Non-Recyclable Plastic Packaging Market Overview Regional Assessment, Segment Insights, Market Dynamics, Companies, and Supply Chain Evaluation

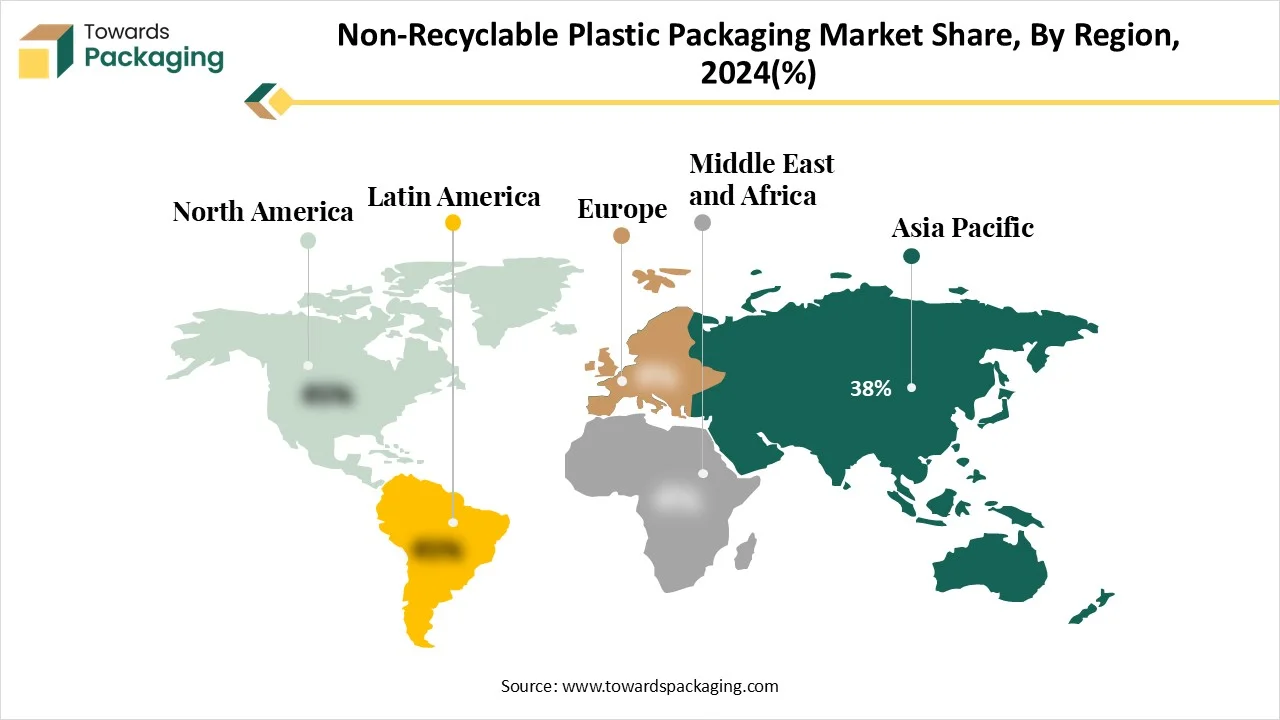

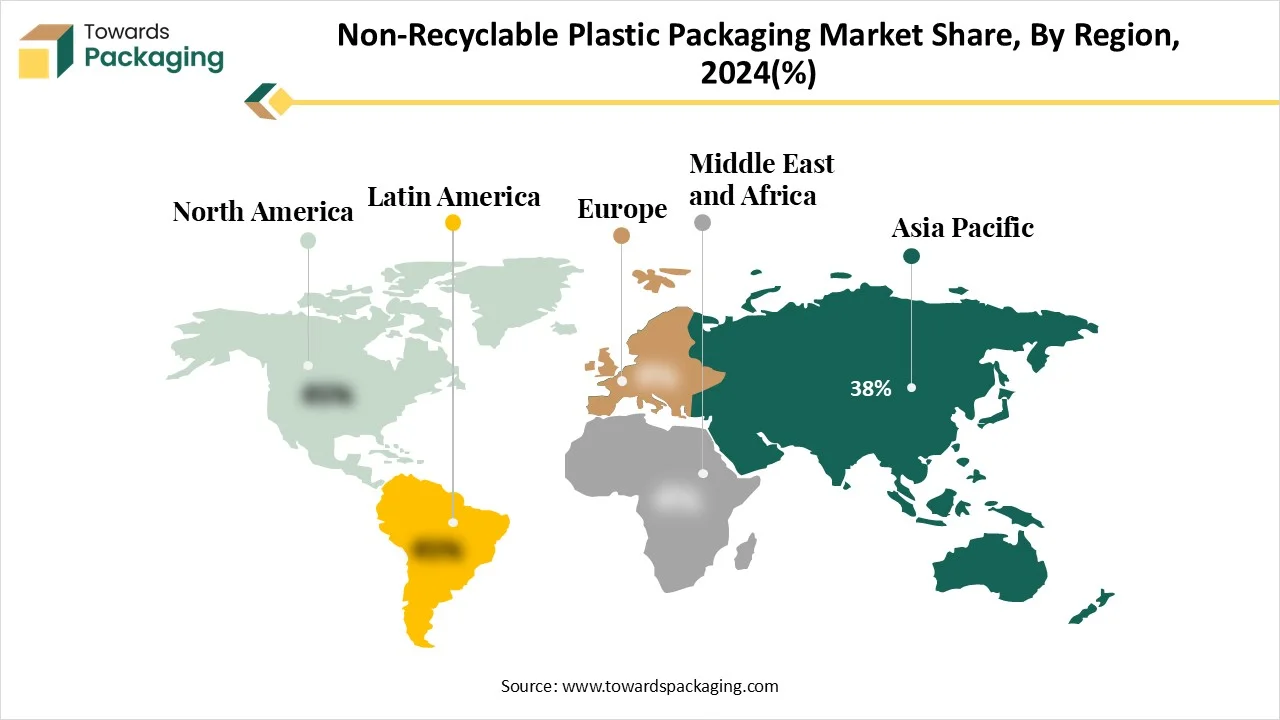

The non-recyclable plastic packaging market covers global revenue size, growth trends, and detailed segmentation by material type, product category, and end-use industries, backed by complete regional data for North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. This analysis includes market shares such as Asia Pacific holding 38% in 2024 and segment highlights like flexible films dominating with 40% share. It features competitive mapping of leading companies including Amcor, Berry Global, Huhtamaki, Mondi, and Sonoco, along with value chain structures, cost dynamics, trade flow patterns, and supplier/manufacturer profiling across major economies. Forecast data up to 2034 including CAGR projections, fastest-growing regions, and expanding material segments like PVC are thoroughly integrated.

Key Takeaways

- Asia Pacific dominated the non-recyclable plastic packaging market with the largest revenue share of 38% in 2024.

- The Middle East and Africa have witnessed the fastest-growing market.

- By material type, the multi-layered and compostable plastics segment contributed the biggest revenue share of 35% in 2024.

- By material type, the PVC segment will expand at a significant CAGR between 2025 and 2034.

- By product type, the flexible films and wraps segment contributed 40% revenue share in 2024.

- By product type, the blister packaging systems segment will expand at a significant CAGR between 2025 and 2034.

- By end-use industry, the food and beverages segment contributed 48% revenue share in 2024.

- By end-use industry, the healthcare and pharmaceuticals segment will expand at a significant CAGR between 2025 and 2034.

Non-recyclable Plastic Packaging Overview

The Non-Recyclable Plastic Packaging Market encompasses the production, sale, and use of plastic packaging materials that are not readily recyclable in most established systems. The Non-Recyclable Plastic Packaging Market is a challenging but currently present segment within the broader packaging industry. While its existence is primarily due to functional and cost advantages, it is under significant pressure to shrink due to environmental regulations and the growing demand for sustainable alternatives.

Non-recyclable plastic includes various types of materials that cannot be recycled by means of regular recycling procedures. In a perfect world, most plastic materials would be recyclable; however, their recyclability is limited because of their chemical structure. The various types of plastic material that are non-recyclable are frequently removed from the environment, leading to environmental degradation.

Non-Recyclable Plastic Packaging Market Trends

- Mono-material packaging's specific goal is to substitute multi-material composite layered and/or recyclable packaging, in uses ranging from food packaging to the pharmaceutical sector, including personal care products, and even apparel manufacturing. They are made from single-material polymer, which is particularly useful in applications such as beverage containers, food wrapping, and personal care products, allowing for easier recycling and better classification in waste streams.

- Single-use plastics are meant for long-term use. They are completely trashed after one use. Prevalent examples are straws, water bottles, food wrappers, and plastic bags, too. These kinds of items may be small, but they harm our surroundings in a huge way. These plastic products are created from materials that can take many years to break down.

- Plastic packaging is an evergreen and hugely used material that plays an important role in protecting, preserving, and shipping products. Its durability, flexibility, and cost-effectiveness make it a perfect choice for different industries, from food and beverages to electronics and pharmaceuticals. Comprehending the various forms and applications of plastic packaging can assist businesses in selecting the correct type for their particular needs.

- The versatility and flexibility of plastics are very tough to align with. Hence, increased levels of packaging, manufacturing, and usage, specifically in short-lived uses, have led to growing waste levels and pollution of these universal materials in recent years. With more ambitious policies, the addition of plastic production, usage, and waste will further grow by 70 % by the year 2040.

AI Integration in Non-Recyclable Plastic Packaging Market

Artificial Intelligence (AI has been integrated into software to automatically change data throughout the collection procedure. This examines any brands and feet in the images, which helps us make sure the waste collection team aligns with safety and health compliance standards, by wearing the gloves and shoes that we provide them. Since introducing these characteristics, the number of workers using shoes, not sandals, has grown rapidly. On the other hand, for each person on the planet, it's calculated that there are 21,000 pieces of plastic floating in the ocean. The Ocean Cleanup is a non-profit company that uses Artificial Intelligence to examine and track plastic pollution in the Great Pacific Garbage Patch. This company utilises an expedited method of autonomous boats to gather data on the size and location of plastic debris. But the AI can do more than just map out plastic pollution -it can assist in serving the latest cleanup technologies.

Non-Recyclable Plastic Packaging Market Dynamics

Driver

Rising awareness of problems like plastic pollution and climate change has encouraged users to align their purchases with their values. Brands that lessen their environmental impact are heavily favored. Users are also giving importance to health. Non-toxic, organic, and eco-conscious products are more in demand as people understand the connection between environmental health and personal health, too. Ethical purchasing has become an influential driver as users increasingly pay attention to where the products come from, how they are created, and the working conditions behind them. Problems like human rights, fair trade, and social justice are central to the growth of conscious materialism.

Restraint

Non-recyclable plastics have actually negative consequences for producers, way beyond just classifying waste. Primarily, if our procedure totally depends on plastics that cannot be recycled, one is stuck with higher costs for disposal. Landfills are not cheap, and those that are heavily priced can add up, particularly for companies shifting serious volumes. Sorting and cleaning issues occur when non-recyclable plastics are found in recycling flows. They clog machines, slow everything down, and sometimes break machines too. Minute organizations feel this loss the most as downtime costs big money.

Opportunity

Non-recyclable plastic packaging serves the capability to meet environmental aims with socio-economic objectives, especially in developing countries, specifically for alternatives generated from agri-residues and other sources, which are not intensive in land usage. For these countries, manufacturing these materials can reshape native potential, boost exports, and create jobs, hence capitalizing on their natural waste and resources. This is the case for bagasse, a by-product of sugar manufacturing, which is widely used in making countries and is heavily found as a feasible substitute for plastics in packaging and everyday products such as bags and cutlery.

Wandering from algae-based polymers for bioplastics to marine elements that are utilised as fillers in ceramics and glass,marine-based substitutes and alterations to plastics are of natural origin and derived from abundant marine resources.

Segmental Insights

How did the Multi-layered /Composite Plastics Dominate the Non-recyclable Plastic Packaging Market?

Multi-layered plastics are any material utilised for packaging and having a minimal layer of plastic as the key ingredient in integration with one or more layers of materials such as paperboard, paper, polymeric materials, aluminium foils, and metalised layers either in the design of laminate or co-ejected. Multi-layered plastics are cherished packaging materials for the food sector as they protect the exposed food products and hence provide a longer shelf life. The packaging sector used to have materials like metal, PET Bottles, or glass.MLP makes transportation easy, lightweight in nature, and graphics-friendly too. The characteristics of MLP protect the food items in these heavy surroundings.

Polyvinyl chloride (PVC is a widely used synthetic plastic that has become important in different sectors, specifically construction and manufacturing. Launched in 1800, PVC has gained attention when American scientist Waldo Semon examined its capability for waterproof uses, which led to the usage of products in raincoats. Over the years, PVC's reliability has seen it accepted for different uses, including flooring, piping, and electrical insulation, specifically during World War 2, when it was used for ship wiring.

How Flexible Films and Wraps have Dominated the Product type in the Non-recyclable Plastic Packaging Market

Flexible films and wraps are initially created from polymers such as polyethylene (PE), polypropylene, and polyethylene terephthalate (PET). These materials serve as a perfect barrier, assisting in food freshness, expanding shelf life, and preventing contamination. Transparency is another main benefit, as it allows users to visually examine products without opening the packaging, a factor that can encourage buying decisions. For retailers and manufacturers, clear films and wraps are cost-effective and lightweight. It lowers weight, develops fuel efficiency in travelling, and lowers carbon emissions as compared to heavier packaging options. One main invention is a multi-layer plastic film that integrates several polymers to develop performance. For example, a film might have an oxygen barrier for food protection and a heat-sealable exterior layer for packaging convenience. This flexibility has led to the acceptance of clear plastic film that dominates the flexible packaging market, especially in fast-moving consumer goods (FMCG).

Blister packaging includes pre-formed plastic cavities that carry products in one place. These cavities are generally created from clear plastic, and the product is held within them by a pliable lid or backing material. The word "blister" comes from the shape of the cavities, which are often deep and form blisters on our skin. This kind of packaging is incredibly evergreen, which makes it perfect for a series of industries from consumer goods to pharmaceuticals. It can be manufactured in different shapes and sizes to match the product being packaged. They are generally sealed with heat, making a strong bond that keeps the product protected inside until it's ready for use.

How did the Food and Beverages End-user Industry Dominate the Non-recyclable Plastic Packaging Market?

Single-use plastics have long been the negligent choice for food packaging because of their durability, convenience, and low cost. Hence, their environmental effect is important. Plastics can take hundreds of years to decompose, polluting oceans and land and poisoning wildlife. As per the UN, over 300 million tonnes of plastic waste are generated globally each year, with food packaging as a main contributor. Environmental organizations and governments are heavily pushing for bans on single-use plastics, making an urgent demand for sustainable alternatives in the food sector. This movement has opened the door for inventive packaging solutions crafted to lower waste and environmental harm.

Non-prescribed medications and medical supplies, such as inhalers and syringes, make a significant amount of plastic waste. Pharmacies are now presenting plastic-free pill organizers, other alternatives, and medication storage options that are both sustainable and practical. By marketing customer awareness and serving eco-friendly choices, pharmacies are playing a crucial role in lowering single-use plastics in the healthcare industry. A rising trend towards "green pharmacies" is developing, with healthcare and pharmacies accepting sustainable practices and finding certifications that recognize their efforts to reduce plastic waste. Products and sustainable gifts play a crucial role in creating these green brands, serving customers with reusable, eco-friendly items that support the pharmacy's environmental goal.

By Region

How Asia Pacific Dominated the Non-recyclable Plastic Packaging Market?

In many parts of the Asia Pacific, informal networks still play a key role in managing non-recyclable plastic packaging. Processors and small collectors are essential to waste management, especially in countries like India, Vietnam, and Indonesia. These networks help prevent non-recyclable plastics from ending up in landfills but face issues such as variable feedstock quality, lack of transparency, and limited traceability. Unsafe working conditions also restrict how much waste can be upgraded to higher-value products. China, formerly the world's leading plastic waste importer, is now shifting focus to domestic circularity. Government initiatives are promoting large-scale recycling and the recovery of materials like metals, plastics, and textiles. India is advancing nationwide extended producer responsibility (EPR) policies.

The Middle East and Africa are the fastest-growing regions in the non-recyclable plastic packaging market.

Many influencing factors shape the growth of the non-recyclable plastic packaging sector in MEA, including volatility in virgin plastic prices and the availability of plastic waste flows. As oil-based virgin polymer costs fluctuate, producers shift to non-recyclable plastics packaging as a cost-stable and sustainable raw material. This economic alteration is encouraging huge investment in plastic waste collection infrastructure and recycling technologies across the region. Furthermore, collaborations between government agencies and private recyclers are making and allowing an environment for long-term growth, enhancing supply chain effectiveness, and reducing logistical limitations.

Top Players in the Non-Recyclable Plastic Packaging Market

Industry Leader Announcement

- On 23 July 2025, the SM Group is solidifying its loyalty to lower plastic waste as a shared responsibility across its business space. It is led by parent company, SM I Investments Corporation, the conglomerate has recently made a working group committee which convenes and conducts regular dialogues, involving SM's different businesses to include plastic reduction into their respective sustainability roadmaps. (Source: PRNewswire)

Recent Developments

- On 14 February 2025, Mondi and Proquimia partnered with paper-based, stand-up pouches for dishwashing tabs in Portugal and Spain. A paper server and sustainable packaging, Mondi has conducted internal product effect assessments, which display that the new solution has mainly lower CO2 emissions from gate to cradle, as compared to plastic pollution alternatives. (Source: Interplas Insights)

- Pakka had disclosed compostable packaging solutions and a new series of flexible packaging solutions. The changed product line has set a goal to meet the growing demand for flexible packaging in the food and beverages industry with compostable solutions towards a cleaner planet. (Source: Packaging Strategies)

Segments of the Non-Recyclable Plastic Packaging Market

By Material

- Polyvinyl Chloride (PVC)

- Polystyrene (PS) / Expanded Polystyrene (EPS)

- Multi-layered / Composite Plastics

- Low-Density Polyethylene (LDPE) (e.g., plastic bags, films not collected)

- Other Complex or Contaminated Plastics

By Product Type

- Flexible Films & Wraps

- Foam Packaging

- Blister Packaging

- Certain Disposable Cutlery & Straws

- Non-reusable Containers with Complex Layers

- Other Product Types

By End-Use Industry

- Food & Beverages

- Healthcare & Pharmaceuticals

- Consumer Goods

- Retail

- Other Applications

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa