Sustainable Plastic Packaging Market Size, Share, Trends and Growth

The sustainable plastic packaging market is forecasted to expand from USD 117.79 million in 2026 to USD 189.58 million by 2035, growing at a CAGR of 5.43% from 2026 to 2035. Asia Pacific is projected to dominate the market, while North America is expected to show rapid growth. Major companies include Amcor, Mondi Group, and Berry Global.

The rising awareness of ecological issues has raised the demand for sustainable packaging of products. Due to the presence of small-scale businesses, there is a huge demand for packaging which are cost-effective, where plastic materials play a significant role. The Asia Pacific region is considered to be dominating in the production of sustainable plastic packages due to the continuous advancement in technology of its production and packaging techniques.

Key Insights

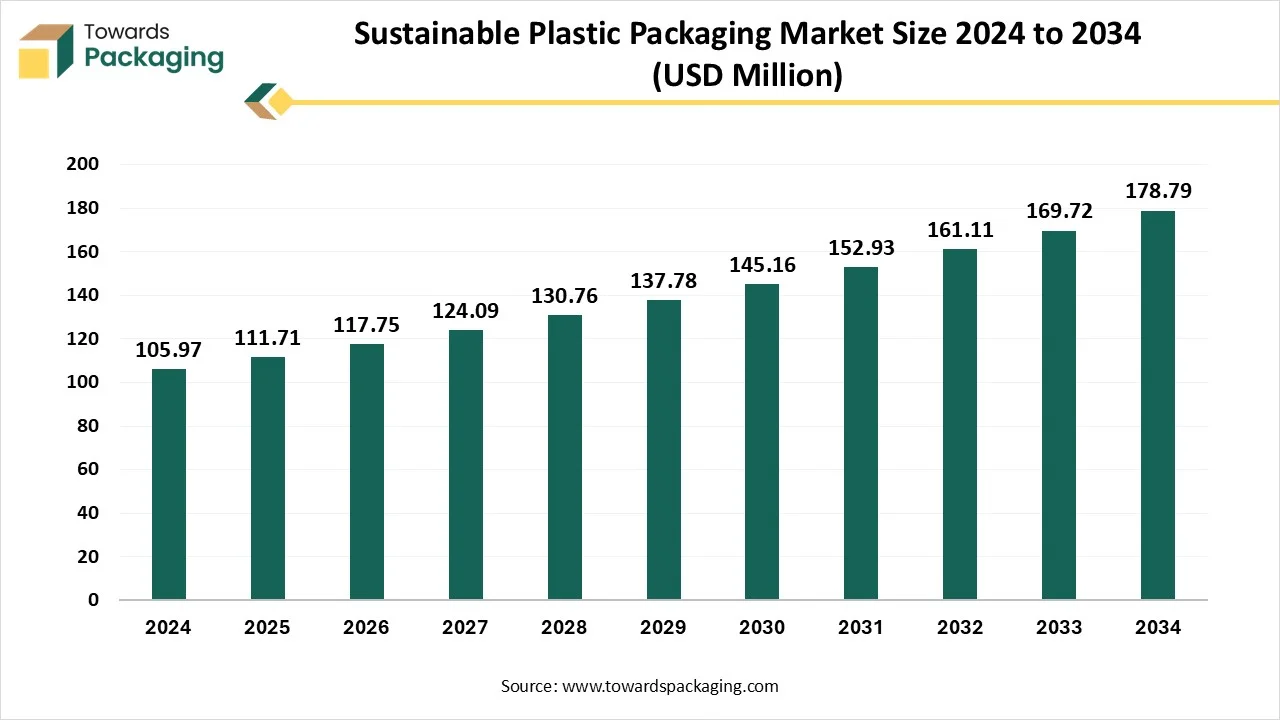

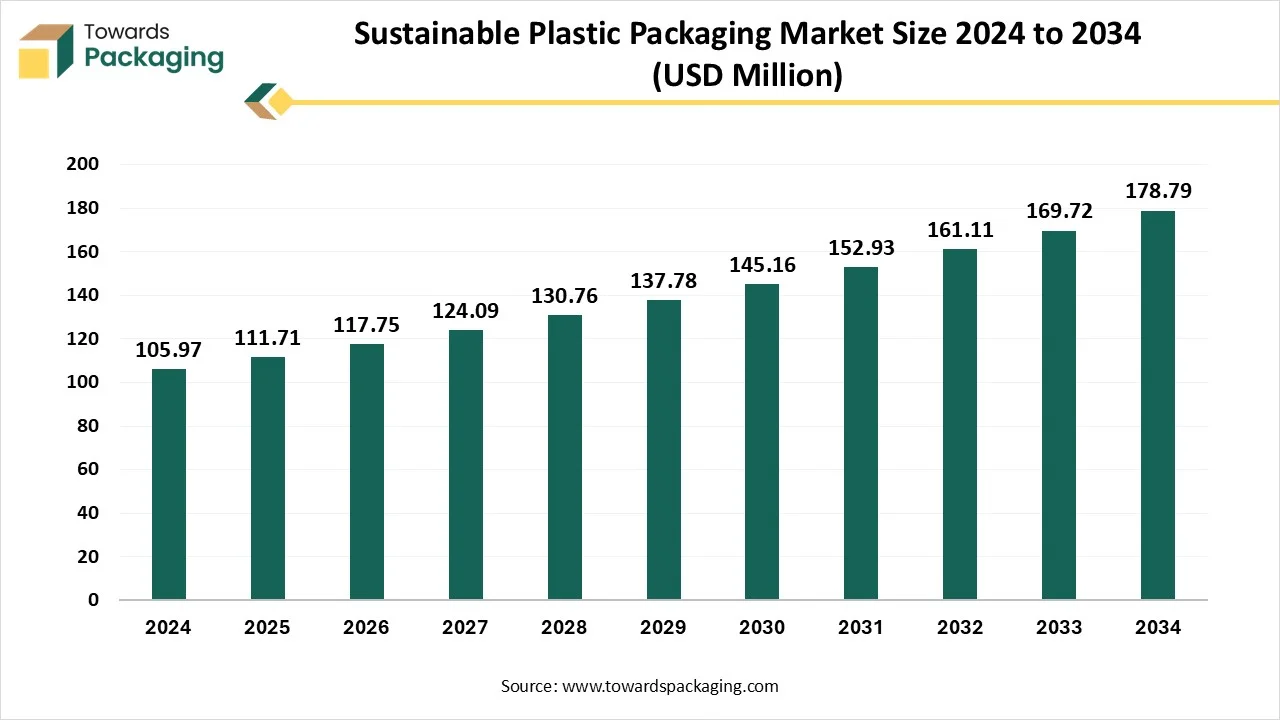

- In terms of revenue, the market is valued at USD 111.71 million in 2025.

- The market is projected to reach USD 178.79 million by 2034.

- Rapid growth at a CAGR of 5.43% will be observed in the period between 2025 and 2034.

- Asia Pacific dominated the global market with the largest revenue share in 2024.

- North America is expected to grow at a notable CAGR from 2025 to 2034.

- By material, the polyethylene (PE) segment contributed the biggest revenue share in 2024.

- By material, the bioplastics segment will grow at the fastest CAGR between 2025 and 2034.

- By type, the flexible packaging segment dominated the market in 2024.

- By type, the rigid packaging segment will grow rapidly between 2025 and 2034.

- By packaging format, the primary packaging segment contributed the biggest revenue share in 2024.

- By packaging format, the secondary packaging segment will grow at the fastest CAGR between 2025 and 2034.

- By process, the biodegradable segment contributed the biggest revenue share in 2024.

- By process, the recyclable process segment will expand at a significant CAGR between 2025 and 2034.

- By application, the food and beverages segment dominated the market in 2024.

- By application, the healthcare segment is expected to grow at the fastest CAGR between 2025 and 2034.

Sustainable Plastic: Need for Effective Packaging

The sustainable plastic packaging is enthusiastically evolving the packaging sector as it offers advanced solutions to the most pressing ecological challenges of today’s world. With a rising customer base and resulting professional demand for environment-friendly products, industries are progressively accepting plastic sustainable packaging to decrease their ecological footprint. The drive for sustainable plastic packaging has seen significant progress in recent years, mainly due to rising awareness of ecological concerns like waste and pollution and waste.

Customers and businesses alike are identifying the pressing need to directly address the influence that traditional packaging resources can have on the situation, mainly plastics. Customer behaviour is progressively inclining toward plastic sustainability packaging, with more people eager to pay extra for goods packaged in environment-friendly materials. This continuing shift is inducing corporations to rethink their packaging policies, targeting to align with customer values while also decreasing their ecological impact.

What are the New Trends in the Sustainable Plastic Packaging Market?

- Growing Preference Towards Bioplastic

Bioplastics are mainly utilized in disposable substances such as straws, packaging, containers, plastic piping, bags, bottles, medical implants, non-disposable carpets, phone casings, 3D printing, and car insulation. They have the capacity to significantly decrease the dependence on fossil fuels, which are found to be more toxic to the atmosphere than bioplastics.

- Inclination towards Primary Packaging

Primary packaging is the resource that is placed in direct contact with the packaged products. It keeps the packed products in place and shields them from biological, mechanical, and chemical damage.

- Demand for Cost-effective Packaging

With the rising demand for packaging which are cost-effective without compromising the safety of the products during transportation increased demand for sustainable plastic packaging.

How Can AI Improve the Sustainable Plastic Packaging Market?

In sustainable plastic packaging, AI performs a crucial role in optimizing the resources utilized for the packaging of the products to enhance the reliability with high-quality resource usage. These advanced technologies are widely used for designing packages that reduce the overconsumption of materials by analyzing the demand of the market. AI encourages sustainable expansion through better recycling and environment-friendly packaging globally. It offers a future vision of how it can be active by delivering an example with recent companies involved in artificial intelligence.

Market Dynamics

Driver

Rising Demand for Innovative Biodegradable Packaging

The rising concern of the brands to develop innovative biodegradable packaging has raised the demand for the sustainable plastic packaging market. Innovative biodegradable patterns that provide the same functionality and durability as conventional plastics packaging while confirming they decay fully under suitable conditions, offering a sustainable substitute to traditional single-use plastics. These packages are designed to certainly decompose without leaving toxic remainders. This invention shows a noteworthy step in decreasing plastic waste and helping sustainable packaging options. The introduction highlights the shift of the industries in the direction of environment-friendly resources that fulfil both ecological goals and customer demand for greener substitutes. As customers and governments drive for greener substitutes, corporations globally are pivoting in the direction of advanced solutions that balance costs, functionality, and ecological impact.

Restraint

Limited Infrastructure for the Recycling Process

The availability of limited infrastructure for recycling and composting of the resources has become a major challenge to the efficient management of the sustainable plastic packaging market. Many regions lack suitable services to develop compostable or biodegradable plastics, resulting in gaps in effective end-of-life discarding and sometimes resulting in these resources being directed towards landfills. High production charges, limited accessibility of raw resources, and the requirement for customer education on recycling are some of the important hurdles in the development of this market.

Opportunity

Rising Customer Awareness

There are constant initiatives by the government that have raised awareness among consumers towards eco-friendly packaging of products has led to the development of the sustainable plastic packaging market. The potential for charge savings through resource efficacy and the increasing demand for environment-friendly goods make this market an attractive venture for trades across several sectors. Customer likes are also playing an important role in influencing the development of the market. There has been a visible change in the behaviour of the customers, with a growing number of people choosing goods that are packed in an ecologically accountable manner. The demand for sustainable plastic packaging is rising industries to integrate environment-friendly resources and performs into their distribution chains to improve their brand value and fulfill customer expectations.

Growth of Patented Innovations in Sustainable Plastics Technologies: 1990-2017

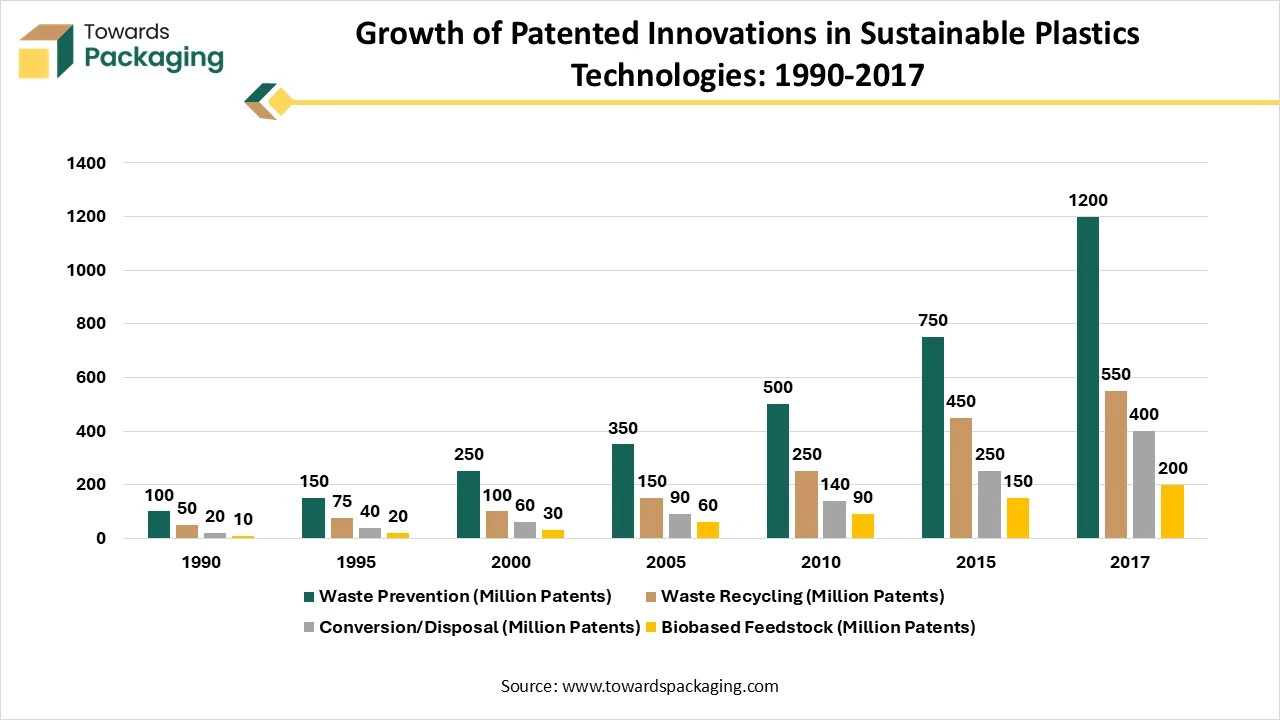

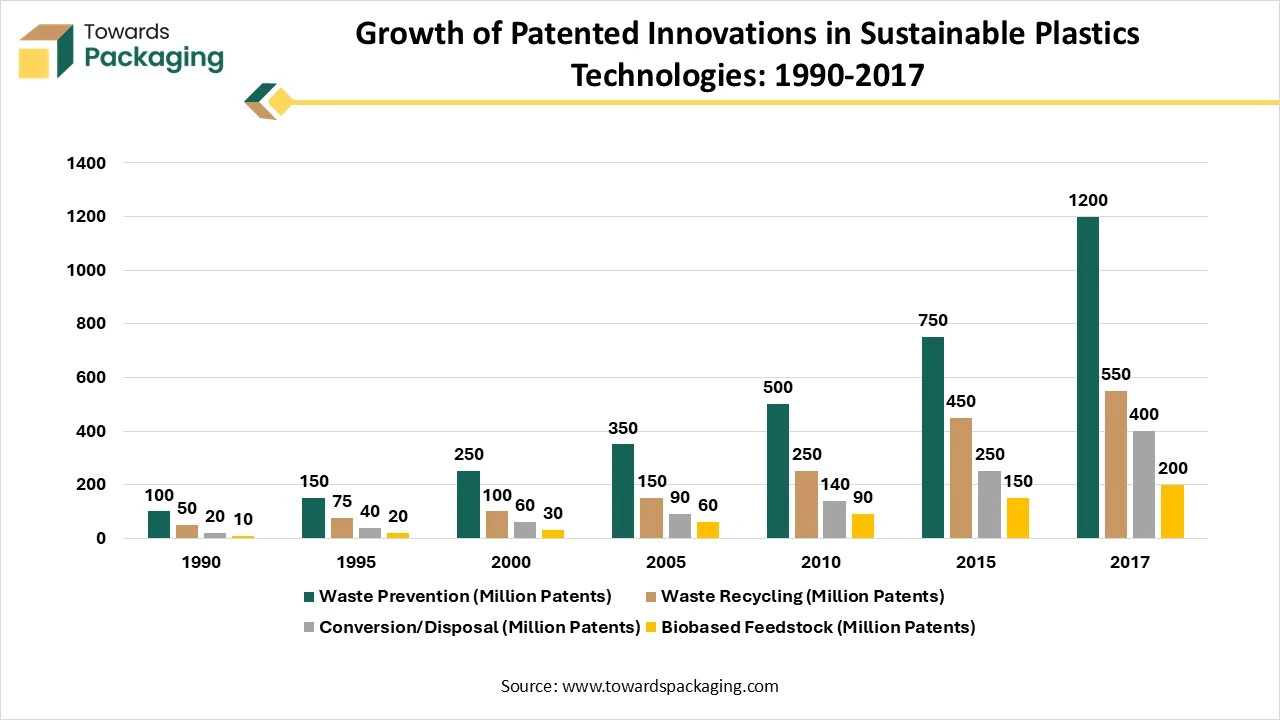

Innovation in plastics technologies with a focus on sustainability has grown significantly between 1990 and 2017, helping reduce the use of virgin materials, prolong the life of products, and support recycling efforts. Patented technologies in this area have increased 3.4 times during this period. However, despite this progress, these innovations still represent a small portion of the overall plastics-related inventions. By 2017, innovations in waste prevention and recycling accounted for just 1.2% of all plastics-related innovations. More ambitious policies are necessary to drive technological advancements aimed at closing the plastics loop and preventing environmental leakage.

Segmental Insights

Why Polyethylene (PE) Segment Dominated the market in 2024?

The polyethylene (PE) segment is expected to have a considerable share of the sustainable plastic packaging market in 2024 due to its strength and durability. There is a huge demand for packaging which are durable due to the growing e-commerce sector, which requires transportation over longer distances. The increasing trend for online ordering has influenced the high-quality packaging demand for an enhanced unboxing experience for consumers. Such strong packaging material reduces the risk of damage during the transportation and handling of the products.

The bioplastic material segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. This material is manufactured in such a way that it decomposes easily, which reduces the harmful effects on the environment and enhances the usage of such materials significantly. The continuous rise of consumers towards eco-friendly packaging has influenced the usage of such materials. These bioplastics packaging helps to reduce the pollution caused due to the utilization of plastic for the packaging of products.

What Made Flexible Packaging the Dominant Segment in 2024?

The flexible packaging segment is expected its dominance the sustainable plastic packaging market in 2024 due to the lower requirement for materials for packaging. The usage of fewer materials results in less adverse impact on the environment. Flexible plastic packaging, like films, pouches, and wraps, has appeared as a widespread option for producers aiming to decrease their ecological footprint while upholding product quality. Inventions in compostable, biodegradable, and recyclable materials are influencing the change in the direction of more sustainable flexible packaging choices, which support brands and fulfil customer demand for ecologically accountable products.

The rigid plastic packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. It has a huge capacity to withstand high temperatures, pressure, and various other adverse ecological impacts. These are useful in several ways, such as emitting less carbon, lower transportation costs, longevity, and many others.

Why the Primary Packaging Segment Dominated the Market in 2024?

The primary packaging segment is expected to dominant over the sustainable plastic packaging market in 2024 as it is useful in storing products fresh and maintaining the quality of food products. It avoids exposure to essentials that could cause degradation, spoilage, or contamination of the sensory attributes of the products. As customers progressively give importance to sustainability, brands are accepting environment-friendly resources such as plant-based polymers, recycled plastics, and biodegradable choices for the primary packaging of the products. This modification is influenced by both supervisory pressures and a rising customer preference for goods that use less plastic or are completely plastic-free, helping decrease waste and expand recyclability.

The secondary packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. It is widely used to enhance the safety of the products. This type of packaging is used outside primary packaging. This ensures to maintain of the quality and integrity of the products while transporting or storing products in an adverse ecological situation.

Why the Biodegradable Process Segment Dominated the market in 2024?

The biodegradable process segment is expected to have a considerable share of the sustainable plastic packaging market in 2024, as it decomposes easily and causes no harm to the environment. Such packaging attracts a huge consumer base and helps the business to grow rapidly. This property has raised the biodegradable process for manufacturing sustainable plastic packaging and provides an alternative in the packaging industry. Various materials are extracted from natural sources such as plants and others.

The recyclable process segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. The wide acceptance of the recyclable method has helped this segment to grow rapidly. It is to reduce the adverse impact of plastic on the environment. This is significantly used to reduce landfill deposition and the single-use utility of plastics. The rising concern for the management of plastic waste has also encouraged the growth of this method.

Why the Food and Beverages Segment Dominated the market in 2024?

The food and beverages segment is expected to dominant over the sustainable plastic packaging market in 2024 due to the growing alignment of the food business towards social and ecological responsibilities. Acceptance of sustainable materials for the packaging of products in this industry is rising significantly. This growth in the adoption of bioplastics due to their biodegradability has raised the demand for this material in the food and beverage sector. Recyclable PET and HDPE are two forms of plastics that are widely used in this industry and can be recovered into new products. This type of packaging is also used to build the brand’s image and attract a huge number of consumers toward it.

The healthcare segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. As these packaging materials are in direct contact with drugs hence such materials are used which does not react when kept in direct contact with drugs and are strong enough to hold for a longer period. These sustainable plastic packaging enhanced the storage capacity of the drugs, which increases the usage of such materials. These materials protect the packaged products from contamination and keep them safe for a longer period.

Regional Insights

Increasing Demand for Consumer Goods Influencing Asia Pacific’s Dominance

Asia Pacific held the largest share of the sustainable plastic packaging market in 2024, due to the rising demand for consumer goods packaging enhancement. In countries such as India, Japan, China, South Korea, and Thailand, there is a huge support for the sustainable plastic packaging sector due to the rapid growth in the e-commerce sector. The growing influence of sustainable plastic packaging has forced the major market players, such as Amcor, Mondi Group, and several others, to introduce innovation in this market.

India Sustainable Plastic Packaging Market

India is the fastest-growing market for sustainable plastic packaging, fueled by a strong regulatory push for eco-friendly and recyclable packaging as well as an increase in plastic consumption. Brands are being encouraged to switch to sustainable formats by EPR implementation and recycled content mandates. Adoption is being accelerated by the expansion of food FMCG and e-commerce packaging. Investments in recyclable and mono-material packaging solutions are rising among domestic manufacturers.

Middle East and Africa Sustainable Plastic Packaging Market Trends

The MEA region is growing rapidly as governments support programs to reduce plastic waste and promote sustainability. Infrastructure for recycling and environmentally friendly packaging solutions is receiving more funding. The food, beverage, and retail industries demand is driving market growth. Through their commitments to global sustainability, multinational brands operating in the region are also promoting adoption

UAE is a notable market within MEA because of the government's robust sustainability plans and circular economy objectives. The demand for sustainable packaging is increasing as a result of regulations that encourage the use of fewer single-use plastics. Market expansion is supported by growth in the retail tourism and food service industries. Additionally, the nation is becoming a regional center for cutting-edge recyclable packaging solutions.

Europe Sustainable Plastic Packaging Market Trends

Europe held a notable share in the sustainable plastic packaging market due to stringent environmental laws and increased consumer awareness. Directives on packaging waste and targets for recycled content are hastening the transition to sustainable materials. Market leadership is supported by robust demand from the food, beverage, and personal care industries. Europe's position is strengthened by ongoing innovation in recyclable and biobased plastics.

Germany leads the European market with advanced recycling systems and strong sustainability compliance. Growth is supported by the strong demand from the consumer goods and industrial sectors for reusable and recyclable packaging. The availability of materials is guaranteed by a well-established infrastructure for collection and sorting. Lightweight and mono-material packaging formats are being actively adopted by German brands.

North America Sustainable Plastic Packaging Market Trends

North America is a notable and steadily growing market, motivated by growing regulatory pressure and corporate sustainability pledges. Plastic packaging made of recyclable, compostable, and recycled materials is becoming more popular among major brands. Demand is still being driven by growth in food packaging and e-commerce. The supply of sustainable materials is being improved through investments in cutting-edge recycling technologies.

The U.S. is a key contributor to the North American market, backed by robust sustainability initiatives led by the brand. Adoption of sustainable packaging is being promoted by state-level laws and packaging waste reduction objectives. Market expansion is supported by the food, beverage, and consumer goods industries in high demand. Innovation in bio-based and recycled plastics is increasing options for domestic supply.

Top Companies in the Sustainable Plastic Packaging Market

- Amcor

- Mondi Group

- Be Green Packaging LLC

- Better Packaging

- Berry Global

- Sealed Air Corporation

- Tetra Pak

- Ball Corporation

- Uflex Limited

- DS Smith

- Elevate Packaging

- Oji Holdings

- Stora Enso

- Alpha Packaging, Inc

- Ardagh Group

- BioPak

- Calvin Klein

Latest Announcements by Industry Leaders

- In May 2025, Founder of RE: CIRCLE Solutions, Clemens Stockreiter, expressed, “Oroflex is more than a plastics manufacturing and recycling company; we are partners in environmental stewardship. Retailers, governments, and the public are increasingly demanding sustainable methods for producing and using plastic materials. We are dedicated to becoming the supplier of choice across the U.S. for comprehensive flexible packaging solutions to meet those demands.” (Source: Business Wire)

New Advancements in the Market

- In May 2025, Oroville Flexible Packaging, LLC, announced the launch of “Oroflex,” which is a sustainable flexible plastics, packaging, and recycling system. (Source: Business Wire)

- In March 2025, Mars and Berry Global launch 100% recycled plastic jars for M&M’s, Skittles and Starburst. (Source: Sustainability)

Sustainable Plastic Packaging Market Segments

By Material

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polyvinyl Chloride (PVC)

- Bioplastics

- Others

By Type

By Packaging Format

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By Process

- Recyclable

- Reusable

- Biodegradable

By Application

- Food and Beverages

- Personal Care and Cosmetics

- Healthcare

- Others

By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait