Europe Recyclable Packaging Market Size, Demand and Trends Analysis

The europe recyclable packaging market is forecasted to expand from USD 7.65 billion in 2026 to USD 12.93 billion by 2035, growing at a CAGR of 6.0% from 2026 to 2035. It includes market segmentation by material (plastic, paper, glass, metal), packaging type (bottles & jars, bags & pouches, cartons), and applications (food & beverage, healthcare, personal care, industrial, consumer goods, logistics). The study provides regional data across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, competitive profiles of major companies including Mondi, DS Smith, Stora Enso, Smurfit Kappa, Huhtamaki, ALPLA, Amcor, along with supply-chain and value-chain analysis. It also includes trade data insights, pricing trends, raw material availability, and the evolving role of technology and AI in improving recycling and circular economy infrastructure.

Governments in Europe and the EU continue to implement powerful circular economy policies such as the Packaging and Packaging Waste Directive (PPWD) and Extended Producer Responsibility (EPR) which are pushing industries to adopt sustainable packaging formats. Sectors including food & beverages, personal care, e-commerce, and healthcare are rapidly transitioning toward recyclable solutions to meet regulatory and brand-led sustainability commitments.

The Europe recyclable packaging market is driven by strict environment regulations, rising consumer awareness about sustainability, and increasing demand for eco-friendly alternatives across industries. Governments and the EU have implemented policies encouraging circular economy practices, boosting innovation in recyclable materials like paper, cardboard, and mono-material plastics. Key sectors such as food and beverage, personal care, and e-commerce are adopting recyclable packaging to meet green goals. Technological advancements and brand commitments to reduce plastic waste further support market growth and transition.

Key Insights

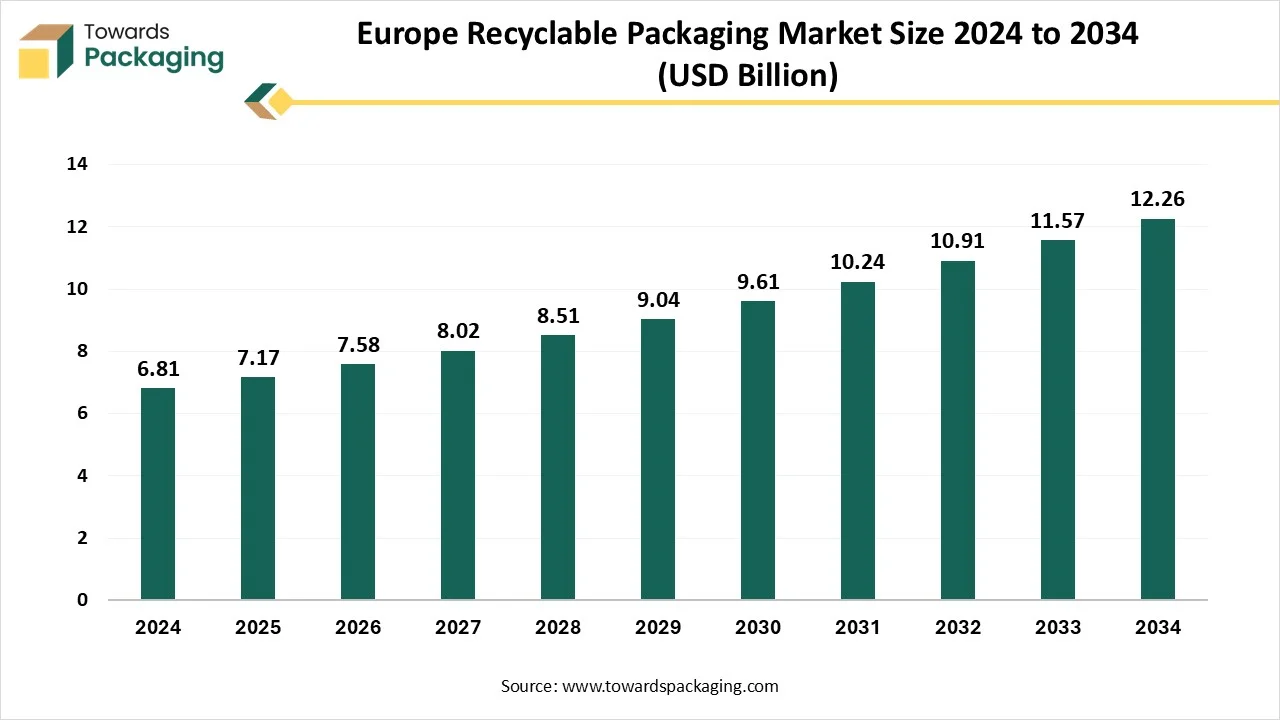

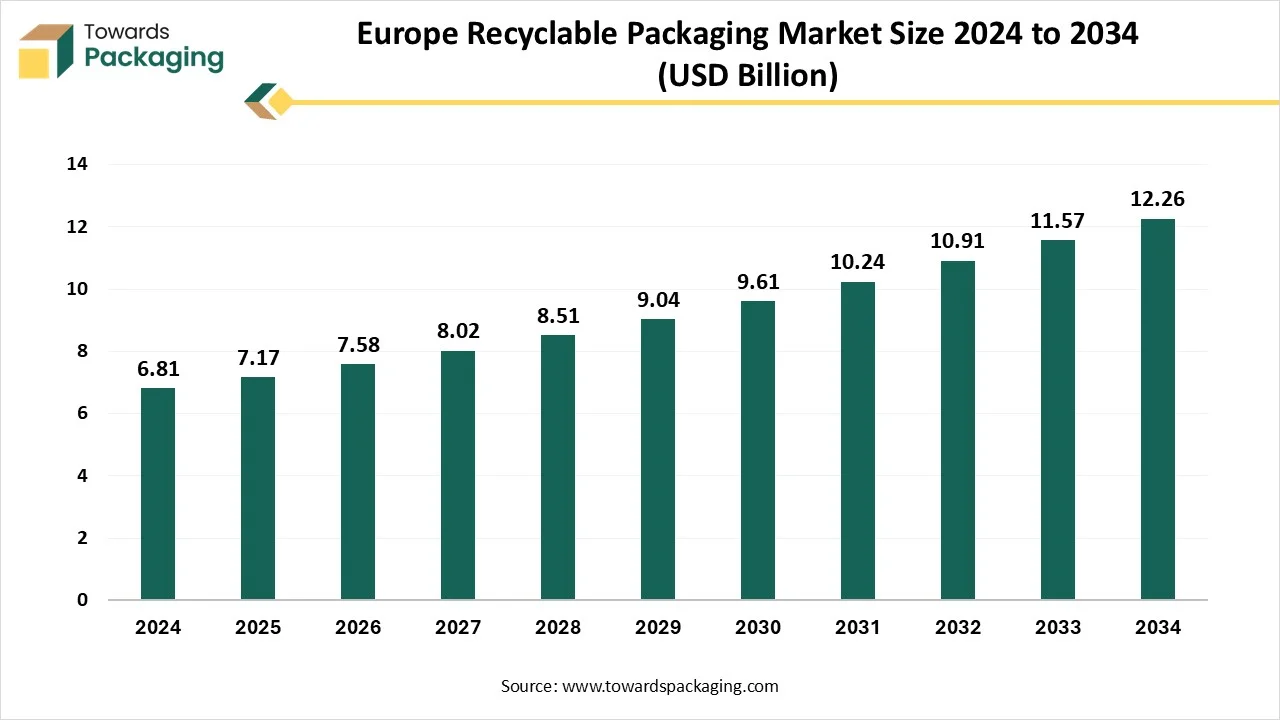

- In terms of revenue, the market is valued at USD 7.17 billion in 2025.

- The market is projected to reach USD 12.93 billion by 2035.

- Rapid growth at a CAGR of 6.0% will be observed in the period between 2025 and 2034.

- By material, the plastic segment dominated the market with the largest revenue share.

- By type of packaging, the bottles and jars segment registered its dominance over the market in 2024.

- By application, the food and beverage segment dominated the market in 2024.

Market Overview

Recyclable packaging refers to packaging materials that can be collected, processed, and reused to manufacture new products after their initial use. Unlike single-use packaging, which ends up in landfills or incinerators, recyclable packaging enters a circular loop, reducing environmental impact and conserving natural resources. These materials typically include paper, cardboard, glass, metals like aluminium, and certain types of plastics (e.g., PET, HDPE), which can be sorted and processed through industrial recycling systems. For packaging to be truly recyclable, it must be clean, free from contaminants like food residues, and composed of materials that are accepted by local recycling infrastructure.

Some advanced packaging designs now use mono-materials, single-type polymers that are easier to recycle compared to multi-layered or composite packaging. Recyclable packaging plays a crucial role in sustainable development goals by reducing carbon emissions, minimizing waste, and supporting a circular economy. It is widely used across industries such as food, beverages, personal care, and ecommerce.

Key Metrics and Overview

| Metric |

Details |

| Market Size in 2025 |

USD 7.22 Billion |

| Projected Market Size in 2035 |

USD 12.93 Billion |

| CAGR (2026 - 2035) |

6.0% |

| Market Segmentation |

By Material, By Type of Packaging and By Application |

| Top Key Players |

The Brand Company, S.L., PERA LABEL and PACKAGING, Mondi Group, Stora Enso, DS Smith, Smurfit Kappa, Stora Enso |

What are the New Trends in the Recyclable Packaging Market?

- Mono-material and Minimalist Designs

Brands are shifting away from multi-layer composites, adopting single-material packaging, for example, all-polypropylene pouches, paper mailers. To simplify recycling and comply with emerging circular economy regulations.

- Compostable, Biodegradable, and Plant-Based Materials

Expect to see more packaging made from PLA, PHA, cornstarch, seaweed, bamboo, and mushroom mycelium materials that safely decompose or can be composted industrially or at home.

- Connected and Smart Packaging

Integration of QR codes, RFID, NFC sensors, and even battery-free freshness monitors enhances traceability, consumer info access, and recycling compliance.

- Refill Systems and Circular Economy

Growing implementation of closed-loop models, including refillable containers, deposit-return schemes, and subscription-based reuse systems, coexist with recyclable packaging.

- Carbon Footprint Labelling

Transparent on-pack carbon labels (e.g., “A=low CO2/kg”) are gaining traction, empowering consumers and aligning with the EU’s carbon policy movement.

