BioProcess Container (BPC) Market Size, Trends, Share and Innovations

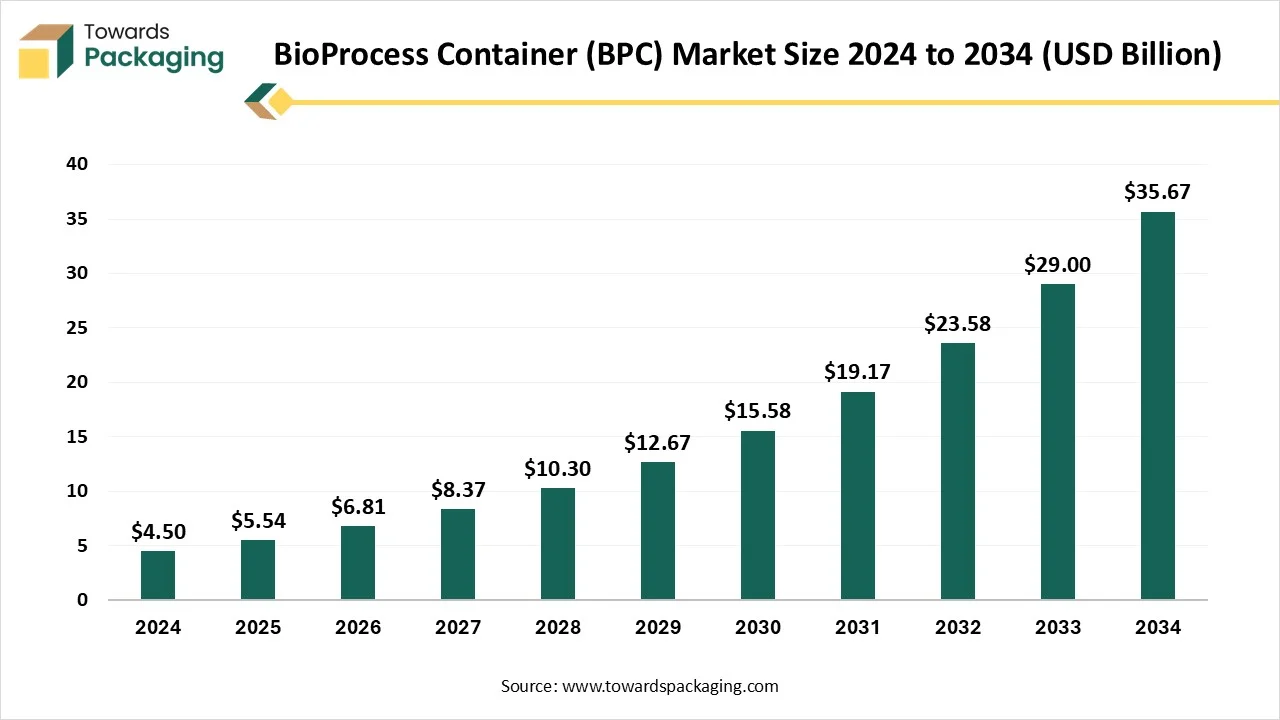

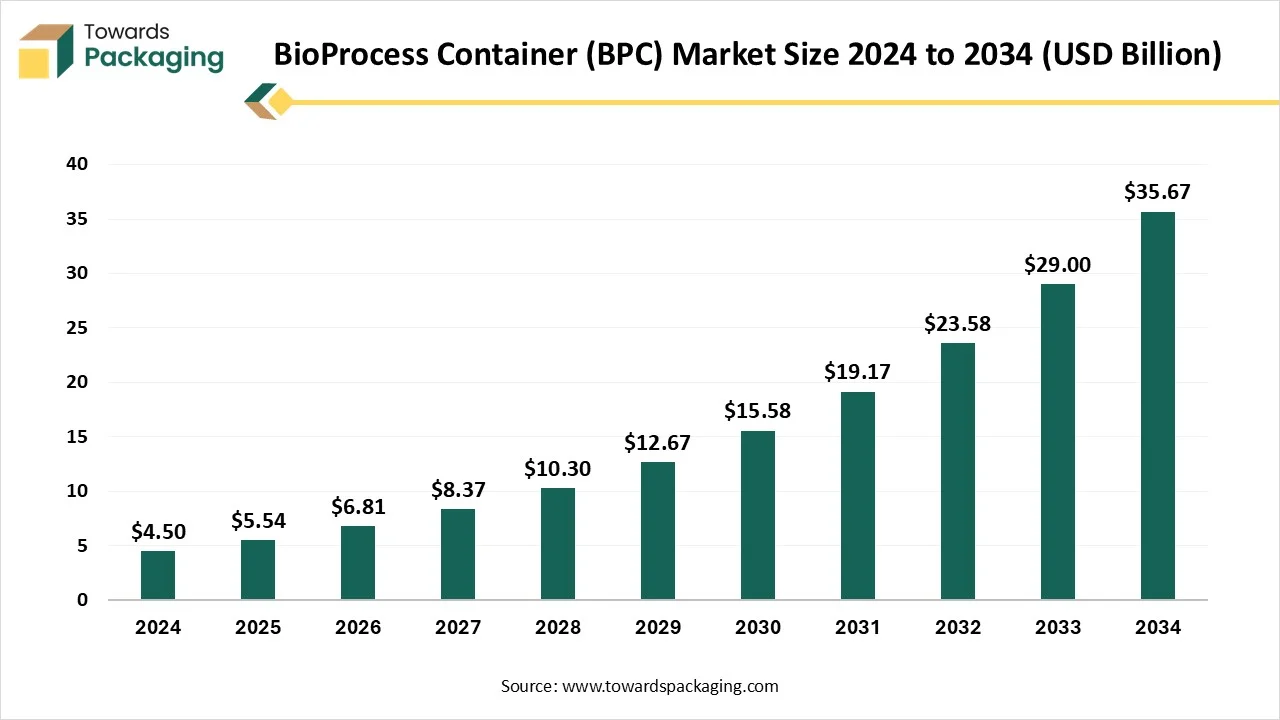

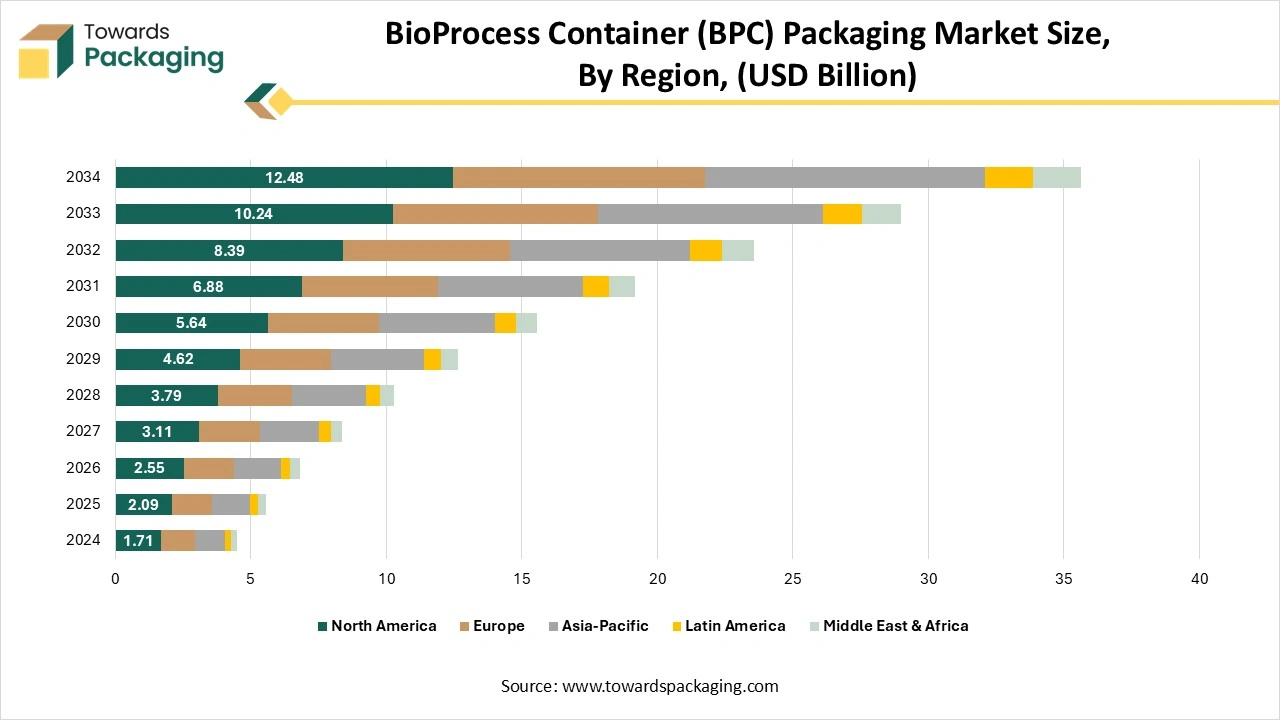

The bioprocess container (BPC) market is anticipated to grow from USD 6.81 billion in 2026 to USD 43.87 billion by 2035, with a compound annual growth rate (CAGR) of 23% during the forecast period from 2026 to 2035. The bioprocess containers allow laboratory technicians to smoothly shift the fluid media across the research facilities and keep them efficiently in the cleanroom whenever it is needed.

