Healthcare and Laboratory Label Market Size, Share, Trends and Growth Forecast

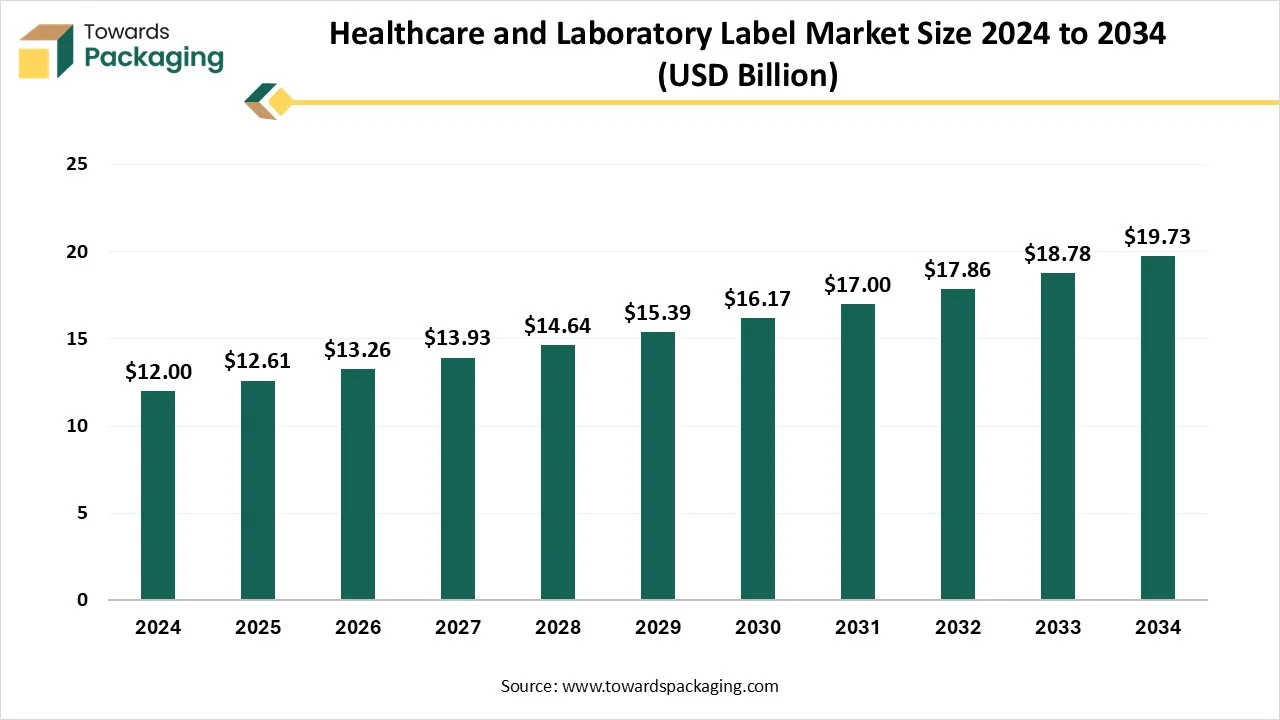

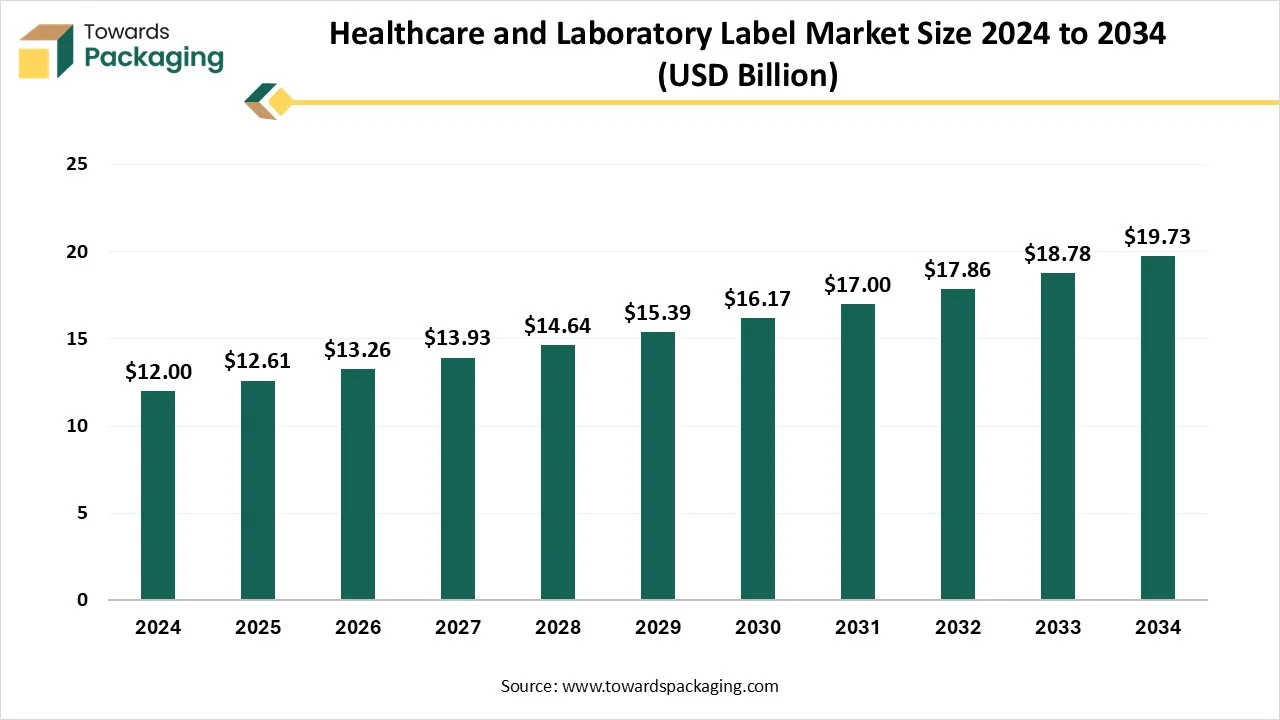

The healthcare and laboratory label market is predicted to expand from USD 13.26 billion in 2026 to USD 20.74 billion by 2035, growing at a CAGR of 5.10% during the forecast period from 2026 to 2035. The demand for healthcare and laboratory labels is being driven by rigid regulatory needs for patient safety, the complicated demands of accurate and precise information on drug dosage and usage, and the compulsion to track and check products throughout the supply chain.

Key Takeaways

- In terms of revenue, the market is valued at USD 12 Billion in 2024.

- The market is predicted to reach USD 19.73 Billion by the year 2034.

- Rapid growth at a CAGR of 5.10% will be officially experienced between 2025 and 2034.

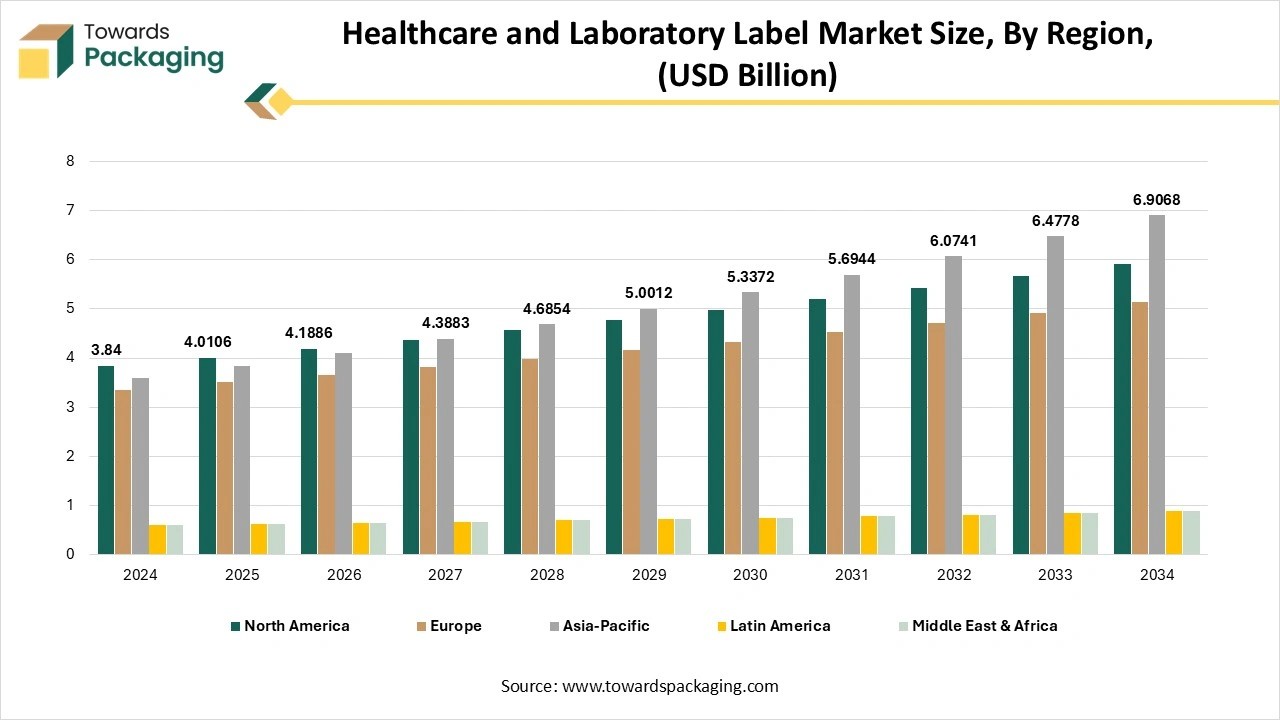

- By region, North America dominated the market in 2024.

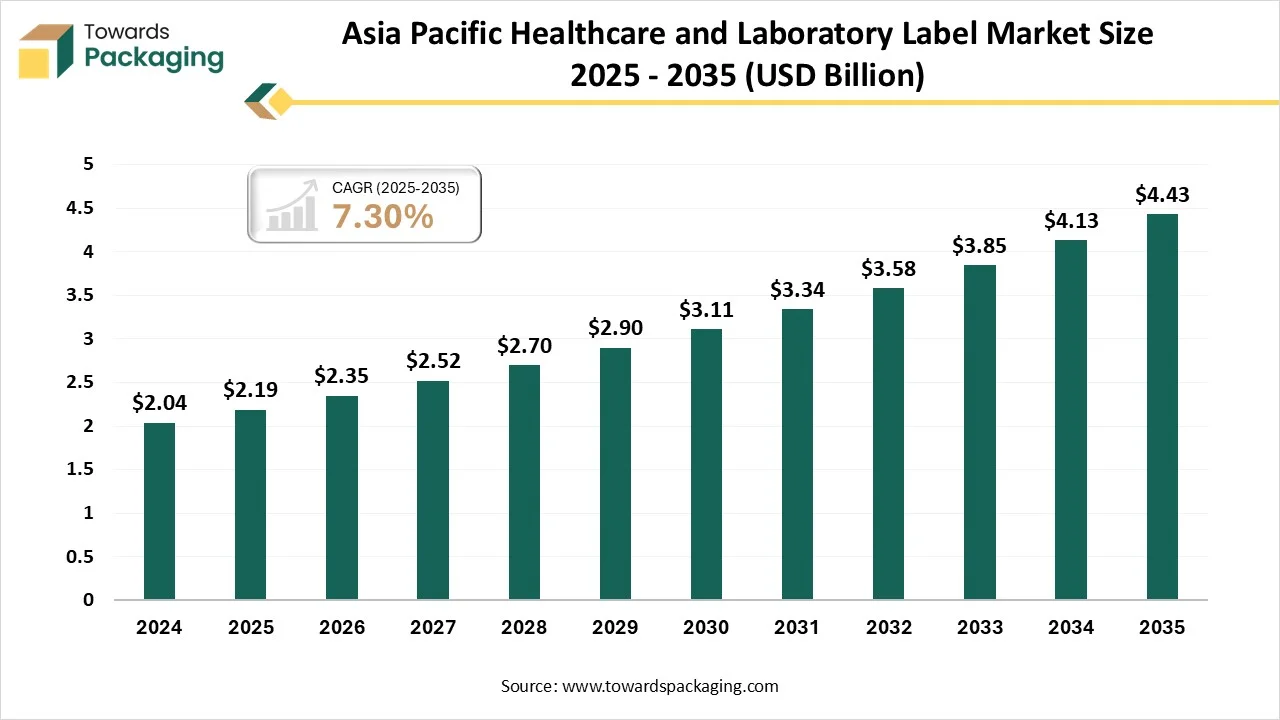

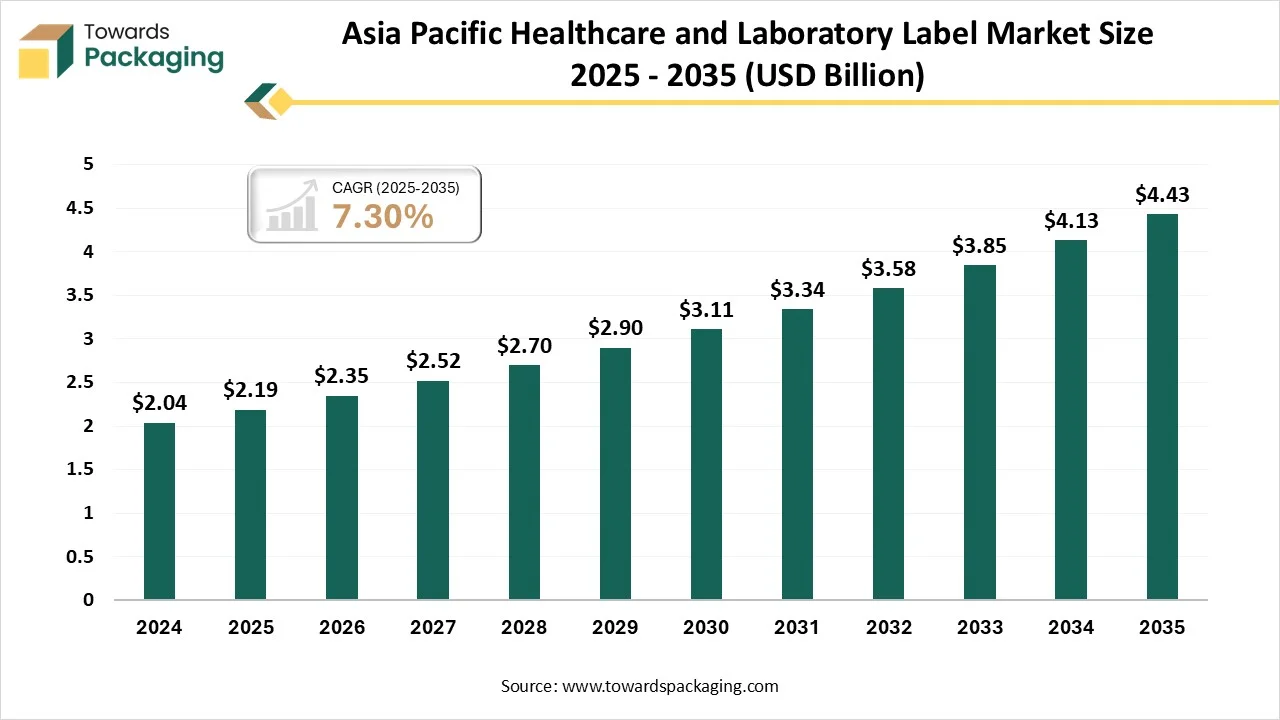

- By region, Asia Pacific is expected to rise at a notable CAGR between 2025 and 2034.

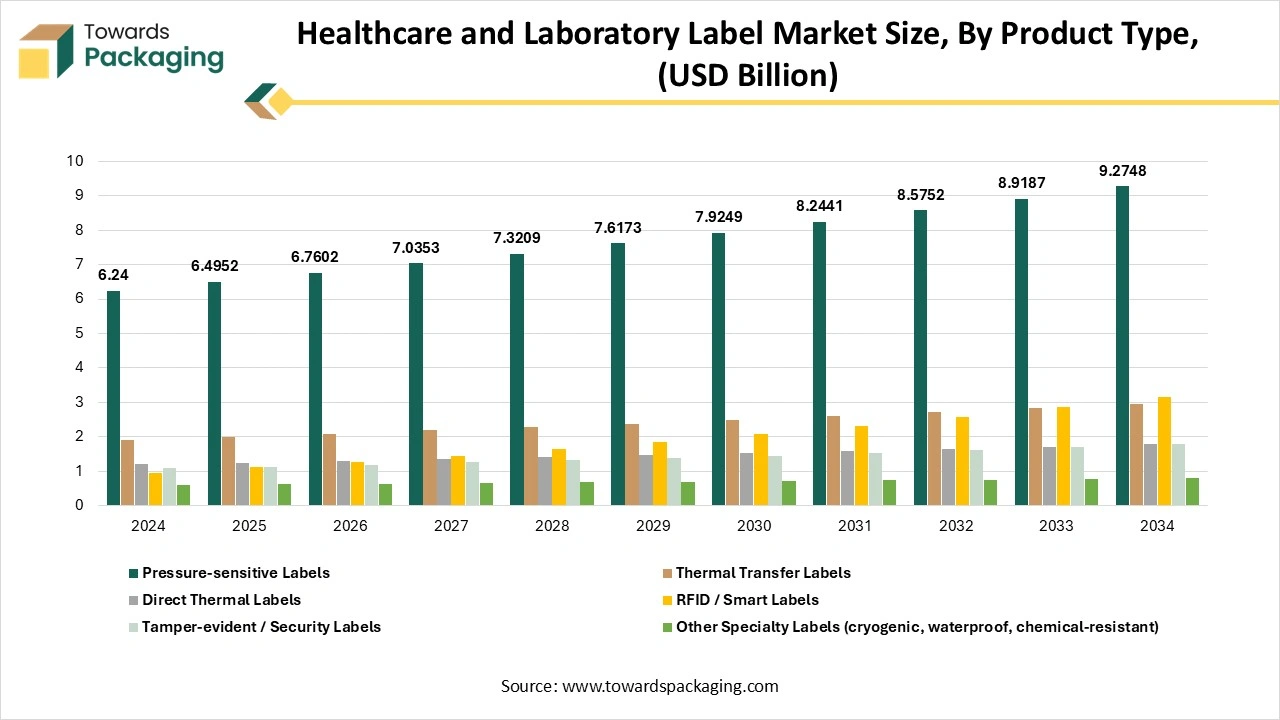

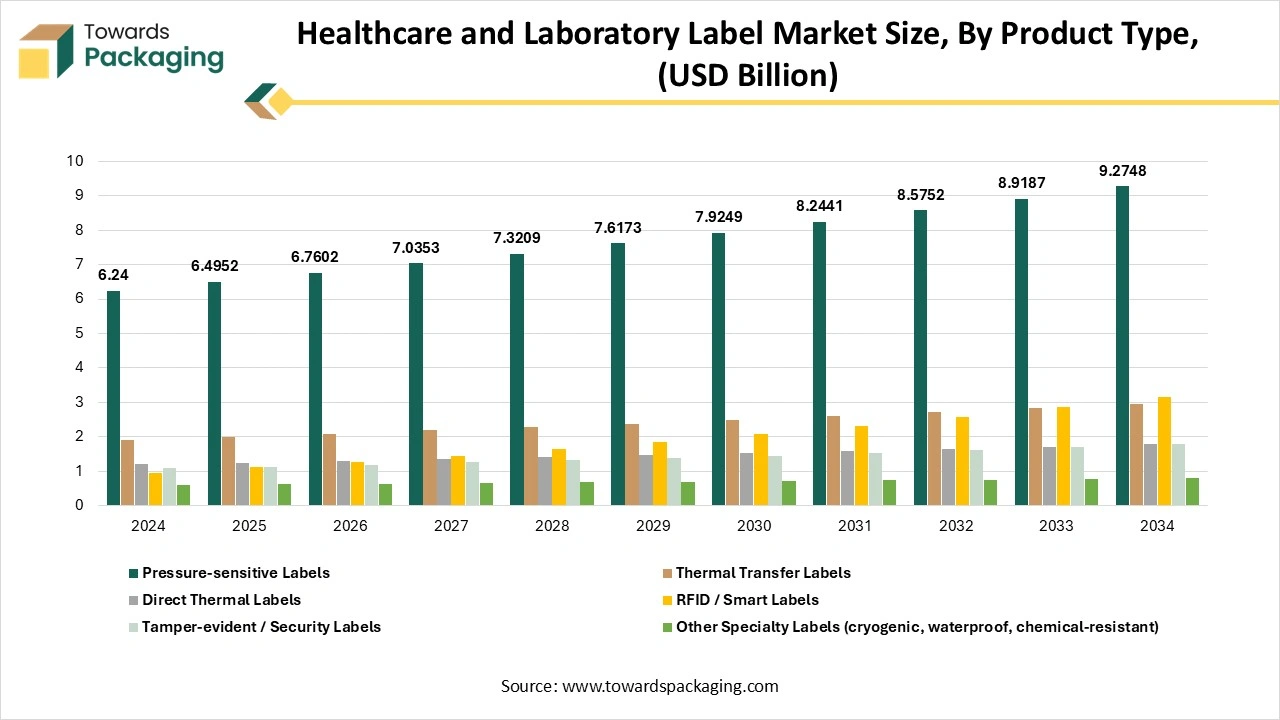

- By product type, pressure-sensitive labels segment contributed to the largest share in 2024.

- By product type, RFID/Smart Labels segment expected to grow at a notable CAGR between 2025 and 2034.

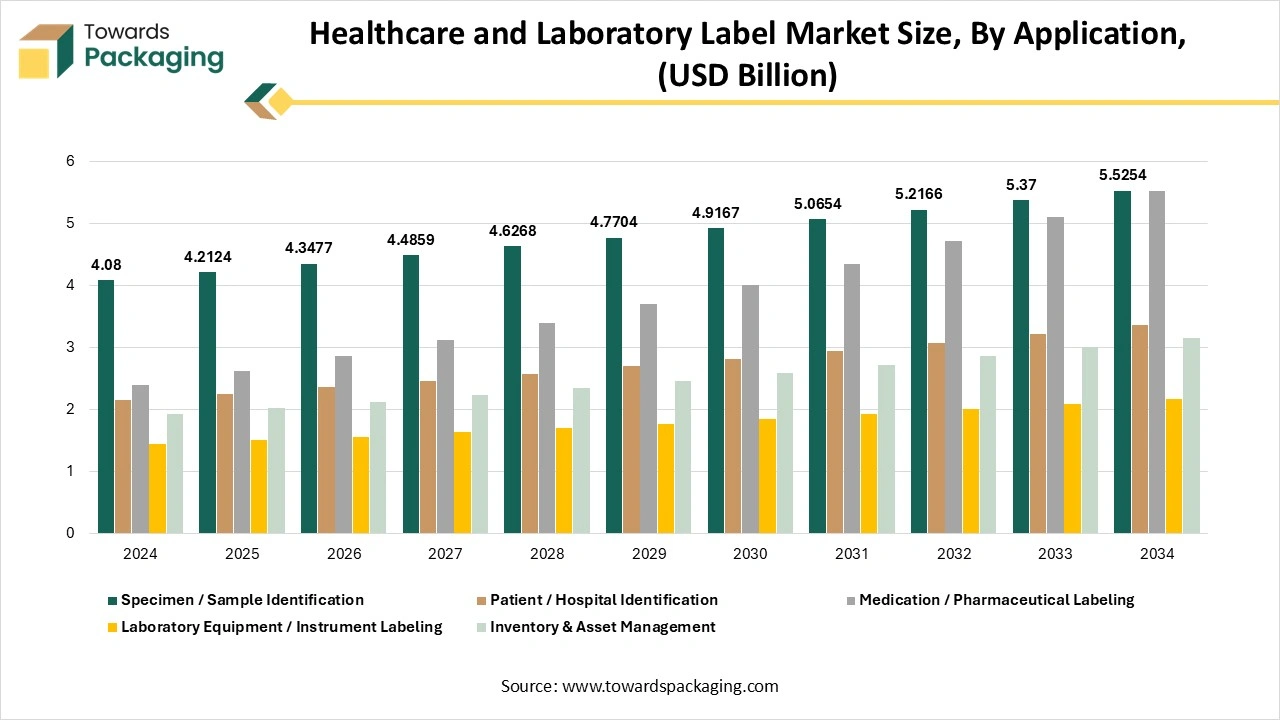

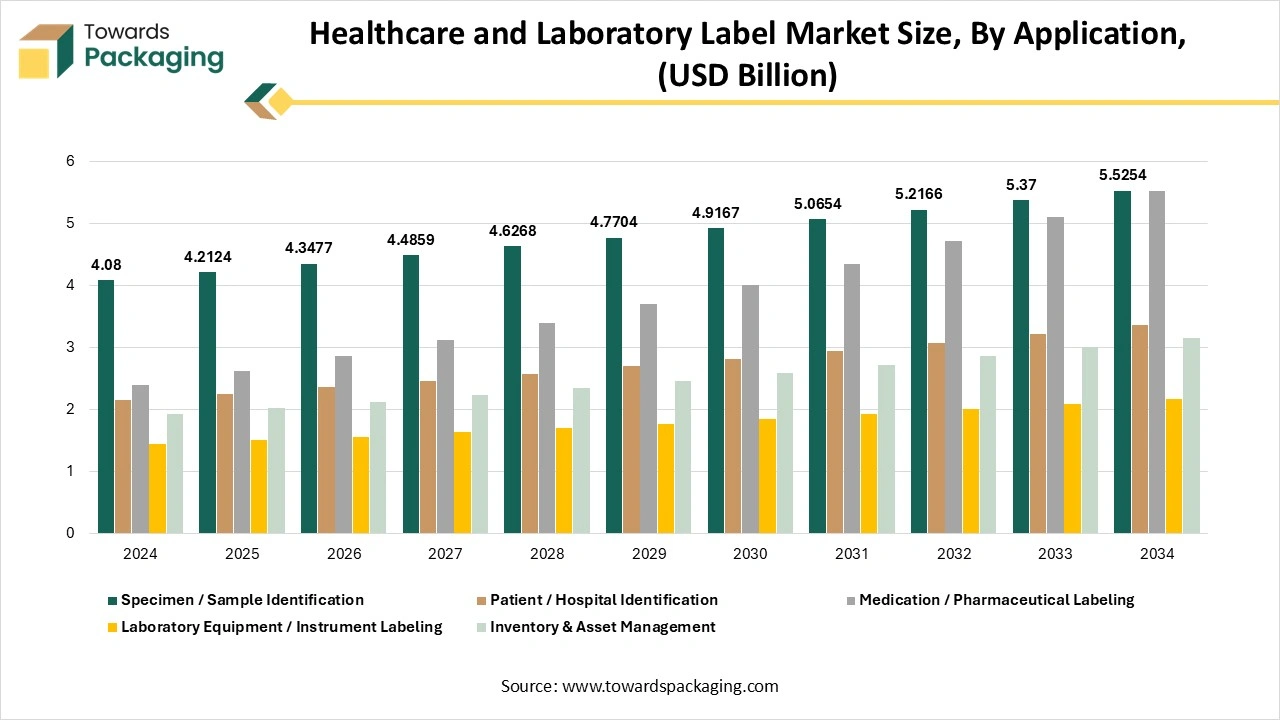

- By application, specimen/sample identification segment contributed to the largest share in 2024.

- By application, medication/pharmaceutical labelling segment expected to grow at a notable CAGR between 2025 and 2034.

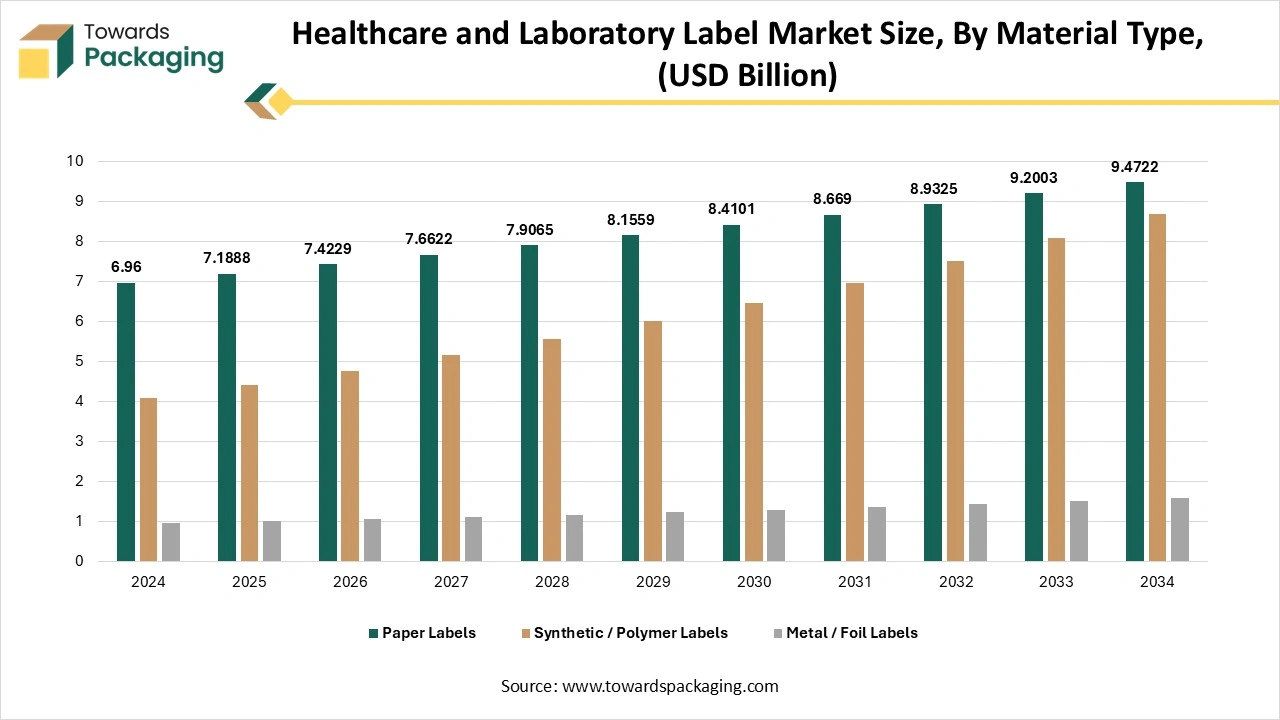

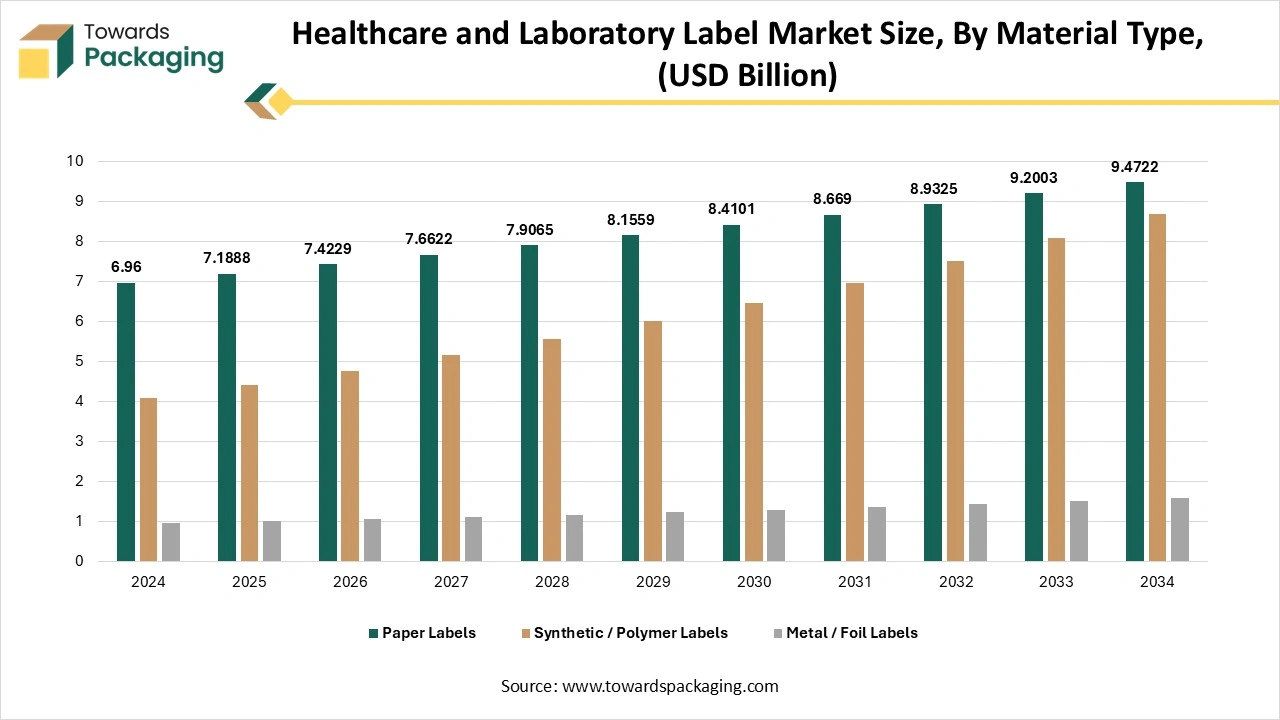

- By material type, paper labels segment contributed to the largest share in 2024.

- By material type, synthetic/polymer labels segment expected to grow at a notable CAGR between 2025 and 2034.

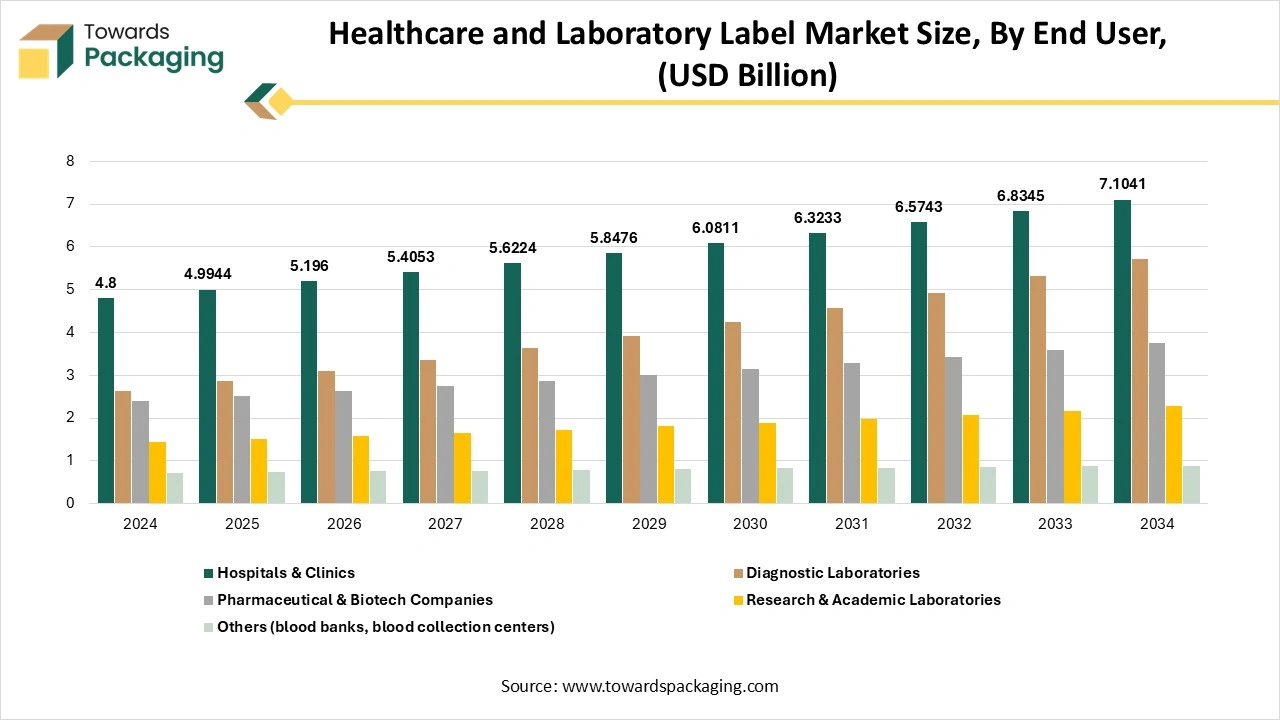

- By end-use industry, hospitals and clinics segment contributed to the largest share in 2024.

- By end-use industry, diagnostic laboratories segment expected to grow at a notable CAGR between 2025 and 2034.

Market Overview

The healthcare and laboratory label market refers to labels, tags, and printing solutions specifically designed for use in hospitals, clinical laboratories, diagnostics centers, pharmaceutical companies, and research facilities. These labels are used for specimen tracking, patient identification, medication labeling, sample management, and compliance with regulatory standards such as barcoding, RFID, and tamper-evident labeling. The market includes consumables, labeling systems, and software for label design, printing, and tracking.

Emerging Trends in the Healthcare and Laboratory Label Market

- Smart Labels Revolutionizing Patient Engagement: Smart Labels are updating how pharmaceutical products communicate with users and healthcare providers. These labels include high-level technologies like Near Field Communication (NFC) and Radio Frequency Identification (RFI) to serve real-time access to data. Patients can utilise the smart labels in order to obtain dosage reminders, access detailed product information, and manage medication usage via smartphones. As digital health becomes more common, smart labels will develop engagement and patient adherence.

- Sustainability in Labelling Practices: As users urge eco-friendly solutions, sustainability has become a complicated procedure for the pharmaceutical organizations. Organizations are shifting to biodegradable materials, waste-reduction practices, and water-based inks, too. Sustainable labelling aligns with the corporate social responsibility aim and grows brand reputation in an eco-friendly industry.

- Advanced label management systems: Worldwide expansion serves different challenges to pharmaceutical labelling, specifically while managing different products across different markets. The high-level management labels system serves as a centralized stage for making, updating, and controlling labels. These systems serve version control, template-based label making, and real-time updates to ensure compliance and consistency with regional regulations.

- AI-powered labelling solutions: Artificial Intelligence is updating the pharmaceutical sector, and its final effect on labelling automation is already being found. AI-powered tools can examine complicated Regulatory needs, optimize label design, and automate compliance checks, too. By optimising the AI, organizations can lower the human error, make sure accurate labelling across different markets and accelerate time-to-market. Incorporating AI into labelling workflows will be a paradigm shift for pharmaceutical companies whose goal is to achieve efficiency while tracking compliance.

- Large-Volume Change Automation: Pharmaceutical organizations often experience huge-scale label pattern updates due to Regulatory updates or product changes, too. Tracking these changes manually can be time-consuming and can lead to problems. Heavy-volume changes automation solutions streamline this procedure by allowing the bulk updates across multiple labels while tracking the compliance and accuracy. These kinds of machines and tools, while lowering the risks linked with manual intervention, are a complicated benefit in a market where accuracy is very important.

- Automation for streamlined operations: Pharmaceutical organizations must accept automation to update their labelling procedure. Automated systems are updating color management, prepress workflows, and lowering the manual intervention, and minimizing issues. Automation is widely used across the sector, allowing quick turnaround times and developing operational efficiency. Organisations that invest in an automated labelling solution will gain a competitive advantage while ensuring compliance with strong Regulatory standards.

Market Dynamics

Market Driver

Pharmaceutical Organizations Drive The Healthcare And Laboratory Label Industry At Great Speed

Healthcare and pharmaceutical packaging label reliability is important in pharma applications. Pharmaceutical labels have crucial dosage or safety information that demands to stay in place and be sensitive for the complete life of the product. From low migration label materials with low leachability elements to particular materials that can withstand demanding conditions, one label material specification director summarizes the main things we should consider to succeed in healthcare and pharmaceutical labelling.

On the other hand, the healthcare and pharmaceutical industry is rapidly including digital solutions, from virtual care to cloud EHR solutions, and white-label serving is the main gateway of this trend. In a white label model, a vendor serves a complete built c, protecting the healthcare IT platform that can be rebranded by itself.

Market Restraint

Mislabelling Leads To Problems Within The Healthcare And Laboratory Label Market

One of the biggest challenges in healthcare is the mislabelling or misunderstanding of prescription labels, which can lead to complicated circumstances like hospitalization or injury. This problem is particularly concerning for patients with lower health literacy, who may struggle to comprehend the aim of their medication or understand drug communications, specifically while using different prescriptions. Smooth labelling in pharmaceutical geos far beyond the description on the physical bottle. It includes the warnings, prescribing details, cautionary statements, and adverse effects, too, which must be cross-checked once by patients. Apart from this, several people trust their doctor's prescription completely without completely engaging with the informational inserts served by pharmacies, which points to a lack of awareness and potential risks.

Market Opportunity

Advanced Level Technology Is The Future Of The Healthcare And Laboratory Label Market

The future of pharmaceutical labelling is likely to be encouraged by technological growth. Digital labels and QR codes can provide patients and healthcare providers with convenient access to overall and up-to-date information. By scanning the QR code on the label, users can access in-depth information related to the drug, communicative content, and instructional videos. Too. This invention can develop patient adherence and education, too. As tailored medicine becomes more important, labelling will demand to grow to serve individualized information depending on the patient’s health status, genetic profile, and treatment history, too. Personalized labels can serve tailored dosing instructions, particular warnings, and potential drug communications, which contribute to more accurate and smooth treatment.

Product Type Insights

How Have Pressure-Sensitive Labels Segment Dominated The Healthcare And Laboratory Label Market?

The pressure-sensitive labels segment dominated the healthcare and laboratory label market in 2024, as they have officially captured 80% of the market. These tailored labels can be used on food and beverages, chemical containers, consumer goods, pharmaceutical bottles, and industrial enclosures, too. Pressure-sensitive labels are a multifarious label solution with no limits to potential, which can be applied to almost any surface. A pressure-sensitive label, also called a self-adhesive label, has adhesive on at least one side. These bespoke labels are used with light pressure, which makes them a convenient and straightforward label solution.

The RFID and smart labels segment is expected to be the fastest in the market during the forecast period. In pharmaceutical manufacturing, RFID plays an important role in automating the production procedure. By combining the RFID tags on machines and materials, the production line can run more smoothly, lowering the manual intervention and error rates, too. Automated data collection from RFID systems improves the quality control and regulatory compliance by tracking the precise records of every production step. RFID allows the making of smart medicine packaging that serves to provide important information to healthcare providers and patients, too. For example, RFID tags can showcase the medicine’s storage information, dosage step-by-step instructions, and expiration date too. Such smart packaging solutions improve patient adherence to prescribed treatments, develop healthcare solutions, and lower medication errors.

Application Insights

How Has The Specimen/Sample Detection Segment Dominated The Healthcare And Laboratory Label Market?

The specimen/sample identification detection segment has dominated the healthcare and laboratory label market in 2024, as its main objective of accurate specimen labelling and identification is to create particulars that the specimen is connected to the accurate patient. Precise patient identification is important for providing accurate treatment to the correct patient at the correct time. For the purpose of laboratory testing, this counts the precise labelling of patient samples with required information, such as the patient name, medical record number, date of birth, and the date and time of collection.

The probity of the specimen is important for obtaining precise and reliable EST results. Perfect specimen labelling and identification include tracking the integrity of the sample in different ways.

The medication/pharmaceutical labelling segment is predicted to be the fastest in the market during the forecast period. The pharmaceutical labelling, also called prescription labelling or drug labelling, points to printed, written, or graphic information showcased on the containers of their containers, as well as the accompanying materials. The initial aim of drug labelling is to examine the contents of the drug and provide instructions and warnings which serve its storage, instructions, and disposal too.

The growth of drug labelling has advanced with the passing time due to the urge for fair trade practices, public health awareness, and identification of toxins. Various countries and regions have fluctuating requirements like drug labelling, encouraged by their healthcare systems, commercial considerations, and experiences regarding the drugs.

The pharmaceutical labels are found on any retail item that has the drug in it. This counts the products such as the prescription drugs and over-the-counter drugs, too. Several other products fall into the pharmaceutical labelling needs and demands. For instance, rubbing alcohol, anti-cavity toothpaste, sunscreen containing cosmetics, and hand sanitizer, too.

Material Type Insights

How Did The Paper Labels Segment Dominate The Healthcare And Laboratory Label Market?

The paper labels segment dominated the healthcare and laboratory label market in 2024, as paper labels play a main role in the healthcare and laboratory labelling sector, as they serve a cost-effective, eco-friendly, and versatile solution for product identification, regulatory compliance, and tracking too. These labels are widely used on pharmaceutical bottles, lab samples, blood bags, test tubes, and medical device packaging, too, which indirectly ensure proper identification and traceability throughout the supply chain. Paper labels can be covered or uncovered, pressure-sensitive, and often integrated with advanced printing technologies like barcodes and QR codes for digital tracking.

The synthetic /polymer labels segment is predicted to be the fastest in the market during the forecast period. Synthetic labels, also known as film labels, are being created from materials such as polypropylene (PP), polyethylene (PE), and polyester. These types of materials serve an evergreen and strong labelling solution, particularly for products that need developed resilience and opposition to surrounding elements. They are frequently utilised in industries where synthetic labels can witness rough conditions. This counts paints, chemicals, automotive parts, cleaning products, and outdoor machines, too.They are also prevalent in the transport and logistics industries due to their longevity and resilience.

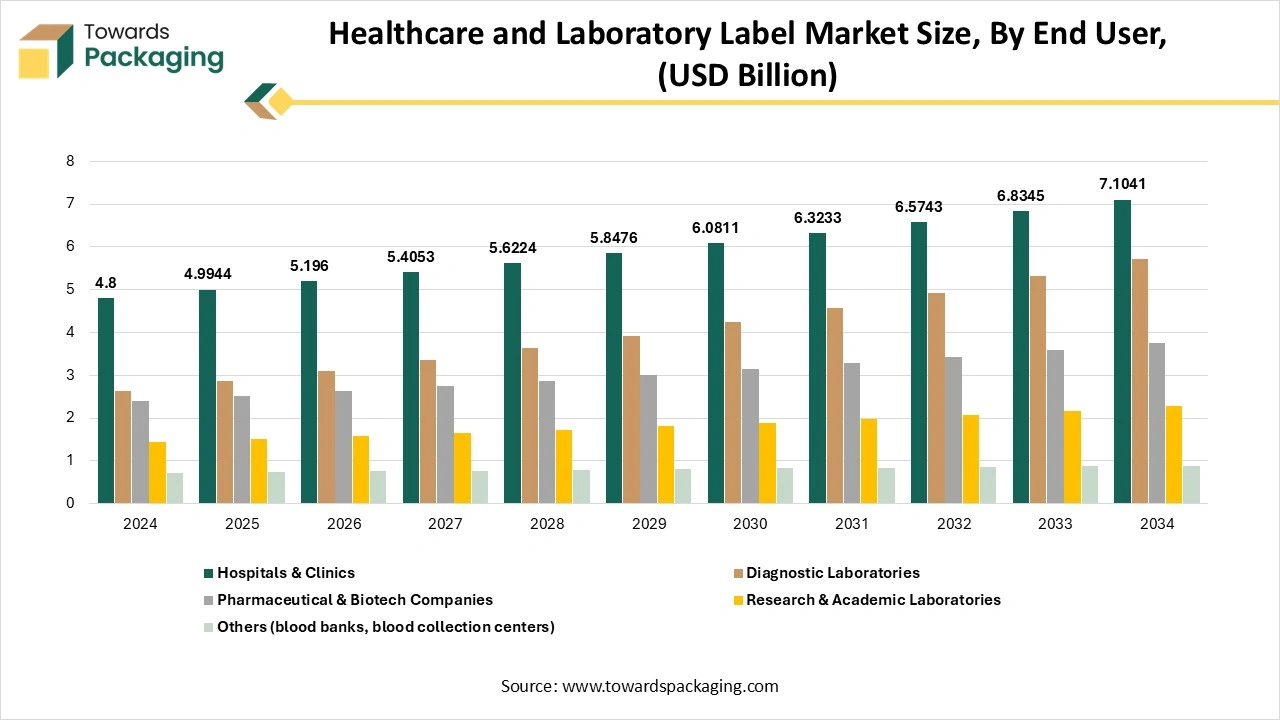

End-Use Industry Insights

How Did The Hospitals And Clinics Segment Dominate The Healthcare And Laboratory Label Market?

The hospitals and clinics segment dominated the healthcare and laboratory label market in 2024, as printing is important in healthcare, assisting patient identification, clear documentation, and patient identification. It directly affects patient safety, compliance, and operational smoothness, too, which makes it an important element of daily workflows.

Hospital and clinic facilities rely on labelling and printing systems with a huge range of tasks that are crucial to their day-to-day operations. Printed wristbands track patients and make sure the correct treatments, procedures, and prescriptions are given to them. Labels on test samples and medication vials protect precision in diagnosis. Furthermore, payment receipts and invoices assist in simplified financial transactions, providing clarity to both administrative teams and patients.

The diagnostic laboratories segment is expected to be the fastest in the market during the forecast period. Diagnostic laboratories have several urges that go far beyond office settings. Water baths, extreme temperatures, constant hustle, and harsh chemicals of inventory controlling and testing are putting all codes on the labelling systems to examine them. This is the reason why laboratory labels are so essential. These labels make a personalized procedure of predicting solutions, samples, and machines, which allows labs to avoid guesswork, revamp day-to-day tasks, and address human issues, too.

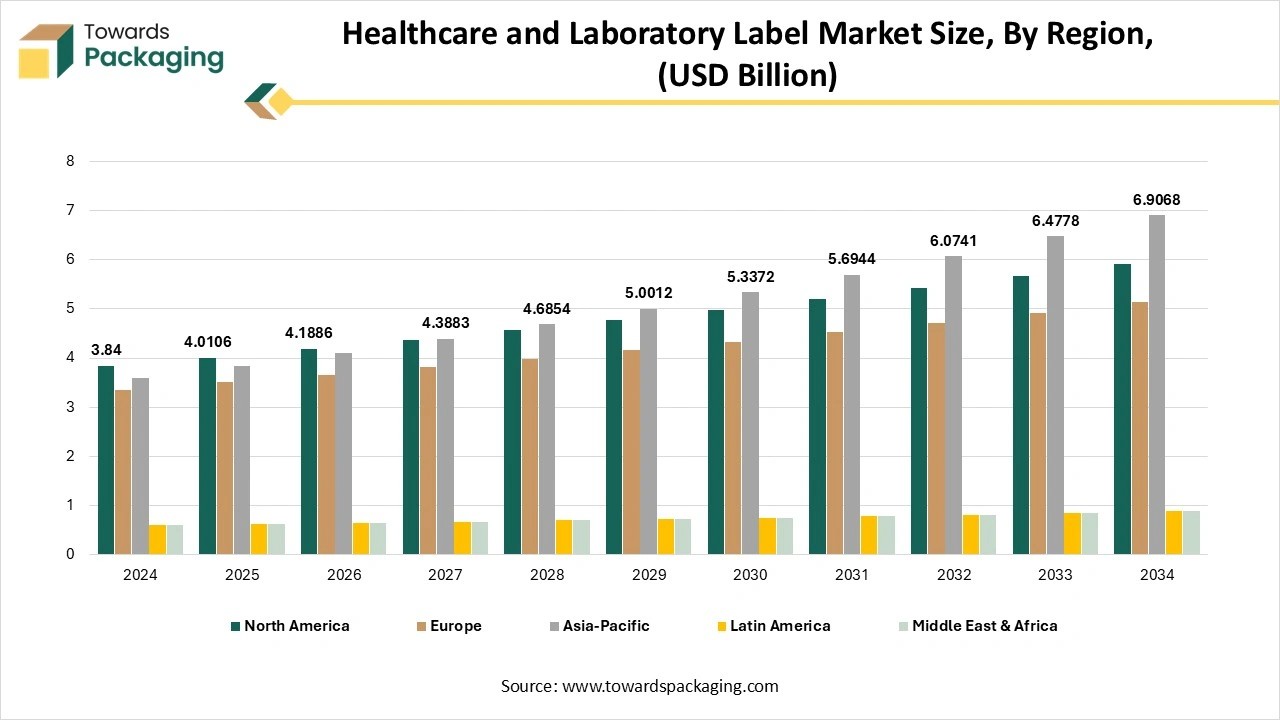

Regional Insights

How Did The North American Dominate The Healthcare And Laboratory Label Market?

North America dominated the healthcare and laboratory label market in 2024 as the healthcare and laboratory label in North America have huge demand for producers, medical machine imports and exports, which serve different safety policymakers. So the United States of America and North America need premarket submissions to showcase that the devices meet all useful demands and needs. Establishments that need and serve medical devices have healthcare and laboratory labeling that follow the FDA’s procedure of scientific and regulatory updates to check the adherence and safety of particular devices. Foreign producers should designate a United States agent who will be completely responsible for helping the FDA while talking with the foreign establishments. Also, Original Equipment Manufacturers are responsible for labelling the machine to assist in the safe operation. In several ways, a labelling program stretches the other corporate practices, such as quality assurance, safety management, and product development, too, of healthcare and laboratory labels in the North America region.

The urge for the healthcare and laboratory label market in Canada is growing because of health systems and regulatory authorities that encourage digital updation. There is a rising main framework for allowing the exchange of healthcare data named Fast Healthcare Interoperability Resources (FHIR), which includes the product labelling information. FHIR is a sophisticated way of exchanging healthcare information electronically. It is crafted to develop interoperability and coordinate the smooth data that is shared across various healthcare machines. It enables the productive and safe exchange of administrative and clinical data.

Asia Pacific is predicted to be the fastest-growing in the market during the forecast period. The demand in this region is growing rapidly due to the expanding pharmaceutical industry, growing diagnostic laboratories, and increasing focus on patient safety and regulatory compliance. Countries such as China, India, and Japan are leading this development, driven by large-scale medicine manufacturing and clinical research activities. The demand for durable, chemical-resistant, and temperature labels is increasing, too, particularly in blood banks, pharmaceutical packaging, and pathology labs.

Healthcare and Laboratory Label Market Value Chain Analysis

- Material Processing and Conversion: Material processing and conversion for healthcare and laboratory label counts resistant materials like personalised adhesives and polymers, choosing durable and transforming them into printable labels which can oppose toxic surroundings, chemicals, sterilisation, and extreme temperatures too. Conversions can also include the label formats, such as converting codes like NDC to Universal design, ensuring compliance with regulations and medical standards for precise tracking and identification.

- Package Design and Prototyping: Healthcare and Laboratory design affairs, because it delivers as the initial line of defence in making sure the efficacy and security of medical products. Accurately designed packaging prevents products from pollutants and damage during storage and transportation, protecting and integrating till they reach the end-users sector.

- Logistics and Distribution: The distribution and logistics of healthcare and laboratory label counts the personalised supply chain management to make sure labels are stored, handled correctly, and transported to track their integrity and functionality too. Main elements include real-time traceability for patient safety, temperature control for particular suppliers and labels, and the usage of compliant label solutions like polyolefin and polyester (PET), too.

Regulations & Compliance:

Necessary elements needed for Medical product Labels

Regulatory urges need that every medical product label showcase its serial number, an important identifier for machine tracking and safety, too. Compliance with each FDA standard in the European and United States regulations assists transparent labelling practices, which satisfy the medical and healthcare products regulatory agency, ensuring that the product’s starting and history are precisely documented.

Producers accept clear labelling measures to count the accurate product details, such as serial number, which aids in tracking the responsibility of medical equipment and devices too.

Healthcare and Laboratory Label Market Top Companies

Tier 1

- Avery Dennison Corporation

- CCL Industries Inc.

- Danaher Corporation (Cytiva / Labelling solutions)

- Zebra Technologies Corporation

- Honeywell International Inc.

- 3M Company

- Multi-Color Corporation (MCC)

- UPM Raflatac

Tier 2

- Brady Corporation

- International Paper Company

- SATO Holdings Corporation

- Omron Corporation

- Hitachi Printing Solutions

- Fortis Label Solutions

- Identiv, Inc.

- R.R. Donnelley (United Ad Label / UAL)

- Inovar Packaging

- PDC Healthcare

- Cardinal Health

Tier 3

- Labelon

- Primera Technology, Inc.

- LabelValue / LabelValue.com

- Watson Label Products

- LabTAG

- Shamrock Labels

- ID Images

- Coast Label

- United Ad Label (if considered separately from RRD)

- ABLT

- Chicago Tag & Label

- Taylor / T&L Graphic Systems

Latest Announcements By Industry Leader

- In January 2025, NVIDIA recently disclosed that the latest mergers will update the USD 10 trillion life sciences and healthcare sector by developing drug discovery, developing genomic research, and advanced-level healthcare services with the assistance of generative AI and agentic too.

- In November 2024, Matt Bolton, who is a director of worldwide clinical supply technology invention from Merck, and Peter Piron, who is a science and technology engineer from Johnson and Johnson Innovative Medicine, officially merged to update the pharmaceutical sector using digital display labels.

Recent Developments

- In August 2025, Oregon’s current independent, family-owned grocery store, Market of Choice, will stretch its private label offerings with the revelation of the latest supplement collection created exclusively for Market of Choice in collaboration with Oregon-owned and operated Highland Laboratories, which is a reliable supplement producer based in Mt. Angel, Oregon.

- In October 2024, CHAI Model Cards, which is a Coalition of health AI, created a high-level draft framework for how the assistance will be provided by Independent Assurance Labs and assist in standardizing the results of these labs, which is a kind of nutrition label and ingredient too.

- In January 2025, DYMO, which is a top supplier of inventive labelling and printing solutions and part of the Newell Brands Profile, and GA International, which is at the forefront in terms of exceptional Laboratory and industrial identification series, have revealed the crucial partnership that makes the high-quality cryogenic LabelWriter® label.

Segmentation of Healthcare and Laboratory Label Market

By Product Type

- Pressure-sensitive Labels

- Thermal Transfer Labels

- Direct Thermal Labels

- RFID / Smart Labels

- Tamper-evident / Security Labels

- Other Specialty Labels (cryogenic, waterproof, chemical-resistant)

- Dominant: Pressure-sensitive labels.

- Fastest-growing: RFID / smart labels.

By Application

- Specimen / Sample Identification

- Patient / Hospital Identification

- Medication / Pharmaceutical Labeling

- Laboratory Equipment / Instrument Labeling

- Inventory & Asset Management

- Dominant: Specimen/sample identification

- Fastest-growing: Medication / pharmaceutical labeling

By Material Type

- Paper Labels

- Synthetic / Polymer Labels

- Metal / Foil Labels

- Dominant: Paper labels

- Fastest-growing: Synthetic / polymer labels

By End-User

- Hospitals & Clinics

- Diagnostic Laboratories

- Pharmaceutical & Biotech Companies

- Research & Academic Laboratories

- Others (blood banks, blood collection centers)

- Dominant: Hospitals & clinics.

- Fastest-growing: Diagnostic laboratories

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait