Ready-to-Use Pharmaceutical Packaging Market Forecast 2026-2035: Size, Trends, Regional Analysis & Key Players

The ready-to-use pharmaceutical packaging market is projected to grow from USD 11.56 billion in 2026 to USD 26.71 billion by 2035, registering a CAGR of 9.75%. This report provides detailed segmentation by packaging type (pre-filled syringes, vials, cartridges & ampoules, pre-filled bags, others), material type (glass, plastic/polymer, hybrid, biodegradable/sustainable polymers), drug type/application (biologics & vaccines, small molecule injectables, oncology drugs), and end-user (hospitals & clinics, CMOs, retail pharmacies, homecare). Regional insights cover North America, Europe, Asia-Pacific, Latin America, and MEA, with North America holding 40% market share and Asia Pacific growing at notable CAGR.

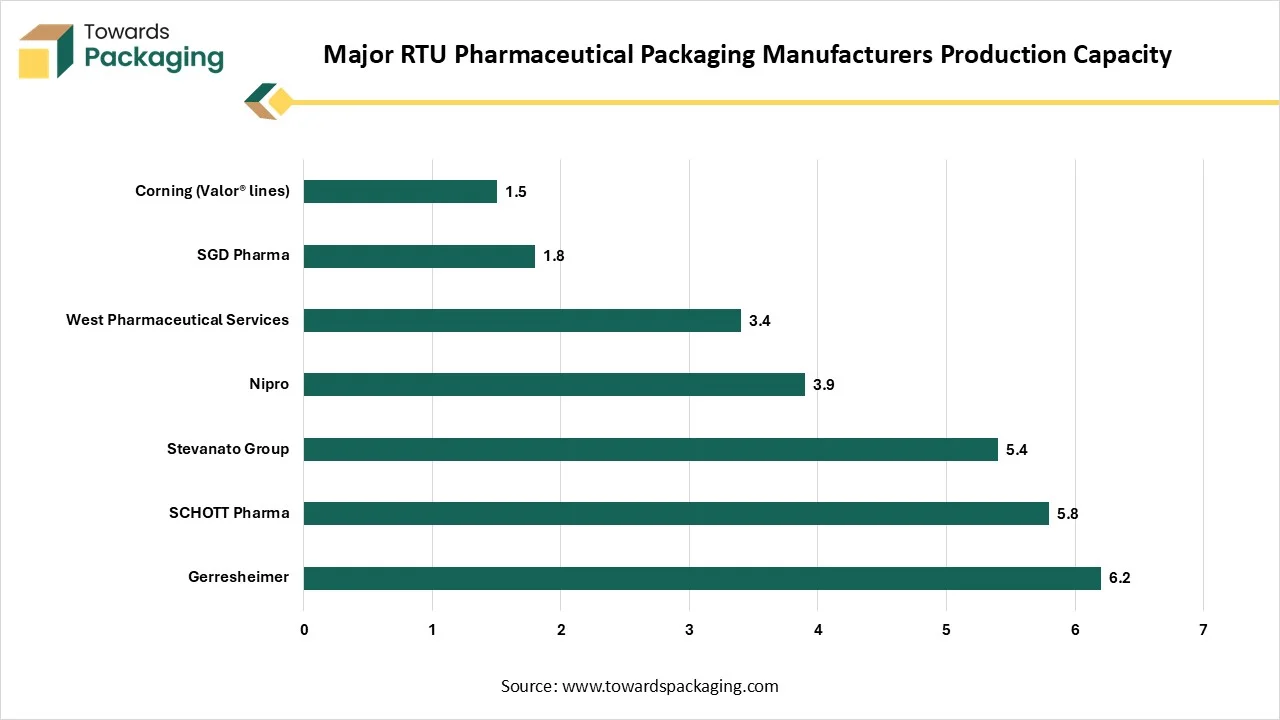

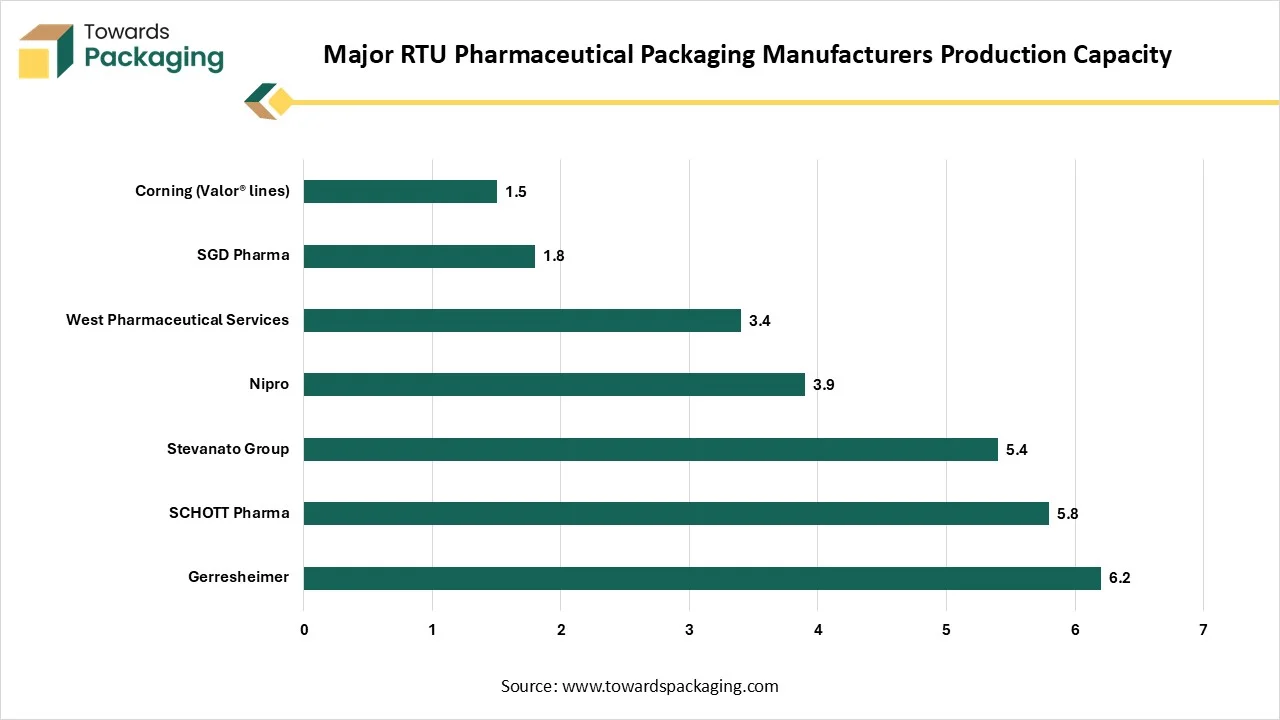

It also includes competitive analysis of West Pharmaceutical Services, SCHOTT AG, Gerresheimer, Nipro, SGD Pharma, Stevanato Group, value chain mapping, trade analysis with global exports valued at USD 29.4 billion, and manufacturer production capacities, e.g., Gerresheimer 6.2B units, SCHOTT 5.8B units.

Major Key Insights of the Ready-to-use Pharmaceutical Packaging Market

- In terms of revenue, the market is valued at USD 11.56 billion in 2026.

- The market is projected to reach USD 26.71 billion by 2035.

- Rapid growth at a CAGR of 9.75% will be observed in the period between 2025 and 2035.

- By region, North America dominated the global market by holding highest market share of approximately 40% in 2024.

- By region, Asia Pacific is expected to grow at a notable CAGR from 2025 to 2035.

- By packaging type, the pre-filled syringes segment contributed the biggest market share of approximately 38% in 2024.

- By packaging type, others (ready-to-Use kits, combination devices) segment is expected to expand at a significant CAGR in between 2025 and 2035.

- By material type, the glass packaging segment contributed the biggest market share of approximately 48% in 2024.

- By material type, the others (biodegradable / sustainable polymers) segment is expanding at a significant CAGR in between 2025 and 2035.

- By drug type / application, the biologics & vaccines segment contributed the biggest market share of approximately 40% in 2024.

- By drug type / application, the oncology drugs segment is expanding at a significant CAGR in between 2025 and 2035.

- By end-user industry, the hospitals & clinics segment contributed the biggest market share of approximately 52% in 2024.

- By end-user industry, the retail pharmacies / specialty pharmacies segment is expanding at a significant CAGR in between 2025 and 2035.

What is Ready-to-Use Pharmaceutical Packaging?

The ready-to-use pharmaceutical packaging includes pre-sterilized, pre-filled, and pre-assembled packaging solutions for injectable drugs, biologics, vaccines, and other parenteral therapies. RTU systems reduce preparation steps, minimize contamination risk, improve workflow efficiency in hospitals, clinics, and pharmacies, and ensure regulatory compliance. Products include pre-filled syringes, vials, cartridges, ampoules, bags, and associated closures, stoppers, and administration devices. Growing biologics production, the shift toward single-use systems, and stringent sterility requirements drive market expansion.

| RTU Packaging Type |

Annual Production (Billion Units) |

Share (%) |

| RTU vials |

13.8 |

50 |

| RTU prefilled syringes |

8.2 |

30 |

| RTU cartridges |

4.1 |

15 |

| RTU ampoules |

1.4 |

5 |

Ready-to-Use Pharmaceutical Packaging Market Outlook

- Market Growth Overview: The rising demand for sterile packaging, convenient and advanced technology, regulatory compliance, and manufacturing efficacy are the major factors behind the growth of this market.

- Global Expansion: Regions such as North America, Asia Pacific, and Europe are witnessing enhanced drug pipelines, streamlined manufacturing, regulatory compliance, growth of biologics, patient safety and product integrity, and enhanced demand for sterile syringes and vials.

- Major Market Players: Ready-to-use pharmaceutical packaging market comprises Schott AG, SGD Pharma, Datwyer, Aptar Group, Nipro Corporation, West Pharmaceutical Services, and various others.

- Startup Ecosystem: The major focus of the startup industries is to advance sterilization process, supply chain efficacy, or smart packing solutions because this market is rising swiftly due to amplified demand for convenience, safety, and speed.

Key Technological Shifts in Ready-to-Use Pharmaceutical Packaging Market

The ready-to-use pharmaceutical packaging market is experiencing major technological shift to enhance the adoption of smart packing and pre-sterilized mechanisms. Smart packaging utilizes technologies such as entrenched NFC, sensors, and IoT to enhance patient observance and allow data distribution with healthcare workers. The change in the direction of pre-sterilized ready-to-use mechanisms such as syringes and vials streamlines engineering procedures, decreases pollution risk, and progresses operative efficacy by eradicating in-house sterilization processes.

Trade Analysis of Ready-to-Use Pharmaceutical Packaging Market: Import & Export Statistics

- India: It is leading among top exporters of Pharmaceutical Packaging worldwide which is estimated around 6,986 shipments till August 2025.

- United States: It is considered as second top most exporter of Pharmaceutical Packaging globally which is 1,784 shipments in 2025.

- Germany: It is the third major exporter of the Pharmaceutical Packaging with 850 shipments till 2025.

Global Trade Statistics RTU Pharmaceutical Containers

| Trade Indicator |

Statistical Value |

| Global exports in sterile glass pharma containers |

USD 29.4 billion |

| Global imports in sterile glass pharma containers |

USD 27.8 billion |

| Share shipped as RTU formats |

45 to 50% |

| Trade value attributable to RTU packaging |

USD 13.2 to 14.7 billion |

Ready-to-Use Pharmaceutical Packaging Market- Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are plastics (like PET and PP), cardboard and paperboard, glass and metal.

- Key Players: SGD Pharma, SCHOTT AG

Component Manufacturing

The component manufacturing in this market comprises the production of pre-treated and pre-sterilized products such as syringes, vials, and stoppers to rationalize fill-finish actions for drug producers.

- Key Players: West Pharmaceutical Services, Berry Global.

Logistics and Distribution

This segment comprises filling procedure, decreasing operational charges and enhancing patient safety.

- Key Players: Daikyo Seiko, Stevanato Group

Major RTU Pharmaceutical Packaging Manufacturers Production Capacity

| Manufacturer |

Country |

Annual RTU Capacity (Billion Units) |

| Gerresheimer |

Germany |

6.2 |

| SCHOTT Pharma |

Germany |

5.8 |

| Stevanato Group |

Italy |

5.4 |

| Nipro |

Japan |

3.9 |

| West Pharmaceutical Services |

United States |

3.4 |

| SGD Pharma |

France |

1.8 |

| Corning (Valor® lines) |

United States |

1.5 |

Packaging Type Insights

Why Pre-Filled Syringes Segment Dominated the Ready-to-Use Pharmaceutical Packaging Market In 2024?

The pre-filled syringes segment dominated the market with highest share in 2024 due to improved convenience, security, and accuracy. The segment is influenced by the growing occurrence of chronic diseases, an increasing trend in the direction of self-administration, and the rising usage of multifaceted biologic drugs. The rising occurrence of chronic situations such as autoimmune disorders, diabetes, cancer, and rheumatoid arthritis needs frequent and accurate injections in which provide pre-filled syringes reliably. With a growing emphasis on home-based health care, it provides patients a convenient and simple method to self-inject, refining handling observance and individuality.

The others (ready-to-Use kits, combination devices) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to requirement for customized packaging. Sensitive and complex biologic medicines need focused, sterile packing, which is frequently provided in ready-to-use arrangements. Inventions in resources science and the growth of smart, linked devices are improving product integrity and functionality.

Material Type Insights

Why Glass Packaging Segment Dominated the Ready-to-Use Pharmaceutical Packaging Market In 2024?

The glass packaging segment dominated the market with highest share in 2024 due to regulatory standard and sterility. New technologies in strengthened and coated glass are showing historical apprehensions about delamination and breakage, leading glass more feasible for high-amount packaging lines. Glass packaging can be effortlessly sterilized, which is important for injectable medicines and vaccines. Strict regulations about patient security and drug steadiness support the fondness for glass, particularly for sensitive and complex formulations. The demand is rising for pre-filled needles utilized for self-administration of medicines such as insulin and biologics.

The others (biodegradable / sustainable polymers) segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to rising pressure to decrease ecological impact. Inventions are substituting old-style aluminum blister packets and PVC. Governments and worldwide bodies are presenting strict guidelines on plastic waste and endorsing circular economy ideologies. Rising ecological awareness among customers is growing the demand for environment-friendly as well as sustainable packaging.

Drug Type / Application Insights

Why Biologics & Vaccines Segment Dominated the Ready-to-Use Pharmaceutical Packaging Market In 2024?

The biologics & vaccines segment dominated the market with highest share in 2024 due to need for high-quality packaging. The growth in biosimilars and biologics needs dedicated packing that is sensitive, stable, and sterile to features such as light and temperature. Ready-to-use packing is important for vaccines and biologics to preserve product quality, avoid contamination, and fulfil strong regulatory values. The growing utilizes of self-managed biologics, frequently in prefilled needles, is a main development area for ready-to-use packing.

The oncology drugs segment is expected to grow at the fastest CAGR during the forecast period. This segment is rising due to increasing occurrence of cancer and the requirement for sterile, safe packing for multifaceted treatments. There is a sturdy focus on safeguarding the integrity and sterility of oncology medicines, and ready-to-use packing supports guarantee the transparency of drugs from the producer to the patient. The business is observing a trend in the direction of progressive packaging resolutions. The rising demand for multifaceted treatments such as gene and cell therapies is a significant driver for focused ready-to-use packing designed for sterile fill and appearance.

End User Insights

Why Hospitals & Clinics Segment Dominated the Ready-to-Use Pharmaceutical Packaging Market In 2024?

The hospitals & clinics segment dominated the market with highest share in 2024 due to rising demand for unit-dose and pre-sterilized packaging. This segment also comprises demand for pre-filled drugs and other particular containers personalized for precise drug delivery requirements. The rise of biosimilars, biologics, and vaccines, which frequently need sterile and precise delivery, influences the demand for progressive ready-to-use packing such as specialized vials and pre-filled syringes. Healthcare establishments are progressively supporting for packing that improves patient sterility and safety. Ready-to-use packaging supports in fulfilling these strict regulatory guidelines.

The retail pharmacies / specialty pharmacies segment is expected to grow at the fastest CAGR during the forecast period. This segment is rising due to enhanced demand for patient-centric packing. Structures such as blister cards noticeable with days and large-print labelling assist patients with correct medications. Several specialty medicines are injectables that need a cold chain distribution. Their ready-to-use packaging must put up precise temperature panels and comprises needles to display quality during transportation.

Regional Insights

Strong Pharmaceutical Base in North America Promote Dominance

North America held the largest share in the ready-to-use pharmaceutical packaging market in 2024, due to robust pharmaceutical manufacturing base. A huge number of aging populations with an enhanced rate of chronic diseases boosts demand for pharmaceuticals and, thus, their packing. Higher per capita health care outflow in the U.S. offers to a strong market for medicinal products and packing. The acceptance of artificial intelligence and automation is enhancing packing procedures and refining overall efficacy.

Presence of Huge Biopharmaceutical Industry Boost Ready-to-Use Pharmaceutical Packaging Market in the U.S.

U.S. is dominating in the market in North America region due to the presence of huge biopharmaceutical industries. It is a major hub for manufacturing biopharmaceutical products, which generates a huge need for pre-sterilized, ready-to-use packing such as vials and syringes to confirm product security and efficacy. Pharmaceutical industries are gradually accepting ready-to-use packaging to rationalize production by eradicating the requirement for in-house sterilization procedures and decreasing the risk of pollution. Supportive monitoring reassurance for sterile and excellent-quality packing improves the development of the market. The development of modified medicine needs smaller and regular doses, growing the requirement for pre-filled syringes and several other ready-to-use formats.

Asia Pacific’s Expanding Healthcare Infrastructures

Asia Pacific expects the significant growth in the ready-to-use pharmaceutical packaging market during the forecast period. This market is growing due to rapid expansion of healthcare infrastructures. The extension of pharmaceutical manufacturing, mainly for biologics and generics, is a major driver. Increasing healthcare organizations and amplified admittance to medicines in developing economies are enhancing demand. There is a rising emphasis on sustainable packing resolutions across all the region, and it is driving invention in resources and design.

Rising Healthcare Spending in China Promote the Ready-to-Use Pharmaceutical Packaging Market Growth

China has a huge market due to rising expenditure towards healthcare sector. A rising population, growing chronic diseases, and support of the government for healthcare upgrading are enhancing pharmaceutical manufacture and demand for packing. Stricter guidelines, such as the need for anti-counterfeiting measures and unit-level serialization, are influencing investment in progressive packaging lines as well as resources. Major pharmaceutical packaging industries are investing in study and growth to generate innovative, safe, useful, and sustainable packing.

Regional Production Distribution in RTU Pharmaceutical Packaging

| Region |

Annual Production (Billion Units) |

Share (%) |

| Europe |

10.6 |

39 |

| North America |

8.8 |

32 |

| Asia (Japan, China, India) |

6.3 |

23 |

| Rest of World |

1.8 |

6 |

Europe is Notably Growing Region in the Ready-to-Use Pharmaceutical Packaging Market

Europe is notably growing due to increasing demand for pre-sterilized packaging has influenced the growth of the market. The industry is rising frequently for pre-sterilized mainly packaging like cartridges, vials, and syringes which are ready for filling, also streamlines manufacturing and reduces downtime. The pharmaceutical sector’s emphasis on technological and automation advancements is influencing the acceptance of ready-to-use schemes to rationalize the packing procedure.

Focus on Accurate Medicine in Germany Promote the Ready-to-Use Pharmaceutical Packaging Market Growth

Germany has a huge ready-to-use pharmaceutical packaging market due to huge Emphasis on accurate medicine. Continuous advancement in the pharmaceutical industry and growing demand for drug protection and environment-friendly resources are the major factors boosting the growth of this market. Germany has a strong pharmaceutical industry with wide production and sturdy R&D, which boosts demand for enhanced-quality packing solutions. Growing consciousness of ecological influence is inspiring the acceptance of more environment-friendly and sustainable packing resources in the industry.

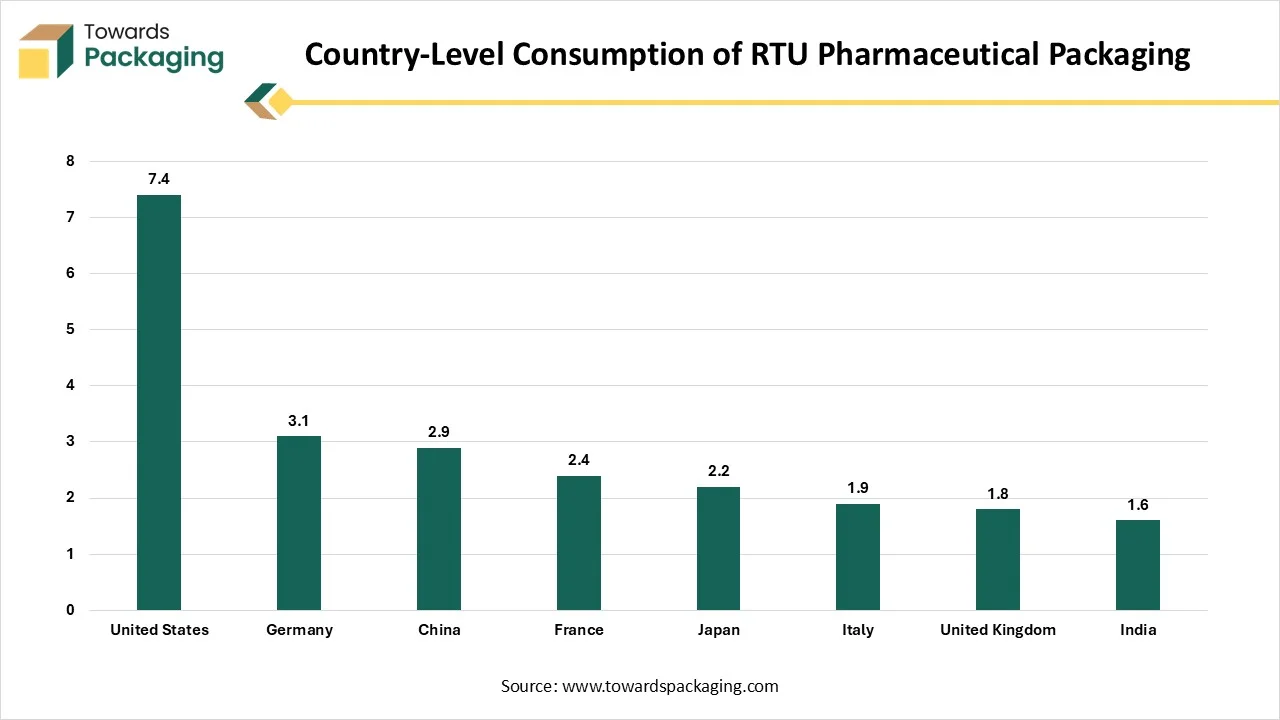

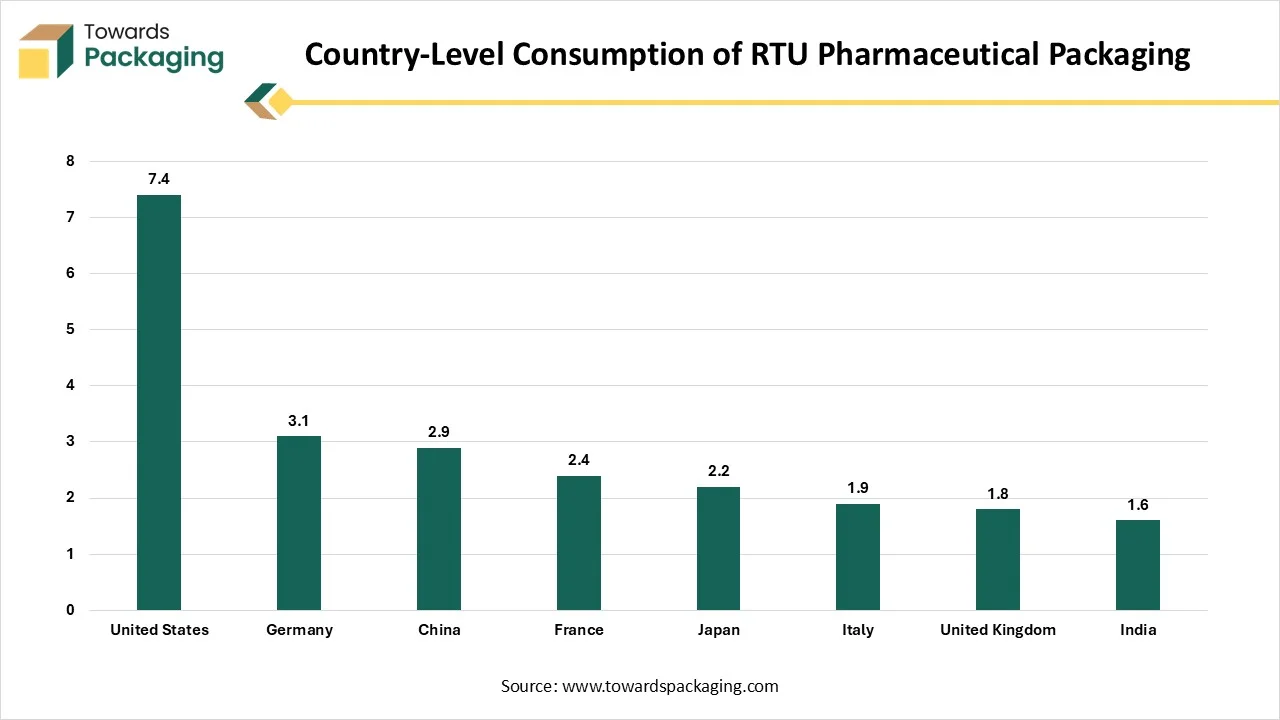

Country-Level Consumption of RTU Pharmaceutical Packaging

| Country |

Annual Consumption (Billion Units) |

| United States |

7.4 |

| Germany |

3.1 |

| China |

2.9 |

| France |

2.4 |

| Japan |

2.2 |

| Italy |

1.9 |

| United Kingdom |

1.8 |

| India |

1.6 |

Recent Developments

- In October 2025, Linuo Pharmaceutical Packaging launches worldwide Ready-to-Use product line. It is pioneering smart engineering and superior quality pharma packaging.

- In April 2025, Syntegon has introduced its latest MLD advanced filling machine, personalized for ready-to-use (RTU) nested syringes. It is designed to fulfil the rising demands of pharmaceutical producers for high result influenced with 100% in-process control (IPC), confirming accurate filling.

Top Companies in the Ready-to-Use Pharmaceutical Packaging Market

- West Pharmaceutical Services: It is well-known for advanced, high-tech containment resolutions.

- SCHOTT AG: It produces superior-quality glass containers and advanced choices for sensitive pharmaceuticals products.

- Gerresheimer AG: It is a worldwide partner for pharmaceutical packing and drug delivery schemes, utilizing both plastic and glass materials.

- Nipro Corporation: It offers an extensive range of main packaging and delivery plans.

- SGD Pharma: It focuses on glass ampoules and vials for pharmaceutical usage.

- Others: Catalent, Inc., Becton Dickinson (BD), Ypsomed AG, Terumo Corporation, Stevanato Group, HCT Group (HCT Group Biopharma Packaging), ROVI Group (via CDMO services), Vetter Pharma-Fertigung, AptarGroup, Amcor Limited, Daikyo Seiko, Ltd., SHL Group, Unilife Corporation, Corning Inc. (vials, cartridges), and BioSolutions / Specialty CDMO packaging suppliers.

Ready-to-Use Pharmaceutical Packaging Market Segments Covered

By Packaging Type

- Pre-Filled Syringes

- Vials (Single-use / Multi-dose)

- Cartridges & Ampoules

- Pre-Filled Bags (e.g., infusion bags)

- Others (Ready-to-Use kits, combination devices)

By Material Type

- Glass Packaging

- Plastic / Polymer Packaging

- Hybrid / Multi-layer Materials

- Others (biodegradable / sustainable polymers)

By Drug Type / Application

- Biologics & Vaccines

- Small Molecule Injectable Drugs

- Oncology Drugs

- Others (antibiotics, hormones, anesthetics)

By End User

- Hospitals & Clinics

- Contract Manufacturing Organizations (CMOs) / Pharmaceutical Manufacturers

- Retail Pharmacies / Specialty Pharmacies

- Homecare / Patient-administered Settings

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA