Box and Carton Overwrap Films Market Size, Share, Trends and Forecast Analysis

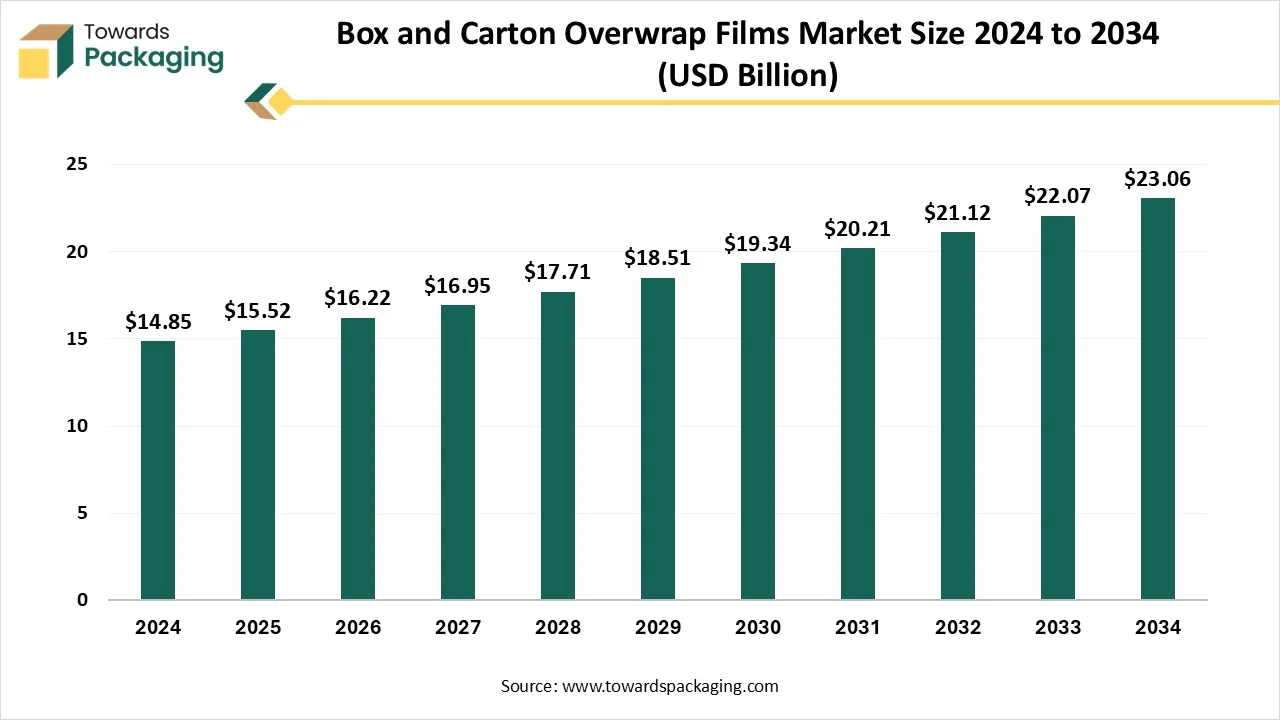

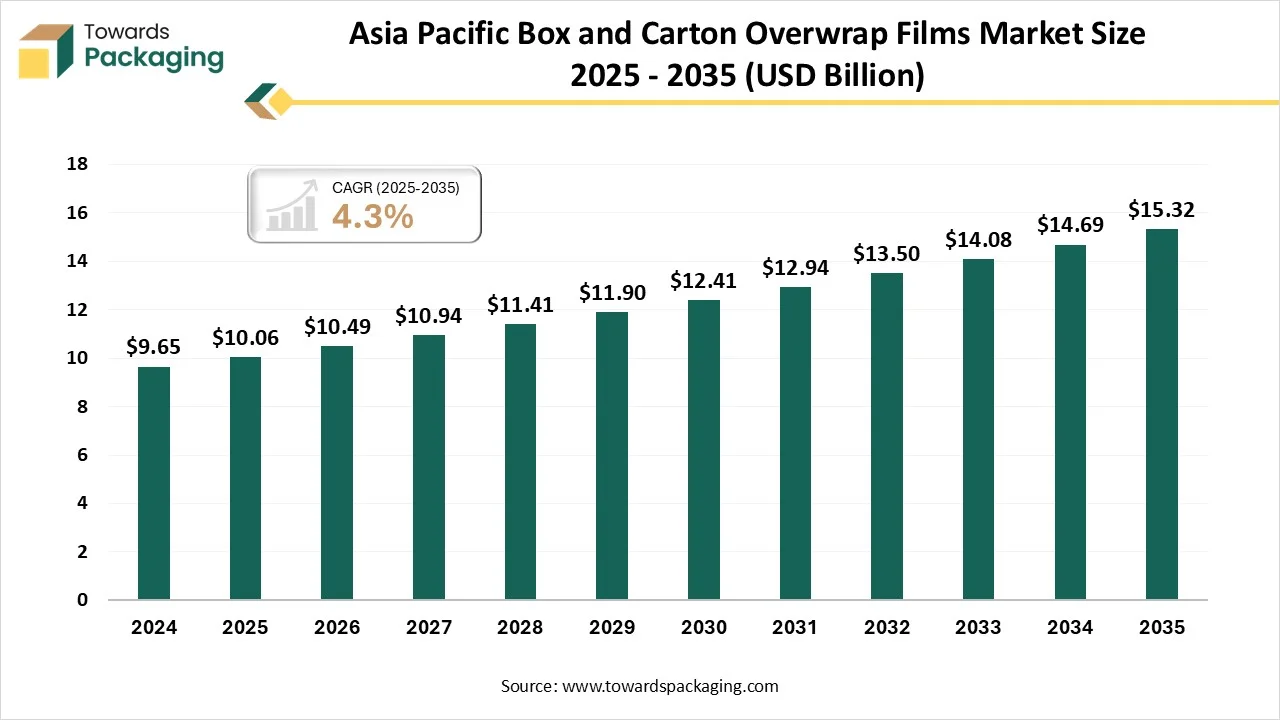

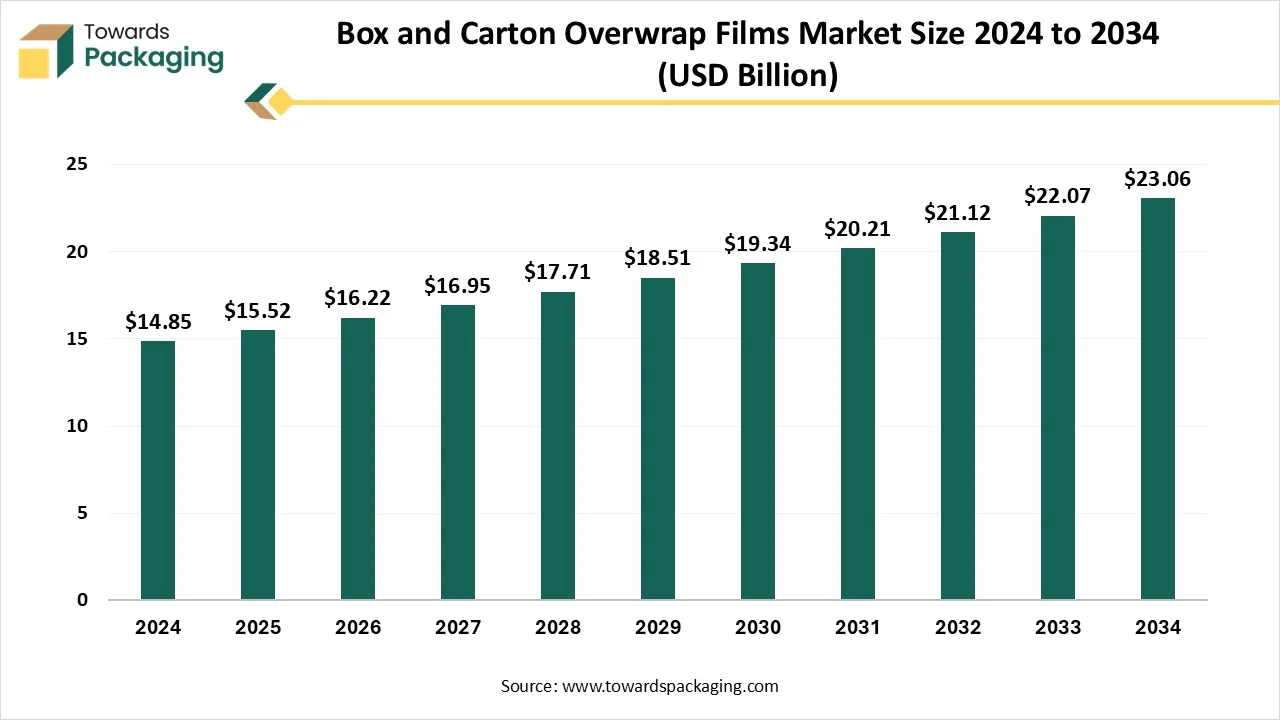

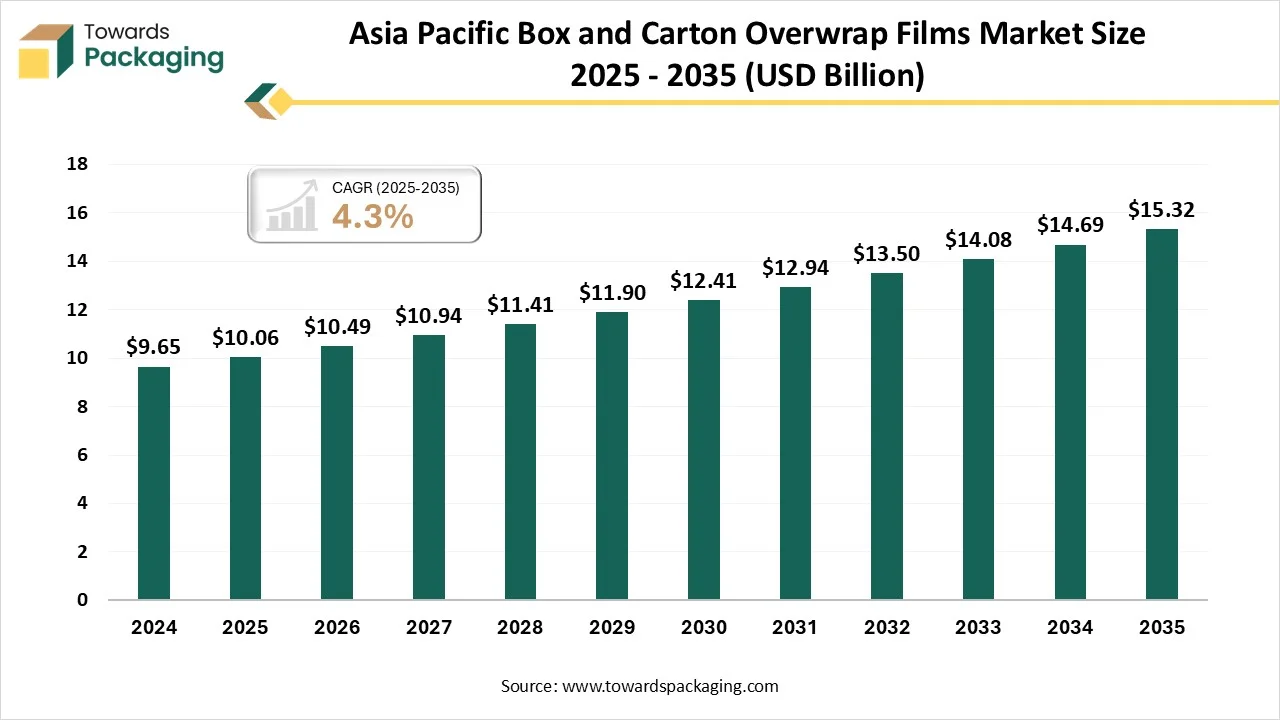

The box and carton overwrap films market is valued at USD 16.22 billion in 2026 and is projected to reach USD 24.1 billion by 2035, growing at a CAGR of 4.5% from 2026 to 2035. The report delivers a complete analysis of material types PP, PE, PVC, PET, bioplastics, film types BOPP, shrink, stretch, barrier, metallized, thickness segments up to 20 microns, 20-40 microns, above 40 microns and end-use industries, with food & beverages accounting for nearly 45% market share in 2024. Regionally, Asia Pacific dominates with 65% share, while North America shows strong CAGR growth driven by e-commerce and pharmaceuticals. The study includes competitive landscape of key companies such as Amcor, Berry Global, Sealed Air, Mondi, and Jindal Poly Films, along with trade data, production volumes, pricing benchmarks, EBITDA margins (14 to 20%), and value chain analysis from raw materials to logistics and distribution.

Major Key Insights of the Box and Carton Overwrap Films Market

- In terms of revenue, the market is valued at USD 16.22 billion in 2026.

- The market is projected to reach USD 24.1 billion by 2035.

- Rapid growth at a CAGR of 4.5% will be observed in the period between 2025 and 2034.

- By region, Asia Pacific dominated the global market by holding highest market share of approximately 65% in 2024.

- By region, North America is expected to grow at a notable CAGR from 2025 to 2034.

- By material type, the polypropylene (PP) segment contributed the biggest market share of approximately 60% in 2024.

- By material type, the bioplastics segment will be expanding at a significant CAGR in between 2025 and 2034.

- By film type, the transparent Films (BOPP) segment contributed the biggest market share of approximately 55% in 2024.

- By film type, the barrier films segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By thickness, the 20–40 microns segment contributed the biggest market share of approximately 50% in 2024.

- By thickness, the Up to 20 microns segment is expanding at a significant CAGR in between 2025 and 2034.

- By end-use industry, the food & beverages segment dominated the market with the share of approximately 45% in 2024.

- By end-use industry, the pharmaceuticals segment will be expanding at a significant CAGR in between 2025 and 2034.

Market Overview

The box and carton overwrap films market refer to the industry for flexible plastic and sustainable films used to wrap boxes and cartons for retail, food, beverage, personal care, pharmaceutical, and industrial applications. These films provide tamper evidence, product protection, moisture resistance, and enhanced shelf appeal. Overwrap films are used in multipack bundling, protective wrapping, and promotional packaging. Market growth is fueled by rising demand for packaged food and beverages, increasing retail-ready packaging adoption, e-commerce expansion, and the shift toward recyclable and biodegradable film solutions.

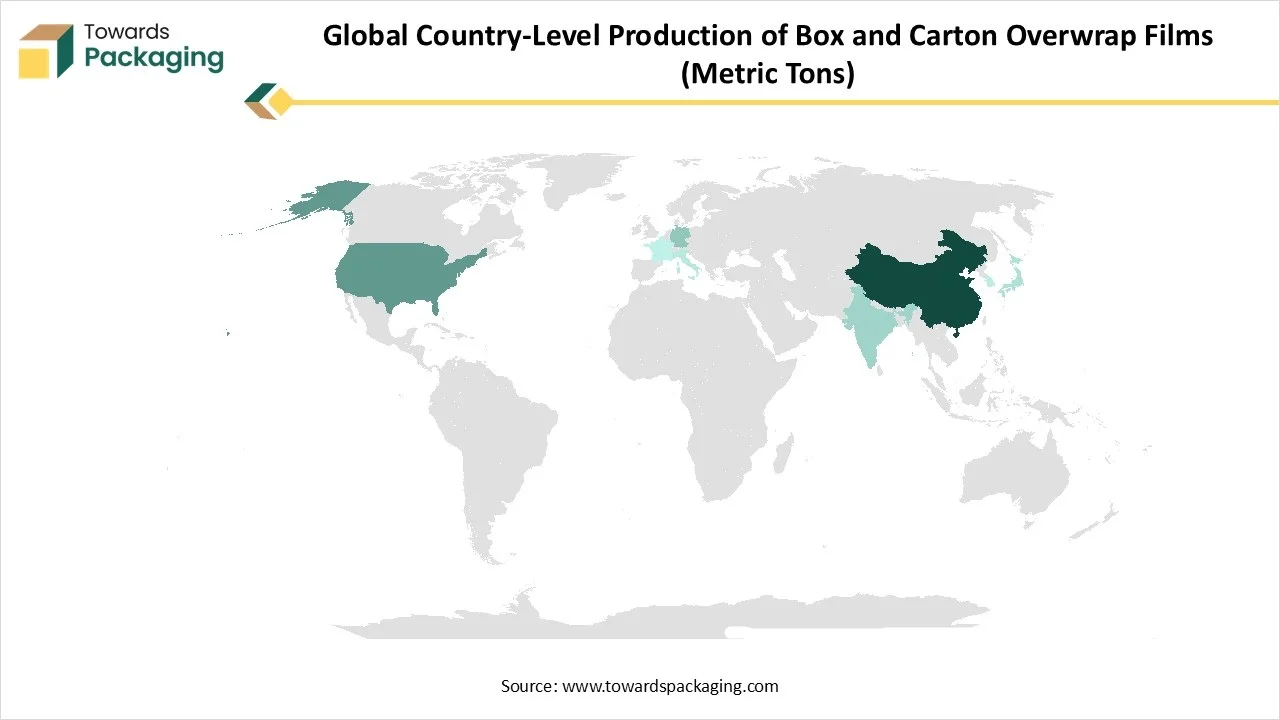

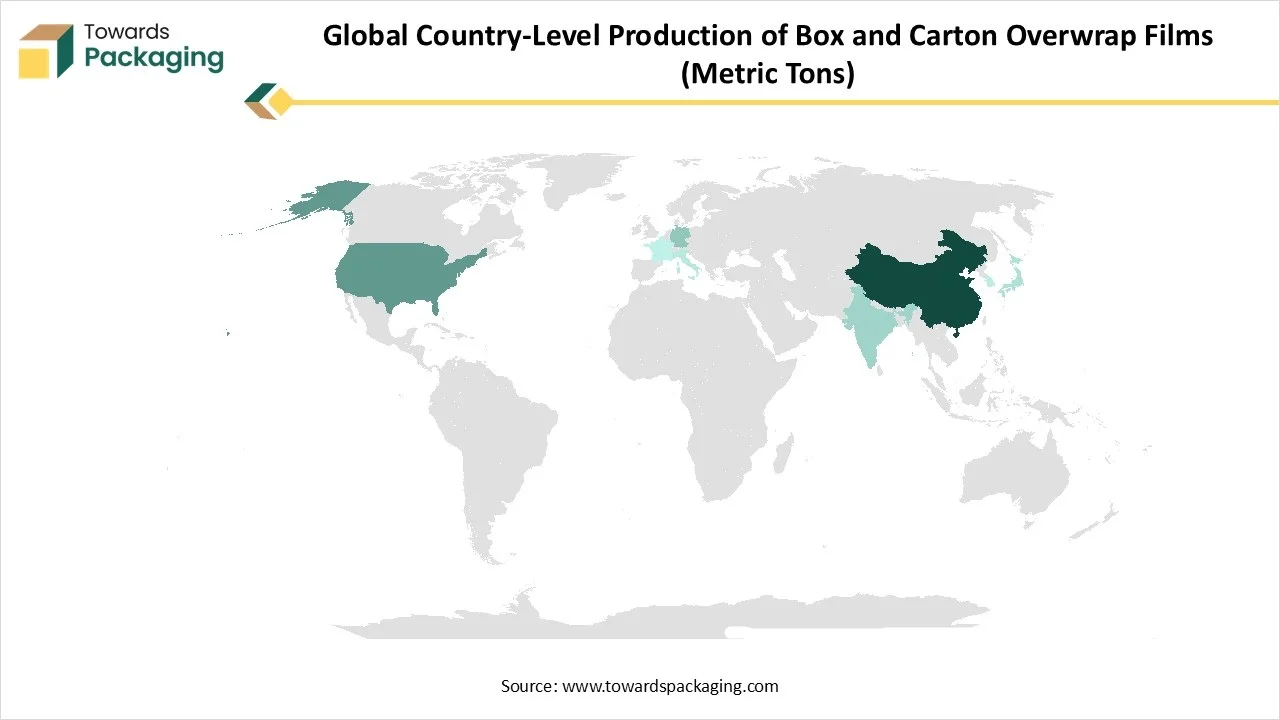

Global Country-Level Production of Box and Carton Overwrap Films (Metric Tons)

Where overwrap film supply is manufactured at scale

| Country |

Production (MT) |

| China |

6,850,000 |

| United States |

4,420,000 |

| Germany |

2,980,000 |

| India |

2,540,000 |

| Japan |

2,120,000 |

| Italy |

1,860,000 |

| South Korea |

1,740,000 |

| France |

1,620,000 |

What are New Trends in the Box and Carton Overwrap Films Market?

Increasing Sustainability Innovations

Rising Smart & Active Packaging Technology

Enhanced E-commerce and Brand Experience

- Enhanced e-commerce sector and brand experience has influenced the demand for this film market.

How Can AI Improve the Box and Carton Overwrap Films Market?

The addition of AI technology in the market plays a crucial role in improving efficient predictive maintenance. It enhances the designing and customization process in this industry. With the incorporation of generative AI tool, it is possible to create various types of films with wide range of shapes and sizes. It helps in selection of high-quality materials which result in production of less defective and highly efficient films.

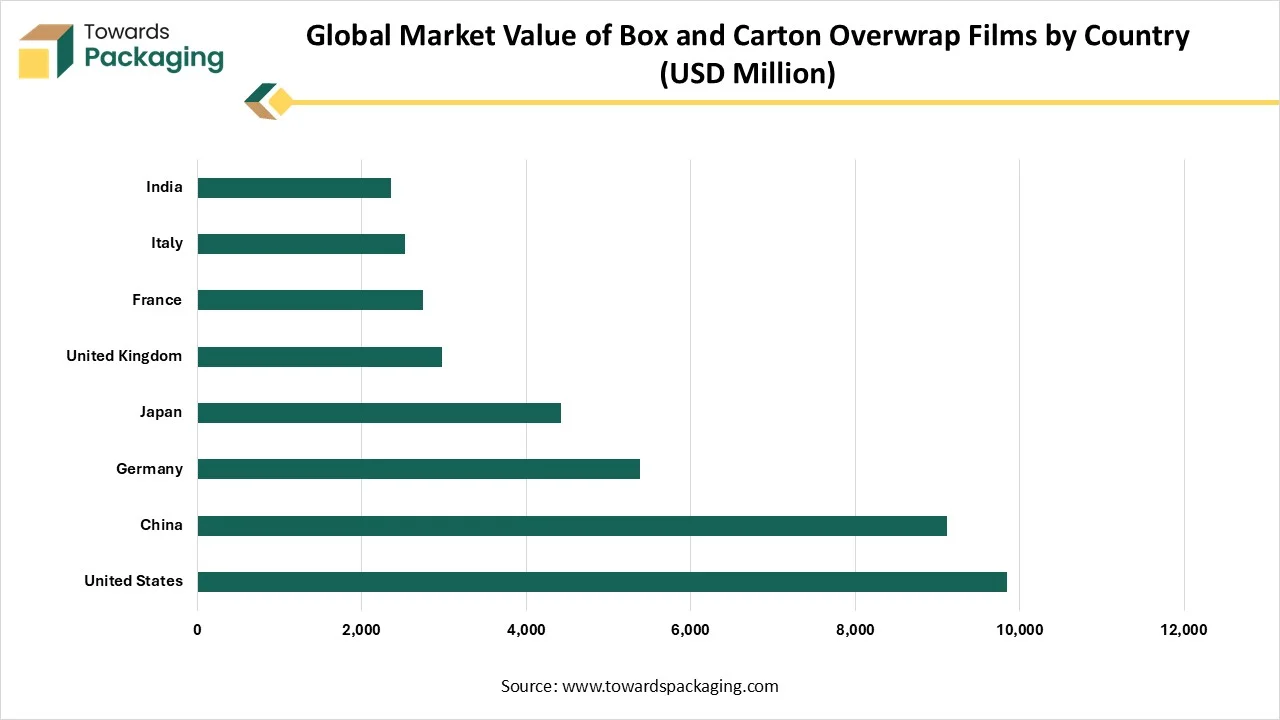

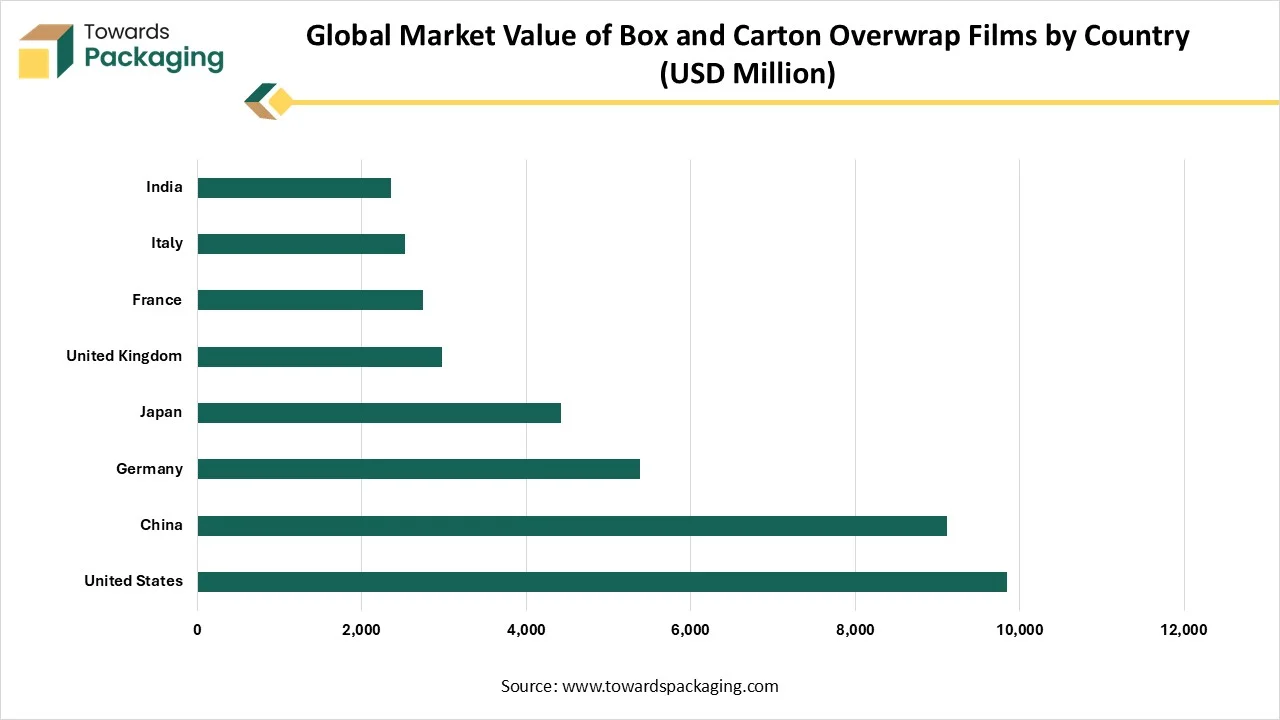

Global Market Value of Box and Carton Overwrap Films by Country (USD Million)

Revenue concentration and pricing strength

| Country |

Market Value |

| United States |

9,850 |

| China |

9,120 |

| Germany |

5,380 |

| Japan |

4,420 |

| United Kingdom |

2,980 |

| France |

2,740 |

| Italy |

2,520 |

| India |

2,360 |

Market Dynamics

Market Driver

Rising Concern for Product Safety

The rising concern for product safety has driven the innovation in the market. As customers becoming more concern about health issues and look for products with extended freshness, producers are progressively accepting cutting-edge overwrap films that provide excellent barrier capacity against contamination, moisture, and oxygen. These films improve the appearance and labelling of packaged products and confirm tamper mark and shield during transport and storing. The propagation of ready-to-eat food products, processed food products, and top confectionery goods has additionally enhanced the acceptance of box and carton overwrap films, particularly in developing markets where development and huge incomes are on the escalation.

Challenges and restraints

Health & Safety Guidelines

The rising health & safety guidelines and concern among consumers has hindered the market. Acquiescence with precise packaging necessities is one of the major challenges for producers to fulfil the varied and developing supervisory setting, given the intricacy of health and safety guidelines, mainly in the pharmacy and food industry.

Market Opportunity

Rising E-commerce Sector

The continuous development in the e-commerce sector has raised the opportunities for development of the market. There is high focus towards safe and attractive packing to confirm product quality and improve consumer involvement. Box and carton overwrap films are progressively being utilized to packet of numerous products, ease bulk management, and decrease pilferage throughout last-mile distribution. The change in the direction of lesser, single-serve packing formats in reply to shifting customer lifestyles is also generating new chances for films producers. As retail hulks and logistics benefactors arrange effectual packaging resolutions to enhance supply chains system and the demand for high-presentation films is anticipated to persist robust through the estimated period.

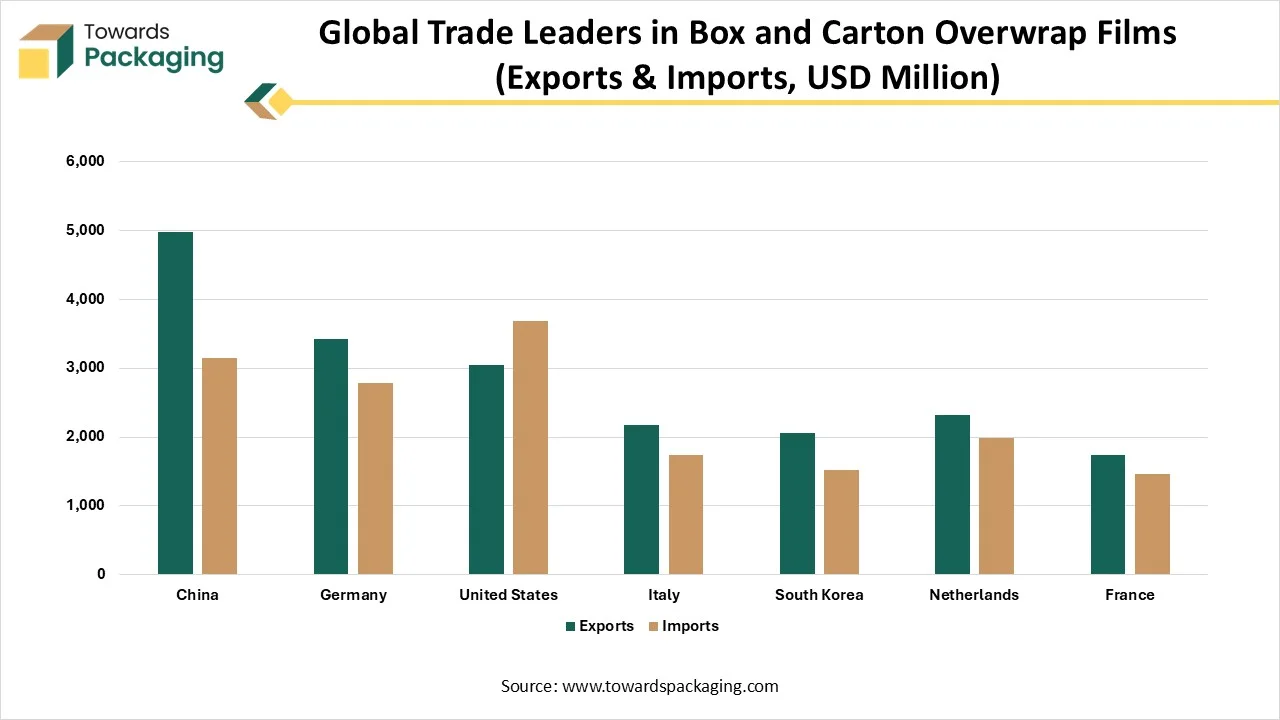

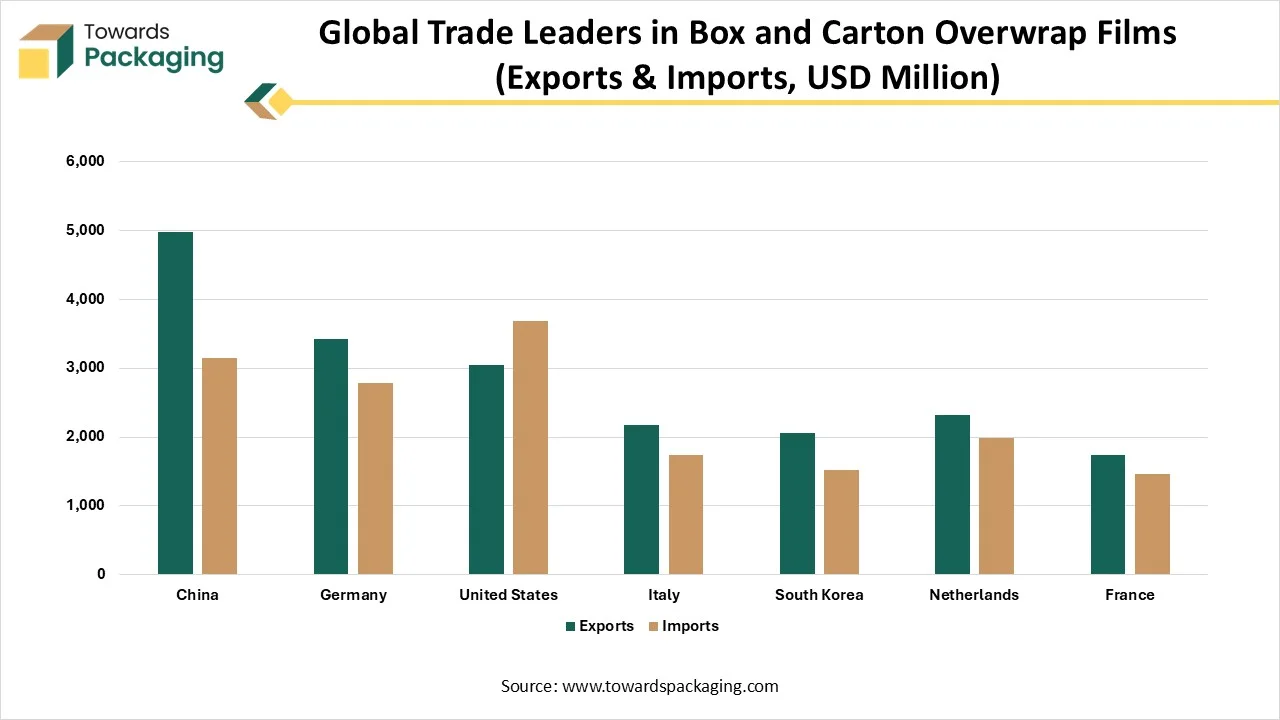

Global Trade Leaders in Box and Carton Overwrap Films (Exports & Imports, USD Million)

Cross-border supply influence and sourcing dependency

| Country |

Exports |

Imports |

| China |

4,980 |

3,150 |

| Germany |

3,420 |

2,780 |

| United States |

3,050 |

3,680 |

| Italy |

2,180 |

1,740 |

| South Korea |

2,060 |

1,520 |

| Netherlands |

2,320 |

1,980 |

| France |

1,740 |

1,460 |

Material Type Insights

Why Polypropylene (PP) Segment Dominated the Box and Carton Overwrap Films Market In 2024?

The polypropylene (PP) segment dominated the market in 2024 due to its cost-efficiency, superior transparency, and huge tensile strength. These films are extensively utilized in food packing, where moisture resistance and transparency are important. The ability of the material to be effortlessly printed or laminated marks it as preferred choice for branding and promotional packaging. It majorly focuses on the low-density polyethylene (LDPE), is getting traction due to its excellent flexibility and puncture resistance that has made up it appropriate for durable packaging usages. As producers struggle for light and durable packing.

The bioplastics segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to increasing demand for sustainable packaging of products. Presence of strict packaging regulation due to ecological impact has raised the consumption of this segment. These bioplastic films are majorly used in the consumer electronics, food & beverages, and cosmetic industries.

Film Type Insights

Why Transparent Films (BOPP) Segment Dominated the Box and Carton Overwrap Films Market In 2024?

The transparent films (BOPP) segment held the largest share of the market in 2024 due to its superior oxygen and moisture barrier properties. It has the capacity to enhance the visual appearance of the products which attract huge consumers towards this market. This segment is widely used for the packaging of bakery products, food items, snacks, cosmetic products, electronic goods, and personal care products. Continuous innovation for the development of ecofriendly films has influenced the demand for this segment in the box and carton overwrap films industry.

The barrier films segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing rapidly due to its clarity and tamper-evident packaging capacity. The rising demand for packaged food products has influenced the demand for this segment. Continuous evolution in the packaging design has boosted the consumption of these films.

Thickness Insights

Why 20 to 40 Microns Segment Dominated the Box and Carton Overwrap Films Market In 2024?

The 20–40 microns segment held the largest share of the market in 2024 due to rising e-commerce sector. The growing trend of online ordering of products has encouraged the usage of films of this thickness. These films are striking a stability between cost-efficacy, strength, and flexibility. These are extensively utilized for the wrapping of consumer goods, food & beverages, where modest shield and visual clearness are essential. The capability to tailor thickness as per specific product requirements has ended this section highly appealing for producers searching flexibility and scalability.

The Up to 20 microns segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to its lightweight nature and affordability. The trend in the direction of source decrease and resource savings has influenced the growth of ultra-thin overwrap films that uphold presentation while lessening ecological influence. Developments in film processing and resin technology have permitted to produce thinner overwrap films with improved mechanical possessions, backing sustainability aim and charge optimization.

End-use Industry Insights

Why Food & Beverages Segment Dominated the Box and Carton Overwrap Films Market In 2024?

The food & beverages segment held the largest share of the box and carton overwrap films market in 2024 due to rising concern for protective packaging of food products. Overwrap films are widely utilized to pack snacks, bakery products, confectionery, ready-to-eat food products, and several beverages, offering shield against pollution, moisture loss, and decomposition. The growing preference for suitable, on-the-go packing arrangements and the propagation of exclusive food items are influencing the acceptance of innovative overwrap films in this segment.

The pharmaceuticals segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is growing due to rising concern toward safe storage and transportation of medicines. The rising demand for excellent barrier films that shield sensitive medications from light, moisture, and oxygen, is on the upsurge, mainly in the packing of medical devices, blister packs, and vials. The constant development of the worldwide healthcare segment, attached with the growing incidence of chronic illnesses which is anticipated to boost sustained development in this section.

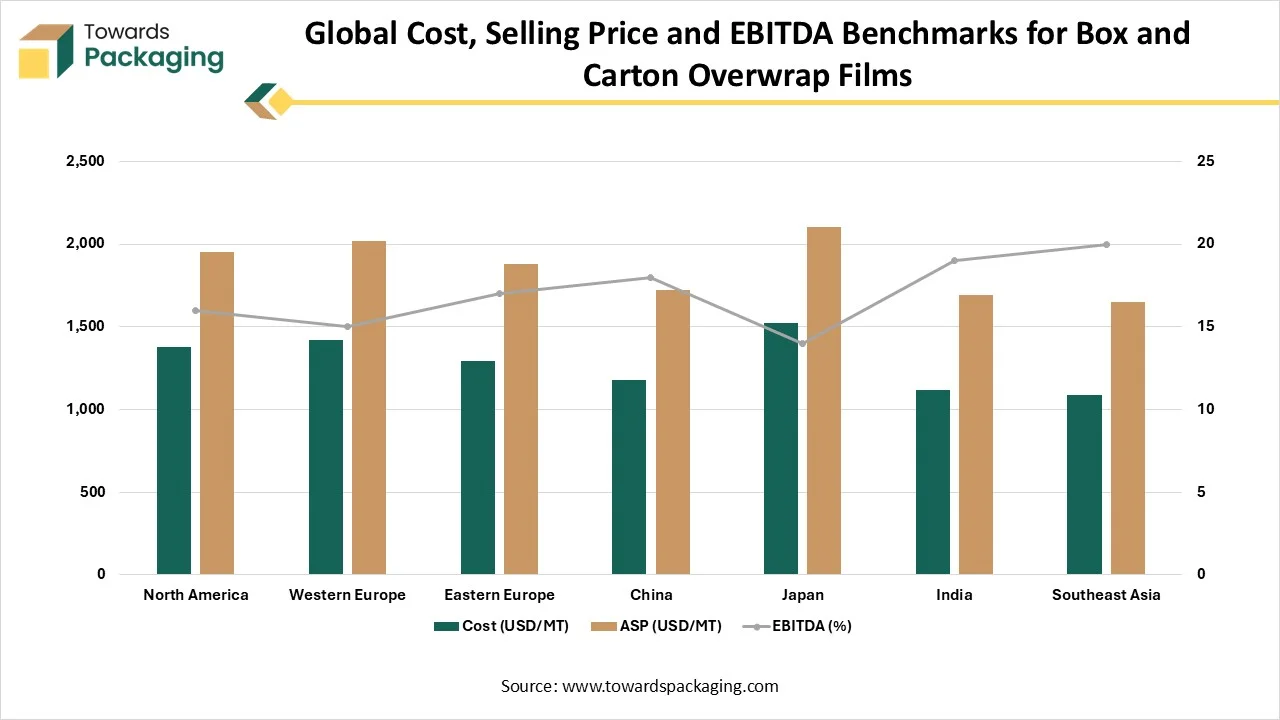

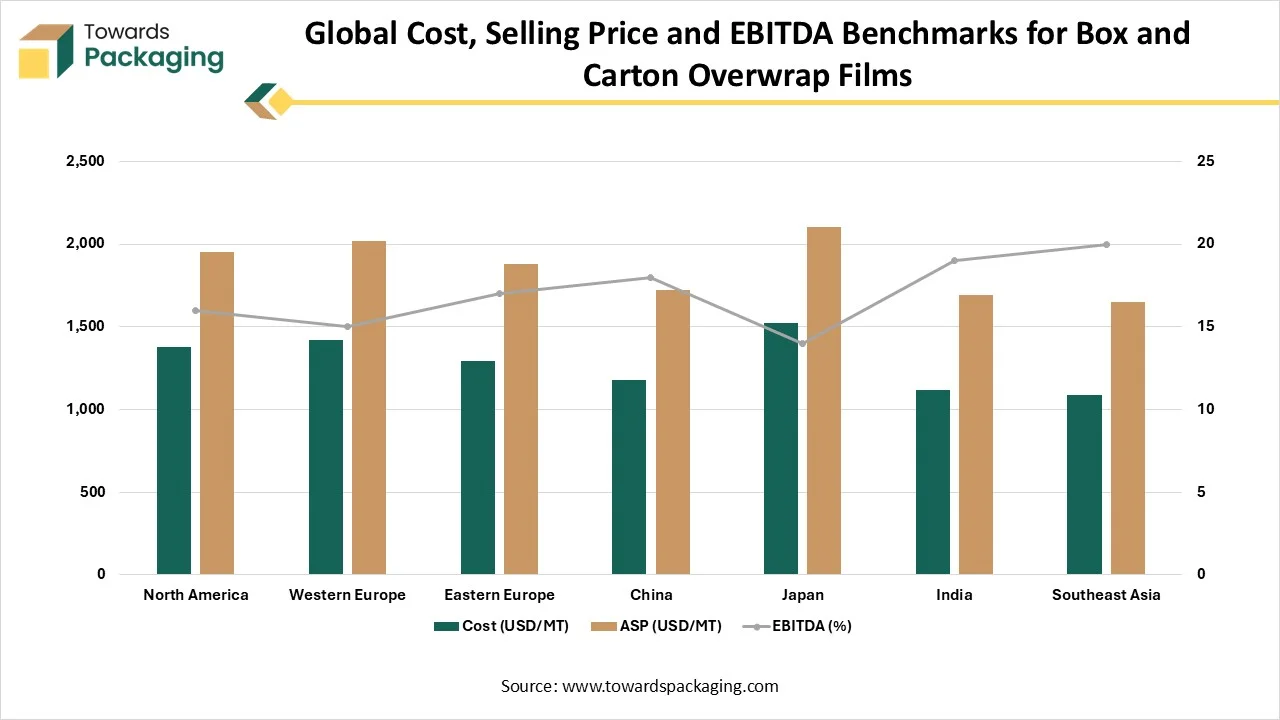

Global Cost, Selling Price and EBITDA Benchmarks for Box and Carton Overwrap Films

Margin performance and investment attractiveness

| Region |

Cost (USD/MT) |

ASP (USD/MT) |

EBITDA (%) |

| North America |

1,380 |

1,950 |

16 |

| Western Europe |

1,420 |

2,020 |

15 |

| Eastern Europe |

1,290 |

1,880 |

17 |

| China |

1,180 |

1,720 |

18 |

| Japan |

1,520 |

2,100 |

14 |

| India |

1,120 |

1,690 |

19 |

| Southeast Asia |

1,090 |

1,650 |

20 |

Regional Insights

Growing Consumer Base in Asia-Pacific Promote Dominance

Asia Pacific held the largest share of the market in 2024, due to growing consumer base, rapid urbanization, and industrialization. Countries such as Japan, China, India, South Korea, and several other are at the front of this development, with growing demand for packed food and consumer products. The rising e-commerce industry in this region has further expands the necessity for operative packaging resolutions, pushing the demand for the box and carton overwrap films.

Presence of Huge Production Industry Promote Box and Carton Overwrap Films Market in China

Presence of huge manufacturing industries has raised the expansion of the market in China. The major market players are continuously introducing innovation in this market which boost the demand for this packaging sector. The rapid shift towards flexible packaging has raised the usage of box and carton overwrap films in industries like food & beverages, cosmetics, and several others.

North America’s Rapid E-commerce Sector Development Enhance Demand

North America expects the significant growth in the market during the forecast period. Rapid growth in the e-commerce sector has influenced the demand for such packaging. Canada and the United States are major suppliers, with high demand from the personal care, food, and pharmaceutical sectors. The acceptance of bio-based and recyclable films is gaining thrust, reinforced by active government guidelines and growing customer preference for environment-friendly packing. The market in this region is anticipated to uphold steady development, determined by continuing funds in research and expansion and the incorporation of smart wrapping technologies.

Box and Carton Overwrap Films Market- Value Chain Analysis

Raw Material Sourcing

The raw materials utilized in this market are majorly polyvinyl chloride, polyethylene, polyethylene terephthalate, and polypropylene.

- Key Players: Dow Chemicals, SABIC

Component Manufacturing

The major components are transforming the market with the presence of nylon and polyethylene.

- Key Players: Berry Global Inc., Terichem AS

Logistics and Distribution

This segment is focusing towards protective films, transportation, and enhancing end-users.

- Key Players: CCL Industries, Smurfit Kappa

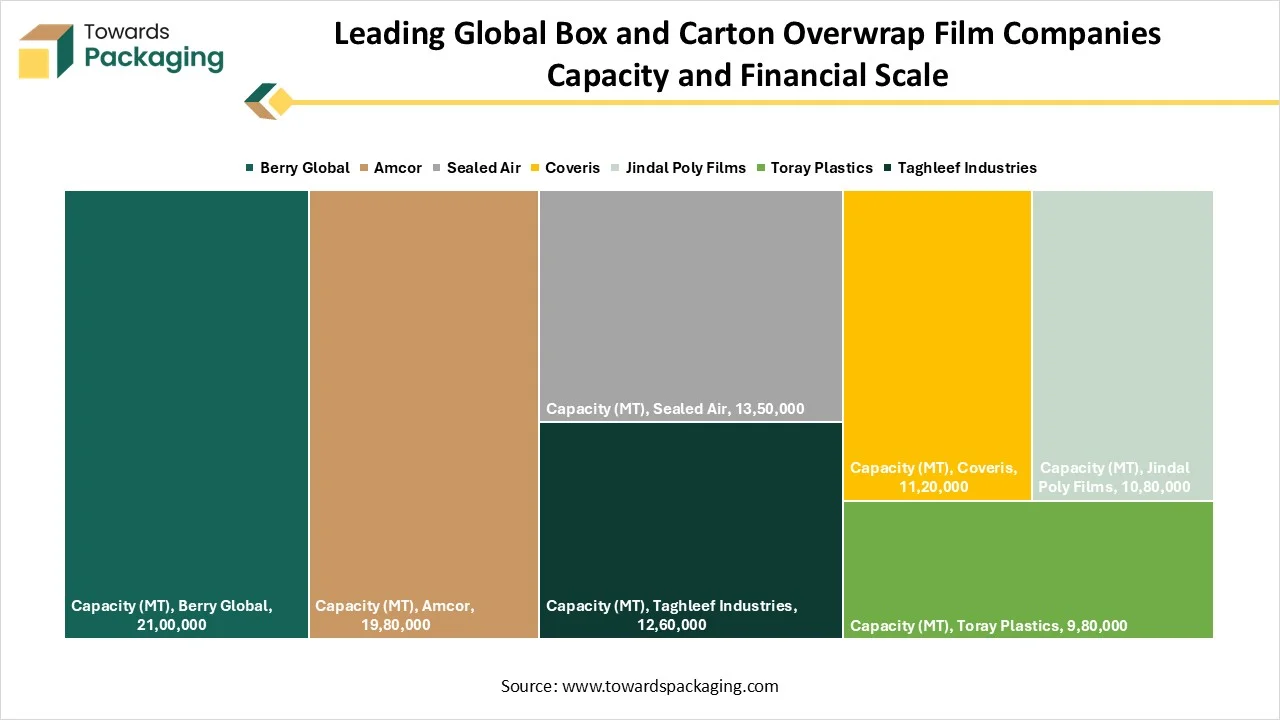

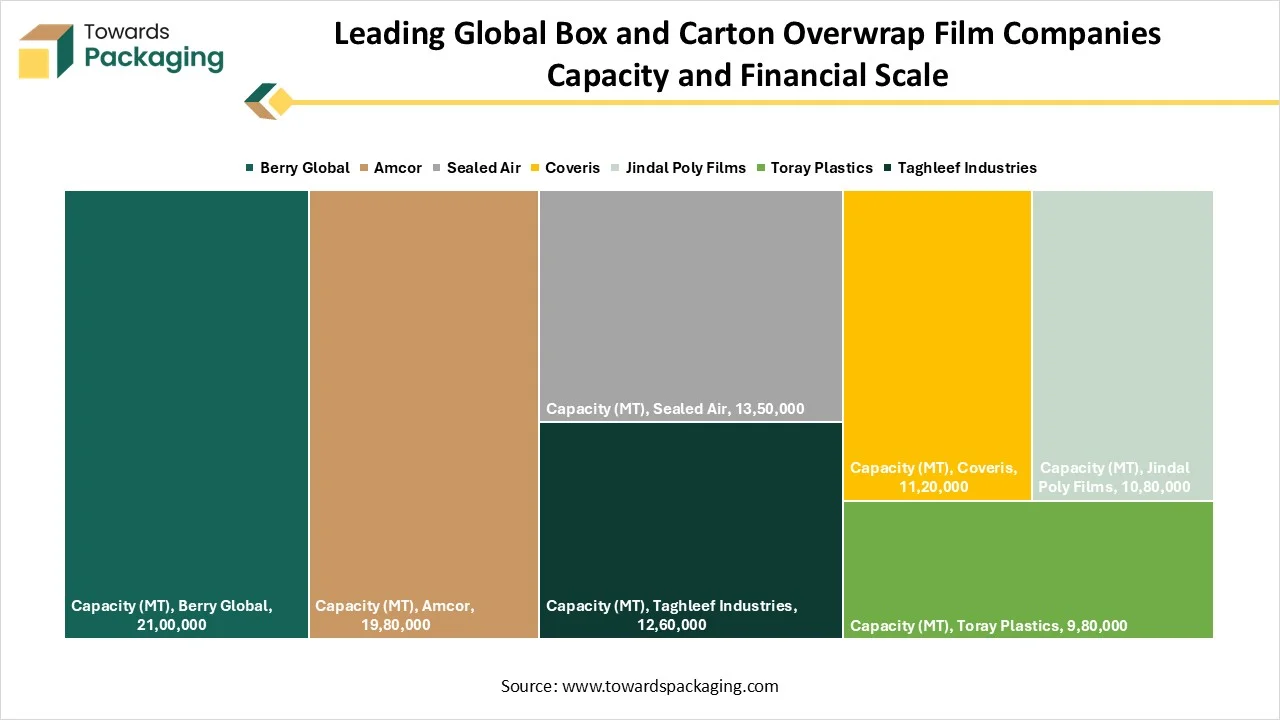

Leading Global Box and Carton Overwrap Film Companies Capacity and Financial Scale

| Company |

Capacity (MT) |

Revenue (USD Million) |

Countries of Operation |

| Berry Global |

2,100,000 |

13,200 |

35 |

| Amcor |

1,980,000 |

14,700 |

40 |

| Sealed Air |

1,350,000 |

5,500 |

30 |

| Coveris |

1,120,000 |

3,200 |

25 |

| Jindal Poly Films |

1,080,000 |

2,400 |

15 |

| Toray Plastics |

980,000 |

2,800 |

18 |

| Taghleef Industries |

1,260,000 |

3,100 |

22 |

Top Companies in the Box and Carton Overwrap Films Market

Recent Developments

- In March 2024, TOPPAN Group declared to introduce GL-SP which is a barrier film that utilize biaxially oriented polypropylene (BOPP) as substratum. This development is majorly contributed by TOPPAN Speciality Films Private Limited (TSF) based on India.

Box and Carton Overwrap Films Market Segment

By Material Type

- Polypropylene (PP)

- Polyethylene (PE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Others (bioplastics, multilayer composites)

By Film Type

- Shrink Films

- Stretch Films

- Transparent/BOPP Films

- Metallized Films

- Barrier Films

- Others

By Thickness

- Up to 20 microns

- 20–40 microns

- Above 40 microns

By End-Use Industry

- Food & Beverages (bakery, confectionery, ready meals, frozen foods)

- Personal Care & Cosmetics

- Pharmaceuticals & Healthcare

- Consumer Goods & Electronics

- Industrial Goods

- Others (stationery, media, etc.)

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait