Aseptic Flex Bag Market Size, Share, Trends and Forecast Analysis

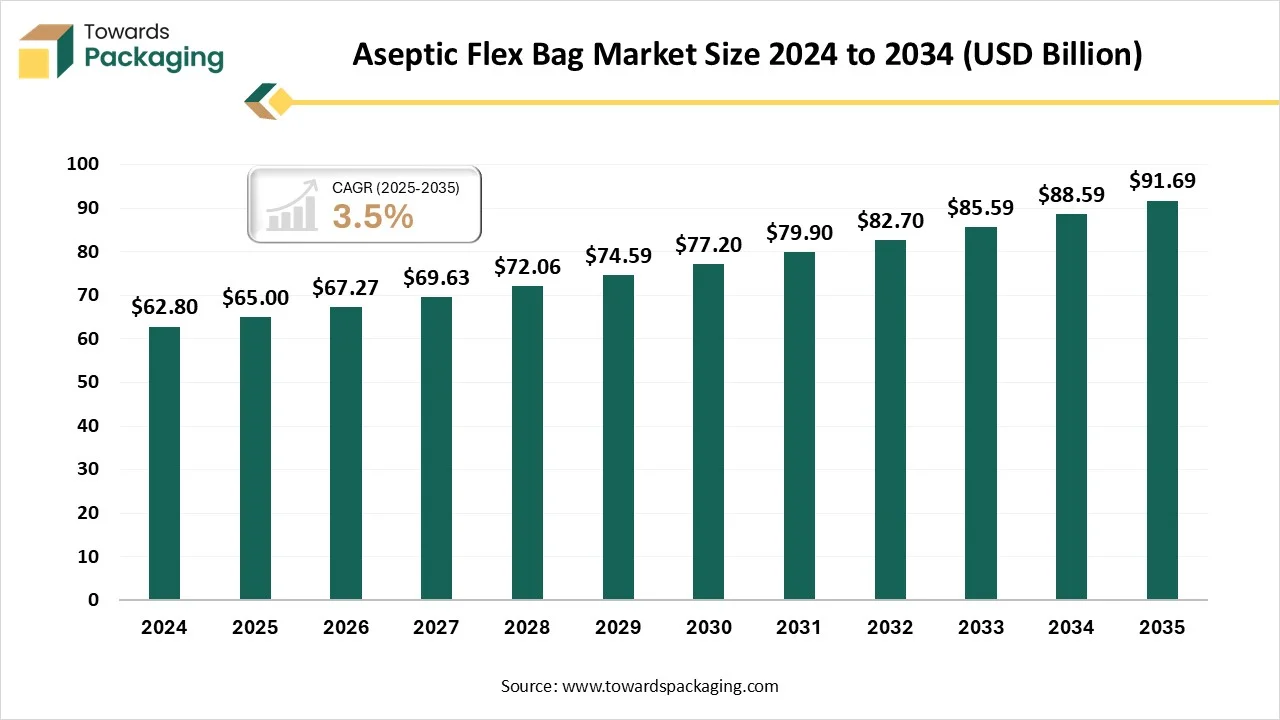

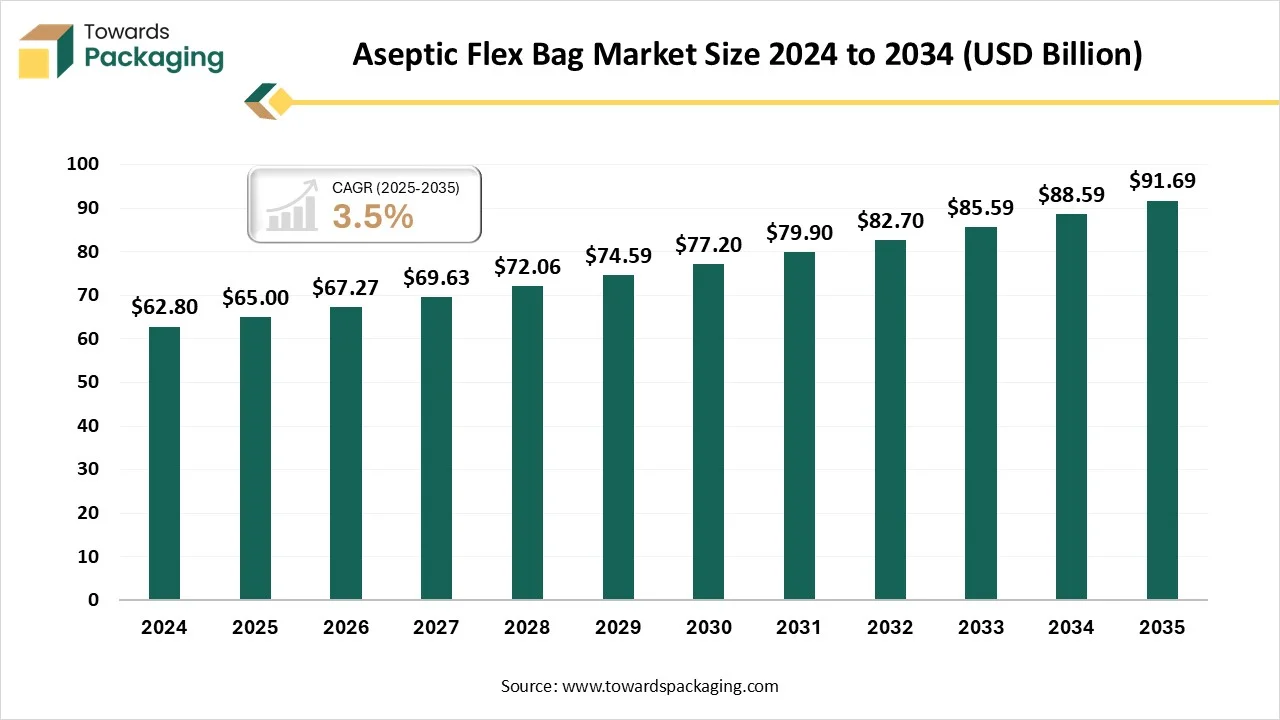

The aseptic flex bag market is forecasted to expand from USD 67.27 billion in 2026 to USD 91.69 billion by 2035, growing at a CAGR of 3.5% from 2026 to 2035.The rise in busier lifestyles and working individuals influences demand for ready-to-eat, hygienically packaged food & beverage goods that provide prolonged shelf life without refrigeration. The necessity for packing that confirms product security and durability throughout transport is important for the increasing online retail industry. Aseptic packaging is appropriate for this resolution, mainly for fragile liquid products.

Major Key Insights of the Aseptic Flex Bag Market

- In terms of revenue, the market is valued at USD 67.27 billion in 2026.

- The market is projected to reach USD 91.69 billion by 2035.

- Rapid growth at a CAGR of 3.5% will be observed in the period between 2025 and 2034.

- By region, North America dominated the global market by holding highest market share of 45.4% in 2024.

- By region, Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By type, the 2D bags segment contributed the biggest market share of 70.3% in 2024.

- By type, the 3D bags segment will be expanding at a significant CAGR in between 2025 and 2034.

- By layer material, the polyethylene segment contributed the biggest market share of 66.4% in 2024.

- By layer material, the ethylene vinyl acetate segment will be expanding at a significant CAGR in between 2025 and 2034.

- By application, the biopharmaceutical processing segment contributed the biggest market share of 71.4% in 2024.

- By application, the food & beverage segment will be expanding at a significant CAGR in between 2025 and 2034.

- By end-use, the pharmaceutical & biotechnology companies segment contributed the biggest market share of 68.8% in 2024.

- By end-use, the contract manufacturing organizations segment is expanding at a significant CAGR in between 2025 and 2034.

What is Aseptic Flex Bag?

The Aseptic Flex Bag comprises flexible, sterilized containers used for storing and transporting sterile liquids such as biopharmaceuticals, vaccines, culture media, and food products. These bags ensure product sterility, reduce contamination risks, and support single-use bioprocessing systems. Their demand is driven by the growing biopharmaceutical and food & beverage industries, the shift toward single-use technologies, and the need for cost-efficient, contamination-free storage and transfer solutions in aseptic manufacturing environments.

Aseptic Flex Bag Market Outlook

- Market Growth Overview: The market is growing rapidly due to rising food & beverages and pharmaceutical industry, sustainable packaging demand and geographical growth.

- Global Expansion: Regions such as North America, Asia Pacific, Europe, South America, Middle East & Africa are witnessing technological advancement, regulatory shift, product preservation which are the major factors behind the market expansion.

- Major Market Players: market includes Uflex Ltd., Amcor, Tetra Pak, Hansin Packing, and Scholle IPN.

- Startup Ecosystem: The startup industries play an important role in developing sustainable materials, automation and digitalization, specialized application, and cost-effective technology.

The increasing demand for enhanced sterilization process, automated filling and various such advancement has transformed the manufacturing technology of the market. The incorporation of digital monitoring throughout the manufacturing process has enhanced the integrity of the product and efficacy. This market is progressively influenced by digital alteration, with developments in automation through the value chain distribution process. Intelligent packaging process are being established to monitor food situations and freshness throughout transportation and storage.

Trade Analysis of Aseptic Flex Bag Market: Import & Export Statistics

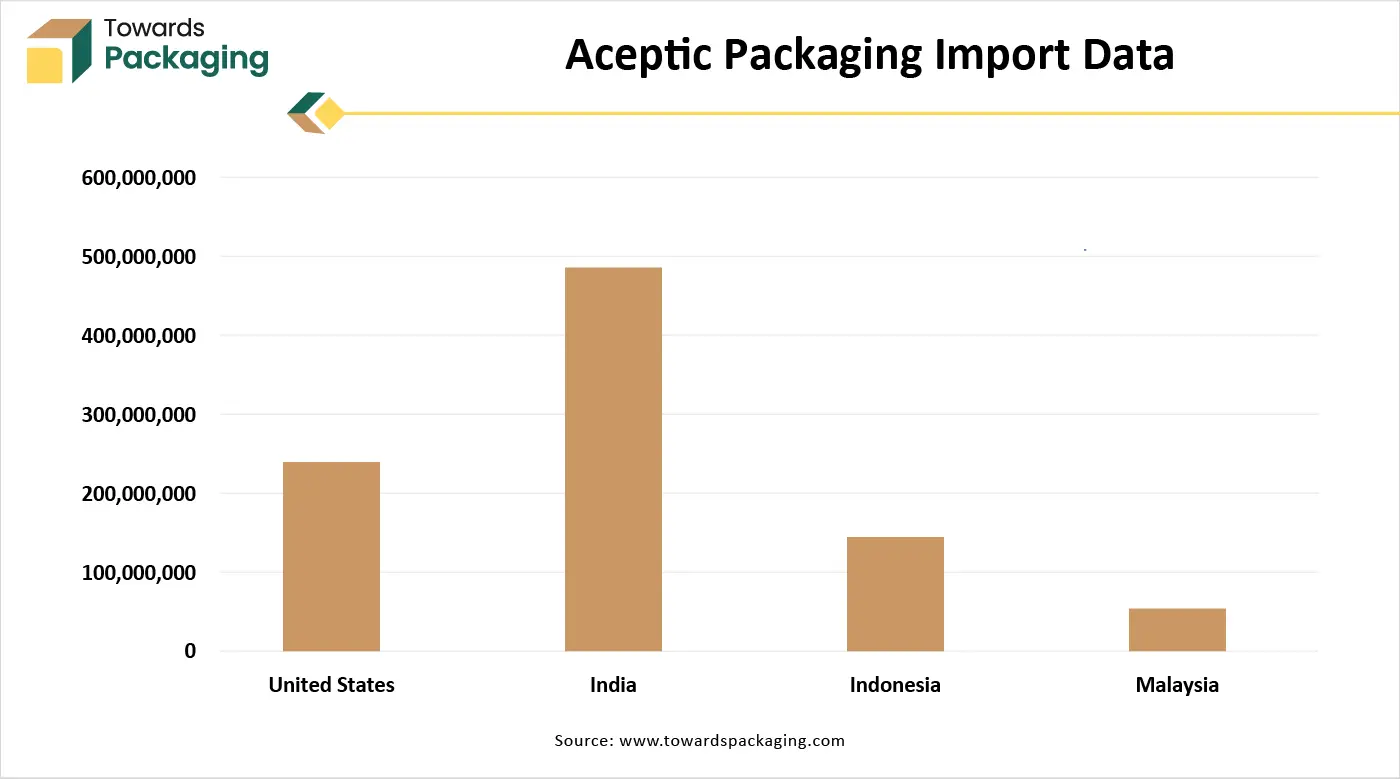

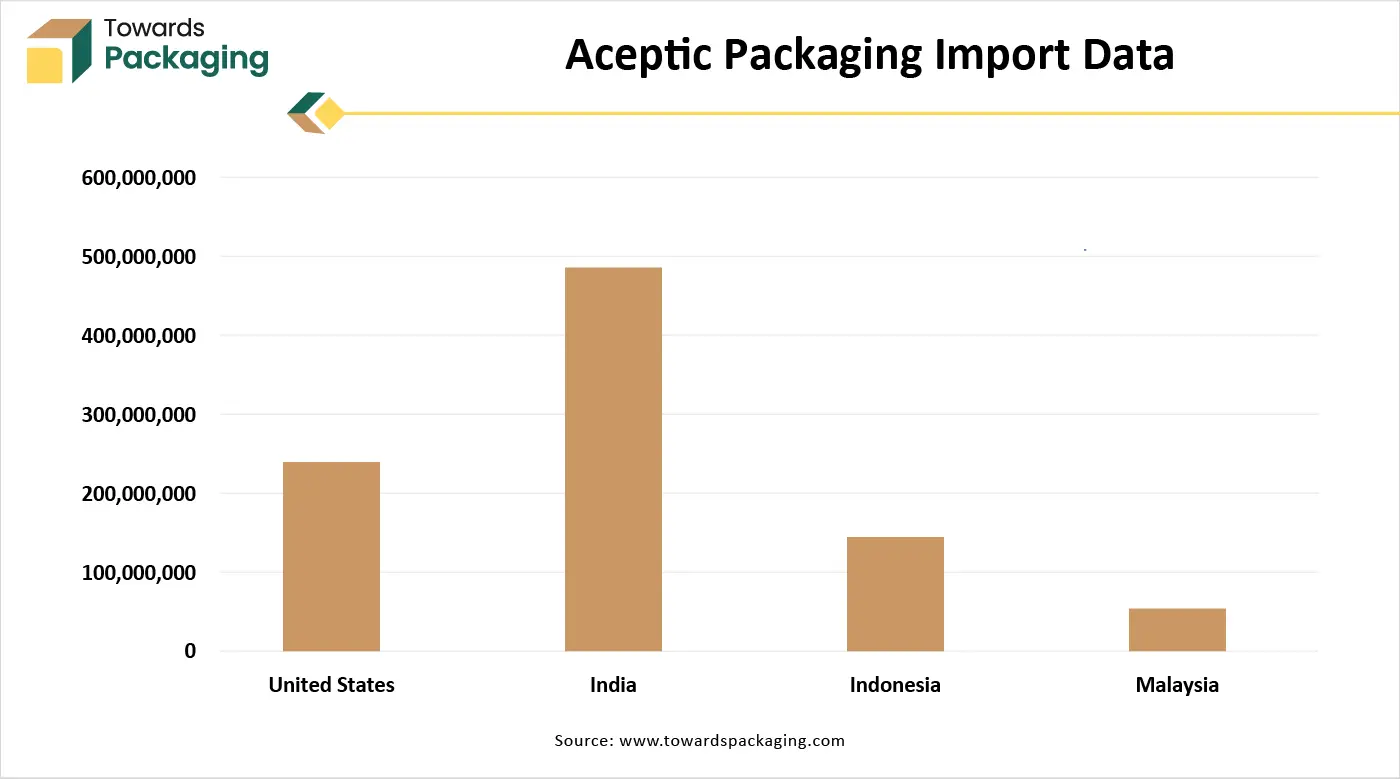

- Vietnam: It is the top most Aseptic Packaging importers with an estimation of 2,643 shipments.

- India: It is second leading importer of Aseptic Packaging with 2,626 shipments.

- United States: It is at third spot with 2,521 shipments of import of Aseptic Packaging.

The chart shows that India leads aseptic packaging imports among the listed countries, highlighting strong demand from its expanding dairy, beverage, and packaged food sectors. The United States follows, driven by the need for advanced aseptic solutions and premium packaging formats. Indonesia’s import levels reflect growing consumption of shelf-stable food and beverages across urban markets. Malaysia records comparatively lower imports, indicating a smaller but steadily developing aseptic packaging market. Overall, the data underscores rising global reliance on aseptic packaging to ensure longer shelf life and food safety.

E-commerce Growth in the Aseptic Flex Bag Market’s Largest Potential

E-commerce growth is significantly accelerating demand for aseptic flex bags as sales of direct-to-consumer beverages and online groceries increase. Ready-to-drink juices, dairy substitutes, and liquid foods are becoming increasingly popular for home delivery, which increases the demand for strong, lightweight aseptic packaging that can endure lengthy shipping periods. Flex bags are becoming popular among brands and retailers due to their ease of use, lower shipping costs, and capacity to preserve product quality without refrigeration. Flex bag formats and sustainable credentials also appeal to eco-aware online consumers, which promotes market adoption. Manufacturers are being prompted by this trend to develop flexible aseptic solutions specifically designed for e-commerce distribution.

Future demands

- Growing adoption of e-commerce and direct-to-consumer food delivery is increasing demand for lightweight, leak-proof aseptic flex bags.

- Rising consumption of shelf-stable beverages, dairy alternatives, and liquid foods is supporting long-term market growth.

- Foodservice operators and institutional buyers are increasingly shifting toward bulk aseptic flex bags for cost and storage efficiency.

- Sustainability-focused packaging strategies are driving demand for flexible formats with lower material usage and carbon footprint.

- Technological advancements in barrier films and aseptic filling systems are improving product safety and expanding application scope.

Type Insights

Why 2D Bags Segment Dominated the Aseptic Flex Bag Market In 2024?

The 2D bags segment dominated the market with highest share in 2024 due to its cost-effectiveness and versatility. The increasing prevalence of diseases such as diabetes and cancer boosts the necessity for operative biopharmaceutical handlings, fuelling the demand for correlated apparatus. Enhancements in bag pattern and resources, such as improved sturdiness and puncture barrier, are making these bags more appealing to producers. A rising trend in the direction of tailored and scalable solutions permits producers to make bags for exact bioprocessing usage.

The 3D bags segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to increasing investment in the pharmaceutical sector. They are utilized for storage a variety of goods, comprising culture and buffer media, stock resolutions, and transitional goods, mainly in the biopharmaceutical segment. The development is influenced by amplified funds in healthcare, the rising preference for throwaway bioprocessing technologies, and the growing demand for biopharmaceuticals. They show a high-development section within the wider aseptic packaging industry, which also comprises cans, cartons, and bottles.

Layer Material Insights

Why Polyethylene Segment Dominated the Aseptic Flex Bag Market In 2024?

The polyethylene segment dominated the market with highest share in 2024 due to protection against contamination and moisture barrier. This segment is influenced by demand from the food & beverage and pharmaceutical businesses, which depend on the shielding, chemical-unaffected, and non-reactive possessions of PE for prolonged shelf-life. These films are shared with other resources, like aluminum foil, to defend against moisture, oxygen, and light. This segment is essential for the disinfection procedure intricate in aseptic flex bag packaging.

The ethylene vinyl acetate segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to increasing home healthcare services. The rising number of IV therapies and the increasing occurrence of chronic diseases are influencing the demand for this segment. The extension of home-based healthcare facilities is also an important aspect, growing the requirement for portable and easy-to-handle IV bags. Constant research and growth emphasized on enhancing the biocompatibility and medication firmness of EVA infusion bags is additionally stimulating market development.

Application Insights

Why Biopharmaceutical Processing Segment Dominated the Aseptic Flex Bag Market In 2024?

The biopharmaceutical processing segment dominated the market with highest share in 2024 due to enhanced sterility and integrity of the products. These are important for preserving the integrity and sterility of these complex, frequently temperature-controlled, resources. This segment comprises applications such as cell therapies, sterile injectables, and reconstructed lyophilized powders, with the sector facing rapid development due to increasing medical demands, severer guidelines, and progressions in biopharmaceutical skills. Major influencer includes the necessity to protect microbial contamination and deprivation, and the growing intricacy of biologics, like gene and cell therapies, that need aseptic flex bag processing.

The food & beverage segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to convenience and extended shelf-life. The rising worldwide demand for packaged food & beverages is a major influencer. There is a growing emphasis on sustainability in packing, and aseptic bag can support to decrease food waste by encompassing shelf-life. The demand for suitable, easy-to-eat products has amplified the usage of aseptic flex bag for on-the-go feeding.

End User Insights

Why Pharmaceutical & Biotechnology Companies Segment Dominated the Aseptic Flex Bag Market In 2024?

The pharmaceutical & biotechnology companies segment dominated the market with highest share in 2024 due to continuous innovation towards sterile packaging for enhanced safety. This market comprises packaging of wide range of products such as injectables, liquid medicines, and biologics. Packaging resources must offer exceptional barrier belongings to guard against degradation and contamination. It is because of growing medical requirements, an upsurge in biopharmaceutical construction, and higher customer spending supremacy. This sector profits from trends like invention in sterilization technology, the growth of advanced resources, and an emphasis on sustainability. Corporations are also intensifying their collections to fulfil the precise requirements of the pharmaceutical & biotechnology sector.

The contract manufacturing organizations segment is expected to grow at the fastest CAGR during the forecast period. This segment is growing due to increasing demand for ready-to-administer drug formats. It is boosting the necessity for dedicated aseptic packaging bags, thus growing the dependence on CMOs. There is a rising demand for sustainable packing resolutions in the pharmaceutical sector, and incorporated CMOs are situated to influence resource invention, such as utilization recyclable resources and negligible plastics, which drive the pattern of forthcoming aseptic flex bags.

Regional Insights

How North America is Dominating in the Aseptic Flex Bag Market?

North America held the largest share in the market in 2024, due to strong pharmaceutical and healthcare industries. High economic upright permits for important venture in R&D, resulting to technologically progressive goods and advanced packaging solutions. A huge population with rising disposable earning influences demand for packed personal care products, food & beverages, all of the advantages from aseptic packing. An increasing focus on sustainability and the necessity for goods with prolonged shelf life are boosting the industry in the direction of flexible, frequently more sustainable, packing choices.

Why Aseptic Flex Bag Market is Dominating in the U.S.?

Presence of strong pharmaceutical and food & beverage industry has evolved the demand for market in the U.S. It has a cultured healthcare arrangement that boosts the demand for aseptic flex bag packaging for medical goods. The increasing emphasis on sustainability and the requirement for goods to have a prolonged shelf life are key market influencers, as aseptic flex bag packaging can decrease waste and the necessity for preservatives. A huge population with an increasing fondness for convenient, hygienic, and safe packing for ready-to-eat food products and other goods also boosts consumption.

Why Aseptic Flex Bag Market is Growing Rapidly in Asia Pacific?

The market is growing rapidly in Asia Pacific due to a combination of demographic and economic factors. A growing population in countries like China, Japan, India, Thailand, South Korea, and several others coupled with increasing urbanization, resulting in a larger customer base for packed products. The quick expansion of e-commerce sector in the region needs strong, safe, and lightweight packing for transport, which aseptic flex bag offer. There is a rising customer preference for suitability, one-time serve, and ready-to-consume items has increased the demand for aseptic flex bags.

How Aseptic Flex Bag Market is Expanding in China?

Increasing disposable income among people has boosted the development process in the market in China. Customers are progressively observing goods that are good to eat and have an extended shelf life improves the need for aseptic flex bag packaging. The key drivers for aseptic flex bag are the food & beverage segments, comprising dairy, juices, and ready-to-consume products. China's robust production sector and sustained fundings in packaging invention, comprising lighter and enhanced sustainable choices, help the development of the market.

Which Factor is Responsible for Notable Growth of Aseptic Flex Bag Market in Europe?

The major factors influencing the growth of aseptic flex bag market are increasing demand for sustainable and eco-friendly packaging solution. Changing customer lifestyles, considered by rising urbanization and a huge demand for suitability, influenced the requirement for ready-to-consume and on-the-go items that are easy to manage, safe, and hygienic. Strict food safety guidelines across Europe need strong, sterile packing solutions, which aseptic flex bag packaging proficiently offers. Aseptic flex bag permits pharmaceuticals, food & beverages to have an extended shelf life, which decreases food waste and lower down on cold chain logistics charges.

Why Germany is Utilizing these Bags Significantly?

There is strict government guidelines towards packaging industry in Germany which fuelled the development of the market. The increasing ecological issues has raised the demand for aseptic flex bag as a sustainable option which cover a wide range of industries. Rapid growth in the manufacturing technology introduced durable and versatile packaging solution.

Why Aseptic Flex Bag Market is Growing Rapidly in South America?

The market in South America is showing robust growth, driven by rising demand for shelf-stable food and beverage packaging and expansion of processing and distribution infrastructure. Key drivers include increasing consumption of processed foods and beverages, modernisation of dairy and juice production, and demand for high-barrier, lightweight packaging.

Brazil Aseptic Flex Bag Market Trends

The aseptic flexbag segment in Brazil is gaining momentum. Key drivers include rising demand for shelfstable foods and beverages such as dairy, juices and ready meals, driven by shifting consumer lifestyles, increased urbanisation and greater focus on food safety. In particular, the flexibility, lighter weight and extended shelf life offered by flexbag formats appeal to both manufacturers and consumers coping with logistical challenges across Brazil’s vast geography.

