Fiberboard Packaging Market Size, Trends, Share and Innovations

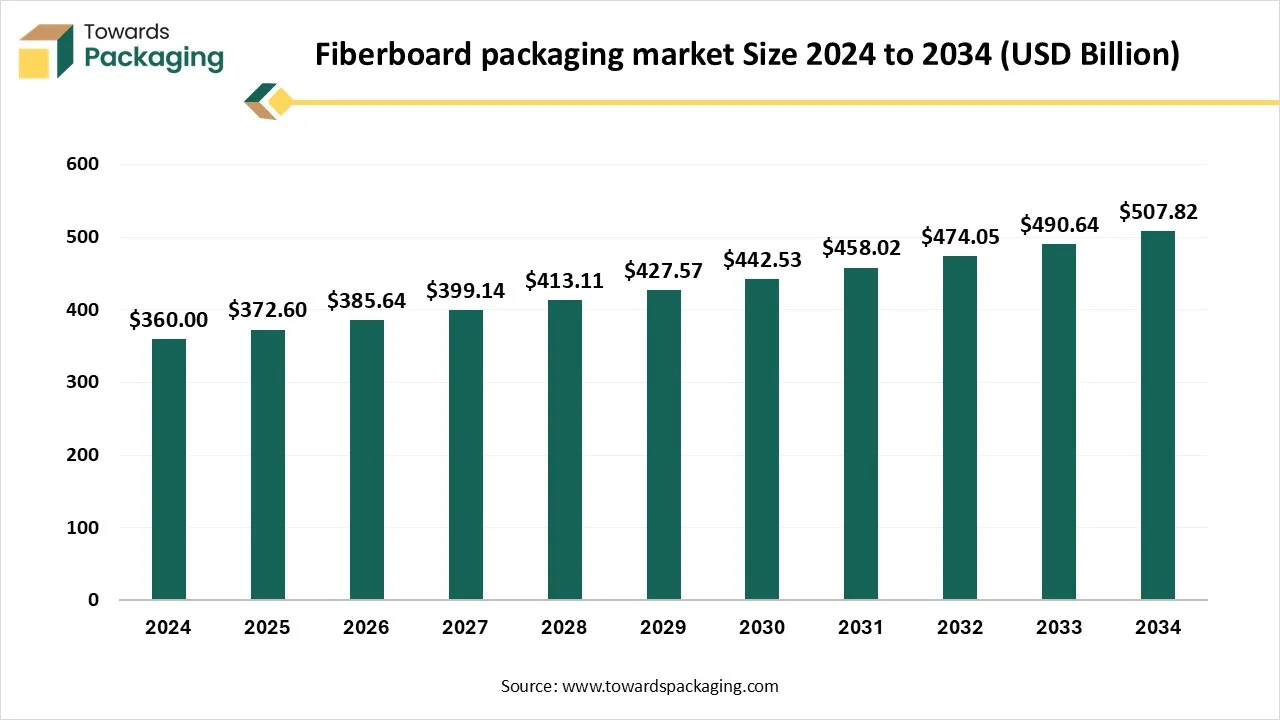

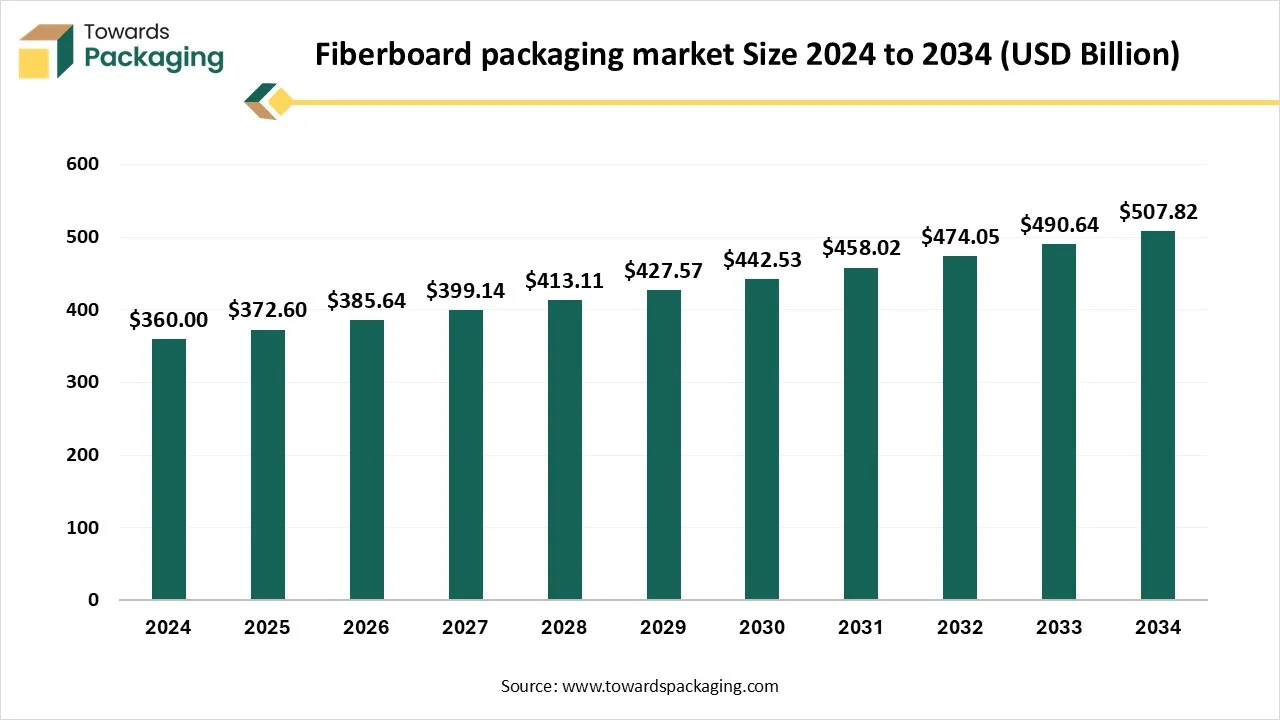

The fiberboard packaging market is projected to reach USD 525.59 billion by 2035, expanding from USD 385.64 billion in 2026, at an annual growth rate of 3.5% during the forecast period from 2026 to 2035. Growing demand is driven by e-commerce penetration, rising focus on eco-friendly packaging, and regulatory support for sustainable materials. End users range from logistics and retail to healthcare and electronics industries, with the Asia Pacific dominating due to large-scale manufacturing and booming export activity.

Key Takeaways

- In terms of revenue, the market is valued at USD 385.64 billion in 2026.

- The market is predicted to reach USD 525.59 billion by 2035.

- Rapid growth at a CAGR of 3.5% will be officially experienced between 2025 and 2034.

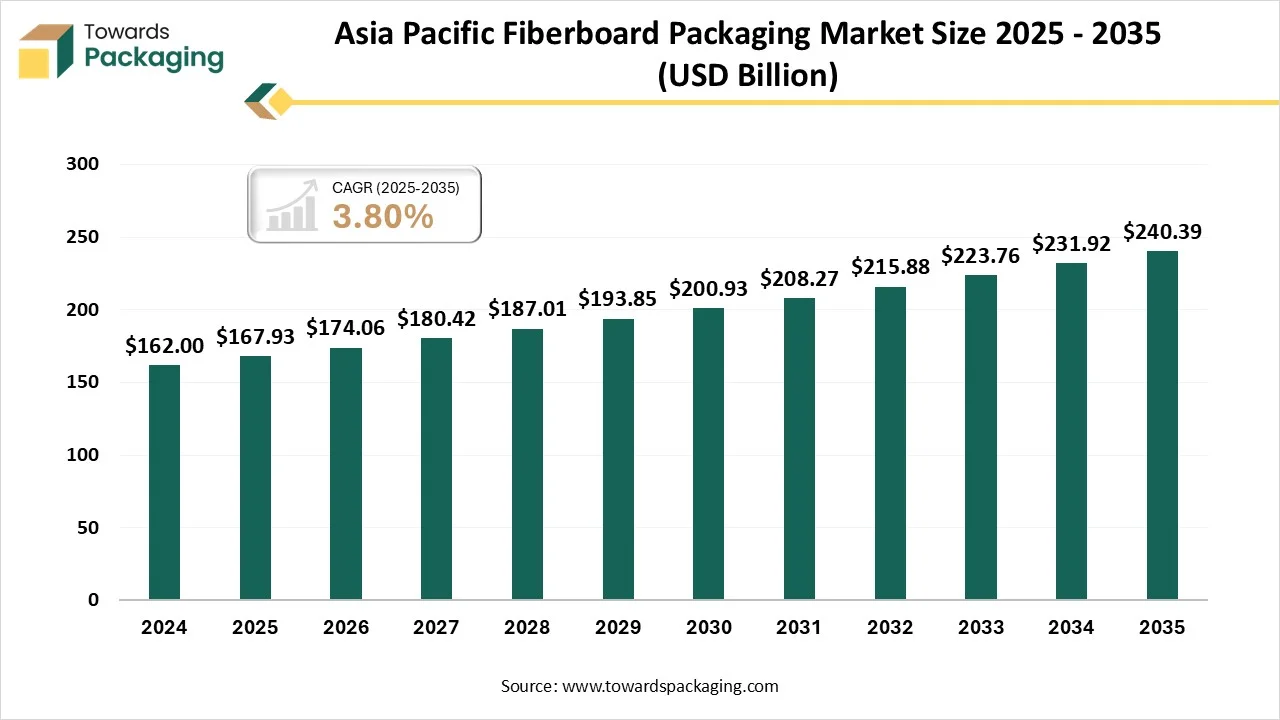

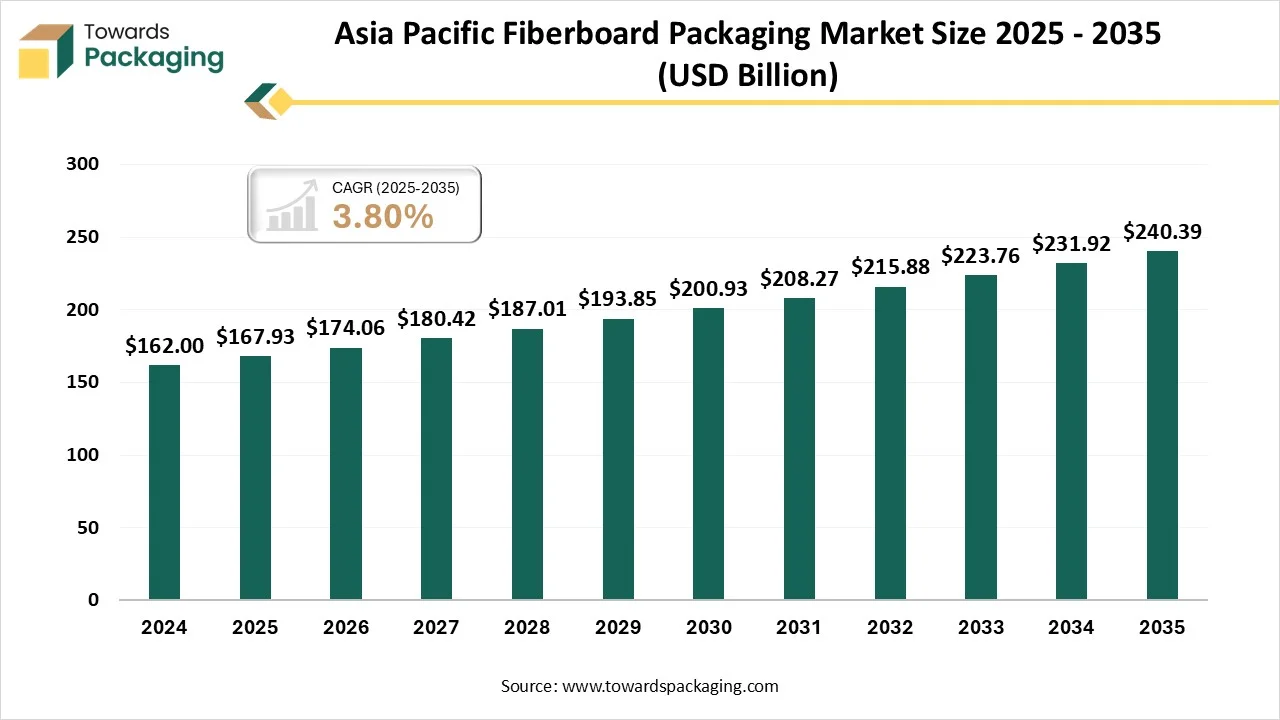

- By region, Asia Pacific dominated the market with the share of approximately 45% in 2024.

- By region, North America is expected to rise at a notable CAGR between 2025 and 2034.

- By product type, the corrugated single-wall segment contributed to the largest share of approximately 55% in 2024.

- By product type, the corrugated double-wall segment will rise at a notable CAGR between 2025 and 2034.

- By grade, the recycled fiberboard- Testliner segment contributed to the biggest share of approximately 50% in 2024.

- By grade, the virgin fiberboard -kraft paper segment will grow at a notable CAGR between 2025 and 2034.

- By packaging type, the boxes and cartons-slotted boxes segment has contributed to the largest share of approximately 60% in 2024.

- By packaging type, the folding cartons segment will grow at a notable CAGR between 2025 and 2034.

- By application, the food and beverages segment invested the largest share of approximately 35% in 2024.

- By application, the e-commerce and retail segment will grow at a notable CAGR between 2025 and 2034.

- By end-user, the manufacturers segment contributed to the biggest share of approximately 40% in 2024.

- By the end of 2034, e-commerce companies will grow at a notable CAGR between 2025 and 2034.

What is Fiberboard Packaging?

The fiberboard packaging market refers to the production and use of packaging materials made from fiberboard, a derivative of wood pulp that includes corrugated fiberboard, solid fiberboard, and composite structures. Widely adopted across food & beverage, consumer goods, e-commerce, and industrial applications, fiberboard packaging provides strength, flexibility, and recyclability, making it a sustainable alternative to plastics. Its lightweight structure lowers transportation costs, while customization options such as printing and lamination enhance brand visibility.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 372.6 Billion |

| Projected Market Size in 2034 |

USD 507.82 Billion |

| CAGR (2025 - 2034) |

3.5% |

| Leading Region |

Asia Pacific |

| Market Segmentation |

By Product Type, By Grade, By Packaging Type, By Application, By End User and By Region |

| Top Key Players |

Graphic Packaging International, Smurfit Kappa Group plc, WestRock Company, International Paper Company, Mondi Group, DS Smith plc, Packaging Corporation of America (PCA), Nine Dragons |

Emerging Trends in the Fiberboard Packaging Market

- Sustainability Remains Initial: We all have become familiar with finding eco-friendly packaging, be it the parcel in which products are sealed or the paper bag in which we buy our groceries. As user choice for brands displaying eco-conscious efforts develops, the brands are also making their best efforts to align with customers’ needs and demands.

