The honeycomb cardboard market report delivers a complete, numbers-backed view of the industry, covering historical data and forecasts for market size, growth rates, and revenue up to 2034. It breaks down the market by product type, raw material, cell size, application, end-use industry, and region, with detailed coverage of North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The study also profiles key companies, maps the competitive landscape, examines the value chain from raw material suppliers to end users, and presents trade data, manufacturing footprints, and supplier information, supported by comprehensive statistical tables, charts, and segment-level metrics.

Honeycomb cardboard (also called honeycomb paperboard or honeycomb board) is a lightweight but strong packaging and structural material made of paper or cardboard layers arranged in a honeycomb structure. It gets its name from the hexagonal, beehive-like pattern in the core, which resembles a honeycomb. A central layer made up of hexagon-shaped cells (like a beehive). Outer layers (liners) have flat sheets (usually kraft paper or cardboard) bonded to the top and bottom of the core.

Rising demand from regulations & brands: Major companies like IKEA, Unilever, Amazon, Flipkart, and Lush are shifting away from plastic fillers toward honeycomb board due to regulatory mandates (such as the EU’s PPWR and India’s 2025 plastic rules) and corporate circular‑economy goals. Honeycomb cores require up to 60–70% less fiberboard than traditional corrugated alternatives while maintaining strength, helping reduce CO₂ emissions by up to ~35% per volume compared to expanded plastics. Innovations in bio‑based adhesives, antimicrobial coatings, and recyclable water‑based barrier chemistries are expanding uses even in humid or sensitive applications like produce or electronics.

AI integration can significantly enhance the honeycomb cardboard industry by optimizing manufacturing efficiency, reducing material waste, and enabling high-level customization. Through predictive analytics and real-time monitoring, AI can detect defects early in the production process, ensuring consistent quality while minimizing downtime. Machine learning algorithms can optimize cutting patterns and core-cell designs to maximize strength while using less material, reducing costs, and environmental impact. AI-driven robotics streamlines repetitive tasks such as folding, gluing, and packaging, increasing throughput and precision.

AI can analyze customer demand patterns and automatically adjust production schedules, helping manufacturers offer just-in-time delivery and personalized solutions. In design and prototyping, AI tools enable the rapid simulation of various honeycomb structures to meet diverse needs across industries such as automotive, electronics, and e-commerce. Overall, AI integration fosters a smarter, more sustainable, and responsive supply chain, positioning honeycomb cardboard as a high-performance, eco-friendly alternative to traditional packaging materials.

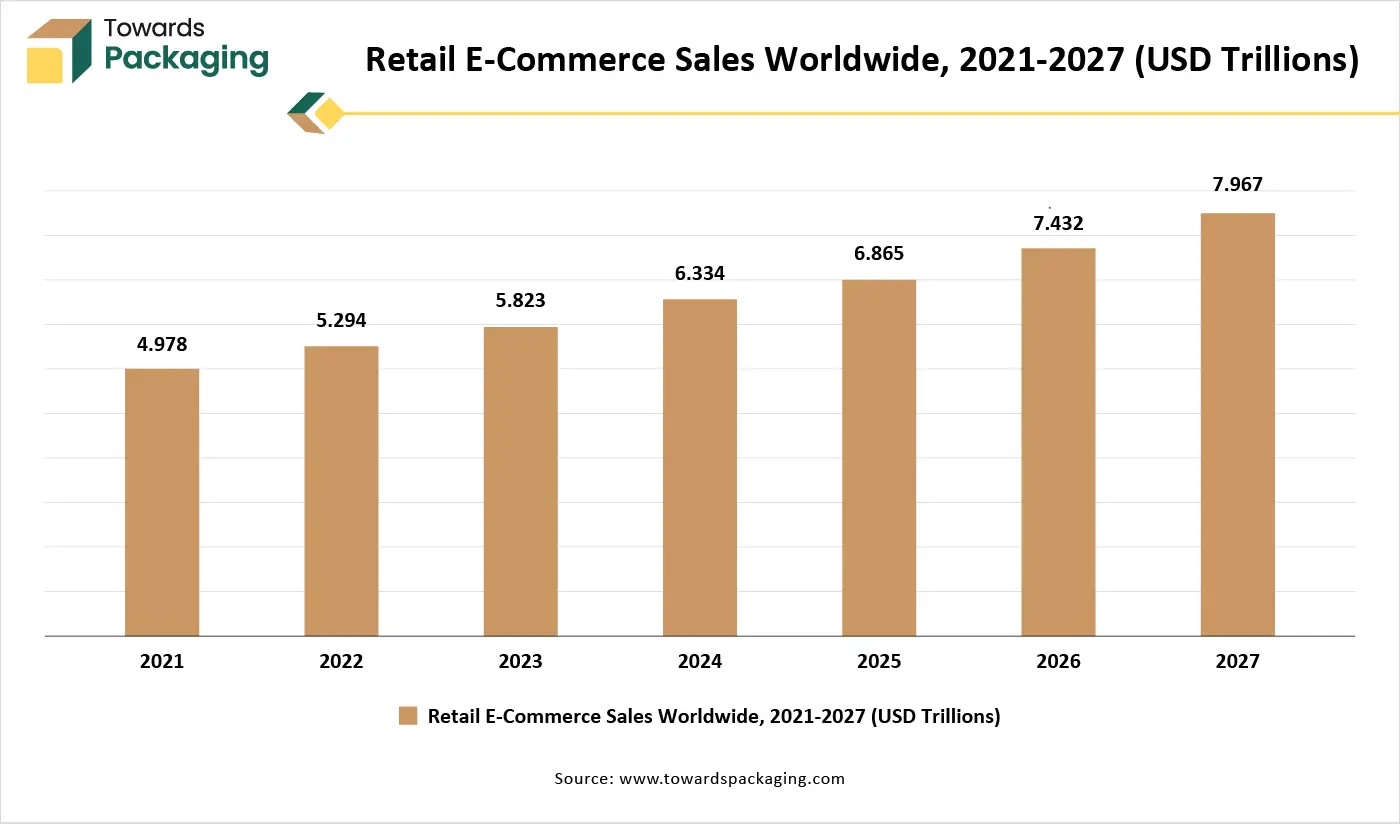

Rapid Growth in E-commerce and Logistics

The explosion of e-commerce and online shopping has created demand for lightweight yet durable protective packaging. Honeycomb cardboard is ideal for this because it provides excellent cushioning, shock absorption, and stack strength while reducing shipping weight and costs. Brands like Amazon and Flipkart are adopting honeycomb fillers to replace bubble wrap and thermocol. Governments, brands, and consumers are increasingly seeking eco-friendly packaging alternatives to plastic and foam.

Honeycomb cardboard offers a superior strength-to-weight ratio compared to traditional corrugated cardboard or molded plastic. Its hexagonal cell structure distributes weight evenly and protects products with minimal material use. These cardboard, made from recycled paper and fully recyclable themselves, aligns perfectly with these goals. Regulations such as the EU’s Packaging and Packaging Waste Regulation (PPWR) and India’s 2025 plastic reduction targets are pushing industries to adopt biodegradable and recyclable materials. This is fueling demand across sectors like e-commerce, appliances, and consumer goods.

Limited Moisture and Water Resistance & Structural Limitations Compared to Wood or Metal

The key players operating in the market are facing issues due to limited moisture resistance and competition from alternative materials, which is estimated to restrict the growth of the market. Honeycomb cardboard is highly susceptible to moisture, humidity, and water damage, making it less suitable for outdoor use or in environments with high humidity, such as cold chains or fresh produce logistics. While water-resistant coatings exist, they add cost and may reduce recyclability. Despite being strong for its weight, honeycomb cardboard cannot match the load-bearing strength of solid wood, metals, or high-density plastic in heavy-duty applications.

As environmental concerns and government regulations intensify, industries are actively seeking eco-friendly alternatives to plastic, Styrofoam, and other non-biodegradable materials. Honeycomb cardboard, being recyclable, biodegradable, and made from renewable paper sources, is well-positioned to meet the rising demand for sustainable packaging. Legislative frameworks such as the EU’s Green Deal, India’s plastic ban policies, and the U.S. Plastics Pact are fueling this transition, opening up opportunities across e-commerce, consumer goods, and industrial packaging sectors.

Honeycomb cardboard is increasingly being adopted in non-packaging sectors due to its strength-to-weight advantage. In furniture, it is used for internal partitions, panels, and doors. In construction, it is emerging as a substitute for plywood in lightweight partitions and insulation panels. In the automotive sector, it is used in trunk liners, parcel shelves, and crumple zones. These diverse applications provide a broader revenue base and long-term market growth potential beyond traditional packaging.

Modern production methods, such as automation, AI integration, and precision die-cutting, are making honeycomb cardboard more customizable, scalable, and cost-efficient. These innovations allow manufacturers to produce tailor-made core cell structures, improve coating durability, and reduce material usage all while maintaining structural integrity. This opens up opportunities for high-performance use in electronics, aerospace, and high-end consumer products.

The continuous paper honeycomb segment is dominant in the honeycomb cardboard market due to its superior structural consistency, high production efficiency, and cost-effectiveness. This format allows for seamless, uninterrupted core structures, enhancing strength and uniform load distribution, which is crucial for packaging, furniture, and construction applications. Continuous honeycomb cores are also easier to automate in manufacturing, reducing material waste and labor costs. Their adaptability to various sizes and thicknesses makes them suitable for mass production and large-scale industrial use. Additionally, continuous formats support customization and are widely preferred for producing lightweight, durable, and recyclable panels for diverse end-use industries.

The expanded paper honeycomb segment is the fastest-growing product type in the honeycomb cardboard market due to several compelling advantages. Its superior strength‑to‑weight ratio and excellent dimensional stability make it ideal as a core filling material in interior doors, partition walls, furniture panels, and automotive components. It effectively replaces traditional solid fillers, tube board, and chipboard stripes, offering lighter, recyclable, and cost‑effective alternatives. As applications in sectors like furniture, building, and automotive expand, demand for expanded honeycomb grows accordingly. Continuous innovation in manufacturing and environmentally driven regulations further boost its adoption, accelerating its revenue CAGR within the segment.

The recycled kraft paper segment is the dominant raw material in the honeycomb cardboard market due to its strong balance of durability, affordability, and environmental sustainability. It provides excellent tensile strength, cushioning, and rigidity, making it ideal for producing lightweight yet robust honeycomb structures. Manufacturers prefer recycled kraft paper as it aligns with global sustainability goals and helps reduce reliance on virgin materials, supporting circular economy practices. Additionally, it is widely available and cost-effective, making it a practical choice for large-scale production. Its consistent quality and structural integrity further enhance its suitability across various packaging and industrial applications.

The specialty-coated paper segment is the fastest-growing raw material category in the honeycomb cardboard market due to its ability to improve moisture and grease resistance, enabling applications previously limited by uncoated paper's weaknesses. Coatings including bio‑based barriers enhance durability and functional performance in industries like food packaging, pharmaceuticals, and tropical logistics, while maintaining recyclability. As supply chains shift toward humid or contaminant-prone environments, specialty coatings help honeycomb structures maintain integrity without sacrificing sustainability. This makes coated substrates favored by brands needing premium performance in harsh conditions, driving their growth at a noticeably higher rate than traditional kraft paper types.

The standard cell size segment (typically 10–20 mm, also referred to as the "standard" range) holds dominance in the honeycomb cardboard market due to its optimal blend of mechanical performance, efficiency, and broad applicability. Packaged between 10 mm and 20 mm cells, it strikes the ideal balance between cushioning, weight, and material usage, making it suitable for a wide array of applications from furniture and logistics to durable packaging. Its structure offers consistent energy absorption and load distribution while minimizing material consumption, enhancing cost-effectiveness. The well-established industry infrastructure and tooling support standard cell dimensions, enabling high-volume production and design uniformity. As a result, manufacturers favor this segment for its reliability, versatility, and production efficiency, cementing its dominant market position.

The micro honeycomb core segment, characterized by cell sizes smaller than 10 mm, is the fastest-growing part of the honeycomb cardboard market. This expansion is driven by its precise vibration dampening, high energy absorption, and compact form factor, which make it ideal for sensitive applications in electronics, automotive interiors, and precision equipment packaging. Micro-cell structures provide tighter tolerances and better mechanical consistency than standard cores, allowing for efficient space use without sacrificing tensile strength. Technological advances now allow manufacturers to produce these cores with premium automation and thin adhesive layers, enabling functionality such as thermal dissipation in chip and battery housings. As demand rises for high-performance, lightweight packaging in emerging sectors, micro honeycomb cores are becoming the go-to for premium, space-efficient solutions.

The protective packaging segment is the dominant application in the honeycomb cardboard market due to its exceptional shock absorption, impact resistance, and lightweight strength, making it ideal for safeguarding goods during transportation and handling. Honeycomb cardboard provides a sustainable alternative to foam, plastic, and wood packaging, aligning with rising environmental concerns and corporate sustainability goals. Its hexagonal core structure distributes pressure evenly, protecting fragile, heavy, or irregularly shaped items, especially in industries like electronics, appliances, automotive parts, and e-commerce. Additionally, honeycomb cardboard is customizable, allowing manufacturers to create inserts, edge protectors, and cushioning components that suit specific product needs. The material’s recyclability and cost-effectiveness further enhance its appeal, especially as companies shift to eco-friendly logistics solutions. With global supply chains increasingly prioritizing damage-free, sustainable transport, the versatility and protective qualities of honeycomb cardboard packaging continue to make it the preferred choice across a wide range of industrial and commercial sectors.

The automotive interior segment is the fastest-growing application area in the honeycomb cardboard market, thanks to its unmatched potential for vehicle lightweighting and sustainability. Paper-based honeycomb cores are increasingly used in non-structural vehicle components such as trunk floors, parcel shelves, headliners, and door liners because they deliver remarkable strength-to-weight advantages, helping automakers improve fuel efficiency and reduce CO₂ emissions without compromising performance. These materials provide excellent vibration damping, load distribution, and design flexibility, and pose minimal safety certification risks since they’re not used in crash-critical zones. With mounting regulatory pressure to reduce vehicle weight and consumer demand for greener vehicles, honeycomb paper cores offer a cost-effective, recyclable alternative to heavier materials, driving rapid adoption and growth in automotive interiors.

The packaging and logistics segment is the dominant end-use industry in the honeycomb cardboard market due to the material's exceptional strength, light weight, and sustainability, which are highly valued in supply chain operations. Honeycomb cardboard offers superior protection against impact, vibration, and compression, making it ideal for shipping a wide range of goods from electronics and appliances to industrial machinery and fragile items. Its lightweight nature helps reduce shipping costs, while its recyclability and biodegradability align with the global shift toward eco-friendly packaging solutions. Additionally, the material can be easily customized into pallets, crates, edge protectors, separators, and box linings, catering to the unique needs of logistics providers and manufacturers. As e-commerce, global trade, and just-in-time delivery systems continue to expand, there is a growing demand for efficient and protective packaging. Honeycomb cardboard meets these needs while supporting corporate sustainability goals, solidifying its role as the preferred choice in the logistics and packaging industries.

The electronics segment is the fastest-growing end-use industry in the honeycomb cardboard market because it demands high-performance, lightweight, and recyclable packaging capable of protecting delicate electronic and electrical components. Manufacturers in electronics rely on honeycomb paperboard's excellent cushioning, shock absorption, and dimensional stability, reducing the risk of damage during shipping and handling a critical requirement for items like circuit boards, smartphones, and sensors. Treated honeycomb cores provide static-dissipative and moisture-resistant protection, helping prevent electrostatic discharge and condensation in sensitive electronics during transit. Moreover, the sector benefits from honeycomb cardboard’s customizable cell structures and precision inserts, which allow snug fitting of irregularly shaped items while minimizing material waste. As e-commerce-driven shipping volumes rise globally, the electronics industry's need for sustainable, lightweight, and damage-free packaging continues to fuel rapid adoption of honeycomb solutions.

The Asia-Pacific region dominates the honeycomb cardboard market due to a combination of economic, industrial, and environmental factors. Rapid industrialization and urbanization in countries like China, India, Vietnam, and Indonesia have led to growing demand for lightweight, durable, and cost-effective materials in sectors such as automotive, electronics, construction, and consumer goods. Additionally, the region’s booming e-commerce sector driven by major platforms like Alibaba, JD.com, Flipkart, and Amazon India has increased the need for protective and eco-friendly packaging solutions, where honeycomb cardboard plays a crucial role.

As a global manufacturing hub, Asia-Pacific also benefits from large-scale production and export activity, with industries relying on efficient, sustainable packaging materials for both domestic distribution and international shipments. Government support and environmental regulations, such as India’s single-use plastic ban and China’s green logistics initiatives, are further encouraging the adoption of paper-based and recyclable packaging. Moreover, the region has abundant access to raw materials like kraft and recycled paper, along with low labor and manufacturing costs, making it a cost-effective center for honeycomb cardboard production.

China Market Trends

China is the largest contributor to the honeycomb cardboard market in Asia-Pacific due to its massive manufacturing base and export-oriented economy. With leading industries in electronics, automotive, appliances, and e-commerce, there is a consistent demand for lightweight and protective packaging materials. The government’s strong push toward green logistics, plastic reduction, and circular economy under its “Dual Carbon” goals has led to large-scale adoption of eco-friendly packaging like honeycomb cardboard. Additionally, China benefits from infrastructure investment, raw material availability, and advanced automated production capacity, making it a global supplier of honeycomb solutions.

India Market Trends

India is experiencing rapid growth in the honeycomb cardboard market due to its expanding e-commerce sector (Amazon India, Flipkart), booming real estate and furniture industries, and the government’s strict ban on single-use plastics. With increasing awareness about sustainability and a rising middle class, both manufacturers and consumers are shifting toward biodegradable and recyclable packaging. India’s construction industry also contributes significantly, using honeycomb boards in partition panels and lightweight doors. Moreover, cost-effective labor and an abundant recycled paper supply support the growth of domestic honeycomb cardboard production.

Japan Market Trends

Japan’s contribution is driven by its automotive, electronics, and high-end consumer goods sectors, which require precise, shock-absorbent, and high-quality packaging. The country places a strong emphasis on waste reduction, recycling, and sustainable packaging standards, which align with the characteristics of honeycomb cardboard. Innovations in automated manufacturing and a focus on clean, branded packaging for retail have strengthened its market position.

South Korea Market Trends

South Korea’s honeycomb cardboard market is growing due to increasing demand in electronics exports, furniture manufacturing, and sustainable logistics. The government promotes green packaging policies through national environmental standards, and local companies are investing in customized and high-performance honeycomb solutions for domestic and export markets. South Korea also integrates advanced automation and digitalization in production, improving efficiency and customization.

Vietnam Market Trends

Vietnam is becoming a rising player in the honeycomb cardboard market thanks to its fast-growing manufacturing and export economy, particularly in furniture, textiles, electronics, and food processing. Its competitive labor and material costs, along with increasing foreign direct investment (FDI) in sustainable packaging and green infrastructure, are fostering the adoption of honeycomb boards as an affordable, eco-friendly option.

Indonesia Market Trends

Indonesia’s expanding e-commerce, FMCG, and logistics sectors are creating strong demand for protective and cost-effective packaging. The government’s push to reduce plastic waste and promote sustainable packaging alternatives has encouraged businesses to shift toward honeycomb cardboard. Additionally, the availability of pulp and paper resources supports domestic production growth.

The North America region is experiencing notable growth in the honeycomb paper market due to a strong focus on sustainability, advanced manufacturing capabilities, and growing demand from key industries. Rising environmental awareness among consumers and increasing regulatory pressure to reduce plastic and non-recyclable packaging have accelerated the shift toward eco-friendly materials like honeycomb paper. The United States and Canada, in particular, are witnessing a surge in e-commerce, furniture, automotive, and electronics sectors, all of which require lightweight, durable, and recyclable packaging solutions. Honeycomb paper is being increasingly adopted for protective packaging, void fill, and structural panels in these industries due to its high strength-to-weight ratio and recyclability.

Technological advancements such as automation, precision die-cutting, and integration of smart packaging features like QR codes and tracking tags are improving the versatility and appeal of honeycomb products. The presence of established packaging companies and innovations in bio-based coatings also supports the region's growth. Additionally, North America’s robust logistics infrastructure, rising export activity, and the push for greener supply chains among major retailers and manufacturers are creating new opportunities for honeycomb paper adoption, making it one of the most dynamic growth regions in the global market.

By Product Type

By Raw Material

By Cell Size

By Application

By End-Use Industry

By Region

January 2026

January 2026

January 2026

January 2026