Jewellery Box Packaging Market Intelligence, Benchmarking, Consumer Insights & Growth Strategies

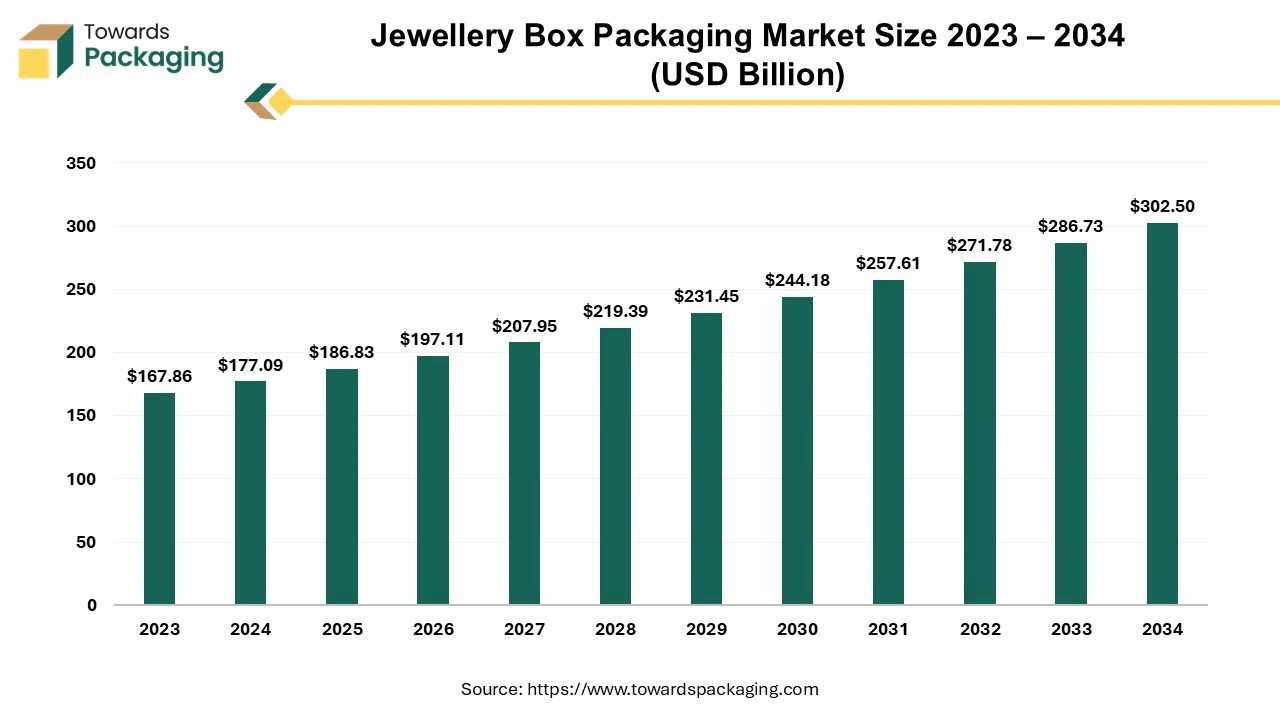

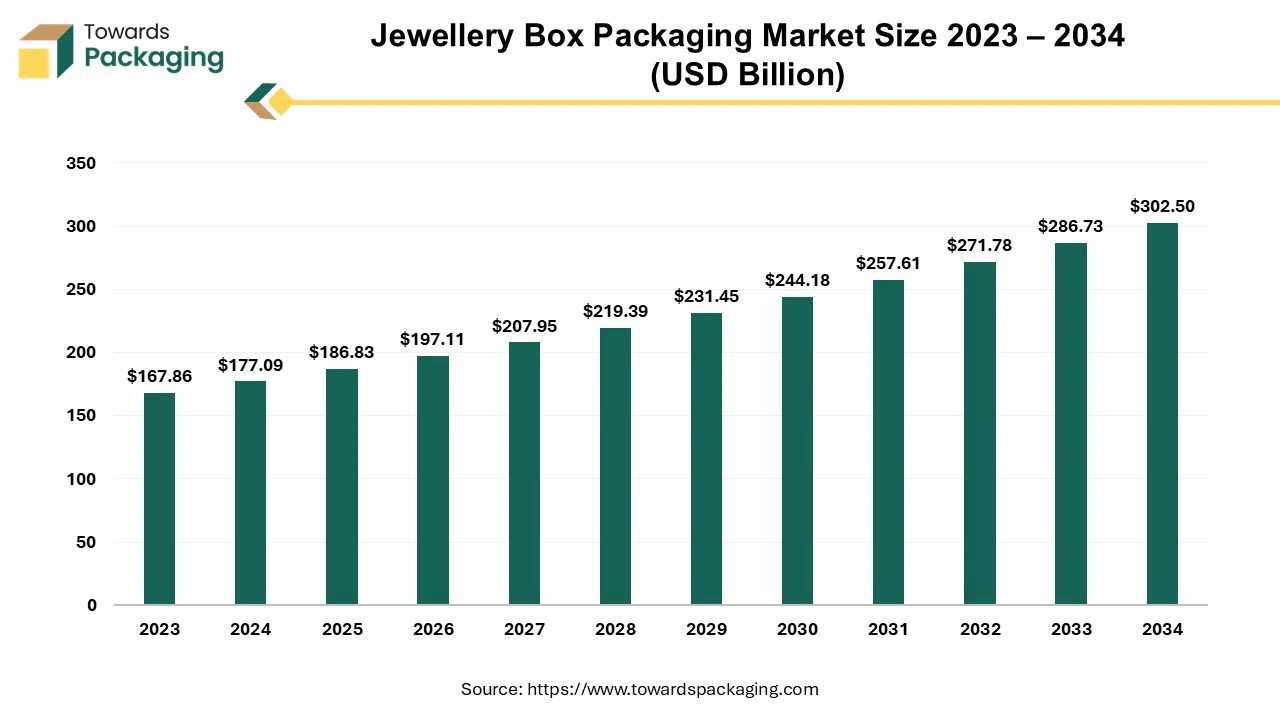

The Jewellery Box Packaging market is forecasted to expand from USD 197.11 billion in 2026 to USD 319.13 billion by 2035, growing at a CAGR of 5.5% from 2026 to 2035. This report examines regional dynamics, with a focus on North America's dominance and Europe's rapid growth. It highlights sustainability trends, the rising demand for eco-friendly materials, and the significance of necklaces in packaging design, while exploring the role of offline stores in delivering personalized customer experiences.

Report Highlights: Important Revelations

- North America's pre-eminence in jewellery box packaging market.

- Europe's expeditious growth in jewellery box packaging market.

- Creative advances in paper-based jewellery box designs.

- Necklaces' vital role in jewellery box packaging market.

- Offline stores' impact on jewellery box packaging market.

The jewellery box's packing is made to improve the presentation and safeguard the priceless items within. The box's exquisite design, which was made with great care to detail, matches the beauty of the jewellery it holds. Because of its strong structure, which guarantees longevity, the priceless goods are protected from harm while stored or transported. Packaging is essential for drawing customers' attention and increasing sales because it receives more than 50% of their attention when it comes to jewellery products.

The packaging's surface is embellished with elaborate designs and motifs that give it a luxurious and seductive feel. The package radiates richness and refinement, whether with a voguish, elaborate ornamentation or a sleek, minimalist design. The jewellery box's overall aesthetic appeal and perceived worth are further enhanced by the selection of materials, which include premium paper, fabric, or wood.

The packaging's interior is actively crafted to ensure that each jewellery item fits snugly and securely. Soft velvet lining or cushioning inserts protect against scratches and abrasions, ensuring the contents remain in excellent condition. Some packaging may have sections or trays for storing various jewellery types, improving ease and functionality. The jewellery box packaging blends aesthetic appeal, durability, and utility to deliver a high-quality experience for both the giver and the recipient.

For Instance,

- In June 2023, The Kering-owned jewellery business announced revamping its iconic cases, introducing new forms, and reducing the materials to just two under its new sustainability requirements.

Jewellery Box Packaging Market Trends

- Manufacturers of jewellery boxes are concentrating on cutting-edge functionality and design elements to improve user experience and efficiently display the jewelry.

- With consumers becoming more environmentally conscious, sustainability is a significant concern in the jewellery box business.

- Jewellery manufacturers are responding to the demands of customers who travel regularly or have busy lifestyles by providing small and convenient travel-friendly packaging options.

- Brands use jewellery packaging to tell consumers about their history, level of craftsmanship, and core beliefs.

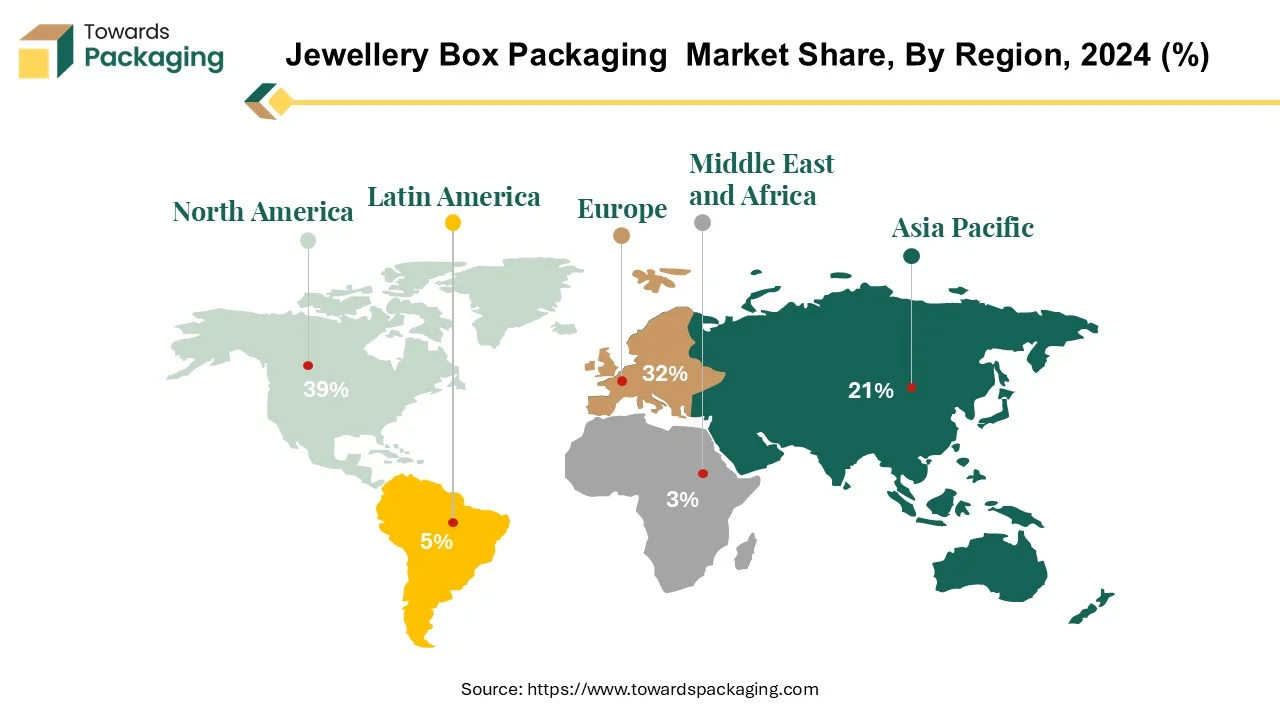

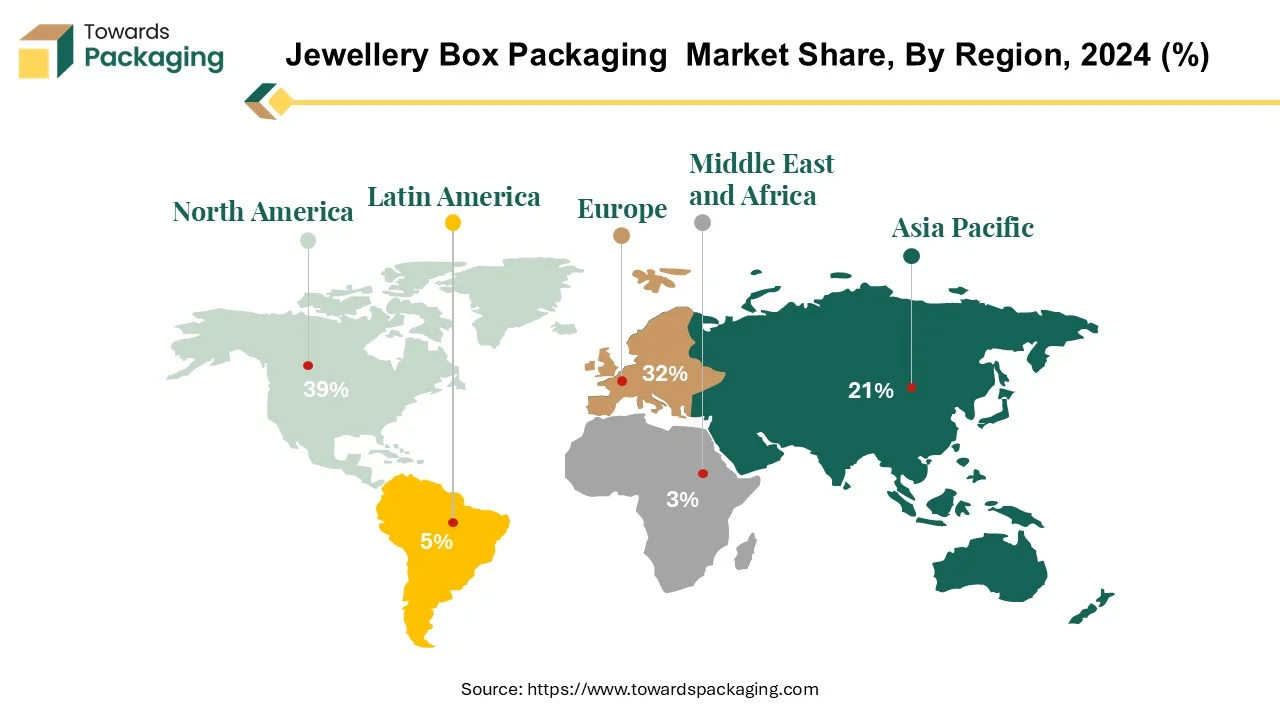

North America's Dominance in the Jewellery Box Packaging Market

North America maintains its position as a prominent region in the jewellery box packaging market, bolstered by factors that highlight its critical role in creating the industry landscape. With a thriving jewellery market and a culture that values elegance and refinement, North America strongly demands high-quality packaging solutions to complement the attractiveness of its jewellery products. Retailers in the region prioritize packaging that ensures secure storage and improves the presentation and perceived worth of jewellery.

North America's excellent production skills and unique packaging designs help it maintain its market leadership. Packaging producers are constantly pushing the frontiers of inventiveness, providing a wide range of alternatives customized to the changing preferences of both merchants and customers. Customization, high-quality materials, and eco-friendly packaging solutions are significant trends driving the region's demand for jewellery box packaging.

Tiffany & Co. is the most renowned jewellery brand in the United States, with 47 percent of respondents enjoying it. Pandora comes in second. Cartier and Dior are also famous among consumers familiar with the labels, demonstrating a preference for established names. While acknowledged, more esoteric businesses like Buccellati, Monica Vinader, and Mejuri need to boost customer brand recognition. Data suggests a generally balanced preference distribution, implying a highly competitive market and resulting in growth in packaging boxes.

Strategic cooperation between packaging makers and jewellery businesses reinforces North America's reputation as a center of innovation and excellence in jewellery box packaging. North American companies set industry standards and drive worldwide trends by utilizing cutting-edge technologies and sustainable practices. Overall, North America's consistent dedication to quality, innovation, and customer happiness solidifies its position as the market leader in jewellery box packaging.

For Instance,

- In January 2023, GPA Global ("GPA") announced that it had acquired Cosfibel Group ("Cosfibel"), a prominent leader in the luxury gifting, merchandising, and promotional packaging industries.

Rapid Growth of Europe in the Jewellery Box Packaging Market

Europe is a challenging player in the jewellery box packaging market, having secured its place as the second top area after North America. European countries are renowned for their long heritage of craftsmanship, and they excel in producing magnificent jewellery and packaging to match. The region's reputation for luxury and sophistication fuels the demand for attractive, well-crafted jewellery boxes.

European packaging producers promote quality, innovation, and sustainability, responding to the sophisticated tastes of both consumers and jeweller brands. With an emphasis on artisanal techniques and attention to detail, European jewellery box packaging oozes beauty and charm, appealing to a global audience looking for premium presentation options.

Europe's commitment to environmental stewardship is consistent with the growing demand for sustainable packaging options. Packaging companies in the region use environmentally friendly materials and techniques, helping to create a greener future while serving the changing needs of the jewellery industry. Europe continues to make outstanding achievements in the jewellery box packaging business, establishing itself as a prominent player globally through a combination of heritage, innovation, and sustainability.

For Instance,

- In June 2023, The Kering-owned jewellery firm announced a revamp of its iconic cases, presenting new forms and reducing the materials by two under its new environmental requirements.

Jewellery Box Packaging Market, DRO

Demand:

- Jewellery boxes must guarantee the security and safety of priceless jewellery pieces while shielding them from tarnish, scratches, and other harm. Jewellery pieces are kept beautiful and intact with the help of soft interior linings, padded sections, and tight closures.

Restrain:

- Depending on the materials, craftsmanship, and intricacy of the design, jewellery boxes can range in price considerably.

Opportunity:

- Jewellery box designs, materials, and features present potential for creativity. Modular designs, creative storage options, and multipurpose sections meet changing lifestyle demands and consumer preferences.

Design Innovations in Paper-based Jewellery Boxes

Paper is a critical packaging material in the jewellery box packaging market, providing the ideal balance of adaptability, elegance, and sustainability. Paper-based jewellery boxes are well-known for their ability to display rich designs and textures, making them an elegant presentation for costly items.

Paper's versatility provides various finishing options, including embossing, foiling, and printing, allowing firms to personalize packaging to reflect their personality and appeal to discriminating consumers. Furthermore, paper is lightweight and robust, protecting delicate jewellery objects during storage and shipping.

One of the primary benefits of paper-based jewellery boxes is their environmental friendliness. With growing environmental concerns, consumers and brands gravitate toward sustainable packaging options, and paper fits the bill wonderfully. Paper, which is recyclable, biodegradable, and made from renewable materials, meets the growing demand for environmentally friendly products, making it a popular choice in the jewellery box packaging industry. Paper's adaptability, aesthetic appeal, and environmental benefits make it a prominent material in this market, promoting wider adoption by jewellery manufacturers worldwide.

For Instance,

- In September 2021, Pandora, a Danish jewellery brand, introduced 'new and upgraded' packaging in its physical and online stores to replace plastic carrier bags.

Significance of Necklaces in Jewellery Box Packaging Market

Necklaces are a standout product in the jewellery box packaging market, known for their timeless elegance and adaptability. Necklaces are a mainstay of personal ornamentation and have significant cultural and sentimental worth. Therefore, their packaging is critical in retaining their attractiveness and protecting them from damage.

Necklace-specific jewellery boxes frequently include dedicated compartments or inserts to securely contain and exhibit these items, preventing tangling and guaranteeing their perfect appearance. Additionally, necklace boxes may consist of padding, clasps, and transparent panes to improve presentation and accessibility.

Given the elaborate designs and expensive materials used in necklaces, consumers seek packaging that complements their attractiveness while ensuring quality and authenticity. As a result, jewellery box producers focus on creating stylish and durable packaging options that improve the unwrapping experience while maintaining the status of the necklace inside.

Necklaces are a common choice among customers as their preferred jewellery piece. Brands catering to this need include high-end names like Cartier and rising designers like Swarovski and Bea Bongiasca, who offer a wide choice of colourful and traditional items. The thrill of discovering a new brand match finding the perfect jewellery piece, especially with unique and premium packaging. This emphasis on packaging increases customer appeal and sales in all jewellery categories.

For Instance,

- In July 2022, A Menasha Corporation subsidiary, Menasha Packaging Company, LLC, announced that it had completed the acquisition of Colour-Box, a business unit of Georgia-Pacific, LLC.

Role of Offline Stores in the Jewellery Box Packaging Market

Offline stores continue to be the primary distribution and sales channel in the jewellery box packaging market, providing customers with a tactile and immersive shopping experience. These physical stores play an essential role in the industry because they allow customers to browse, engage with items, and make informed purchasing decisions.

Offline retailers are essential partners for jewellery box makers in promoting their items to a wide range of customers. Furthermore, offline businesses allow clients to obtain individualized advice from competent salespeople, which improves the buying experience and fosters faith in the product.

Even with the growth of e-commerce, many customers still prefer the in-person shopping experience, especially when buying high-end products like jewellery boxes. Because of this, physical retailers continue to be essential for marketing and delivering jewellery box packaging while meeting their clientele's varied needs and tastes.

| Major Jewellers Sales, 2023 ($ million,%) |

| Company |

2023 Sales ($ millions) |

Change Vs. 2022 |

| Signet Jewellers |

1,660 |

-9% |

| Brilliant Earth |

98 |

-2% |

| LVMH Watches and Jewellery |

5,919 |

15% |

| Richemont Jewellery Maison’s |

7,591 |

28% |

| Titan Company |

241 |

25% |

Bridal sales at Signet saw a significant decline in overall and same-store sales. This fall was ascribed to lower transaction values from the expected decline in bridal purchases and the impact of inflation on consumer spending. Brilliant Earth experienced similar difficulties, with higher orders but lower average order values offsetting a minor decline in revenue. Conversely, prominent jewellers in Hong Kong and India saw market recoveries, while luxury retailers such as LVMH and Richemont observed notable rises in their jewellery division sales. However, because of inflationary pressures on its mid-price market-focused e-commerce division, Birks Group saw a 10% decline in sales.

For Instance,

- In September 2023, the luxury packaging business of a French company that specializes in gifts with purchase and accessories is expanding at a faster pace. A new line of calendars, gift boxes, and collateral has been unveiled by Anaïk. In October, the new items will be on display in all of its showrooms and at Luxe Pack Monaco.

Key Players and Competitive Dynamics in the Jewellery Box Packaging Market

The competitive landscape of the jewellery box packaging market is dominated by established industry giants such as Taylor Box Company (US), American Chest Company (US), Wellery Boxes Potters Limited (Europe), Stockpak (UK), Finer Packaging (UK), McLaren Packaging Ltd. (Europe), Dahlinger GmbH and Co KG (Europe), Thomas Sabo GmbH and Company KG (Europe), Sacher & Co. GmbH (Germany, EU), Prebox (Europe), Holmen AB ADR (Europe), Westpack (Australia), Gunther Mele Limited (Canada), Scanlux Packaging A/S (Europe), M. K. Packaging (Gujarat, India), Right Industries (India) and MS Wooden Box Company (China).These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Westpack charges a nominal fee to order samples of jewelry boxes, gift boxes, carrying bags, and other items. Placing an order on the internet store is simple; it just requires a few clicks.

- In June 2022, A heads of agreement was signed by BT Funds Management Limited (Trustee) and Westpac to combine BT's corporate and individual superannuation funds into Mercer Super Trust through a successor fund transfer (SFT).

The Taylor Box Company's secret sauce is collaboration, competence, and invention. Whether it's a napkin drawing or a 3D rendering, the structural design team is eager to see their idea realized.

Jewellery Box Packaging Market Player

- Taylor Box Company (US)

- American Chest Company (US)

- Wellery Boxes Potters Limited (Europe)

- Stockpak (UK)

- Finer Packaging (UK)

- McLaren Packaging Ltd. (Europe)

- Dahlinger GmbH and Co KG (Europe)

- Thomas Sabo GmbH and Company KG (Europe)

- Sacher & Co. GmbH (Germany, EU)

- Prebox (Europe)

- Holmen AB ADR (Europe)

- Westpack (Australia)

- Gunther Mele Limited (Canada)

- Scanlux Packaging A/S (Europe)

- M. K. Packaging (Gujarat, India)

- Right Industries (India)

- MS Wooden Box Company (China)

Jewellery Box Packaging Market Segments

By Material

- Paper

- Plastic

- Wood

- Metal

- Others

By Product Type

- Necklace

- Earring & Rings

- Watches

- Bracelets

- Others

By Distribution Channel

By Region

- North America

- Europe

- Asia Pacific

- LA

- MEA