Key Takeaways

- In terms of revenue, the market is valued at USD 4.5 Billion in 2024.

- The market is predicted to reach USD 43.87 billion by 2035.

- Rapid growth at a CAGR of 23% will be officially experienced between 2025 and 2034.

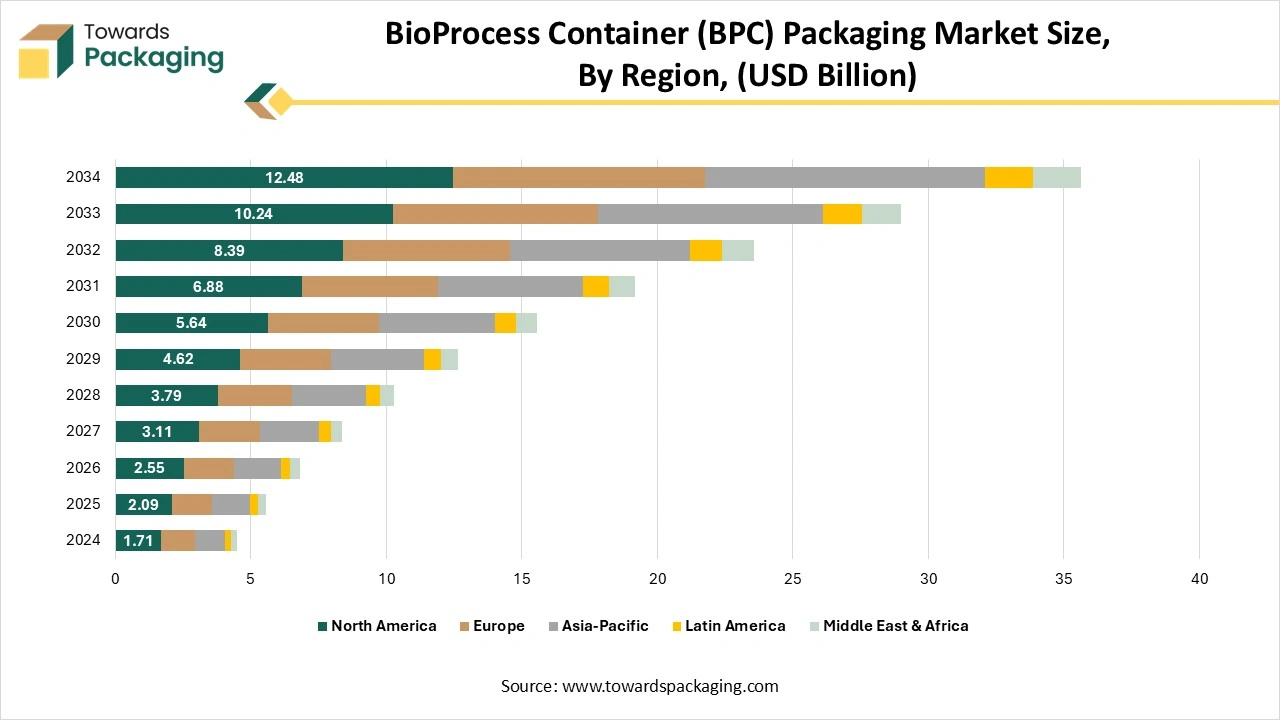

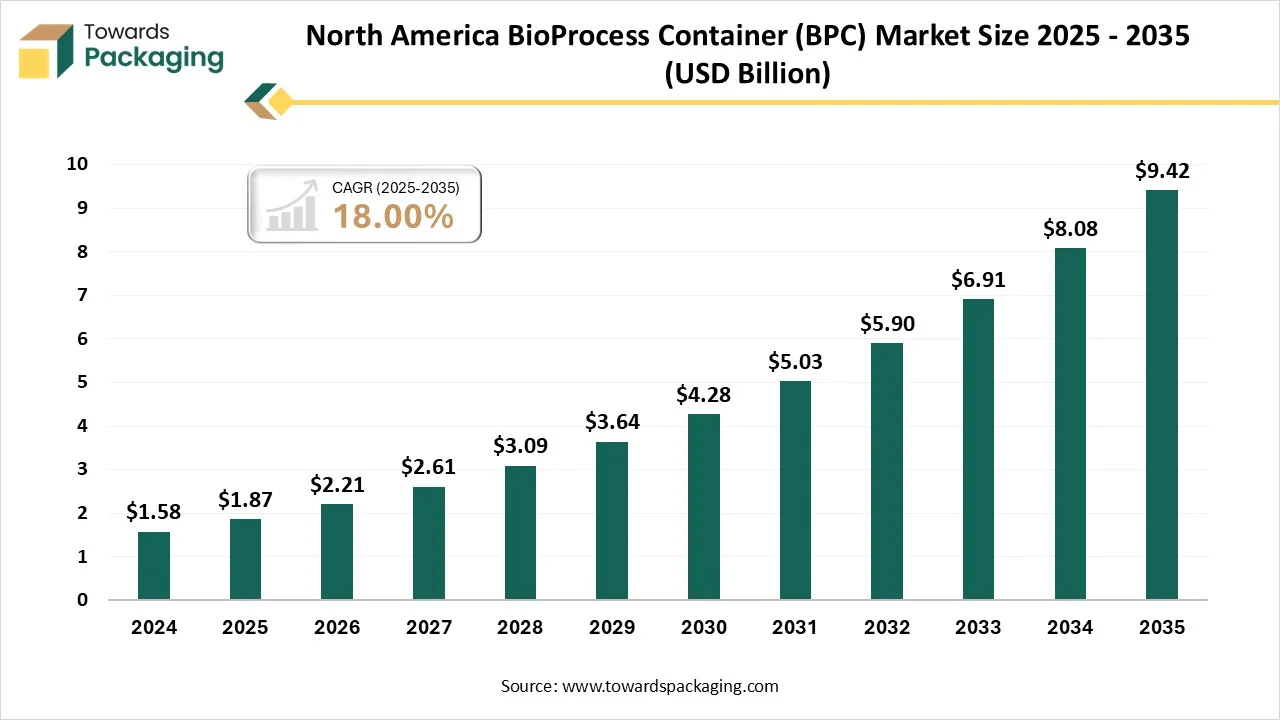

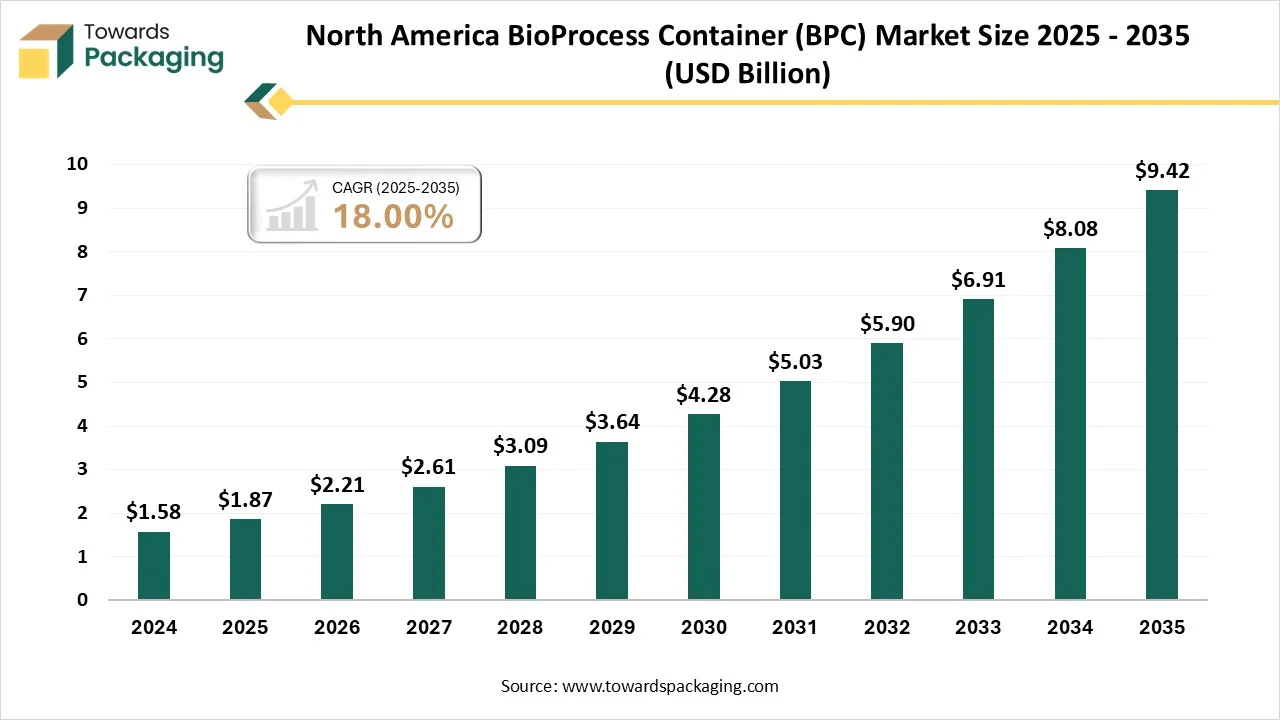

- By region, North America dominated the region, having the biggest share of 35% in 2024.

- By region, Asia Pacific expected to rise at a notable CAGR between 2025 and 2034.

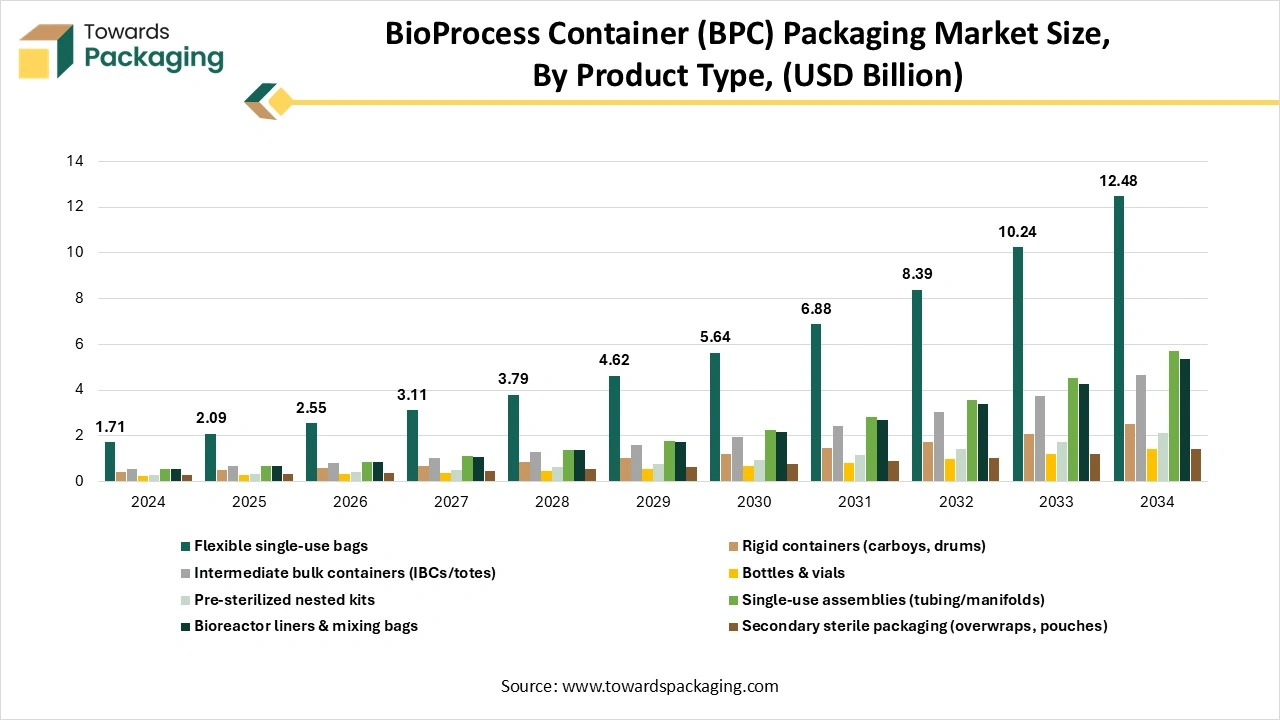

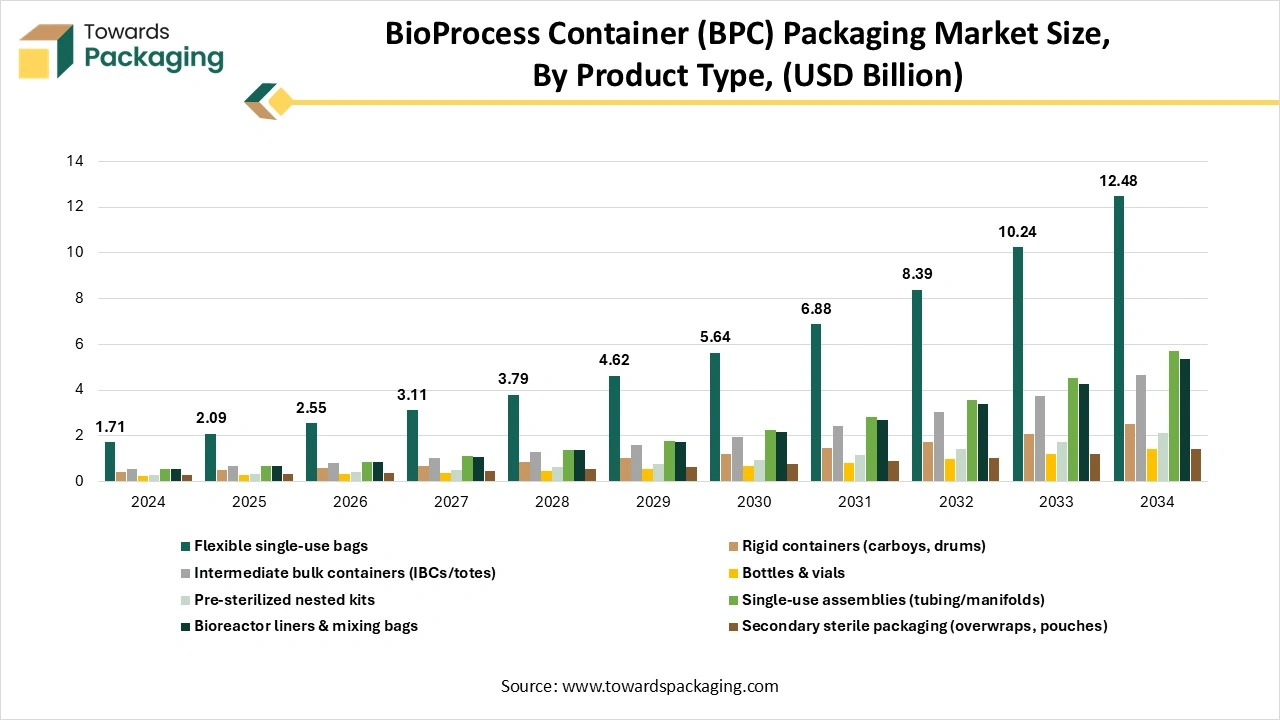

- By product type, flexible single-use bags segment contributed to the largest share of 55% in 2024.

- By product type, single-use assemblies segment will grow at a notable CAGR between 2025 and 2034.

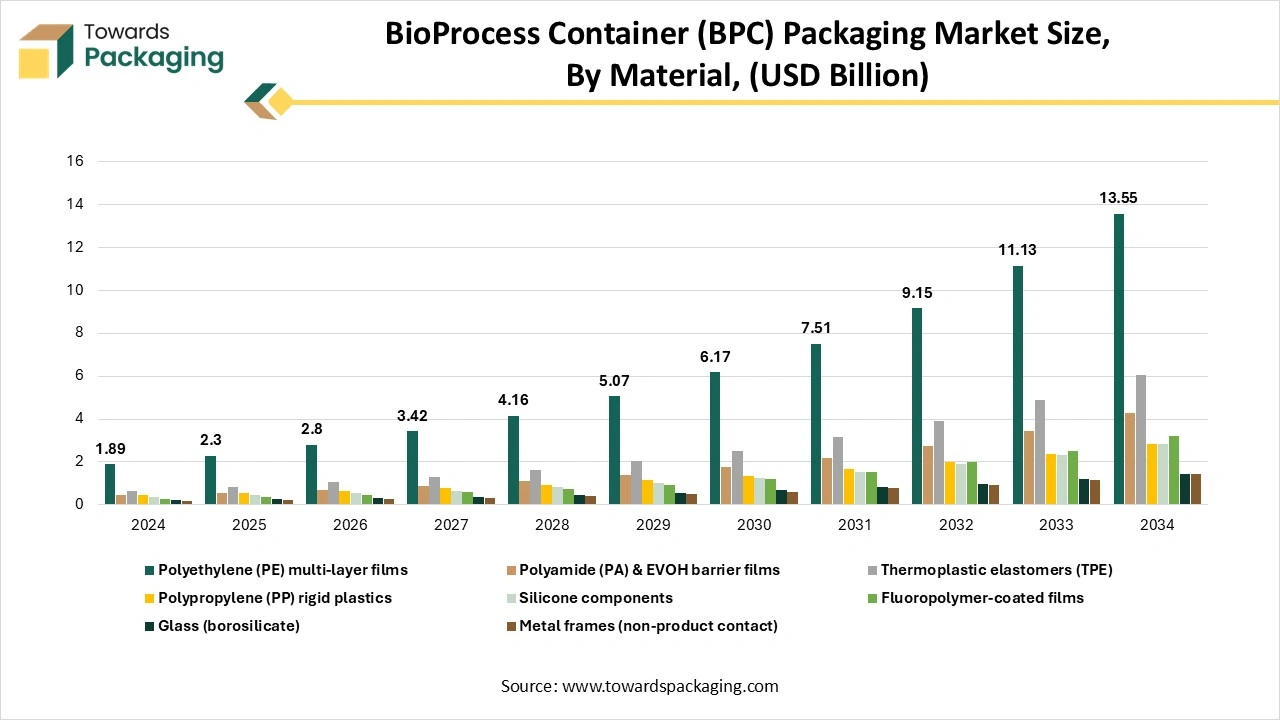

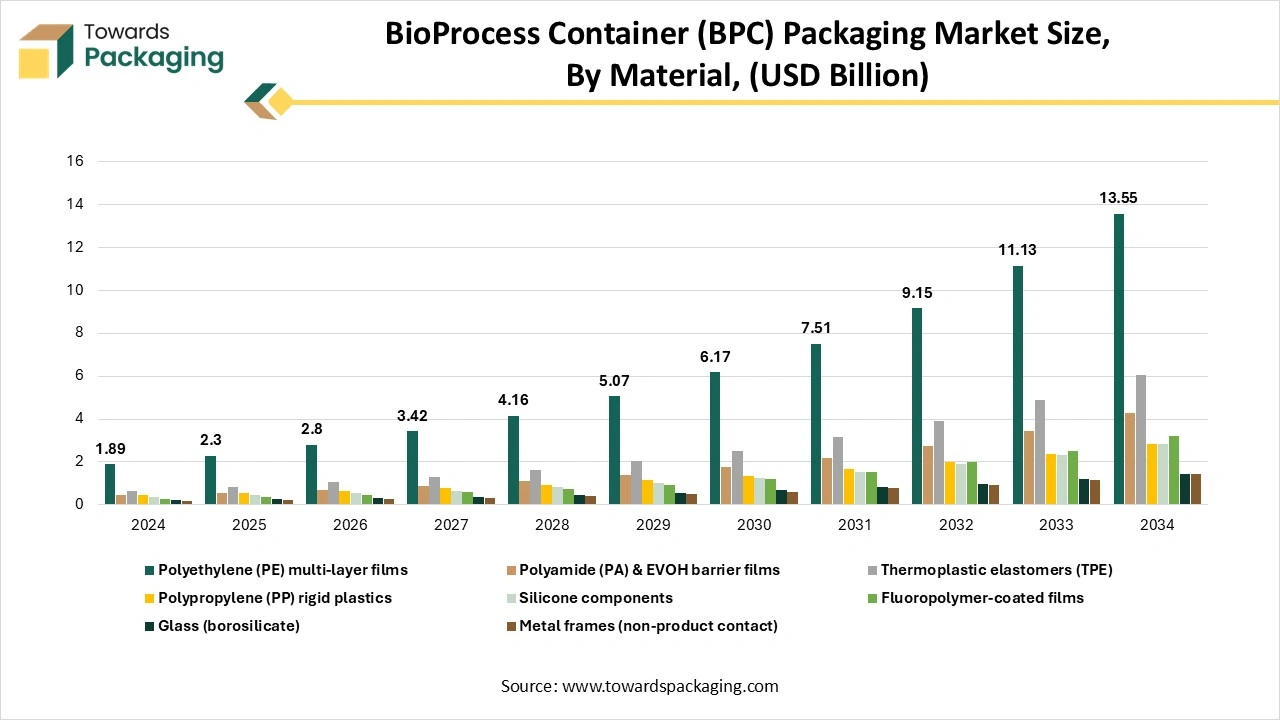

- By material type, polyethylene films segment contributed to the largest share of 42% in 2024.

- By material type, fluoropolymer-coated films segment will grow at a notable CAGR between 2025 and 2034.

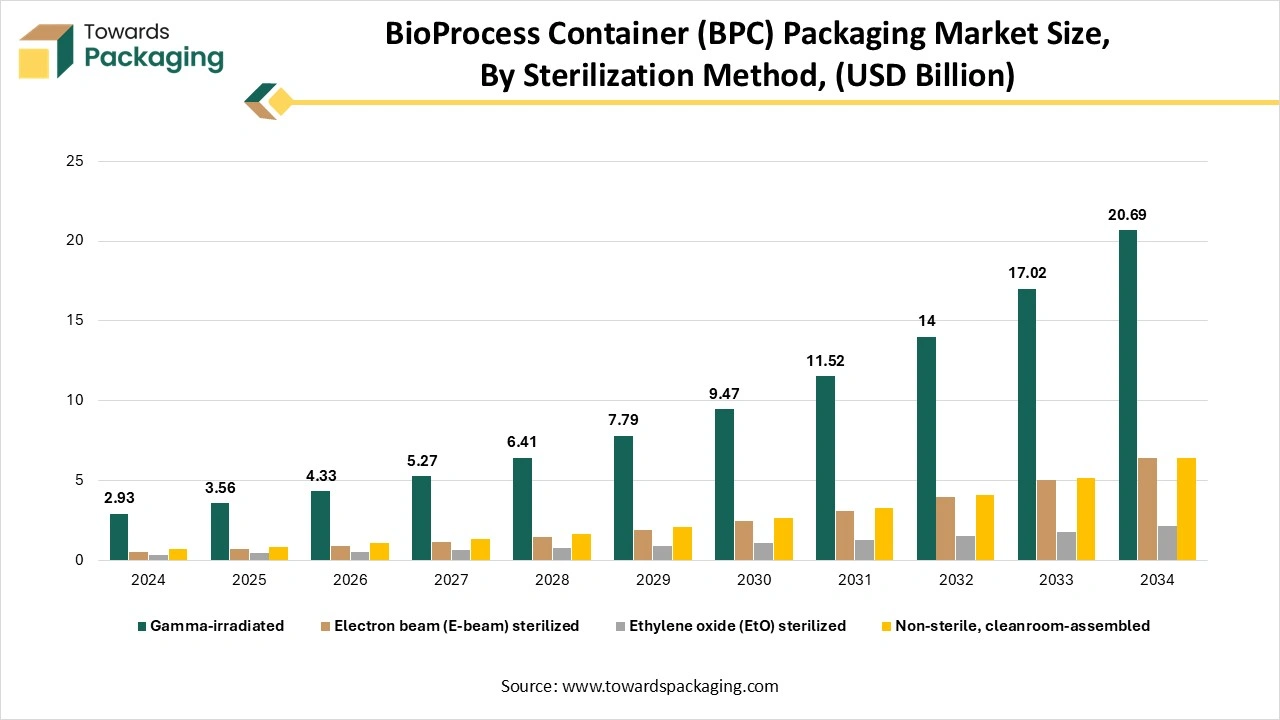

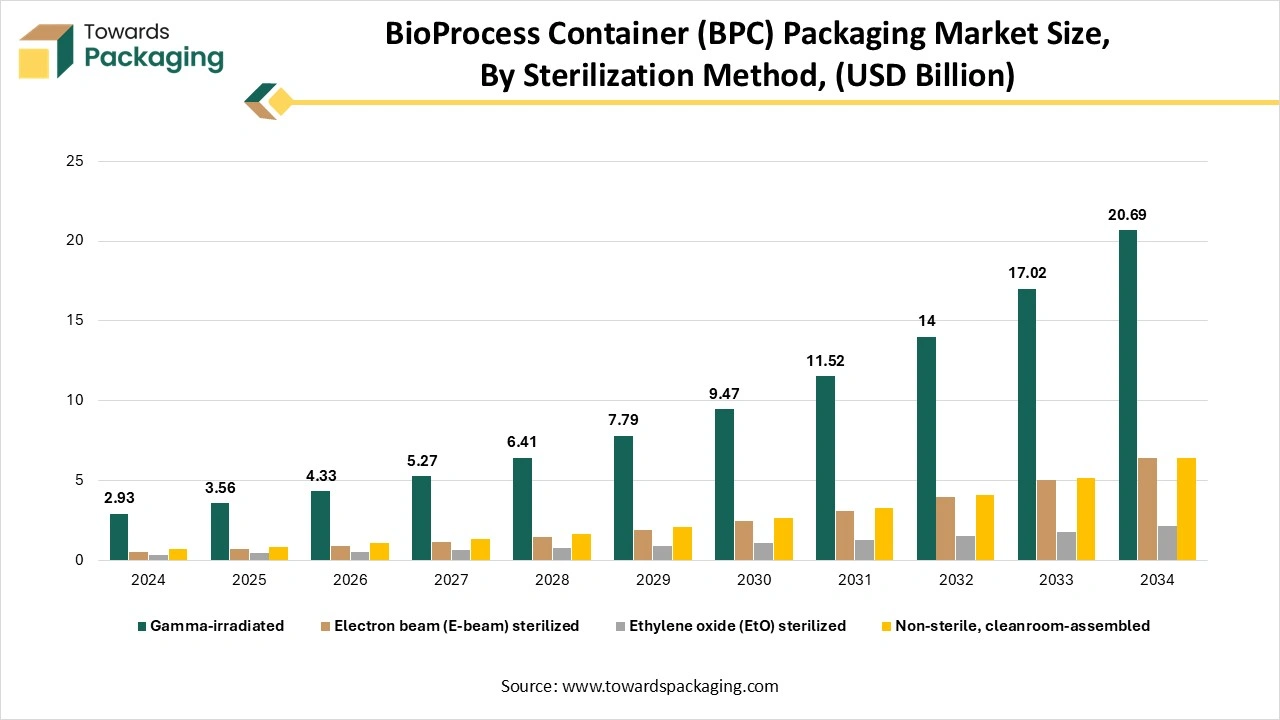

- By sterilization method, gamma irradiation segment contributed to the largest share of 60% in 2024.

- By the sterilization method, E-beam sterilized products segment will grow at a notable CAGR between 2025 and 2034.

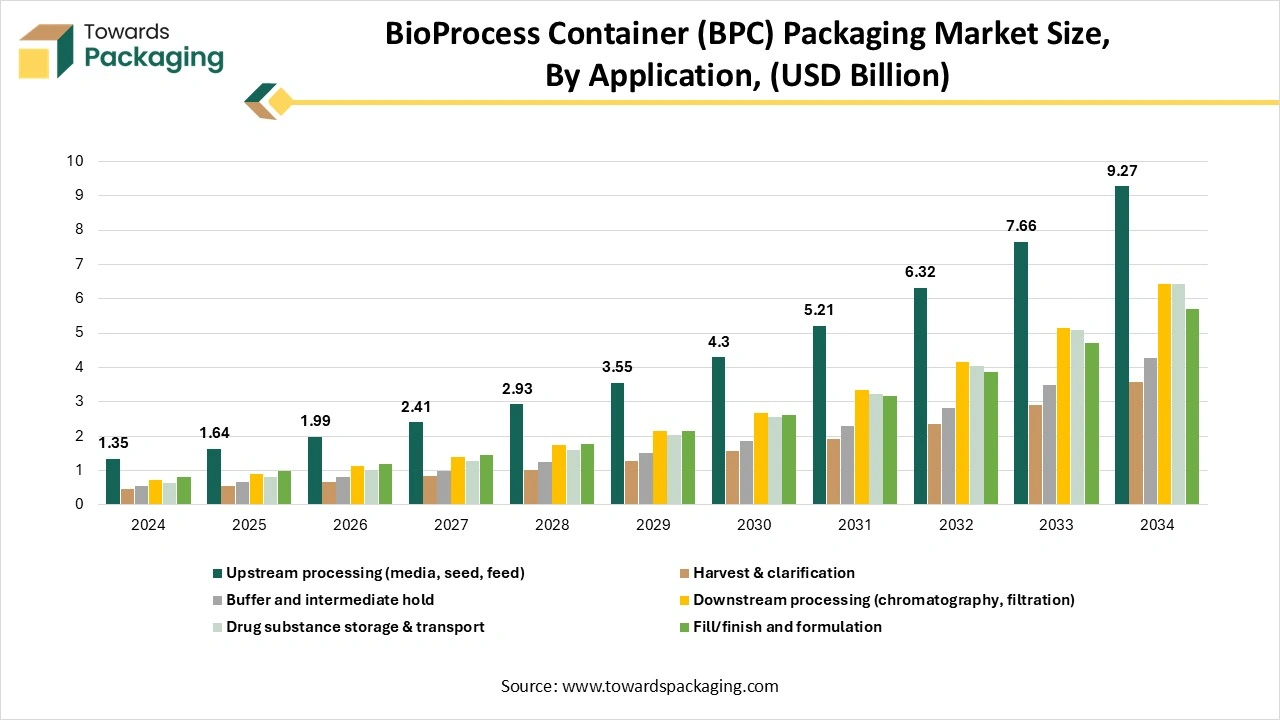

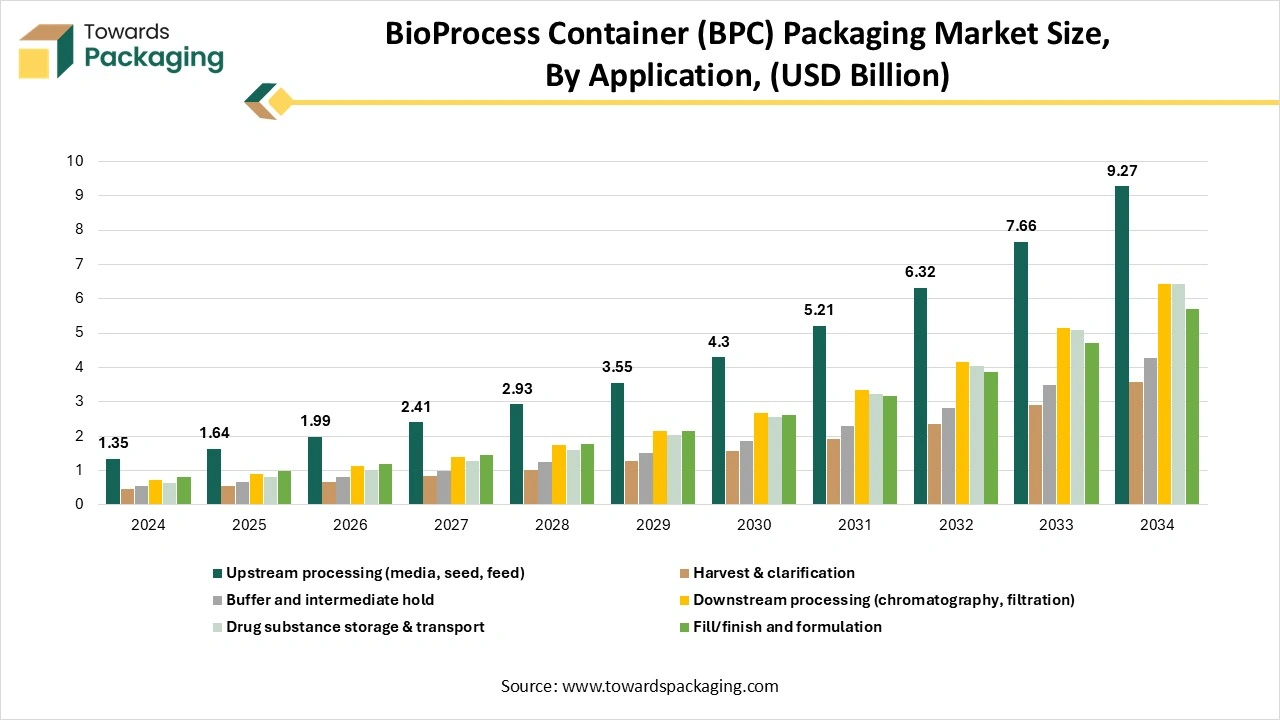

- By application, upstream processing segment contributed to the largest share of 39% in 2024.

- By application, fill/finish and formulation segment will grow at a notable CAGR between 2025 and 2034.

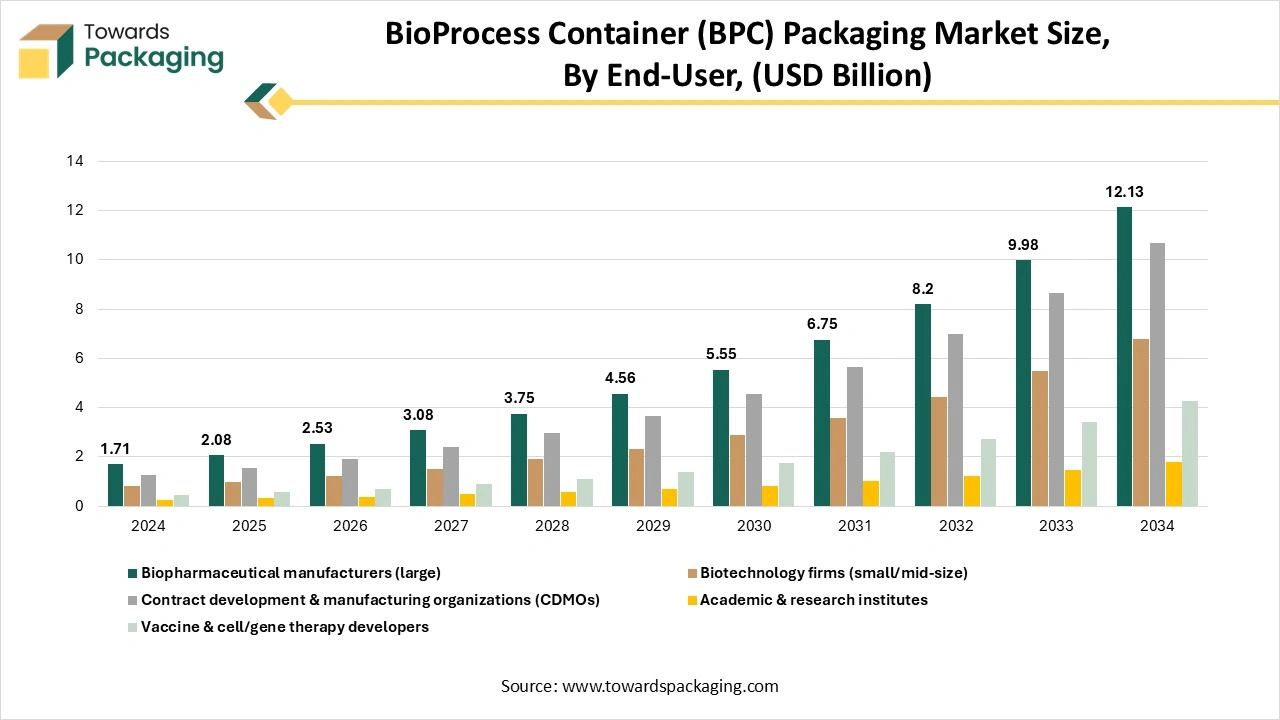

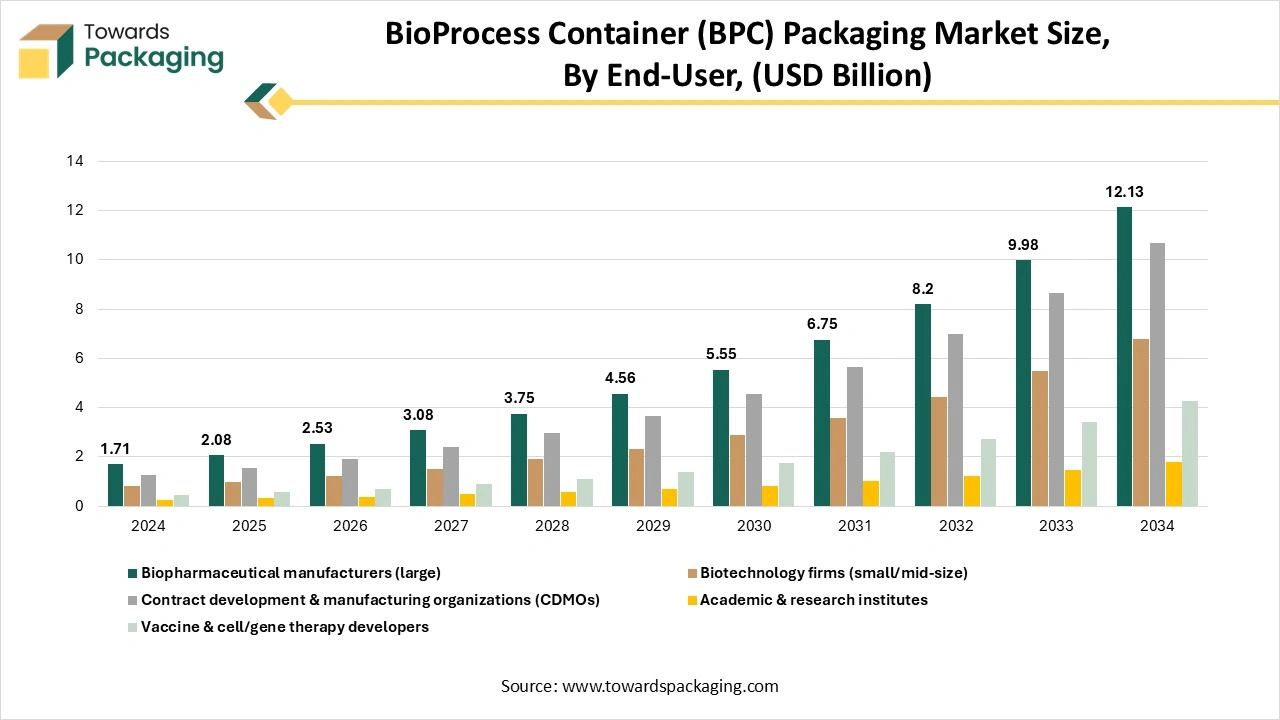

- By end-user, biopharmaceutical manufacturers segment contributed to the largest share of 41 % in 2024.

- By end-user, vaccine & cell & therapy developers segment will grow at a notable CAGR between 2025 and 2034.

Market Overview

Bioprocess container packaging is a dedicated packaging solution engineered for safe, sterile, and compliant containment, storage, transport, and handling of biological process materials (cell culture media, buffers, intermediates, drug substances, and biologics) across upstream and downstream biomanufacturing. Encompasses flexible and rigid systems, with accessories and service models specific to single-use bioprocessing.

Also, it is defined as a flexible fluid-control machine crafted for different applications in the biopharmaceutical field and the life sciences. Specifically, bioprocess containers are used to store and transport bags of fluids, such as buffers, upstreaming media, and biohazardous waste, too. These types of machines are made available in various shapes and sizes to align with several needs and demands. Hence, custom bio containers are always an option for many specialised workflow procedures.

Emerging Trends In The Bioprocess Container (BPC) Market

- Automation and Digitalization in Bioprocessing: One of the biggest updates in the sector is the integration of high-level software and artificial intelligence to update real-time manufacturing. Machine learning and AI will allow cell culture to update and optimise the prediction. Smart sensors in bioreactors will collect accurate data, ensuring total process control too.

- Scalability in bioprocessing: Perfusion systems will enable constant production and develop cell density. Hybrid systems update costs and production flexibility. Apart from these, modular platforms that facilitate scaling up without changing the adjusting procedure quality. Modular designs in terms of bioprocessing allow faster acceptance of production changes without major interruptions. These advances will create scalability more smoothly, enabling companies to adapt their manufacturing to market demands. The potential to manage production volumes quickly will be a main factor in the success of biopharmaceutical organizations.

- Expansion of Single-use systems: The usage of single-use bioreactors continues to expand, and operational efficiency. The trends in bioprocessing for the year 2025 will surely confirm that these systems will be the mainstay for biopharmaceutical manufacturing for different reasons, such as being scalable, enabling a seamless transition from laboratory to industrial production without major investments. Apart from this, partial reuse and recycling strategies of elements are being used to reduce the ecological footprint.

- Growth of Advanced Therapies: Advanced Therapies, such as cell therapies and gene therapies, are driving inventions in terms of bioprocessing. Growth of specialized bioreactors in terms of cell expansion and the safe handling of generic material. Growing demand for automated and closed systems for cell therapy manufacturing. Acceptance of high-level technologies to ensure product stability during transport and storage time.

- Sustainable and efficient production: Surrounding regulations are driving the demand for more sustainable bioprocesses. The trend in bioprocessing shows that companies will aim to develop biodegradable and recyclable materials for single-use equipment, optimise waste management, and lower energy and water use in production. Update the waste management, which is being generated by bioprocesses.

Market Dynamics

Market Driver

Procedure And Techniques Drives The Bioprocess Container Packaging

Fluid handling procedure and proven laboratory practices during the upstream bioprocessing, which include securely storing biological liquids in bioprocess containers. Bioprocess containers are a type of secondary liquid packaging unit crafted to carry the 2D and 3D media bags containing valuable fluid media, which are utilised during the upstreaming, such as bioreactor feeds or buffer solutions. Warehousing the bags safely in bioprocess containers assists in lowering the chances of bag ruptures and leads to cross-contamination during the upstream bioprocessing, which indirectly lessens the capability for poor-quality products.

Also, bioprocess containers allow laboratory technicians to smoothly shift the fluid media across the research facilities and keep them efficiently in cleanrooms when needed. By storing the media bags organised within a container, staff can easily access the liquids they need quickly, assisting in making the upstreaming procedure smoother.

Market Restraint

Strict Guidelines Lead To Challenges

The Food and Drug Administration (FDA), the World Health Organization (WHO), and the European Medicines Agency are just a of the international and national companies that have developed rigid guidelines for the purpose of pharmaceutical packaging. The pharmaceutical field has a serious issue with counterfeiting, which puts patient safety at serious risk. As per the estimates from the World Health Organization, up to 10% of the medications in middle-income and low-income countries are not original. Fake medications have damaged the reputation of actual ones and might be toxic or ineffective, too. Also, pharmaceutical companies are exerting more pressure to lower the environmental impact of their packaging as environmental sustainability becomes more crucial.

Market Opportunity

Advanced-Level Machines Will Be On Top In Bioprocess Container Packaging

Latest bioprocessing often needs big upfront investments and years of construction, too. The machinery is being personalised to a particular product, with little wiggle room for updation. Modular platforms, hence, broke down these monolithic systems into minute, unexchangeable units. These modules can be thought of as autonomous spaces like filtration skids, bioreactors, and analytics labs, which are crafted for fast deployment, designed for integration and scalability too. Instead of constructing it again for each of the latest drugs, cultured food, or enzyme, match modules or operators mix too, creating a flexible module. Plant-based proteins, cultured meat, and accurate fermentation that come from bioprocessors are utilised in pharmacy, but run on various economies and scales too. Modular systems are perfect for food inventors who want to quickly prototype and scale recipes and procedures, too. Biopharmaceuticals are complicated molecules that are hormones, antibodies, gene and cell therapies, which demand accurate and constant manufacturing facilities. With patient-specific medicines and just-in-time manufacturing, a constant factory quickly becomes the limiting factor.

Product Type Insights

How Have Flexible Single-Use Bags Segment Dominated The Bioprocess Container (BPC) Market?

The flexible single-use bags segment has dominated the bioprocess container (BPC) market in 2024 as single-use assemblies are tailored, pre-assembled, single-use solutions which is crafted for fluid transfer in terms of bioprocessing. They usually count the connectors, bottles, tubings, bags, etc. Instead of stainless steel tanks and pipes, which demand sterilising and cleaning, these types of assemblies are pre-sterilized and ready to use too. Once the procedure is done, the complete assembly is thrown away.

Sampling during cell culture and periodic aseptic supplementation during the cell culture are needed to track and regulate the cultivation, aiming to receive optimal results.

The single-use assemblies segment is predicted to be the fastest in the market during the forecast period. Single-use assemblies assist the cost-competiveness of manufacturing in the biopharma sector by a huge reduction of resources for cleaning goals. There are some instances of time-consuming cleaning cycles, cleaning media, analytics, and operator time. Also, there is a lower risk of cross-contamination. Having the end-to-end solutions instead of drug substance handling, which are compatible throughout the various bioprocessing stages, such as freezing and thawing, liquid transport, and transportation, proves to have higher smoothness.

Particularly for innovative techniques in terms of individualized and regenerative medicine and tissue engineering, single-use solutions are the logical solution. Single-use machine delivers the multipurpose manufacturing because of high-level changeover times and throughout too. Apart from this, the single-use assemblies in bioprocessing are more sustainable in nature than stainless-steel equipment from a holistic view.

Material Insights

How Did The Polyethylene Films Segment Dominate The Bioprocess Container (BPC) Market?

The polyethylene films segment dominated the market in 2024 as synthetic polymers, plastic substances have heavily substituted inorganic materials such as metal and glass in terms of pharmaceutical packaging because of their low cost, flexibility, and ease of manufacturing. Polyethylene is a well-known plastic material utilised in the pharmaceutical field. PE (Polyethylene ) releases flexibility, enabling it to meet with various drug shapes, along with perfect chemical stability, which rarely reacts chemically with pharmaceuticals.

Also, polyethylene (PE) is a widely used polymer in terms of packaging for its durability, flexibility, and cost-effectiveness. It serves as a perfect opposition to chemicals, moisture, and effects, which make it ideal for uses like in plastic bags, containers, and other plastic bags too. It is made available in plastic materials like HDPE, LDPE, and LLDPE, as it meets various packaging demands. Current discoveries concentrate on recyclable and biodegradable PE to develop sustainability.

The fluoropolymer-coated films segment is expected to be the fastest in the market during the forecast period. Data-driven for the aim of parental packaging, industry trends show the rising demand for fluoropolymer-coated films for the elastomeric closures, initially to mitigate the risks linked to drug compatibility and stability, too. To align with the rising demands of the biologics sector, the Omniflex fluoropolymer coating is the initial coating that simultaneously serves the barrier characteristics and avoids the closure as a source of silicone-oil-dependent subvisible substances (SbVPs).

Sterilization Method Insights

How Did The Gamma Irradiation Segment Dominate The Bioprocess Container (BPC) Market?

The gamma-irradiated segment dominated the bioprocess container (BPC) market in 2024, as sterilization in terms of gamma irradiation is a type of standard procedure for the medical services, food sector, and pharmaceutical industry, too. Several worldwide industrial websites serve gamma irradiation as a means of sterilization. Furthermore, over the many years, the latest irradiation sources such as X-rays or electron beams are becoming greatly used to align with growing and upcoming sterilisation demand. Alterations to gamma irradiation are being driven in the space of long lead times, site location challenges, huge lead times, and radioactive characteristics tracking and disposal security, as well as by the cost reduction opportunities.

The E-beam sterilisation segment is expected to be the fastest in the market during the forecast period. Electron beam (E-Beam ) sterilization is becoming a selected procedure to sterilise bioprocess containers, such as single-use bags, tubing, bottles, and other disposable items used in biopharma and biotech operations, as it utilises the high-energy electrons to inactivate micro-organisms quickly, without the demand for toxic chemicals or long dwell times. The procedure allows containers that need to be sterilized in their final packaging, lowering the risk of pollutants and handling. It is heavily compatible with several polymer materials like PET, PP, or PE, with less material degradation as compared to procedures like gamma radiation, due to shorter exposure time.

Application Insights

How Has The Upstream Processing Segment Dominated The Bioprocess Container (BPC) Market?

The upstream processing segment dominated the bioprocess container (BPC) market in 2024, as upstream bioprocessing is complicated for the success of bioprocessing, as it sets the basis for the quality of the final product. In bioprocessing, upstream bioprocessing points to the primary stage of the manufacturing procedure in which biological materials are made and updated for downstream bioprocessing. This platform broadly covers knowledge from the field of microbiology, as it includes the cultivation of microorganisms or cells that are used in the production of biopharmaceutical products. Process growth begins with the selection of the accurate micro-organisms or cell line, followed by media growth, which includes choosing the optimal nutrient composition and surrounding conditions to promote growth and productivity too.

The best procedure is inoculation, in which the selected microorganisms or cells are introduced into the media and enabled to multiply and grow. Thai is being followed by cell culture and fermentation, in which the cells are cultivated under controlled conditions, including pH, temperature, and oxygen levels.

The fill/finish formulation segment is expected to be the fastest in the market during the forecast period. They are frequently referred to as sterile fill finish or aseptic fill and finish, which is the important final stage of drug product production. At this point, a sterile bulk drug item is filled into its outcome container, which consists of pre-filled syringes, glass vials, or ampoules. It is then packed under systematically controlled aseptic conditions. Just like terminal sterilisation, which applies in dry heat or other procedures after packaging, aseptic processing and filling controls the sterility of the drug product throughout the production procedure.

Current filling lines, often built from stainless steel or equipped with single-use systems, are crafted to lower the pollutants and assist the highest standards of aseptic manufacturing.

End-User Industry Insights

How Did The Biopharmaceutical Manufacturers Segment Dominate The Bioprocess Container (BPC) Market?

The biopharmaceutical manufacturers segment dominated the market in 2024 to house and prevent the single-use bags from having sensitive biological fluids during storage, production, and transport, too. These rigid containers, which can be reusable or part of single-use systems, facilitate fluid tracking and controlling, prevent pollutants, facilitate fluid management, and track sterile conditions from cell culture to purification. They develop the operational efficiency, scalability, and product safety by serving secure contaminants for buffers, media, and biotherapeutics throughout the production workflow.

The vaccine and cell and gene therapy developers segment are expected to be the fastest in the market during the forecast period. The surfaces inside the cleanroom (walls, area, ceiling, and floor, etc) should be flat and smooth, without tight joints, cracks, or particles falling off, and be able to withstand disinfection and cleaning too, without dust collection or mold development. This is extremely crucial for protecting the pollutants in the manufacturing of cells, genes, and vaccines, as these products are very fragile to even little particles and microorganisms in the environment. Once the particles fall off or microorganisms develop, it may affect the product quality. Electricity, water, and steam that are used to construct pipelines in the cleanroom must be concealed. This can lower the possibility of dust gathering and microbial adhesion on the surface of the pipeline, and avoid contamination of the manufacturing machine.

Regional Insights

How Has The North America Dominated The Bioprocess Container (BPC) Market?

North America dominated the bioprocess container (BPC) market in 2024, as the growth in biopharmaceutical development and manufacturing has fueled the demand for bioprocess bags, utilised in the handling and storage of biological procedures. Bioprocess bags serve as cost-efficient and flexible solutions as compared to regular rigid containers, which drives the exception in the pharmaceutical sector. Another urge is for growing regulatory assistance and approvals for bioprocess bag usage in the healthcare sector, making sure the safety and more managed production surrounding it, too.

Asia Pacific is the fastest-growing in the market during the forecast period. The demand for bioprocess containers in the Asia Pacific region is experiencing fast growth, driven by the expansion of biopharmaceutical manufacturing in countries like China, India, South Korea, and Japan. The growing adoption of single-use technologies is a main factor, as they reduce costs, minimize contamination risk, and offer flexibility for both large-scale and contract manufacturing organizations (CMOs). So, India and China are coming up as growing major hubs due to investments in biosimilars and vaccines, too, while South Korea and Japan are concentrating on advanced bioprocessing systems with intelligent, sensor-enabled containers. Overall, the Asia-Pacific is one of the fastest-growing markets globally, with double-digit CAGR operations, assisted by rising biologics manufacturing, demand for cost-efficient manufacturing, and greater emphasis on localized supply chains.

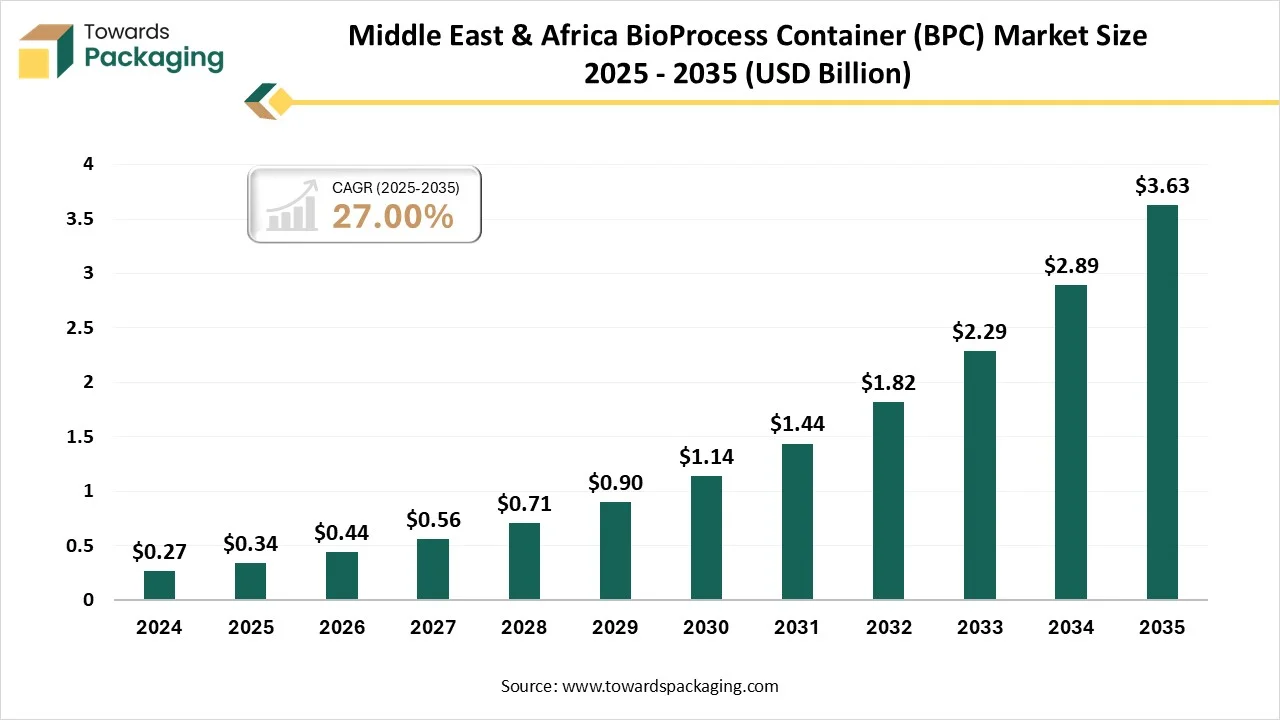

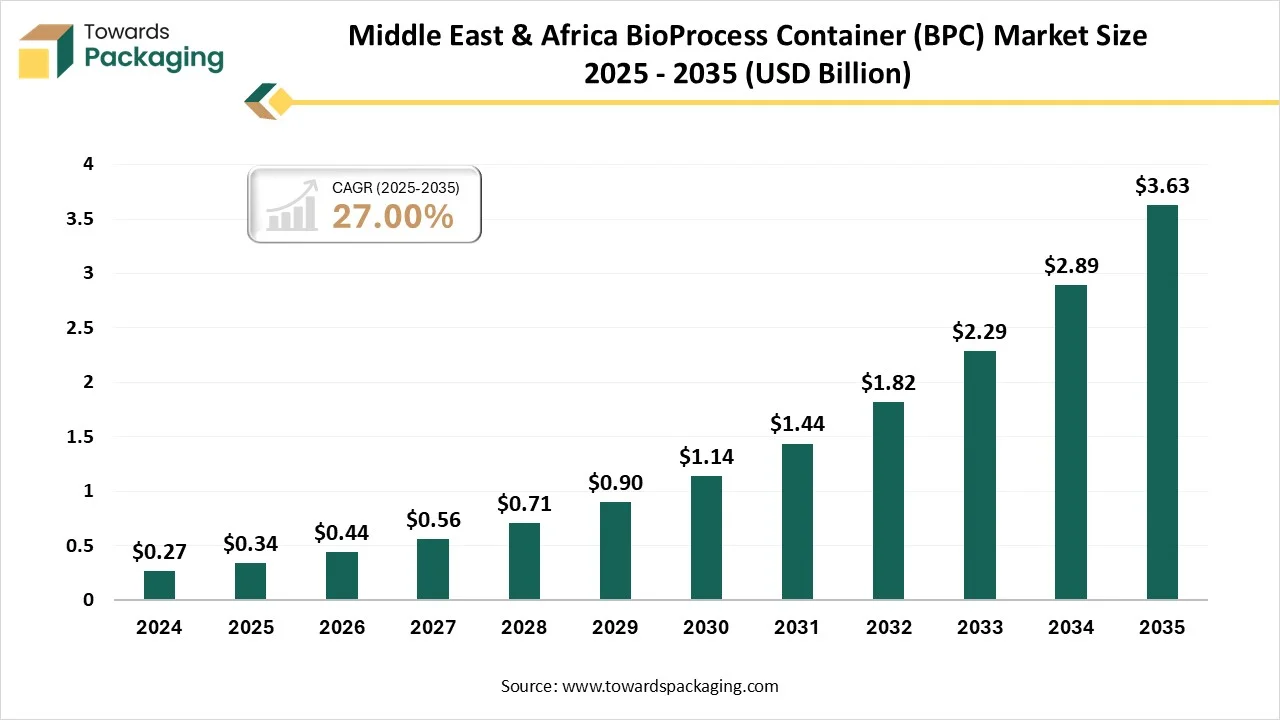

Middle East & Africa BioProcess Container (BPC) Market Size 2025 - 2035 (USD Billion)

Bioprocess Container (BPC) Market - Value Chain Analysis

- Material Processing and Conversion: Material processing and conversion of bioprocess container packaging specifically begins with transforming polymer resins into films or bags with the assistance of blown film or cast film extrusion, too. After creating the basic film, operations like metallization, lamination, coating, and printing are used to make the multilayer structure with the desired properties.

- Package Design and Prototyping: Package design and prototyping for bioprocess containers includes making tailored outer packaging that protectively carries inner media bags, often concentrating on features like ease of movement, secure storage, personalization of bag port positions, asset tracking, branding, and cleanroom sustainability etc.

- Logistics and Distribution: The logistics and distribution of bioprocess container packaging needs careful controlling to ensure the sterility and integrity of the contents and the containers themselves, often relying on specialized packaging to track temperature control and prevent contamination during traveling and warehousing, too.

Top BioProcess Container Companies Globally

Tier 1

- Sartorius Stedim Biotech

- Thermo Fisher Scientific

- Merck Millipore (MilliporeSigma / Merck KGaA)

- Cytiva

- Pall Corporation (Danaher)

- Corning Incorporated

- 3M Company

- GEA Group

- Becton, Dickinson and Company (BD)

- Lonza Group

- Catalent plc

- West Pharmaceutical Services

- SCHOTT AG

- Gerresheimer AG

- Stevanato Group

- Amcor plc

- Berry Global Group, Inc.

Tier 2

- Parker Hannifin Corporation

- Saint-Gobain Performance Plastics

- Fresenius Kabi

- B. Braun Melsungen AG

- Nipro Corporation

- Terumo Corporation

- Repligen Corporation

- Eppendorf AG / Eppendorf SE

- WuXi Biologics / WuXi AppTec

- Aptar Pharma / AptarGroup

- Bio-Rad Laboratories

Tier 3

- DWK Life Sciences

- Nelipak Healthcare

- Origin Pharma Packaging

- Sonoco

- Huhtamaki

- Distek, Inc.

- Emerson

Latest Announcements By Industry Leader

- In September 2024, TekniPlex Healthcare, which uses high-level material science expertise to assist perfect patient results, will give importance to its expertise and intellectual property linked to single-use bioprocessing cell and gene therapy at CPI Milan, which took place between 8 and 10 October.

Recent Developments

- In August 2025, Rotzinger Pharmapack is introducing the latest filling and capping stage for the aim of over-the-counter (OTC) products such as non-aseptic pharmaceuticals, as well as liquid and solid items from the personal care, cosmetics, and nutraceutical industries.

Segmentation Of Bioprocess Container (BPC) Market

By Product Type

- Flexible single-use bags

- Rigid containers (carboys, drums)

- Intermediate bulk containers (IBCs/totes)

- Bottles & vials

- Pre-sterilized nested kits

- Single-use assemblies (tubing/manifolds)

- Bioreactor liners & mixing bags

- Secondary sterile packaging (overwraps, pouches)

By Material

- Polyethylene (PE) multi-layer films

- Polyamide (PA) & EVOH barrier films

- Thermoplastic elastomers (TPE)

- Polypropylene (PP) rigid plastics

- Silicone components

- Fluoropolymer-coated films

- Glass (borosilicate)

- Metal frames (non-product contact)

By Sterilization Method

- Gamma-irradiated

- Electron beam (E-beam) sterilized

- Ethylene oxide (EtO) sterilized

- Non-sterile, cleanroom-assembled

By Application

- Upstream processing (media, seed, feed)

- Harvest & clarification

- Buffer and intermediate hold

- Downstream processing (chromatography, filtration)

- Drug substance storage & transport

- Fill/finish and formulation

By End-User

- Biopharmaceutical manufacturers (large)

- Biotechnology firms (small/mid-size)

- Contract development & manufacturing organizations (CDMOs)

- Academic & research institutes

- Vaccine & cell/gene therapy developers

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait