Pharmaceutical Polymer Vials Market Industry Size, Regional Insights (NA, EU, APAC, LA, MEA), Segmentation, Value Chain & Key Players

The pharmaceutical polymer vials market presents a detailed examination of global market size, growth patterns, and future opportunities, covering all major segments such as polymer type, application, capacity, sterilization method, end user, and distribution channels. The report also provides regional insights covering North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. It includes competitive benchmarking of top companies, deep value chain mapping from raw material suppliers to end-product distributors, trade flow statistics, manufacturing footprints, and supplier networks, along with all relevant quantitative and statistical data.

Major Key Insights of the Pharmaceutical Polymer Vials Market

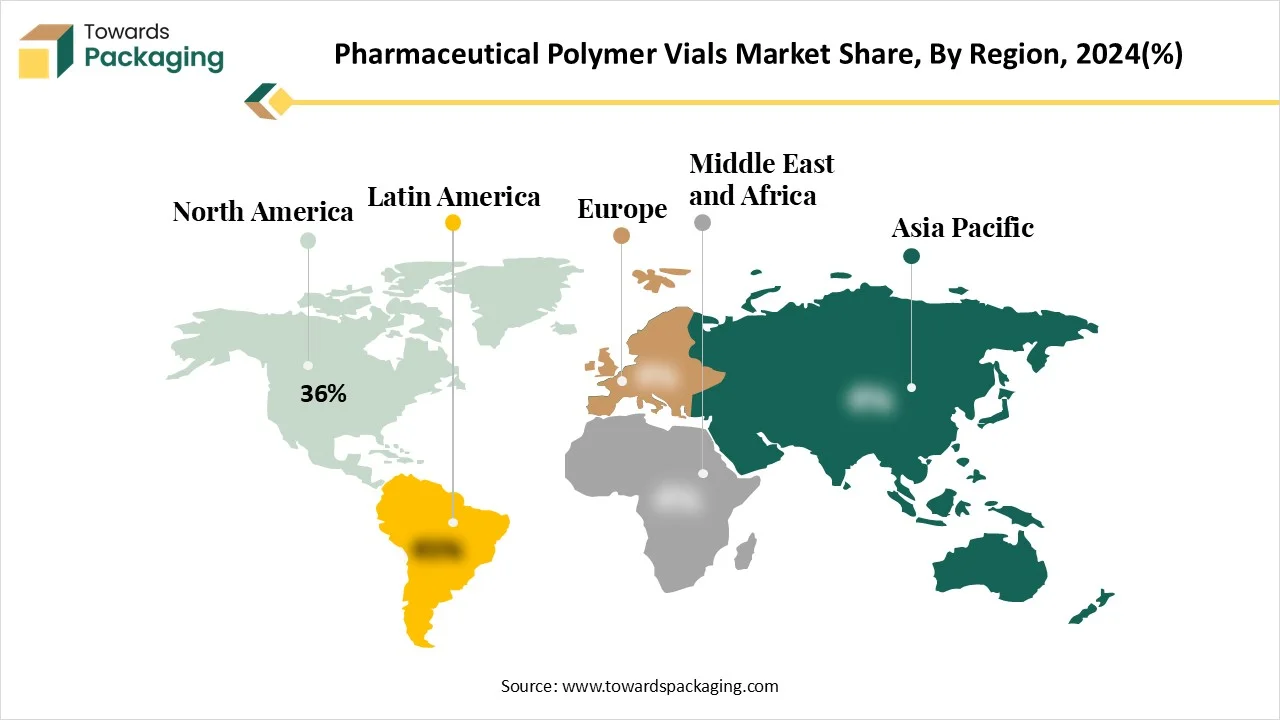

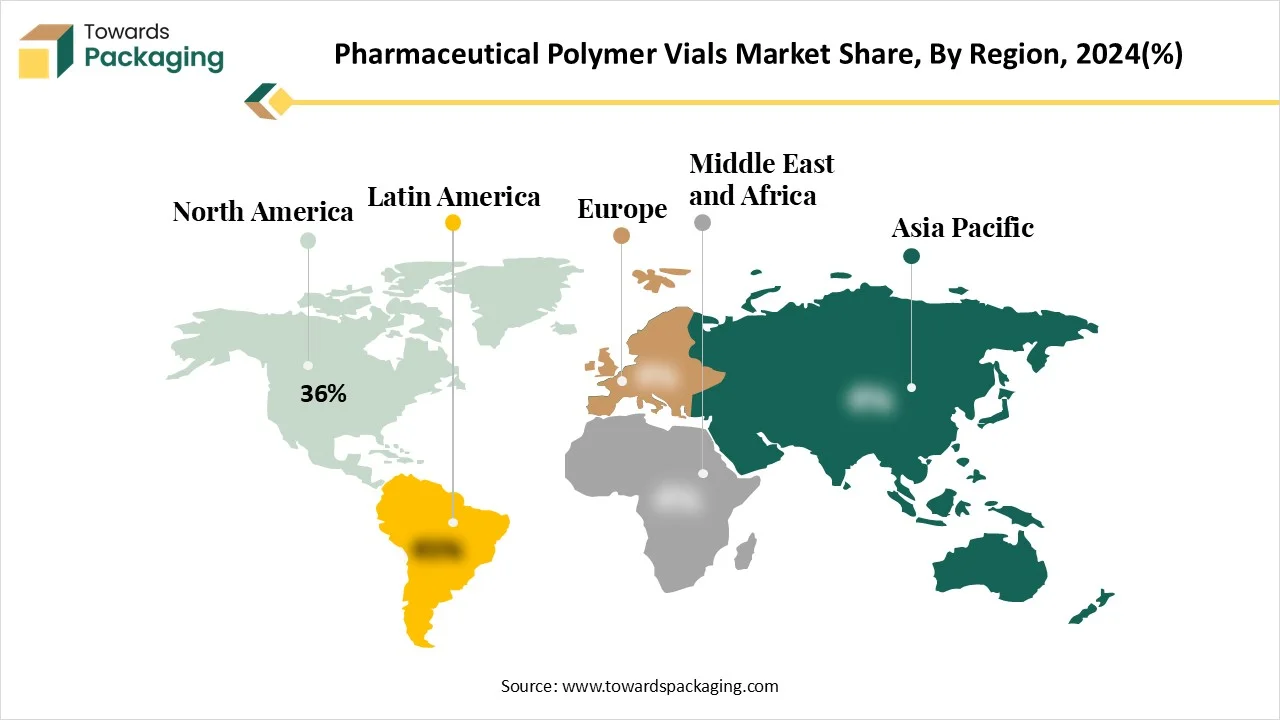

- By region, North America dominated the global market by holding more than 36% of the market share in 2024.

- By region, Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By polymer type, the COP segment contributed the biggest market share in 2024.

- By polymer type, the COC segment is expected to expand at a significant CAGR in between 2025 and 2034.

- By application, the injectable drugs segment dominated the market in 2024.

- By application, the biologics segment will be expanding at a significant CAGR in between 2025 and 2034.

- By capacity, the 5–10 mL segment held the major market share in 2024.

- By capacity, the <5 mL segment is projected to grow at a CAGR in between 2025 and 2034.

- By sterilization method, the gamma radiation segment contributed the biggest market share in 2024.

- By sterilization method, the electron beam segment is expanding at a significant CAGR in between 2025 and 2034.

- By end user, the pharmaceutical companies segment dominated the market in 2024.

- By end user, the CDMOs segment will be expanding at a significant CAGR in between 2025 and 2034.

- By distribution channel, the direct sales segment contributed the biggest market share in 2024.

- By distribution channel, the online platforms segment will be expanding at a significant CAGR in between 2025 and 2034.

Market Overview

Pharmaceutical polymer vials are containers made from advanced polymer materials (such as COP, COC, and polypropylene) used to store injectable drugs, biologics, and vaccines. These vials offer superior chemical resistance, reduced breakage risk, and better drug compatibility compared to traditional glass vials. They are widely used in biotechnology, pharmaceutical manufacturing, and clinical trials due to their lightweight nature, scalability, and sterility support.

What are New Trends in the Pharmaceutical Polymer Vials Market?

Rising Demand for Injectable Drugs

- Rising prevalence of chronic diseases has raised the usage of injectable drugs and influence the development of polymer vials.

Growing Shift towards Polymer Material

- With the rapid shift towards polymer material has driven this pharmaceutical polymer vials market significantly.

Increasing Usage of Personalized Medication

How Can AI Improve the Pharmaceutical Polymer Vials Market?

The incorporation of AI in the pharmaceutical polymer vials market plays an important role to enhance the production and development process of vials. AI is widely used for quality controlling, personalized medicine packaging, and selection of materials. It reduces the downtime and confirms regular production of the vials. Such advanced technology is extremely used for customization of vials or product packaging required for the treatment procedure.

Market Dynamics

Market Driver

Increasing Demand for Biosimilars and Biologics Boost the Pharmaceutical Polymer Vials Market Development

The increasing demand for biosimilars and biologics has driven the market to grow significantly. This type of packaging ensures integrity and stability of the quality of the drugs. The increasing ratio of chronic diseases such as diabetes, cancer, and various other enhance the requirement of injectable drugs which result in rising demand for advancement in vials. Rising guidelines for safety of drugs and innovation in the polymer materials has driven the growth of this market.

Market Challenges and Restraints

Volatility in Charges of Raw Materials Hindered the Pharmaceutical Polymer Vials Market Growth

The volatility in the charges of raw materials restraint the market. Continuous competition between raw materials such as glass, plastics and other material hinder the growth of this market. It has been a challenge for the market to maintain the quality of the vials and making it leak-proof which hinder the development of this market.

Market Opportunity

Rising Acceptance for Advanced Polymer Enhanced the Opportunities of the Pharmaceutical Polymer Vials Market

The increasing acceptance for advanced polymer enhanced the opportunities of the market. The growing occurrence of chronic diseases and the expansion of new injectable treatments boost the demand for polymer vials. Single-dose polymer vials are gaining approval because of their enhanced sterility and decreased risk of pollution, additionally influencing market extension. This tendency alone is projected to enhance hundreds of millions of components to yearly demand in the upcoming period. Growing ecological apprehensions are boosting the producers in the direction of accepting environment-friendly polymers and supportable engineering choices.

Segmental Insights

Polymer Type Insights

Why COP Segment Dominated the Pharmaceutical Polymer Vials Market In 2024?

The COP segment dominated the market in 2024 due to the superior quality packaging. These are dominating in the plastic vials or ampoules market as it is considered as high-quality material. It provides resistance from chemicals, and protect pharmaceutical products from various factors such as light, moisture, and oxygen. This material provides high durability, safety, and purity to the product.

The COC segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. It is due to its suitability and exclusive properties for sensitive biologics and drugs. These are also useful in enabling visual inspection and optical clarity of the contents. Increasing demand for biocompatible materials in the pharma industry has raised the utilization of this material.

Application Insight

Why Injectable Drugs Segment Dominated the Pharmaceutical Polymer Vials Market In 2024?

The injectable drugs segment held the largest share of the pharmaceutical polymer vials market in 2024 due to rising utilization of injectable drugs. Increasing prevalence of chronic diseases such as diabetes, cancer, and several other diseases. The growing treatment like gene therapy and biologic drugs is highly contributing towards the increasing demand for vials manufacturing. The rising trend towards single-dose vials has influenced the growth of this segment significantly.

The biologics segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment comprises vials which are made up of cyclic olefin polymers and polypropylene which enhance the demand for this segment. These are widely utilized due to their compatibility with biologics and has the capacity to maintain the stability of the drugs.

Capacity Insights

Why 5–10 mL Segment Dominated the Pharmaceutical Polymer Vials Market In 2024?

The 5–10 mL segment held the largest share of the market in 2024 due to its versatility and utilization in several places like hospitals, clinics, and many other. The rising demand towards low-dosage therapy and personalized treatment has raised the influence of this segment. The increasing focus towards reduction of contamination as well as wastage of raw materials has raised the production of such vials with 5-10 ml capacity.

The <5 mL segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is experiencing robust growth due to the increasing demand for unit dose packaging of the drugs. These are widely utilized for sample preservation, and customized therapeutics. It decreases the wastage of drugs and enhances delivery safety. The rapid growth in commercial drug manufacturing, drug development, and clinical trials has helped this segment to develop significantly.

Sterilization Method Insights

Why Gamma Radiation Segment Dominated the Pharmaceutical Polymer Vials Market in 2024?

The gamma radiation segment dominated the market in 2024 due to increasing material modification and sterilization process. It offers a wide range of pharmaceutical benefits such as sterilization of medical devices and implants. It reduces the influence of toxicity due to chemicals used in the pharmaceutical industry. It provides benefits such as isothermal character, low validation demand, high-volume processing, better penetration, and no residues.

The electron beam segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is rising significantly due to the continuous advancement in the technology. It is a process used for sterilizing polymer vials and various single use medical equipment. It utilizes high-energy electrons for the sterilization and penetration process which is efficiently troublemaking DNA of microorganisms. These are durable, safe, and cost-efficient solution for polymer vials.

End User Insight

Why Pharmaceutical Companies Segment Dominated the Pharmaceutical Polymer Vials Market In 2024?

The pharmaceutical companies held the largest share of the market in 2024 due to dispensing of vaccines, injectable medicines, and several other powder or liquid medications. This segment is concentrating on technological advancement like enhanced sterilization process, digitalization, and several other technologies. Major market players such as Nipro, Amcor, Gerresheimer, Stevanato Group, and many others are continuously enhancing technology for packaging of drugs. They also focus majorly towards safety and efficacy of the packages.

The CDMOs segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This segment is increasing significantly due to increasing demand for injectable medicines mainly its sterilization process. The continuous advancement in the packaging technology has evolved this segment development rapidly. It provides special infrastructure for methods such as sterile filling which plays a crucial role in injectable medication.

Distribution Channel Insights

Why Direct Sales Segment Dominated the Pharmaceutical Polymer Vials Market in 2024?

The direct sales segment dominated the market in 2024 due to the close relationship establishment between companies and consumers. It helps to maintain the transparency in the market and enhance the reliability. It provides flexibility and helps in customization of the vials as per requirement. The increasing demand for injectable drugs has raised this segment due to high production and supply process.

The online platforms segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. The rising trend for telemedicine has influenced the development of online platforms. The increasing convenience in accessibility of the medicines has encourage online ordering facility which led to the enhancement of the online medicine distribution portals.

Regional Insights

Huge Pharmaceutical Production in North America Promote Dominance

North America held the largest share of the market in 2024, due to the rising production demand for polymer vials for pharmaceutical purpose. The presence of strict guidelines of the government towards pharmaceutical packaging sector has influence the demand for this market to develop rapidly. Rising expenditure towards healthcare sector has evolve the market.

Asia Pacific’s Huge Development Potential Support Growth

Asia Pacific expects the significant growth in the market during the forecast period. Huge potential for growth of the healthcare sector has influenced the demand for polymer vials. The increasing demand for sanitized vials has raised the innovation process of the market. Rising acceptance for injectable drugs has evolved this market to expand rapidly.

Top Companies in the Pharmaceutical Polymer Vials Market

- SCHOTT Pharma

- West Pharmaceutical Services

- Gerresheimer AG

- SGD Pharma

- Stevanato Group

- SiO2 Materials Science

- Bormioli Pharma

- Berry Global

- Nipro Corporation

- Corning Incorporated

- Origin Pharma Packaging

- DWK Life Sciences

- Catalent Inc.

- Adelphi Healthcare Packaging

- Medtronic (Pharmaceutical Packaging Division)

- Thermo Fisher Scientific

- BD (Becton, Dickinson and Company)

- Amcor Plc

- AptarGroup, Inc.

- Ompi (a Stevanato Group company)

Latest Announcements by the Pharmaceutical Polymer Vials Market

- In January 2025, CEO of SCHOTT Pharma, Andreas Reisse, expressed, “With the advancement of polymer syringe process, we are raising the evolution standard in the pharmaceutical industry by offering a process which confirm packaging that maintain the stability of the drugs, enhance the operational efficacy, and decrease valuable drugs and waste generation during packaging.”

Recent Developments

- In January 2024, SCHOTT Pharma announced the launch of new vials for gene therapy and mRNA medication. It is developed with an aim to provide contamination free packaging of the products.

- In April 2025, Syntegon announced the launch of MLD Advanced to fulfil the rising need of pharmaceutical producer high output 100% IPC.

Pharmaceutical Polymer Vials Market Segments

By Polymer Type

- Cyclic Olefin Polymer (COP)

- Cyclic Olefin Copolymer (COC)

- Polypropylene (PP)

- Polyethylene (PE)

- Others (PVC, Polystyrene, etc.)

By Application

- Biologics

- Vaccines

- Injectable Drugs

- Lyophilized Drugs

- Others (Diagnostics, Ophthalmics)

By Capacity

- <5 mL

- 5–10 mL

- 10–20 mL

- >20 mL

By Sterilization Method

- Gamma Radiation

- Ethylene Oxide (EtO)

- Autoclaving

- Electron Beam

By End User

- Pharmaceutical Companies

- Biotechnology Firms

- CDMOs

- Research Institutions

- Hospitals & Clinics

By Distribution Channel

- Direct Sales

- Distributors

- Online Platforms

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East & Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwai