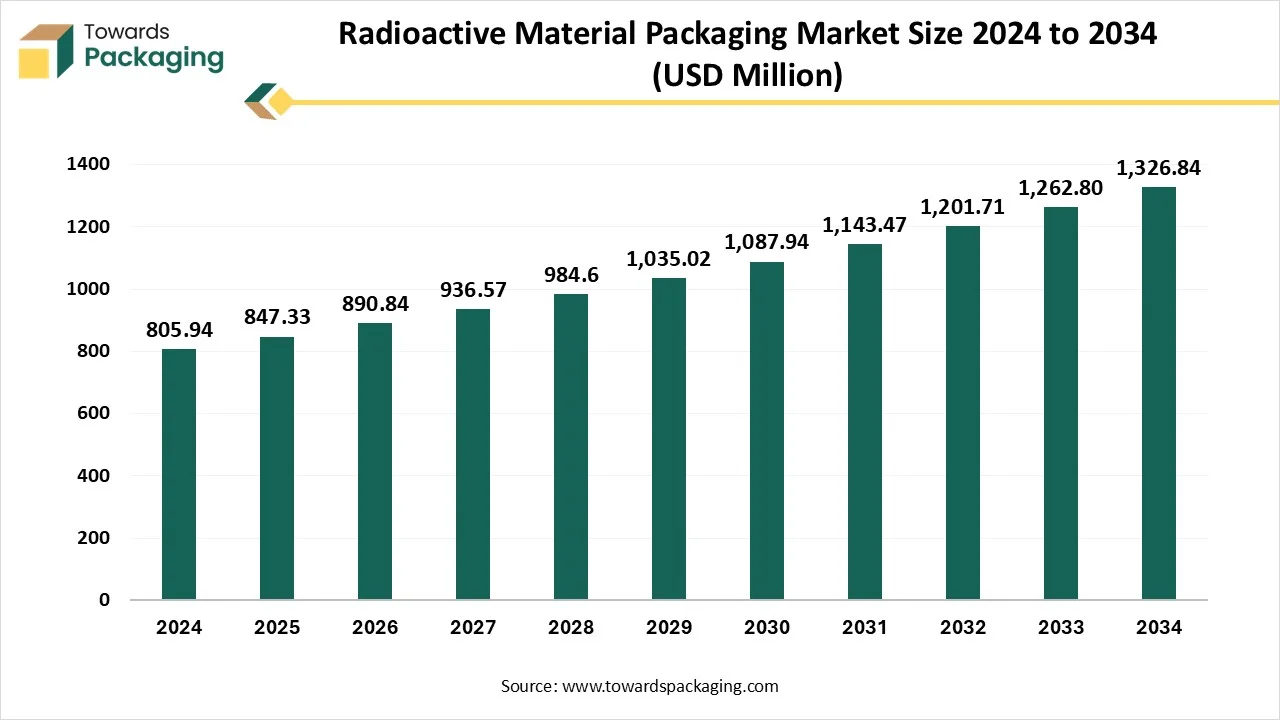

The radioactive material packaging market is forecasted to expand from USD 890.92 million in 2026 to USD 1,398.78 million by 2035, growing at a CAGR of 5.14% from 2026 to 2035. The report covers market segmentation by type (Type A, Type B, Others), product (Bottles, Drums, IBCs, Others), and material (Plastic, Metal, Others). Regional insights include North America, Europe, Asia Pacific, Latin America, and MEA, highlighting trends, demand drivers, and regulatory frameworks.

The study also provides a detailed competitive analysis, value chain mapping, trade data, and profiles of key manufacturers and suppliers, including Kvark Ltd., Waste Control Systems, General Plastics, Croft Limited, and PerkinElmer.

Radioactive material packaging involves specialized containers and methods used to safely transport radioactive substances from one location to another. These materials emit ionizing radiation, which can be harmful to people and the environment if not properly contained. Thus, the primary purpose of this packaging is to protect individuals and the environment from radiation exposure, to prevent damage or loss of the radioactive material during transport, and to safeguard against leaks, spills, or contamination in case of accidents. Packaging is designed with key features such as radiation shielding to reduce emissions, containment systems to prevent leaks, structural durability, and proper labeling to inform and warn handlers about the radioactive contents.

There are several types of radioactive material packaging, classified based on the type and quantity of radioactive material being transported. Excepted packaging is used for materials with very low levels of radioactivity and requires minimal shielding; it is often utilized for medical isotopes or small instruments containing radioactive sources. Industrial packaging, which includes IP-1, IP-2, and IP-3 types, is used for materials with low to moderate radioactivity, such as contaminated equipment or waste. These provide increasing levels of protection, with IP-3 being the most robust.

| Metric | Details |

| Market Size in 2025 | USD 847.37 Million |

| Projected Market Size in 2035 | USD 1,398.78 Million |

| CAGR (2026 - 2035) | 5.14% |

| Leading Region | North America |

| Market Segmentation | By Type, By Product, By Material and By Region |

| Top Key Players | Kvark Ltd., Waste Control Systems, General Plastics, Waste Control Systems, Croft Limited, PerkinElmer |

The incorporation of embedded sensors, GPS tracking, and real-time monitoring systems is enhancing the traceability and security of radioactive shipments. For instance, the Smart Packaging for Critical Energy Shipments (SPaCES) project utilizes 3D printing and advanced electronics to monitor packages throughout their lifecycle, ensuring compliance and safety.

There is a rising emphasis on eco-friendly packaging solutions, such as lead-free composites and biodegradable materials. Companies like QSA Global and EcoSolutions are developing green composite material-based packaging options to replace traditional lead-based solutions, aligning with global sustainability goals.

Innovations in shielding materials, including composite polymers and nanomaterials, are improving both the safety and weight of radioactive material packaging. These advancements contribute to more efficient and secure transportation of radioactive substances.

Packaging solutions are becoming more tailored to specific applications, considering factors such as the type of radioactive material, transportation mode, and destination. This customization enhances safety and reduces the risk of accidents.

AI integration is poised to significantly enhance the radioactive material packaging industry by improving safety, efficiency, compliance, and decision-making. One of the key benefits is real-time monitoring and predictive maintenance. By processing data from embedded sensors, AI can monitor temperature, radiation levels, shock, and vibration during transport. Artificial intelligence has the ability to predict component failures, allowing for timely maintenance and reducing the risk of accidents. Additionally, AI-powered simulations and machine learning can optimize packaging design by analyzing material performance under stress and suggesting improvements in geometry, shielding, and sustainability, which helps accelerate the development of safer and more efficient packaging solutions.

In logistics, AI can optimize routes by considering traffic, weather, and geopolitical risks, ensuring safer and more efficient transportation of radioactive materials. It also aids in regulatory compliance by using natural language processing to automate documentation, verify regulatory requirements, and alert operators to changes in laws and standards. For risk assessment and emergency response, AI can simulate accident scenarios to evaluate packaging performance and support emergency planning, enhancing overall safety preparedness.

Furthermore, AI improves quality control through computer vision systems that inspect packaging for defects or tampering, ensuring high manufacturing standards. It also supports lifecycle management by tracking the usage, radiation exposure, and maintenance history of packaging units, helping operators determine when containers need recertification or replacement. Overall, AI brings intelligent automation and predictive capabilities to an industry where precision and safety are paramount, contributing to a more secure, efficient, and forward-looking approach to handling radioactive materials.

Growing use of Radioactive Materials in Medicine

One of the most significant growth drivers is the expanding use of radioactive isotopes in medical diagnostics and treatment, especially in nuclear medicine, cancer radiotherapy, and diagnostic imaging. The increasing number of cancer cases worldwide and the demand for advanced healthcare technologies are fueling this trend, leading to higher demand for secure and compliant packaging solutions.

As countries seek cleaner energy alternatives to fossil fuels, nuclear power is experiencing renewed interest, particularly in developing regions. This includes the construction of new nuclear power plants, the transportation of nuclear fuel, and the safe disposal of radioactive waste all of which require specialized packaging.

Strict Regulatory Standards and Environmental and Safety Concerns

The key players operating in the radioactive material packaging market are facing issues due to strict environmental standards and safety concerns, which are estimated to restrict the growth of the market. Governments and international bodies like the International Atomic Energy Agency (IAEA) have set very stringent safety and security regulations for packaging radioactive materials. These regulations can make it time-consuming and costly to develop new packaging solutions or even modify existing ones. Manufacturers must meet strict standards such as radiation shielding, leakage prevention, and thermal resistance.

Managing the disposal of radioactive packaging materials, especially after use, is a significant concern. Many packaging solutions are designed for long-term use and require proper disposal methods, which can be costly and challenging. Increasing concerns over environmental pollution and waste management pose a challenge to the industry. Packaging that is not recyclable or poses risks of contamination can face strong regulatory scrutiny and public opposition.

Beyond healthcare and energy, radioactive materials are widely used in industrial radiography, mining, food irradiation, and scientific research. The increasing adoption of radiological technologies in these sectors contributes to a growing need for reliable and application-specific packaging.

The development of advanced shielding materials, smart packaging, and lightweight composites is making radioactive material packaging more effective and cost-efficient. These innovations are attracting investment and adoption across industries by improving safety and compliance while reducing logistics costs.

With a stronger global focus on sustainability, there is growing awareness of the importance of safe radioactive waste handling and disposal. This includes packaging used for long-term storage and transport of low, intermediate, and high-level radioactive waste, creating additional market demand.

In some regions, the transport and storage of radioactive materials for defense, security, and research purposes also drive demand. This includes nuclear weapons programs, border security efforts, and emergency preparedness operations, all of which require secure and compliant packaging solutions.

The Type A segment holds a dominant presence in the market as this type provides protection during transit and is cost-effective. Type A packaging is extensively used for transporting radioactive materials due to its ability to provide a safe, cost-effective, and reliable means of containment for materials with low to moderate levels of radioactivity. Designed to meet stringent international safety standards, such as those set by the International Atomic Energy Agency (IAEA), Type A packaging ensures that radioactive materials are safely contained under normal transport conditions, including impacts, temperature fluctuations, and handling. It is specifically intended for materials that do not pose a high risk of radiation exposure, such as medical isotopes, industrial radiography sources, and certain types of waste. Its lightweight and cost-effective design makes it a practical solution for routine shipments, ensuring the safety of both the environment and people involved in transport.

In addition, Type A packaging is durable, capable of withstanding minor accidents or mishandling without compromising its structural integrity, which helps prevent the release of radioactive materials. The versatility of Type A packaging, which can be adapted to contain radioactive materials in various forms, solid, liquid, or gas, further enhances its widespread use in medical, industrial, and research settings.

The intermediate bulk containers (IBCs) segment accounted for the dominant revenue share of the radioactive material packaging market in 2024. Intermediate Bulk Containers (IBCs) are widely used for radioactive material packaging due to their large storage capacity, durability, and compliance with safety standards. They provide leak-proof containment, preventing radiation release during transport. IBCs are easy to handle, stackable, and designed for safe movement with forklifts, offering efficiency in storage and transport. Their versatility allows them to hold both liquid and solid radioactive materials, and they are reusable, making them cost-effective and environmentally friendly. IBCs also protect against external factors like temperature fluctuations and UV radiation, making them ideal for industries handling bulk radioactive materials in medical, industrial, and research applications.

The plastic segment dominates the market due to its chemical resistance property, lightweight nature, and moldability. Plastic materials, particularly high-density polyethylene (HDPE), are extensively used for packaging radioactive materials due to their durability, chemical resistance, and cost-effectiveness. Plastics are tough and resistant to cracking, ensuring that radioactive substances are securely contained without risk of leakage during transport or handling. They are also chemically resistant, preventing reactions with hazardous substances often associated with radioactive materials.

Additionally, plastics are lightweight, making them easier and cheaper to transport compared to metal containers. They are non-corrosive, ensuring long-term integrity of the packaging, and can be easily molded into various shapes to accommodate different types of radioactive materials. While plastics do not offer the same level of radiation shielding as metals like lead, they can still provide some protection for low-level radioactivity, especially when combined with other shielding materials. Furthermore, plastic containers are easy to clean, making them reusable, which is particularly beneficial in industries like healthcare and research. Their environmental impact can also be mitigated by using recyclable plastics, aligning with sustainability goals.

North America region held the largest share of the sustainable minimalistic tableware packaging market in 2024, owing to advanced technological infrastructure and a large nuclear industry in the region. The region benefits from a strict regulatory framework, with agencies like the U.S. Nuclear Regulatory Commission (NRC) and the Canadian Nuclear Safety Commission (CNSC) enforcing high safety standards, driving demand for advanced packaging solutions that comply with rigorous regulations. Additionally, North America has a well-established nuclear industry, including numerous power plants and research reactors, particularly in the U.S. and Canada, which creates continuous demand for safe and efficient radioactive material packaging.

North America is a hub for medical and industrial applications of radioactive materials, further driving packaging needs for medical isotopes and industrial radiography. Moreover, the investment in nuclear waste management, including the safe handling, storage, and transport of spent nuclear fuel, has spurred the development of specialized containers for long-term use. Its well-developed supply chain and manufacturing capacity, coupled with strong research and development (R&D) in material science and packaging technologies, ensure that the region remains at the forefront of packaging innovation.

The emphasis on nuclear security and non-proliferation, particularly in the U.S. and Canada, has also led to the development of tamper-proof and highly secure packaging solutions. Additionally, the demand for North American packaging solutions extends globally, positioning the region as a major exporter. Finally, the focus on sustainability and the development of reusable and environmentally friendly packaging solutions further reinforces North America’s leadership in this market.

U.S. Market Trends

The U.S. is the dominant player in the North American radioactive material packaging market, driven by its extensive nuclear energy sector, significant medical isotope production, and research facilities. The U.S. has stringent regulatory bodies like the Nuclear Regulatory Commission (NRC) and the Department of Transportation (DOT) that enforce high safety standards for radioactive material transport and storage. Its advanced technological infrastructure supports the development of specialized packaging solutions. Moreover, the U.S. leads in nuclear waste management, which requires robust containment solutions.

Canada Market Trends

Canada plays a significant role in the North American radioactive material packaging market, with its well-established nuclear industry, particularly in the fields of nuclear energy and medical applications. The Canadian Nuclear Safety Commission (CNSC) ensures strict adherence to safety regulations in handling and transporting radioactive materials. Canada's focus on nuclear waste management, coupled with its extensive research in radiation protection, drives the demand for specialized packaging solutions. Additionally, the country’s commitment to sustainability and environmental goals influences the adoption of reusable and eco-friendly packaging options.

The Asia Pacific market is expanding rapidly due to export opportunities and regional trade in the region. Countries like India, China, Japan, and South Korea are expanding nuclear power capacity, creating strong demand for packaging solutions to transport fuel and manage radioactive waste. The increased use of radioisotopes in medical diagnostics and cancer treatments, along with industrial applications such as non-destructive testing, further drives this demand.

Government investments and policies are supporting nuclear infrastructure and regulatory reforms aligned with IAEA standards, fueling the need for compliant packaging. Additionally, the increase in the number of local manufacturers enhances regional self-sufficiency and innovation in packaging technologies. Asia-Pacific countries are also focusing on nuclear waste management and developing long-term storage solutions, with advancements in material science, growing export activity, and expanding industrial applications.

China Market Trends

China is a leading force in the Asia Pacific radioactive material packaging market, driven by rapid expansion in nuclear power generation. With an aggressive plan to build new nuclear reactors and become carbon neutral, China requires extensive radioactive packaging solutions for nuclear fuel transport, waste management, and radiopharmaceuticals. The government’s strong investment in nuclear infrastructure and research also supports domestic packaging innovation. Additionally, China’s growing use of radioisotopes in medical diagnostics and industrial applications increases demand for compliant, high-performance packaging. Local manufacturing capacity and regulatory alignment with IAEA standards further bolster China’s market position.

India Market Trends

India’s market is fuelled by a strong nuclear energy program and the growing use of radioisotopes in healthcare and industry. The Department of Atomic Energy (DAE) and Bhabha Atomic Research Centre (BARC) play key roles in regulating and advancing nuclear technologies. India is a major producer and exporter of medical isotopes, particularly for cancer diagnostics and therapy, which drives demand for secure and approved packaging. Ongoing investments in nuclear waste management and infrastructure expansion are increasing the need for long-term containment and transportation solutions. Additionally, India's emphasis on self-reliance encourages domestic development of packaging technologies.

Japan Market Trends

Japan, with its advanced nuclear technology and strict regulatory oversight, remains a significant player in the radioactive material packaging market. Post-Fukushima, there has been a heightened focus on safety, which includes stringent standards for radioactive material packaging. Japan also uses radioisotopes extensively in medical and industrial sectors, necessitating safe, compliant transport packaging. The country’s strong R&D capabilities and mature manufacturing sector contribute to the production of high-quality packaging solutions. Additionally, Japan’s ongoing decommissioning efforts and nuclear waste management initiatives are driving demand for durable, shielded packaging.

South Korea Market Trends

South Korea has a well-developed nuclear power industry and is known for exporting nuclear technology and fuel. The Korea Hydro & Nuclear Power (KHNP) and related government bodies enforce strict safety regulations, which extend to packaging standards. South Korea also has a growing radiopharmaceutical industry, supporting healthcare applications of radioactive materials. The country’s industrial radiography and research sectors further contribute to the demand for secure transport packaging. With its advanced technological infrastructure and commitment to safety, South Korea continues to expand its role in the regional radioactive material packaging market.

Europe is experiencing rapid growth in the radioactive material packaging market due to a combination of stringent regulations, nuclear industry developments, and technological advancements. The region is governed by strong regulatory frameworks, including EURATOM and national bodies, ensuring high safety standards and harmonized packaging requirements across EU member states. While some countries are phasing out nuclear energy, others, such as France, the UK, and several Eastern European nations, are investing in new reactors and life extension projects, boosting the need for radioactive material packaging.

The widespread decommissioning of aging nuclear facilities, specifically in Germany and Sweden, has increased demand for specialized containers to safely transport and store dismantled radioactive components and spent fuel. Europe’s leadership in radiopharmaceuticals, especially in the Netherlands, Belgium, and Germany, further drives market demand for compliant packaging in the medical sector. The region’s commitment to long-term nuclear waste management, including deep geological repositories, calls for advanced and durable packaging solutions.

Europe is at the forefront of innovation, developing corrosion-resistant, recyclable, and sustainable materials in line with its circular economy goals. High volumes of cross-border transport of radioactive materials for research, medicine, and industrial use increase the need for standardized, certified packaging. Moreover, support from the European Union through programs like Horizon Europe encourages research and funding in nuclear safety and packaging technologies.

By Type

By Product

By Material

By Region

February 2026

February 2026

February 2026

February 2026