The north america corrugated packaging market is forecasted to expand from USD 43.93 billion in 2026 to USD 55.93 billion by 2035, growing at a CAGR of 2.72% from 2026 to 2035. This market analysis covers complete insights into market size, industry trends, regional data across NA, EU, APAC, Latin America, and MEA, and full segmentation by end-user industry and country. It includes profiles of major companies like Smurfit Kappa, International Paper, DS Smith, PCA, and Georgia-Pacific, along with competitive benchmarking, supply chain and value-chain mapping, and detailed trade statistics for the corrugated packaging industry.

Corrugated packaging is a kind of cardboard material that is made up of three layers: an inside liner, an outside liner, and a fluting corrugated medium sandwiched between the liner sheets. The fluting corrugated medium is generally made of kraft paper, which is rigid and more durable than regular paper. Corrugated containers remain stable even when exposed to moisture, shocks, and sudden temperature fluctuations. While no container is discreet to extreme force or prolonged or rigid conditions, corrugated serves a great level of assurance that our products will shift from our warehouse to their final point in great shape.

The fluting medium provides corrugated packaging with its different design and structure, which makes it perfect for storing products and shipping goods. Corrugated packaging is prevalently utilised in retail packaging, shipping boxes, storage boxes, and cereal boxes too. But as technology has grown and materials have developed, the corrugated sheets of packaging have become more tailored and versatile. Currently, corrugated packaging is widely used in different industries, including food and beverage, electronics, automotive, and more. Its eco-friendly option and cost-effective nature provide perfect product protection during handling and shipping.

| Metric | Details |

| Market Size in 2025 | USD 42.76 Billion |

| Projected Market Size in 2035 | USD 55.93 Billion |

| CAGR (2026 - 2035) | 2.72% |

| Market Segmentation | By End-User Industry and By Country |

| Top Key Players | Smurfit Kappa Group plc, International Paper Company, Packaging Corporation of America, DS Smith PLC, Georgia Pacific LLC. |

By influencing machine learning, AI can now foretell how various materials will perform under different conditions, serving manufacturers with valuable analytics on which packaging to develop, which utilises lesser material without compromising quality. The power of artificial intelligence in the growth stage is primarily the potential to improve the performance of a plethora of various materials under several environmental conditions, to ensure they meet permanent standards while lowering waste. Based on this search, AI can then independently examine and suggest the usage of most biodegradable and lightweight materials that lower the carbon footprint of packaging, while still maintaining durability and environmental impact.

AI design tools can make inventive packaging solutions that promote sustainability. These tools can make many design iterations, changing factors such as structural integrity, material use, and recyclability, too. AI can also collaborate with current packaging design, which can be easily dismantled and recycled. It also plays an important role in educating users about sustainable packaging and promoting eco-friendly conduct. AI-powered apps can provide information on how to accurately dispose of packaging materials, serve incentives for sustainable practices, and manage recycling habits, too.

Double-sided Corrugated Packaging: Protecting Products, Elevating E-commerce

Packaging in terms of e-commerce goes beyond the line as the simple act of isolation; it's a mixture of product protection and brand presentation. It delivers as the initial physical touchpoint for users in an otherwise digital transaction, which sets the stage for a complete shopping experience. The aim of packaging in e-commerce is twofold: to protect goods from the meticulous of shipping and to pass brand reputation. As e-commerce constantly grows, the urge for responsible packaging solutions is growing, specifically in North America. Double-sided corrugated packaging has become a go-to solution for effective, secure, and cost-effective packaging. As companies seek to simplify their packaging procedure, the usage of good-quality double-sided corrugated boxes has grown significantly.

Which Factors Restraints the North America Corrugated Packaging Market Growth?

Sustainability is no longer beneficial but a standard function expectation for packaging. Businesses, governments, and consumers are urging biodegradable and recyclable solutions that lower resource use. While this has limited the demand in some spaces, it also creates opportunities for manufacturers of corrugated boxes and folding cartons. Box producers can grow their market standing by developing recycling efficiency, which reduces carbon footprint through lightweight and more effective product designs, and create high-performance and sustainable coatings. Corrugated boxes can be greatly affected by weather as they are not waterproof, which means snow or rain can easily damage them. These kinds of boxes can carry normal shipping, but are not that rigid under heavy pressure. This could cause them to fall or crumble.

Sustainable Packaging Made Simple with Corrugated Packaging

Brown corrugated boxes are an intelligent and cost-effective packaging solution for every business of all sizes. They are an eco-friendly packaging solution that serves superior product protection. With their relentless power, these boxes can firm wear and tear during handling, shipping, and storage, which ensures that our products arrive at their destination in accurate condition. Furthermore, the natural brown colours provide these boxes with a clean and classic appearance and make them a perfect choice for branding purposes. Whether you are a small business owner or a big corporation, corrugated boxes provide an evergreen solution that can meet all of your packaging demands.

One of the most remarkable benefits of corrugated boxes is their environmental sustainability. Paper, which is used to create corrugated packaging boxes, is created from a renewable resource, trees. Referencing to your fiber from sustainably tracked timber lands is a great decision that can benefit your business and the surrounding area. Corrugated boxes can also be produced from recycled materials, OCC (old corrugated containers), and post-consumer waste. Brown Kraft boxes display a strong message for sustainability. By selecting to utilize corrugated boxes, businesses can assist and market sustainable practices and ensure a healthier planet.

As processed foods have become a main thing in the American diet, they have resoundingly changed our physical health. Processed foods are a contributor to the obesity pandemic and chronic diseases like type 2 diabetes. It is mainly due to heavily processed foods containing ingredients such as saturated fats, which include sodium and sugar. Also, it has been calculated that ultra-processed food accounts for 90% of the total calories received from added sugars, in addition to being stripped of its nutrients. The Food and Drug Administration (FDA) in the United States regulates terms that food organizations use on their packaging, which defines the criteria by which companies can use terms like “low fat”, “low-calorie”, and more.

Fresh produce food needs packaging that can resist the demands of transportation, which includes loading, bumpy rides, and unloading all the way. Corrugated boxes are crafted to absorb these effects, which ensures products such as fruits and vegetables arrive fresh and untouched. Corrugated packaging not only delivers physical protection but also privacy. Its fluted pattern makes air pockets that behave as a blockage against temperature fluctuations, assisting in maintaining the freshness of perishable produce. These insulating characteristics are important in protecting produce from immediate transformation in temperature transformation during transportation. It can also be tailored to fit particular products, serving optimal cushioning and protection. For sensitive items like vegetables or fruits, corrugated packaging can be personalized to include compartments or inserts that protect movement and lessen the risk of bruising.

U.S

U.S.-based producers tend to have bigger environmental and labor standards than several overseas suppliers. These have included rules on wastewater discharge, chemical sourcing, energy usage, and waste disposal. Brands that select U.S.-made corrugated boxes can create plausible sustainability claims with higher transparency and fewer unknowns. As in 2025, the U.S will constantly charge tariffs on a huge range of goods imported from abroad. New trade actions focusing on Chinese-made goods have added considerable cost to several types of paperboard, inked packaging, and liners. While some tariffs are industry-specific, their consequent effect frequently touches food and beverage, e-commerce, and retail brands alike. Consumer-direct shipments demand boxes that look perfect and can withstand the transit. Quicker iterations and rigid materials from U.S producers assist DTC Brands stay constant and prevent their margins.

Canada

The Canadian Corrugated and Containerboard Association ( CCCA) is the national voice of the corrugated sector. CCCA members include containerboard mills, corrugator plants, and linked companies from coastline to coastline who transform to CCCA for value-added assistance, education, and resources. CCCA is loyal to assisting and developing the industry and displaying the recyclable, reliable, and inventive advantages of corrugated packaging to every Canadian. Corrugated packaging boxes are the key Canadian producing industry. In 1996, usage expenditure for this type of product was valued at some 1.5 million dollars, which shows a rise of more than 9% as compared to the previous year. Thai growth is by far perfect for the increase of every packaging product, which is 2.9%.

The corrugated packaging market is expected to expand from USD 309.86 billion in 2025 to USD 444.85 billion by 2034, growing at a CAGR of 4.10% from 2025 to 2034. Rapid expansion in online retail and the need for sturdy, cost-effective shipping solutions drive strong demand. Growing environmental regulations also push companies to adopt eco-friendly alternatives, fueling market growth.

Corrugated packaging refers to a type of lightweight, durable, and eco-friendly packaging manufactured from corrugated fiberboard, which consists of a fluted (wavy) middle layer sandwiched between two flat linerboards. This structure provides strength, impact resistance, and cushioning, making it ideal for shipping, storage, and product protection. Corrugated fiberboard is made up of three main components: liner board, fluting (Medium), and adhesives. The key benefits of corrugated packaging have been mentioned here as follows: strength, durability, cost-effective, lightweight, and versatility.

The global corrugated boxes market is projected to reach USD 283.02 billion by 2034, expanding from USD 180.26 billion in 2025, at an annual growth rate of 5.14% during the forecast period from 2025 to 2034. Increasing trend towards sustainable packaging is significant factor anticipated to drive the growth of the corrugated boxes market over the forecast period.

A corrugated box is a disposable container with three layers of material on its sides an outside layer, an inner layer, and a middle layer. When weighted materials are placed inside a corrugated box, the intermediate layer, which is fluted is designed in stiff, wave-shaped arches that act as supports and cushions. The process of aligning corrugated plastic or fiberboard (also known as corrugated cardboard) design elements with the functional, processing, and end-use requirements is known as corrugated box design. Packaging engineers strive to keep overall system costs under control while satisfying a box's performance criteria.

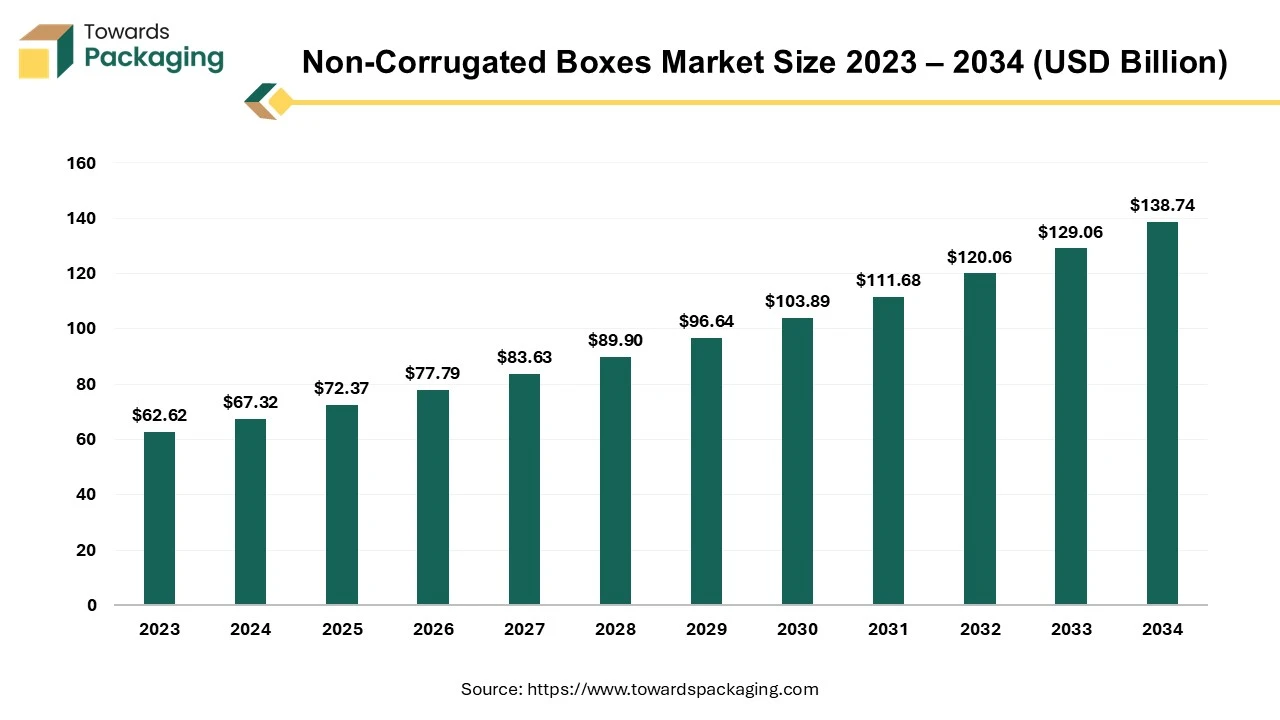

The non-corrugated boxes market is forecast to grow from USD 72.37 billion in 2025 to USD 138.74 billion by 2034, driven by a CAGR of 7.5% from 2025 to 2034. Due to rising trend of the fancy gift boxes the demand for the non-corrugated boxes increased which is estimated to drive the growth of the non-corrugated boxes market over the forecast period.

A non-corrugated box is a type of packaging box that does not have the fluted or ribbed layer found in corrugated boxes. Non-corrugated boxes are typically made from a single layer of material, such as cardboard, paperboard, or plastic. They lack the internal layer of fluted paper that corrugated boxes have. Common materials used for manufacturing non-corrugated boxes is paperboard, plastic, and cardboard among others. Plastic is in non-corrugated boxes manufacturing for meeting more durable and moisture-resistant packaging needs. Non-corrugated boxes are usually less durable than corrugated boxes because they lack the additional layer that provides cushioning and strength. They are often lighter, which can be beneficial for reducing shipping costs.

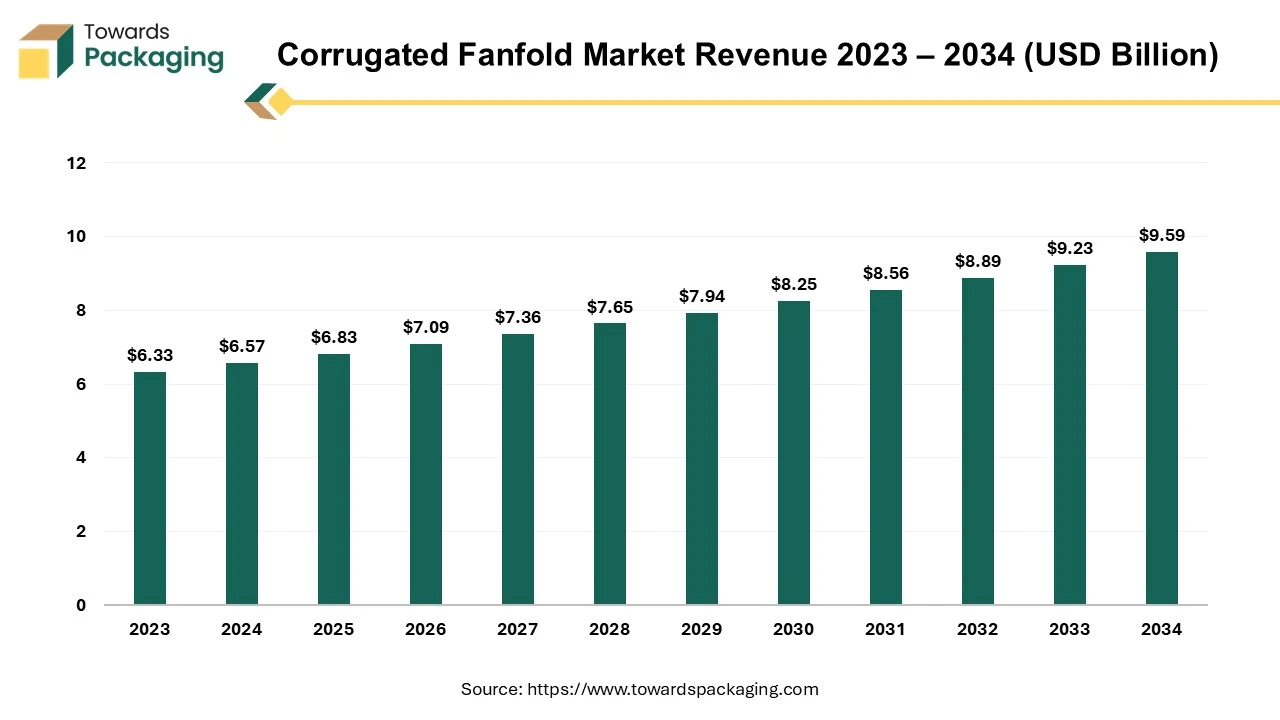

The global corrugated fanfold market is expected to grow from USD 6.83 billion in 2025 to USD 9.59 billion by 2034, registering a compound annual growth rate (CAGR) of 3.85% during the forecast period. This market expansion is primarily attributed to the rising demand for sustainable, cost-efficient, and customizable packaging particularly across e-commerce, logistics, and retail sectors. According to Smithers, the increasing shift toward on-demand packaging and right-sizing solutions continues to drive the adoption of corrugated fanfold among packaging manufacturers.

The market proliferates due to the rising e-commerce sector and the requirement of shipping & logistics where the safe and durable packaging of products is required. There is an increasing demand for sustainable packaging among consumers and strict government guidelines result in the growth of corrugated fanfold market development.

By End-User Industry

By Country

February 2026

February 2026

February 2026

February 2026