What Are The Factors That Boosts The Expansion Of The Aseptic Flex Bag Market In The Middle East And Africa

The aseptic flex bag market in the Middle East & Africa (MEA) is growing steadily. Key drivers include increasing urbanisation, rising demand for shelfstable foods and beverages in hot climates, expansion of dairy and juice processing facilities (especially in countries such as Saudi Arabia and South Africa) and growth in modern retail networks.

Saudi Arabia Aseptic Flex Bag Market Trends

The market in Saudi Arabia is witnessing strong growth, driven by rising demand for shelfstable food and beverages, modernised food processing infrastructure, and regulatory push for higher packaging standards. Saudi Arabia presents a favourable environment for aseptic flexbag formats (high barrier, ambient‐stable pouches) given the combination of climate (favoring ambient shelf life), growing processed food demand, and packaging infrastructure upgrades.

Recent Development

- In October 2025, ALCA Corp and SIG collaborated to declared the launch of the first items filled on SIG’s next-generation aseptic emitted pouch system comprising in-line pouch sterilization: SIG Prime 55 In-Line Aseptic, eliminating the requirement for third-party pre-sterilization of spouted pouches.

- In September 2025, Amneal Pharmaceuticals, Inc. declared that it has started U.S. commercialization of TEPADINA® (thiotepa) for Injection 200 mg in an original multichambered bag.

- In January 2026, SIG Group announced that its first high-tech aseptic production facility in Ahmedabad, India, is now fully operational. The €90 million plant features an initial annual capacity of 4 billion packs, serving the rapidly growing local dairy and non-carbonated beverage sectors. The facility utilizes advanced printing and finishing technology to produce aseptic solutions that maintain product shelf life without the need for refrigeration.

Aseptic Flex Bag Market - Value Chain Analysis

Raw Material Sourcing

The major raw materials utilized in this market are polyethylene, aluminum foil, EVOH, and Nylon.

- Key Players: Amcor Limited, Sealed Air

Component Manufacturing

The component manufacturing in this market comprises the bag material, fitments, and related machinery.

- Key Players: Amcor, Tetra Pak

Logistics and Distribution

This segment ensures product integrity and sterility until they reach the consumer.

- Key Players: XPO Logistics, CEVA Logistics

Top Companies in the Aseptic Flex Bag Market

Amcor plc

Corporate Information

- Name: Amcor plc

- Headquarters: Zurich, Switzerland (though Australianorigin)

- Stock Listings: NYSE ticker AMCR, ASX ticker AMC.

- Employees / Reach: ~77,000 employees and operations in 3540+ countries.

- Business Segments: Two major segments are “Flexibles” (flexible packaging) and “Rigid Plastics/Containers” (rigid packaging) for food, beverage, pharmaceuticals, medical, personalcare, etc.

History and Background

- The company traces its roots back to paper mills near Melbourne, Australia in the 1860s; the firm Australian Paper Mills Company Pty Ltd was formed in 1896.

- Over time it transitioned from paper/pulp into global packaging, including flexible and rigid plastics.

Key Developments and Strategic Initiatives

- Sustainability & circular economy: The company has placed a strong emphasis on recyclable, reusable and lighterweight packaging solutions, and increasing use of recycled content. E.g., use of postconsumer recycled (PCR) content, biobased polymers.

- Innovation: Amcor invests in material science (films/coatings), smart packaging (embedded electronics/RFID) and monomaterial packaging for easier recycling.

Mergers & Acquisitions

In August 2018, Amcor acquired the U.S. packager Bemis Company, Inc. (approx. US$5.25 billion) to expand its flexible packaging business.

A major recent development: allstock combination with Berry Global Group, Inc. effective April/May 2025. This significantly broadens Amcor’s portfolio, especially in rigid and flexible consumer and healthcare packaging.

- The merger is expected to unlock ~$650 million in synergies by end of FY 2028.

- EPS accretion target: ~12% in FY 2026, >35% by FY 2028.

Partnerships & Collaborations

- Strategic investment in PragmatIC Semiconductor (UK) to embed ultralow cost flexible electronics (RFID/NFC) into packaging a farreaching initiative into smart packaging.

- Collaboration with global brands such as Cadbury (via Mondelēz International) to help achieve high levels (e.g., 80%) of recycled plastic content in packaging for UK/Ireland markets.

Product Launches / Innovations

- AmFiniti™ recycled content solutions: Designed to incorporate PCR or postindustrial recycled (PIR) material, reducing reliance on virgin plastics.

- AmPrima® / AmPrima® Plus: Monomaterial packaging formats (e.g., mayonnaise pouch) enabling recycling readiness while maintaining barrier/heat properties.

- AmSky™ Blister System: Healthcareoriented, recycleready, monoPP blister system for nutraceuticals or pharmaceuticals.

Key Technology Focus Areas

- Material science & barrier technologies: Developing films and coatings that provide protection (for pharma/food) yet are recyclable or monomaterial.

- Circular economy / recycled content: Designing for reuse, recycling, lower carbon footprint, increasing PCR content, reducing virgin materials.

- Smart/connected packaging: Using embedded electronics (RFID/NFC) for supply chain traceability, consumer engagement and recycling information.

R&D Organisation & Investment

- Amcor invests substantially in innovation and corporate venturing as indicated by their strategic investment in PragmatIC Semiconductor.

- The company has Innovation Centres (e.g., the Innovation Center Europe in Gent, Belgium) to collaborate with brands and develop packaging from concept to production.

SWOT Analysis

Strengths:

- Global scale and diversified portfolio across flexible and rigid packaging formats.

- Strong technology & material science capabilities; strong innovation pipeline (monomaterial, smart packaging).

- Commitment to sustainability and circular economy aligns with increasing regulatory and consumer pressure.

- Recent merger with Berry Global gives enhanced scale, broader geographic reach and expanded capabilities.

Weaknesses:

- Large scale and complexity bring integration risk (especially post Berry merger).

- High leverage/debt due to major acquisition; financial risk if synergies are delayed.

- Exposure to raw materials cost inflation (plastics/polymers), and currency fluctuations due to global footprint.

- The packaging industry is mature with relatively modest organic volume growth relies heavily on innovation and margin improvement rather than growth alone.

Opportunities:

- Trend toward increased recyclable/monomaterial packaging, biobased materials and reducedplastics solutions.

- Growth in healthcare packaging (medical, pharmaceutical) and e-commerce packaging.

- Smart packaging and digital features (RFID/NFC) to differentiate and add value to clients.

- Portfolio optimization: divesting noncore segments and focusing on highergrowth, highermargin categories.

Threats:

- Macroeconomic headwinds: weaker consumer demand, especially in developed markets, may reduce packaging volumes.

- Regulatory risks: tighter packaging waste laws, taxes on plastics, restrictions on polymers could raise costs or require redesigns.

- Competitive pressure from other packaging firms, substitutes (e.g., glass, metal) and emerging lowcost producers.

- Integration risk: failure to realize announced synergies, or culture/operational issues from the Berry merger could hurt margins.

Recent News & Strategic Updates

- The completion of the combination with Berry Global on April 30, 2025, marking a major milestone in Amcor’s strategy.

- Financially, Amcor forecasts ~12% EPS accretion in FY 2026 from synergies alone, and over 35% accretion by FY 2028.

Other Top Companies

- Sartorius AG: It offers the Flexsafe and Flexboy brands of single-use bioprocess bags, available in both 2D and 3D configurations and various sizes (5ml to 50L).

- Thermo Fisher Scientific Inc.: It provides HyPerforma Bioprocess Containers and Thermo Scientific Single-Use Bioprocess Containers.

- Merck KGaA: It offers the mobius single-use bags as a primary product line within its single-use bioprocessing portfolio.

- Cytiva (Danaher Corporation): It offers a broad and deep portfolio of tools and technologies that bring speed, efficiency, and capacity to manufacturing workflows, from discovery to delivery.

- Saint-Gobain Performance Plastics: It focuses on innovative film constructions that maintain integrity during processes like gamma irradiation and aim to reduce leachable profiles.

- Others: Corning Incorporated, Pall Corporation, Meissner Filtration Products, Inc., Lonza Group AG, Entegris, Inc., FlexBiosys Inc., Compagnie de Saint-Gobain, Sealed Air Corporation, CellBios Healthcare & Lifesciences Pvt. Ltd., ARDAGH Group

Aseptic Flex Bag Market Segments Covered

By Type

By Layer Material

- Polyethylene

- Ethylene Vinyl Acetate

By Application

- Biopharmaceutical Processing

- Food & Beverage

By End Use

Pharmaceutical & Biotechnology Companies

Contract Manufacturing Organizations

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA