North America Flexible Packaging Market Size, Demand and Trends Analysis

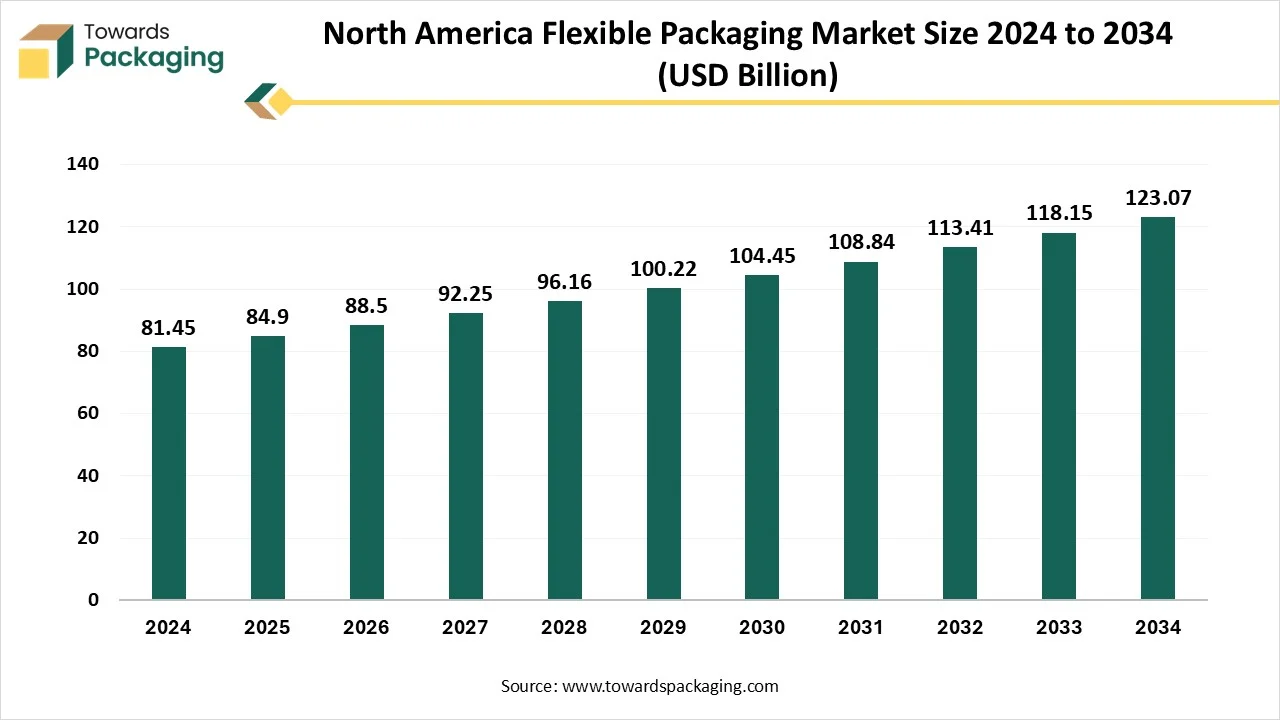

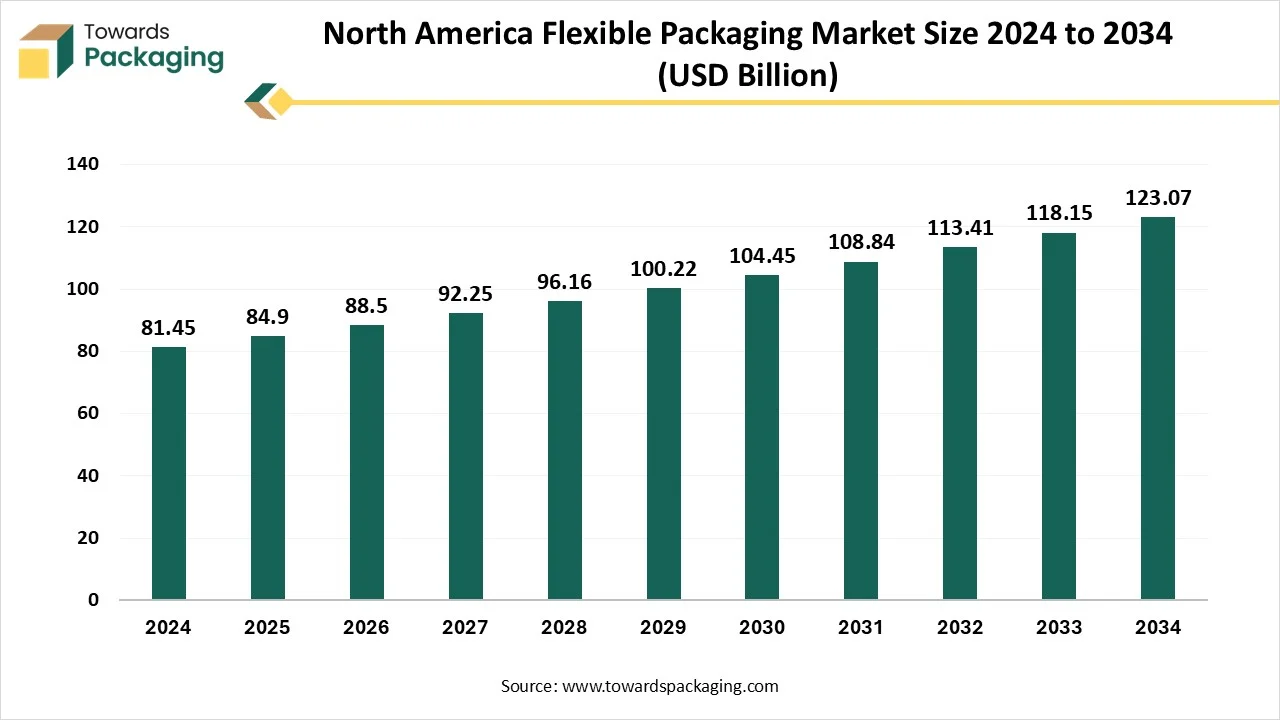

The North America flexible packaging market is expected to grow from USD 84.9 billion in 2025 to USD 123.07 billion by 2034, at a CAGR of 4.23%. The market is driven by the rising consumer demand for convenience, sustainability, and innovation in packaging solutions. The plastics segment is leading in terms of material share, while pouches dominate product types, particularly in the food & beverage sector. Regulatory pressures and sustainability trends further influence growth, with key players like Amcor and Sealed Air enhancing their focus on eco-friendly packaging. Additionally, the market is shaped by technological advancements in packaging design and materials, especially in North America, which leads global trends.

Flexible packaging is widely used in the food and beverage sector, which remains the dominant end-user due to its cost-effectiveness and extended shelf life benefits. Technological advancements, such as recyclable mono-materials and high-barrier films, are supporting eco-friendly trends. Additionally, the rapid expansion of e-commerce and regulatory emphasis on sustainable practices continue to shape the future of this dynamic industry.

Major Key Insights of the North America Flexible Packaging Market

- By material, the plastics segment dominated the market with the largest share in 2024.

- By product, the pouches segment registered its dominance over the North America flexible packaging market in 2024.

- By application, the food & beverage segment dominated the market with the largest share in 2024.

North America Flexible Packaging Market: Overview

A type of packaging made from easily shaped materials such as plastic, foil, paper, or a combination of these, which can be molded into various shapes and forms is known as flexible packaging. Unlike rigid packaging, flexible packaging adapts to the shape of the product it holds, offering versatility, lightweight characteristics, and efficient use of materials. It includes items like pouches, bags, wraps, and sachets. This type of packaging is widely used in industries such as food and beverage, pharmaceuticals, cosmetics, and household goods due to its cost-effectiveness, ease of transport, and ability to extend shelf life by providing excellent barrier protection against moisture, air, and contaminants. Additionally, flexible packaging supports innovative designs, resealable features, and user convenience, making it a preferred choice among consumers and manufacturers. Its eco-friendly potential, through lightweight materials and increasing recyclability—also aligns with the growing global emphasis on sustainability and waste reduction.

What are New Trends in the Flexible Packaging Market?

Smart and Interactive Packaging

The integration of technologies such as QR codes, Near Field Communication (NFC) tags, and sensors into packaging is enhancing consumer engagement and providing real-time product information. This trend is particularly prevalent in food, beverage, and pharmaceutical sectors, where traceability and freshness monitoring are crucial. For instance, battery-free, stretchable, and autonomous smart packaging systems have been developed to monitor food freshness and extend shelf life by releasing active compounds when spoilage is detected.

Sustainability and Eco-Friendly Materials

There is a growing emphasis on adopting biodegradable, compostable, and recyclable materials in packaging. Regulatory measures, such as California's law mandating recyclable or compostable packaging by 2032, are accelerating this shift. Despite challenges like rising material costs and tariffs, consumer demand for sustainable packaging remains strong.

Advancements in Printing Technologies

Digital and high-definition printing technologies are enabling more vibrant, detailed, and customized packaging designs. These advancements cater to the growing consumer demand for personalization and branding, allowing brands to create eye-catching packaging that stands out in competitive retail environments.

Convenience and Portability

Consumer preferences are shifting towards packaging that offers convenience and portability. On-the-go consumption is fueling the demand for pre-packed fresh foods, microwavable meals, and smaller pack sizes. Additionally, portable and resealable packaging solutions are becoming increasingly popular, catering to consumers who value flexibility and convenience.

E-commerce and Direct-to-Consumer Packaging

The rise of e-commerce has significantly increased the demand for durable and lightweight flexible packaging. Online shopping platforms require packaging solutions that ensure product safety during transit while offering an excellent unboxing experience. Flexible packaging's versatility and cost-effectiveness make it a preferred choice in this sector.

Active Packaging Solutions

Active packaging systems are designed to interact with the contents of the package to extend shelf life and maintain product quality. These systems include features like oxygen scavengers, carbon dioxide generators, and ethylene absorbers, which help preserve the freshness of food products.

Industry Consolidation

Major players in the packaging industry are pursuing strategic mergers and acquisitions to strengthen their market positions. For example, Amcor's acquisition of Berry Global Group is set to establish Amcor as the world's largest plastic packaging company, enhancing its presence in North America, Western Europe, and emerging markets.

Sustainability & Regulatory Compliance

Regulatory pressures are compelling companies to adopt eco-friendly materials and reduce packaging waste. For example, New York State has passed legislation mandating large companies to cut packaging by 30% within 12 years and use more recyclable or reusable materials by 2052. This trend is pushing the industry toward biodegradable, compostable, and recycled packaging solutions.

Customization & Convenience

Flexible packaging offers versatility in design, allowing brands to create eye-catching products that stand out on store shelves. Features like resealable pouches, easy-opening mechanisms, and portion control capabilities enhance user convenience, catering to the modern consumer's preferences.

Advancements in Printing Technologies

Digital printing technologies are transforming the flexible packaging industry by enabling faster, more cost-effective, and high-quality customization. AI-powered web-to-print solutions streamline workflows, reduce waste, and ensure color accuracy across batches, allowing brands to offer personalized packaging solutions.

Financial Snapshot of Publicly Traded North American Flexible Packaging Companies (2025)

| Company Name |

Ticker |

Country |

Market Cap (USD B) |

P/E |

P/B |

EV/EBITDA |

P/S |

EPS (TTM) |

Debt/EBITDA |

Cash (USD B) |

Revenue (TTM USD B) |

Employees |

Float % |

5-Yr Revenue Trend |

Flexible-Packaging Focus |

| Amcor plc |

AMCR (NYSE) |

USA/UK (HQ Switzerland) |

16.3 |

22.7 |

3.6 |

9.3 |

106.00% |

0.55 |

3.2 |

1 |

14.69 |

44,000 |

99 |

Steady |

Flexible & rigid plastic packaging |

| Sealed Air Corp. |

SEE (NYSE) |

USA |

5.8 |

13.2 |

5.4 |

8.7 |

1.02 |

2.52 |

3.1 |

0 |

5.6 |

16,300 |

98 |

Flat |

Protective & flexible films |

| Berry Global Group Inc. |

BERY (NYSE) |

USA |

7.1 |

15.8 |

2.7 |

7.9 |

74.00% |

5.47 |

4.2 |

0 |

13.3 |

46,000 |

97 |

Growing |

Extensive flexible packaging |

| Sonoco Products Co. |

SON (NYSE) |

USA |

6.2 |

12.5 |

1.8 |

7.4 |

100.00% |

5.24 |

2.7 |

0.15 |

7.26 |

22,000 |

99 |

Stable |

Paper-based & flexible packaging |

| Transcontinental Inc. |

TCL.A (TSX) |

Canada |

1.1 |

11.4 |

0.9 |

5.8 |

55.00% |

1.92 |

2.5 |

0 |

2.11 |

8,000 |

88 |

Declining |

Flexible packaging & printing |

| Winpak Ltd. |

WPK (TSX) |

Canada |

2.5 |

22.4 |

2.4 |

11.6 |

209.00% |

2.76 |

0.1 |

0 |

1.2 |

2,600 |

70 |

Steady |

Rigid & flexible packaging films |

| Graphic Packaging Holding Co. |

GPK (NYSE) |

USA |

8.7 |

10.6 |

2.1 |

6.9 |

77.00% |

2.47 |

2.8 |

0 |

9.3 |

24,000 |

98 |

Growing |

Cartonboard & flexible wraps |

| WestRock Co. |

WRK (NYSE) |

USA |

11.9 |

15.1 |

0.8 |

7 |

0.67 |

3.03 |

3.6 |

0.35 |

20.33 |

56,000 |

99 |

Flat |

Paperboard & flexible solutions |

| Packaging Corp. of America |

PKG (NYSE) |

USA |

17.5 |

17.2 |

3.5 |

9.8 |

1.48 |

9.85 |

2.1 |

0.4 |

8.76 |

15,000 |

98 |

Steady |

Carton & corrugated + some flexible |

| International Paper Co. |

IP (NYSE) |

USA |

14.8 |

19.6 |

2.2 |

7.1 |

0.78 |

2.67 |

3 |

1.75 |

18.8 |

39,000 |

99 |

Declining |

Paper & flexible products blend |

| Avery Dennison Corp. |

AVY (NYSE) |

USA |

17.7 |

20.8 |

9.1 |

13.2 |

1.92 |

7.23 |

2.2 |

0.55 |

9.9 |

36,000 |

98 |

Steady |

Labels & adhesive flexible films |

| Dow Inc. |

DOW (NYSE) |

USA |

42.9 |

18.3 |

2.1 |

7.6 |

0.82 |

4.53 |

2.5 |

3.22 |

45 |

35,900 |

99 |

Volatile |

Polyethylene film & packaging materials |

How Can AI Improve the Flexible Packaging Industry?

AI integration is revolutionizing the flexible packaging industry by enhancing efficiency, quality, and sustainability across the entire value chain. One of the most impactful applications is predictive maintenance, where AI-powered sensors and algorithms monitor equipment performance to anticipate failures before they occur. AI also plays a crucial role in supply chain and inventory management by forecasting demand, optimizing raw material procurement, and streamlining logistics. This leads to lower costs, reduced lead times, and minimized stockouts or overproduction.

Additionally, AI supports sustainability initiatives by identifying ways to reduce waste, simulate eco-friendly packaging formats, and monitor environmental impact during production. It can, for example, highlight excessive trim waste and suggest more efficient layout designs. Furthermore, AI helps businesses stay competitive by analyzing market trends, consumer behaviour, and social media data to guide packaging decisions.

Driver

Growth of E-commerce and Retail

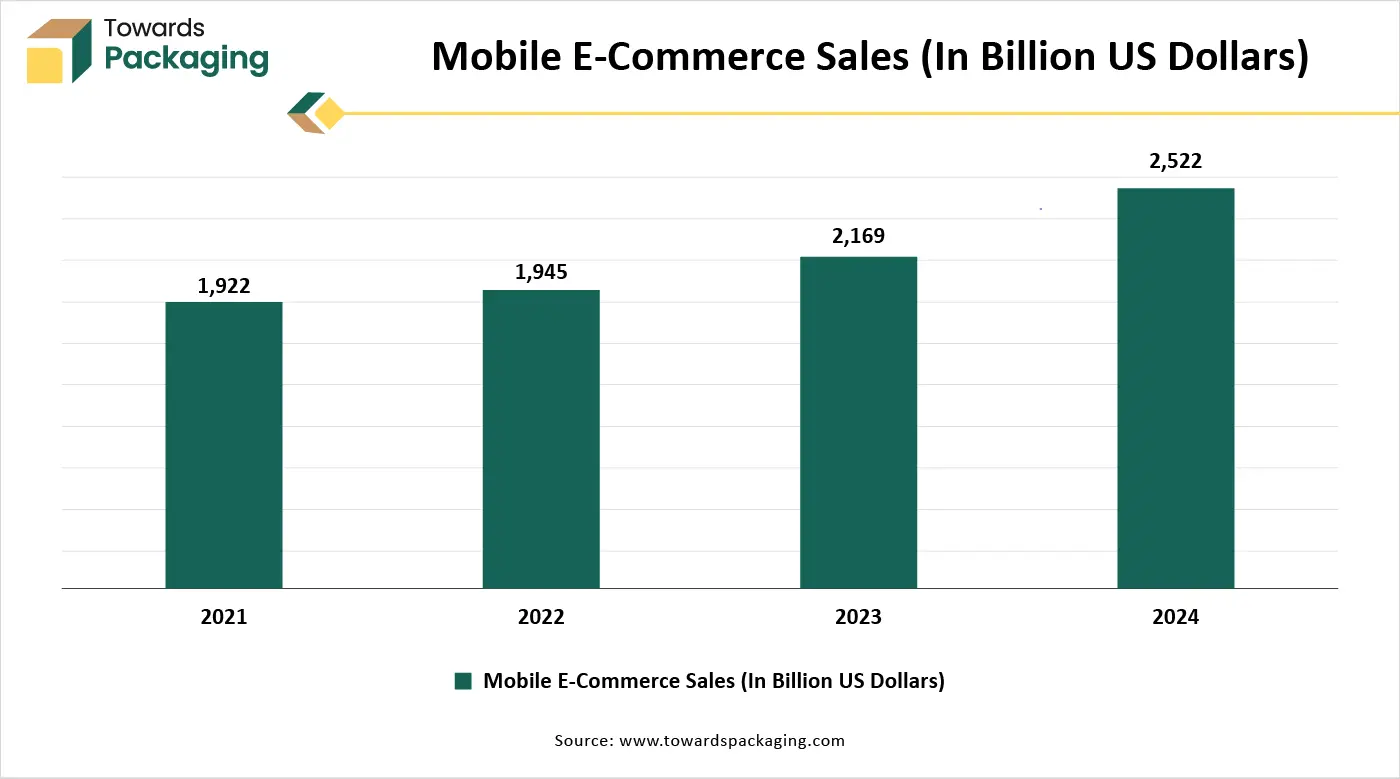

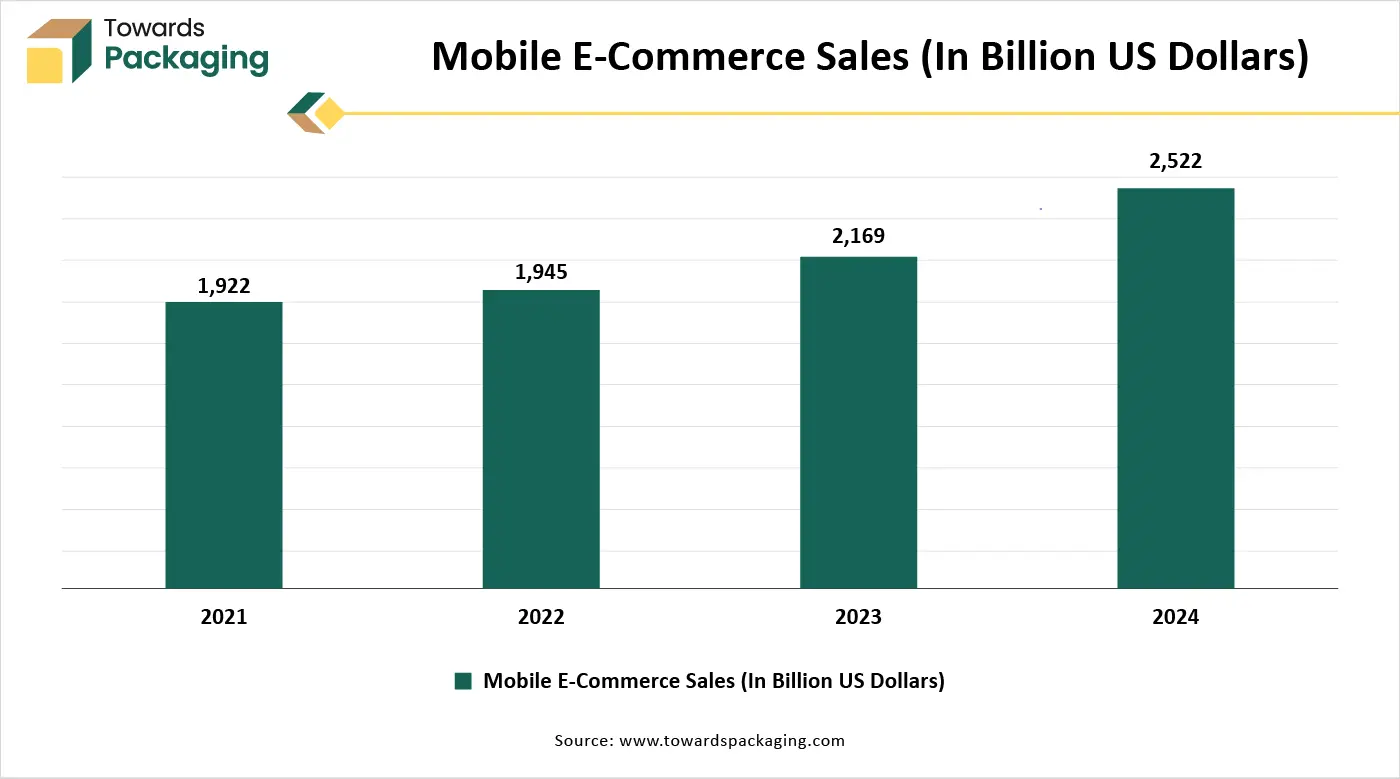

With the global increase in urbanization and busier lifestyles, consumers are leaning toward ready-to-eat, convenient food and beverage options. Flexible packaging is ideal for these products due to its lightweight, resealable, and durable nature. The boom in e-commerce and organized retail has increased the need for packaging that is lightweight, durable, and cost-effective. Flexible packaging meets these demands while also offering aesthetic appeal and brand differentiation. Flexible packaging uses less material and energy compared to rigid packaging, making it more economical in production and transportation. This cost efficiency is particularly attractive to manufacturers looking to reduce expenses without compromising product safety.

- In January 2025, according to the data published by the B2B eCommerce Association, by 2025, there will be 2.77 billion internet shoppers worldwide. This indicates that 33% of people worldwide shop online. This is a 2.2% increase over the 2024 year. With 904.6 million online consumers in China and 288.45 million in the U.S., the number of online shoppers is expected to reach 2.86 billion by 2026, demonstrating the growth in commerce brought about by greater internet access and convenience.

Which Factors Restraints the North America Flexible Packaging Market Growth?

High Competition and Price Pressure & Volatility in Raw Material Prices

Intense competition from local and global player’s compresses profit margins. Price-sensitive industries (e.g., food) often push for low-cost packaging solutions, limiting innovation and premium product adoption. Flexible packaging relies heavily on petroleum-based polymers like polyethylene and polypropylene. Fluctuations in crude oil prices directly affect raw material costs, reducing manufacturer stability and profitability.

What are the Opportunities for the Growth of the North America Flexible Packaging Market?

Sustainability Trends

As companies and consumers push for more sustainable solutions, flexible packaging stands out for its potential to reduce carbon footprint, especially when made with recyclable, biodegradable, or compostable materials. Innovations in mono-material and recyclable film structures further support this trend.

Expansion of Pharmaceutical and Healthcare Industry

The demand for secure, sterile, and tamper-proof packaging in the pharmaceutical and healthcare sectors has contributed to the expansion of flexible packaging. It offers lightweight solutions that maintain the integrity and shelf life of medical products.

Segmental Insights

Which Material Segment Dominated the North America Flexible Packaging Market in 2024?

The plastics segment held a dominant presence in the North America flexible packaging market in 2024. Plastic is widely used in flexible packaging due to its lightweight, durability, and cost-effectiveness. Materials like PE, PP, and PET offer excellent barrier properties against moisture, oxygen, and light, helping extend product shelf life. Plastics are versatile, easily molded, printed, and sealed into various formats with features like zippers and spouts.

They are compatible with high-speed packaging machinery and resist breakage and contamination, making them ideal for food, pharmaceuticals, and personal care. Additionally, plastic allows for attractive branding through high-quality printing. Its efficiency, adaptability, and protective qualities make it a preferred choice across multiple packaging industries.

What Made Pouches Product Type the Dominant Segment in the North America Flexible Packaging Market in 2024?

The pouches segment accounted for a significant share of the cigarette packaging market in 2024, owing to a combination of functional, economic, and consumer-oriented advantages. Pouches offer exceptional convenience and portability, making them ideal for on-the-go consumption, particularly in categories like snacks, baby food, pet food, and beverages. Their compact and flexible design also allows for space efficiency, reducing storage and shipping costs. Pouches are manufactured with high-barrier materials that protect against moisture, oxygen, and light, which extends product shelf life an essential feature for food and pharmaceutical products.

Additionally, pouches are more sustainable than many rigid alternatives, as they use less material and energy during production and transportation. They are cost-effective, both in terms of raw material use and logistics. The segment also benefits from high customization potential, with features such as resealable zippers, spouts, and easy-tear openings, making them suitable for a wide range of products, including liquids, powders, and solids. Their large printable surface area provides strong branding and shelf appeal, influencing consumer buying decisions. With widespread adoption across food, personal care, and healthcare industries and growing demand from e-commerce channels pouches continue to lead the flexible packaging market in North America.

Why Food & Beverages Segment Dominated the North America Flexible Packaging Market?

The food & beverages segment registered its dominance over the North America Flexible Packaging Market in 2024 owing to high demand for convenience foods, such as ready-to-eat and single-serve items. Flexible packaging offers lightweight, resealable, and cost-effective solutions that support busy lifestyles and e-commerce growth. The region’s strong food industry, frequent product launches, and consumer focus on sustainability further drive demand.

Advanced materials provide excellent barrier protection, extending shelf life and ensuring food safety. Innovations like vacuum sealing and modified atmosphere packaging enhance functionality, while high-quality printing and customizable designs boost brand visibility. Additionally, flexible packaging reduces environmental impact compared to rigid alternatives, aligning with evolving regulatory and consumer preferences, making it the preferred choice for food and beverage manufacturers in North America.

What to Expect in North America’s Flexible Packaging Market till 2040?

North America flexible packaging market growth is supported by several structural, economic, and industry-specific factors, with country-wise contributions led by the United States, followed by Canada and Mexico. Advanced manufacturing technologies and widespread automation also support high-volume, efficient production of flexible packaging.

North America is home to several leading global packaging companies like Amcor plc, Mondi Group, Huhtamaki Flexible Packaging, Sonoco Products Company, Sealed Air, DS Smith, Berry Global, Constantia Flexibles, Bemis Manufacturing Company, UkrMetal, ProAmpac and Wipak Group among others that invest heavily in research and development, driving innovation in materials, printing techniques, and barrier technologies.

The region also shows a strong shift toward sustainable and recyclable packaging, influenced by rising environmental awareness and evolving government regulations, especially in the U.S. and Canada. The robust healthcare and pharmaceutical sectors contribute to demand for sterile, safe, and protective flexible packaging solutions. Additionally, North America's logistics and retail infrastructure, including the growth of e-commerce, favors lightweight and durable packaging options that lower shipping costs and reduce product damage.

U.S. Flexible Packaging Market Trends

In the United States, the largest and most mature market in the region, dominance is fueled by a well-established food and beverage industry, high consumer demand for convenient and sustainable packaging, and significant investments in packaging innovation. U.S. consumers favor single-serve, resealable, and lightweight options, which aligns perfectly with flexible packaging formats like pouches and wraps. Additionally, the U.S. is home to major global packaging companies and has a robust infrastructure supporting high-speed production, logistics, and advanced printing technologies. The strong presence of the pharmaceutical, personal care, and pet food sectors also drives consistent demand for flexible packaging. Moreover, regulatory shifts and rising environmental awareness are pushing companies to invest in recyclable and biodegradable flexible solutions, giving the U.S. a leading edge in sustainable packaging innovation.

Canada Flexible Packaging Market Trends

In Canada, the flexible packaging market benefits from a highly urbanized population, growing demand for packaged and ready-to-eat foods, and increased health and hygiene awareness post-COVID. Canadian consumers are particularly responsive to environmentally responsible packaging, prompting brands to adopt flexible materials with lower environmental footprints. While the market is smaller than the U.S., Canada has seen growth in domestic manufacturing and imports of flexible packaging solutions. Government regulations supporting recycling and sustainable practices are also encouraging innovation in this space.

Flexible Packaging Market

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

North America Flexible Packaging Market Players

- Amcor plc

- Mondi Group

- Huhtamaki Flexible Packaging

- Sonoco Products Company

- Sealed Air

- DS Smith

- Berry Global

- Constantia Flexibles

- Bemis Manufacturing Company

- UkrMetal

- ProAmpac

- Wipak Group

- FlexPak Services

- Transcontinental Inc.

- Coveris Holdings

- American Packaging Corporation

- InterFlex Group

- FLEX-PACK ENGINEERING, INC.

- Innovia Films

- Cosmo Films

- Novolex

- Sigma Plastics Group

- Graphic Packaging International, LLC

- Bischof+Klein SE & Co. KG

- Südpack

Latest Announcements by North America Flexible Packaging Industry Leaders

- Keith Schrage, North America Director of Sales, Food Packaging at Klöckner Pentaplast (kp) company, stated that more intelligent approaches to material selection and design are necessary in light of the increasing wave of legislation targeting expanded polystyrene single-use food packaging in North America. (Source: WhatTheyThink)

New Advancements in North America Flexible Packaging Industry

- In March 2025, ProAmpac, a pioneer in material science and flexible packaging, is expanding its ProActive Intelligence platform with the introduction of cutting-edge products in its Moisture Protect line. ProAmpac now provides a variety of moisture-adsorbing films, building on the success of the Moisture Protect platform and offering specialized solutions for a range of applications. These solutions, developed in partnership with Aptar SP Technologies, are intended to improve product protection while advancing sustainability objectives. (Source: ProAmpac)

- In February 205, Proquimia and Mondi, a world leader in environmentally friendly paper and packaging, have partnered to introduce paper-based stand-up pouches for dishwashing tabs in Spain and Portugal. In comparison to the previous plastic solution, the new solution has substantially fewer CO2 emissions from cradle to gate, according to Modi's internal product impact evaluation. There are twenty water-soluble dishwashing tablets in the flexible stand-up pouches. Modi's re/cycle FunctionalBarrier Paper 95/5 was utilized to create the new paper-based solution, which replaces the plastic solution that was previously in use. (Source: Mondi)

- In May 2025, Wisconsin-based SC Johnson, in collaboration with Canadian retailer London Drugs, introduced the first refillable container system for its Method and Mrs. Meyer's Clean Day products in North America. A refill station for hand and dish soaps is part of the brand-new London Drugs flagship store in British Columbia, which opened on May 9. The Method and Mrs. Meyer's soaps can be dispensed by customers into reusable plastic bags. Smaller than the new pouches, the products are packaged in their conventional hard plastic packaging, and the machine is placed next to a store shelf. (Source: Packaging Dive)

- In October, 2024, Pouches.com, a new company in the flexible packaging business, has made its debut in the US market with a simple, all-in-one online ordering platform. Pouches.com provides custom-printed pouches and packaging for business-to-business clients nationwide. It is user-friendly, has quick turnaround times, and is sustainable. For companies of all sizes, the platform makes it simple to place fast, environmentally friendly packaging orders. (Source: Informa markets)

North America Flexible Packaging Market Segments

By Material

- Plastics

- Polyethylene (PE)

- Polypropylene (PP)

- Polyamide (PA)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Others

- Paper

- Metal

- Bioplastics

By Product

- Bags

- Pouches

- Retort Pouches

- Refill Pouches

- Rollstock

- Films & Wraps

- Others

By Application

- Food & Beverages

- Pharmaceutical & Healthcare

- Personal Care & Cosmetics

- Others