- Automation, AI and Digital Tech

“Packaging 4.0” is here-AI driven design tools, digital twins, robotics, and industry-grade smart sorting are optimizing material use, efficiency, and recyclability.

- Recycled and Upcycled Content

Use of post-consumer recycled (PCR) materials is expanding for both rigid and flexible formats, reducing dependency on virgin inputs.

- Eco-friendly Inks and Adhesives

Moving toward water-based or soy-based inks, compostable adhesives, and labels designed for clean separability enhances recyclability.

Country-Wise Insights

Germany Market Trends

Germany leads the recyclable packaging market due to its stringent recycling laws like the Verpackungsgesetz (Packaging Act), which mandates producers to ensure recyclability. The country also has a well-established dual collection system and high consumer participation in sorting waste. Major players like ALPLA and Klockner Pentaplast contribute to innovation and circular packaging.

Germany Recyclable Packaging Market Data (2021 to 2025)

| 2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

| 939.5 |

996.9 |

1057.6 |

1051.5 |

1116.3 |

1180.3 |

1248.8 |

1320.2 |

1398.4 |

France Market Trends

France's recyclable packaging market is driven by aggressive policies, such as the Anti-Waste Law for a Circular Economy, aiming for 100% recyclable plastic by 2025. The government supports eco-design, compostable materials, and bans on non-recyclable plastics. Investment in recycling infrastructure and companies like Suez drives national-scale sustainability.

France Recyclable Packaging Market Data (2021 to 2025)

| 2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

| 645.8 |

677.9 |

711.4 |

707.9 |

743.3 |

777.9 |

814.5 |

852.3 |

893.5 |

U.K. Market Trends

Despite Brexit, the UK maintains high sustainability standards through the Plastic Packaging Tax, Extended Producer Responsibility (EPR), and consistent consumer pressure. Strong demand for paper-based and compostable packaging has boosted growth, supported by key players like DS Smith and Mondi’s UK operations.

U.K. Recyclable Packaging Market Data (2021 to 2025)

| 2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

| 726.2 |

771.7 |

819.8 |

813.6 |

864.9 |

915.7 |

969.9 |

1,027.7 |

1,092.6 |

Italy Market Trends

Italy plays a major role through higher paper and cardboard recycling rates, backed by CONAI (National Packaging Consortium). Local brands increasingly adopt fiber-based and bio-based packaging, especially in the food and luxury goods sectors. Italy’s strong circular economy culture enhances its market position.

Italy Recyclable Packaging Market Data (2021 to 2025)

| 2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

| 607.7 |

631.2 |

655.4 |

652.0 |

677.4 |

701.9 |

727.6 |

754.8 |

785.4 |

How Can AI Improve the Recyclable Packaging Market?

AI integration is transforming the recyclable packaging industry by optimizing design, production, and waste management processes. Through advanced algorithms, AI enables packaging designers to create materials that are easier to recycle, using mono-materials and lightweight structures without compromising strength or functionality. In manufacturing, AI-driven automation enhances efficiency by reducing material waste and energy consumption. Machine learning models can analyze large datasets to predict consumer preferences for sustainable packaging, helping brands align with eco-conscious demand.

In waste sorting and recycling plants, AI-powered robots and vision systems accurately identify, separate, and process recyclable materials at high speeds, improving recovery rates and reducing contamination. Furthermore, AI can monitor supply chains to ensure sustainable sourcing and track carbon footprints, aiding compliance with environmental regulations. By enabling smarter decisions at every stage of the packaging lifecycle, AI helps the industry move closer to a circular economy, where packaging is not only recyclable but also efficiently recovered and reused.

Market Dynamics

Driver

Circular Economy Initiatives and Strict Environmental Regulations

National and regional efforts to promote a circular economy encourage recycling, reuse, and minimal packaging waste, directly supporting recyclable packaging. The European Union’s Green Deal, Packaging and Packaging Waste Directive (PPWD), and Extended Producer Responsibility (EPR) laws are pushing manufacturers to adopt recyclable packaging. European consumers are increasingly prioritizing sustainability, demanding eco-friendly packaging options across food, cosmetics, and retail sectors.

- In May 2025, the circular economy transition is at a turning point with the adoption of the European Union’s enacted Regulation (EU) 2025/40 on packaging and packaging waste. The new regulation highlights that all packaging must be recyclable by 2030, reaching Grade C by 2038. This covers technical evaluations of sorting, packaging design, and large-scale recyclables.

Restraint

Contamination Issues and Complex Packaging Formats

The key players operating in the European recyclable packaging market are facing issues due to complex packaging formats and contamination issues in the region. Improper disposal and mixing of materials (like food-contaminated packaging) reduce recyclability and increase waste rejection rates. Multi-layer or composite packaging used in certain products remains difficult to recycle, and alternatives may not yet match performance or shelf-life standards. Inconsistent labeling and unclear disposal instructions can lead to poor recycling habits, reducing the effectiveness of recyclable packaging.

Opportunity

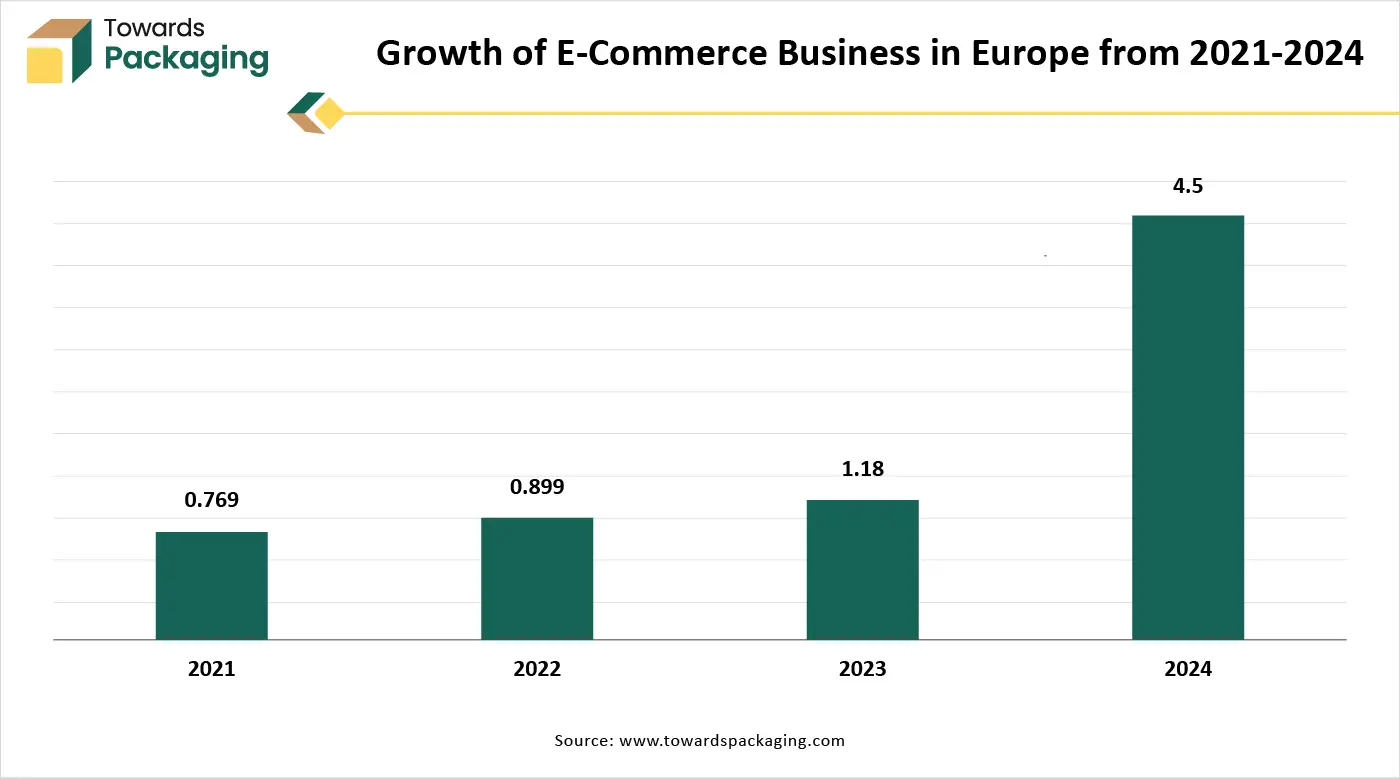

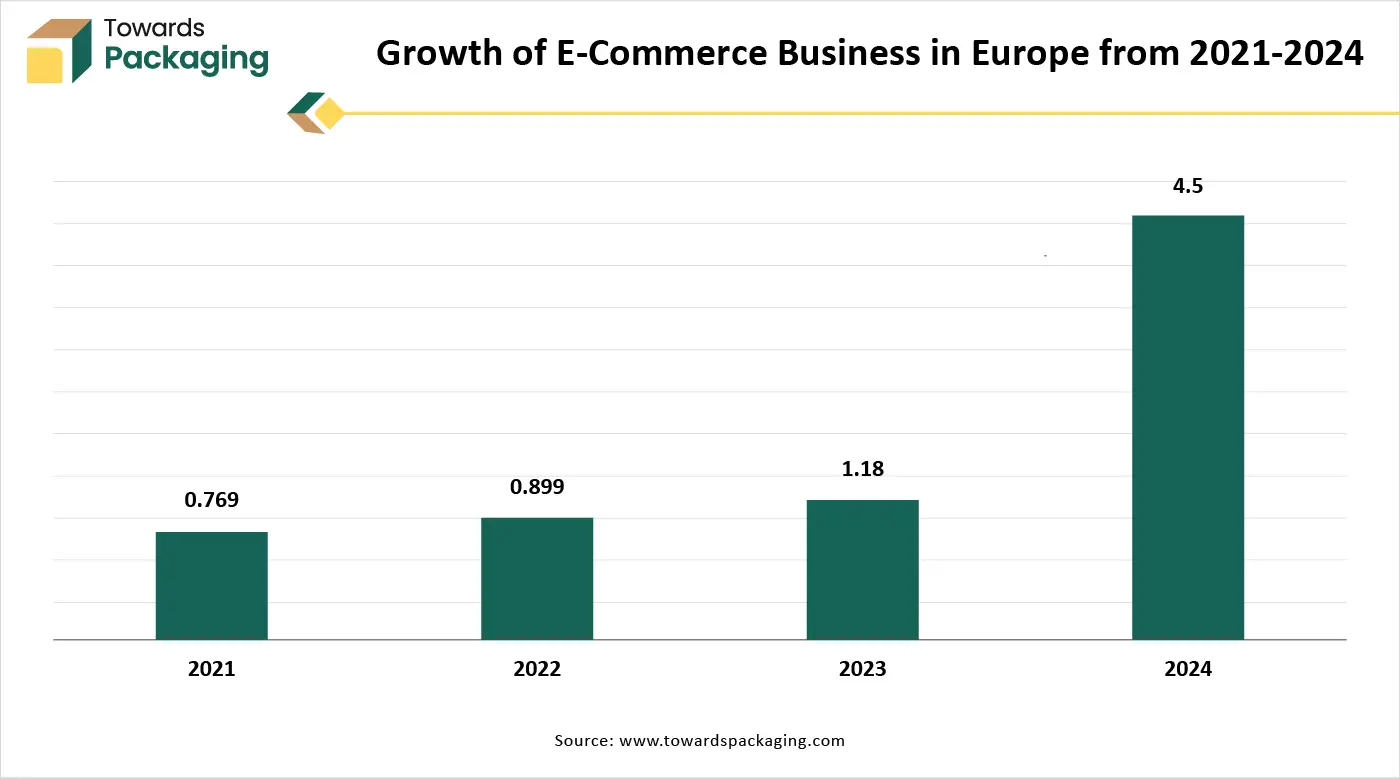

Growth in the E-Commerce Sector

The rapid growth of e-commerce in Europe is a significant driver for the recyclable packaging industry. As online shopping increased, so has the demand for secure, lightweight, and sustainable packaging solutions. E-commerce platforms require vast quantities of packaging for shipping individual products, leading to greater environmental concerns about packaging waste. In response, businesses are shifting to recyclable packaging to meet consumer expectations for sustainability and to comply with strict European regulations.

Recyclable materials such as corrugated cardboard, paper-based mailers, and mono-material plastics are being widely adopted to reduce the environmental impact of deliveries. Additionally, many e-commerce companies are embracing eco-conscious branding, using recyclable packaging to enhance their reputation and meet corporate sustainability goals. With the in eco-aware consumers and cross-border online sales, the need for standardized, easily recyclable packaging formats is growing, further encouraging innovation and investment in recyclable packaging technologies across Europe’s e-commerce supply chain.

- According to the data published by the European eCommerce and Omni Channel Trade Association (EMOTA), E-commerce will make up a sizable amount of retail revenues in Europe by 2029. The U.K. is expected to lead, with e-commerce accounting for 32% of total retail sales in 2029, up from 27% in 2024.

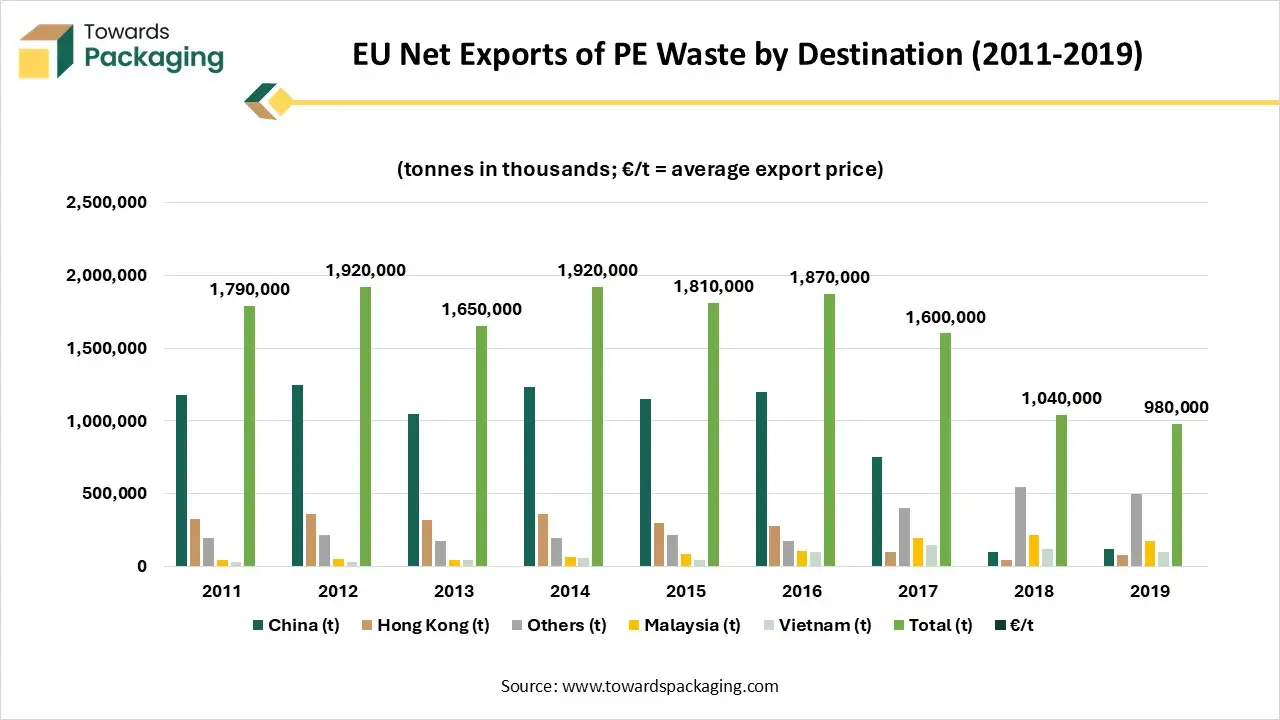

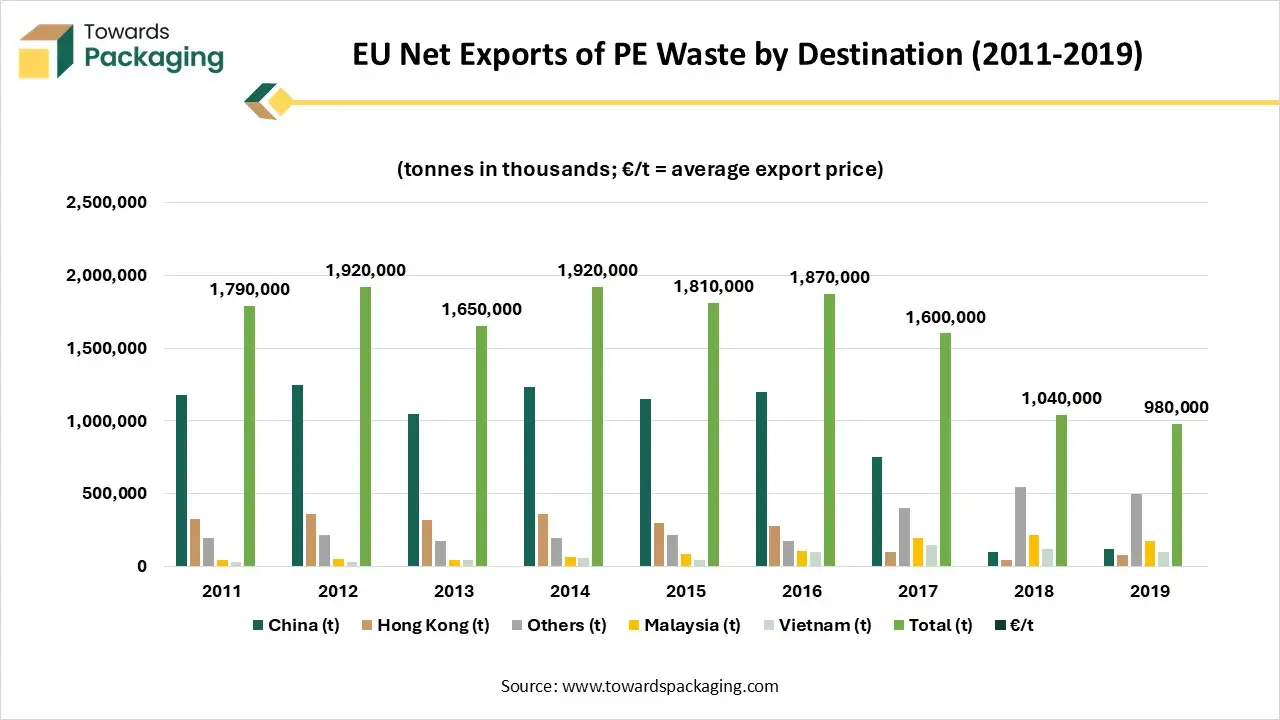

EU Net Exports of PE Waste by Destination (2011-2019)

The data shows a sharp decline in EU net exports of polyethylene (PE) waste after 2016, driven primarily by China’s import restrictions on plastic waste (including the 2018 National Sword policy). Until 2016, China and Hong Kong together absorbed over 70% of EU PE waste exports, but their volumes collapsed rapidly from 2017 onward.

As exports to China fell, shipments were diverted to other Southeast Asian countries especially Malaysia, Vietnam, and “Other” regional destinations but these increases were not enough to offset the loss of the Chinese market. Overall export volumes dropped from nearly 1.9 million tonnes in 2016 to under 1 million tonnes by 2019. Meanwhile, prices (€/t) also declined steadily as global market demand weakened and processing capacity tightened.

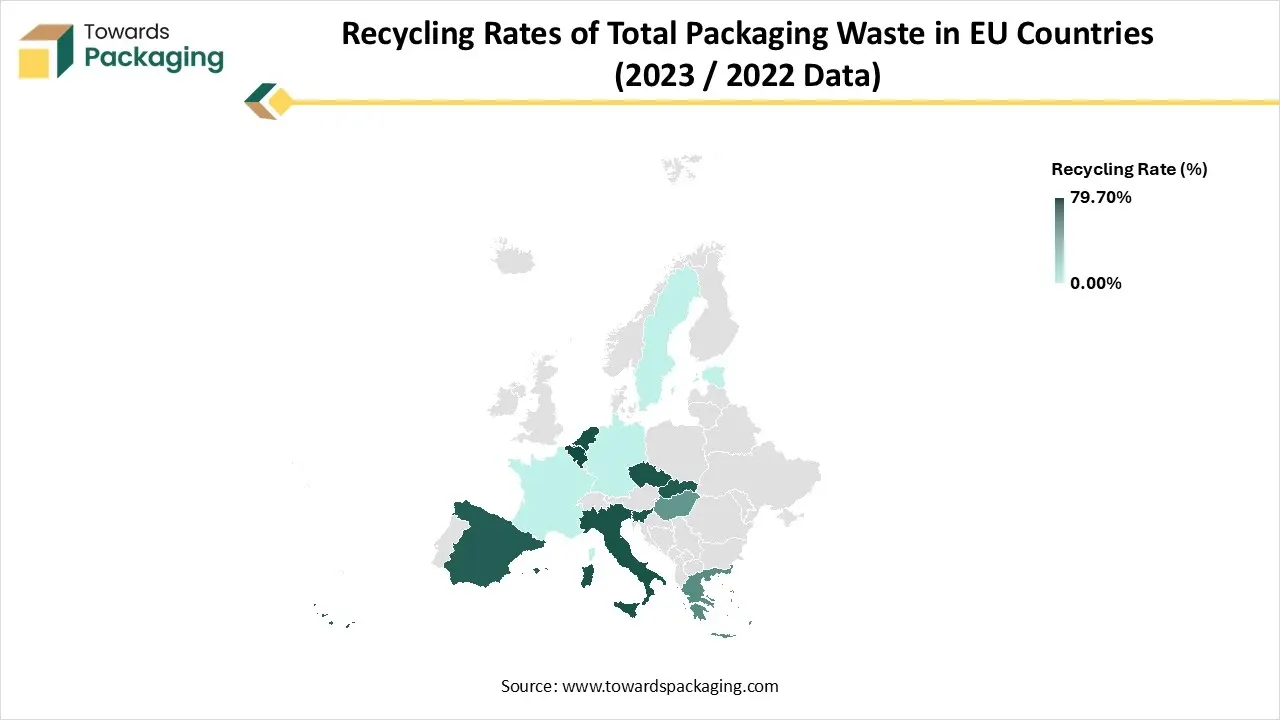

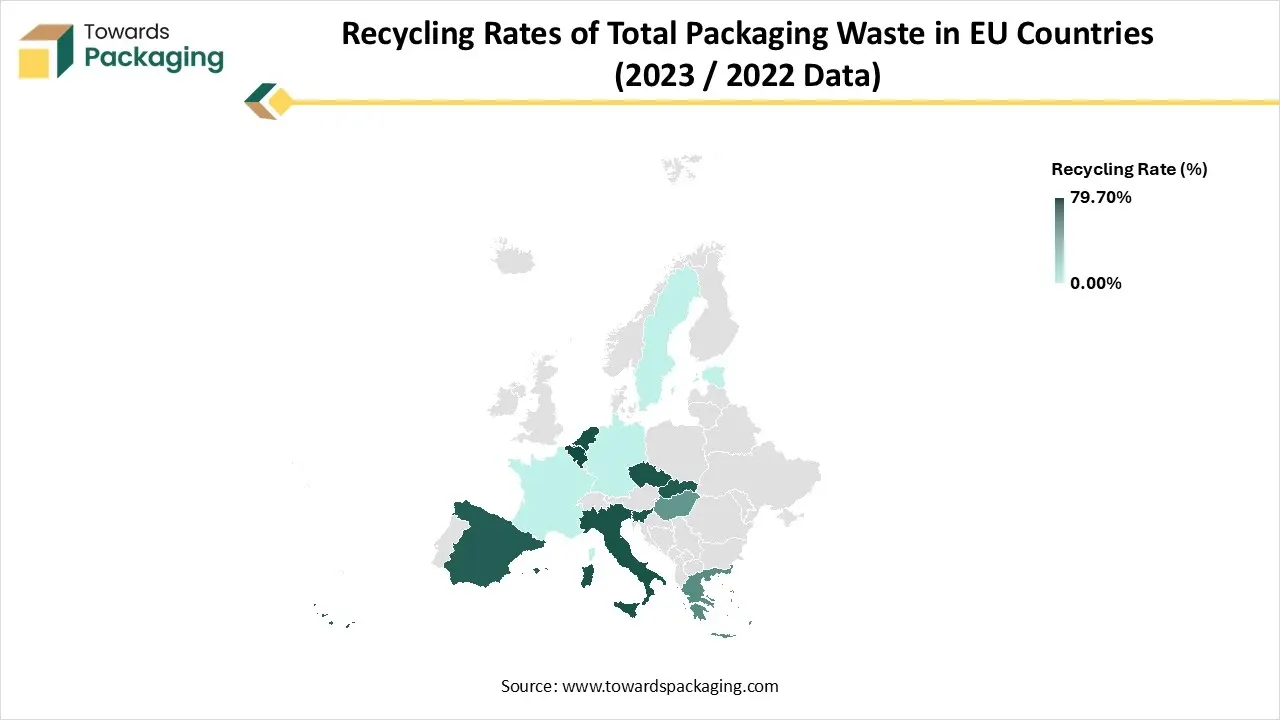

EU Household Film Recycling Collection – Coverage by Country

The map and information show the extent to which European countries include household plastic film waste (like packaging films, carrier bags, and wrapping) in their recycling systems. Around 65-70% of the EU population lives in countries where plastic films are collected for recycling as part of the main household recycling scheme. However, recycling systems vary significantly across Europe: Countries such as Germany, Belgium, Netherlands, Spain and Portugal have well-structured collection schemes where household PE films are routinely collected and sorted.

A group of countries including France, Italy, Poland and Scandinavian regions only collect films in some areas, showing partial progress. Countries like Greece, Hungary, and Nordic nations have limited or no collection infrastructure for household films, meaning most of these materials end up in landfill or incineration. Variation depends largely on system maturity, contamination challenges, and investment into sorting plants. Improvement efforts are driven by EU recycling targets and national waste policy reforms.

The EU aims to recycle 70% of all packaging waste by 2030, with even higher targets for specific materials like 85% for paper, 75% for glass, and 55% for plastics. In 2023, the EU was close to reaching this goal, achieving a recycling rate of 67.5%.

Seven EU countries have already surpassed the 70% target, including Belgium, Netherlands, Italy, Czechia, Slovenia, Slovakia, and Spain. Many others, such as Germany, France, Estonia, Sweden, and Cyprus, are very close, reporting recycling rates between 68.5% and 69.5%. However, some countries are struggling: Romania, Hungary, Malta, and Greece achieved recycling rates below 50%, far from the EU’s 2030 ambitions.

Segmental Insights

Why does the Plastic Segment Dominate the Recyclable Packaging Market?

The plastic segment holds a dominant presence in the market as these materials are durable and provide excellent barrier properties. Plastic material is used extensively for manufacturing recyclable packaging due to its versatility, durability, and ability to be engineered for recyclability. Certain types of plastics, such as PET (polyethylene terephthalate), HDPE (High Density Polyethylene), and PP (Polypropylene), are highly recyclable and widely accepted in European recycling systems. These materials offer excellent barrier properties, lightweight structure, and cost-efficiency. Making them ideal for food, beverage, personal care, and e-commerce packaging. Plastics can be molded into various shapes and used in both rigid and flexible formats while maintaining product protection and shelf life.

Which Type of Packaging Dominated the Recyclable Packaging Market in 2024?

The bottles and jars segment accounted for the dominant revenue share of the recyclable packaging market in 2024. Bottles and jars, especially those made from glass, PET, and HDPE, are easily recyclable and widely accepted in European recycling systems, making them a preferred choice for sustainable packaging. These containers are extensively used for packaging water, soft drinks, sauces, dairy, oils, and other beverages and condiments, which are major consumer products in Europe. Bottles and jars provide excellent barrier properties, preserving product freshness, preventing contamination, and offering leak-proof solutions, especially important for liquid and semi-liquid items. EU regulations and brand-led sustainability initiatives push for the use of easily recyclable formats like bottles and jars, reinforcing their market dominance.

Why does the Food and Beverage Segment Dominate the Recyclable Packaging Market?

The food and beverage segment registered its dominance over the recyclable packaging market in 2024, due to safety and freshness. Strict EU laws and national policies require food and beverage companies to reduce waste and use recyclable materials, driving widespread adoption. Eco-conscious consumers increasingly prefer products packaged in recyclable materials, especially in Europe, where sustainability awareness is high. Recyclable packaging, such as PET bottles, aluminium cans, glass jars, and paper-based cartons, offers excellent protection against moisture, oxygen, and contamination, helping preserve food quality and shelf-life. Recyclable materials like glass, aluminium, and certain plastics are versatile, allowing use across a wide range of products including beverages, dairy, sauces, and snacks.

Europe Recyclable Packaging Market Key Players

Latest Announcements by Industry Leaders

- In February 2025, Fredrik Davidsson, President of Fiber Foodservice Europe, stated that the customers in Europe can better meet consumer demands for less plastic in packaging with the use of Huhtamaki single-coated paper cups. The single-coated paper cups launched by the Huhtamaki company are cost-effective and meet customer and consumer expectations for innovative food packaging. The company’s solution is very functional in terms of product performance and barrier qualities.

New Advancements in the Market

- In February 2025, Huhtamaki, a packaging company, revealed the introduction of single-coated, recyclable paper cups for dairy and yogurt. ‘ProDairy’ is an innovative packaging solution that maintains high performance criteria while reducing the plastic content to less than 10%. As a leader in environmentally friendly food packaging, Huhtamaki is pleased to present ProDairy, a line of recyclable single-coated paper cups made especially for yogurt and dairy products.

- In April 2025, BASF Gastronomy started using premium goods from Werz Wurst-Fleisch-Convenience GmbH in its corporate canteens in the Ludwigshafen, Limburgerhof, and Lampertheim locations as well as in all event spaces. Werz is now using BASF's sustainable polyamide Ultramid Cycled in meat and sausage packaging for the first time in the Horeca sector (hotel, restaurant, and community catering) as part of a cross-value chain partnership with SÜDPACK, a top provider of high-performance packaging films.

Europe Recyclable Packaging Market Segments

By Material

- Plastic

- Glass

- Paper

- Tinplate

- Wood

- Aluminum

- Others

By Type of Packaging

- Bottles and Jars

- Bags and Pouches

- Boxes and Cartons

- Trays and Containers

- Drums and Cans

- Others

By Application

- Food and Beverage

- Healthcare and Pharmaceutical

- Personal Care and Cosmetics

- Industrial and Chemical

- Consumer Goods

- Logistics

- Others