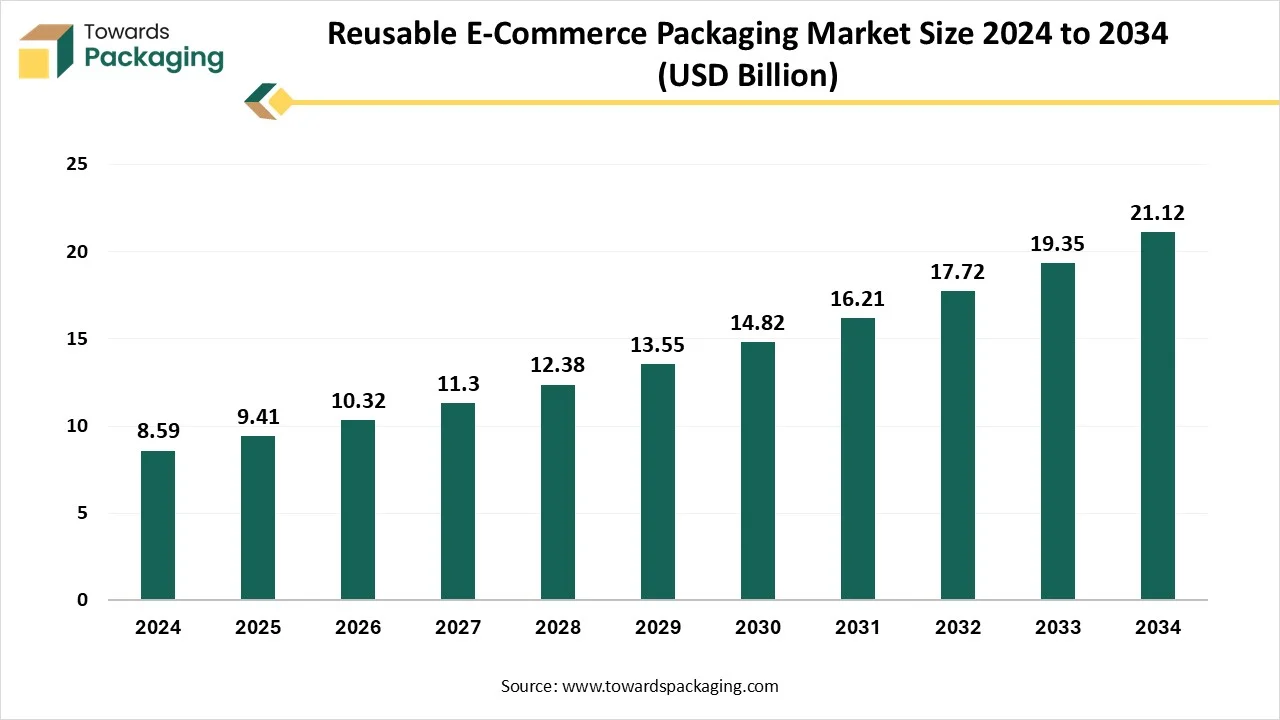

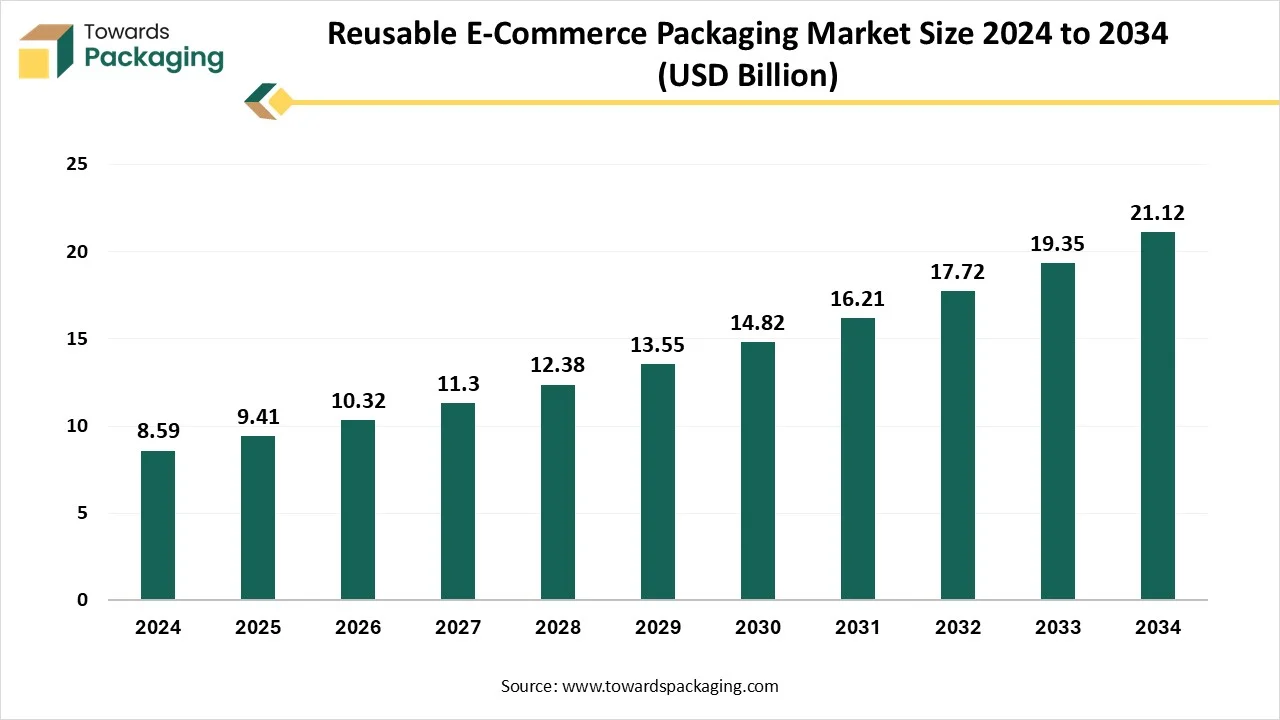

The reusable e-commerce packaging market is forecasted to expand from USD 10.31 billion in 2026 to USD 23.40 billion by 2035, growing at a CAGR of 9.54% from 2026 to 2035. This report covers detailed trend analysis, including sustainability-driven innovations, AI-enabled logistics optimization, and advancements in reverse logistics systems. It includes full segmentation by material, packaging type, and end-use industry, with plastics dominating in 2024 and paperboard segments growing fastest between 2025 and 2034.

The study presents an in-depth regional analysis across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, showing North America’s 2024 leadership and strong future growth in APAC. It also evaluates key companies such as DS Smith, THIMM Group, Corplex, and Stora Enso, along with competitive strategies, mergers, and funding updates. The report further covers value chain analysis, manufacturer and supplier mapping, and global trade data, helping stakeholders understand sourcing, production, and distribution flows.

The reuse of packaging for online purchases is becoming more and more sought-after in the industry, with the specification that such packaging must be capable of repeated use. Unpacking spilling in the package, on the other hand, is rated an ecological nightmare for the carbon footprint. Environmental considerations are mounting, enforcement of stringent regulations is being imposed, and ESG commitments are being churned out. Such types of packaging include boxes, bags, mailers, and containers that are recyclable or environmentally friendly (recycled plastics being one alternative, but to a large extent, coated paperboard is also used). RFID tracking or modular design is one of the technological developments assisting in improved logistics efficiency. Despite deterrents of high capital expenditure and complicated reverse logistics, it is expected to grow in markets where strong infrastructure and consumer awareness exist. Design or some materials will bring changes to landscape packaging as impacted by circular economy-tinted practices.

Sustainability has grown so fundamental because of backward consumers and the plight of Mother Earth. Companies are striving for alternative materials considered recyclable, biodegradable, or compostable to avoid landfill situations. Marketing and storage require only the most austere designs and thin plastic therapies to reduce costs and carbon emissions. Retailers implement retro packaging with back-end schemes. Regulatory pressure hastens green options emanating from corporate sustainability goals. The more eco-aware customers become, the more trust and loyalty these brands with sustainable packaging options will garner from them.

Customization and personalization will ultimately become an especially strong medium to build brand identity and enhance customer experiences. Gone are the days when brands used to send off empty brown boxes. Now, packaging customized with logos, colors, and messages is used to create memorable unboxing experiences and communicate the brand's identity. Digital printing technologies provide means for brands to cost-effectively customize packaging in small runs of high quality, thus increasing brand loyalty, encouraging sharing on social media, and enabling brands to stand out in an overcrowded market.

Artificial intelligence-powered innovation has duly enhanced the reusable packaging industry for e-commerce by adding efficiency, traceability, and sustainability. Packing designs are now optimized by AI as it studies usage patterns and material performances, thereby providing products that are stronger yet lighter. Make use of AI for smart inventory and return management systems, wasting less and costing less on operations. While inspections are going on, computer vision and machine learning detect damaged packaging so that reuse rates are improved. Route planning and smart tracking, running under an AI umbrella, employ reverse logistics for the timely and most cost-effective return of reusable packaging. It also encourages engagement by offering tailor-made packing options and return incentives for consumers under circular packaging concepts.

Growth in e-commerce

Growth in e-commerce has created a high demand for reusable packaging solutions. More packaging waste and a tired call for sustainability are some reasons for this. Reusable packaging is cost-effective and environmentally friendly. Its durability supports multiple shipping cycles. Thus, it reduces packaging waste, lowers shipping costs, and allows efficient reverse logistics. Hence, reusable packaging is drawing the market growth with the view of faster delivery and sustainable practices pursued by e-commerce businesses.

In the packaging industry for e-commerce, two more restraints come into play than the others: the very high cost of sustainable materials, and the lack of recycling infrastructure. The costliness of eco-friendly options like recycled paper, biodegradable plastics, or compostables turns out to be prohibitive for many small- and medium-sized enterprises, impacting their profitability and therefore making the acceptance of sustainable packaging an arduous act. Larger industries might promote their expenditures through economies of scale, whereas small businesses struggle to put up a fight. While this disparity in cost dissuades widespread adoption, it also delays the transition to sustainable packaging.

When poorly developed infrastructures are supplied for recycling, such a this presents a great impediment for the e-commerce packaging market, especially in developing or rural areas. Therefore, it is very difficult for people or companies to have their packaging materials properly disposed of; hence, demolition is the next available option, with a considerable environmental threat. So the infrastructural gap further delays and inhibits businesses from fulfilling circular economic goals and statutory requirements.

The e-commerce packaging industry has several opportunities, mainly centered on protective packaging that ensures the safety of products during transit. With the increase in online selling, product distribution has become a long journey, during which the product suffers from harsh treatment and variation in environmental conditions. Thus, durable packaging solutions in variations of corrugated boxes, air pillows, bubble wrap, and molded pulp are quite in demand. Such protective packaging helps reduce damage to products and requests for returns, thereby improving customer satisfaction. This segment is forecasted to expand through most product categories.

Smart and interactive packaging, such as QR codes, RFID tags, and sensors, offers significant growth opportunities. They signify supply chain visibility, track the condition of goods in real-time, and provide an interactive experience. Digital engagement through packaging thus can offer much differentiation and customer satisfaction amidst intense e-commerce competition. This junction of packaging and technology helps open many innovative doors in logistics, marketing, and customer service.

Plastic materials are being used in this e-commerce packaging division as lighter yet durable materials. The main feature of this packaging is that they do not disintegrate upon multiple uses and is, therefore, suitable for long-duration logistics. Enhancing sustainability ideology is an array of commercial and regional variations in bio-based and recyclable plastics that also earn their keep along economic lines. From a utilization standpoint, since plastics are accompanied by a ready supply chain and are cheap to produce, they will always be popular among industries that require scalable, reusable packaging solutions in e-commerce.

The paper and paperboard segment is expected to grow at the fastest rate during the forecast period due to environmental concerns and regulatory restrictions on plastic usage. Coated, water-resistant, and durable paperboard is being invented to increase the possibility of reuse throughout multiple cycles. Consumers are willing to pay for plastic alternatives, supporting brands that offer such products that are biodegradable and recyclable. The paper and paperboard sector stands to grow enormously, especially in the fashion, cosmetic, and light-consumer-goods industries.

Being strong in construction and highly versatile, boxes and containers serve as reusable packaging types across several industries in the e-commerce marketplace. They are used ideally for moving electronics, fashion articles, and perishable goods with protection. Thanks to the modular designs, returns are simplified, the closure can be cleaned, and this only goes to increase the efficiency of use.

Bags are on the rise because they are highly versatile, lightweight, and affordable, especially in the fashion and apparel industry. With subscription-based retail models on the rise, reusable bags provide brands with an avenue of convenience and sustainability.

The food and beverage segment dominated the reusable packaging because of the sustained demand for food delivery and zero-waste grocery facilities. Insulated and temperature-controlled container technologies make fresh meal kit delivery and perishables feasible. In a market where a lot of regulations are targeted at the safety and hygiene of food, the companies may be pushed to go for tamper-evident and reusable packaging formats. The segment is going to work hand in hand with environment-friendly logistics to cut down packaging waste during last-mile delivery.

On the other hand, the pharma segment is expected to grow at the fastest CAGR owing to stringent packaging regulations and an increase in online medicine purchases. Reusable packaging is necessary for compliance and product safety, while cold-chain innovations enable the safe delivery of medicines in reusable insulated packaging.

North America leads the reusable packaging market with well-structured regulatory conditions, with recycling and logistics systems being quite advanced. Rising consumer demand for sustainable solutions, enhanced corporate ESG commitments, and the evolving regulatory framework on sustainability issues are fostering the growth of the market worldwide. The reusable packaging industry leads the U.S. market over the European market, driven by very robust legislation focused on sustainability and consumer support towards environmental initiatives.

Asia Pacific holds a remarkable presence in the e-commerce packaging industry. China's reusable e-commerce packaging market is seeing rapid growth due to the parallel development of online retail and the increasing regulatory focus on reducing packaging waste. The market dynamics are affected by the government initiatives and innovations in logistics. The Japanese market for reusable e-commerce packaging is sustained by a robust culture emphasizing waste reduction and environmental consciousness. A developed technological infrastructure, on the other hand, coupled with corporate commitment towards sustainable practices, enables the growth of returnable packaging systems. Despite the initial cost of implementation, consumer awareness and willingness to participate in environmentally friendly behavior have kept the market progressing.

By Product

By Material

By Application

By End-Use Industry

By Region

February 2026

February 2026

February 2026

February 2026