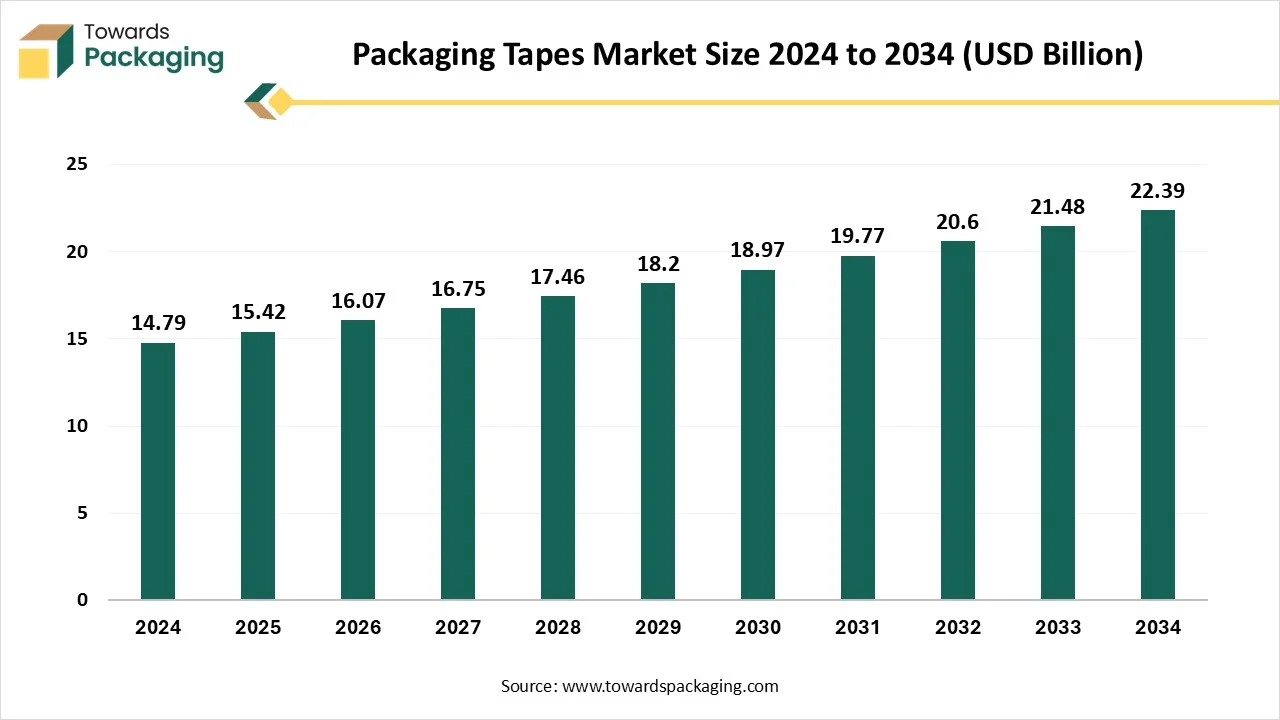

The packaging tapes market is forecasted to expand from USD 16.07 billion in 2026 to USD 23.35 billion by 2035, growing at a CAGR of 4.24% from 2026 to 2035. This report covers market trends, including the rise of specialty tapes, sustainable and eco-friendly tapes, and AI integration in packaging operations. It provides a detailed segmentation by tape type, material, and end-use across regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

The analysis also highlights top manufacturers including 3M, Avery Dennison, and Nitto Denko Corporation, along with competitive strategies, value chain dynamics, and trade data for a comprehensive understanding of the market.

Packaging tape, also known as parcel tape, is a pressure-sensitive adhesive tape that is used to pack and secure packaging materials, such as cardboard boxes. It's crafted to stick tightly to surfaces, avoid tearing or splitting, and remain effective under various surroundings like cold, heat, and damp. Businesses that deal with shipping should have products and this type of tape. Packaging tape is also known as shipping tape or simply ship tape. It is also utilized to seal corrugated cardboard boxes. A rigid plastic or polypropylene material covered with an effective adhesive makes it useful for this aim. It is famous as the best tape for cardboard boxes.

| Metric | Details |

| Market Size in 2025 | USD 15.42 billion |

| Projected Market Size in 2035 | USD 23.35 billion |

| CAGR (2025 - 2035) | 4.24% |

| Leading Region | North America |

| Market Segmentation | By Tape Type, By Material, By End-use and By Region |

| Top Key Players | 3M, I Tape Solutions Pune, Popular Plastics, Avery Dennison, Maxim Adhesive Tapes Pvt Ltd, Nitto Denko Corporation |

The role of artificial intelligence in this industry is ready to grow further .AI technologies are growing from performing understandable automated tasks to more complicated functions such as predictive analytics and decision-making. In the packaging industry, AI can be utilized to examine real-time data from production lines to update operations, control quality, and forecast maintenance needs. For example, AI-powered online inspection systems can detect faults in packaging at much greater speeds and precision than humans can achieve. AI integration collaborates with greater flexibility in terms of production lines, which allows manufacturers to quickly accept changes in product design or packaging requirements with less downtime. As consumer demand grows more varied and supply chains become more powerful, this flexibility will be important in maintaining efficiency and competitiveness in the sector.

Balancing Cost and Sustainability in Current Packaging

Economic factors play an important role in shaping consumption demands. With worldwide economies recovering from the disturbances caused by the COVID-19 pandemic, there is a renewed concentration on cost-efficiency balanced against consumer demand for high-quality and secure packaging options. Environmental issues are another main driver affecting consumption demands, with a rising segment of the consumer base urging sustainable and eco-friendly packaging options. This move is not a choice but an incumbent, as regulatory bodies overall strict regulations on waste and recycling. The packaging industry must invent ways to reduce its carbon footprint and improve the lifecycle of packaging materials through the best recycling technologies and the acceptance of biodegradable materials.

Packaging Tape Application: Surface, Environment, and Shelf life Insights

Packaging tapes can adhere to specific surfaces without advanced treatment. Transformers can use corona treatments to temporarily improve adhesion on lower surface energy plastics. Accurate surface preparation during use is important for making a strong bond; failure may lead to bond failure. Environmental conditions encourage the effectiveness of packaging tapes. Based on the tape's condition, a humid or moist environment can affect the adhesive properties. Packaging tapes have a shelf life similar to the best-by date for food. Producers mark rolls with a suggested use-by date, though several adhesives remain effective well past this date. On the other hand, packaging tapes are usually affordable, but costs can grow with custom design jobs, and automation can reduce labor costs that make personalization more cost-effective.

Enhancing Packaging Efficiency Through Workflow Optimization

Tracking metrics such as packaging time per order or issue rates can provide quantitative data that highlights areas that demand attention. By completely understanding our current operations, we can make informed decisions on where to implement changes. Effective workflow is frequently a central theme in developing the packaging procedure. An effective package station is important for accelerating the packaging procedure while ensuring quality. A well-organized package or packing station simplifies easy access to tools, materials, and equipment necessary for packaging orders. Furthermore, implementing the correct technology is important to make sure that our employees are well-versed in packaging procedures and best practices.

The demand for parcel tape is growing due to the rapid growth of e-commerce, global shipping activities, and logistics. With more goods being shipped daily, businesses and individuals need reliable packaging solutions to ensure secure, safe, and tamper-proof packaging. Parcel tape serves rigid adhesion, ease of use, and durability, which makes it perfect for sealing boxes and parcels during transit. Furthermore, personalized and eco-friendly parcel tape options are gaining popularity as companies find branding opportunities and more sustainable packaging choices.

Filament tape is one of the most evergreen tapes in the industry and is utilized in industries such as food packaging to simple office government. The filament tape is more rigid than any other tape in the industry. With the same size, the filament tape cannot be ripped. If there is any fatigue regarding filament tape, it can be parted ways in terms of length with a little bit of force. Hence, this is unlikely to occur if applied accurately and in events in which the filament deals with huge pressure. The tape is a requirement within the packaging sector as well as the office. Filament tape can be utilized within the packaging industry as well as in the office. Filament tape can be utilized to confine corrugated boxes in offices or the factory floor, and due to its power, it can also be a perfect tape that bundling items

Acrylic tape is a rigid and adaptable linking solution that has gained specific popularity across different industries due to its extraordinary adaptability and performance. This stress-sensitive tape includes an acrylic-adhesive-based material applied to a backing material, which can be a plastic film, foam, or other substrates. Its different characteristics make it a perfect choice for different uses, from packaging and construction to automotive manufacturing and electronics assembly. This bond can link with a large series of materials such as plastic, metal, and even wood. Its convertibility makes it useful in different sectors.

Melted tape is prevalently utilized as hot melt packaging tape, which is in heavy demand due to its strong adhesion, durability, and fast linking time. It is created using hot melt adhesive, which is melted during use and quickly forms a secure bond as it cools. This makes it perfect for packing cartons and boxes in high-speed packaging lines, specifically in logistics, e-commerce, and food retail industries. As packaging operations scale up worldwide, especially with growing online orders, hot melt tapes are becoming a preferred choice for several businesses seeking reliable, fast, and secure sealing solutions.

Carton-sealing packaging is a perfect solution for food and beverage packaging, which plays an important role in both the busy commercial sphere and the quiet corners of the home. It is usually known as box or packaging tape. This staple assists in making sure that everything from your new gadget to your favorite snack reaches home. It is created from strong materials like polypropylene and covered with a rigid adhesive; this tape adheres reliably to cardboard and other packaging materials. Its resistance to weather, durability, and potential to withstand weight and avoid tears make it a dependable choice for securing our items.

Chemical companies utilize packaging tapes extensively to ensure the secure and safe transportation of their products, many of which are harmful or sensitive. These tapes play an important role in packing boxes, drums, and containers to protect against leaks and contamination. Personalized tapes, such as chemical-resistant and tamper-proof tapes, assist in tracking product integrity and show unauthorized access during transit. Furthermore, transparent tapes are often utilized to protect important labels and safety information on packaging. Color-coded and printed tapes further help in identifying chemical categories and tracking regulatory compliance. Overall, packaging tapes are important for traceability, safety, and effective logistics in the chemical industry.

The market growth is heavily driven by the rising e-commerce and food and beverage sectors, which grew during the COVID-19 Pandemic and continue to demand robust, dependable packaging solutions. Countries such as India, China, and South Korea, and China lead regional consumption because of their rigid online retail structure and manufacturing sectors. Among tape types, pressure-sensitive tapes -specifically hot-melt variants -dominate because of their fast linking capabilities, low cost, and harmony with automated packaging lines. At the same time, water-activated tapes are gaining attention for heavy-duty,tamper-proof usage in shipping and logistics.

In North America, the demand for packaging tape is constantly growing, driven by the continuous expansion in logistics, e-commerce, and food delivery services sectors. The region has the advantage of a perfectly established retail and distribution structure, which makes it a significant market for different types of packaging tapes, specifically pressure-sensitive adhesive tapes, including hot-melt, acrylic, and rubber-based tapes. The United States leads the industry due to its heavy-scale warehousing and shipping operations, while Mexico and Canada are also undergoing growth due to increased cross-border trade and a growth in consumer goods movement. The rise of automated packaging systems in North American industries has further increased the demand for fast-application, reliable tapes that track rigid adhesion during transit.

By Tape Type

By Material

By End-use

By Region

February 2026

February 2026

February 2026

February 2026