- E-commerce-centric packaging: users today choose the ease of ordering a product within a few clicks and receiving it directly at their doorstep. The prediction is that the products must be served in an advantageous state. E-commerce businesses are discovering the options of water-resistant packaging, box patterns that are convenient to assemble, and secure logistics.

- Advanced Digital Printing: Technologically high-level digital printing has already made statements in 2024. But this year, the concentration has moved to developing the affordability and speed. More and more organisations are finding printed packaging solutions. Local trend in digital printing demands is the making of inventive, tailored designs, ready-to-display packaging, receipts, and short-run manufacturing.

- Anti-counterfeiting Measures: As worldwide markets continue to grow, the risk of counterfeit products expands. 2025 serves more exploration with holographic labels, product serialization, and tamper-evident seals. Brands witnessing the issues with fake items that jeopardize their reputation can expect to breathe a sigh of relief.

- Smart Interactive Packaging: Organizations are getting joyful with what they can do with intelligent technology. QR codes, augmented reality experience. Hence, more can be extracted from them in order to develop the communicative experience. Many studies disclose that users are willing to pay extra for the consumer experience as compared to the cost of the item.

- Trade regulations: As many of the industries are affected by trade regulations, it's essential that stay communicative and proactive for the packaging sector. Partnering across the supply chain, contributing inventive materials, and concentrating on compliance are all important steps for showing the direction for these regulatory challenges while using sustainable development.

- Paperization Trend: The concentration of companies is moving to fiber-based alternatives, aligning with sustainability goals, regulatory needs, and demands. Corrugated and kraft paper packaging not only aligns with the lower design choices of users but also creates packaging that is more attention-grabbing. This trend is ready to develop the molded fiber material that is biodegradable and durable.

Market Dynamics

Market Driver

Benefits Drives The Fiberboard Packaging Market

Fiberboard packaging is the most cost-effective packaging selection since it lowers the usage while lowering the waste. Lower machinery and labor costs are assisted by lower raw material prices and the potential for huge production. This kind of material is prevalently used for anything from transportation to packaging and is conveniently made available. They are heavily used in retail foundations to display materials to ship the containers while being cost-effective at the same time. They are transferring boxes, and warehouse solutions are instances of how it is used at home.

The advantages of corrugated cardboard are several, as they are the possibilities it serves. This material plays an important role in every aspect of your items, from delivery to buying. Corrugated fiberboard is the most economical and environmentally friendly option for your packaging, preventing goods from being damaged while also sending a strong message about the perfect suitability of this planet.

Market Restraint

Natural Factors Affect Fiberboard Packaging

Corrugated boxes can be impacted by the condition. They are not at all water-resistant, which means snow or rain can easily damage them. This is the big issue if anyone transports or keeps items outside. These types of boxes can track normal shipping loads but are not rigid under heavy pressure. This could cause them to crumble or fall. It's important to analyze if your items are too heavy for these boxes. Corrugated boxes are not reusable, just like plastic or metal. These points that one demands to buy more frequently can increase costs. Businesses might appear for other choices that can be used several times.

Market Opportunities

Main Ingredient Are The Upcoming Growth In Fiberboard Packaging Market

Wood Pulp is the key material used in the making of the corrugated packaging that can be produced from used newspapers and leftover substances from different sectors. The fact that these boxes are being made from recycled materials, which are hig0hly eco-friendly and are a reliable option for any organisation. Producers of this packaging can reuse their residual waste to develop unique boxes. As wood pulp is the organic integration of the corrugated boxes, it is conveniently decomposed when exposed to oxygen and moisture in the surrounding environment.

The procedure of its decomposition generally takes fewer days to complete, and the perfect space is where less toxin is generated during this period. This biodegradable nature makes them the best option for the ecosystem as compared to plastic packaging. Furthermore, the pivotal reason for ocean acidification is the sector that regularly releases its waste into these water bodies. Its outcomes in lowering the carbonate make the survival of marine organisms challenging. So, the accurate solution to tackle this problem is to increase the usage of corrugated fiberboard boxes.

VTT Technical Research Centre of Finland, in partnership with Finnish industrial partners and Aalto University has created the latest technology for making the cardboard in a different continuous procedure to make reel–to-reel origami -inspired patterns and designs for fibre-based packaging materials.

How is Artificial Intelligence Being used in the Fiberboard Packaging Market?

Research and development and invention are the main drivers for development in the packaging and paper sector, particularly given the worldwide concentration on sustainability and a movement to green materials. Feedbacks believe that generative AI can surely develop the Research and Development productivity by helping every stage of the R&D life cycle, assisting organisations in making the latest ideas with the help of intellectual property (IP) and patient analysis, serving customer analysis, making personalization options, growing the idea-to-imagine procedure, and optimizing field-testing response.

- From a complete landscape, Gen Ai is predicted to develop competence across all main cost drivers, feedbacks believe it will assist in streamlining the supply chain and production procedure, which optimizes the acquisition of raw materials, and automate the assistance functions.

Product Type Insights

How Did The Corrugated Single-Wall Segment Dominate The Fiberboard Packaging Market?

The corrugated-single wall segment dominated the fiberboard packaging in 2024, as single-wall corrugated boxes are one of the most prevalent kinds of packaging utilised in industries globally. These boxes have a single layer of fluted paper, which is placed between two flat linerboards. The pattern delivers the boxes a lightweight pattern while serving enough power for carrying and transporting different products. Single-wall boxes are specifically used for the transportation of non-sensitive items that do not need full security. Instances of items generally packaged in single-wall corrugated boxes include books, clothing, non-breakable items, and small electronics, too. They serve as a cost-effective and smooth solution for general storage and shipping.

The corrugated double-wall segment is predicted to be the fastest in the market during the forecast period. Double-wall corrugated fiberboard boxes are a rigid, more reliable alternative to single-wall containers, which are crafted for bulkier, heavier, and more sensitive products. These boxes consist of two surfaces of fluted paper classified by the three linerboards. The extra fluted surface in a double-wall box develops its power, serving superior protection against external pressure that affects the rough handling. The double-wall construction serves the main platform when it comes to a huge transit period, more frequent carrying, or adaptation to changing surrounding conditions.

Grade Insights

How Has The Recycled Fiberboard-Testliner Segment Dominated The Fiberboard Packaging Market?

The recycled fiberboard-testliner segment has dominated the fiberboard packaging market in 2024, as testliners are strips of fiberboard that are assembled to make the cells or compartments within a box. These cells are utilised to classify and prevent individual items during shipping, such as glass containers, sensitive items, and bottles. By protecting products from meeting, each other, the recycled fiberboard testliners assist in lowering the risk of damage during logistics and transportation. They are important in ensuring that products arrive at their destination undamaged and intact, too.

The virgin paperboard -kraft paper segment is predicted to be the fastest-growing in the market during the forecast period. Kraft paper boxes are produced from kraft paper, which is a paperboard generated by the chemical pulping procedure known as the "kraft process”. This generates the unbleached and rigid yet eco-friendly packaging bulk, prevalently brown with an irregular pattern. They are 100% biodegradable, recyclable, and compostable. It's a natural wood pulp item that is not generally bleached or chemically refined, which makes it one of the most environmentally-friendly packaging materials.

Packaging type Insights

How Did The Boxes And Cartons -Slotted Boxes Segment Dominate The Fiberboard Packaging Market?

The boxes and cartons-slotted boxes segment dominated the market in 2024 as cardboard packaging points to packaging boxes and materials created from a thick and strong type of paper, a dependent material known as cardboard. Cardboard is an evergreen and widely used packaging material because of its strength, durability, and affordability. It is made of several layers of paper fibers, which are compressed together to make a strong and sturdy pattern and structure. As it comes in different forms, including cartons, boxes, inserts, and trays, it can be conveniently folded, cut, and shaped into various designs and sizes to suit particular packaging demands.

The carton box or cardboard box is a necessary packaging created from a single sheet of either corrugated fiberboard or paperboard. Carton boxes are utilised for packaging, which delivers goods to materials. Carton boxes are created from recycled paper, to make it strong, which is placed between two liners. The liners are generated by pressing moist fibers together from rags or wood and even grasses, which then dry to make flexible sheets.

The folding cartons segment is expected to be the fastest in the market during the forecast period. The folding carton packaging is created from paperboard and is crafted to be shaped. It is a famous selection for packaging suitable goods, pharmaceuticals, and food, too. Specifically, it is a lightweight yet reliable enough item during shipping and storage, too. Just like rigid boxes, folding cartons should be sealed, which lowers the storage and shipping costs, too. Folding cartons serve as a cost-effective solution for organisations that demand both affordability and quality. Since they are created from paperboard, they are usually less costly than strong packaging selections. Furthermore, folding carton packaging is generally tailored, allowing businesses to align with packaging for their brand touch, having printed designs, logos, and eco-friendly selections.

Application Insights

How Did The Food And Beverage Industry Segment Dominate The Fiberboard Packaging Market?

The food and beverage segment dominated the fiberboard packaging in 2024, as fiberboard is a versatile kind of protective packaging material. Their request stems from the fact that they are compostable, biodegradable, and recyclable. They are convenient to brand and personalise into various shapes and sizes, ensuring easy handling, transportation, and storage. Unfortunately, cardboard and paper don’t serve the same reliability, impact prevention, and transportation and storage as the other protective packaging materials. Initially, it came from renewable wood fibers; fiberboard is biodegradable and recyclable, as it serves branding possibilities and different designs, which are compatible with different shapes and finishes.

The E-commerce and retail segment is expected to be the fastest in the market during the forecast period. Corrugated cardboard boxes are the ideal choice for much of the sector. Cardboard is rigid, which does not require pouring the package’s weight, and is recyclable. For every sensitive or bulky product, double-walled cardboard serves retailers with an extra layer of power and protection. In some scenarios, items come in their own box, which is perfect for transportation. On the other hand, fiberboard packaging is created from surfaces of recycled paper, making it strong and lightweight. This means it is optimal for retail supply chains, serving reliable corrugated packaging options which protect products and lower the overall shipping costs too.

End-User Insights

How Did The Manufacturers Segment Dominate The Fiberboard Packaging Market?

The manufacturers segment has dominated the fiberboard packaging market in 2024 as Chemist Carl F. Dahl created the procedure of pulping wood, which was later utilized in the paper-making development. So a pulp mill is a manufacturing facility that generally uses large-scale processes to transform woodchips, timber, and other wood products into pulp using the kraft process. Then the fibres from any tree or plant can be utilised to make paper; hence, the power and quality of these fibers change among tree varieties.

So the goal of the pulping procedure is to classify the pattern of the fibre source into the fibres that are ready to be created into industrial pulp. Also, the filler supplies, such as clays and chalks, can be added, which encourages the complexity of the outcome product. Scaling, such as rosins, starch, and gums, can also be added at this platform, and ranging will affect the path ink feedback with the paper; the selection of evaluation is dependent upon the demanding usage of the paper.

The e-commerce companies segment are predicted to be the fastest-growing in the market during the forecast period. Several e-commerce stages transport millions of packages daily and depend on corrugated boxes for packaging. And the reason after this is that the corrugated boxes serve the ideal balance between cost-efficiency and reliability. The usage of corrugated boxes also creates a smooth workflow, along with gaining user commitment.

Also, the latest state of the corrugated boxes, particularly in the e-commerce scenario, is going perfectly, as they are transforming the go-to option for many brands for their items, in terms of storage and transportation. Their even patterns are cutting-edge, as they serve as a wanted extra layer for the product's security above all, as they are environmentally friendly, which means they are recyclable as well.

Regional Insights

How Has The Asia Pacific Dominated The Fiberboard Packaging Market?

Asia Pacific dominated the fiberboard packaging market in 2024, as fiberboard packaging in recent years is all about the presentation, smoothness, personalization, and sustainability, which are crucial priorities. As trends such as fit-to-product automated packaging solutions, advanced level digital printing, and retail-ready packaging gain attention, organizations investing in these services will be perfect, which are tracked to align with customer costs, retailer demands, and lower the negative surrounding impact.

As these inventions update the fiberboard sector, operating with a packaging partner that experiences growing technologies will serve as a competitive edge.

North America is predicted to be the fastest-growing in the market during the forecast period. In this region, fiberboard packaging is witnessing constant growth, driven by sustainability urges, regulatory pressure, and the bottom of e-commerce. Brands and retailers are moving towards molded fiber and fiberboard solutions as environmentally friendly alternatives to plastics, giving importance to recyclability and greater recycled content, too. Fiberboard packaging stays dominant for logistics and shipping, while molded fiber packaging is stretching in electronics, foodservice, and cosmetics due to its biodegradability and protective qualities, too.

UFP packaging is a loyal corrugated (fiberboard ) producer in Texas, Indiana, and soon in the Western United States, which generates different cost-effective packaging for cardboard solutions, including point-of-purchase displays, stock corrugated boxes, retail-ready packaging, and custom four-colour die-cutting packaging, and e-commerce shippers too.

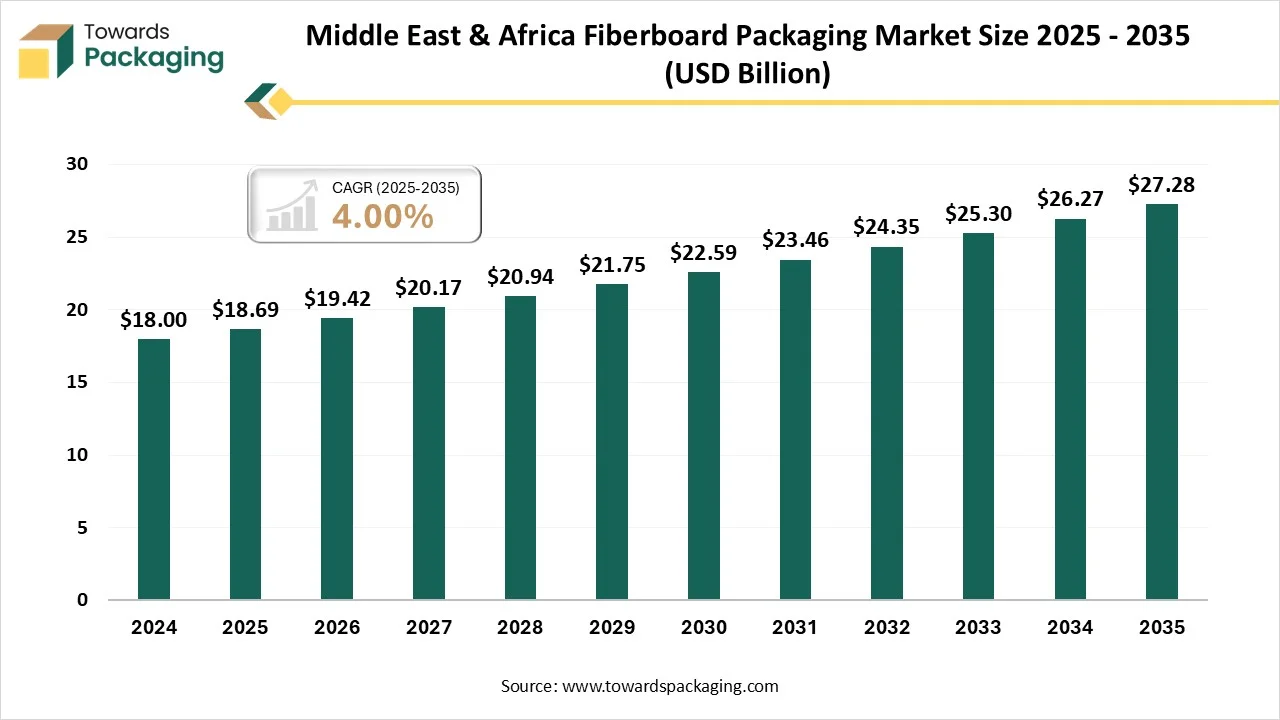

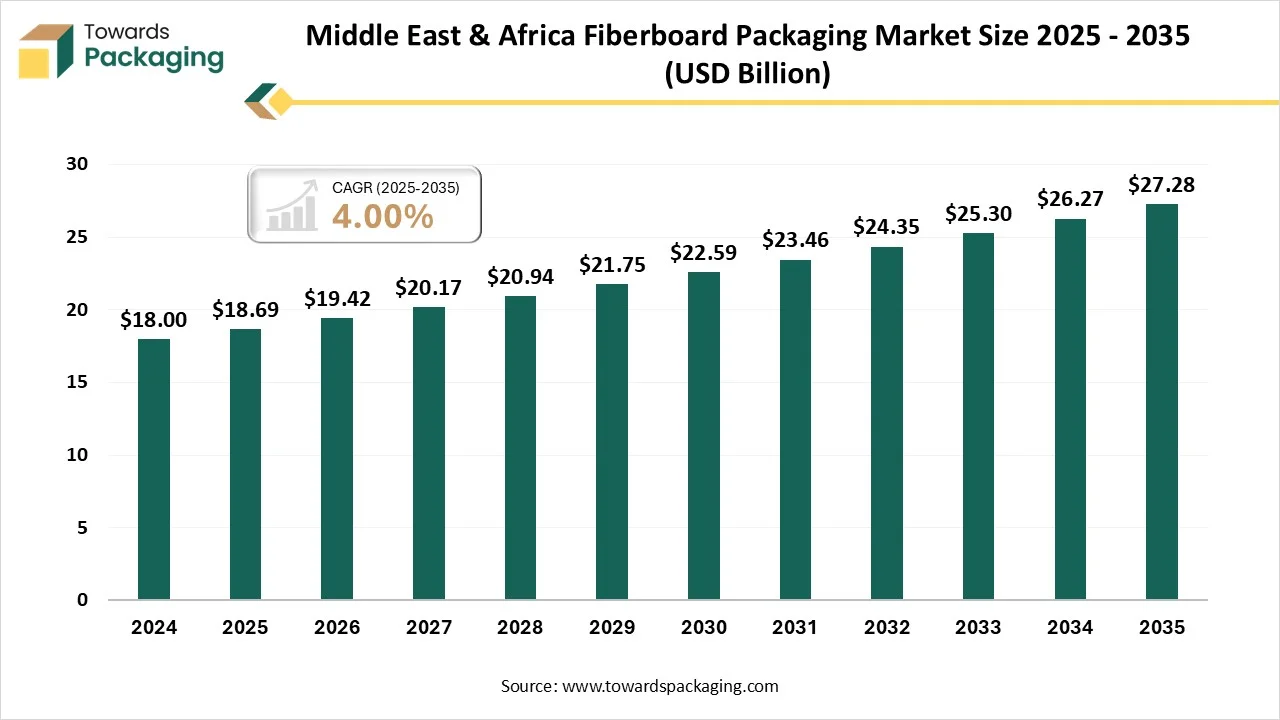

Middle East & Africa Fiberboard Packaging Market Size 2025 - 2035 (USD Billion)

Fiberboard Packaging Market - Value Chain Analysis

- Material Processing and Conversion: The material processing and conversion of fiberboard packaging is updated from raw cellulose pulp by primarily wood chips or recycled cardboard into a pulp, which is then utilized to make paper and linerboard sheets on the paper machines. These sheets are fed into a corrugator, in which the paper is shaped into wave-like flutes and linked with linerboard to create fiberboard packaging.

- Package Design and Prototyping: The package design and prototyping of fiberboard packaging involves a step-by-step procedure to create functional, thermal, and aesthetically pleasing shipping containers, utilizing materials like paperboard or corrugated fiberboard. Main steps include defining items and user demands, making a design concept that considers material characteristics, visual branding, and structural integrity.

- Logistics and Distribution: The logistics and distribution of fiberboard packaging include transporting and making fiberboard in a coordinated system to ensure that goods are protected, handled smoothly, and delivered to their destination on time and in perfect condition. This procedure needs reliable packaging, cost-effectiveness that is convenient to pack and assemble, use methods like just-in-time delivery, and accurate transportation, which serves third-party logistics.

Leading Companies in the Fiberboard Packaging Market

Tier 1

- Graphic Packaging International

- Smurfit Kappa Group plc

- WestRock Company

- International Paper Company

- Mondi Group

- DS Smith plc

- Packaging Corporation of America (PCA)

- Nine Dragons Paper (ND Paper / Nine Dragons)

- Stora Enso

- Oji Holdings Corporation

- Sonoco Products Company

- Amcor Plc

Tier 2

- Georgia-Pacific LLC

- Huhtamaki Oyj

- Cascades Inc.

- Veritiv Corporation

- UFP Industries, Inc.

- ND Paper (US operations / brand)

- Sappi Limited

Tier 3

- Kaindl

- Sonae Arauco

- Duratex

- Fle-Hex

- Creative Corrupack

- Grief, Inc.

Latest Announcements By Industry Leaders

- In September 2025, Morocco’s top leader in paper and corrugated cardboard packaging, named GPC Papier et Carton, as part of the Ynna Holding, has disclosed the MAD 500 Million investment to update its Mohammedia Website. This shift goal is to develop capacity, and create jobs in a sector experiencing the worldwide and local urge, and lastly to accept new technology.

- In January 2025, Saica Flex, which is a flexible packaging division of the Saica Group, participated in the Future Packaging Innovations and Empack event at the National Exhibition Centre (NEC) in Birmingham on February 12th and 13th, 2025.

- In August 2025, One of the overseeing private labels, named Radiance Living, and a contract manufacturer of personal care products and home, in partnership with Graphic Packaging International, has disclosed a category-first, which is an initial certified child-resistant, curbside-recyclable fiberboard package for laundry pods.

Recent Developments

- In September 2025, Koch-owned Georgia-Pacific had disclosed that it had entered an investment to merge with Anchor Packaging, a portfolio organization of private equity firm TJC. The organizations do not reveal financial details of the agreement.

- In May 2025, APP Group launched the Sinar Vanda Hi-Bite CIS, a sustainable fiberboard packaging solution that is crafted to align with the high-performance urges of smooth and eco-friendly conscious businesses. The items are personalized to assist the companies in achieving their aim while tracking the luxury packaging quality standards.

- In May 2025, Amazon was delighted to announce that it could implement high-level machines for creating custom-fit packaging across its European network, allowing the manufacturing of paper bags and custom-made cardboard boxes for user deliveries.

- In September 2025, Holmen Board and Paper, a Swedish paper producer, revealed the latest lightweight kraftliner, named Homen Elevate. It is characterized as the "lightest" in the market; the kraftliner comes in 83gsm,72gsm, and 92gsm options.

Segmentation of the Fiberboard Packaging Market

By Product Type

- Corrugated Fiberboard

- Single Wall

- Double Wall

- Triple Wall

- Solid Fiberboard

- Composite Fiberboard

- Others

By Grade

- Virgin Fiberboard

- Kraft Paper-based

- Bleached Paperboard

- Recycled Fiberboard

By Packaging Type

- Boxes & Cartons

- Slotted Boxes

- Rigid Boxes

- Folding Cartons

- Trays

- Inserts & Dividers

- Pallets & Bulk Containers

- Others

By Application

- Food & Beverages

- Consumer Goods

- Healthcare & Pharmaceuticals

- Electronics & Electricals

- Industrial Goods

- E-commerce & Retail

- Others

By End User

- Manufacturers

- Retailers & Wholesalers

- Logistics & Transportation Companies

- E-commerce Companies

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait