Pre-Conditioned Packaging Market Trends, Forecasts, Regional & Company Analysis

The pre-conditioned packaging market is projected to grow from USD 1.2 billion in 2025 to over USD 1.8 billion by 2034, at a CAGR of 4.7%. The report covers market trends, key segments including material type (plastic, paper & paperboard, aluminum laminates, and biodegradable materials), closure type (zipper, spout, flip lid, tear notch), and end-use industries such as food and beverage, pharmaceuticals, cosmetics, and agriculture.

Regional insights include North America, Europe, Asia Pacific, Latin America, and MEA, highlighting market dominance in North America in 2024 and fastest growth in APAC. The report analyzes major players such as International Paper, Berry Global, DS Smith, Amcor, and Cold Chain Technologies, providing a comprehensive competitive analysis, trade statistics, value chain overview, and insights on manufacturers and suppliers.

Key Insights

- North America dominated the pre-conditioned packaging market in 2024.

- Asia Pacific is expected to grow significantly during the forecast period.

- The European market is expected to grow at a notable rate in the foreseeable future.

- By material type, the plastic segment dominated the market in 2024.

- By material type, the paper and paperboard segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034.

- By closure type, the zipper segment dominated the market with the largest revenue share.

- By end-use, the food and beverage segment registered its dominance over the market in 2024.

Pre-Conditioned Packaging Market Overview

Pre-conditioned packaging refers to packaging materials or containers that have been treated or prepared under specific environmental conditions before they are used for storing, shipping, or displaying products. The purpose is to ensure the packaging performs as expected when exposed to temperature, humidity, or pressure. Packaging is pre-conditioned to simulate real-world storage or transit environments, such as high humidity or cold chain logistics. It ensures the packaging maintains barrier properties, sterility, and label adhesion. Before conducting mechanical or environmental tests, packages may be pre-conditioned in a climate chamber for a set period. This ensures consistency and accuracy in test results, especially for materials sensitive to moisture or temperature. Some food or pharmaceutical packages are pre-conditioned by flushing out air and replacing it with a gas mixture to extend shelf life. The package is sealed in this altered state—technically a form of pre-conditioning. The pre-conditioned packaging ensures product safety and quality.

What are the New Trends in the Pre-Conditioned Packaging Market?

Integration of Smart and IoT-Enabled Packaging

Modern pre-conditioned packaging increasingly incorporates smart technologies to enhance monitoring and ensure product integrity:

- Batter-Free Smart Packaging:

Innovations include autonomous systems that monitor product freshness and release active compounds to extend shelf life, all without the need for batteries.

- IOT Sensors and Data Loggers:

Real-time tracking of temperature, humidity, and location helps maintain optimal conditions during transit, reducing spoilage and ensuring compliance with regulatory standards.

Emphasis on Eco-Friendly and Sustainability Materials

Environmental concerns are prompting a shift towards more sustainable packaging solutions:

- Recyclable and Biodegradable Materials:

The use of materials like mycelium, algae-based polymers, and recycled plastics is increasing, aiming to reduce environmental impact.

- Recyclable and Biodegradable Materials:

There’s a growing trend towards packaging that can be reused, aligning with circular economy principles and reducing waste.

Advancements in Passive Thermal Control

To maintain temperature without external power sources, passive thermal control technologies are being enhanced:

- Phase Change materials (PCMs):

PCMs are increasingly used for their ability to maintain specific temperature ranges, offering superior thermal stability and reusability compared to traditional methods like dry ice.

- Vacuum-Insulated Panels (VIPs):

VIPs provide exceptional insulation in a thin profile, making them ideal for space-constrained applications requiring strict temperature control.

Customized for Specific Industry Needs

Pre-conditioned packaging is being tailored to meet the unique requirements of various industries:

- Pharmaceutical and Biologics:

Customized solutions are developed to maintain the efficacy of temperature-sensitive products like vaccines and cell therapies during transit.

- E-commerce and Direct-to-Consumer:

Packaging is designed to accommodate various product sizes and delivery conditions, ensuring product integrity upon arrival.

How Can AI Improve the Pre-Conditioned Packaging Industry?

Integrating artificial intelligence (AI) into the pre-conditioned packaging industry offers transformative benefits across design, production, logistics, and compliance. One of the most impactful applications is smart monitoring and real-time tracking. By leveraging AI-powered sensors and IoT devices, companies can continuously monitor critical environmental parameters such as temperature, humidity, and shock during transit. These systems provide real-time alerts for temperature excursions, helping preserve product integrity, particularly crucial for temperature-sensitive goods like vaccines, biologics, and fresh foods, and generate automated compliance reports required by regulatory bodies such as the FDA or EMA.

AI also plays a key role in predictive analytics for cold chain management. By analyzing historical and real-time data, AI can predict potential risks such as temperature breaches or packaging failures before they occur. It can also optimize shipping routes and carriers to improve thermal performance and forecast demand fluctuations, enabling proactive planning and reducing spoilage or waste. AI helps optimize materials and structures by simulating insulation performance under various climate conditions. It can also identify the best combinations of materials for strength, flexibility, and barrier properties while supporting sustainable design initiatives. This reduces both development time and material costs while enabling eco-friendlier packaging solutions.

AI-driven quality control is another major advancement. Machine vision systems can detect production defects, verify labeling accuracy, and monitor packaging lines for inconsistencies or anomalies. This ensures higher production precision, minimizes human error, and supports continuous improvement. From a regulatory perspective, AI simplifies compliance by automating documentation for Good Distribution Practice (GDP) standards and tracking temperature excursions during logistics, which is especially valuable for pharmaceutical products. Additionally, AI can analyze customer feedback and product data to identify packaging issues, predict complaints or returns, and recommend design improvements, thereby closing the feedback loop efficiently.

Market Dynamics

Drivers

Increasing Demand for Temperature-Sensitive Products

Vaccines, insulin, and biologics require strict temperature control during storage and transportation. Frozen, perishable, and ready-to-eat food products require controlled environments to maintain freshness and safety. Certain high-end and natural cosmetics are sensitive to heat and need protective packaging. The increasing demand for temperature-sensitive products is a major driver of growth in the pre-conditioned packaging market, as it creates a critical need for packaging solutions that ensure product integrity during storage and transportation. These products—ranging from pharmaceuticals and biologics to perishable foods, cosmetics, and chemicals—must be kept within specific temperature ranges to maintain their safety, efficacy, or quality.

In the pharmaceutical industry, the rise in biologics, personalized medicines, and vaccines (especially post-COVID-19) has significantly increased the need for reliable cold chain logistics. Many of these products are highly sensitive and require storage within narrow temperature bands, such as 2°C–8°C or even sub-zero conditions. Pre-conditioned packaging ensures that these temperatures are maintained throughout the supply chain, from manufacturer to end user, minimizing spoilage and regulatory risks.

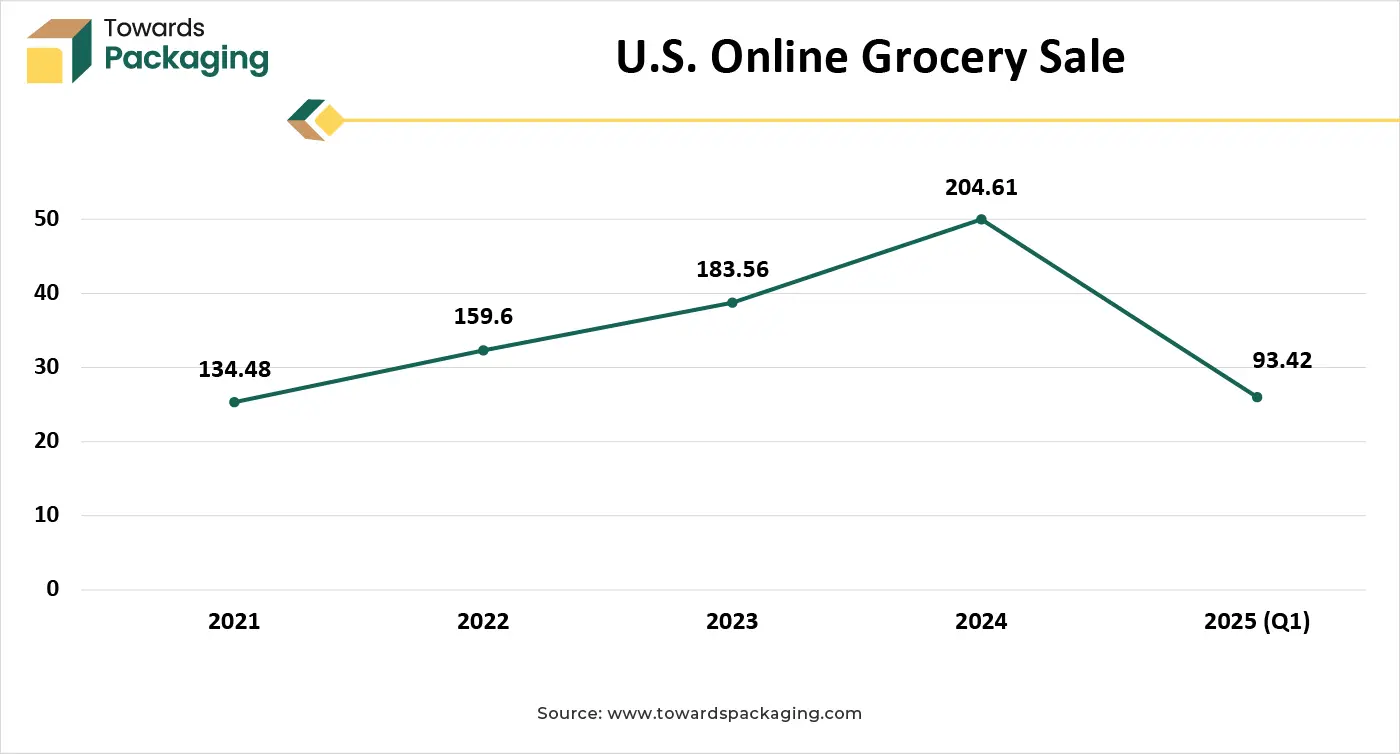

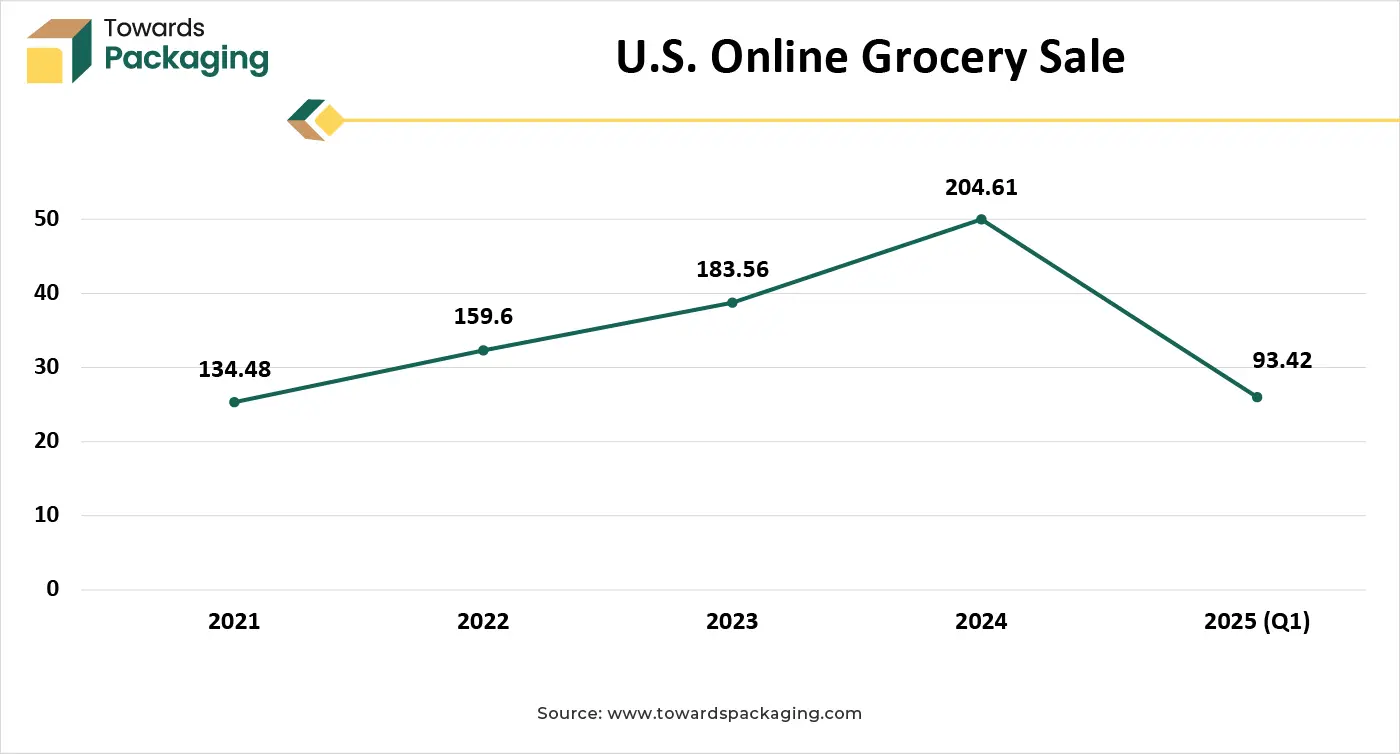

In the food and beverage sector, the growth in online grocery shopping, meal kit services, and global food trade has fuelled demand for packaging that can preserve freshness and safety during long transit times. Pre-conditioned packaging solutions with thermal insulation or phase change materials help maintain ideal temperatures, reducing food waste and enhancing consumer trust in perishable deliveries. The cosmetic and personal care industry also benefits, as certain ingredients and formulations, like natural extracts or probiotic-based creams, are sensitive to heat or humidity. These products require temperature-controlled packaging, especially for e-commerce and global distribution.

Growth in E-commerce and Direct-to-Consumer (D2C) Deliveries

Surge in online shopping, especially for groceries, meal kits, and health products, necessitates robust and reliable packaging solutions that maintain product integrity over longer transit times. In January 2025, according to the data published by the B2B eCommerce Association, international shopping is reported by more than half of internet shoppers. This is mostly because internet ordering is convenient and overseas shipping is simple. 72% of Mexicans reported making purchases from both local and foreign websites, making them the most noticeable country for international transactions. 63% of respondents said they shopped from local websites, indicating that consumers in the U.S. and the U.K. were more likely to purchase locally.

Restraints

Environmental Concerns and Strict Regulatory Compliance

Many pre-conditioned packaging materials, such as EPS foam, plastics, and phase change materials, are not eco-friendly. Increasing pressure to reduce single-use plastic and develop biodegradable alternatives is challenging and costly for manufacturers. Especially in pharmaceuticals and food sectors, companies must comply with stringent FDA, EMA, and WHO regulations. This adds layers of validation, documentation, and testing that slow down innovation and adoption.

What are the Opportunities for the Growth of the Pre-Conditioned Packaging Market?

Growth of the Cold Chain Logistics Sector

Rising global demand for temperature-sensitive products (e.g., vaccines, biologics, frozen foods) is fueling the need for reliable cold chain packaging. Expansion of e-commerce in perishables and pharmaceuticals is increasing reliance on pre-conditioned packaging to maintain product safety during transit.

Expansion into Emerging Markets

Rapid industrialization and healthcare expansion in Asia-Pacific, Latin America, and Africa are creating new demand for cold chain solutions. Governments and NGOs are investing in improving cold chain infrastructure, especially for vaccine distribution and agriculture.

Pharmaceutical and Biotechnology Industry Growth

Personalized medicine, biologics, and clinical trials often require precise temperature control. Stringent regulatory environments are pushing pharmaceutical companies to adopt more advanced and compliant packaging systems.

Innovation in Sustainable and Reusable Packaging

There's increasing Research and Development in eco-friendly, recyclable, and reusable materials (e.g., biodegradable insulation, water-based PCM, reusable gel packs). Brands are differentiating themselves through sustainable packaging, responding to consumer demand for green logistics solutions.

Technological Advancements in Smart Packaging

Growth in IoT-enabled packaging that monitors and logs temperature, humidity, shock, and location in real time. Integration of blockchain and RFID/NFC technologies ensures transparency and traceability in cold chain logistics. For example, pre-filled syringe (PFS) and OD serialization standards are being supported by smart labels that use radio-frequency identification (RFID) or near-field communication (NFC) technologies. These smart labels can offer more comprehensive information than ordinary labels, such as serialization data and unique identities, which are essential for regulatory compliance and smooth scanning during transportation.

They may also be able to link serialization compliance with operational efficiency and harmonize data systems throughout the pharmaceutical supply chain. Additionally, smart labels with processing cores can allow for real-time temperature monitoring during transportation for therapeutic goods that are sensitive to temperature, including biologics. The information can be sent to a central database, which will help with future root-cause investigation and enable the identification and destruction of units with temperature excursions.

Segmental Insights

Why does the Plastic Segment Dominated the Pre-Conditioned Packaging Market?

The plastic segment held a dominant presence in the pre-conditioned packaging market in 2024. Plastic materials are extensively used for pre-conditioned ore packaging (or more broadly, for ore-conditioned packaging) for several practical reasons. Plastic is inert to many chemicals and doesn't react with ores, which often contain reactive minerals or moisture. It provides an effective barrier against water, air, and contaminants, helping maintain the ore's quality during transport or storage. Compared to metal or wooden containers, plastic is much lighter, reducing shipping costs and improving ease of handling. Plastics can be easily molded or extruded into various forms bags, liners, drums, or containers, depending on the ore type and handling method. It allows for vacuum sealing or airtight packaging for sensitive ores.

On a large scale, plastics are relatively inexpensive to produce and maintain compared to alternatives like metal or composites. Many industrial plastic packaging types are now made to be recyclable or reusable, which helps industries meet environmental regulations while retaining cost benefits. Plastic packaging can be made clean and sterile, reducing the risk of contamination or mixing different ore batches, especially in high-purity or export-grade ore industries.

Paperboard offers moderate strength and rigidity, protecting items from physical damage. It can be coated or laminated to enhance moisture, grease, or gas barriers, especially for food packaging. Paper and paperboard are renewable materials and easily recyclable, making them ideal for environmentally conscious packaging. Most are made from responsibly managed forests or recycled fibers.

Which Closure Type Segment Held the Dominating Share of the Pre-Conditioned Packaging Market in 2024?

The zipper segment accounted for a significant share of the pre-conditioned packaging market in 2024. Zipper closures allow the package to be opened and resealed multiple times without losing its protective function. This is ideal for pre-conditioned packaging that stores products needing repeated access while maintaining temperature and hygiene integrity. Zipper closures work well with high-barrier materials. They help preserve temperature-sensitive product quality over extended periods by minimizing air exchange after opening.

Zippers are commonly integrated into thermal bags and insulated pouches used in cold chain packaging. Their secure seal supports passive thermal regulation, especially in pharmaceuticals, biologics, or meal kits that require stable temperatures during transit. Zipper closures can be paired with tamper-evident seals or tear notches, ensuring product safety while preserving reusability. Modern zipper closure systems can be efficiently integrated into automated packaging lines, supporting high-speed filling and sealing with consistent quality. This lowers production costs and enhances scalability in commercial applications.

Food and Beverage Industry Dominates

The food and beverage segment registered its dominance over the global pre-conditioned packaging market in 2024. Many food and beverage products, such as dairy, meat, seafood, frozen foods, ready-to-eat meals, and beverages, require strict temperature control to preserve freshness, taste, and safety. Pre-conditioned packaging ensures products stay within the required temperature range during storage and transit. The rapid rise of online grocery shopping, meal kits, and food delivery services has increased the need for reliable, pre-conditioned packaging that can maintain product quality during last-mile delivery. Consumers expect food to arrive fresh, safe, and in perfect condition—even after several hours in transit. Regulatory bodies like the U.S. FDA, EFSA, and national food safety agencies impose strict cold chain and food hygiene standards. Pre-conditioned packaging helps companies comply with these regulations by maintaining optimal environmental conditions, thus reducing the risk of spoilage or contamination.

Unlike pharmaceuticals or consumer electronics, many food products have short shelf lives and are highly perishable. Even brief exposure to unsuitable temperatures can lead to spoilage or loss of nutritional value. Pre-conditioned packaging plays a crucial role in extending shelf life and reducing food waste. For premium or health-focused brands, packaging is a key part of brand identity and trust. Pre-conditioned packaging demonstrates care, quality control, and professionalism, which improves customer satisfaction and retention. The food and beverage sector frequently drives innovation in packaging design. From zipper-sealed pouches for reusable snacks to insulated boxes for frozen gourmet items, customized pre-conditioned packaging solutions enhance both functionality and brand appeal.

Regional Insights

What Made the North America Region Dominant in 2024?

North America region held the largest share of the pre-conditioned packaging market in 2024, owing to the robust food and beverage industry. North America, especially the United States and Canada, has a well-developed cold chain infrastructure that supports the storage and transportation of temperature-sensitive goods. This includes widespread use of temperature-controlled warehouses, refrigerated transportation, and last-mile cold delivery systems, which all require reliable pre-conditioned packaging solutions to maintain product integrity. Agencies like the U.S. Food and Drug Administration (FDA) and Health Canada impose strict regulations on the storage and distribution of temperature-sensitive goods, particularly pharmaceuticals and food. Pre-conditioned packaging is essential to meet these requirements, as it helps maintain Good Distribution Practice (GDP) standards and ensures product safety and compliance.

U.S. Market Trends

The U.S. pre-conditioned packaging market is driven by the presence of leading global packaging key players. The U.S. is home to industry giants like International Paper, WestRock, Berry Global, Sealed Air, and Amcor. These companies set global trends in sustainable, smart, and high-performance packaging. U.S. policies and corporate responsibility trends push for recyclable, compostable, and eco-friendly packaging. Regulatory agencies drive innovation in safe and compliant packaging, especially for food and pharmaceuticals.

Canada Market Trends

Canada's pre-conditioned packaging market is driven by the strategic trade position. Canada is part of major trade agreements like USMCA, CETA, and CPTPP, increasing demand for export-compliant, durable, and efficient packaging. Canada invests heavily in clean tech and smart manufacturing, applying this to packaging innovations such as Bioplastics, Smart packaging, and Lightweight composites. Innovation hubs in Ontario, Quebec, and British Columbia lead research and development in packaging engineering. Canada has one of the world's largest forest reserves, making it a major global producer of paper and paperboard, both widely used in pre-conditioned packaging. This gives Canada a strategic advantage in renewable packaging materials.

Why is Asia Pacific Projected as Fastest Fastest-Growing Region?

Asia Pacific is expected to grow with the fastest CAGR in the pre-conditioned packaging market as countries like China, India, Australia, and Indonesia are global leaders in the mining of iron ore, bauxite, coal, copper, lithium, and rare earth elements. The scale of ore extraction and export creates huge demand for bulk, protective, and pre-conditioned packaging solutions to maintain ore quality during storage and transit. Massive growth in construction, infrastructure, and manufacturing across Asia-Pacific countries increases demand for raw materials like metals and minerals. This drives the need for efficient and reliable packaging solutions for transporting ore from mines to processing plants or ports. Countries such as Australia and Indonesia are major exporters of ores.

Increasing adoption of automated filling, vacuum sealing, bulk container liners, and moisture control technologies for ore packaging. Major packaging companies and logistics providers are expanding their presence in Asia Pacific to meet demand. While still developing, regulations in countries like China, Japan, and South Korea are increasingly enforcing safe handling and transport of hazardous materials, dust and spill control, and sustainable and recyclable packaging practices. Major ports and transnational railway networks make bulk ore transportation efficient. Packaging must be designed to withstand multimodal transport over long distances.

China Market Trends

China's pre-conditioned packaging market is driven by the large cold chain and e-commerce sectors in the country. China is one of the world’s top exporters of packaged goods. To protect products during long-distance shipping, durable and condition-specific packaging is in high demand. China's rapidly growing cold chain logistics demands pre-conditioned packaging like insulated liners, vacuum packs, and gel packs. The massive e-commerce market increases demand for protective, tamper-evident, and branded packaging. With over 1.4 billion people, China’s domestic demand for high-quality, safely packaged goods drives large-scale production of pre-conditioned packaging. China’s policies, such as “Made in China 2025”, support domestic innovation in advanced materials, automation, and green packaging.

Europe’s Government Initiatives to Support Steady Growth in 2024

Europe is expected to grow at a notable rate in the foreseeable future. The EU’s Green Deal and Circular Economy Action Plan are pushing industries toward sustainable, recyclable, and reusable packaging. Regulations like the Single-Use Plastics Directive and Packaging and Packaging Waste Regulation (PPWR) encourage rapid innovation and investment in eco-friendly pre-conditioned packaging. European consumers are highly aware of environmental and health concerns. Brands are under pressure to use pre-conditioned packaging that is sustainable, transparent, and tamper-evident, especially in food, cosmetics, and pharmaceuticals.

Countries like Germany, Italy, and France are major producers and exporters of food, wine, cosmetics, and pharmaceuticals, all requiring high-grade pre-conditioned packaging to ensure quality and compliance. Europe hosts leading packaging firms and materials companies (e.g., Amcor Europe, Huhtamaki, Mondi, DS Smith). The EU single market enables efficient cross-border trade, but it also demands standardized, compliant packaging to meet quality and logistics needs across nations.

Pre-Conditioned Packaging Market Key Players

Latest Announcements by Pre-Conditioned Packaging Industry Leaders

- In January 2025, Marlena Hardy, innovation product manager at DS Smith, stated that TailorTemp shows how adaptable and dependable fiber-based materials can be, not just to regulate temperatures in cold chain logistics but also to provide a recyclable result for clients looking to fulfill sustainability goals. (Source: PackagingGateway)

New Advancements in the Pre-Conditioned Packaging Industry

- In April 2025, Performa Nova, a next-generation folding boxboard (BB) that combines high yield with outstanding performance, was introduced by Stora Enso as part of an expansion of its core packaging material offering. For industries including dry, frozen, and chilled food, chocolate, and confections, the new board is made to satisfy the increasing need for packaging solutions that are efficient, recyclable, and renewable. (Source: The Packman)

- In January 2025, at PharmaPack Europe 2025, DS Smith showcased a novel temperature-controlled, fiber-based packaging solution, emphasizing its 36-hour cooling time, recyclability, and parametric algorithm customization. (Source: DS Smit)

Global Pre-Conditioned Packaging Market Segments

By Material Type

- Plastic

- Paper and Paperboard

- Aluminum Laminates

- Others (e.g., biodegradable materials)

By Closure Type

- Zipper

- Spout

- Flip Lid

- Tear Notch

- Others

By End-Use Industry

- Food and Beverage

- Pharmaceuticals and Cosmeceuticals

- Personal Care and Cosmetics

- Veterinary Food

- Chemicals

- Agriculture

- Automotive

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait