Electronic Packaging Market Size Intelligence, Benchmarking, Consumer Insights & Growth Strategies

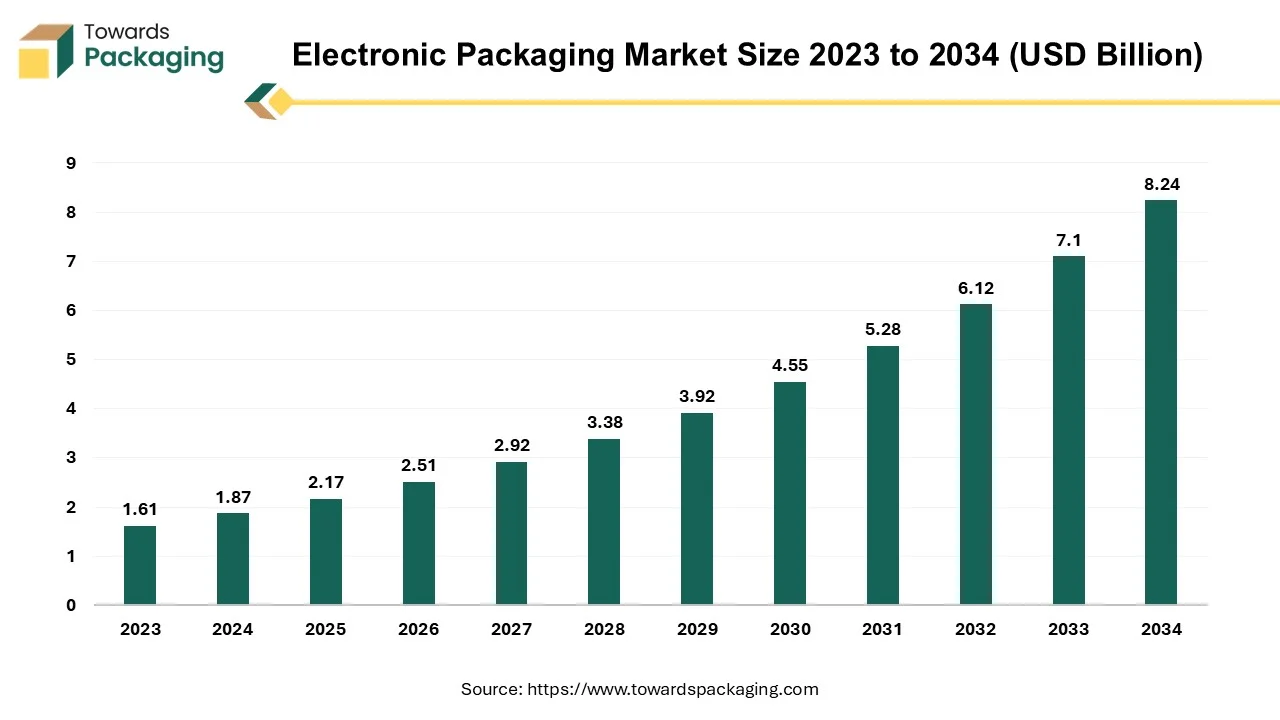

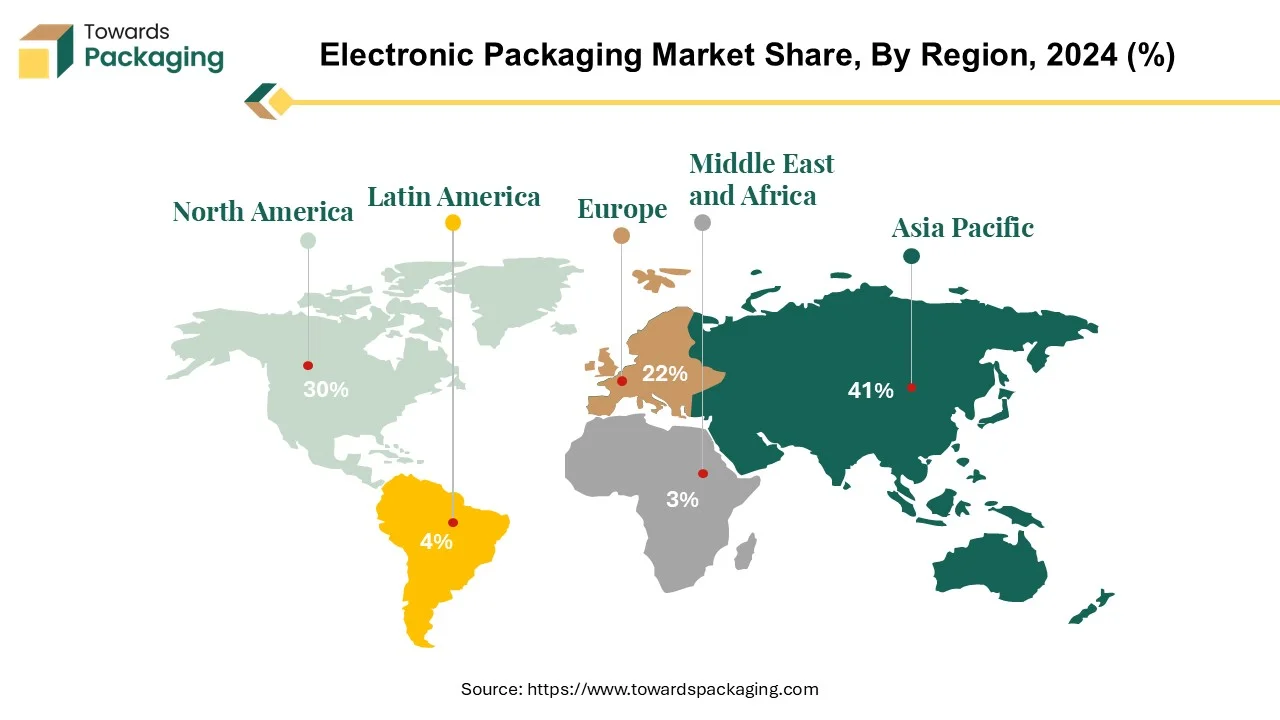

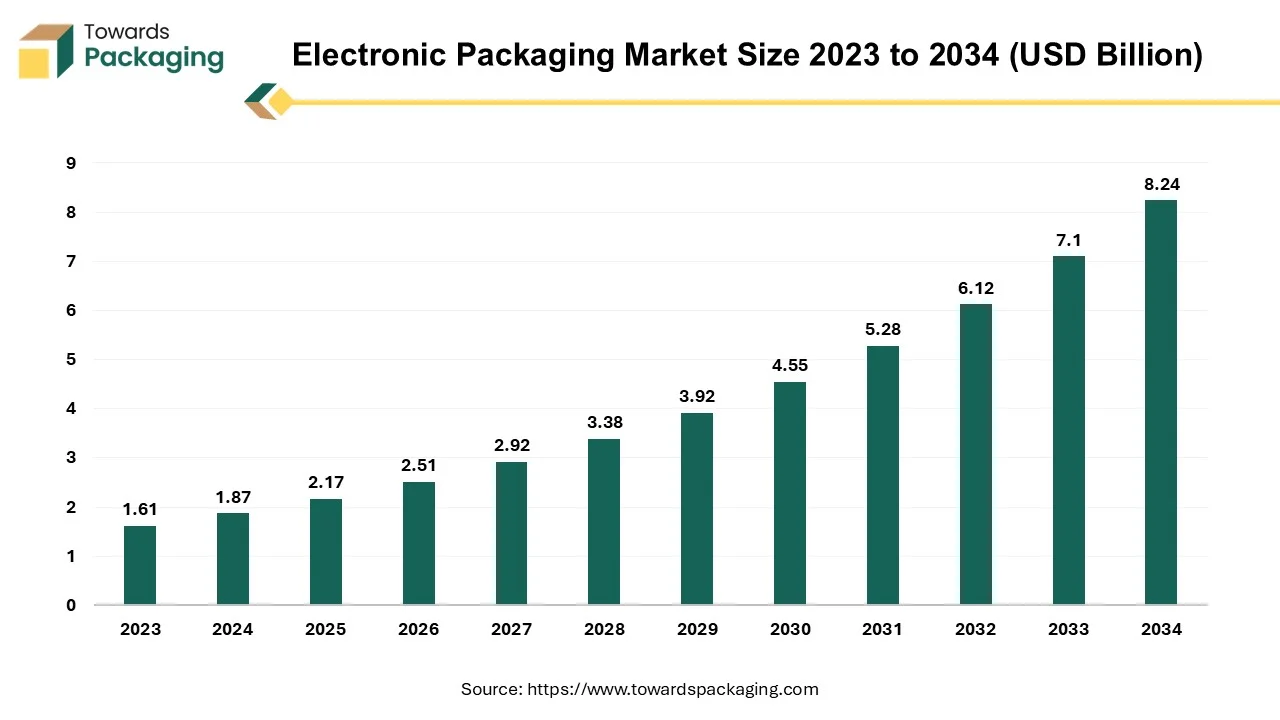

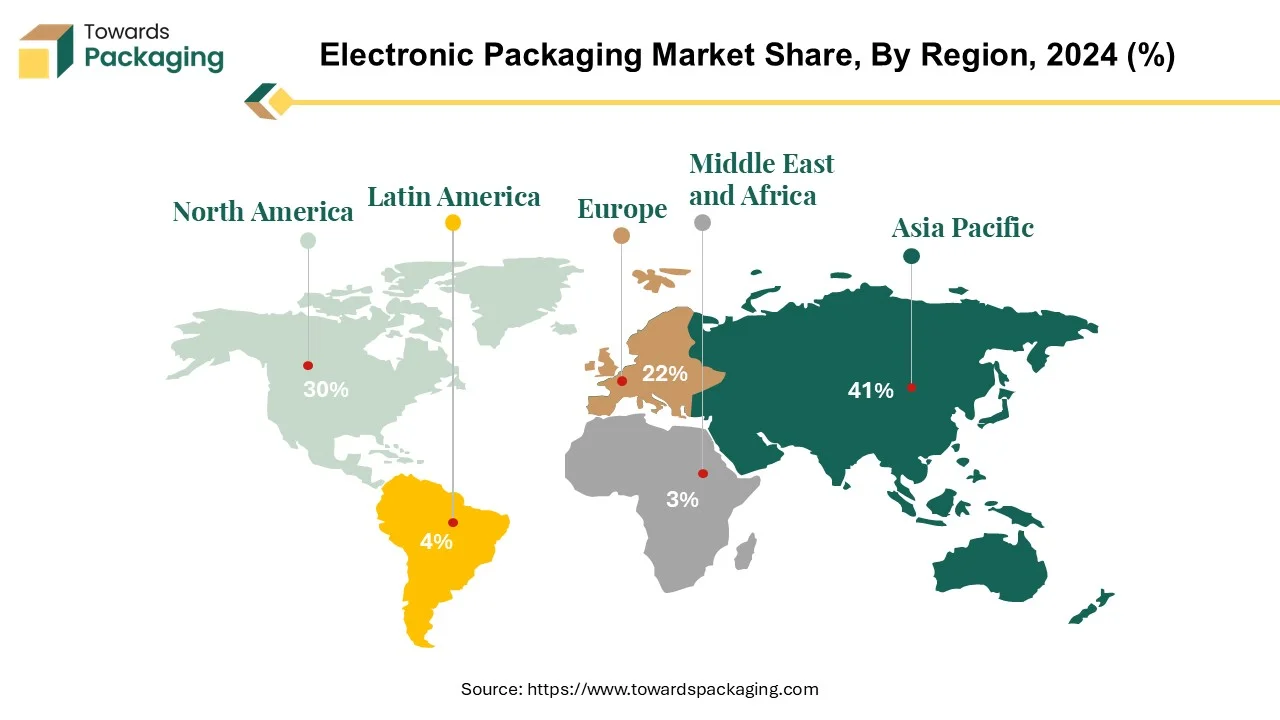

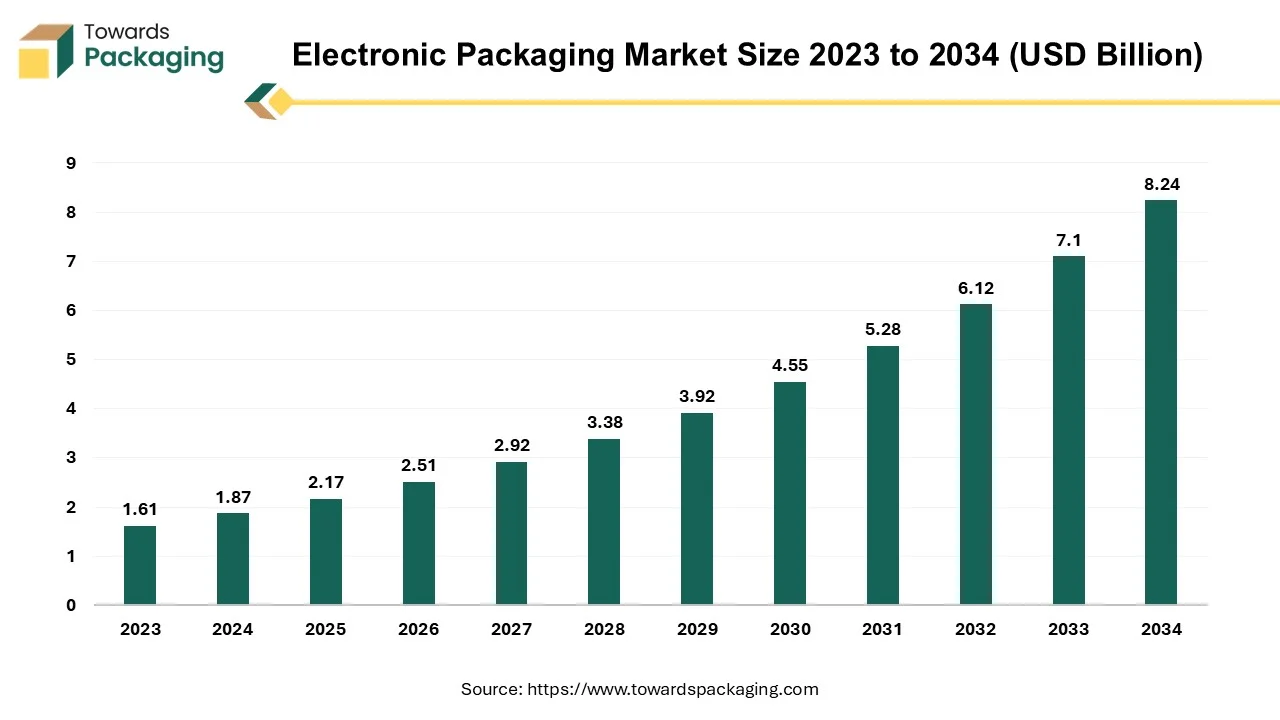

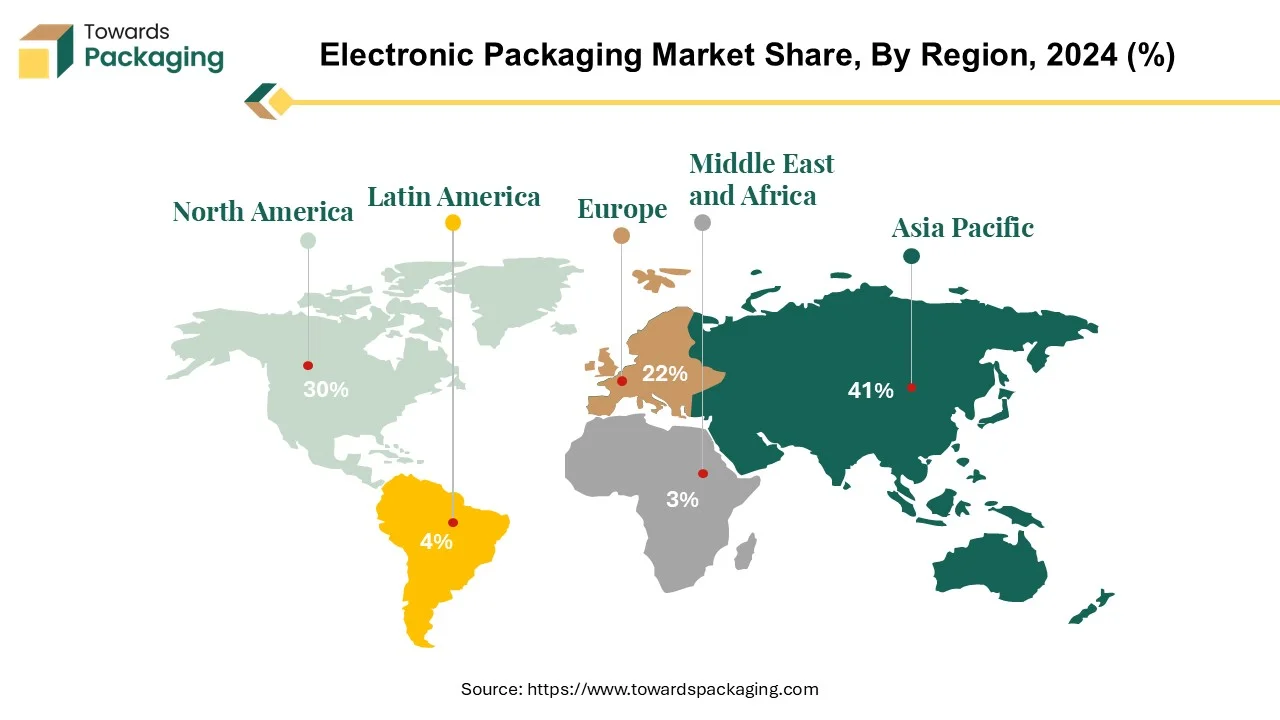

The electronic packaging market is projected to grow from USD 2.17 billion in 2025 to USD 8.24 billion by 2034, at a CAGR of 16.0%. The report examines material segmentation (plastic, paper, metal, and glass), product segmentation (corrugated boxes, thermoformed trays, blister packs), and end-use industries (consumer electronics, automotive, healthcare, aerospace, and defense). It delivers a regional breakdown Asia Pacific leads due to China and India’s expanding manufacturing base, North America follows with rising e-commerce packaging demand, and Europe benefits from sustainability-led innovation. The report also covers Latin America (LA) and Middle East & Africa (MEA) growth trajectories, competitive benchmarking of companies like Amkor, Intel, and ASE Group, detailed value chain mapping, and global trade flow data for corrugated and plastic packaging exports.

Report Highlights: Important Revelations

- Exploring Asia Pacific's leading role in the electronic packaging industry.

- Understanding the growth of consumer electronics in North America.

- Discovering the versatility of plastic solutions for electronic component security.

- Leading the way of corrugated boxes in eco-friendly packaging.

- Enhancing the consumer electronics experience with innovative packaging.

The electronic packaging industry is the foundation of current technological breakthroughs, enabling seamless incorporation and protection of intricate electronic components. Investigate the diverse range of electronic packaging materials and their critical role in guaranteeing the best possible performance and longevity of electronic systems. Electronic packaging materials are a wide range of materials that have been carefully designed to perform a variety of essential tasks. These materials are primarily employed for mechanical support, heat dissipation, electrical connection, moisture-proofing, and stress reduction. They let electronic gadgets to function effectively in a variety of environmental scenarios by protecting integrated circuits (ICs) and other components.

Today's consumers have access to a wide variety of electronic devices for shopping and entertainment, including computers, smartphones, tablets, and even smart speakers. Knowing which modern consumers' most popular devices are driving the packaging demand market is crucial for e-commerce business owners. The electronic packaging industry has experienced significant change in the last few years due to growing customer expectations for improved performance, dependability, functionality, and affordability. The constant advancement of technology is also fueling this shift; new paradigms like 5G, the Internet of Things (IoT), artificial intelligence (AI), and robots are leading to unparalleled expansion and disruption.

The global electronics manufacturing services market stands as a testament to the burgeoning significance of electronic packaging solutions. Projections indicate a meteoric rise, with market revenues expected to soar to $1,145 billion by 2026, reflecting a robust CAGR of 5.4% from 2021 to 2026. This exponential growth trajectory is fueled by the relentless march of technological progress, encompassing domains such as smart manufacturing, autonomous mobility, and industrial automation. Through the adoption of new technologies and the development of cooperative alliances, we are well-positioned to open up previously uncharted territory and drive the electronic packaging sector to previously unheard-of levels of achievement.

For Instance,

- In January 2024, Global styrenics manufacturer INEOS Styrolution has announced the introduction of new methyl methacrylate butadiene styrene materials in the Zylar grade.

Electronic Packaging Market Trends

- The desire for sophisticated packaging solutions that enable the miniaturisation and integration of electronic components is being driven by the trend towards smaller, lighter, and more compact electronic products.

- To manage the rising complexity and density of electronic circuits, high-density interconnect (HDI) technologies are being used increasingly in electronic packaging.

- Maintaining the dependability and functionality of electronic equipment requires effective thermal management, since power densities and operational temperatures grow.

- The demand for flexible packaging designs that can hold bending, elastic, and conformable electronic components is being driven by the increasing acceptance of flexible and wearable electronics.

Asia Pacific's Dominance Exploring the Electronic Packaging Industry's Power

Asia Pacific has the largest share of the market in the electronic packaging industry, mostly due to there is significant expansion being driven by major players like China, India, and Taiwan, which has solidified their position as the global leaders in electronics production. The region is widely recognised as an electronics powerhouse, with China leading the way and producing a significant portion of the world's electrical goods. In despite of current barriers including US-China trade tensions and interruptions due to COVID-19, China continues to play an important part as the premier destination for electronics production.

China's outstanding production capabilities and wide export reach define its supremacy in the electronics manufacturing industry. The country supplies about half of the global market for laptops and telephones, making it a significant exporter of these devices. China produces a vast range of components that are used in manufacturing processes all over the world, making it an essential player in the global electronics supply chain. This strategic edge strengthens China's position as the centre of the world's electronics industry, especially when combined with centralised production centres in the South.

Exports of electronic goods increased 14.41% to USD 2.63 billion in December 2022 from USD 2.30 billion in the same month the previous year. The record for the biggest monthly export of electronics during the current fiscal year is December 2023. India is expected to be the global leader in the production of electronics, with a 15% growth rate expected to reach a market value of USD 115 billion by 2024. In order to spur innovation and increase market competitiveness, major firms in India's electronics sector are placing a growing emphasis on value addition in terms of component and product development. The production of mobile phones, which is anticipated to reach USD 50 billion by March 2024 a considerable rise from prior fiscal years is a prime illustration of India's expanding electronics manufacturing process. In addition to highlighting India's expanding prominence in the electronics industry, this spike in mobile phone manufacture also supports the expansion of the packaging industry.

The Asia Pacific region extends to lead innovation and growth in the electronic packaging business, despite China and India maintaining their dominance in electronics production. The packaging is positioned to achieve extraordinary success in influencing the future of electronics due to the confluence of technical developments, strong manufacturing capabilities, and strategic investments.

For Instance,

- In January 2024, Fedrigoni stated that it had completed the acquisition of HKK3's full share capital on December 2023. HKK3 Limited is the owner of the Arjowiggins China group, which runs the paper mill in Quzhou, China.

Navigating North America's Consumer Electronics Growth

North America's electronic packaging market ranks as one of the largest in the entire globe, driven by a number of reasons like the strong demand for consumer electronics and the expanding e-commerce industry. Leading the pack, the US is set to take the largest proportion of the market due to its consumption of high-end electronics, which means creative and protective packaging solutions are needed to keep these items safe. The increase in online sales acts as a significant stimulant, pushing businesses to customise packaging for online fulfilment and improve shipping damage control. There has been a significant increase in the use of corrugated cardboard and protective plastic packaging designed primarily for electronics.

| Top Ecommerce Stores in Electronics Market U.S. (Million, %) |

| Stores |

Filtered Revenue / Share (Million, %) |

Global Revenue |

| Apple |

US$25,857.2/ 54.9% |

US$47,198.3 |

| BestBuy |

US$5,102.4 / 40% |

US$13,082.9 |

| Dell |

US$1,633.1 / 52.4% |

US$3,125.5 |

The top five e-commerce companies in the US consumer electronics industry in 2023 are dell.com, bestbuy.com, apple.com, and amazon.com. Amazon.com is the industry leader in consumer electronics with significant revenues, closely followed by Apple Inc., a prominent player based on market capitalization. The key businesses dominance highlights the significant impact of e-commerce sales on the need for packaging materials.

Growing environmental awareness has led to a focus on sustainability, which has accelerated the use of eco-friendly packaging materials such recycled or biodegradable alternatives. A highly competitive environment is also fostered by the existence of well-established industry players, as businesses compete to gain market share by combining tactics for product differentiation, competitive price, and higher quality.

The market for electronic packaging in North America is expected to increase steadily due to factors including rising disposable income and the general use of innovative electronics. The market's trajectory will also be significantly shaped by the emphasis on environmentally friendly packaging options and customisation to meet the needs of particular customer groups.

For Instance,

Electronic Packaging Market, DRO

Demand:

- Environmental factors which include heat, vibration, moisture, and dust can affect electronic devices and components, lowering their dependability and performance. For electronics to remain intact, useful, and long-lasting, their packaging has to offer appropriate protection from these pollutants.

Restraint:

- Electronic components produce heat, which can result in issues with heating such thermal runaway, overheating, and premature component failure.

Opportunity:

- Electronic packaging providers can satisfy specific customer demands and market expectations by providing customised packaging services, such as design, prototyping, testing, and assembly.

Unveiling the Power of Plastic Versatile Solutions for Electronic Component Security

Electronic packaging is a lot more than just a container; it includes vital features including corrosion resistance, electrical insulation, and coordination of vital processes. Insulation and protection from corrosion and oxidation are essential, especially for components that are subject to handling or environmental exposure. Plastics are essential in this field because they provide protection while also enabling heat dissipation in a nuanced manner. Two materials that are frequently used in the packaging of electrical products are plastic foam and thermoformed plastic, both of which have different functions. Plastic foam is great at cushioning and absorbing stress, but thermoformed plastic is mostly used to hold electronic contents in place and keep components from colliding.

UFP Technologies is a reliable resource that provides customised advice based on individual requirements and preferences when it comes to choosing the best material for a certain application. To preserve the integrity of electronic contents and guard against internal damage from contact or movement, thermoformed polymers, for example, are frequently utilised. Because it is less expensive and has the benefits of being smaller and lighter than other packaging options, plastic has become a popular choice for commercial electronics. In situations when harsh weather is unimportant and hermetic sealing is not strictly necessary, it is widely used.

Plastic packaging stands out by its non-hermetic nature, which permits regulated gas and moisture permeability. This property also makes plastics spatially variable in reaction to humidity variations, which might have an impact on things like frequency tuning and overall performance. Plastic packaging maintains an appropriate balance between functional performance and cost-effectiveness to provide a flexible alternative for electronic protection. Considering recent advances in packaging technology and materials science, plastics' place in electronic packaging is expected to grow as the industry's demands change over time.

- In May 2023, DuPont declared that it and AEA Investors had reached a final agreement for DuPont to purchase Spectrum Plastics Group (Spectrum).

Corrugated Boxes Leading the Charge in Eco-Friendly Packaging

Corrugated boxes are essential in electronic packaging, providing a versatile and dependable alternative for protecting electronic components as they travel from manufacture to delivery. These corrugated cardboard boxes have a distinctive construction with corrugated layers placed between robust outer liners.

This design provides a strong barrier against the rigours of handling, transit, and distribution, successfully protecting sensitive electronic items like circuit boards, chips, and sensors from impacts, shocks, and vibrations. A major amount of the world's corrugated packaging box exports is sent to crucial destinations such as Vietnam, India, and the United States, importance their global relevance in guaranteeing product safety.

Top 3 exporter of corrugated packaging in the global packaging market is Vietnam, China and India. These leading exporters are essential to satisfying the various packaging requirements of global industry and guaranteeing the effective and safe transnational movement of goods. Corrugated cardboard's eco-friendly composition, made from renewable and recyclable resources, is consistent with the increased emphasis on sustainable packaging techniques. Corrugated boxes are a popular choice for environmentally conscious producers and customers because of its inherent sustainability, providing both solid protection for electronic items and a dedication to preserving the planet's resources.

For Instance,

- In July 2022, Menasha Packaging, a US-based packaging and merchandising firm, has completed its acquisition of Color-Box, a corrugated packaging manufacturer.

Elevating the Consumer Electronics Experience Through Innovative Packaging

End-user consumer electronics constitute a substantial market with specific packaging needs when it comes to electrical packaging. Products that fall under the category of consumer electronics include wearable technology, game consoles, computers, tablets, TVs, and mobile phones, among many more items. Due to their personal and recreational designs, these gadgets are in great demand among customers all over the world. Consumer electronics packaging solutions in the electronic packaging industry provide top priority to aspects including product protection, visual attractiveness, and user experience.

Packing needs to raise the product's perceived worth while protecting the fragile electrical components from handling and transit harm. The packing of consumer electronics must also be optimised for efficient shipment and protection against possible risks during transit, especially with the growth of e-commerce and online shopping.

In the consumer electronics industry, there is a growing need for sustainable packaging materials and designs as customers prioritise sustainability more and more. In order to fulfil the changing needs of tech-savvy customers, improve brand reputation, and ensure product safety, packaging for end-user consumer electronics is essential.

For Instance,

- In December 2023, PwC US and Surfaceink, a well-known company that specialises in consumer electronics and Internet of Things (IoT) projects, have reached a formal agreement for PwC US to buy nearly all of Surfaceink's assets.

Role of Electronic Packaging Includes

Mechanical Protection:

- Provides reliable mechanical protection for chips and components.

- Ensures devices can withstand environmental challenges and conditions.

- Maintains proper functioning of the devices.

Signal Distribution:

- Minimizes signal delay by reducing the interconnect distance between the chip and I/O pins.

- Proper routing mitigates issues like signal crosstalk, especially for high-frequency signals.

Thermal Dissipation:

- Addresses heat dissipation concerns during prolonged operation.

- Different packaging types and materials have varying thermal dissipation effects.

- High-power devices may require additional measures like heatsinks or cooling methods (air or liquid) to operate within the required temperature range.

Giants to Innovators Navigating the Competitive Landscape of Electronic Packaging

The competitive landscape of the electronic packaging market is dominated by established industry giants such as Amkor Technology, ASE Group, FUJITSU LIMITED, Intel Corporation, Texas Instruments, Apple, Sealed Air Corporation, Nantong Fujitsu Microele, KYOCERA CORPORATION, Powertech Technology Inc and Advanced Semiconductor Engineering Inc. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

A variety of packages are available from Fujitsu Semiconductor to optimise applications in the way that best meets the needs of clients. need for electronic devices, including PDAs, cell phones, and PCs, has been rising, and technological advancements have kept pace with this need. Customers can now and in the future satisfy market expectations with the help of IC technology.

For Instance,

- In Decmber 2023, Japan Investment Corp. headed a syndicate that purchased Shinko Electric Industries, a semiconductor packaging company listed in Tokyo, from Fujitsu.

Intel is driving the data-centric age with coordinated and co-architected advancements in chip design, packaging, and transistor technology. No other business can match our fab foundation, internal R&D capabilities, innovation pipeline, and integrated device manufacturing advantage—a special combination of complementary skills that will completely reshape the computer industry.

For Instance,

- In February 2024, ASAT features, such as enhanced packaging, are among the major customer volume of Intel Foundry's offerings. The company has won design victories across many generations of foundry processes, including Intel 18A, Intel 16, and Intel 3. All all, Intel Foundry expects its lifetime contract value to exceed $15 billion, encompassing both wafer and advanced packaging.

Electronic Packaging Market Player

Electronic Packaging Market Segments

By Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Others

By Product

- Corrugated Box

- Thermoformed Trays

- Paper Box

- Blister Packs

- Clamshells

By End Use

- Consumer Electronics

- Automotive

- Aerospace and Defence

- Healthcare

- Others

By Region

- Asia Pacific

- North America

- Europe

- LA

- MEA