy these needs. Anticipate a greater emphasis on cutting carbon emissions throughout the supply chain in 2025. In addition to wanting to source lighter-weight corrugated materials without sacrificing durability, consumers are pressing for corrugated packaging with larger percentages of recycled content.

- Eco-Friendly Materials: There's a strong shift towards recyclable, biodegradable, and compostable bubble wrap alternatives, such as those made from recycled paper, cornstarch, or agricultural waste. These materials align with global efforts to reduce plastic waste and support circular economy initiatives.

- Consumer Demand: A significant portion of consumers, especially younger demographics, are willing to pay a premium for products with sustainable packaging. This trend is prompting companies to adopt greener practices in their packaging solutions.

- Technological Innovations in Packaging: Smart Features: Integration of technologies like RFID tracking, tamper-evident designs, and shock sensors is enhancing the functionality of bubble wrap, particularly in sectors requiring high-security packaging.

- Customization: Advancements in digital printing and automation are enabling manufacturers to offer customized bubble wrap solutions tailored to specific product needs, improving both protection and branding opportunities.

- Automation: As supply chain issues and labor shortages persist beyond 2025, the industry is concentrating on creating packaging that is compatible with automation. Corrugated solutions are being designed to effortlessly interface with automated packing lines, guaranteeing uniformity and cutting costs, in response to the ongoing demand to make packaging easier to store and assemble. Pre-created templates and modular designs are becoming more and more common since they increase productivity and streamline processes.

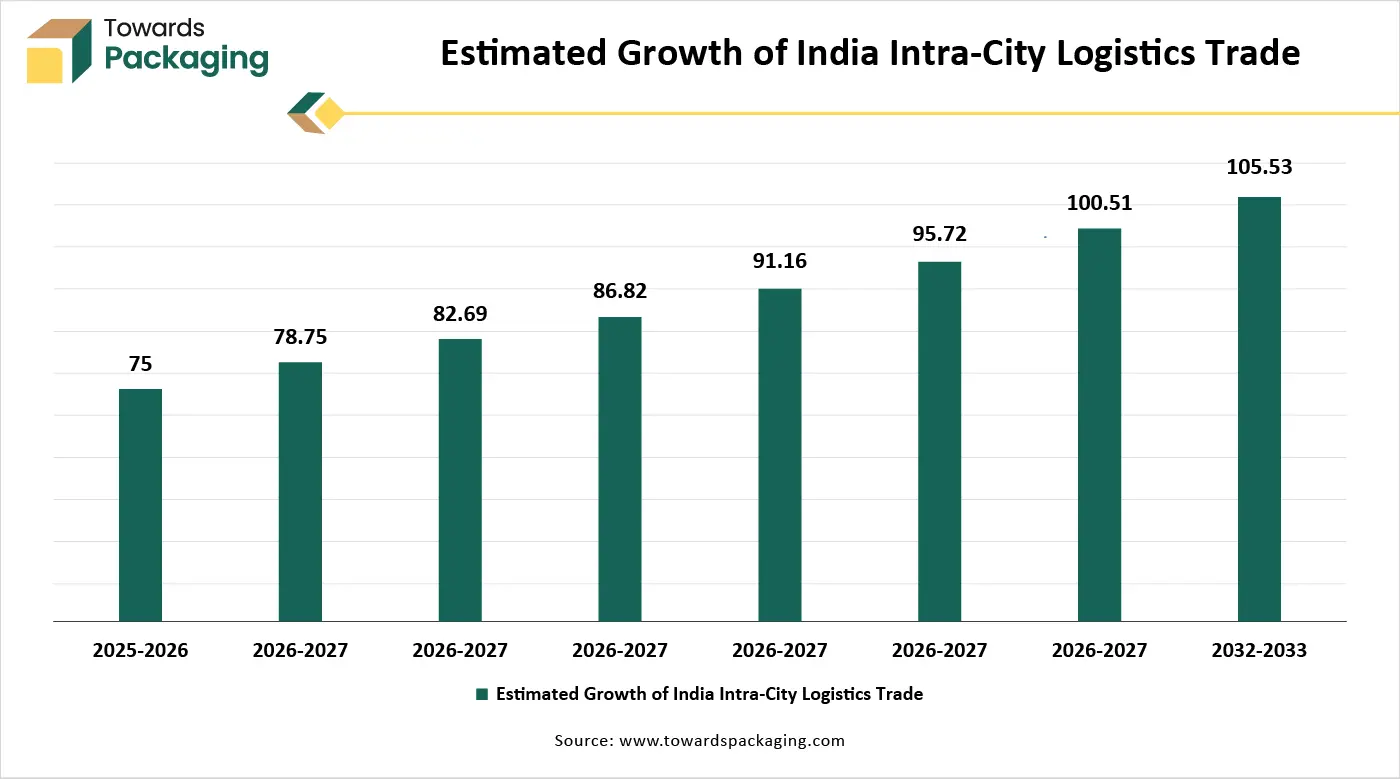

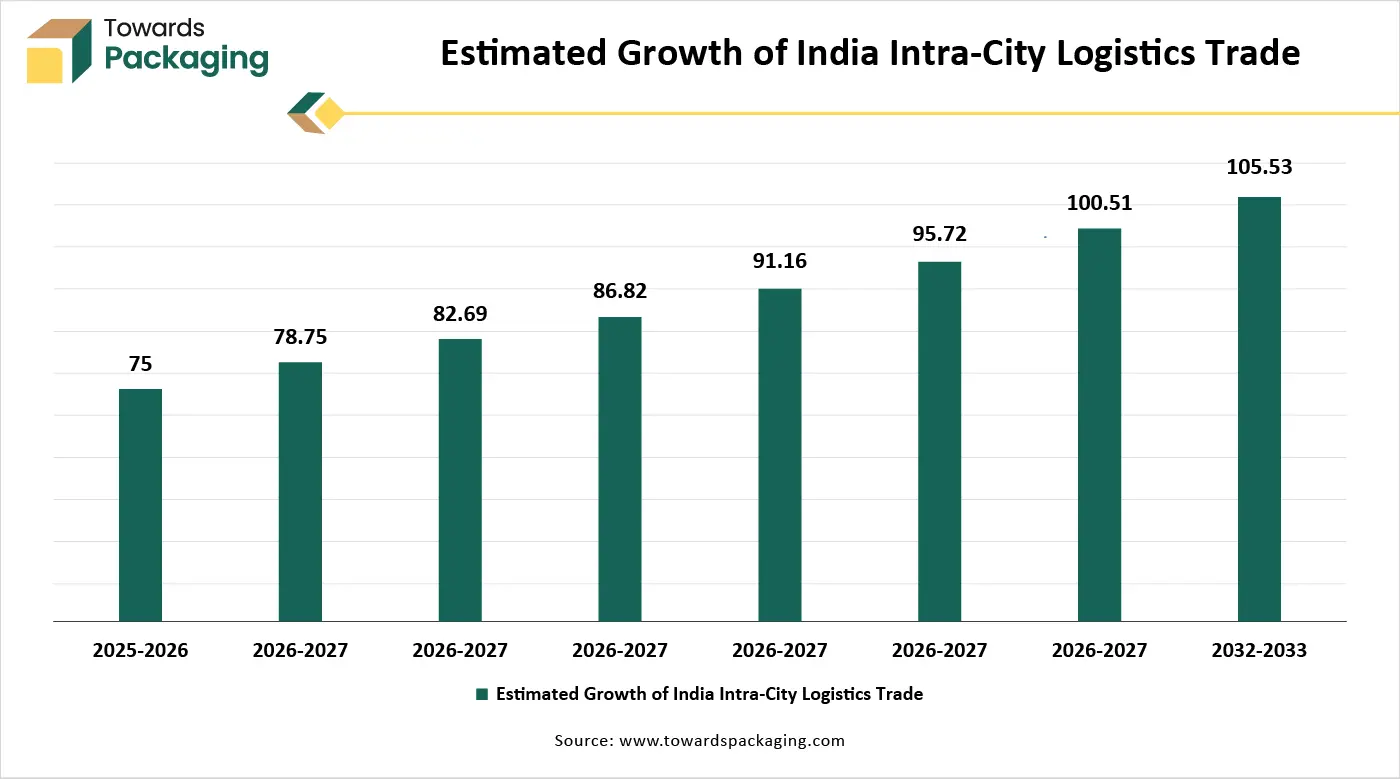

- Increased Demand Due to Logistics: The rapid expansion of e-commerce, particularly in regions like Asia and India, is driving the need for reliable protective packaging. Bubble wrap remains a preferred choice for safeguarding fragile items during transit.

- Logistics Applications: Paper-based bubble wrap is gaining traction in the logistics industry for palletizing and securing products during transportation, offering an eco-friendly alternative to traditional plastic wraps.

- Printed Packaging: Incorporating QR codes and other links to the brand's website guarantees that corrugated packaging not only protects goods but also functions as a marketing tool. The benefits of printing on packaging will continue to be driven by the need to better connect with customers and stand out from the competition. Printing on packaging will continue to offer enhanced branding and seasonal references, elevating the customer's unboxing experience.

How Can AI Improve the Corrugated Bubble Wrap Industry?

AI integration can significantly enhance the corrugated bubble wrap industry by improving manufacturing efficiency, quality control, supply chain management, product customization, and sustainability efforts. In manufacturing, AI enables predictive maintenance by monitoring machinery such as extrusion and corrugation equipment, allowing manufacturers to identify and address potential failures before they lead to costly downtime. Machine learning algorithms can also optimize production settings, such as temperature, pressure, and feed rate, reducing material waste and increasing throughput.

Robotics guided by AI and computer vision can automate the inspection and packaging processes, ensuring greater consistency and speed on the production floor. Quality control is another critical area where AI adds value. Computer vision systems can detect defects like misaligned corrugation, inconsistent bubble inflation, or tears in real time, helping maintain high product standards. These systems also ensure uniformity in bubble size, shape, and material thickness, which are essential for the protective performance of bubble wrap.

In terms of supply chain and inventory management, AI improves operational efficiency by forecasting demand using historical sales data and current market trends. This allows for better inventory control, reducing overproduction or shortages. AI can also assist in dynamic pricing strategies based on real-time supply and demand fluctuations, as well as changes in raw material costs. AI further enables product customization and innovation by analyzing customer data to develop tailored packaging solutions for specific products, such as fragile electronics or heavy industrial components. It also supports research and development efforts to create new, more sustainable materials through simulation and design optimization.

Sustainability is increasingly important, and AI contributes by identifying ways to reduce plastic usage without compromising the performance of bubble wrap. Image recognition can be used to sort and recycle manufacturing scraps more efficiently, while AI models can evaluate the carbon footprint of various production strategies to support greener practices. Finally, AI enhances the customer experience by powering chatbots and digital portals that facilitate customized orders, delivery tracking, and issue resolution. It can also analyze customer feedback to inform product improvements and better align with market needs. Altogether, AI represents a transformative force that can drive the corrugated bubble wrap industry toward greater efficiency, innovation, and environmental responsibility.

Market Dynamics

Driver

Growth Online Retail Business & Logistics Global Trade

The rapid expansion of e-commerce platforms like Amazon, Alibaba, and Shopify has significantly increased the demand for protective packaging. Corrugated bubble wrap offers cushioning and rigidity, making it ideal for shipping delicate or valuable goods across long distances. As more consumers shop online, especially for electronics, cosmetics, and fragile household items, the need for reliable protective packaging grows. As global trade and logistics services expand, there is a higher volume of goods being shipped both internationally and domestically. This drives demand for packaging materials that ensure product safety during transit, especially in industries like electronics, pharmaceuticals, and industrial machinery.

- According to the data published by the National E-commerce Association, e-commerce revenues are expected to reach USD 8.09 trillion by 2028, up from USD 5.13 trillion in 2022. After increasing by 8.4% from the year before, internet transaction revenue is expected to cross USD 6 trillion in 2024. Global e-commerce is mostly driven by the United States and China, whose combined sales in 2023 were expected to reach over USD 2.32 trillion.

Restraint

Limited Protective Capability and Slow Adoption of Sustainable Packaging

The key players operating in the corrugated bubble wraps market are facing issues due to the availability of alternative options and bulkiness, and storage challenges. Corrugated bubble wrap, though eco-friendlier, often lacks the same level of moisture resistance, flexibility, and durability as traditional plastic bubble wrap. This makes it less suitable for heavy, sharp, or high-moisture products, limiting its adoption in certain sectors like food packaging or heavy industrial equipment. Corrugated bubble wrap tends to be bulkier and less compressible than plastic alternatives. This creates storage and transportation inefficiencies, increasing warehousing and shipping costs.

What are the Opportunities for the Growth of the Corrugated Bubble Wrap Market?

- Environmental Concerns and Shift Toward Sustainable Packaging

Corrugated bubble wrap is often seen as a more sustainable alternative to traditional plastic bubble wrap, especially when made with recycled paper and biodegradable materials. Rising consumer and regulatory pressure to reduce plastic waste is pushing companies to adopt eco-friendly packaging solutions, thus driving growth in the corrugated bubble wrap segment.

- Packaging Innovation and Product Versatility

The corrugated bubble wrap market benefits from ongoing innovation in material design and structure, offering products that are lightweight, strong, recyclable, and customizable. Manufacturers can create wraps tailored to specific applications, whether it's electronics, glassware, or automotive parts, increasing the material’s appeal across sectors.

- Rising Demand for Damage-Resistant Packaging

Companies are under pressure to minimize product returns and damages, which can be costly and harmful to brand reputation. Corrugated bubble wrap provides both cushioning and structural support, reducing the likelihood of transit damage and offering a cost-effective solution for damage prevention.

- Rise in Small Businesses and Direct-to-Consumer Models

More small businesses and startups are entering the market with direct-to-consumer (DTC) models. These businesses require affordable, customizable, and eco-conscious packaging materials, which makes corrugated bubble wrap an ideal choice for shipping goods directly to customers.

- Regulatory Support for Sustainable Packaging

Governments and international bodies are introducing regulations to curb plastic waste and promote recyclable materials. Such policies are encouraging businesses to switch to paper-based or biodegradable packaging, which directly boosts demand for corrugated bubble wrap.

Segmental Insights

Why does the Corrugated Bubble Sheets Segment Dominate the Corrugated Bubble Wrap Market?

The corrugated bubble sheets segment holds a dominant presence in the market due to its excellent shock absorption property and lightweight nature. Corrugated bubble sheets are popular in packaging due to their excellent shock absorption, combining air-filled bubbles with a corrugated structure to protect fragile items during transit. Lightweight and cost-effective, they help reduce shipping costs while minimizing damage-related expenses. Their flexibility allows them to wrap around various product shapes, making them ideal for items like electronics, glassware, and automotive parts. Made from moisture-resistant plastics, they also guard against scratches, spills, and humidity. Additionally, some variants are recyclable or reusable, contributing to environmental sustainability. With mild insulating properties and customizable options in size and thickness, corrugated bubble sheets offer a versatile, efficient packaging solution. Their durability, adaptability, and protective features make them a reliable choice across many industries.

The corrugated bubble bags/mailers are extensively used for packaging due to their lower cost, protective nature, and convenience. These mailers are designed with a layer of bubble wrap for cushioning and a corrugated outer layer for added rigidity and durability. This dual structure protects items from impacts, compression, and punctures during shipping, making them ideal for fragile or valuable products such as electronics, cosmetics, books, and accessories. They are also lightweight, helping to lower shipping costs, and pre-formed, which makes them easy and fast to pack, saving time in fulfillment centers. Many are also water-resistant and tamper-evident, offering additional security. With recyclable and eco-friendly options available, corrugated bubble mailers are a sustainable and reliable choice for e-commerce and logistics.

Which End-Use Industries Dominated the Corrugated Bubble Wrap Market in 2024?

The electronics and electrical segment accounted for the dominant revenue share of the corrugated bubble wrap market in 2024. Corrugated bubble packaging is extensively used for electronics and electrical products because it offers superior protection, insulation, and handling convenience all critical for delicate and high-value items. Firstly, the bubble layer provides excellent shock absorption, which protects sensitive components from mechanical shocks, vibrations, and drops during transit. This is essential for preventing internal damage to circuit boards, chips, and other fragile parts. The corrugated outer layer adds structural strength, shielding against external pressure and punctures. Additionally, this packaging can be made from anti-static or ESD (Electrostatic Discharge) materials, which is crucial for electronics, as static discharge can damage or destroy sensitive components. Corrugated bubble packaging is also lightweight, reducing shipping costs, and customizable to fit different device shapes and sizes, ensuring a snug, secure fit. Its moisture resistance protects electronics from humidity and minor water exposure, while its clean, dust-free surface keeps devices contamination-free. All these factors make corrugated bubble packaging an ideal, reliable, and efficient solution for electronics and electrical applications.

Regional Insights

Which Region Dominated the Corrugated Bubble Wrap Market in 2024?

Asia Pacific held the largest share of the corrugated bubble wrap market in 2024, owing to the booming e-commerce sector and cost-effective production. Rapid growth of online shopping, especially in countries like China, India, and Southeast Asian nations, has created high demand for protective packaging like corrugated bubble wrap to safely deliver goods. The region is a global hub for manufacturing, especially in electronics, consumer goods, automotive, and industrial equipment, all of which require protective packaging during storage and transit. Asia Pacific offers lower production and labor costs, making it attractive for manufacturers of packaging materials, including corrugated bubble wrap.

A large and growing consumer base, coupled with rapid urbanization, increases demand for packaged goods, which in turn drives the need for effective packaging solutions. Ongoing investments in logistics and warehousing infrastructure support efficient distribution and supply chains, further promoting the use of protective packaging. Increasing awareness around sustainable packaging is encouraging regional companies to innovate with recyclable or eco-friendly corrugated bubble wraps, enhancing market appeal. Pro-manufacturing policies and export incentives in countries like China, India, and Vietnam are fostering growth in packaging material production and global supply.

China Market Trends

China's corrugated bubble wrap market is growing due to its massive manufacturing base for electronics, consumer goods, and industrial equipment, all of which require protective packaging. China country has low production costs, strong logistics infrastructure, and government support for export-driven growth. Rising e-commerce and focus on eco-friendly packaging materials are further fueling demand in China. China is the market leader in production and export.

India Market Trends

India's corrugated bubble wrap market is growing, owing to its rapidly expanding e-commerce, retail, and electronics sectors are driving significant demand for protective packaging solutions like corrugated bubble wrap. A growing middle class, increased smartphone and internet penetration, and a large logistics and delivery network in India support the market growth. Increasing interest in domestic manufacturing and ‘Make in India’ initiatives is also boosting the packaging industry investments.

Japan Market Trends

Japan has a mature packaging industry with a focus on precision, quality, and sustainability. Japan has a high-tech and quality-driven market. Strong demand from electronics, automotive, and healthcare sectors in Japan drives the growth of the corrugated bubble wrap market. Also known for adopting environmentally responsible packaging. Emphasis on recyclable and biodegradable materials in line with national environmental goals drives the growth of the corrugated bubble wrap market.

South Korea Market Trends

The South Korea corrugated bubble wrap market is driven by the presence of the advanced electronics hub in the country. South Korea is a global leader in semiconductors, consumer electronics, and telecom equipment, all of which require safe packaging during shipment. In South Korea, high R&D spending and demand for anti-static and shock-resistant packaging fuel the market growth. Innovations in smart and sustainable packaging are gaining momentum in South Korea, which is a key factor for market growth.

What Promotes the Growth of the North American Corrugated Bubble Wrap Market?

North America is the fastest-growing region in the corrugated bubble wrap market due to several key factors. The rapid expansion of e-commerce has driven demand for protective packaging, especially for electronics and fragile goods. A well-developed logistics infrastructure supports efficient distribution, boosting the need for reliable packaging. Growing environmental awareness has led to increased use of recyclable and biodegradable bubble wrap, aligning with consumer preferences and regulations. Technological advancements, such as automation and customizable solutions, enhance production efficiency and product quality. Additionally, a significant number of consumers are willing to pay more for sustainable packaging, with 82% favouring eco-friendly options, especially among younger buyers.

U.S. Market Trends

The U.S. holds the largest share of the North American corrugated bubble wrap market. A strong online retail sector (Amazon, Walmart, etc.) fuels demand for protective packaging. U.S. companies are rapidly adopting eco-friendly materials in response to consumer and regulatory pressures. Technological advancements in packaging design and materials are frequently developed and adopted here. High demand from electronics, automotive, and medical device sectors.

Canada Market Trends

Canada's market is growing steadily, driven by increased e-commerce and cross-border trade. Provincial regulations are pushing companies toward biodegradable and recyclable packaging. Rising urban populations and improvements in logistics are supporting market expansion. Growth of online and omnichannel retail fuels bubble wrap usage in Canada.

Europe’s Large Consumption of Packed Cosmetics & Luxury Items to Project Steady Growth

The Europe region is expected to grow at a notable rate in the foreseeable future. The surge in online retail across Europe has significantly increased the demand for protective packaging solutions. Bubble wrap, known for its lightweight and cushioning properties, is widely used to safeguard fragile items during transit. Countries like the Netherlands and France are witnessing notable growth in bubble wrap packaging due to the booming e-commerce sector. Additionally, advancements in automated packaging systems are enabling faster and more efficient packaging processes.

Environmental concerns are prompting European manufacturers to develop eco-friendly packaging solutions. The adoption of recyclable and biodegradable bubble wrap is on the rise, aligning with the European Union's stringent regulations on plastic waste reduction. Germany, in particular, is at the forefront of this shift, with increasing importance placed on sustainable materials in the packaging industry. Innovations in packaging materials are enhancing the efficiency and effectiveness of bubble wrap. Manufacturers are developing lighter, stronger, and more puncture-resistant bubble wraps, catering to the growing demand for high-quality protective packaging.

The European Union's regulations on plastic waste and packaging materials are encouraging manufacturers to adopt sustainable alternatives. These regulations are prompting companies to develop biodegradable bubble wrap made from recycled materials, such as kraft paper and agricultural waste. The presence of stringent regulations in countries like Germany, Italy, France, and the United Kingdom is driving the growth of the bubble wrap packaging market in Europe. Furthermore, Europe's strong industrial base, particularly in sectors like electronics, automotive, and pharmaceuticals, is fueling the demand for protective packaging. The need to ensure the safe transportation of goods is driving the adoption of bubble wrap packaging solutions. Countries such as Germany and the United Kingdom, with their well-developed logistics and manufacturing sectors, are key markets within Europe.

Future of Corrugated Packaging Market

The corrugated packaging market is expected to expand from USD 309.86 billion in 2025 to USD 444.85 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

Corrugated packaging refers to a type of lightweight, durable, and eco-friendly packaging manufactured from corrugated fiberboard, which consists of a fluted (wavy) middle layer sandwiched between two flat linerboards. This structure provides strength, impact resistance, and cushioning, making it ideal for shipping, storage, and product protection. Corrugated fiberboard is made up of three main components: liner board, fluting (Medium), and adhesives. The key benefits of corrugated packaging have been mentioned here as follows: strength, durability, cost-effective, lightweight, and versatility.

Future of Corrugated Boxes Market

The global corrugated boxes market is projected to reach USD 283.02 billion by 2034, expanding from USD 180.26 billion in 2025, at an annual growth rate of 5.14% during the forecast period from 2025 to 2034. Increasing trend towards sustainable packaging is significant factor anticipated to drive the growth of the corrugated boxes market over the forecast period.

A corrugated box is a disposable container with three layers of material on its sides an outside layer, an inner layer, and a middle layer. When weighted materials are placed inside a corrugated box, the intermediate layer, which is fluted is designed in stiff, wave-shaped arches that act as supports and cushions. The process of aligning corrugated plastic or fiberboard (also known as corrugated cardboard) design elements with the functional, processing, and end-use requirements is known as corrugated box design. Packaging engineers strive to keep overall system costs under control while satisfying a box's performance criteria.

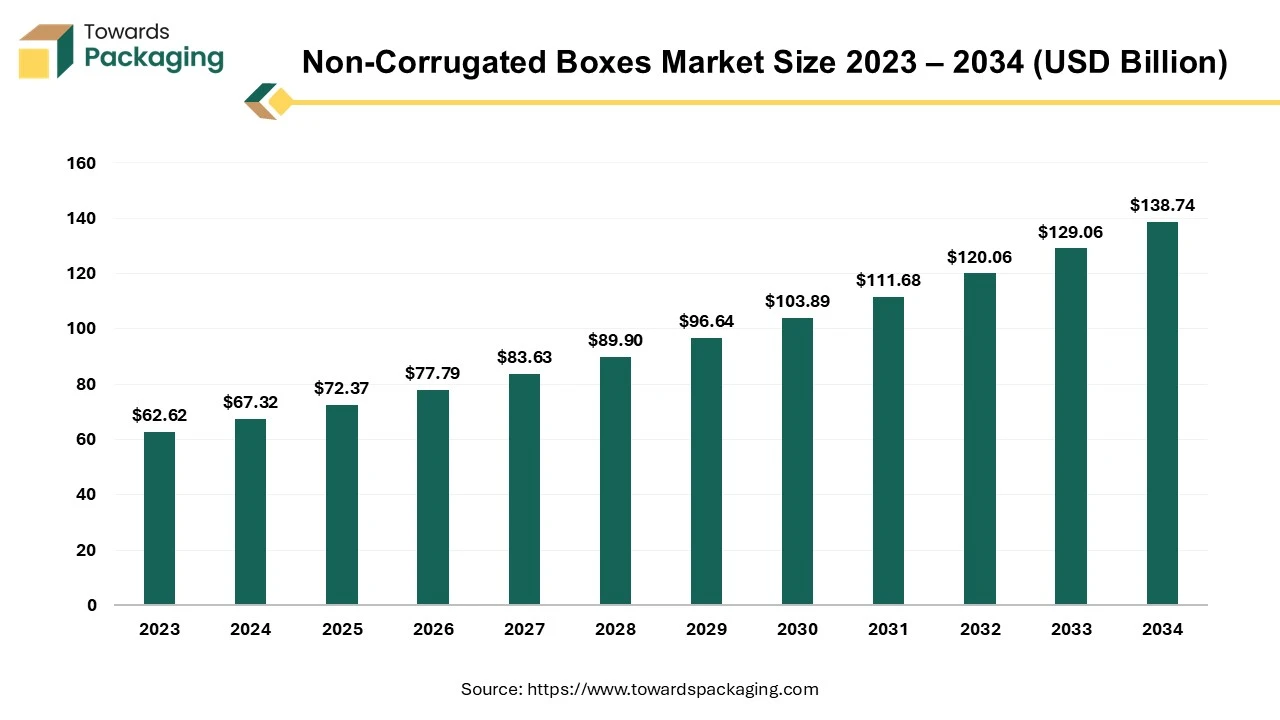

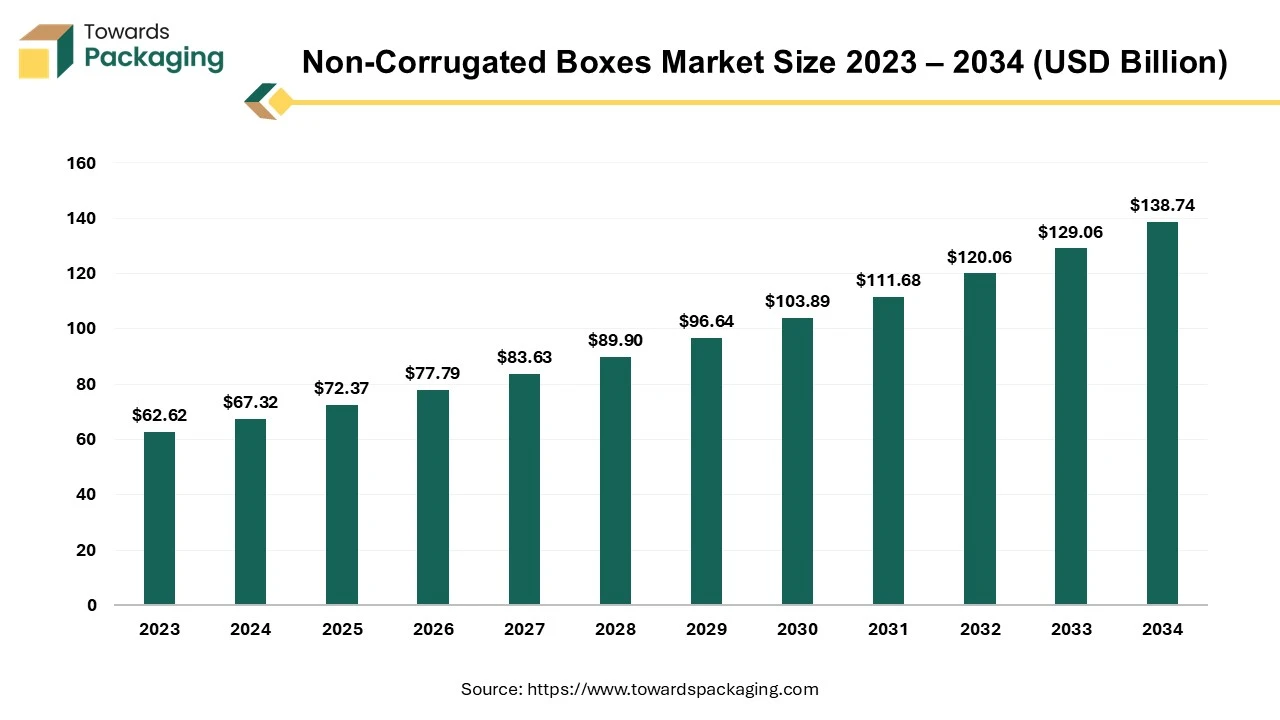

Future of Non-Corrugated Boxes Market

The non-corrugated boxes market is forecast to grow from USD 72.37 billion in 2025 to USD 138.74 billion by 2034, driven by a CAGR of 7.5% from 2025 to 2034. Due to rising trend of the fancy gift boxes the demand for the non-corrugated boxes increased which is estimated to drive the growth of the non-corrugated boxes market over the forecast period.

A non-corrugated box is a type of packaging box that does not have the fluted or ribbed layer found in corrugated boxes. Non-corrugated boxes are typically made from a single layer of material, such as cardboard, paperboard, or plastic. They lack the internal layer of fluted paper that corrugated boxes have. Common materials used for manufacturing non-corrugated boxes is paperboard, plastic, and cardboard among others. Plastic is in non-corrugated boxes manufacturing for meeting more durable and moisture-resistant packaging needs. Non-corrugated boxes are usually less durable than corrugated boxes because they lack the additional layer that provides cushioning and strength. They are often lighter, which can be beneficial for reducing shipping costs.

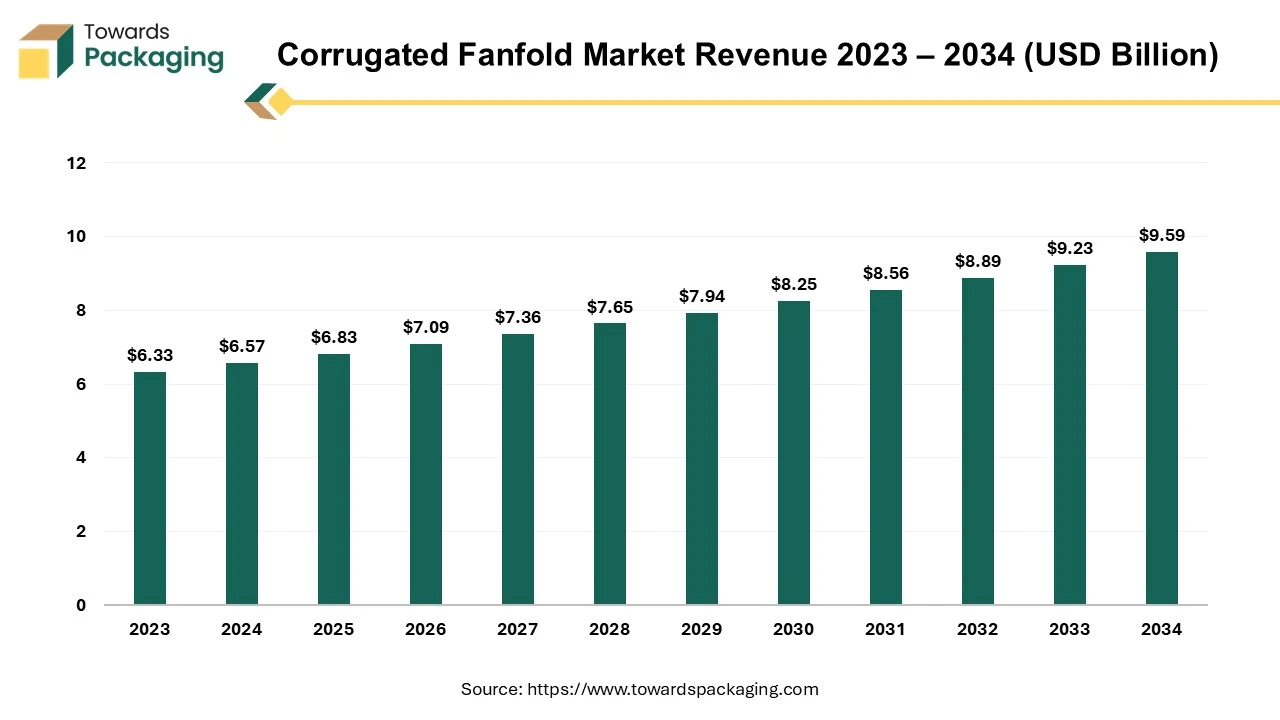

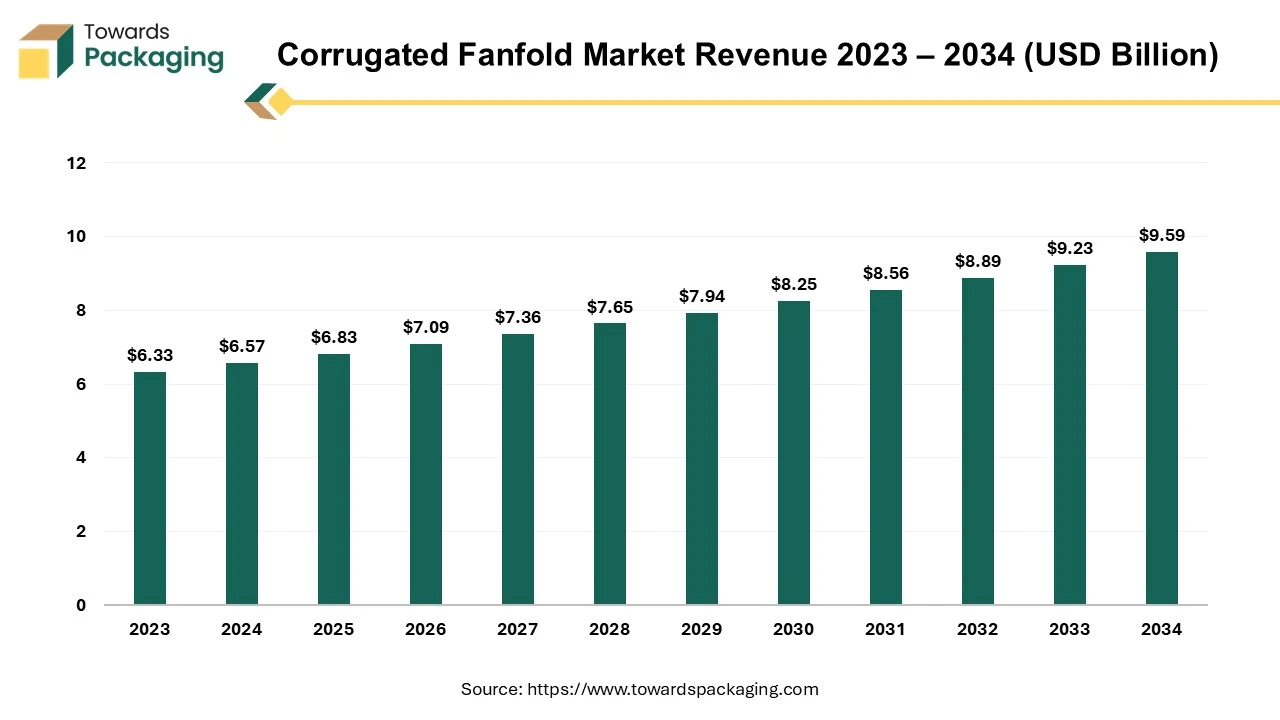

Future of Corrugated Fanfold Market

The global corrugated fanfold market is expected to grow from USD 6.83 billion in 2025 to USD 9.59 billion by 2034, registering a compound annual growth rate (CAGR) of 3.85% during the forecast period. This market expansion is primarily attributed to the rising demand for sustainable, cost-efficient, and customizable packaging particularly across e-commerce, logistics, and retail sectors. According to Smithers, the increasing shift toward on-demand packaging and right-sizing solutions continues to drive the adoption of corrugated fanfold among packaging manufacturers.

The market proliferates due to the rising e-commerce sector and the requirement of shipping & logistics where the safe and durable packaging of products is required. There is an increasing demand for sustainable packaging among consumers and strict government guidelines result in the growth of corrugated fanfold market development.

Global Corrugated Bubble Wrap Market Players

Latest Announcements by Industry Leaders

- In August 2024, according to Paper Product Manager Eric Davis, BUBBLE WRAP brand Ready-To-Roll Embossed Paper is a major development in paper wrapping with a robust innovation pipeline. This introduction is a component of SEE's larger sustainability campaign, which aims to highlight Sealed Air’s extensive selection of paper packaging options. (Source: Sealedair)

New Advancements in the Market

- On 6 September 2024, Power Adhesives revealed the launch of its biodegradable hot melt adhesive, which is the world’s first and crafted for use by carton, corrugated packaging, point of sale (POS), and contract packers too. (Source: Packaging Europe)

- On 3 December 2024, VTT Technical Research Centre of Finland, in partnership with Aalto University and Finnish Industrial partners, has developed a new technology for creating cardboard in a different continuous procedure to make reel-to-reel origami-inspired structures for fibre-based packaging material. (Source: VTT)

- On 22 April 2025, Coastal Source, which is a designer and producer of high-performance outdoor audio and lighting, disclosed that it will serve its new EVO Outdoor lighting solutions in new packaging. (Source: Cepro)

- In December 2024, the VTT Technical Research Centre of Finland created a novel continuous process for bending cardboard to produce reel-to-reel origami-inspired structures for fiber-based packaging materials. This technology was developed in partnership with Aalto University and Finnish industry partners. (Source: Vttresearch)

- In March 2025, according to Savannah River National Laboratory, a research and development laboratory for the U.S. Department of Energy (DOE) Office of Environmental Management, their radially oriented honeycomb structures have been granted a patent. By addressing the deformation of cylindrical honeycomb structures made of flat panels, the technology makes it possible to construct structures with thicker walls than those made using conventional techniques. (Source: Nuclear Newswire)

Global Corrugated Bubble Wrap Market Segments

By Product Type

- Corrugated Bubble Sheets

- Corrugated Bubble Bags/ Mailers

By End-Use Industries

- Electronics and Electrical

- Automotive

- Healthcare

- Food & Beverage

- Cosmetics and Personal Care

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait